As

filed with the Securities and Exchange Commission on August 20, 2024

Registration

No. 333-274563

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

POST-EFFECTIVE

AMENDMENT NO. 1

TO

FORM S-1 ON

FORM

S-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

DIGITAL

BRANDS GROUP, INC.

(Exact

name of registrant as specified in its charter)

Delaware

(State

or other jurisdiction

of incorporation or organization) |

|

46-1942864

(I.R.S.

Employer

Identification Number) |

1400

Lavaca Street

Austin,

TX 78701

(209)

651-0172

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John

Hilburn Davis IV

President

and Chief Executive Officer

1400

Lavaca Street

Austin,

TX 78701

(209)

651-0172

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Laura

Anthony, Esq.

Craig

D. Linder, Esq.

Anthony,

Linder & Cacomanolis, PLLC

1700

Palm Beach Lakes Blvd., Suite 820

West

Palm Beach, Florida 33401

Telephone:

(561) 514-0936

Approximate

date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If

the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large

accelerated filer |

☐ |

|

Accelerated

filer |

☐ |

| |

Non-accelerated

filer |

☒ |

|

Smaller

reporting company |

☒ |

| |

|

|

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

THE

REGISTRANT HEREBY AMENDS THIS POST-EFFECTIVE AMENDMENT TO THE REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY

ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL

THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT

SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

EXPLANATORY

NOTE

The

Registrant filed (A) a registration statement on Form S–1 (File No. 333-274563) with the Securities and Exchange Commission (the

“SEC”) on September 18, 2023, which was amended on September 21, 2023, and declared effective on September 25, 2023 (the

“Resale Registration Statement”) registering the issuance of up to an aggregate of 1,580,166 shares of our common stock,

par value $0.0001 per share, consisting of 32,000 shares of common stock, up to 481,875 shares of common stock issuable upon exercise

of pre-funded warrants (the “Pre-Funded Warrants”), up to 513,875 shares of common stock issuable upon exercise of Series

A Warrants (the “Series A Warrants”), up to 513,875 shares of common stock issuable upon exercise of Series B Warrants (the

“Series B Warrants) and 38,541 shares of common stock issuable upon exercise of placement agent warrants (the “Placement

Agent Warrants”). Subsequently, the Registrant filed a prospectus with respect to such Resale Registration Statement on September

25, 2023, as well as a prospectus supplement to such Resale Registration Statement on May 7, 2024.

If

any securities previously registered under the Resale Registration Statement (File No. 333-274563) were sold under the Resale Registration

Statement or pursuant to the exemption from registration provided by Rule 144, the amount of previously registered securities so sold

will not be included in the prospectus hereunder.

This

Post-Effective Amendment No. 1 to Form S-1 on Form S-3, is being filed to (i) convert the registration statement on Form S-1 into a registration

statement on Form S-3 and (ii) include an updated prospectus relating to the registration of Common Stock for issuance by the Registrant

and the offering and sale of Common Stock that was registered for resale by the selling security holders named in the prospectus to this

Post-Effective Amendment No. 1 to Form S-1 on Form S-3. Pursuant to Rule 429, Post-Effective Amendment No. 1 to Form S-1 on Form S-3

upon effectiveness will serve as a post-effective amendment to the Resale Registration Statement (File No. 333-274563).

No

additional securities are being registered under this Post-Effective Amendment No. 1 to Form S-1 on Form S-3 and all applicable registration

and filing fees were paid at the time of the original filing of the registration statement.

THE

INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT

FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES, AND IT IS NOT

SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Subject

to Completion, dated August 20, 2024

PROSPECTUS

DIGITAL

BRANDS GROUP, INC.

COMMON

STOCK, $0.0001 PAR VALUE

687,541 SHARES

This

prospectus relates to the resale, from time to time, of up to 687,541 shares of our common stock, par value $0.0001 per share (“Common

Stock”), by the selling stockholders named herein. On or around August 31, 2023, we entered into a securities purchase agreement

(the “Agreement”) with Armistice Capital Master Fund Ltd. (the “Investor”). Pursuant to the Agreement, the Company

issued to the Investor a Series A common share purchase warrant to purchase up to 513,875 shares of Common Stock (“Series A Warrant”)

and Series B common share purchase warrant to purchase up to 513,875 shares of Common Stock (“Series B Warrant”, and collectively

with the Series A Warrant, the “Warrants”) on or around September 5, 2023, pursuant to Section 4(a)(2) of the Securities

Act of 1933, as amended (“Securities Act”), each at an initial exercise price equal to $9.43 per share of Common Stock. The

Series A Warrant is exercisable immediately upon issuance and expires five and one-half (5.5) years following the issuance date and the

Series B Warrant is exercisable immediately upon issuance and expires fifteen (15) months following the issuance date. On May 3, 2024,

we entered into an inducement offer to exercise of the Warrants (the “Inducement Agreement”) with the Investor, pursuant

to which the Company agreed to reduce the exercise price of such Warrants to $3.13 per share of Common Stock and the Investor exercised

the Warrants into 1,027,750 shares of Common Stock. Such shares of Common Stock may only be issued in accordance with the beneficial

ownership limitations in the Inducement Agreement, with the balance to be held in abeyance, which abeyance shall be evidenced through

the Warrants and shall be deemed prepaid thereafter (including the cash payment in full of the exercise price), and exercised pursuant

to a Notice of Exercise in the Warrants (provided no additional exercise price shall be due and payable). The balance of Common Stock

currently held in abeyance under the Warrants is 649,000 shares of Common Stock.

In

connection with the Agreement, we entered into an engagement agreement with H.C. Wainwright & Co., LLC (“Wainwright”),

pursuant to which we have, among other things, issued to Wainwright’s designees warrants to purchase up to 38,541 shares of Common

Stock (the “Wainwright Warrants”). The terms of the Wainwright Warrants are substantially the same as the terms of the Series

A Warrant except that they have an exercise price of $12.1625 per share.

Pursuant

to the Inducement Agreement, the Company is required to file a registration statement to register the resale of the shares of Common

Stock issuable upon exercise of the Warrants within 30 calendar days of the date of the Inducement Agreement.

We

are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of shares by any Selling

Stockholders, however, we will receive proceeds from the exercise of the Warrants and/or Wainwright Warrants if the Warrants and/or Wainwright

Warrants are exercised for cash. The Selling Stockholders may sell the shares of Common Stock underlying the Warrants and Wainwright

Warrants described in this prospectus in a number of different ways and at varying prices. We provide more information about how the

Selling Stockholders may resell its shares of our Common Stock underlying the Warrants and Wainwright Warrants in the section titled

“Plan of Distribution” beginning on page 8. We will pay the expenses incurred in registering the shares, including legal

and accounting fees.

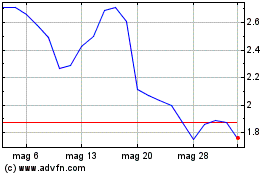

Our

Common Stock and Class A Warrants trade on The Nasdaq Capital Market under the symbols “DBGI” and “DBGIW,” respectively.

On August 9, 2024, the last reported sale price of our Common Stock was $1.06 per share and Class A Warrants was $11.21 per share. Prospective

purchasers of our securities are urged to obtain current information as to the market prices of our Common Stock and Class A Warrants.

Investing

in our securities involves risks. Before deciding whether to invest in our securities, you should consider carefully the risks that we

have described on page 3 of this prospectus under the caption “Risk Factors.”

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is [●], 2024.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC. This prospectus does

not contain all of the information included in the registration statement. For a more complete understanding of the offering of the securities,

you should refer to the registration statement, including its exhibits. This prospectus, together with the documents incorporated by

reference into this prospectus, includes all material information relating to the offering of securities under this prospectus. You should

carefully read this prospectus, the information and documents incorporated herein by reference and the additional information under the

heading “Where You Can Find More Information” before making an investment decision.

We

and the Selling Stockholders have not authorized anyone to provide you with information different from that contained or incorporated

by reference in this prospectus. No dealer, salesperson or other person is authorized to give any information or to represent anything

not contained or incorporated by reference in this prospectus. We and the Selling Stockholders take no responsibility for, and can provide

no assurances as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the

securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the

information in this prospectus or any prospectus supplement is accurate only as of the date on the front of the document and that any

information incorporated herein by reference is accurate only as of the date of the document incorporated by reference, regardless of

the time of delivery of this prospectus or any sale of a security.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference in the accompanying prospectus were made solely for the benefit of the parties to such agreement, including,

in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless

the context otherwise requires, references to “we,” “our,” “us,” or the “Company” in

this prospectus mean Digital Brands Group, Inc., together with its subsidiaries.

PROSPECTUS

SUMMARY

The

following is a summary of what we believe to be the most important aspects of our business and a general description of the securities

that may be offered for resale or other disposition by the Selling Stockholders. We urge you to read this entire prospectus, including

the more detailed consolidated financial statements, notes to the consolidated financial statements and other information incorporated

by reference from our other filings with the SEC. Investing in our securities involves risks. Therefore, carefully consider the risk

factors set forth in our most recent annual and quarterly filings with the SEC, as well as other information in this prospectus and the

documents incorporated by reference herein, before purchasing our securities. Each of the risk factors could adversely affect our business,

operating results and financial condition, as well as adversely affect the value of an investment in our securities.

Overview

Digital

Brands Group is a curated collection of lifestyle brands, including Bailey 44, DSTLD, Stateside, Sundry and ACE Studios, that offers

a variety of apparel products through direct-to-consumer and wholesale distribution. Our complementary brand portfolio provides us with

the unique opportunity to cross merchandise our brands. We aim for our customers to wear our brands head to toe and to capture what we

call “closet share” by gaining insight into their preferences to create targeted and personalized content specific to their

cohort. Operating our brands under one portfolio provides us with the ability to better utilize our technological, human capital and

operational capabilities across all brands. As a result, we have been able to realize operational efficiencies and continue to identify

additional cost saving opportunities to scale our brands and overall portfolio.

Our

portfolio currently consists of four significant brands that leverage our three channels: our websites, wholesale and our own stores.

●

Bailey 44 combines beautiful, luxe fabrics and on-trend designs to create sophisticated ready-to-wear capsules for women on-the-go.

Designing for real life, this brand focuses on feeling and comfort rather than how it looks on a runway. Bailey 44 is primarily a wholesale

brand, which we are transitioning to a digital, direct-to-consumer brand.

●

DSTLD offers stylish high-quality garments without the luxury retail markup valuing customer experience over labels. DSTLD is

primarily a digital direct-to-consumer brand, to which we recently added select wholesale retailers to generate brand awareness.

●

Stateside is an elevated, America first brand with all knitting, dyeing, cutting and sewing sourced and manufactured locally in

Los Angeles. The collection is influenced by the evolution of the classic T-shirt offering a simple yet elegant look. Stateside is primarily

a wholesale brand that we will be transitioning to a digital, direct-to-consumer brand.

●

Sundry offers distinct collections of women’s clothing, including dresses, shirts, sweaters, skirts, shorts, athleisure

bottoms and other accessory products. Sundry’s products are coastal casual and consist of soft, relaxed and colorful designs that

feature a distinct French chic, resembling the spirits of the French Mediterranean and the energy of Venice Beach in Southern California.

Sundry is primarily a wholesale brand that we will be transitioning to a digital, direct-to-consumer brand.

We

believe that successful apparel brands sell in all revenue channels. However, each channel offers different margin structures and requires

different customer acquisition and retention strategies. We were founded as a digital-first retailer that has strategically expanded

into select wholesale and direct retail channels. We strive to strategically create omnichannel strategies for each of our brands that

blend physical and online channels to engage consumers in the channel of their choosing. Our products are sold direct-to-consumers principally

through our websites and our own showrooms, but also through our wholesale channel, primarily in specialty stores and select department

stores. With the continued expansion of our wholesale distribution, we believe developing an omnichannel solution further strengthens

our ability to efficiently acquire and retain customers while also driving high customer lifetime value.

We

believe that by leveraging a physical footprint to acquire customers and increase brand awareness, we can use digital marketing to focus

on retention and a very tight, disciplined high value new customer acquisition strategy, especially targeting potential customers lower

in the sales funnel. Building a direct relationship with the customer as the customer transacts directly with us allows us to better

understand our customer’s preferences and shopping habits. Our substantial experience as a company originally founded as a digitally

native-first retailer gives us the ability to strategically review and analyze the customer’s data, including contact information,

browsing and shopping cart data, purchase history and style preferences. This in turn has the effect of lowering our inventory risk and

cash needs since we can order and replenish product based on the data from our online sales history, replenish specific inventory by

size, color and SKU based on real times sales data, and control our mark-down and promotional strategies versus being told what mark

downs and promotions we have to offer by the department stores and boutique retailers.

We

define “closet share” as the percentage (“share”) of a customer’s clothing units that (“of closet”)

she or he owns in her or his closet and the amount of those units that go to the brands that are selling these units. For example, if

a customer buys 20 units of clothing a year and the brands that we own represent 10 of those units purchased, then our closet share is

50% of that customer’s closet, or 10 of our branded units divided by 20 units they purchased in entirety. Closet share is a similar

concept to the widely used term wallet share, it is just specific to the customer’s closet. The higher our closet share, the higher

our revenue as higher closet share suggests the customer is purchasing more of our brands than our competitors.

We

have strategically expanded into an omnichannel brand offering these styles and content not only on-line but at selected wholesale and

retail storefronts. We believe this approach allows us opportunities to successfully drive Lifetime Value (“LTV”) while increasing

new customer growth. We define Lifetime Value or LTV as an estimate of the average revenue that a customer will generate throughout their

lifespan as our customer. This value/revenue of a customer helps us determine many economic decisions, such as marketing budgets per

marketing channel, retention versus acquisition decisions, unit level economics, profitability and revenue forecasting.

We

acquired Bailey in February 2020, Stateside in August 2021 and Sundry in December 2022. We agreed on the consideration that we paid in

each acquisition in the course of arm’s length negotiations with the holders of the membership interests in each of Bailey, H&J,

Stateside and Sundry. In determining and negotiating this consideration, we relied on the experience and judgment of our management and

our evaluation of the potential synergies that could be achieved in combining the operations of Bailey, Stateside and Sundry. We did

not obtain independent valuations, appraisals or fairness opinions to support the consideration that we paid/agreed to pay.

Company

Information

We

were incorporated in Delaware in January 2013 under the name Denim.LA, Inc, and changed our name to Digital Brands Group, Inc. in December

2020. Our corporate offices are located at 1400 Lavaca Street, Austin, TX 78701. Our telephone number is (209) 651-0172. Our website

is www.digitalbrandsgroup.co. None of the information on our website or any other website identified herein is part of this prospectus

or the registration statement of which it forms a part.

THE

OFFERING

We

are registering for resale by the selling stockholders named herein the 687,541 shares as described below:

| Securities

Offered |

|

687,541

shares of our common stock issuable upon exercise of Warrants and Wainwright Warrants acquired by the selling stockholders in private

placement transactions on September 5, 2023. |

| |

|

|

| Use

of Proceeds |

|

We

will not receive any of the proceeds from the sale or other disposition of shares of our common stock by the selling stockholders,

or from the exercise of the Warrants since the Warrants are deemed prepaid, however, we will receive proceeds from the exercise of

the Wainwright Warrants if the Wainwright Warrants are exercised for cash and retain broad discretion over the use of such proceeds.

Our board of directors believes the flexibility in application of such proceeds is prudent. |

| |

|

|

| Risk

Factors |

|

Investing

in our securities involves a high degree of risk. See the information contained in or incorporated by reference under the heading

“Risk Factors” in this prospectus and in the documents incorporated by reference into this prospectus and any free writing

prospectus that we authorize for use. |

| |

|

|

| Market

symbol and trading: |

|

Our

common stock is listed on the Nasdaq Capital Market under the symbol “DBGI”. |

RISK

FACTORS

Investing

in our securities involves significant risks. You should review carefully the risks and uncertainties described under the heading “Risk

Factors” contained in, or incorporated into, the applicable prospectus supplement and any related free writing prospectus, and

under similar headings in the other documents that are incorporated by reference herein or therein, including but not limited to those

set forth in the “Risk Factors” section of our most recent Annual Report on Form 10-K filed with the SEC, as revised or supplemented

by our Quarterly Reports on Form 10-Q filed with the SEC since the filing of our most recent Annual Report on Form 10-K, all of which

are incorporated by reference into this prospectus, as updated by annual, quarterly and other reports and documents we file with the

SEC after the date of this prospectus and that are incorporated by reference herein or in the applicable prospectus supplement. You should

also carefully consider any other information we include or incorporate by reference in this prospectus or include in any applicable

prospectus supplement. Each of the risks described in these sections and documents could materially and adversely affect our business,

financial condition, results of operations and prospects, and could result in a partial or complete loss of your investment.

The

exercise of all or any number of outstanding Warrants may dilute your holding of shares of our common stock.

Pursuant

to the Agreement, the Company issued to the Investor a Series A common share purchase warrant to purchase up to 513,875 shares of Common

Stock (“Series A Warrant”) and Series B common share purchase warrant to purchase up to 513,875 shares of Common Stock (“Series

B Warrant”, and collectively with the Series A Warrant, the “Warrants”) on September 5, 2023, each at an initial exercise

price equal to $9.43 per share of Common Stock. In connection with the Agreement, we entered into an engagement agreement with Wainwright,

pursuant to which we have, among other things, issued to Wainwright’s designees warrants to purchase up to 38,541 shares of Common

Stock (the “Wainwright Warrants”). The terms of the Wainwright Warrants are substantially the same as the terms of the Series

A Warrant except that they have an exercise price of $12.1625 per share. In connection with the Inducement Agreement, we reduced the

exercise price of the Warrants to $3.13 per share of Common Stock and the Investor exercised the Warrants into 1,027,750 shares of Common

Stock. Such shares of Common Stock may only be issued in accordance with the beneficial ownership limitations in the Inducement Agreement,

with the balance to be held in abeyance, which abeyance shall be evidenced through the Warrants and shall be deemed prepaid thereafter

(including the cash payment in full of the exercise price), and exercised pursuant to a Notice of Exercise in the Warrants (provided

no additional exercise price shall be due and payable). Our shareholders could be subject to increased dilution upon the exercise of

the Warrants and/or Wainwright Warrants. In addition, the exercise of the Warrants and/or Wainwright Warrants, and the subsequent sale

of shares of common stock issued thereby, could have an adverse effect on the market for our common stock, including the price that a

shareholder could obtain for their shares. Further, our shareholders may experience dilution in the value of their investment in our

common stock upon the exercise of the Warrants and/or Wainwright Warrants.

The

number of shares of common stock which are registered, including the shares to be issued upon exercise of the Warrants and/or Wainwright

Warrants, is significant in relation to our currently outstanding common stock and could cause downward pressure on the market price

for our common stock.

The

number of shares of common stock registered for resale upon exercise of the Warrants and/or Wainwright Warrants is significant in relation

to the number of shares of common stock currently outstanding. If the Selling Securityholder determines to sell a substantial number

of shares into the market at any given time, there may not be sufficient demand in the market to purchase the shares without a decline

in the market price for our common stock. Moreover, continuous sales into the market of a number of shares in excess of the typical trading

volume for our common stock, or even the availability of such a large number of shares, could depress the trading market for our common

stock over an extended period of time.

Our

common stock may be delisted from The Nasdaq Capital Market if we cannot maintain compliance with Nasdaq Capital Market’s continued

listing requirements.

Our

common stock is listed on the Nasdaq Capital Market. There are a number of continued listing requirements that we must satisfy in order

to maintain our listing on the Nasdaq Capital Market.

We

cannot assure you our securities will meet the continued listing requirements to be listed on Nasdaq Capital Market in the future. If

the Nasdaq Capital Market delists our common stock from trading on its exchange, we could face significant material adverse consequences

including:

| |

● |

a

limited availability of market quotations for our securities; |

| |

|

|

| |

● |

a

determination that our common stock is a “penny stock” which will require brokers trading in our common stock to adhere

to more stringent rules and possibly resulting in a reduced level of trading activity in the secondary trading market for our common

stock; |

| |

|

|

| |

● |

a

limited amount of news and analyst coverage for our company; and |

| |

|

|

| |

● |

a

decreased ability to issue additional securities or obtain additional financing in the future. |

If

we fail to maintain compliance with all applicable continued listing requirements for the Nasdaq Capital Market and Nasdaq Capital Market

determines to delist our common stock, the delisting could adversely affect the market liquidity of our common stock, our ability to

obtain financing to repay debt and fund our operations.

If

our common stock is delisted from the The Nasdaq Capital Market and the price of our common stock remains below $5.00 per share, our

common stock would come within the definition of “penny stock”.

Transactions

in securities that are traded in the United States that are not traded on The Nasdaq Capital Market or on other securities exchange by

companies, with net tangible assets of $5,000,000 or less and a market price per share of less than $5.00, may be subject to the “penny

stock” rules. The market price of our common stock is currently less than $5.00 per share. If our common stock is delisted from

the The Nasdaq Capital Market and the price of our common stock remains below $5.00 per share and our net tangible assets remain $5,000,000

or less, our common stock would come within the definition of “penny stock”.

Under

these penny stock rules, broker-dealers that recommend such securities to persons other than institutional accredited investors:

| |

● |

must

make a special written suitability determination for the purchaser; |

| |

|

|

| |

● |

receive

the purchaser’s written agreement to a transaction prior to sale; |

| |

|

|

| |

● |

provide

the purchaser with risk disclosure documents which identify risks associated with investing in “penny stocks” and which

describe the market for these “penny stocks” as well as a purchaser’s legal remedies; and |

| |

|

|

| |

● |

obtain

a signed and dated acknowledgment from the purchaser demonstrating that the purchaser has actually received the required risk disclosure

document before a transaction in a “penny stock” can be completed. |

As

a result of these requirements, if our common stock is at such time subject to the “penny stock” rules, broker-dealers may

find it difficult to effectuate customer transactions and trading activity in these shares in the United States may be significantly

limited. Accordingly, the market price of the shares may be depressed, and investors may find it more difficult to sell the shares.

Our

common stock may be affected by limited trading volume and may fluctuate significantly.

Our

common stock is traded on the Nasdaq Capital Market. Although an active trading market has developed for our common stock, there can

be no assurance that an active trading market for our common stock will be sustained. Failure to maintain an active trading market for

our common stock may adversely affect our shareholders’ ability to sell our common stock in short time periods, or at all. Our

common stock has experienced, and may experience in the future, significant price and volume fluctuations, which could adversely affect

the market price of our common stock.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, including the documents we incorporate by reference into it, contains forward-looking statements within the meaning of Section

27A of the Securities Act, and Section 21E of the Exchange Act, the Private Securities Litigation Reform Act of 1995 (the “PSLRA”)

or in releases made by the SEC. Such statements include, without limitation, statements regarding our expectations, hopes or intentions

regarding the future. Statements that are not historical fact are forward- looking statements. These forward-looking statements can often

be identified by their use of words such as “expect,” “believe,” “anticipate,” “outlook,”

“could,” “target,” “project,” “intend,” “plan,” “seek,” “estimate,”

“should,” “will,” “may” and “assume,” as well as variations of such words and similar

expressions referring to the future. These cautionary statements are being made pursuant to the Securities Act, the Exchange Act and

the PSLRA with the intention of obtaining the benefits of the “safe harbor” provisions of such laws.

The

forward-looking statements contained in or incorporated by reference into this prospectus are largely based on our expectations, which

reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently

known market conditions and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain

and involve certain risks and uncertainties, many of which are beyond our control. If any of those risks and uncertainties materialize,

actual results could differ materially from those discussed in any such forward-looking statement. Among the factors that could cause

actual results to differ materially from those discussed in forward-looking statements are those discussed under the heading “Risk

Factors” below, those discussed under the heading “Risk Factors” and in other sections of our Annual Report on Form 10-K for the year ended December 31, 2023, as well as in our other reports filed from time to time with the SEC that are incorporated

by reference into this prospectus. See “Available Information” and “Incorporation of Certain Information by Reference”

for information about how to obtain copies of those documents.

All

readers are cautioned that the forward-looking statements contained in this prospectus and in the documents incorporated by reference

into this prospectus are not guarantees of future performance, and we cannot assure any reader that such statements will be realized

or that the forward-looking events and circumstances will occur. Actual results may differ materially from those anticipated or implied

in the forward-looking statements. All forward-looking statements in this prospectus and the documents incorporated by reference into

it are made only as of the date of the document in which they are contained, based on information available to us as of the date of that

document, and we caution you not to place undue reliance on forward-looking statements in light of the risks and uncertainties associated

with them. Except as required by law, we undertake no obligation to update any forward-looking statements, whether as a result of new

information, future events or otherwise.

USE

OF PROCEEDS

The

Selling Stockholders will receive all of the proceeds from the sale of shares of Common Stock under this prospectus. We will not receive

any proceeds from these sales, however, we will receive proceeds from the exercise of the Warrants and/or Wainwright Warrants if the

Warrants and/or Wainwright Warrants are exercised for cash and retain broad discretion over the use of such proceeds. Our board of directors

believes the flexibility in application of such proceeds is prudent. The Selling Stockholders will pay any underwriting discounts and

agent’s commissions and expenses it incurs for brokerage, accounting, tax or legal services or any other expenses they incur in

disposing of the shares. We will bear all other costs, fees and expenses incurred in effecting the registration of the shares covered

by this prospectus. These may include, without limitation, all registration and filing fees, SEC filing fees and expenses of compliance

with state securities or “blue sky” laws.

SELLING

STOCKHOLDERS

This

prospectus relates to the resale, from time to time, of up to 687,541 shares of our common stock, par value $0.0001 per share (“Common

Stock”), by the selling stockholders named herein. On or around August 31, 2023, we entered into a securities purchase agreement

(the “Agreement”) with Armistice Capital Master Fund Ltd. (the “Investor”). Pursuant to the Agreement, the Company

issued to the Investor a Series A common share purchase warrant to purchase up to 513,875 shares of Common Stock (“Series A Warrant”)

and Series B common share purchase warrant to purchase up to 513,875 shares of Common Stock (“Series B Warrant”, and collectively

with the Series A Warrant, the “Warrants”) on or around September 5, 2023, pursuant to Section 4(a)(2) of the Securities

Act of 1933, as amended (“Securities Act”), each at an initial exercise price equal to $9.43 per share of Common Stock. The

Series A Warrant is exercisable immediately upon issuance and expires five and one-half (5.5) years following the issuance date and the

Series B Warrant is exercisable immediately upon issuance and expires fifteen (15) months following the issuance date. On May 3, 2024,

we entered into an inducement offer to exercise of the Warrants (the “Inducement Agreement”) with the Investor, pursuant

to which the Company agreed to reduce the exercise price of such Warrants to $3.13 per share of Common Stock and the Investor exercised

the Warrants into 1,027,750 shares of Common Stock. Such shares of Common Stock may only be issued in accordance with the beneficial

ownership limitations in the Inducement Agreement, with the balance to be held in abeyance, which abeyance shall be evidenced through

the Warrants and shall be deemed prepaid thereafter (including the cash payment in full of the exercise price), and exercised pursuant

to a Notice of Exercise in the Warrants (provided no additional exercise price shall be due and payable). The balance of Common Stock

currently held in abeyance under the Warrants is 649,000 shares of Common Stock.

In

connection with the Agreement, we entered into an engagement agreement with H.C. Wainwright & Co., LLC (“Wainwright”),

pursuant to which we have, among other things, issued to Wainwright’s designees warrants to purchase up to 38,541 shares of Common

Stock (the “Wainwright Warrants”). The terms of the Wainwright Warrants are substantially the same as the terms of the Series

A Warrant except that they have an exercise price of $12.1625 per share.

This

prospectus relates to the offer, resale or other disposition of up to 687,541 shares of our Common Stock issuable to the Selling Stockholders

upon exercise of the Warrants and Wainwright Warrants. We are registering the shares of Common Stock in order to permit the Selling Stockholders

to offer the shares for resale from time to time. None of the persons named in the table has held any position or office or had any other

material relationship with us or our affiliates during the three years prior to the date of this prospectus.

The

table below lists the Selling Stockholders and other information regarding their beneficial ownership (as determined under Section 13(d)

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations thereunder) of shares

of our Common Stock. These rules generally provide that a person is the beneficial owner of securities if such person has or shares the

power to vote or direct the voting thereof, or to dispose or direct the disposition thereof, or has the right to acquire such powers

within 60 days. The second column lists the number of shares of Common Stock beneficially owned by the Selling Stockholders as of August

19, 2024. The fourth column lists the shares of Common Stock being offered by the Selling Stockholders pursuant to this prospectus.

In

accordance with the terms of the Agreement, this prospectus covers the offer, resale or other disposition of the shares of Common Stock

issuable to the Selling Stockholders upon exercise of the Warrants and Wainwright Warrants issued to the Selling Stockholders pursuant

to the transactions contemplated by the Agreement and Inducement Agreement. Percentage ownership is based on 2,617,027 shares

of Common Stock outstanding as of August 19, 2024.

Because

the Selling Stockholders may dispose of all, none or some portion of its securities, no estimate can be given as to the number of securities

that will be beneficially owned by the Selling Stockholders upon termination of this offering. See “Plan of Distribution.”

For purposes of the table below, however, we have assumed that after termination of this offering none of the securities covered by this

prospectus will be beneficially owned by the Selling Stockholders and further assumed that the Selling Stockholders will not acquire

beneficial ownership of any additional securities during the offering. In addition, the Selling Stockholders may have sold, transferred

or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time, our securities in transactions

exempt from the registration requirements of the Securities Act after the date on which the information in the table is presented. This

information is based upon our review of public filings, our stockholder and option holder registers and information furnished by the

Selling Stockholders.

| Selling

Stockholders (1) | |

Shares

Beneficially Owned Immediately Prior to the Offering(4) | | |

Number

of Shares Being Offered for Resale Under this Prospectus(4) | | |

Number

of Shares Beneficially Owned After Sale of Warrant Shares(2) | | |

Percentage

of Outstanding Shares of Common Stock Beneficially Owned Immediately Following the Sale of Warrant Shares(3)(4) | |

| Armistice Capital,

LLC(5) | |

| 2,796,296 | (5) | |

| 649,000 | | |

| 2,147,296 | | |

| 64.98 | % |

| Michael Vasinkevich(6) | |

| 80,097 | (7) | |

| 24,714 | | |

| 55,383 | | |

| 1.0 | % |

| Noam Rubinstein(6) | |

| 39,346 | (8) | |

| 12,140 | | |

| 27,206 | | |

| * | % |

| Craig Schwabe(6) | |

| 4,215 | (9) | |

| 1,301 | | |

| 2,914 | | |

| * | % |

| Charles Worthman(6) | |

| 1,250 | (10) | |

| 386 | | |

| 864 | | |

| * | % |

| |

|

*less

than 1% |

| |

|

|

| |

(1) |

The

Warrants are subject to a beneficial ownership limitation of 4.99% (or, at the election of the holder, 9.99%) (the “Beneficial

Ownership Limitation”), which limitation precludes each Selling Stockholder from exercising any portion of its Warrants to

the extent that, following such exercise, such Selling Stockholder’s ownership of our Common Stock would exceed the Beneficial

Ownership Limitation. |

| |

|

|

| |

(2) |

Assumes

all shares offered by the selling securityholder hereby are sold and that the selling securityholder buys or sells no additional

shares of common stock prior to the completion of this offering. |

| |

|

|

| |

(3) |

Percentage

calculated based upon 2,617,027 shares of common stock outstanding as of August 19, 2024 and gives effect to the total

number of shares of common stock beneficially owned by the Selling Stockholders assuming full exercise of the Warrants and Wainwright

Warrants registered hereunder. |

| |

|

|

| |

(4) |

The

amounts and percentages in the table are provided without regard to the applicable Beneficial Ownership Limitation. “Beneficial

ownership” is a term broadly defined by the SEC in Rule 13d-3 under the Exchange Act and includes more than the typical form

of stock ownership, that is, stock held in the person’s name. The term also includes what is referred to as “indirect

ownership,” meaning ownership of shares as to which a person has or shares investment power. For purposes of this table, a

person or group of persons is deemed to have “beneficial ownership” of any shares that are currently exercisable or exercisable

within 60 days of August 19, 2024. |

| |

|

|

| |

(5) |

The

securities consist of common stock and warrants directly held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company

(the “Master Fund”) and may be deemed to be beneficially owned by: (i) Armistice Capital, LLC (“Armistice Capital”),

as the investment manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. Warrants are subject

to a beneficial ownership limitation of 4.99%, which such limitation restrict the holder from exercising or releasing that portion

of warrant that would result in the holder and its affiliates owning, after exercise or release, a number of shares of common stock

in excess of the beneficial ownership limitation. The address of Armistice Capital, LLC is 510 Madison Avenue, 7th Floor, New York,

NY 10022. As of the date of this filing, Master Fund currently holds: |

| |

(I) |

0

shares of the Company’s common stock; and |

| |

|

|

| |

(II) |

Series

B Warrants and Series C Warrants issued on or around November 23, 2022, subject to a 4.99% blocker, exercisable into an aggregate

of 91,796 shares of the Company’s common stock, and |

| |

|

|

| |

(III) |

Series

A Warrants and Series B Warrants issued on or around September 5, 2023, subject to a 9.99% blocker, exercisable into an aggregate

of 649,000 shares of the Company’s common stock, which are deemed prepaid in accordance with the Inducement Agreement, and |

| |

|

|

| |

(IV) |

Series

A-1 Warrants issued on or around May 7, 2024, subject to a 4.99% blocker, exercisable into 1,027,750 shares of the Company’s

common stock, and |

| |

|

|

| |

(V) |

Series

B-1 Warrants issued on or around May 7, 2024, subject to a 4.99% blocker, exercisable into 1,027,750 shares of the Company’s

common stock. |

| |

(6) |

The

selling stockholder is affiliated with H.C. Wainwright & Co., LLC, a registered broker dealer with a registered address of c/o

H.C. Wainwright & Co., 430 Park Ave, 3rd Floor, New York, NY 10022, and has sole voting and dispositive power over the securities

held. The number of shares to be sold in this offering consists of shares of common stock issuable upon exercise of Wainwright Warrants,

which were received as compensation for our placement of the securities issued pursuant to the Inducement Agreement. The selling

stockholder acquired the Wainwright Warrants in the ordinary course of business and, at the time the Wainwright Warrants were acquired,

the selling stockholder had no agreement or understanding, directly or indirectly, with any person to distribute such securities.

|

| |

|

|

| |

(7) |

The

securities consist of common stock underlying warrants directly held by Michael Vasinkevich. Warrants are subject to a beneficial

ownership limitation of 4.99%, which such limitation restrict the holder from exercising or releasing that portion of warrant that

would result in the holder and its affiliates owning, after exercise or release, a number of shares of common stock in excess of

the beneficial ownership limitation. As of the date of this filing, Michael Vasinkevich currently holds: (i) warrants issued on or

around December 1, 2022, exercisable into an aggregate of 3,498 shares of the Company’s common stock, (ii) warrants issued

on or around January 13, 2023, exercisable into an aggregate of 2,457 shares of the Company’s common stock, (iii) warrants

issued on or around September 5, 2023, exercisable into an aggregate of 24,714 shares of the Company’s common stock, and (iv)

warrants issued on or around May 7, 2024, exercisable into an aggregate of 49,428 shares of the Company’s common stock. |

| |

|

|

| |

(8) |

The

securities consist of common stock underlying warrants directly held by Noam Rubinstein. Warrants are subject to a beneficial ownership

limitation of 4.99%, which such limitation restrict the holder from exercising or releasing that portion of warrant that would result

in the holder and its affiliates owning, after exercise or release, a number of shares of common stock in excess of the beneficial

ownership limitation. As of the date of this filing, Noam Rubinstein currently holds: (i) warrants issued on or around December 1,

2022, exercisable into an aggregate of 1,207 shares of the Company’s common stock, (ii) warrants issued on or around January

13, 2023, exercisable into an aggregate of 1,718 shares of the Company’s common stock, (iii) warrants issued on or around September

5, 2023, exercisable into an aggregate of 12,140 shares of the Company’s common stock, and (iv) warrants issued on or around

May 7, 2024, exercisable into an aggregate of 24,281 shares of the Company’s common stock. |

| |

|

|

| |

(9) |

The

securities consist of common stock underlying warrants directly held by Craig Schwabe. Warrants are subject to a beneficial ownership

limitation of 4.99%, which such limitation restrict the holder from exercising or releasing that portion of warrant that would result

in the holder and its affiliates owning, after exercise or release, a number of shares of common stock in excess of the beneficial

ownership limitation. As of the date of this filing, Craig Schwabe currently holds: (i) warrants issued on or around December 1,

2022, exercisable into an aggregate of 184 shares of the Company’s common stock, (ii) warrants issued on or around January

13, 2023, exercisable into an aggregate of 129 shares of the Company’s common stock, (iii) warrants issued on or around September

5, 2023, exercisable into an aggregate of 1,301 shares of the Company’s common stock, and (iv) warrants issued on or around

May 7, 2024, exercisable into an aggregate of 2,601 shares of the Company’s common stock. |

| |

|

|

| |

(10)

|

The

securities consist of common stock underlying warrants directly held by Charles Worthman. Warrants are subject to a beneficial ownership

limitation of 4.99%, which such limitation restrict the holder from exercising or releasing that portion of warrant that would result

in the holder and its affiliates owning, after exercise or release, a number of shares of common stock in excess of the beneficial

ownership limitation. As of the date of this filing, Charles Worthman currently holds: (i) warrants issued on or around December

1, 2022, exercisable into an aggregate of 55 shares of the Company’s common stock, (ii) warrants issued on or around January

13, 2023, exercisable into an aggregate of 38 shares of the Company’s common stock, (iii) warrants issued on or around September

5, 2023, exercisable into an aggregate of 386 shares of the Company’s common stock, and (iv) warrants issued on or around May

7, 2024, exercisable into an aggregate of 771 shares of the Company’s common stock. |

PLAN

OF DISTRIBUTION

We

are registering the shares of Common Stock issuable to the Selling Stockholders upon exercise of the Warrants and Wainwright Warrants

issued to the Selling Stockholders in connection with the Inducement Agreement, in order to permit the Selling Stockholders to offer

the shares for resale from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the

Selling Stockholders of the shares of Common Stock. We will bear all fees and expenses incident to our obligation to register the shares

of Common Stock.

The

Selling Stockholders and any of its pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities

covered hereby on The Nasdaq Capital Market or any other stock exchange, market or trading facility on which the securities are traded

or in private transactions. These sales may be at fixed or negotiated prices. The Selling Stockholders may use any one or more of the

following methods when selling securities.

| |

● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block

trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block

as principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately

negotiated transactions; |

| |

|

|

| |

● |

settlement

of short sales; |

| |

|

|

| |

● |

in

transactions through broker-dealers that agree with the Selling Stockholders to sell a specified number of such securities at a stipulated

price per security; |

| |

|

|

| |

● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

|

| |

● |

a

combination of any such methods of sale; or |

| |

|

|

| |

● |

any

other method permitted pursuant to applicable law. |

The

Selling Stockholders may also sell securities under Rule 144 or any other exemption from registration under the Securities Act of 1933,

as amended (the “Securities Act”), if available, rather than under this prospectus. Broker-dealers engaged by the Selling

Stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from

the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be

negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary

brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or markdown in compliance

with FINRA Rule 2121.

In

connection with the sale of the securities or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they

assume. The Selling Stockholders may also sell securities short and deliver these securities to close out their short positions, or loan

or pledge the securities to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option

or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the

delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer

or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The

Selling Stockholders and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters”

within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act. Each of the Selling Stockholders has informed the Company that it does not have any written or oral agreement

or understanding, directly or indirectly, with any person to distribute the securities.

The

Company is required to pay certain fees and expenses incurred by the Company incident to the registration of the securities. The Company

has agreed to indemnify the Selling Stockholders against certain losses, claims, damages and liabilities, including liabilities under

the Securities Act.

We

agreed to keep this prospectus effective until the all of the securities have been sold pursuant to this prospectus or Rule 144 under

the Securities Act or any other rule of similar effect. The resale securities will be sold only through registered or licensed brokers

or dealers if required under applicable state securities laws. In addition, in certain states, the resale securities covered hereby may

not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification

requirement is available and is complied with.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously

engage in market making activities with respect to the shares of Common Stock for the applicable restricted period, as defined in Regulation

M, prior to the commencement of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the

Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the

shares of Common Stock by the Selling Stockholders or any other person. We will make copies of this prospectus available to the Selling

Stockholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the

sale (including by compliance with Rule 172 under the Securities Act).

CERTAIN

PROVISIONS OF DELAWARE LAW AND OF

THE COMPANY’S CERTIFICATE OF INCORPORATION AND BYLAWS

Anti-Takeover

Provisions and Choice of Forum

Certain

provisions of Delaware law and our sixth amended and restated certificate of incorporation and bylaws could make the following more difficult:

| |

● |

the

acquisition of us by means of a tender offer; |

| |

|

|

| |

● |

acquisition

of control of us by means of a proxy contest or otherwise; and |

| |

|

|

| |

● |

the

removal of our incumbent officers and directors. |

These

provisions, summarized below, are expected to discourage certain types of coercive takeover practices and inadequate takeover bids and

are designed to encourage persons seeking to acquire control of us to negotiate with our board of directors. We believe that the benefits

of increased protection against an unfriendly or unsolicited proposal to acquire or restructure us outweigh the disadvantages of discouraging

such proposals. Among other things, negotiation of such proposals could result in an improvement of their terms.

Delaware

Anti-Takeover Law. We are subject to Section 203 of the Delaware General Corporation Law, an anti-takeover law. In general, Section

203 prohibits a publicly held Delaware corporation from engaging in a “business acquisition” with an “interested stockholder”

for a period of three years following the date the person became an interested stockholder, unless the “business acquisition”

or the transaction in which the person became an interested stockholder is approved by our board of directors in a prescribed manner.

Generally, a “business acquisition” includes a merger, asset or stock sale, or other transaction resulting in a financial

benefit to the interested stockholder. Generally, an “interested stockholder” is a person who, together with affiliates and

associates, owns or, within three years prior to the determination of interested stockholder status, did own, 15% or more of a corporation’s

voting stock. The existence of this provision may have an anti-takeover effect with respect to transactions not approved in advance by

the board of directors, including discouraging attempts that might result in a premium over the market price for the shares of common

stock held by stockholders.

Stockholder

Meetings. Under our bylaws, only the board of directors, the chairman of the board, the chief executive officer and the president,

and stockholders holding an aggregate of 25% of our shares of our common stock may call special meetings of stockholders.

No

Cumulative Voting. Our sixth amended and restated certificate of incorporation and bylaws do not provide for cumulative voting in

the election of directors.

Action

by Written Consent of Stockholders Prohibited. Our sixth amended and restated certificate of incorporation does not allow stockholders

to act by written consent in lieu of a meeting, unless approved in advance by our board of directors.

Undesignated

Preferred Stock. The authorization of undesignated preferred stock makes it possible for the board of directors without stockholder

approval to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt to obtain control

of us. These and other provisions may have the effect of deferring hostile takeovers or delaying changes in control or management of

us.

Amendment

of Provisions in the Sixth Amended and Restated Certificate of Incorporation. The Sixth amended and restated certificate of incorporation

will generally require the affirmative vote of the holders of at least 662∕3% of the outstanding voting stock in order to amend

any provisions of the sixth amended and restated certificate of incorporation concerning, among other things:

| |

● |

the

required vote to amend certain provisions of the sixth amended and restated certificate of incorporation; |

| |

|

|

| |

● |

the

reservation of the board of director’s right to amend the amended and restated bylaws, with all rights granted to stockholders

being subject to this reservation; |

| |

|

|

| |

● |

management

of the business by the board of directors; |

| |

|

|

| |

● |

number

of directors and structure of the board of directors; |

| |

|

|

| |

● |

removal

and appointment of directors; |

| |

|

|

| |

● |

director

nominations by stockholders; |

| |

|

|

| |

● |

prohibition

of action by written consent of stockholders; |

| |

|

|

| |

● |

personal

liability of directors to us and our stockholders; and |

| |

|

|

| |

● |

indemnification

of our directors, officers, employees and agents. |

Choice

of Forum. Our sixth amended and restated certificate of incorporation provides that, unless we consent in writing to the selection

of an alternative forum, the Court of Chancery of the State of Delaware (or, if and only if the Court of Chancery of the State of Delaware

lacks subject matter jurisdiction, any state court located within the State of Delaware or, if and only if all such state courts lack

subject matter jurisdiction, the federal district court for the District of Delaware) shall be the sole and exclusive forum for the following

types of actions or proceedings under Delaware statutory or common law:

| |

● |

any

derivative action or proceeding brought on our behalf; |

| |

|

|

| |

● |

any

action asserting a breach of a fiduciary duty owed by any of our directors, officers or other employees to us or our stockholders;

|

| |

|

|

| |

● |

any

action asserting a claim against us or our directors, officers or other employees arising under the Delaware General Corporation

Law, our sixth amended and restated certificate of incorporation or our bylaws; |

| |

|

|

| |

● |

any

action or proceeding to interpret, apply, enforce or determine the validity of our sixth amended and restated certificate of incorporation

or our bylaws; |

| |

|

|

| |

● |

any

action or proceeding as to which the Delaware General Corporation Law confers jurisdiction to the Court of Chancery of the State

of Delaware; or |

| |

|

|

| |

● |

any

action asserting a claim against us or our directors, officers or other employees that is governed by the “internal affairs

doctrine” as that term is defined in Section 115 of the Delaware General Corporation Law, in all cases to the fullest extent

permitted by law and subject to the court’s having personal jurisdiction over the indispensable parties named as defendants.

|

Our

sixth amended and restated certificate of incorporation further provides that unless the Company consents in writing to the selection

of an alternative forum, the U.S. federal district courts have exclusive jurisdiction of the resolution of any complaint asserting a

cause of action arising under the Securities Act. The enforceability of similar exclusive federal forum provisions in other companies’

organizational documents has been challenged in legal proceedings, and while the Delaware Supreme Court has ruled that this type of exclusive

federal forum provision is facially valid under Delaware law, there is uncertainty as to whether other courts would enforce such provisions

and that investors cannot waive compliance with the federal securities laws and the rules and regulations thereunder. This exclusive

forum provision does not apply to suits brought to enforce a duty or liability created by the Exchange Act or any other claim for which

the federal courts have exclusive jurisdiction.

Any

person or entity purchasing or otherwise acquiring any interest in shares of our capital stock will be deemed to have notice of and to

have consented to this exclusive forum provision of our sixth amended and restated certificate of incorporation. This choice of forum

provision may limit a stockholder’s ability to bring a claim in a judicial forum that it finds favorable for disputes with us or

any of our directors, officers, other employees or stockholders, which may discourage lawsuits with respect to such claims. Alternatively,

if a court were to find this choice of forum provision in our sixth amended and restated certificate of incorporation to be inapplicable

or unenforceable in an action, we may incur additional costs associated with resolving such action in other jurisdictions. Additional

costs associated with resolving an action in other jurisdictions could materially adversely affect our business, financial condition

and results of operations

Limitations

on Directors’ Liability and Indemnification

Our

sixth amended and restated certificate of incorporation provides that our directors will not be personally liable to us or our stockholders

for monetary damages for breach of their fiduciary duties as directors, except liability for any of the following:

| |

● |

any

breach of their duty of loyalty to the corporation or its stockholders; |

| |

● |

acts

or omissions not in good faith or which involve intentional misconduct or a knowing violation of law; |

| |

● |

payments

of dividends or approval of stock repurchases or redemptions that are prohibited by Delaware law; or |

| |

● |

any

transaction from which the director derived an improper personal benefit. |

This

limitation of liability does not apply to liabilities arising under the federal securities laws and does not affect the availability

of equitable remedies such as injunctive relief or rescission.

Our

sixth amended and restated certificate of incorporation provides that we shall indemnify our directors, officers, employees and other

agents to the fullest extent permitted by law, and our amended and restated bylaws provide that we shall indemnify our directors and

officers, and may indemnify our employees and other agents, to the fullest extent permitted by law. We believe that indemnification under

our bylaws covers at least negligence and gross negligence on the part of indemnified parties. Our bylaws also permit us to secure insurance

on behalf of any officer, director, employee or other agent for any liability arising out of his or her actions in such capacity, regardless

of whether Delaware law would permit indemnification.

We

have entered into agreements to indemnify our directors and executive officers, in addition to the indemnification provided for in our

sixth amended and restated certificate of incorporation and bylaws. These agreements, among other things, provide for indemnification

of our directors and officers for expenses, judgments, fines, penalties and settlement amounts incurred by any such person in any action

or proceeding arising out of such person’s services as a director or officer or at our request.

We

believe that these provisions and agreements are necessary to attract and retain qualified persons as directors and executive officers.

There is no pending litigation or proceeding involving any of our directors, officers, employees or agents. We are not aware of any pending

or threatened litigation or proceeding that might result in a claim for indemnification by a director, officer, employee or agent.

LEGAL

MATTERS

The

validity of the securities offered by this prospectus will be passed upon for us by Anthony, Linder & Cacomanolis, PLLC, 1700 Palm

Beach Lakes Blvd., Suite 820, West Palm Beach, Florida 33401.

EXPERTS

The

consolidated financial statements for the year ended December 31, 2022 and 2023, appearing in the Digital Brands Group, Inc.’s

Annual Report on Form 10-K/A filed on June 3, 2024, for the year ended December 31, 2023, have been audited by dbbmckennon (with respect

to the year ended December 31, 2022) and Macias, Gini and O’Connell LLP (with respect to the year ended December 31, 2023), respectively,

independent registered public accounting firms, as set forth in their report thereon, included therein, and incorporated herein by reference.

Such consolidated financial statements are incorporated herein by reference in reliance upon such report given on the authority of such

firm as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

are a public company and file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings

are available to the public at the SEC’s website at http://www.sec.gov, and on our website at https://www.digitalbrandsgroup.co/.

The information contained on our website is not included or incorporated by reference into this prospectus. In addition, our Common Stock

and Class A Warrants are listed for trading on The Nasdaq Capital Market under the symbols “DBGI” and “DBGIW,”

respectively.

This

prospectus is only part of a Registration Statement on Form S-3 that we have filed with the SEC under the Securities Act, and therefore

omits certain information contained in the Registration Statement. We have also filed exhibits and schedules with the Registration Statement

that are excluded from this prospectus, and you should refer to the applicable exhibit or schedule for a complete description of any

statement referring to any contract or other document. You may obtain a copy from the SEC’s website or our website.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

The

SEC’s rules allow us to incorporate by reference information into this prospectus. This means that we can disclose important information

to you by referring you to another document. Any information referred to in this way is considered part of this prospectus from the date

we file that document. Any reports filed by us with the SEC after the date of this prospectus and before the date that the offering of

the securities by means of this prospectus is terminated will automatically update and, where applicable, supersede any information contained

in this prospectus or incorporated by reference in this prospectus.

We

incorporate by reference into this prospectus the following documents or information filed with the SEC (other than, in each case, documents

or information deemed to have been furnished and not filed in accordance with SEC rules):

| |

● |

Our

Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on April 15, 2024 (File No. 001-40400), as amended

by Form 10-K/A (Amendment No. 1) for the year ended December 31, 2023, filed with the SEC on June 3, 2024 (File No. 001-40400); |

| |

|

|

| |

● |

Our

Quarterly Reports on Form

10-Q for the period ended March 31, 2024 and June 30, 2024, filed with the SEC on May 20, 2024 and August 19, 2024

respectively (File No. 001-40400); |

| |

|

|

| |

● |

Our

Current Reports on Form 8-K filed with the SEC on April 25, 2024, May 3, 2024, May 7, 2024, May 21, 2024, May 29, 2024, and June 7, 2024 (in each case, excluding Items 2.02 and 7.01 on Form 8-K and Item 9.01 related thereto); and |

| |

|

|

| |

● |

The

description of our securities contained in our Registration Statement on Form 8-A filed on May 11, 2021 (File No. 001-40400), pursuant

to Section 12(b) of the Exchange Act, and any amendment or report filed with the SEC for purposes of updating such description. |

Additionally,

all documents filed by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, after (i) the date of the initial

registration statement and prior to effectiveness of the registration statement, and (ii) the date of this prospectus and before the

termination or completion of this offering, shall be deemed to be incorporated by reference into this prospectus from the respective