Tariff Easing Fuels Altcoin Rally: Solana, DOGE, And ADA Shine While Bitcoin Stalls

25 Marzo 2025 - 6:30AM

NEWSBTC

Bitcoin (BTC) has experienced a notable surge, gaining 3% in the

last 24 hours, climbing from $84,000 to $88,600, following reports

that upcoming US tariffs on major trading partners will be less

severe than initially anticipated. However, altcoins like

Solana (SOL), Dogecoin (DOGE), and Cardano (ADA) have outperformed

Bitcoin’s surge in the 24-hour time frame, being the top gainers in

the ten largest cryptocurrencies list. Bitcoin And Top

Altcoins Experience Significant Gains Scheduled for announcement on

April 2, President Donald Trump had previously indicated that he

would impose both reciprocal and sector-specific tariffs on

countries including Canada, China, and Mexico. However,

anonymous sources within the White House, as reported by Bloomberg

and the Wall Street Journal, have suggested that the president may

opt for a narrower approach, focusing solely on reciprocal

tariffs. According to the reports, this shift in strategy

appears to signal a tempering of the administration’s approach to a

“potential trade war”, which has historically led to increased

volatility in both the cryptocurrency and equity markets. Related

Reading: XRP Price Could Suffer April Flash Crash, Analyst Shows

How Low It Could Go Dan Greer, CEO of Defi App, a decentralized

finance platform, noted the correlation between Bitcoin’s recent

price increase and the news of the tariff adjustments. “This surge

in Bitcoin’s price coincides with reports that the Trump

administration is considering narrowing the scope of tariffs set to

take effect on April 2,” he stated. The positive sentiment

surrounding Bitcoin has extended to the broader cryptocurrency

market, with nearly all of the top 10 cryptocurrencies by market

capitalization experiencing gains on Monday. Ethereum rose by

4%, XRP by 2%, Solana, DOGE and Cardano led the pack with increases

of 8%, 7.8% and 4.5% respectively. The stock market reflected this

optimism, with both the Nasdaq and S&P 500 indices rising 2%

over the past 24 hours. Expert Insights On BTC’s Recent

Fluctuations Greer highlighted that this development has alleviated

some market uncertainties, leading to increased investor confidence

across both cryptocurrency and equity markets. The crypto

sector, which has faced mixed reactions since Trump took office,

has been grappling with the implications of his fluctuating tariff

policies. These policies have introduced a considerable degree of

economic uncertainty, prompting many investors to retreat from

riskier assets. Related Reading: Analyst Sets Dogecoin Next Target

As Ascending Triangle Forms The anticipated tariffs—expected to

raise the prices of foreign goods—could lead to inflation, further

complicating the economic landscape. Bitcoin, which reached an

all-time high of $109,000 in January, has seen a decline, dropping

to $78,000 earlier this month amid fears that aggressive economic

policies could trigger a recession. Colin Closser, investor

relations manager at crypto wallet company Exodus, expressed his

understanding of the crypto market’s reaction to Trump’s policies.

“I expect markets to show emotion and volatility during times of

change and stress in the United States, and you can see that

volatility in Bitcoin this morning,” he remarked. Since the spike,

Bitcoin has seen a bit of a pullback towards the $86,930 level,

with the most notable support floor between $83,000 and $84,000.

Featured image from DALL-E, chart from TradingView.com

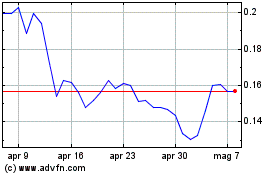

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Mar 2025 a Mar 2025

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Mar 2024 a Mar 2025