China Maintains Benchmark Lending Rates

20 Marzo 2025 - 3:33AM

RTTF2

China left its benchmark lending rates unchanged for the fifth

straight month, as widely expected, on Thursday.

The People's Bank of China kept its one-year loan prime rate

unchanged at 3.10 percent. Likewise, the five-year LPR, the

benchmark for mortgage rates, was retained at 3.60 percent.

Both the rates were last reduced by 25 basis points each in

October 2024.

The announcement came after the US Federal Reserve left its

interest rate unchanged on Wednesday. But the Fed signaled that it

is still likely to lower rates later this year.

The PBoC fixes the LPR monthly based on the submission of 18

designated banks. However, Beijing has influence over the fixing.

The LPR replaced the traditional benchmark lending rate in August

2019.

The weakness of yuan currently limits the capability to ease

monetary policy further. Early this month, PBoC Governor Pan

Gongsheng said the bank aims to maintain the yuan basically stable

at a reasonable and balanced level.

The PBoC had pledged to lower interest rates and the reserve

requirement ratio to prop up economic growth.

China retained its growth target for 2025 at "around 5 percent"

but the government was more cautious about nominal growth and

inflation outlook amid heightened uncertainty surrounding the U.S

trade tariff threats.

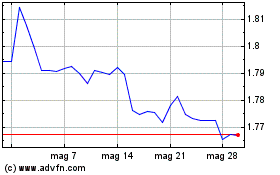

Grafico Cross Euro vs NZD (FX:EURNZD)

Da Feb 2025 a Mar 2025

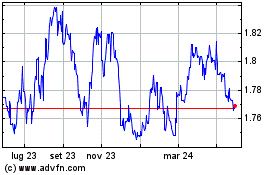

Grafico Cross Euro vs NZD (FX:EURNZD)

Da Mar 2024 a Mar 2025