Singapore, Singapore, March 26th, 2025,

Chainwire

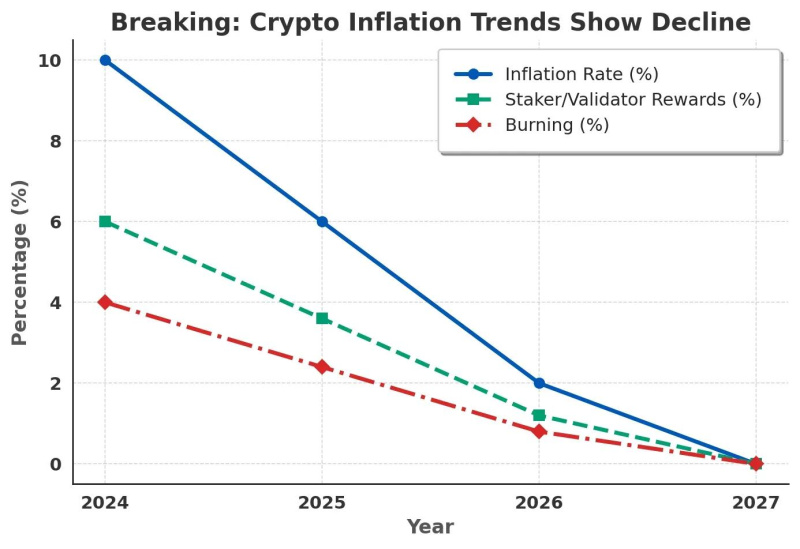

In 2024, StaFi introduced a burn mechanism as

part of its broader initiative to enhance the long-term

sustainability of the protocol. Building on this foundation, a new

proposal seeks to reduce the fixed inflation rate, aiming to

improve overall network stability. The proposal outlines a phased

approach to lowering FIS inflation, with the objective of aligning

StaFi's tokenomics with its transition toward an AI-powered Liquid

Staking as a Service (LSaaS) framework.

Inflation Reduction Plan

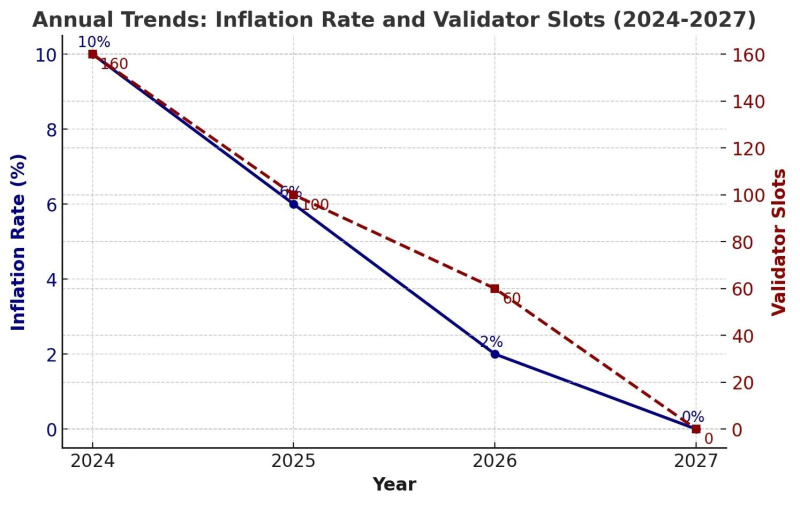

Under this proposal, StaFiChain’s current 10% inflation rate

will be reduced by 4% annually starting in 2025, gradually bringing

the inflation rate down to 6% in 2025, 2% in 2026, and ultimately

reaching 0% by 2027.

This

gradual reduction ensures sufficient time for StaFiChain's appchain

ecosystem to adapt to LSaaS adoption, fostering a more diverse and

sustainable token economy. Additionally, it aligns with

StaFiChain’s rebranding efforts.

This

gradual reduction ensures sufficient time for StaFiChain's appchain

ecosystem to adapt to LSaaS adoption, fostering a more diverse and

sustainable token economy. Additionally, it aligns with

StaFiChain’s rebranding efforts.

Benefits

Reducing inflation results in lower token issuance, which

contributes to a more controlled token supply. This change aligns

with StaFi’s broader strategy to support long-term protocol

sustainability.

Implementation Strategy

Reducing inflation directly impacts validator rewards. With 160

active validators on StaFiChain, their payouts will decrease by

approximately 40% if this proposal is implemented. To maintain

security, the number of validator slots should be reduced in

alignment with the inflation reduction timeline.

By

2027, StaFiChain will either be operated by a single foundation or

fully transitioned into an infrastructure model. At that stage, FIS

will migrate to an ERC-20 standard or other popular token standard,

unlocking new utilities for token holders.

By

2027, StaFiChain will either be operated by a single foundation or

fully transitioned into an infrastructure model. At that stage, FIS

will migrate to an ERC-20 standard or other popular token standard,

unlocking new utilities for token holders.

Key Objectives

This proposal not only reduces inflation but also accelerates

StaFi’s transition to an AI-powered LSaaS. StaFi must evolve to

remain competitive, requiring efforts in market education,

partnerships, technology upgrades, and industry alignment.

Revenue Generation

- TVL is no longer the primary focus; revenue is the key driver

for the company.

- LSaaS will generate revenue through a new

SubDAO working model.

- A detailed discussion on the DAO-SubDAO structure is

forthcoming.

Adoption & Developer Engagement

- LSaaS, as an infrastructure solution, requires active developer

engagement.

- The current market and developer community must be educated on

LSaaS benefits.

- StaFi must remain financially viable while navigating this

transition.

Future Roadmap

- Step 1: Burn Mechanism – Activated

- Step 2: Inflation Reduction – Pending Vote

- Step 3: FIS Value Enhancement – Coming Soon

The value-enhancement plan will be driven by the SubDAO model,

providing long-term benefits for FIS holders. Users can stay tuned

for more details at StaFi's X.

Outlook and Strategic Direction

The current market remains volatile, with liquidity patterns

continuing to fluctuate. Amid these conditions, StaFi maintains its

strategic focus on evolving into a sustainable AI-powered Liquid

Staking as a Service (LSaaS) ecosystem, prioritizing long-term

infrastructure development and protocol resilience.

About StaFi Protocol

StaFi is a leading Liquid Staking

infrastructure provider and protocol for PoS chains. Its Liquid

Staking as a Service (LSaaS) framework enables developers to create

Liquid Staking Tokens (LSTs) and Liquid Re-staking Tokens (LRTs)

across ecosystems like ETH, EVM, BTC, CosmWasm, and SOL.

By issuing rTokens (e.g., rETH, rBNB), StaFi unlocks the

liquidity of staked assets, allowing users to earn staking rewards

while retaining the flexibility to engage in DeFi. With support for

major blockchains such as Ethereum, Solana, Polygon, BNB Chain, and

Cosmos, StaFi bridges liquidity and security in Proof-of-Stake

networks.

Users can read more about

StaFi 2.0.

Website | rToken App |

LSaaS | X

| Telegram | Discord | Medium | Forum | Mirror

Contact

BD @StaFi

Protocol

Weymi

StaFi

Protocol

weymi@stafi.io