false

0001166691

0001166691

2025-03-19

2025-03-19

0001166691

CMCSA:ClassCommonStock0.01ParValueMember

2025-03-19

2025-03-19

0001166691

CMCSA:Sec0.000NotesDue2026Member

2025-03-19

2025-03-19

0001166691

CMCSA:Sec0.250NotesDue2027Member

2025-03-19

2025-03-19

0001166691

CMCSA:Sec1.500NotesDue2029Member

2025-03-19

2025-03-19

0001166691

CMCSA:Sec0.250NotesDue2029Member

2025-03-19

2025-03-19

0001166691

CMCSA:Sec0.750NotesDue2032Member

2025-03-19

2025-03-19

0001166691

CMCSA:Sec3.250NotesDue2032Member

2025-03-19

2025-03-19

0001166691

CMCSA:Sec1.875NotesDue2036Member

2025-03-19

2025-03-19

0001166691

CMCSA:Sec3.550NotesDue2036Member

2025-03-19

2025-03-19

0001166691

CMCSA:Sec1.250NotesDue2040Member

2025-03-19

2025-03-19

0001166691

CMCSA:Sec5.250NotesDue2040Member

2025-03-19

2025-03-19

0001166691

CMCSA:Sec5.50NotesDue2029Member

2025-03-19

2025-03-19

0001166691

CMCSA:Sec2.0ExchangeableSubordinatedDebenturesDue2029Member

2025-03-19

2025-03-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

March 19, 2025

| Comcast Corporation |

| (Exact Name of Registrant as Specified in its Charter) |

| Pennsylvania |

| (State or Other Jurisdiction of Incorporation) |

| 001-32871 |

|

27-0000798 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| One Comcast Center |

|

|

| Philadelphia, PA |

|

19103-2838 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (215) 286-1700

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of Each Class |

Trading symbol(s) |

Name of Each Exchange on Which Registered |

| Class A Common Stock, $0.01 par value |

CMCSA |

The Nasdaq Stock Market LLC |

| 0.000% Notes due 2026 |

CMCS26 |

The Nasdaq Stock Market LLC |

| 0.250% Notes due 2027 |

CMCS27 |

The Nasdaq Stock Market LLC |

| 1.500% Notes due 2029 |

CMCS29 |

The Nasdaq Stock Market LLC |

| 0.250% Notes due 2029 |

CMCS29A |

The Nasdaq Stock Market LLC |

| 0.750% Notes due 2032 |

CMCS32 |

The Nasdaq Stock Market LLC |

| 3.250% Notes due 2032 |

CMCS32A |

The Nasdaq Stock Market LLC |

| 1.875% Notes due 2036 |

CMCS36 |

The Nasdaq Stock Market LLC |

| 3.550% Notes due 2036 |

CMCS36A |

The Nasdaq Stock Market LLC |

| 1.250% Notes due 2040 |

CMCS40 |

The Nasdaq Stock Market LLC |

| 5.250% Notes due 2040 |

CMCS40A |

The Nasdaq Stock Market LLC |

| 5.50% Notes due 2029 |

CCGBP29 |

New York Stock Exchange |

| 2.0% Exchangeable Subordinated Debentures due 2029 |

CCZ |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

In connection with Comcast Corporation’s planned spin-off of

a strong portfolio of cable channels and complementary digital assets (“SpinCo”), Comcast announced on March 19, 2025 that

David Novak, a director of Comcast, will become non-executive Chairman of the Board of Directors of SpinCo upon completion of the spin-off,

which is expected to occur by the end of 2025. At such time, Mr. Novak will vacate his current position on Comcast’s Board of Directors.

The information contained in Exhibit 99.1 shall not be deemed “filed”

under the Securities Exchange Act of 1934, as amended, or incorporated by reference into its filings under the Securities Act

of 1933, as amended.

Item 9.01(d). Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

COMCAST CORPORATION |

| |

|

|

| |

|

|

| Date: |

March 19, 2025 |

|

By: |

/s/ Elizabeth Wideman |

| |

|

|

|

Name: |

Elizabeth Wideman |

| |

|

|

|

Title: |

Senior Vice President, Senior Deputy General Counsel and Assistant Secretary |

Exhibit 99.1

|

PRESS

RELEASE

Comcast Corporation

One Comcast Center

Philadelphia, PA 19103

www.comcastcorporation.com |

David

Novak to Chair Comcast’s “SpinCo”

Seasoned executive and public company director

to bring significant expertise in strategy, brand development and capital markets to the future publicly traded company board

NEW YORK – March 19, 2025 – Comcast

Corporation (Nasdaq: CMCSA) today announced that David Novak will become Chairman of the Board of Directors of “SpinCo,” the

company’s planned spin-off of select media brands and digital businesses. Mr. Novak previously served as the Co-Founder,

Chairman and CEO of YUM! Brands, Inc. and will bring nearly 40 years of experience leading and growing well-known consumer brands to the

new company’s board.

SpinCo will be a leading independent publicly traded media company comprised

of well-known brands, including USA Network, CNBC, MSNBC, Oxygen, E!, SYFY and Golf Channel, along with complementary

digital assets Fandango, Rotten Tomatoes, GolfNow and SportsEngine.

“As Comcast separates this business, we’re excited that

SpinCo will have the talent and success of David Novak as its new Chairman,” said Brian L. Roberts, Chairman and CEO, Comcast Corporation. “With

David’s track record of driving growth and value creation at public companies, he is the ideal person to assemble and lead a world-class

board. David has been an invaluable member of Comcast’s board and widely recognized as a top CEO – I’m

confident that he will work with Mark Lazarus to give the new company a distinct advantage from day one.”

“David is highly regarded as a strategic leader

with a unique skillset and decades of experience overseeing portfolios of brands and executing the successful spin-off of Yum! Brands

from PepsiCo,” said Mark Lazarus, prospective Chief Executive Officer, SpinCo. “We look forward to working closely

with David as we develop SpinCo’s long-term strategy to maximize the value and potential of our iconic media assets.”

Mr. Novak is the Founder and CEO of David Novak Leadership,

a digital leadership development platform which teaches vital skills to transform people into better leaders. As CEO of YUM! Brands,

Inc. – one of the world’s largest restaurant companies – from 2000 to 2014, he helped grow the company into a global

powerhouse of leading brands with a renowned culture across its franchises.

“It’s an honor to be appointed Chair of SpinCo’s board

during this dynamic time in the media industry,” said Mr. Novak. “This is a unique opportunity to build around

SpinCo’s incredible portfolio of assets alongside some of the top talent in this ever-evolving industry. I look forward

to working closely with Mark and the rest of the leadership team to create the leading independent, modern media company.”

In addition to his current position on Comcast’s

Board of Directors, Mr. Novak sits on the Board of the Lift-a-Life Novak Family Foundation. He previously served as Chairman of the YUM!

Brands Board from 2001 to 2014, Executive Chairman of the YUM! Brands Board from 2015 to 2016 and a Director on the JPMorgan Chase Board

from 2001-2012. Mr. Novak has contributed to or spearheaded a number of philanthropic endeavors throughout his career, including Lead4Change,

The Novak Leadership Institute at the University of Missouri and the Wendy Novak Diabetes Institute, and is the author of several books

dedicated to developing leaders at every stage of life as well as the host of the popular How Leaders Lead Podcast.

Mr.

Novak has received multiple accolades for his CEO leadership, including being named “2012 CEO of the Year” by Chief

Executive magazine, one of the world’s “30 Best CEOs” by Barron’s,

one of the “Top People in Business” by Fortune

Magazine, and one of the “100 Best-Performing CEOs in the World” by Harvard Business Review. He received

the Horatio Alger Award for his commitment to philanthropy and higher education, and the 2012 United Nation’s World Food Program

Leadership Award for Yum! Brands World Hunger Relief.

Upon completion of the spin-off from Comcast, SpinCo will be an industry-leading

news, sports and entertainment business with a defined strategic growth strategy, dedicated management team and stable of marquee brands

that will reach over 65 million U.S. households. The company will be ideally positioned to provide a diverse and differentiated

content offering with live news, sports and entertainment at the centerpiece of its brand-based growth strategy. The assets

making up SpinCo generate approximately $7 billion in revenue annually and the company will be focused on growing its beloved brands,

building audience and expanding monetization.

Mr. Novak will formally assume the role upon completion

of the spin-off, at which time he will vacate his current position on Comcast’s Board of Directors, which he has held since December

2016.

About SpinCo

SpinCo will be a leading independent publicly traded media company comprised

of most of NBCUniversal’s cable television networks, including USA Network, CNBC, MSNBC, Oxygen, E!, SYFY and Golf Channel along

with complementary digital assets Fandango, Rotten Tomatoes, GolfNow, GolfPass, and SportsEngine. The well-capitalized company will have

significant scale as a pure-play set of assets anchored by leading news, sports and entertainment content. The spin-off is expected to

be completed during 2025.

About Comcast Corporation

Comcast Corporation (Nasdaq: CMCSA) is

a global media and technology company. From the connectivity and platforms we provide, to the content and experiences we create, our

businesses reach hundreds of millions of customers, viewers, and guests worldwide. We deliver world-class broadband, wireless, and video

through Xfinity, Comcast Business, and Sky; produce, distribute, and stream leading entertainment, sports, and news through brands including

NBC, Telemundo, Universal, Peacock, and Sky; and bring incredible theme parks and attractions to life through Universal Destinations

& Experiences. Visit www.comcastcorporation.com for more information.

Caution Concerning Forward-Looking Statements

This press release includes statements that may constitute forward-looking

statements. In evaluating these statements, readers should consider various factors, including the risks and uncertainties described in

the “Risk Factors” sections of Comcast’s most recent Annual Report on Form 10-K, its most recent Quarterly Report on

Form 10-Q and other reports filed with the Securities and Exchange Commission (SEC). Factors that could cause actual results to differ

materially from these forward-looking statements include changes in and/or risks associated with: the competitive environment; consumer

behavior; the advertising market; consumer acceptance of the content; programming costs; key distribution and/or licensing agreements;

use and protection of intellectual property; reliance on third-party hardware, software and operational support; keeping pace with technological

developments; cyber attacks, security breaches or technology disruptions; weak economic conditions; acquisitions and strategic initiatives;

operating businesses internationally; natural disasters, severe weather-related and other uncontrollable events; loss of key personnel;

labor disputes; laws and regulations; adverse decisions in litigation or governmental investigations; and other risks described from time

to time in reports and other documents Comcast files with the SEC. Readers are cautioned not to place undue reliance on forward-looking

statements, which speak only as of the date they are made, and involve risks and uncertainties that could cause actual events or actual

results to differ materially from those expressed in any such forward-looking statements. We undertake no obligation to update or revise

publicly any forward-looking statements, whether because of new information, future events or otherwise. The amount and timing of any

dividends and share repurchases are subject to business, economic and other relevant factors.

# # #

Media Contacts:

| SpinCo |

Comcast |

| Keith

Cocozza, (917) 553-0380 |

John

Demming, (215) 429-4744 |

v3.25.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CMCSA_ClassCommonStock0.01ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CMCSA_Sec0.000NotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CMCSA_Sec0.250NotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CMCSA_Sec1.500NotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CMCSA_Sec0.250NotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CMCSA_Sec0.750NotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CMCSA_Sec3.250NotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CMCSA_Sec1.875NotesDue2036Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CMCSA_Sec3.550NotesDue2036Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CMCSA_Sec1.250NotesDue2040Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CMCSA_Sec5.250NotesDue2040Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CMCSA_Sec5.50NotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CMCSA_Sec2.0ExchangeableSubordinatedDebenturesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

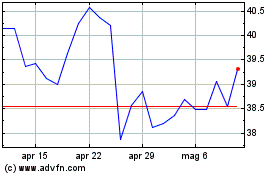

Grafico Azioni Comcast (NASDAQ:CMCSA)

Storico

Da Feb 2025 a Mar 2025

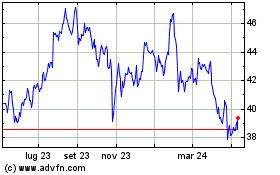

Grafico Azioni Comcast (NASDAQ:CMCSA)

Storico

Da Mar 2024 a Mar 2025