Interim Results: 1 May 2023 – 31 October 2023

Vast Resources plc / Ticker: VAST / Index: AIM /

Sector: Mining

31 January 2024

Vast Resources plc

(‘Vast’ or the ‘Company’)

Interim Results: 1 May 2023 – 31 October

2023

Vast Resources plc, the AIM-listed mining

company, is pleased to announce that it has released its unaudited

interim report and financial results for period from 1 May 2023 to

31 October 2023.

The report can be found on the Company’s website at the

following address:

https://www.vastplc.com/investor-information/document-downloads

Market Abuse Regulation (MAR)

Disclosure

Certain information contained within this

announcement is deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014 as it forms part of UK Domestic Law by virtue of the

European Union (Withdrawal) Act 2018 (“UK MAR”) until the release

of this announcement.

**ENDS**

For further information, visit

www.vastplc.com or please contact:

Vast

Resources plc

Andrew Prelea (CEO)

|

www.vastplc.com

+44 (0) 20 7846 0974 |

Beaumont

Cornish – Financial & Nominated Advisor

Roland Cornish

James Biddle

|

www.beaumontcornish.com

+44 (0) 20 7628 3396 |

Shore

Capital Stockbrokers Limited – Joint Broker

Toby Gibbs / James Thomas (Corporate Advisory)

|

www.shorecapmarkets.co.uk

+44 (0) 20 7408 4050 |

Axis

Capital Markets Limited – Joint Broker

Richard Hutchinson

|

www.axcap247.com

+44 (0) 20 3206 0320 |

St Brides

Partners Limited

Susie Geliher / Zoe Briggs |

www.stbridespartners.co.uk

+44 (0) 20 7236 1177 |

ABOUT VAST RESOURCES PLC

Vast Resources plc is a United Kingdom AIM

listed mining company with mines and projects in Romania,

Tajikistan, and Zimbabwe.

In Romania, the Company is focused on the rapid

advancement of high-quality projects by recommencing production at

previously producing mines.

The Company's Romanian portfolio includes 100%

interest in Vast Baita Plai SA which owns 100% of the producing

Baita Plai Polymetallic Mine, located in the Apuseni Mountains,

Transylvania, an area which hosts Romania's largest polymetallic

mines. The mine has a JORC compliant Reserve & Resource Report

which underpins the initial mine production life of approximately

3-4 years with an in-situ total mineral resource of 15,695 tonnes

copper equivalent with a further 1.8M-3M tonnes exploration target.

The Company is now working on confirming an enlarged exploration

target of up to 5.8M tonnes.

The Company also owns the Manaila Polymetallic

Mine in Romania, which the Company is looking to bring back into

production following a period of care and maintenance. The Company

has also been granted the Manaila Carlibaba Extended Exploitation

Licence that will allow the Company to re-examine the exploitation

of the mineral resources within the larger Manaila Carlibaba

licence area.

Vast has an interest in a joint venture company

which provides exposure to a near term revenue opportunity from the

Takob Mine processing facility in Tajikistan. The Takob Mine

opportunity, which is 100% financed, will provide Vast with a 12.25

percent royalty over all sales of non-ferrous concentrate and any

other metals produced. Vast has also been contractually appointed

to manage and develop the Aprelevka Gold Mines located along the

Tien Shan Belt that extends through Central Asia, currently

producing approximately 11,600 oz of gold and 116,000 oz of silver

per annum. It is the intention to increase production closer to

historical peak production of 27,000 oz gold and 250,000 oz silver.

Vast will be entitled to a 4.9% effective interest in the mines

with the option to acquire equity in the future.

The Company retains a continued presence in

Zimbabwe in respect of the Historic claims.

Overview of the Interim Results for the

six months to 31 October 2023

Financial

- 7.4% decrease in revenues for the

six month period ended 31 October 2023 (US$1.791 million) compared

to the six month period ended 31 October 2022 ($1.934 million) due

mainly due to a reduction in consultancy revenues.

- 4.4% decrease in administrative and

overhead expenses for the six month period ended 31 October 2023

(US$1.848 million) compared to the six month period ended 31

October 2022 (US$1.934 million). Administrative and overhead

expenses for the six month period ended 31 October 2023 (US$1.848

million) are lower compared to the six month period ended 30 April

2023 (US$1.946 million).

- A decrease in losses after taxation

in the six month period ended 31 October 2023 (US$6.220 million)

compared to the six month period ended 31 October 2022 (US$6.779

million). Eliminating the effects of foreign exchange gains and

losses, the loss for the period has decreased 4.6% from US$5.094

million for the six month period ended 31 October 2022 to US$4.861

million for the six month period ended 31 October 2023.

- Foreign exchange loss of US$1.359

million for the period compared to a loss of US$1.685 million for

the six month period ended 31 October 2022. These losses are

substantially offset by exchange gains on translation of foreign

operations.

- Cash balances at the end of the

period US$0.964 million compared to $0.604 million as at 31 October

2022.

- Debt of US$9.825 million at the end

of the period compared to US$9.169 million at 30 April 2023.

Operational Development

- Initial drilling results for BPPM

received after the year end were very encouraging confirming the

potential to extend the mining area.

- On 14 July 2023, an employee was

fatally injured in a mine transportation incident. The Directors

and Management of Vast express their sincere condolences to the

family and colleagues of the deceased.

- Execution of first shipment to

Trafigura of lead and zinc concentrate from the Takob mine in

Tajikistan.

Post period end:

- On 16 January 2024, Bay Square Ltd

acquired the entire share capital of Gulf International Minerals

Ltd (‘Gulf’). Gulf has a 49% interest in an undertaking with the

Government of Tajikistan (holding 51%) which owns the Joint

Tajik-Canadian Limited Liability Company, Aprelevka. Vast has been

contractually appointed to manage and develop the Aprelevka gold

mines in the Tien Shan Belt of Tajikistan on behalf of the

owners.

- Execution of a three-year marketing

agreement with a Swiss investment company for the exclusive

distribution of high grade PGM concentrates produced within the EU.

Vast will receive a 2.5% commission based on the sales value of the

concentrates distributed under this agreement.

Funding

Share issues during the period: gross proceeds /

consideration before cost of issue

|

£ |

$ |

Shares Issued |

Issued to |

|

3,520,350 |

4,409,350 |

1,419,000,000 |

Placing with investors |

|

3,520,350 |

4,409,350 |

1,419,000,000 |

|

Post period end:

|

£ |

$ |

Shares Issued |

Issued to |

|

1,255,625 |

1,594,643 |

1,225,000,000 |

Placing with investors |

|

1,255,625 |

1,594,643 |

1,225,000,000 |

|

Debt Funding

The Company agreed a further debt extension with

Alpha and Mercuria to 30 November 2023 and subsequent to the period

end, agreed a further extension to 31 January 2024 with a period of

one month to 29 February 2024 to effect repayment. The original

maturity date for these facilities was 15 May 2023 and this has

been extended on several occasions. The Company has been in

continuing discussions with Mercuria and Alpha for extensions in

the repayment date for the totality of the debt owed so as to allow

further time to realise the proceeds associated with a historic

claim in its operations. Alpha and Mercuria continue to remain

supportive.

Board and Management

We were very saddened by the passing of Andrew

Hall, Commercial Director of Vast Resources. Andrew joined the Vast

team in 2018 and has been a very valued member of the team. He will

be greatly missed and fondly remembered.

CHAIRMAN’S STATEMENT

The Group continues to make progress in its core

operations. Initial results from our current drilling program at

Baita Polymetallic Mine (‘BPPM’) have been very encouraging

confirming the potential to significantly expand the mining area.

In Tajikistan, the Group executed its first shipment of lead and

zinc concentrate, and subsequent to the period end, begins its

participation in the management and development of the Aprelevka

gold mines in the Tien Shan Belt [of Tajkiistan]. I believe this

reaffirms the underlying potential of the Group and Andrew expands

on this theme in his report.

After the period end, the Company entered into

an exclusive marketing agreement for the distribution of high grade

PGM concentrate and for which we have received our first offer.

This offers an exciting opportunity for the Company, and we hope to

expand this trading relationship in the future. We believe it will

bring significant revenue and further collaborative

opportunities.

Our lenders have been and continue to be very

supportive. We have agreed a number of debt extensions in order to

allow the Company to repay the loans with the proceeds associated

with an historic claim. The current extension is to 31 January 2024

with a period of one month to 29 February 2024 to effect repayment.

Substantial progress has been regarding the historic claim, with

further inroads having been made during the period.

Very sadly, on 14 July 2023, a mine employee at

BPPM was fatally injured in a mine transportation incident. We were

also very saddened by the sudden passing of Andrew Hall, Commercial

Director of Vast. Andrew joined the Vast team in 2018 and has been

a very valued member of the team. Our thoughts go out to their

families, friends, and colleagues.

I wish all our stakeholders well in these

difficult times and, as always, remain committed to the safety of

our employees and the communities in which we operate.

Brian Moritz

Chairman

CHIEF EXECUTIVE OFFICER’S

REPORT

As previously reported, the Group began a

drilling campaign at BPPM with the objective of establishing an

enlarged JORC compliant Mineral Resource potentially upgrading the

existing Mineral Resource with the inclusion of a JORC compliant

Exploration Target of 11.65 to 12.65 million tonnes. Initial

results received during the period were very encouraging confirming

the potential to extend the mining area. Current production, having

improved from low historical levels, is still not at the level we

would like. Given the potential of the mine, and the incorporation

of new data from the drilling campaign, it is important that we

continue to invest further to ensure that we can increase

productivity and smooth natural grade variability. Our primary

focus is on accelerating the development of the decline to access

the higher-grade ore. This investment will realise significant

reduction in both underground fuel consumption and transportation

times, resulting in significant productivity gains. The development

provides accelerated access to high grades at depth versus current

working areas, maximising the value of existing concentrate

production by enhancing the grade.

Our Manaila Polymetallic Mine (MPM) continued to

remain on care and maintenance during the period and we plan to

restart production once we have successfully engaged new lenders

for the project.

Tajikistan provides the Company with an exciting

opportunity to develop local mining and production capabilities in

partnership with Takob. The Company executed its first shipment to

Trafigura of lead and zinc concentrate from the Takob mine in

Tajikistan and on 16 January 2024 was appointed to manage and

develop the Aprelevka gold mines located along the Tien Shan Belt

that extends through Central Asia, currently producing

approximately 11,600 oz of gold and 116,000 oz of silver per annum.

It is the intention to increase production closer to historical

peak production of 27,000 oz gold and 250,000 oz silver. Vast will

be entitled to a 4.9% effective interest in the mines with the

option to acquire equity in the future.

After the period end, the Company executed a

three-year marketing agreement with a Swiss investing company for

the exclusive distribution of high grade PGM concentrates produced

within the EU. Vast will receive a 2.5% commission based on the

final sales value of the concentrate distributed under the

agreement. Vast has commenced to market the product and as

announced on 22 January 2024, has received an offer and is in the

process of finalising execution. This marks the beginning of an

important additional revenue stream for Vast. We anticipate that

this agreement will result in further collaborative opportunities

that will strengthen the operating capabilities of the Company.

We were very saddened on 14 July 2023 by a

fatality at BPPM. An employee was fatality injured in a mine

transportation incident. Very sadly, we also lost Andrew Hall,

Commercial Director of Vast, who passed away at the end of

November. Andrew was a highly valued part of the team and will be

missed very much. Our thoughts go out to their family, friends, and

colleagues.

Many thanks to fellow Board members and

management for the commitment and hard work that has been put into

the Group. I thank all our stakeholders for their continued

support.

Andrew Prelea

Chief Executive Officer

Condensed consolidated statement of

comprehensive income

for the six months ended 31 October 2023

|

|

|

31 Oct 2023 |

30 Apr 2023 |

31 Oct 2022 |

|

|

|

6 Months |

12 Months |

6 Months |

|

|

|

Group |

Group |

Group |

|

|

|

Unaudited |

Audited |

Unaudited |

|

|

Note |

$’000 |

$’000 |

$’000 |

| Revenue |

|

1,791 |

3,720 |

1,934 |

| Cost of

sales |

|

(2,989) |

(8,402) |

(3,827) |

| Gross

loss |

|

(1,198) |

(4,682) |

(1,893) |

| Overhead

expenses |

|

(3,836) |

(3,454) |

(3,983) |

|

Depreciation of property, plant and equipment |

|

(308) |

(706) |

(352) |

|

Profit / (loss) on sale of property, plant and equipment |

|

- |

- |

- |

|

Share option and warrant expense |

|

(329) |

(274) |

- |

|

Sundry income |

|

8 |

(5) |

(12) |

|

Exchange gain / (loss) |

|

(1,359) |

1,411 |

(1,685) |

|

Other administrative and overhead expenses |

|

(1,848) |

(3,880) |

(1,934) |

| |

|

|

|

|

| Fair value

movement in available for sale investments |

|

- |

- |

- |

| Loss

from operations |

|

(5,034) |

(8,136) |

(5,876) |

| Finance

income |

|

- |

- |

- |

| Finance

expense |

|

(1,186) |

(2,370) |

(903) |

| Loss

before taxation from continuing operations |

|

(6,220) |

(10,506) |

(6,779) |

| Taxation

charge |

|

- |

- |

- |

| Total

(loss) taxation for the period |

|

(6,220) |

(10,506) |

(6,779) |

| Other

comprehensive income |

|

|

|

|

| Items that may

be subsequently reclassified to either profit or loss |

|

|

|

|

| (Loss) / gain

on available for sale financial assets |

|

- |

- |

- |

| Exchange gain

/(loss) on translation of foreign operations |

|

1,132 |

(1,197) |

1,219 |

| Total

comprehensive expense for the period |

|

(5,088) |

(11,703) |

(5,560) |

|

|

|

|

|

|

| Total

profit / (loss) attributable to: |

|

|

|

|

| - the

equity holders of the parent company |

|

(6,220) |

(10,506) |

(6,779) |

| -

non-controlling interests |

|

- |

- |

- |

|

|

|

(6,220) |

(10,506) |

(6,779) |

| Total

comprehensive profit / (loss) attributable to: |

|

|

|

|

| - the

equity holders of the parent company |

|

(5,088) |

(11,703) |

(5,560) |

| -

non-controlling interests |

|

- |

- |

- |

|

|

|

(5,088) |

(11,703) |

(5,560) |

| (Loss)

per share - basic and diluted - amount in cents ($) |

4 |

(0.19) |

(0.56) |

(0.51) |

Condensed consolidated statement of

changes in equity

|

|

Share capital |

Share premium |

Share option reserve |

Foreign currency translation reserve |

Retained deficit |

Total |

|

|

$’000 |

$’000 |

$’000 |

$’000 |

$’000 |

$’000 |

| At 30

April 2022 |

41,458 |

94,707 |

2,574 |

(376) |

(136,234) |

2,129 |

| Total

comprehensive loss for the period |

- |

- |

- |

1,219 |

(6,779) |

(5,560) |

| Share option

and warrant charges |

- |

- |

- |

- |

- |

- |

| Share options

and warrants lapsed |

- |

- |

- |

- |

- |

- |

| Share warrants

issued to lenders |

- |

- |

277 |

- |

- |

277 |

| Shares

issued: |

|

|

|

|

|

|

| - for cash

consideration |

1,265 |

4,189 |

- |

- |

- |

5,454 |

| - to settle

liabilities |

630 |

1,120 |

- |

- |

- |

1,750 |

| At 31

October 2022 |

43,353 |

100,016 |

2,851 |

843 |

(143,013) |

4,050 |

| Total

comprehensive loss for the period |

- |

- |

- |

(2,416) |

(3,727) |

(6,143) |

| Share option

and warrant charges |

- |

- |

274 |

- |

- |

274 |

| Share options

and warrants lapsed |

- |

- |

(2,193) |

- |

2,193 |

- |

| Share warrants

issued to lenders |

- |

- |

- |

|

|

- |

| Shares

issued: |

|

|

|

|

|

|

| - for cash

consideration |

1,020 |

3,342 |

- |

- |

- |

4,362 |

| - to settle

liabilities |

- |

- |

- |

- |

- |

- |

| At 30

April 2023 |

44,373 |

103,358 |

932 |

(1,573) |

(144,547) |

2,543 |

| Total

comprehensive loss for the period |

- |

- |

- |

1,132 |

(6,220) |

(5,088) |

| Share option

and warrant charges |

- |

- |

329 |

- |

- |

329 |

| Share options

and warrants lapsed |

- |

- |

- |

- |

- |

- |

| Share warrants

issued to lenders |

- |

- |

- |

- |

- |

- |

| Shares

issued: |

|

|

|

|

|

|

| - for cash

consideration |

1,760 |

2,274 |

- |

- |

- |

4,034 |

| - to settle

liabilities |

- |

- |

- |

- |

- |

- |

| At 31

October 2023 |

46,133 |

105,632 |

1,261 |

(441) |

(150,767) |

1,818 |

for the six months ended 31 October 2023

Condensed consolidated statement of

financial position

As at 31 October 2023

|

|

|

31 Oct 2023 |

30 Apr 2023 |

31 Oct 2022 |

|

|

|

Unaudited |

Audited |

Unaudited |

|

|

|

Group |

Group |

Group |

|

|

|

$’000 |

$’000 |

$’000 |

|

Assets |

Note |

|

|

|

|

Non-current assets |

|

|

|

|

|

Property, plant and equipment |

3 |

17,351 |

17,840 |

16,502 |

|

Available for sale investments |

|

891 |

891 |

891 |

|

Investment in associates |

|

417 |

417 |

417 |

|

|

|

18,659 |

19,148 |

17,810 |

|

Current assets |

|

|

|

|

|

Inventory |

5 |

1,113 |

973 |

1,234 |

|

Receivables |

6 |

3,560 |

2,936 |

2,734 |

|

Cash and cash equivalents |

|

964 |

530 |

604 |

|

Total current assets |

|

5,637 |

4,439 |

4,572 |

|

Total Assets |

|

24,296 |

23,587 |

22,382 |

|

|

|

|

|

|

|

Equity and Liabilities |

|

|

|

|

|

Capital and reserves attributable to equity holders of the

Parent |

|

|

|

|

|

Share capital |

|

46,133 |

44,373 |

43,353 |

|

Share premium |

|

105,632 |

103,358 |

100,016 |

|

Share option reserve |

|

1,261 |

932 |

2,851 |

|

Foreign currency translation reserve |

|

(441) |

(1,573) |

843 |

|

Retained deficit |

|

(150,767) |

(144,547) |

(143,013) |

|

|

|

1,818 |

2,543 |

4,050 |

|

Non-controlling interests |

|

- |

- |

- |

|

Total equity |

|

1,818 |

2,543 |

4,050 |

|

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

Loans and borrowings |

7 |

- |

- |

- |

|

Provisions |

9 |

1,151 |

1,165 |

1,124 |

|

Trade and other payables |

8 |

2,052 |

1,933 |

1,713 |

|

|

|

3,203 |

3,098 |

2,837 |

|

Current liabilities |

|

|

|

|

|

Loans and borrowings |

7 |

9,825 |

9,169 |

8,903 |

|

Trade and other payables |

8 |

9,450 |

8,777 |

6,592 |

|

Total current liabilities |

|

19,275 |

17,946 |

15,495 |

|

Total liabilities |

|

22,478 |

21,044 |

18,332 |

|

Total Equity and Liabilities |

|

24,296 |

23,587 |

22,382 |

Condensed consolidated statement of cash

flow

for the six months ended 31 October 2023

|

|

31 Oct 2023 |

30 Apr 2023 |

31 Oct 2022 |

|

|

Unaudited |

Audited |

Unaudited |

|

|

Group |

Group |

Group |

|

|

$’000 |

$’000 |

$’000 |

|

CASH FLOW FROM OPERATING ACTIVITIES |

|

|

|

|

Profit (loss) before taxation for the period |

(6,220) |

(10,506) |

(6,779) |

|

Adjustments for: |

|

|

|

|

Depreciation and impairment charges |

308 |

706 |

352 |

|

Share option expense |

329 |

274 |

- |

|

Finance expense |

1,186 |

2,370 |

903 |

|

Unrealised foreign currency exchange loss / (gain) |

1,626 |

(1,661) |

1,891 |

|

|

(2,771) |

(8,817) |

(3,633) |

|

Changes in working capital: |

|

|

|

|

Decrease (increase) in receivables |

(624) |

(101) |

100 |

|

Decrease (increase) in inventories |

(140) |

(134) |

(394) |

|

Increase (decrease) in payables |

588 |

2,656 |

373 |

|

|

(176) |

2,421 |

79 |

|

|

|

|

|

|

Taxation paid |

- |

- |

- |

|

|

|

|

|

|

Cash generated by / (used in) operations |

(2,947) |

(6,396) |

(3,554) |

|

|

|

|

|

|

Investing activities: |

|

|

|

|

Payments to acquire property, plant and equipment |

(315) |

(1,896) |

(1,314) |

|

Proceeds on disposal of property, plant and equipment |

1 |

25 |

- |

|

|

|

. |

|

|

Total cash used in investing activities |

(314) |

(1,871) |

(1,314) |

|

|

|

|

|

|

Financing Activities: |

|

|

|

|

Proceeds from the issue of ordinary shares |

4,034 |

9,816 |

5,454 |

|

Proceeds from loans and borrowings granted |

- |

4,500 |

4,265 |

|

Repayment of loans and borrowings |

(339) |

(5,622) |

(4,350) |

|

Total proceeds from financing activities |

3,695 |

8,694 |

5,369 |

|

|

|

|

|

|

Increase (decrease) in cash and cash

equivalents |

434 |

427 |

501 |

|

Cash and cash equivalents at beginning of

period |

530 |

103 |

103 |

|

Cash and cash equivalents at end of period |

964 |

530 |

604 |

Interim report notes

1 Interim

Report

These condensed interim financial statements, which are unaudited,

are for the six months ended 31 October 2023 and consolidate the

financial statements of the Company and all its subsidiaries. The

statements are presented in United States Dollars.

The financial information set out in these

condensed interim financial statements does not constitute

statutory accounts as defined in Section 434(3) of the Companies

Act 2006. The condensed interim financial statements should be read

in conjunction with the consolidated financial statements of the

Group for the period ended 30 April 2023 which have been prepared

in accordance with UK-adopted International Accounting Standards

and the Companies Act 2006. The Auditor's report on those financial

statements was unqualified and did not contain a statement under

s.498(2) or s.498(3) of the Companies Act 2006.

While the Auditors’ report for the period ended

30 April 2023 was unqualified, it did include a material

uncertainty related to going concern, to which the Auditors drew

attention by way of emphasis without qualifying their report. Full

details of these comments are contained in the report of the

Auditors on Pages 24-28 of the annual financial statements for the

period ended 30 April 2023, released elsewhere on this website on

31 October 2023. The accounts for the period have been prepared in

accordance with International Accounting Standard 34 “Interim

Financial Reporting” (“IAS 34”) and the accounting policies are

consistent with those of the annual financial statements for the

period ended 30 April 2023, unless otherwise stated, and those

envisaged for the financial statements for the year ended 30 April

2024.

Changes in Accounting

Policies

At the date of authorisation of these financial statements, a

number of Standards and Interpretations were in issue but were not

yet effective. The Directors do not anticipate that the adoption of

these standards and interpretations, or any of the amendments made

to existing standards as a result of the annual improvements cycle,

will have a material effect on the financial statements in the year

of initial application.

Going concern

After review of the Group’s operations and expectations regarding

the recovery of an historic claim, and ongoing refinancing and

investor discussions, the Directors have a reasonable expectation

that the Group has adequate resources to continue as a going

concern. Accordingly, the Directors continue to adopt the going

concern basis in preparing the unaudited condensed interim

financial statements.

This interim report was approved by the Directors on 30 January

2024.

2

Segmental Analysis

|

|

Mining, exploration, and development |

Admin and corporate |

Total |

|

|

Europe & Central Asia |

Africa |

|

|

|

|

$’000 |

$’000 |

$’000 |

$’000 |

| Year

to 31 October2023 |

|

|

|

|

| Revenue |

1,791 |

- |

- |

1,791 |

| Production

costs |

(2,989) |

- |

- |

(2,989) |

| Gross

profit (loss) |

(1,198) |

- |

- |

(1,198) |

|

Depreciation |

(308) |

- |

- |

(308) |

| Profit (loss)

on sale of property, plant and equipment |

- |

- |

- |

- |

| Share option

and warrant expense |

- |

- |

(329) |

(329) |

| Sundry

income |

8 |

- |

- |

8 |

| Exchange

(loss) gain |

(1,323) |

- |

(36) |

(1,359) |

| Other

administrative and overhead expenses |

(992) |

- |

(856) |

(1,848) |

| Fair value

movement in available for sale investments |

- |

- |

- |

- |

| Finance

income |

- |

- |

- |

- |

| Finance

expense |

(317) |

- |

(869) |

(1,186) |

| Taxation

(charge) |

- |

- |

- |

- |

| Profit

(loss) for the year |

(4,130) |

- |

(2,090) |

(6,220) |

| |

|

|

|

|

| 31

October 2023 |

|

|

|

|

| Total

assets |

22,893 |

- |

1,403 |

24,296 |

| Total

non-current assets |

17,348 |

- |

1,311 |

18,659 |

| Additions to

non-current assets |

315 |

- |

- |

315 |

| Total current

assets |

5,545 |

- |

92 |

5,637 |

| Total

liabilities |

14,642 |

- |

7,836 |

22,478 |

|

|

Mining, exploration, and development |

Admin and corporate |

Total |

|

|

Europe & Central Asia |

Africa |

|

|

|

|

$’000 |

$’000 |

$’000 |

$’000 |

|

Year to 30 April 2023 |

|

|

|

|

|

Revenue |

3,720 |

- |

- |

3,720 |

|

Production costs |

(8,402) |

- |

- |

(8,402) |

|

Gross profit (loss) |

(4,682) |

- |

- |

(4,682) |

|

Depreciation |

(704) |

- |

(2) |

(706) |

|

Share option and warrant expense |

- |

- |

(274) |

(274) |

|

Sundry income |

(5) |

- |

- |

(5) |

|

Exchange (loss) gain |

1,098 |

- |

313 |

1,411 |

|

Other administrative and overhead expenses |

(2,165) |

- |

(1,715) |

(3,880) |

|

Finance expense |

(775) |

- |

(1,595) |

(2,370) |

|

Profit (loss) for the year |

(7,233) |

- |

(3,273) |

(10,506) |

|

|

|

|

|

|

|

30 April 2023 |

|

|

|

|

|

Total assets |

22,290 |

- |

1,297 |

23,587 |

|

Total non-current assets |

17,916 |

- |

1,232 |

19,148 |

|

Additions to non-current assets |

1,595 |

- |

301 |

1,896 |

|

Total current assets |

4,374 |

- |

65 |

4,439 |

|

Total liabilities |

13,937 |

- |

7,107 |

21,044 |

|

|

Mining, exploration, and development |

Admin and corporate |

Total |

|

|

Europe & Central Asia |

Africa |

|

|

|

|

$’000 |

$’000 |

$’000 |

$’000 |

|

Year to 31 October2022 |

|

|

|

|

|

Revenue |

1,934 |

- |

- |

1,934 |

|

Production costs |

(3,827) |

- |

- |

(3,827) |

|

Gross profit (loss) |

(1,893) |

- |

- |

(1,893) |

|

Depreciation |

(352) |

- |

- |

(352) |

|

Sundry income |

(12) |

- |

- |

(12) |

|

Exchange (loss) gain |

(1,561) |

- |

(124) |

(1,685) |

|

Other administrative and overhead expenses |

(788) |

- |

(1,146) |

(1,934) |

|

Finance income |

- |

- |

- |

- |

|

Finance expense |

(385) |

- |

(518) |

(903) |

|

|

|

|

|

|

|

31 October 2022 |

|

|

|

|

|

Total assets |

19,943 |

- |

2,439 |

22,382 |

|

Total non-current assets |

16,839 |

- |

971 |

17,810 |

|

Additions to non-current assets |

1,085 |

- |

229 |

1,314 |

|

Total current assets |

3,104 |

- |

1,468 |

4,572 |

|

Total liabilities |

11,509 |

- |

6,823 |

18,332 |

3 Property,

Plant and equipment

|

Group |

Plant and machinery |

Fixtures, fittings and equipment |

Computer assets |

Motor vehicles |

Buildings and Improvements |

Mining assets |

Capital Work in progress |

Total |

|

|

$’000 |

$’000 |

$’000 |

$’000 |

$’000 |

$’000 |

$’000 |

$’000 |

|

Cost at 1 May 2022 |

3,443 |

72 |

160 |

763 |

3,146 |

12,070 |

2,983 |

22,637 |

|

Additions during the period |

9 |

- |

- |

- |

- |

178 |

1,127 |

1,314 |

|

Reclassification |

297 |

- |

- |

237 |

- |

663 |

(1,197) |

- |

|

Foreign exchange movements |

(177) |

(15) |

(8) |

(89) |

(135) |

(486) |

(129) |

(1,039) |

|

Cost at 31 October 2022 |

3,572 |

57 |

152 |

911 |

3,011 |

12,425 |

2,784 |

22,912 |

|

Additions during the period |

1 |

- |

- |

- |

- |

- |

582 |

583 |

|

Reclassification |

146 |

- |

- |

66 |

- |

28 |

(240) |

- |

|

Disposals during the year |

(5) |

- |

- |

(37) |

- |

(1) |

- |

(43) |

|

Foreign exchange movements |

311 |

18 |

12 |

129 |

237 |

853 |

208 |

1,768 |

|

Cost at 30 April 2023 |

4,025 |

75 |

164 |

1,069 |

3,248 |

13,305 |

3,334 |

25,220 |

|

Additions during the period |

7 |

- |

- |

- |

- |

- |

308 |

315 |

|

Reclassification |

14 |

10 |

- |

18 |

- |

- |

(42) |

- |

|

Disposals during the period |

(1) |

- |

- |

(3) |

- |

- |

- |

(4) |

|

Foreign exchange movements |

(137) |

(15) |

(5) |

(46) |

(92) |

(339) |

(110) |

(744) |

|

Cost at 31 October 2023 |

3,908 |

70 |

159 |

1,038 |

3,156 |

12,966 |

3,490 |

24,787 |

|

Depreciation at 1 May 2022 |

2,838 |

65 |

107 |

190 |

1,037 |

1,584 |

604 |

6,425 |

|

Charge for the period |

146 |

4 |

5 |

24 |

38 |

135 |

- |

352 |

|

Reclassification |

- |

- |

- |

- |

- |

- |

- |

- |

|

Foreign exchange movements |

(148) |

(12) |

(7) |

(60) |

(73) |

(67) |

- |

(367) |

|

Depreciation at 31 October 2022 |

2,836 |

57 |

105 |

154 |

1,002 |

1,652 |

604 |

6,410 |

|

Charge for the period |

116 |

4 |

5 |

37 |

48 |

144 |

- |

354 |

|

Disposals during the period |

(1) |

- |

- |

(16) |

- |

- |

- |

(17) |

|

Reclassification |

- |

(4) |

4 |

- |

- |

- |

- |

- |

|

Foreign exchange movements |

268 |

14 |

11 |

79 |

132 |

129 |

- |

633 |

|

Depreciation at 30 April 2023 |

3,219 |

71 |

125 |

254 |

1,182 |

1,925 |

604 |

7,380 |

|

Charge for the period |

82 |

3 |

5 |

42 |

23 |

153 |

- |

308 |

|

Disposals during the period |

(1) |

- |

- |

(2) |

- |

- |

- |

(3) |

|

Reclassification |

- |

- |

- |

- |

- |

- |

- |

- |

|

Foreign exchange movements |

(107) |

(5) |

(5) |

(25) |

(52) |

(55) |

- |

(249) |

|

Depreciation at 31 October 2023 |

3,193 |

69 |

125 |

269 |

1,153 |

2,023 |

604 |

7,436 |

|

Net book value at 31 October 2022 |

736 |

- |

47 |

757 |

2,009 |

10,773 |

2,180 |

16,502 |

|

Net book value at 30 April 2023 |

806 |

4 |

39 |

815 |

2,066 |

11,380 |

2,730 |

17,840 |

|

Net book value at 31 October 2023 |

715 |

1 |

34 |

769 |

2,003 |

10,943 |

2,886 |

17,351 |

4 Loss

per share

Profit and loss per ordinary share has been

calculated using the weighted average number of ordinary shares in

issue during the relevant financial year.

The weighted average number of ordinary shares

in issue for the period is:

|

|

31 Oct 2023 |

30 Apr 2023 |

31 Oct 2022 |

|

|

Unaudited |

Audited |

Unaudited |

|

|

Group |

Group |

Group |

|

The weighted average number of ordinary shares in issue for the

period is: |

3,250,324,470 |

1,862,916,300 |

1,323,933,416 |

|

Profit / (loss) for the period: ($’000) |

(6,220) |

(10,506) |

(6,779) |

|

Profit / (Loss) per share basic and diluted (cents) |

(0.19) |

(0.56) |

(0.51) |

The effect of all potentially dilutive share

options is anti-dilutive.

5 Inventory

|

|

Oct 2023 |

Apr 2023 |

Oct 2022 |

|

|

Unaudited |

Audited |

Unaudited |

|

|

Group |

Group |

Group |

|

|

$’000 |

$’000 |

$’000 |

|

|

|

|

|

|

Minerals held for sale |

552 |

402 |

634 |

|

Production stockpiles |

6 |

6 |

5 |

|

Consumable stores |

555 |

565 |

595 |

|

|

1,113 |

973 |

1,234 |

6 Receivables

|

|

Oct 2023 |

Apr 2023 |

Oct 2022 |

|

|

Unaudited |

Audited |

Unaudited |

|

|

Group |

Group |

Group |

|

|

$’000 |

$’000 |

$’000 |

|

|

|

|

|

|

Trade receivables |

739 |

215 |

257 |

|

Other receivables |

1,779 |

1,624 |

1,482 |

|

Short term loans |

334 |

335 |

324 |

|

Prepayments |

104 |

125 |

115 |

|

VAT |

604 |

637 |

556 |

|

|

3,560 |

2,936 |

2,734 |

7 Loans

and borrowings

|

|

Oct 2023 |

Apr 2023 |

Oct 2022 |

|

|

Unaudited |

Audited |

Unaudited |

|

|

Group |

Group |

Group |

|

|

$’000 |

$’000 |

$’000 |

|

Non-current |

|

|

|

|

Secured borrowings |

8,967 |

8,213 |

8,161 |

|

Unsecured borrowings |

625 |

728 |

500 |

|

less amounts payable in less than 12 months |

(9,592) |

(8,941) |

(8,661) |

|

|

|

|

|

|

|

- |

- |

- |

|

Current |

|

|

|

|

Secured borrowings |

- |

- |

- |

|

Unsecured borrowings |

232 |

227 |

241 |

|

Bank overdrafts |

1 |

1 |

1 |

|

Current portion of long term borrowings - secured |

8,967 |

8,213 |

8,161 |

|

- unsecured |

625 |

728 |

500 |

|

|

|

|

|

|

|

9,825 |

9,169 |

8,903 |

|

Total loans and borrowings |

9,825 |

9,169 |

8,903 |

8 Trade

and other payables

|

|

Oct 2023 |

Apr 2023 |

Oct 2022 |

|

|

Unaudited |

Audited |

Unaudited |

|

|

Group |

Group |

Group |

|

|

$’000 |

$’000 |

$’000 |

|

|

|

|

|

|

|

|

|

|

|

Trade payables |

3,768 |

3,458 |

3,066 |

|

Other payables |

1,724 |

1,872 |

1,656 |

|

Other taxes and social security taxes |

3,889 |

3,346 |

1,813 |

|

Accrued expenses |

69 |

101 |

57 |

|

|

9,450 |

8,777 |

6,592 |

Vast Baita Plai SA (‘VBP’) established a

repayment schedule on 20 May 2022 to defer the its payroll tax

liability over a five year period. During the period, the Company

has entered into discussions for a new and required restructuring

plan in order to ensure the Company can affordably repay the total

amounts due to the tax authorities. The amounts currently deferred

and disclosed below are consistent with the old plan in existence

and reported on for the year ended 30 April 2023 in line with

management’s current expectations.

|

|

Oct 2023 |

Apr 2023 |

Oct 2022 |

|

|

Unaudited |

Audited |

Unaudited |

|

|

Group |

Group |

Group |

|

|

$’000 |

$’000 |

$’000 |

|

Amounts due between one and two years |

483 |

455 |

495 |

|

Amounts due between two and three years |

615 |

579 |

457 |

|

Amounts due between three and four years |

770 |

725 |

457 |

|

Amounts due between four and five years |

185 |

174 |

304 |

|

|

2,052 |

1,933 |

1,713 |

9 Provisions

|

|

Oct 2023 |

Apr 2023 |

Oct 2022 |

|

|

Unaudited |

Audited |

Unaudited |

|

|

Group |

Group |

Group |

|

|

$’000 |

$’000 |

$’000 |

|

|

|

|

|

|

Provision for rehabilitation of mining properties |

|

|

|

|

- Provision brought forward from previous periods |

1,165 |

1,145 |

1,145 |

|

- Liability recognised during period |

- |

- |

- |

|

- Derecognised on disposal of subsidiary |

- |

- |

- |

|

- Other movements |

(14) |

20 |

(21) |

|

|

1,151 |

1,165 |

1,124 |

10 Contingent liabilities

In the normal course of conducting business in

Romania, the Company’s Romanian businesses are subject to a number

of legal proceedings and claims. These matters comprise claims by

the Romanian tax authorities. The Company records liabilities

related to such matters when management assesses that settlement of

the exposure is probable and can be reasonably estimated. Based on

current information and legal advice, management does not expect

any such proceedings or claims to result in liabilities and

therefore no liabilities have been recorded at 31 October 2023.

However, these matters are subject to inherent uncertainties and

there exists the remote possibility that the outcome of these

proceedings and claims could have a material impact on the

Group.

11 Contingent

assets

As mentioned in the highlights, Chairman’s and

Chief Executive Officer’s report, the Company has an historic claim

in its operations. No asset has been recorded in respect of the

claim.

12 Events

after the reporting date

Share issuance:

|

£ |

$ |

Shares Issued |

Issued to |

|

1,255,625 |

1,594,643 |

1,225,000,000 |

Placing with investors |

|

1,255,625 |

1,594,643 |

1,225,000,000 |

|

On 16 January 2024, the Company was appointed to

manage and develop the Aprelevka gold mines located along the Tien

Shan Belt that extends through Central Asia.

The Company executed a three-year marketing

agreement with a Swiss investing company for the exclusive

distribution of high grade PGM concentrates produced within the

EU.

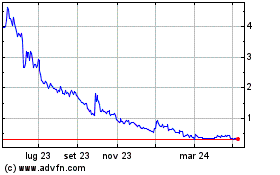

Grafico Azioni Vast Resources (LSE:VAST)

Storico

Da Mar 2025 a Mar 2025

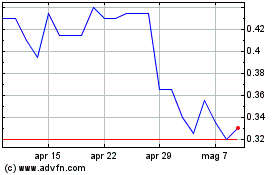

Grafico Azioni Vast Resources (LSE:VAST)

Storico

Da Mar 2024 a Mar 2025