Here’s What Happens If The XRP Price Closes Out This Week Above $2.25

16 Aprile 2025 - 11:00PM

NEWSBTC

XRP is back trading above, $2, and bullish momentum is gradually

creeping back compared to its price action at the end of March and

beginning of April. Crypto analyst EGRAG CRYPTO believes this week

could highlight a turning point for a full flip into bullish

momentum, and how the XRP price closes out the week will be very

important. According to the analyst’s outlook, which was posted on

social media platform X, the current XRP candle on the weekly

timeframe is hovering just above both $2.10 and the 21-week

Exponential Moving Average (EMA). However, he noted that the real

confirmation lies with if XRP can manage to close the week with a

full-bodied candle above $2.25. Why Is $2.25 Important For XRP’s

Price? The $2.25 level has now become more than just another

short-term resistance. It is what EGRAG considers the final barrier

to validating the recovery structure forming after March and

April’s sharp retracement. His weekly chart shows XRP climbing out

from a significant low after bouncing off the 0.888 Fib extension

level and now stabilizing above the yellow 21-week EMA line.

Related Reading: XRP To Flip Bitcoin This Cycle? Analyst Points To

Major Bounce The alignment of XRP’s price above both the $2.10

price level and this moving average adds credibility to the

potential of a bullish continuation, but EGRAG makes it clear that

a weekly close above $2.25 is the “lock-in” point. From a technical

standpoint, this would mark the first full-bodied weekly candle

above the 21W EMA since the past four weeks. If achieved, this can

be interpreted confirmation that bulls have regained dominance and

that a bottom was established on April 7. Furthermore, it suggests

that the April 7 bottom will continue to hold as support going

forward. The chart also outlines close price targets at $2.51 and

$2.60, with Fibonacci extension levels projecting even higher zones

at $2.69 on the way to crossing back above $3. Failing To Close

Above $2.25 Could Reintroduce Unwanted Narratives EGRAG also issued

a cautionary note in case there isn’t a clean breakout. Should XRP

fail to close the weekly candle above $2.25, he warned it could

trigger a return of bearish narratives, including what he referred

to as a possible “tariff issue.” This is referring to the recent

tariff back-and-forth between the US and China in the past month,

which has unbalanced the investment markets. Related Reading:

Crypto Pundit Reveals What Will Happen If XRP Price Does Not Break

$2.3 A strong rejection could see the XRP price pull back toward

the $1.96 Fibonacci level or even lower into the broader support

band of around $1.58 to $1.30. The white box region on the chart

above would then become the primary battleground for bulls and

bears if a close above $2.25 is not secured by the end of the week.

Featured image from iStock, chart from Tradingview.com

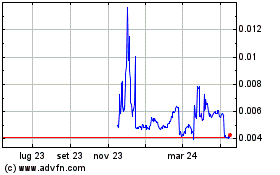

Grafico Azioni Four (COIN:FOURRUSD)

Storico

Da Mar 2025 a Apr 2025

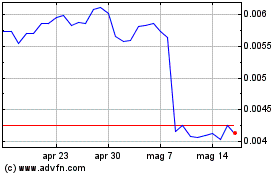

Grafico Azioni Four (COIN:FOURRUSD)

Storico

Da Apr 2024 a Apr 2025