Solana rallies 8% as crypto markets recover — Is there room for more SOL upside?

19 Marzo 2025 - 10:30PM

Cointelegraph

Solana's native token, SOL (SOL), rose 8% on March

19 as investors turned to riskier assets ahead of US Federal

Reserve Chair Jerome Powell's remarks. While interest rates are

expected to stay unchanged, analysts anticipate a softer inflation

outlook for 2025. Meanwhile, key onchain and derivatives metrics

for Solana suggest further upside for SOL price.

The cryptocurrency market mirrored intraday movements in the US

stock market, suggesting SOL's gains were not driven by

industry-specific news, such as reports that the US Securities and

Exchange Commission may drop its

lawsuit against Ripple after clinging to it for four years.

Russell 2000 small-cap index futures (left) vs. SOL/USD

(right). Source: TradingView / Cointelegraph

On March 19, the Russell 2000 index futures, tracking US-listed

small-cap companies, surged to their highest level in twelve days.

Despite a broader slowdown in decentralized application (DApp)

activity, Solana stands out.

Solana’s TVL continues to rise

Solana’s onchain volumes dropped 47% over two weeks, but similar

declines were seen across Ethereum, Arbitrum, Tron, and Avalanche,

highlighting industry-wide trends rather than Solana-specific

issues. The Solana network’s total value locked (TVL), a measure of

deposits, hit its highest level since July 2022, supporting SOL's

bullish momentum.

Solana total value locked (TVL), SOL. Source:

DefiLlama

On March 17, Solana's TVL climbed to 53.2 million SOL, marking a

10% increase from the previous month. By comparison, BNB Chain's

TVL rose 6% in BNB terms, while Tron's deposits fell 8% in TRX

terms over the same period. Despite weaker activity in

decentralized

applications (DApps), Solana continued to attract a steady flow

of deposits, showcasing its resilience.

Solana saw strong momentum, driven by Bybit Staking, which

surged 51% in deposits since Feb. 17, and Drift, a perpetual

trading platform, with a 36% TVL increase.

Restaking app

Fragmentic also recorded a 65% rise in SOL deposits over 30 days.

In nominal terms, Solana secured its second-place position in TVL

at $6.8 billion, ahead of BNB Chain’s $5.4 billion.

Despite the market downturn, several Solana DApps remain among

the top 10 in fees, outperforming larger competitors like Uniswap

and Ethereum’s leading staking solutions.

Ranking by 7-day fees, USD. Source: DefiLlama

Solana’s memecoin launchpad Pump.fun, decentralized exchange

Jupiter, automated market maker

and liquidity provider Meteora, and staking platform Jito are among

the leaders in fees. More notably, Solana’s weekly base layer fees

have surpassed Ethereum’s, which holds the top position with $53.3

billion in TVL.

SOL derivatives hold steady as token unlock fears

subside

Despite a 27% decline in SOL's price over 30 days, demand for

leveraged positions remains balanced between longs (buyers) and

shorts (sellers), as indicated by the futures

funding

rate.

SOL futures 8-hour funding rate. Source: CoinGlass

Periods of high demand for bearish bets typically push the

8-hour perpetual futures funding rate to -0.02%, which equals 1.8%

per month. When the rate turns negative, shorts are the ones paying

to maintain their positions. The opposite occurs when traders are

optimistic about SOL’s price, causing the funding rate to rise

above 0.02%.

The recent price weakness was not enough to instill confidence

in bears, at least not to the extent of adding leveraged positions.

One reason for this can be explained by the reduced growth in SOL

supply going forward, similar to inflation. A total of 2.72 million

SOL will be unlocked in April, but only 0.79 million are expected

for May and June.

Ultimately, SOL is well-positioned to reclaim the $170 level

last seen on March 3, given the resilience in deposits, the lack of

leverage demand from bears, and the reduced supply increase in the

coming months.

This article is for

general information purposes and is not intended to be and should

not be taken as legal or investment advice. The views, thoughts,

and opinions expressed here are the author’s alone and do not

necessarily reflect or represent the views and opinions of

Cointelegraph.

...

Continue reading Solana rallies 8% as crypto markets

recover — Is there room for more SOL upside?

The post

Solana rallies 8% as crypto markets recover — Is

there room for more SOL upside? appeared first on

CoinTelegraph.

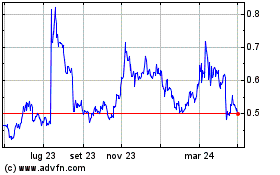

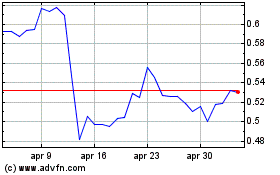

Grafico Azioni Ripple (COIN:XRPUSD)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Ripple (COIN:XRPUSD)

Storico

Da Mar 2024 a Mar 2025