MARKET WRAPS

Forex:

The dollar has already dropped during Asian trade and has scope

to fall back further as its jump higher late on Tuesday was "quite

surprising" and lacked a clear catalyst, ING said.

"The rise in U.S. rates did not look large enough to justify the

rotation from European FX (EUR and GBP) back into the dollar," it

said.

"We...therefore see room for the dollar correction initiated

overnight to extend today."

J.P. Morgan said Wednesday's flash estimate purchasing managers

data are likely to be important for the euro ahead of the European

Central Bank's meeting on Thursday.

The ECB is expected to reiterate vigilance on inflation and push

back against interest-rate cuts priced in by markets, but the

stance will need to be backed up by solid data to lift the euro,

JPM added.

"This is unlikely to move the needle on the outlook for the euro

without an accompanying shift in the data corroborating the ECB

stance."

JPM said EUR/USD was undershooting fair-value of 1.10 based on

elevated real-rate differentials, improving terms of trade and

tighter peripheral spreads.

Sterling rose to its strongest against the euro since September

2023 after U.K. provisional purchasing managers' surveys for

January beat forecasts, diminishing prospects of early Bank of

England interest-rate cuts.

The data will add to the BOE's concerns about persistent

inflation, Capital Economics said.

Energy:

Oil prices edged higher as traders navigated between risks to

supply due to geopolitical tensions and rebounding crude output in

the U.S. along with the restart of production at a major Libyan oil

field.

Growing geopolitical tensions across the Middle East continue to

support the market, but the upward trend looks limited as oil

production and supply haven't been directly affected, according to

analysts.

Metals:

Copper prices rose almost 1.5% on supply concerns and hopes for

a new stimulus package in top consumer, China.

"The copper market this year is set to be in its tightest state

since 2021," Goldman Sachs said.

"The market has suffered a supply shock over the past quarter

from a series of mine supply downgrades, reducing expected growth

this year by 60% from expectations in mid-2023."

Meanwhile, aluminum was around 1.1% higher, supported by a

Politico report saying the EU is considering an embargo on Russian

aluminum.

TODAY'S TOP HEADLINES

United Puts Boeing on Notice. It's Looking at Other Jets.

Boeing stock took a hit after negative comments about another

737 MAX version from United Airlines-a key MAX customer-on

Tuesday.

Boeing's customer sounds frustrated. That's fair. Boeing has

created a lot of problems for its customers recently. But customers

don't have a lot of alternatives for Boeing jets.

Alibaba Shares Rise as Co-Founders Jack Ma, Joe Tsai Buy

Stock

Alibaba Group shares rose on news that co-founders Jack Ma and

Joe Tsai bought about $200 million of the company's stock in the

latest quarter, giving the Chinese tech giant some welcome news

amid a monthslong slide.

Alibaba closed 7.3% higher on Wednesday, outpacing the 4.2% gain

in Hong Kong's benchmark tech index and giving the company its

biggest one-day rise in 10 months. U.S. ADRs rose 7.85%

overnight.

Credit Card Debt Is Up-and It's Taking Longer to Pay Down

From fuel and groceries to hotels and airline tickets, consumers

are putting more purchases on credit cards-and taking longer to pay

them off.

The four biggest U.S. banks reported higher credit card spending

in 2023 compared with the previous year. In fact, since 2020,

credit card spending has steadily increased at three of the four.

The exception is Citigroup, where credit card spending hit a recent

peak in 2021.

Donald Trump Scores Decisive Win in New Hampshire Republican

Primary

CONCORD, N.H.-Donald Trump won New Hampshire's GOP presidential

primary, propelling him closer to the nomination and a rematch with

President Biden, even though Nikki Haley pledged to stay in the

race.

With 77% of the estimated vote counted, Trump led Haley 55% to

44%, according to the Associated Press.

Trump Won New Hampshire, but There Are Warning Signs for

November

For Donald Trump, New Hampshire served up a set of danger signs

along with a resounding victory.

With his convincing win over Nikki Haley in the GOP primary, the

former president showed that a dominating share of the Republican

Party's core voters are still with him and that his momentum toward

the party nomination grows. But the New Hampshire results also

signaled that Trump risks losing enough Republicans-as well as a

substantial share of independent voters-to create a problem for him

as a general-election candidate in November.

U.S. Carries Out Airstrikes Against Iranian-Backed Group and Its

Facilities in Iraq

WASHINGTON-The U.S. conducted strikes against Iran-supported

militants, this time in Iraq after the group attacked American

troops for a second time Tuesday, which amounted to one of the

strongest responses thus far to hundreds of recent attacks against

American forces in Iraq and Syria.

The airstrikes in Iraq come a day after the U.S. struck what it

said were targets in Yemen controlled by the Tehran-backed Houthi

rebels.

Write to ina.kreutz@wsj.com

TODAY IN CANADA

Earnings:

AGF Mgmt 4Q

Economic Indicators (ET):

0830 Dec New Housing Price Index

0945 Bank of Canada interest rate announcement

Stocks to Watch:

Crombie REIT: Financial Chief Clinton Keay to Resign Feb. 23;

Names Kara Cameron as Interim Financial Chief

---

Firan Technology Group Reaches Agreement With Represented

Employees for a New Four Yr Contract

Expected Major Events for Wednesday

00:30/JPN: Jan Japan Flash Manufacturing PMI

08:15/FRA: Jan France Flash PMI

08:30/GER: Jan Germany Flash PMI

09:30/UK: Jan Flash UK PMI

11:00/UK: Jan CBI Industrial Trends Survey

12:00/US: 01/19 MBA Weekly Mortgage Applications Survey

14:45/US: Jan US Flash Manufacturing PMI

14:45/US: Jan US Flash Services PMI

14:45/CAN: Bank of Canada interest rate announcement

15:30/US: 01/19 EIA Weekly Petroleum Status Report

All times in GMT. Powered by Kantar Media and Dow Jones.

Expected Earnings for Wednesday

AGF Management Ltd - Class B (AGF.B.T) is expected to report

$0.29 for 4Q.

AT&T Inc (T) is expected to report $0.55 for 4Q.

Abbott Laboratories (ABT) is expected to report $0.86 for

4Q.

Amerant Bancorp Inc (AMTB) is expected to report for 4Q.

Amphenol Corp (APH) is expected to report $0.77 for 4Q.

BOK Financial Corp (BOKF) is expected to report $1.75 for

4Q.

Blue Foundry Bancorp (BLFY) is expected to report for 4Q.

Capitol Federal Financial (CFFN) is expected to report $0.02 for

1Q.

Carter Bankshares Inc (CARE) is expected to report for 4Q.

ESSA Bancorp Inc (ESSA) is expected to report $0.46 for 1Q.

Eagle Bancorp (Maryland) (EGBN) is expected to report $0.68 for

4Q.

Elevance Health Inc (ELV) is expected to report $5.07 for

4Q.

Esquire Financial Holdings Inc (ESQ) is expected to report $1.17

for 4Q.

Farmers National Banc Corp (FMNB) is expected to report $0.35

for 4Q.

Fidelity D&D Bancorp Inc (FDBC) is expected to report for

4Q.

Fortrea Holdings Inc (FTRE) is expected to report for 4Q.

Freeport-McMoRan Inc (FCX) is expected to report $0.24 for

4Q.

GameStop Corp (GME,GMEB) is expected to report.

General Dynamics Corp (GD) is expected to report $3.73 for

4Q.

HBT Financial Inc (HBT) is expected to report for 4Q.

HomeTrust Bancshares (HTBI) is expected to report $0.69 for

2Q.

John Marshall Bancorp Inc (JMSB) is expected to report for

4Q.

Kimberly-Clark Corp (KMB) is expected to report $1.53 for

4Q.

Mid Penn Bancorp (MPB) is expected to report $0.59 for 4Q.

Monro Inc (MNRO) is expected to report $0.40 for 3Q.

Parke Bancorp Inc (PKBK) is expected to report for 4Q.

Preferred Bank Los Angeles (PFBC) is expected to report $2.54

for 4Q.

Progressive Corp (PGR) is expected to report.

Prosperity Bancshares (PB) is expected to report $1.15 for

4Q.

SeaChange International Inc (SEAC) is expected to report for

3Q.

Simmons First National Corp - Class A (SFNC) is expected to

report $0.33 for 4Q.

Sterling Bancorp Inc (SBT) is expected to report $0.03 for

4Q.

Stifel Financial (SF) is expected to report $1.24 for 4Q.

Stock Yards Bancorp Inc (SYBT) is expected to report $0.86 for

4Q.

TE Connectivity Ltd (TEL) is expected to report $1.68 for

1Q.

Teledyne Technologies Inc (TDY) is expected to report $4.34 for

4Q.

Textron Inc (TXT) is expected to report $1.28 for 4Q.

United Bancorp Inc (UBCP) is expected to report for 4Q.

United Community Banks (UCBI) is expected to report $0.11 for

4Q.

Universal Stainless & Alloy Products Inc (USAP) is expected

to report $0.24 for 4Q.

Powered by Kantar Media and Dow Jones.

ANALYST RATINGS ACTIONS

Alkami Technology Cut to Neutral From Buy by Goldman Sachs

Bill.com Holdings Cut to Equal-Weight From Overweight by Wells

Fargo

Bloomin' Brands Cut to Neutral From Overweight by JP Morgan

Callon Petroleum Cut to Hold From Buy by Stifel

CenterPoint Energy Cut to In-Line From Outperform by Evercore

ISI Group

Cheesecake Factory Cut to Underweight From Neutral by JP

Morgan

Chevron Cut to Market Perform From Outperform by TD Cowen

Coinbase Cut to Underweight From Neutral by JP Morgan

Duke Energy Raised to Outperform From In-Line by Evercore ISI

Group

Enphase Energy Raised to Buy From Hold by Truist Securities

Exxon Mobil Raised to Outperform From Market Perform by TD

Cowen

Inhibrx Cut to Market Perform From Market Outperform by JMP

Securities

NuSTAR Energy Raised to Equal-Weight From Underweight by Wells

Fargo

Philip Morris Cut to Sell From Buy by UBS

Regions Financial Cut to Hold From Buy by Argus Research

Sirius XM Cut to Underweight From Equal-Weight by Wells

Fargo

Sunnova Energy Intl Raised to Buy From Hold by Truist

Securities

SW Energy Cut to Hold From Buy by Stifel

Texas Roadhouse Raised to Neutral From Underweight by JP

Morgan

Tractor Supply Cut to Equal-Weight From Overweight by Stephens

& Co.

Zuora Raised to Buy From Neutral by Goldman Sachs

This article is a text version of a Wall Street Journal

newsletter published earlier today.

(END) Dow Jones Newswires

January 24, 2024 06:16 ET (11:16 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

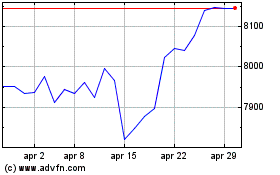

Grafico Indice FTSE 100

Da Mar 2025 a Mar 2025

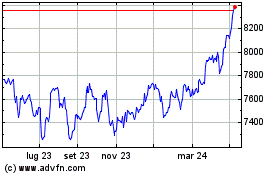

Grafico Indice FTSE 100

Da Mar 2024 a Mar 2025