New record year for Christian Dior group in 2022

New record year for Christian Dior group

in 2022

. Revenue 79 billion euros

. Profit from recurring operations 21

billion euros

. Both up 23%

. A strong social and economic footprint

in France

Paris, January 26th, 2023

Christian Dior group recorded revenue of €79.2

billion in 2022 and profit from recurring operations of €21.0

billion, both up 23%.

All business groups achieved significant organic

revenue growth over the year (see table on page 3). Fashion &

Leather Goods notably reached record levels, with organic revenue

growth of 20%. Profit from recurring operations stood at €21.0

billion for 2022, up 23%. Operating margin remained at the same

level as 2021. Group share of net profit was €5.8 billion, up 17%

compared to 2021. Operating free cash flow surpassed €10

billion.

Europe, the United States and Japan rose

sharply, benefiting from strong demand from local customers and the

recovery of international travel. Asia was stable over the year due

to developments in the health situation in China.

Highlights of 2022 include:

- A record year despite the geopolitical and economic

situation,

- Significant revenue growth for all business groups and market

share gains worldwide,

- Strong growth in business in Europe, Japan and the United

States,

- Good growth in Champagne and Cognac, based on a value creation

strategy,

- A remarkable performance by the Fashion & Leather Goods

business group, notably Louis Vuitton, Christian Dior Couture,

Celine, Fendi, Loro Piana, Loewe and Marc Jacobs, which are gaining

market share globally and reaching record levels of revenue and

earnings,

- Louis Vuitton revenue surpassed 20 billion euros, for the first

time,

- Strong growth in perfumes. The continued global success of

Dior’s Sauvage, once again world leader in 2022,

- Sustained creative momentum for all our Watches & Jewelry

Maisons, in particular Tiffany, Bulgari and TAG Heuer,

- A remarkable rebound for Sephora, which confirmed its place as

world leader in the distribution of beauty products,

- Operating investments of nearly €5 billion, mainly dedicated to

the expansion of the store network, the development of production

facilities and employment,

- Operating free cash flow of more than €10 billion.

A strong social economic footprint in

France and around the world:

- 39,000 young people recruited worldwide in

2022.

- In France, the Group recruited more than 15,000 people

in 2022, which makes it the leading private recruiter in

the country.

- In 2022, the Group invested nearly 215 million

euros in training its employees.

- In France, one job created directly by the Group

generates four for the French economy. That is equivalent

to around 160,000 people working indirectly for the Group.

- More than 500 stores and 110 manufacturing

facilities and workshops located

across France.

- The Group opens several manufacturing facilities each

year in France, notably for Louis Vuitton.

- Five billion euros in corporation taxes paid

worldwide, almost half of which in France.

- More than one billion euros invested in France

each year.

- On average over recent years, the total fiscal

footprint (corporation tax + VAT + social charges) of the

Group in France is more than 4.5 billion euros per

year.

- The salaries of the group's employees are among the most

competitive in their sector of activity.

- Most of our employees in France benefit from

profit-sharing, with an overall total for the group of 400 million

euros in 2022.

- A leader in terms of transparency and

performance in matters concerning the protection of the

climate, forests and water, as recognized by the CDP (Carbon

Disclosure Project), a global not-for-profit environmental

organization. LVMH is now one of 12 companies in the world

awarded a triple A rating, out of more than 15,000 rated

companies.

Key figures

|

Euro Millions |

2021 |

2022 |

Change 2022/2021 |

|

Revenue |

64 215 |

79 184 |

+ 23 % |

|

Profit from recurring operations |

17 139 |

21 050 |

+ 23 % |

|

Group share of net profit |

4 946 |

5 797 |

+ 17 % |

|

Operating free cash flow |

13 518 |

10 110 |

- 25% |

|

Net financial debt |

9 521 |

8 867 |

- 7 % |

|

Total equity |

46 367 |

54 314 |

+ 17 % |

Revenue by business group:

|

Euro Millions |

2021 |

2022 |

Change2022/2021Reported

Organic* |

|

Wines & Spirits |

5 974 |

7 099 |

+ 19 % |

+ 11 % |

|

Fashion & Leather Goods |

30 896 |

38 648 |

+ 25 % |

+ 20 % |

|

Perfumes & Cosmetics |

6 608 |

7 722 |

+ 17 % |

+ 10 % |

|

Watches & Jewelry |

8 964 |

10 581 |

+ 18 % |

+ 12 % |

|

Selective Retailing |

11 754 |

14 852 |

+ 26 % |

+ 17 % |

|

Other activities and eliminations |

19 |

282 |

- |

- |

|

Total |

64 215 |

79 184 |

+ 23 % |

+ 17 % |

* with comparable structure and constant exchange

rates. The structural impact for the Group was zero and the

currency effect was +6 %.

Profit from recurring operations

by business group:

|

Euro Millions |

2021 |

2022 |

Change 2022/2021 |

|

Wines & Spirits |

1 863 |

2 155 |

+ 16 % |

|

Fashion & Leather Goods |

12 842 |

15 709 |

+ 22 % |

|

Perfumes & Cosmetics |

684 |

660 |

- 3 % |

|

Watches & Jewelry |

1 679 |

2 017 |

+ 20% |

|

Selective Retailing |

534 |

788 |

+ 48 % |

|

Other activities and eliminations |

(463) |

(279) |

- |

|

Total |

17 139 |

21 050 |

+ 23 % |

Wines & Spirits: record level of

revenue and earnings

The Wines & Spirits

business group recorded revenue growth of 19% in 2022 (11% on an

organic basis). Profit from recurring operations was up 16%.

Champagne volumes were up 6%, driven by sustained demand leading to

growing pressure on supplies. Momentum was particularly strong in

Europe, Japan and in emerging markets, particularly in “high

energy” channels and gastronomy. Hennessy cognac benefited from its

value creation strategy. The dynamic policy of price increases

offset the effects of the health situation in China, while the

United States was affected at the start of the year by logistical

disruptions. Still wines, in particular the Château d’Esclans rosé,

achieved an excellent performance. Moët Hennessy strengthened its

global portfolio of exceptional wines with the acquisition of the

Joseph Phelps vineyard, one of the most renowned wine properties in

Napa Valley, California.

Fashion & Leather Goods: exceptional

performances by Louis Vuitton, Christian Dior

Couture, Celine, Fendi, Loro Piana, Loewe

and Marc Jacobs

The Fashion & Leather Goods

business group recorded revenue growth of 25% in 2022 (20% on an

organic basis). Profit from recurring operations was up 22%. Louis

Vuitton had an excellent year, again driven by its exceptional

creativity, the quality of its products and its strong ties with

art and culture. The women's ready-to-wear fashion shows created by

Nicolas Ghesquière were extremely well-received. Many new products

were unveiled in leather goods, jewelry and watches. Meanwhile, the

new "LV Dream" exhibition in Paris pays tribute to 160 years of

creative exchanges that fuel Louis Vuitton's spirit of innovation,

and a new collaboration with Japanese artist Yayoi Kusama was

unveiled, revisiting iconic creations of the Maison. Christian Dior

Couture continued its remarkable growth trajectory across all its

product lines. After three years of renovations, the Maison’s

historic store at 30 avenue Montaigne, which reopened in Paris in

early 2022, enjoyed huge success, offering a new experience of the

highest refinement. Its fashion shows continued to offer

exceptional moments, whether in Seville, Spain, for the women's

collections of Maria Grazia Chiuri, or in Egypt at the foot of the

Giza pyramids for the men's show imagined by Kim Jones. Celine

experienced very strong growth thanks to the success of Hedi

Slimane's creations and his extremely modern and precise vision, as

did Loewe, driven by the strong creativity of J.W. Anderson. Fendi

celebrated the 25th anniversary of its iconic Baguette bag in New

York. Loro Piana, Rimowa and Marc Jacobs also had an excellent

year.

Perfumes & Cosmetics: strong

momentum in perfume and continued selective

distribution

The Perfumes & Cosmetics

business group recorded revenue growth of 17% in 2022 (10% on an

organic basis). Profit from recurring operations was slightly down

as a result of a very selective policy of distribution to assert

itself in the prestige universe. Christian Dior enjoyed a

remarkable performance, strengthening its lead. Sauvage confirmed

its position as the world's leading perfume, while the iconic

women's fragrances Miss Dior and J'adore, enriched with its latest

creation Parfum d'Eau, continued to grow. Dior Addict in make-up

and Prestige in skincare also contributed to the rapid growth of

the Maison. Guerlain sustained its growth, driven notably by the

vitality of its Abeille Royale skincare, its Aqua Allegoria

collection and its exceptional perfumes L’Art et la Matière.

Parfums Givenchy benefited from the continued success of its

fragrances. Fenty Beauty doubled its revenue thanks to the

expansion of its distribution network and the success of its

launches.

Watches & Jewelry: rapid growth in

jewelry and watches

The Watches & Jewelry

business group recorded revenue growth of 18% in 2022 (12% on an

organic basis). Profit from recurring operations was up 20%.

Tiffany & Co. had a record year, driven by its increasing

desirability. While its High Jewelry revenue doubled, the new Lock

bracelet collection, rolled out in North America, enjoyed great

success alongside other iconic lines. The “Vision & Virtuosity”

exhibition at the Saatchi Gallery in London showcased 185 years of

creativity and know-how of the Maison over the summer. Bvlgari

confirmed its strong momentum, particularly in Europe, Japan and

the United States. The iconic Serpenti line and the High Jewelry

and High Watchmaking collections were the main growth drivers. The

Octo Finissimo Ultra watch broke a new record of thinness. Chaumet

had a good year and celebrated nature with its “Végétal” exhibition

in Paris. Fred showed strong growth and launched its first

retrospective exhibition at the Palais de Tokyo in Paris. In the

watchmaking sector, TAG Heuer unveiled, among other innovations,

the Carrera Plasma, an avant-garde fusion of watchmaking and lab

grown diamonds. As official timekeeper, Hublot enjoyed strong

visibility during the 2022 Football World Cup. Zenith continued to

expand its in-store and online distribution.

Selective Retailing: excellent

performance by Sephora; DFS impacted by the health situation in

China

Selective Retailing revenue was

up 26% in 2022 (17% on an organic basis). Profit from recurring

operations was up 48%. With a strong rebound in activity in its

stores, Sephora enjoyed a record performance in both revenue and

earnings. Momentum was particularly strong in North America,

Europe, the Middle East and in most Southeast Asian countries.

Further investments were made into Sephora's omnichannel strategy

in order to continuously improve its customers’ purchasing

experience both online and in-store. The network continued to

expand notably due to the partnership with Kohl's in the United

States. Sephora’s Russian business was divested. DFS was still

affected by the health situation in China. The flagship

destinations of Hong Kong and Macau particularly suffered as a

result of the suspension of domestic travel and the complete

absence of tourists but just reopened in January. Le Bon Marché,

which is growing strongly, continued to develop innovative concepts

and benefit from the return of loyal French customers and

international travellers.

Confidence in 2023

With the month of January having started well

and despite an uncertain geopolitical and economic environment,

Christian Dior is confident in its ability to continue the growth

observed in 2022. The Group will pursue its brand development

focused strategy, underpinned by continued innovation and

investment as well as a constant quest for desirability and quality

in its products and their distribution.

Driven by the agility of its teams, their

entrepreneurial spirit and its well diversified presence across

businesses and geographic areas in which its customers are located,

Christian Dior enters 2023 with confidence and once again, sets an

objective of reinforcing its global leadership position in luxury

goods.

Dividend 2022

At the General Meeting of April 20, 2023,

Christian Dior will propose a dividend of 12 euros per share. An

interim dividend of 5 euros per share was paid on December 5 of

last year. The balance of 7 euros will be paid on April 27,

2023.

The Board of Directors met on January 26th to

approve the financial statements for 2022. Audit procedures have

been carried out and the audit report is being issued.

This financial release is available on our website

www.dior-finance.com

APPENDIX

Financial statements for 2022 are included in the

PDF version of the press release.

Revenue by business group and by

quarter

2022 Revenue (Euro

millions)

|

Year 2022 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective retailing |

Other activities and eliminations |

Total |

|

First quarter |

1 638 |

9 123 |

1 905 |

2 338 |

3 040 |

(41) |

18 003 |

|

Second quarter |

1 689 |

9 013 |

1 714 |

2 570 |

3 591 |

149 |

18 726 |

|

First half |

3 327 |

18 136 |

3 618 |

4 909 |

6 630 |

109 |

36 729 |

|

Third quarter |

1 899 |

9 687 |

1 959 |

2 666 |

3 465 |

79 |

19 755 |

|

First nine months |

5 226 |

27 823 |

5 577 |

7 575 |

10 095 |

189 |

56 485 |

|

Fourth quarter |

1 873 |

10 825 |

2 145 |

3 006 |

4 757 |

93 |

22 699 |

|

Total 2022 |

7 099 |

38 648 |

7 722 |

10 581 |

14 852 |

282 |

79 184 |

2022 Revenue (Organic change verses same

period of 2021)

|

Year 2022 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective retailing |

Other activities and eliminations |

Total |

|

First quarter |

+ 2 % |

+ 30 % |

+ 17 % |

+ 19 % |

+ 24 % |

- |

+ 23 % |

|

Second quarter |

+ 30% |

+ 19 % |

+ 8 % |

+ 13 % |

+ 20 % |

- |

+ 19 % |

|

First half |

+ 14 % |

+ 24 % |

+ 13 % |

+ 16 % |

+ 22 % |

- |

+ 21 % |

|

Third quarter |

+ 14 % |

+ 22 % |

+ 10 % |

+ 16 % |

+ 15 % |

- |

+ 19 % |

|

First nine months |

+ 14 % |

+ 24 % |

+ 12 % |

+ 16 % |

+ 20 % |

- |

+ 20 % |

|

Fourth quarter |

+ 4 % |

+ 10 % |

+ 5 % |

+ 3 % |

+ 12 % |

- |

+ 9 % |

|

Total 2022 |

+ 11 % |

+ 20 % |

+ 10 % |

+ 12 % |

+ 17 % |

- |

+ 17 % |

2021 Revenue (Euro

millions)

|

Year 2021 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective retailing |

Other activities and eliminations |

Total |

|

First quarter |

1 510 |

6 738 |

1 550 |

1 883 |

2 337 |

(59) |

13 959 |

|

Second quarter |

1 195 |

7 125 |

1 475 |

2 140 |

2 748 |

23 |

14 706 |

|

First half |

2 705 |

13 863 |

3 025 |

4 023 |

5 085 |

(36) |

28 665 |

|

Third quarter |

1 546 |

7 452 |

1 642 |

2 137 |

2 710 |

25 |

15 512 |

|

First nine months |

4 251 |

21 315 |

4 668 |

6 160 |

7 795 |

(12) |

44 177 |

|

Fourth quarter |

1 723 |

9 581 |

1 941 |

2 804 |

3 959 |

30 |

20 038 |

|

Total 2021 |

5 974 |

30 896 |

6 608 |

8 964 |

11 754 |

19 |

64 215 |

Alternative performance

measures

For the purposes of its financial communication,

in addition to the accounting aggregates defined by the IAS/IFRS

standards, Christian Dior uses alternative performance measures

established in accordance with AMF’s position DOC-2015-12.

The table below lists these measures and the

reference to their definition and their reconciliation with the

aggregates defined by the IAS/IFRS in the published documents.

|

Measures |

Reference to published documents |

|

Operating free cash flow |

AR (condensed consolidated financial statements, consolidated cash

flow statement) |

|

Net financial debt |

AR (Notes 1.23 and 19 of the appendix to the consolidated financial

statements) |

|

Gearing |

AR (Part 7, Comments on the Consolidated Balance Sheet) |

|

Organic growth |

AR (Part 1, Comments on the Consolidated Income Statement) |

AR: Annual Report as at December 31, 2022

This document is a free translation into English

of the original French financial release dated January 26th,

2023.

It is not a binding document.

In the event of a conflict in interpretation,

reference should be made to the French version, which is the

authentic text.

- Christian Dior - Annual results VA - financial release

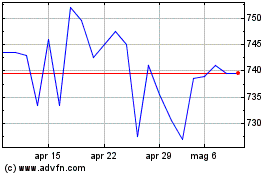

Grafico Azioni Christian Dior (EU:CDI)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Christian Dior (EU:CDI)

Storico

Da Mar 2024 a Mar 2025