MicroStrategy Could Be Forced To Dump Bitcoin Under These Circumstances, Michael Saylor Responds

11 Aprile 2025 - 2:30AM

NEWSBTC

MicroStrategy, the largest corporate holder of Bitcoin, has long

embodied the boldest institutional bet on the cryptocurrency.

Co-founder and chairman Michael Saylor’s unwavering belief in

Bitcoin has defined the company’s strategy for years. However, that

strategy now faces a challenge after a recent SEC filing hinted at

the possibility of MicroStrategy being forced to liquidate some of

its Bitcoin holdings under financial pressure and the recent

Bitcoin price crash. The implications could ripple beyond the

company’s balance sheet and affect Bitcoin’s broader market.

Mounting Debt, Negative Cash Flow, And The Bitcoin Lifeline

MicroStrategy disclosed several important financial vulnerabilities

in a recent Form 8-K filed with the SEC. At the time of filing, the

firm reported holding 528,185 BTC, acquired at an average purchase

price of $67,458 per Bitcoin, for a total cost basis of

approximately $35.63 billion. However, despite the massive size of

its Bitcoin treasury, MicroStrategy admitted that its core

enterprise software business has not been generating positive

operational cash flow. The company is also shouldering $8.22

billion in debt and facing an annual contractual interest burden of

$35.1 million. Related Reading: Crypto Analyst Warns Bitcoin Price

Could See Further Crash If It Falls Below This Level Although it

has issued over $1.6 billion in preferred stock tied to substantial

annual dividend obligations of $146.2 million, these liabilities

are not being met. Instead, MicroStrategy explicitly outlined that

it expects to rely on debt or equity financing to meet its

obligations, and those efforts may become severely strained if

Bitcoin’s price sharply declines. The report warns that if the

market value of its holdings drops significantly, it could

negatively affect the firm’s ability to raise funds. In such a

situation, the company might be forced to sell Bitcoin at a loss.

At the time the report was filed, BTC was trading just 13% above

the company’s average purchase price. Because Bitcoin forms the

majority of MicroStrategy’s assets, its balance sheet is intimately

tied to the crypto’s price. As such, a dip below that level could

create a chain reaction of falling stock prices and ultimately

force selling pressure even on the price of Bitcoin itself.

Michael Saylor’s Response: Staying The Course Michael Saylor,

MicroStrategy’s co-founder and former CEO, is one of the biggest

proponents of Bitcoin and was influential in the company’s adoption

of a Bitcoin strategy. Taking to social media platform X after the

news of the report broke out, Saylor simply tweeted: “HODL,” a

popular mantra among crypto purists that signals long-term

conviction. Related Reading: Here’s How Much Bitcoin Creator

Satoshi Nakamoto Lost After The BTC Price Crash The post has had

over 1.4 million views on the platform and resonated with many

bullish proponents, as seen in the comments section. He followed

that with another tweet: “Bitcoin is the Best Idea. There is no

Second Best.” At the time of writing, BTC is trading at $81,900, up

by 6% in the past 24 hours. Even if MicroStrategy were to sell any

Bitcoin at this point, it wouldn’t be the first sale of its

holdings. Back on December 22, 2022, MicroStrategy sold 704 BTC for

$11.8 million under similar circumstances. Featured image from

Unsplash, chart from Tradingview.com

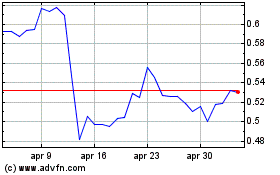

Grafico Azioni Ripple (COIN:XRPUSD)

Storico

Da Mar 2025 a Apr 2025

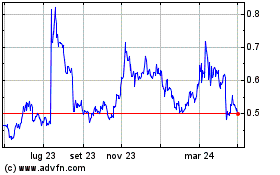

Grafico Azioni Ripple (COIN:XRPUSD)

Storico

Da Apr 2024 a Apr 2025