U.S. Dollar Falls Ahead Of U.S. Presidential Election

04 Novembre 2024 - 2:13AM

RTTF2

The U.S. dollar weakened against other major currencies in the

Asian session on Monday, as traders remain cautious amid the

uncertainty over the U.S. election outcome, lingering geopolitical

tensions in the Middle East and the U.S. Fed's monetary policy

announcement later in the week.

The rising odds of Kamala Harris winning the U.S. presidential

election due on Tuesday, also led to the downward pressure of the

currency.

Meanwhile, data showing weaker than expected U.S. job growth in

October renewed optimism over the outlook for interest rates.

Crude oil prices climbed higher amid expectations of increased

demand from the U.S. and a likely delay in OPEC's planned output

increase from December. West Texas Intermediate Crude oil futures

for December ended higher by $0.65 or 0.95 percent at $69.26 a

barrel.

In the Asian trading today, the U.S. dollar fell to a 5-day low

of 1.2999 against the pound, nearly a 2-week low of 151.60 against

the yen and nearly a 3-week low of 1.0905 against the euro, from

Friday's closing quotes of 1.2926, 152.98 and 1.0834, respectively.

If the greenback extends its downtrend, it is likely to find

support around 1.31 against the pound, 148.00 against the yen and

1.10 against the euro.

The greenback edged down to 0.8642 against the Swiss franc, from

Friday's closing value of 0.8699. On the downside, 0.85 is seen as

the next support level for the greenback.

Against Australia, the New Zealand and the Canadian dollars, the

greenback slid to a 1-week low of 0.6620, nearly a 2-week low of

0.6016 and a 4-day low of 1.3892 from last week's closing quotes of

0.6559, 0.5963 and 1.3950, respectively. The next possible downside

target for the greenback is seen around 0.67 against the aussie,

0.61 against the kiwi and 1.37 against the loonie.

Looking ahead, Eurozone HCOB Eurozone manufacturing PMI for

October and Sentix investor confidence for November are set to be

released in the European session.

In the New York session, U.S. factory orders for September and

total vehicle sales data for October are slated for release.

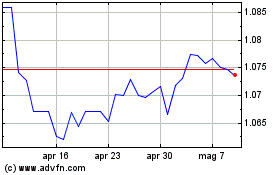

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Feb 2025 a Mar 2025

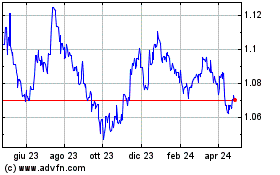

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Mar 2024 a Mar 2025