Bitcoin Keeps Rebounding—But Is Momentum Really Turning Bullish?

05 Aprile 2025 - 1:00AM

NEWSBTC

Bitcoin has seen yet another bounce in the past day, adding to the

recent series of rebounds. Here’s what on-chain data says regarding

if BTC is going anywhere with them. Bitcoin Realized Profit/Loss

Ratio Could Shed Light On Broader Dynamics In its latest weekly

report, the on-chain analytics firm Glassnode has discussed about

the recent trend in the Realized Profit/Loss Ratio for Bitcoin,

which is an indicator that can be useful to study how investors are

reacting to price volatility. Related Reading: Dogecoin To $0.57 Or

$0.06? Analyst Says DOGE’s Fate Hinges On This Level The metric

measures, as its name already suggests, the ratio between the

amount of profit and that of loss being realized by the holders or

addresses as a whole. The indicator works by looking at the

transaction history of each coin being sold on the network to find

what price it was transferred at prior to this sale. If this

previous selling value is less than the latest spot price for any

token, then the metric includes it under the profit volume. The

total profit realized in the sale of the coin is assumed to be

equal to the difference between the two prices. The indicator

calculates this value for all coins belonging to the profit volume

and takes a total sum to determine the scale of profit realization

happening across the blockchain. Similarly, the Realized

Profit/Loss Ratio also finds the total amount of loss being

realized by referring to the sales of the coins of the opposite

type (that is, the tokens with the last transaction value higher

than the current spot price). Then, it takes the ratio between the

two sums, to estimate the net situation for the sector. During the

last couple of months, Bitcoin has been going through a phase of

bearish price action. Here’s what investor trading behavior has

been like in this period, according to the Realized Profit/Loss

Ratio: As the analytics firm has highlighted in the chart, the

indicator has seen dips under the 1 mark during each of BTC’s

recent lows. A value in this region corresponds to loss-taking

being more dominant than profit-taking. “This imbalance typically

marks a degree of seller exhaustion, where downside momentum fades

as sell-side pressure is absorbed,” explains Glassnode. Due to this

reason, capitulation tends to help BTC arrive at local bottoms.

From the graph, it’s visible that the cryptocurrency also benefited

from this effect during the recent bursts of loss realization, as

its price found a rebound following each of them. These Bitcoin

rebounds, however, have so far not been anything sustained. Will

they eventually culminate into a return of proper bullish momentum,

or are they only dead-cat bounces on the way down? To tackle the

question, the analytics firm has referred to a long-term view of

the Realized Profit/Loss Ratio. As shown in the above chart, the

90-day simple moving average (SMA) of the Bitcoin Realized

Profit/Loss Ratio has been sharply trending down recently, despite

the jumps in profit realization that have come on the short-term

view. “These brief profit-driven surges have failed to reverse the

broader downtrend, suggesting that the macro picture remains one of

generally weaker liquidity and deteriorating investor

profitability,” notes Glassnode. Related Reading: Dogecoin, XRP

Among Coins Seeing The Largest Decline In Profit Supply: Data So,

as for whether Bitcoin has been witnessing a shift towards bullish

momentum with the recent rebounds, the answer is seemingly no, at

least from the perspective of the Realized Profit/Loss Ratio. BTC

Price At the time of writing, Bitcoin is trading around $83,600,

down almost 2% in the last seven days. Featured image from Dall-E,

Glassnode.com, chart from TradingView.com

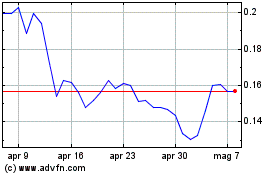

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Apr 2024 a Apr 2025