Bitget’s $12B VOXEL frenzy fizzled fast, but questions remain

21 Aprile 2025 - 4:25PM

Cointelegraph

A little-known VOXEL trading pair on cryptocurrency exchange

Bitget suddenly clocked over $12 billion in volume on April 20,

dwarfing the metrics of the same contract on Binance.

The activity centered on VOXEL/USDT perpetual futures, where

traders reported instant order fills — an anomaly many described as

a bug that allowed savvy traders to rack up outsized profits by

exploiting unusual price behavior.

The atypical metrics drew Bitget’s attention. In the fallout of

its early investigation, the

exchange suspended accounts suspected of market manipulation and

rolled back irregular trades that occurred throughout the day.

Traders who copped losses during that period were offered

compensation.

Bitget’s response and remediation plan may have prevented

lasting investor damage, but the episode is the latest in a series

of cases that raise questions about how exchanges handle market

makers, internal systems and user safeguards. While Bitget promotes

an open API and regularly touts its global market maker program, it

has yet to disclose who was behind the April 20 activity or what

technical factors led to it.

The lack of incident-level detail has fueled speculations

comparable to similar breakdowns on Binance — the world’s largest

exchange by trading volume — that included the sudden price crashes

of cryptocurrencies GoPlus (GPS) and MyShell (SHELL) in March.

Binance kicked out an unnamed market maker it found responsible for

manipulation, but the lack of disclosure added fuel to the crypto

industry’s infamous rumor mongering.

Bitget’s

VOXEL/USDT perpetual futures volume exceeded that of all other top

10 markets combined on April 20. Source:

Thành

Crypto

Bitget’s

VOXEL/USDT perpetual futures volume exceeded that of all other top

10 markets combined on April 20. Source:

Thành

Crypto

Traders VOXEL market maker bug, Bitget disagrees

Crypto market participants pointed to rapid price fluctuations

and what multiple Mandarin-language X accounts described as a bug

in a “market maker” bot as the cause of VOXEL’s excessive

volume.

Traders claimed that VOXEL’s price flickered between several

ranges, such as $0.125 and $0.138. Orders placed between those

bands filled instantly due to the suspected bug, X user Dylan said,

sharing screenshots and videos of profitable accounts. Perpetual

futures contracts are typically matched through an order book, with

each trade requiring a counterparty. But in this case, trades

appeared to execute automatically and without delay.

A

machine-translated post shares how one trader profits hundreds of

thousands of dollars with just $100 USDT in starting capital.

Source: 0xDy_eth

A

machine-translated post shares how one trader profits hundreds of

thousands of dollars with just $100 USDT in starting capital.

Source: 0xDy_eth

Traders who spotted the suspected bug early used high-leverage

bets to boost their profits, X user Qingshui

said, calling the

strategy a “zero-cost exploit.” Like Dylan, Qingshui attributed the

issue to a market maker bot misfiring and questioned why traders

were blocked from accessing profits if the problem originated

from Bitget’s side.

Related: How

Mantra’s OM token collapsed in 24 hours of

chaos

A third user, Hebi555, pointed the finger at

Bitget’s market-making team for its poor performance. Xie Jiayin,

Bitget’s head of Asia, clapped back,

stating that the exchange works with over 1,000 market makers and

institutional clients. He added that Bitget’s API is open to the

public and emphasized that specific market maker identities could

not be disclosed due to confidentiality agreements.

In an April 20 response to Cointelegraph, Bitget CEO Gracy Chen

said that suspicious trades

were between individual market participants, not the platform.

Replying to Cointelegraph’s follow-up inquiry on April 21, Chen

neither confirmed nor denied whether a market maker bot was

involved, only reiterating that the trading was “between

users.”

“We are conducting a thorough review, and once the rollback is

completed, trading and account restrictions will be lifted as

appropriate. Bitget’s security infrastructure is designed to catch

irregularities like this in real time — as it did in this case,”

Chen said.

Bitget’s VOXEL anomaly adds to crypto’s market manipulation

mystery

Concerns over market manipulation in the cryptocurrency industry

have been intensifying. In early March, the prices of two tokens,

GPS and SHELL, crashed in tandem with their

Binance

listings.

The exchange’s investigation found that the two tokens employed

the same unnamed market maker. Binance banished the

dubious trading firm from its platform and confiscated its proceeds

to help fund compensation efforts for GPS and SHELL traders.

Without a suspect to blame, social media users began pointing

fingers at several market makers and trading firms. Those named

denied any

involvement.

GSR

was among the most frequently accused firms, but denied being the

market maker removed by Binance. Source:

GSR

GSR

was among the most frequently accused firms, but denied being the

market maker removed by Binance. Source:

GSR

Binance then kicked out

another unnamed market maker, this time for trading activities

related to the Movement (MOVE) token. The MOVE token’s market maker

on Binance was found to have associations with the market maker for

GPS and

SHELL.

Related: Market maker deals are quietly killing crypto

projects

A recent Cointelegraph report found that market makers are

employing a loan-based model that is killing off small- and

medium-cap projects. The loan model gives market makers access to a

project’s tokens in exchange for liquidity provision. But instead,

what often happens is that market makers dump the loaned tokens on

the open market just to buy them back at a cheaper price, leaving

the projects with damaged price charts.

VOXEL was on Bitget, but exploits aren’t limited to CEXs

Both Bitget and Binance’s cases show that even the largest

centralized exchanges (CEXs) aren’t immune to market manipulation

or traders exploiting platforms for profits.

But a recent case on decentralized exchange (DEX) Hyperliquid

shows the issue isn’t confined to CEXs. In late March, a whale

allegedly exploited the liquidation parameters on Hyperliquid,

resulting in the delisting of the

platform’s JELLY perpetual futures product. Hyperliquid then

announced a compensation plan for affected users, similar to how

Bitget responded to its own VOXEL drama.

X

user spotlights double standards in how exchanges respond to bugs.

Source: Dotyyds1234

X

user spotlights double standards in how exchanges respond to bugs.

Source: Dotyyds1234

Ironically, Bitget’s Chen had some strong words against

Hyperliquid at the time, raising concerns about

the network’s centralization. She compared the DEX to FTX, once a

billion-dollar trading firm whose founder is now serving a

25-year prison

sentence for multiple counts of fraud.

“The way it handled the JELLY incident was immature, unethical,

and unprofessional, triggering user losses and casting serious

doubts over its integrity. Despite presenting itself as an

innovative decentralized exchange with a bold vision, Hyperliquid

operates more like an offshore CEX with no

[Know-Your-Customer/Anti-Money Laundering], enabling illicit flows

and bad actors,” she said.

Bitget’s VOXEL episode may have been contained, and

Hyperliquid’s users may be compensated, but the broader pattern is

harder to ignore for traders. As platforms scramble to maintain

trust, the industry’s vulnerability isn’t just the bugs or

exploits, but the silence that follows them.

Magazine: Uni

students crypto ‘grooming’ scandal, 67K scammed by fake women: Asia

Express

...

Continue reading Bitget’s $12B VOXEL frenzy fizzled

fast, but questions remain

The post

Bitget’s $12B VOXEL frenzy fizzled fast, but

questions remain appeared first on

CoinTelegraph.

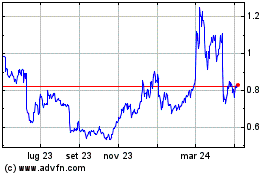

Grafico Azioni EOS (COIN:EOSUSD)

Storico

Da Mar 2025 a Apr 2025

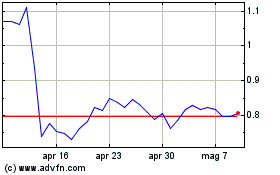

Grafico Azioni EOS (COIN:EOSUSD)

Storico

Da Apr 2024 a Apr 2025