Whales Dump 760,000 Ethereum in Two Weeks — Is More Selling Ahead?

02 Aprile 2025 - 7:00PM

NEWSBTC

Ethereum continues to face strong headwinds as it trades below the

$1,900 mark, with bullish momentum fading and market sentiment

growing increasingly fearful. After a brief attempt to stabilize,

ETH has resumed its downward trajectory, now down over 35% since

late February. Price action remains weak, and investors are bracing

for more potential downside as selling pressure shows no sign of

easing. Related Reading: Whales Offload 200M Cardano During March –

The Start Of A Trend? Contributing to the bearish outlook, on-chain

data from Santiment reveals that whales have offloaded

approximately 760,000 ETH in just the past two weeks. This

significant sell-off by large holders adds weight to the growing

concerns that the market may be entering a deeper correction phase.

When whales exit in size, it often reflects declining confidence

and triggers a wave of additional selling from smaller investors.

With macroeconomic uncertainty still shaking financial markets and

Ethereum’s key support levels under threat, the outlook for ETH

remains fragile. Bulls must act fast to reclaim momentum and

prevent a slide into lower demand zones. Until then, the

combination of fading demand, technical weakness, and aggressive

whale selling continues to cloud Ethereum’s near-term path, leaving

traders on edge as the next move unfolds. Ethereum Whale Selling

Grows and Market Confidence Fades Ethereum continues to show signs

of sustained selling pressure, and the broader market is starting

to accept that the current downtrend may persist. With ETH trading

well below key resistance levels and struggling to hold above

$1,900, confidence among traders and investors is weakening.

Macroeconomic uncertainty, fueled by rising global tensions,

unstable interest rate expectations, and unpredictable policy

moves, has shaken financial markets. High-risk assets like Ethereum

are taking the hardest hits, with volatility amplifying every move.

Despite the weakness, there’s still a glimmer of optimism across

the market. Some investors believe Ethereum could mount an

aggressive recovery, especially if broader conditions stabilize or

if ETH finds strong support around current levels. However, that

optimism is starting to fade in the face of poor price action and

concerning on-chain data. Top analyst Ali Martinez shared insights

on X, revealing that whales have sold approximately 760,000 ETH

over the past two weeks. This significant offloading by large

holders adds to the ongoing bearish pressure and suggests that

confidence among big players is declining. Whale movements are

closely watched, as they often precede or confirm broader market

trends. Still, markets are dynamic, and this trend could shift

quickly. If Ethereum can hold key support zones and macroeconomic

conditions begin to calm, the same large players currently selling

may reenter the market in anticipation of the next rally. For now,

though, Ethereum remains in a fragile state, with continued selling

and cautious sentiment likely to dominate the short-term outlook.

Bulls must step in soon to shift the trend — or risk watching ETH

slide further in the weeks ahead. Related Reading: XRP MVRV Ratio

Dips Below The 200-Day MA – Trend Shift Underway? Bulls Struggle to

Reclaim Key Levels Ethereum is currently trading at $1,880 after

several days of weak price action, caught in a tight range between

$2,000 resistance and $1,750 support. Despite multiple attempts,

bulls have failed to reclaim the critical $2,000–$2,200 zone — a

level that would signal strength and potentially mark the beginning

of a broader recovery phase. Instead, ETH remains trapped in a

downtrend, with momentum continuing to favor the bears. The

inability to push higher is putting bulls in a vulnerable position.

With Ethereum now hovering just below the $1,900 level, the coming

days are crucial. If ETH fails to hold above this mark and cannot

break back above $2,000 with conviction, a sharp drop is likely.

Such a move could lead to a retest of the lower $1,700s or even

deeper, especially if broader market sentiment remains negative.

Related Reading: Dogecoin Holds Key Support: A Demand Spike Could

Trigger A Rally As macroeconomic instability and market uncertainty

persist, investors are growing cautious, and risk appetite

continues to fade. For Ethereum to avoid a deeper selloff, bulls

must step in quickly, reclaim lost ground, and reestablish

confidence above the $2,000 level. Until then, the path of least

resistance appears to remain to the downside. Featured image from

Dall-E, chart from TradingView

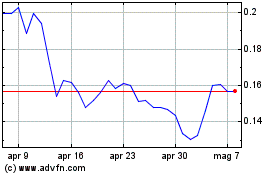

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Apr 2024 a Apr 2025