Challenges Mount For Bitcoin Miners As Difficulty Surges To Record High

12 Settembre 2024 - 1:00PM

NEWSBTC

A recent report by Bloomberg highlights that the difficulty of

mining Bitcoin has surged to a record high, reflecting increasing

competition among cryptocurrency miners. On Wednesday, mining

difficulty rose by 3.5%, as reported by crypto-mining tracker

CoinWarz. This metric, which has been climbing steadily, often

aligns with market expectations for Bitcoin’s price movements.

Post-Halving Challenges Following the April Halving, which reduced

miners’ potential revenue by half, the Bitcoin price has dropped

approximately 10% to a current trading price of $57,000. Per

the report, this reduction has significantly pressured the profit

margins of many mining companies, particularly those operating at

higher costs. Christopher Bendiksen, Bitcoin research lead at

CoinShares, noted: The effect of the all-time high in

difficulty, right on the back of the Halving, is making the outlook

extremely challenging for many miners—especially those at the

higher end of the cost curve. The researcher added that if

current trends persist, some miners may struggle to remain cash

flow positive, let alone achieve profitability. Related Reading:

Polkadot Recovery Stalls As Bearish Pressure Returns With $3.5 In

Sight Miners play a crucial role in the Bitcoin ecosystem by using

specialized computers to validate transaction data on the

blockchain, thereby securing the network. In return for their

efforts, they earn Bitcoin rewards. However, the financial

landscape for miners has been tough this year; shares of major

publicly traded mining companies have plummeted, with Marathon

Digital Inc. and Riot Platforms Inc. experiencing declines of 31%

and 54%, respectively. In contrast, Bitcoin’s price has shown

consistency despite current challenges, climbing 38% and reaching a

record high of $73,798 in March, fueled by optimism surrounding the

demand for US exchange-traded funds (ETFs) that hold BTC.

Additionally, Bitcoin’s hash rate—the total computing power

supporting the network—hit an all-time high in September,

indicating strong participation in mining activities. Crucial

Months Ahead For The Bitcoin Market Historically, the Bitcoin price

has often dipped following its Halving event, only to rebound

several months later, eventually hitting new record highs. Many

industry participants are anticipating a potential rally in the

fourth quarter, with Bobby Zagotta, CEO of crypto exchange Bitstamp

USA, expressing optimism about market movements. However, Bendiksen

cautioned that many miners appear to be banking on a significant

price increase in Bitcoin. “If that fails to materialize, there

will be trouble ahead for some operators,” he warned. Related

Reading: Is Chainlink (LINK) $12 Breakout Imminent? Data Reveals A

Rising Open Interest The coming months will be crucial in

determining the sustainability of mining operations and the broader

health of the market, with expectations for further price

recoveries increasing in the latter part of the year, with other

potential catalysts including easing macroeconomic conditions and

the outcome of the US election. As of now, the largest

cryptocurrency on the market is down a slight 0.4% in the 24-hour

time frame, and nearly 2% in the last seven days, showing BTC’s

struggle to regain previously lost levels. Featured image

from DALL-E, chart from TradingView.com

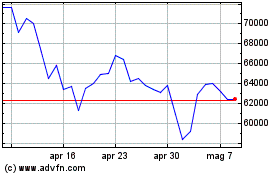

Grafico Azioni Bitcoin (COIN:BTCUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Bitcoin (COIN:BTCUSD)

Storico

Da Apr 2024 a Apr 2025