U.S. Dollar Lower After Soft Retail Sales Data

17 Marzo 2025 - 3:41PM

RTTF2

The U.S. dollar fell against its most major counterparts in the

New York session on Monday, following the release of weak retail

sales data that boosted Fed rate cut expectations.

Data from the Commerce Department showed that retail sales rose

by 0.2 percent in February after tumbling by a revised 1.2 percent

in January.

Economists had expected retail sales to climb by 0.7 percent

compared to the 0.9 percent slump originally reported for the

previous month.

Excluding a decrease in sales by motor vehicle and parts

dealers, retail sales increased by 0.3 percent in February after

falling by 0.6 percent in January. Ex-auto sales were expected to

rise by 0.5 percent.

The Federal Reserve is scheduled to announce its interest rate

decision on Wednesday.

While the Fed is expected to leave interest rates unchanged,

traders will look to the accompanying statement as well as

officials' latest projections for clues about the outlook for

rates.

The greenback declined to a 5-day low of 1.0929 against the

euro, 6-day low of 0.8797 against the franc and more than a 4-month

low of 1.2994 against the pound. The greenback is poised to

challenge support around 1.12 against the euro, 0.85 against the

franc and 1.31 against the pound.

The greenback dropped to a 3-week low of 0.6387 against the

aussie, 10-day low of 1.4282 against the loonie and more than a

3-month low of 0.5821 against the kiwi. The currency is likely to

locate support around 0.65 against the aussie, 1.38 against the

loonie and 0.60 against the kiwi.

In contrast, the greenback hovered at a 5-day high of 147.09

against the yen. The currency is seen finding resistance around the

152.00 level.

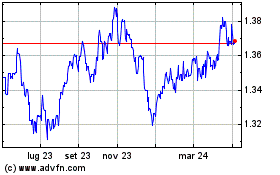

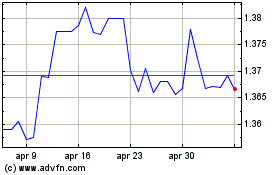

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Feb 2025 a Mar 2025

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Mar 2024 a Mar 2025