Bitcoin On Thin Ice: Peter Schiff Warns Impending SEC Regulations Could Tank Prices

17 Gennaio 2024 - 9:00PM

NEWSBTC

Prominent economist and vocal crypto skeptic Peter Schiff has once

again stirred the pot with his latest prognosis on Bitcoin (BTC).

Schiff, known for his critical stance on digital currencies, has

raised eyebrows with his latest post, where he warns of impending

regulatory changes that could trouble Bitcoin’s transaction costs

and future price trajectory. Regulatory Changes On The Horizon

Schiff’s warnings are anchored in his belief that the US Securities

and Exchange Commission (SEC), under the leadership of Gary

Gensler, is poised to introduce new, more stringent regulations for

cryptocurrencies. Related Reading: Bitcoin Price Signals Recovery

But The Bears Are Not Out of Woods Yet According to Schiff, these

regulations will likely significantly increase the operational

costs of Bitcoin transactions. He argues that this hike in

transaction costs will erode Bitcoin’s practicality as a digital

currency, potentially leading to a sharp decrease in its market

value. Since @GaryGensler was backed into a corner on spot

#BitcoinETFs approval, I think he will soon introduce new onerous

#crypto regulations that will substantially increase the cost of

#Bitcoin transactions, further undermining its “use” case,

resulting in a sharp decline in price. — Peter Schiff

(@PeterSchiff) January 17, 2024 Schiff interprets Gensler’s recent

actions, especially regarding approving spot Bitcoin

exchange-traded funds (ETFs), as a precursor to these anticipated

regulatory measures. Despite the looming threat of increased

regulation, some industry observers have pointed to Gensler’s

previous classification of Bitcoin as a commodity. This

categorization, they argue, might present challenges to the SEC’s

scope of regulation. However, Schiff counters this view by

suggesting that the focus of any impending regulatory changes could

be more aligned with anti-money laundering efforts rather than

strictly within the ambit of securities law. He thinks most are

securities. But he may even change his mind on Bitcoin. But my

thought is that new regulations will relate to AML, not securities

law. — Peter Schiff (@PeterSchiff) January 17, 2024 Technical

Analysis Adds To Bearish Sentiment On Bitcoin Supporting Schiff’s

bearish outlook, market analyst Bitcoinhyper has recently

identified a bearish pattern on Bitcoin’s chart. According to the

analyst, a double-top pattern on the stochastic oscillator, a

well-regarded momentum indicator, has emerged, signifying potential

bearish movement ahead. This technical observation aligns with

recent market trends, where Bitcoin has shown downward movement

following the formation of this pattern. Bitcoinhyper’s analysis

supports the idea of further corrections, suggesting that Bitcoin’s

peak might already be established. As Bitcoin navigates through

these uncertain waters, on-chain data from IntoTheBlock presents

another challenge. The data shows that Bitcoin is currently facing

a robust on-chain resistance zone. This resistance is gauged by the

volume of Bitcoin acquired by investors within the price range of

$42,700 to $44,000. Approximately 2.68 million addresses holding

over a million BTC are clustered in this range, creating a

formidable barrier for price movements. Related Reading: Bitcoin

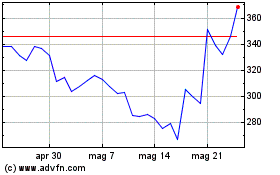

Bearish Forecast: Analyst Signals Continued Downfall Bitcoin’s

trading price currently hovers around $42,601, reflecting a 0.9%

decrease over the last 24 hours and nearly a 5% decline over the

past week. This price action is further compounded by a notable

decrease in trading volume, which has dipped from last week’s $40

billion to below $30 billion today, indicating reduced market

activity. This sluggish market performance comes in the wake of

fading excitement over the recent spot ETF approvals and an absence

of significant market-driving news. Featured image from Unsplash,

Chart from TradingView

Grafico Azioni Gnosis (COIN:GNOUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Gnosis (COIN:GNOUSD)

Storico

Da Apr 2024 a Apr 2025