Bitcoin Spot ETFs See 4 Consecutive Days Of Outflows, Here’s What Happened Last Time

22 Marzo 2024 - 3:00PM

NEWSBTC

Bitcoin Spot ETF outflows have ramped up this week and has seen the

week characterized by price declines throughout the crypto space.

These outflows, like before, are being led by the Grayscale Spot

ETF as investors believe their fees are too high. This has led to

four consecutive week of outflows, which is the second time it is

happening since Spot ETFs were approved for trading. So, where does

the Bitcoin price go from here? Bitcoin Spot ETFs Hit 4 Consecutive

Days Of Outflows The outflows began on Monday and continued into

subsequent days. So far, the highest single-day outflow happened on

Tuesday, March 19, with total net flows for the day coming out to

$326.2 million, a new record for Bitcoin funds. Related Reading:

Top 3 Solana Meme Coins To Buy Amid The Bitcoin Crash That Could

10x Subsequent days have seen lower figures when it comes to

overall net flows but they continue to come out in the negative. On

Wednesday, net flows were $261.5 million, and on Thursday, March

22, net flows came out to $94 million. This marked the second time

that the Spot Bitcoin ETFs are seeing four consecutive days of

outflows this year. The vast majority of these outflows, as

mentioned above, are coming from the Grayscale Bitcoin ETF. In the

last day alone, the fund saw outflows of 5,900 BTC, which

translates to $339 million at current prices. Then, over the last

week, Coinglass data shows that 28,207.5834 BTC has left the fund,

causing its total BTC under management to fall by 7.35% in one

week. Other funds have also seen outflows during this time but to a

much lower degree. For example, the Invesco Galaxy Bitcoin ETF saw

the second-highest outflow of all the funds, but only 667 BTC

flowed out of the fund in the last day. The WisdomTree Bitcoin Fund

saw 10.8.2635 BTC in outflows, while all other outflow figures came

in below 100 BTC. What Happened To BTC The Last Time? The last time

that Spot Bitcoin ETFs saw four consecutive days of outflows was in

January, lasting from January 22 to January 25. This also bears

some similarities to the current outflow trend in some was, one of

which was the outflows began at the start of the week and carried

through to the end. Related Reading: Crypto Analyst Says XRP Price

Is Headed For $27 As 2017 Pattern Emerges However, a difference

between both times is that the ETFs had just begun trading with

trading days fluctuating between inflows and outflows. Meanwhile,

the current trend has come after almost two consecutive weeks of

inflows, something that could have an impact on the BTC price going

forward. In January, after four days, the outflows had begun to

slow down, and by Friday, there was a change in direction, with

inflows beginning to dominate. Once the tide turned and ETF inflows

began to rise, the BTC price followed sharply. With the climb came

a more established rally in the Bitcoin price, causing it to go

from $40,000 to over $70,000 in the space of two months. If this

trend repeats and inflows into Spot BTC ETFs outpace outflows, then

the BTC price is expected to start climbing again. However, if the

outflows continue, then the BTC price could be in for further

crashes. BTC price drops below $65,000 | Source: BTCUSD on

Tradingview.com Featured image from 20 Minutes, chart from

Tradingview.com

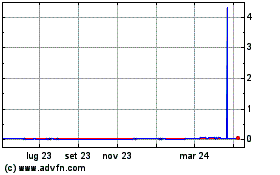

Grafico Azioni Gala (COIN:GALAUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Gala (COIN:GALAUSD)

Storico

Da Apr 2024 a Apr 2025