Misleading crypto narratives continue, driven by 'sensationalist' sentiment

23 Marzo 2025 - 6:00AM

Cointelegraph

A crypto analyst says inaccurate narratives still circulate in

the cryptocurrency market, mainly based on skewed information

rather than onchain data to back it up.

“Beware of misinformation. Despite the data, misleading

narratives persist,” CryptoQuant contributor “onchained,”

said in a

March 22 market report.

“Such claims often lack onchain validation and are driven by

sensationalist market sentiment rather than objective analysis,”

the analyst said, adding:

“Trust data, not noise, verify sources and cross-check

onchain metrics.”

Onchained pointed to the recent movements of Bitcoin

(BTC) long-term

holders (LTH) — those holding for over 155 days — as an example of

false narratives clashing with real data.

The analyst pointed out that while some narratives claim Bitcoin

long-term holders are “capitulating,” the data shows they’re

remaining consistent. “The data leaves no room for speculation,”

Onchained said.

The Inactive Supply Shift Index (ISSI) — which measures the

degree to which long-dormant Bitcoin supply is shifting — “shows no

meaningful LTH selling pressure, reinforcing a narrative of

structural demand outpacing supply,” Onchained said.

Narratives are always being challenged

Crypto analytics platform Glassnode

recently made a similar observation based on data, saying,

“Long-Term Holder activity remains largely subdued, with a notable

decline in their sell-side pressure.”

Crypto market narratives are constantly changing and being

challenged.

One long-standing crypto narrative under debate is the relevance

of the 4-year cycle theory, which suggests that Bitcoin’s price

follows a predictable pattern tied to its halving event every four

years.

Source: Tomas

Greif

MN Trading Capital founder Michael van de Poppe

said in a March 22 X

post, “I assume that we can erase the entire 4-year cycle theory

and that we’re in a longer cycle for Altcoins.”

Related: Crypto markets will be pressured by trade wars

until April: Analyst

Echoing a similar sentiment, Bitwise Invest chief investment

officer Matt Hougan recently said that “the traditional four-year

cycle is over in crypto” due to the recent change in the US

government’s stance.

“Crypto has moved in four-year cycles since its earliest

days. But the change in DC introduces a new wave that will

play out over a decade,” Hougan said.

Alongside this, some analysts are even debating whether the

entire Bitcoin bull

market is over.

CryptoQuant founder and CEO Ki Young Ju

said in a March 17 X

post, “Bitcoin bull cycle is over, expecting 6-12 months of bearish

or sideways price action.”

Ju said all Bitcoin onchain metrics indicate a bear market.

“With fresh liquidity drying up, new whales are selling Bitcoin at

lower prices,” Ju said.

Magazine: Dummies guide to native rollups: L2s as secure

as Ethereum itself

...

Continue reading Misleading crypto narratives

continue, driven by 'sensationalist' sentiment

The post

Misleading crypto narratives continue, driven by

'sensationalist' sentiment appeared first on

CoinTelegraph.

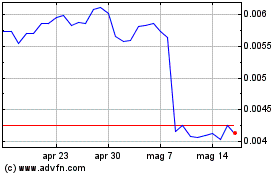

Grafico Azioni Four (COIN:FOURRUSD)

Storico

Da Mar 2025 a Apr 2025

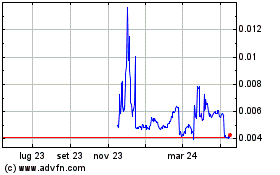

Grafico Azioni Four (COIN:FOURRUSD)

Storico

Da Apr 2024 a Apr 2025