- Profitability impacted by lower sales volumes in the Group's

main markets

- Continuation and reinforcement of the TRANSFORM 2025 plan to

increase the Group's resilience in the face of shortened economic

cycles by enhancing the flexibility of its cost structure

Regulatory News:

SergeFerrari Group (FR0011950682 – SEFER), a leading global

supplier of innovative flexible composite materials, listed on

Euronext Paris – Compartment C, today announced its consolidated

full-year results for the year ended December 31st, 2023, as

approved by the Supervisory Board on March 26th, 2024. These

consolidated financial statements have been audited by the

Statutory Auditors, whose report is currently being prepared.

Audited consolidated financial statements (report being

prepared)

in €m

Dec 31, 2023

Déc 31, 2022

Change

Revenue

327.6

338.7

-3.3%

Adjusted EBIT1

11.3

26.5

-57.5%

Operating Income

12.6

25.1

-50.0%

Net Income, Group Share

4.7

15.5

-69.6%

Sébastien Baril, SergeFerrari Group’s Chairman of the

Executive Board, stated:” Although the adverse environment in

its historic businesses led to a drop in volumes and profitability,

SergeFerrari Group continued to develop its Solutions activities by

extending its geographical coverage in 2023. This development

ambition must, however, be coupled with an adjustment in the

allocation of resources and production facilities to market

conditions and trends. The Group is exposed to ever-shortening

economic cycles. Faced with this reality and driven by the aim of

returning to profitability in line with its standards, the Group is

reconsidering its organization as part of the TRANSFORM 2025 plan.

The plan sets out our strategic direction, while detailing the

operational and financial roadmap that supports it, with the

objective of creating greater value for the Group as a whole.”

2023 Revenues and profitability

Revenues

(in €m)

2023

2022

Change at current scope and

currency

Change at constant scope and

currency

1st quarter

84.8

79.0

+7.3%

+0.2%

2nd quarter

90.7

91.0

-0.3%

-5.6%

3rd quarter

73.0

79.7

-8.3%

-12.8%

4th quarter

79.1

89.0

-11.2%

-10.8%

Full Year Total

327.6

338.7

-3.3%

-6.8%

The Group reported revenues of €327.6 million in 2023, down

-3.3% on a current scope and exchange rate basis and -6.8% on a

constant scope and exchange rate basis, impacted by the contraction

of its historical markets in Europe. The downturn is more

pronounced in innovative materials (around 73% of sales), with

sales volumes down by 12% compared with 2022. This situation is

partially offset by the growth dynamic observed in the SOLUTIONS

activities, with strong organic growth and the impact of

acquisitions made during the period, namely Markleen and BSI. By

the end of December 2023, SOLUTIONS activities represented 12% of

the Group's consolidated sales, or over €40 million.

Audited consolidated financial statements (report being

prepared)

in €m

Dec 31, 2023

Déc 31, 2022

Change

Revenue

327.6

338.7

-3.3%

Adjusted EBIT2

11.3

26.5

-57.5%

Operating Income

12.6

25.1

-50.0%

Net Income, Group Share

4.7

15.5

-69.6%

The decline in the margin rate on purchases consumed over the

period, from 52.3% of revenues in 2022 to 50.6% in 2023, is

explained by the combination of a negative volume effect on sales

and rising energy costs. The sharp reduction in volumes produced in

2023 has enabled the Group to achieve the inventory reduction

targets but has contributed to the recognition of an under-activity

charge.

The Group's adjusted EBIT therefore came to €11.3 million,

compared with €26.5 million the previous year. In conclusion,

SergeFerrari Group recorded operating income of €12.6 million,

compared with €25.1 million in 2022, and net income, Group share,

of €4.7 million, compared with €15.5 million in 2022.

Financial Structure

in €m

Dec 31, 2023

Dec 31, 2022

Net debt

128.2

85.3

Net debt excl. IFRS 16

78.6

61.2

Shareholders' equity, Group

share

118.5

120.0

The operating working capital requirement (WCR) follows the

trajectory of the €8.5 million reduction in inventories recorded in

2023, decreasing to €130.1 million and representing 39.7% of

revenues in 2023 compared with €135.8 million and 40.0% of revenues

in 2022. This decline is also the result of a 6.1% decrease in

trade receivables.

In addition, the Group pursued its external growth policy aimed

at consolidating its position in SOLUTIONS activities, through the

acquisition of a 64% stake in Markleen Management SL in Spain and

the acquisition of a 60% stake in BSI in India.

Net debt used to calculate covenants thus came to €78.6 million,

representing around 61% of Group shareholders' equity. The Group is

in compliance with its banking covenants, the leverage ratio having

been waived on December 31, 2023.

Outlook 2024

Since the end of 2023, SergeFerrari Group has been working to

ensure that its organizational structure can more easily absorb the

business cycles observed in its historical markets, through the

deployment of its TRANSFORM 2025 plan. The first effects of this

program were already felt in the 4th quarter of 2023, notably the

management of working capital through supply chain optimization.

These measures were enhanced by using part-time working in the 1st

quarter 2024.

TRANSFORM 2025 plan

Given the increasingly cyclical nature of business in its main

markets, the Group intends to adapt its cost structure in line with

its TRANSFORM 2025 plan launched at the end of 2023.

This plan aims to increase profitability and optimize the

allocation of resources through a number of levers:

- Industrial reorganization in line with the current production

perimeter, avoiding duplication of jobs by geographical area;

- Preservation of strategic investments and limitation of

capacity investments;

- Optimization and adaptation of the organizational structure to

the seasonality observed in historical markets, with the aim of

achieving a WCR representing 35% of revenues by 2025;

- Deployment of synergies from recent acquisitions and strengthen

the penetration of Solutions activities in new geographies;

- Securing the Group's competitive advantages by maintaining the

momentum of R&D investment, ensuring the renewal of the product

portfolio.

Dividend

At the Annual General Meeting of May 16th, 2024, the Group will

propose a dividend of €0.12 per share for fiscal year 2023, payable

in July 2024.

Governance

Philippe Brun, member of the SergeFerrari Group Executive Board,

has retired and will step down from his operational functions on

March 31st, 2024. Philippe Brun will continue to support the

majority shareholder in its strategic considerations.

Sébastien Ferrari, Chairman of the Supervisory Board of

SergeFerrari Group, comments: "I would like to thank Philippe

Brun for his commitment during his fourteen years within the Group

and will be delighted to continue to benefit from his support

within the Ferrari Participations family holding company. During

this period, the Group's revenues more than doubled to €327 million

in 2023, thanks in particular to some fifteen external growth

operations.”

Financial calendar

- Publication of 2023 Q1 revenues, on

Tuesday, April 23rd, 2024, after market close - Annual

General Meeting: Thursday 16th, 2024, at 10:00 am

ABOUT SERGEFERRARI GROUP

The Serge Ferrari Group is a leading global supplier of

composite materials for Tensile Architecture, Modular Structures,

Solar Protection and Furniture/Marine, in a global market estimated

by the Company at around €6 billion. The unique characteristics of

these products enable applications that meet the major technical

and societal challenges: energy-efficient buildings, energy

management, performance and durability of materials, concern for

comfort and safety together, opening up of interior living spaces

etc. Its main competitive advantage is based on the implementation

of differentiating proprietary technologies and know-how. The Group

has manufacturing facilities in France, Switzerland, Germany, Italy

and Asia. Serge Ferrari operates in 80 countries via subsidiaries,

sales offices and a worldwide network of over 100 independent

distributors.

In 2023, Serge Ferrari posted consolidated revenues of €327.6

million, over 80% of which was generated outside France. The

SergeFerrari Group share is listed on Euronext Paris – Compartment

C (ISIN: FR0011950682). SergeFerrari Group shares are eligible for

the French PEA-PME and FCPI investment schemes.

www.sergeferrari.com

_____________________________ 1 REBIT = Operating income +/-

restructuring costs +/- balance sheet effect of acquired companies’

purchase price allocation operations 2 REBIT = Operating income +/-

restructuring costs +/- balance sheet effect of acquired companies’

purchase price allocation operations

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240326862545/en/

SergeFerrari GROUP Philippe Brun Executive Board

Members Valentin Chefson Head of Investor Relations

investor@sergeferrari.com

NewCap Investor Relations – Financial

Communication Théo Martin / Nicolas Fossiez Tél. : 01 44 71 94

94 sferrari@newcap.eu

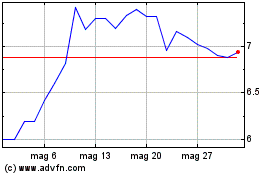

Grafico Azioni Sergeferrari (EU:SEFER)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Sergeferrari (EU:SEFER)

Storico

Da Mar 2024 a Mar 2025