Interactive Brokers Enhances Web-Based Trading Experience for Financial Advisors Globally

19 Dicembre 2024 - 4:00PM

Business Wire

Enhancements Enable Financial Advisors to

Streamline Workflows and Engage Clients More Effectively

Interactive Brokers (Nasdaq: IBKR), an automated global

electronic broker, has introduced significant enhancements to its

web-based Advisor Portal, bringing advanced trading and portfolio

management tools to financial advisors worldwide. These updates

streamline client account management and trading by integrating

powerful features from the company’s flagship desktop platform into

its web-based offering.

The latest enhancements include tools like Portfolio View,

Allocation, Rebalance, and Tax Loss Harvesting, all designed to

help advisors optimize client portfolios efficiently. Additionally,

US-based advisors can now access the AI Commentary Generator, a

cutting-edge generative AI tool that simplifies the creation of

custom portfolio performance reports and market commentary.

“Our web-based Advisor Portal is now more powerful than ever,

offering advisors the same robust trading and portfolio management

experience they’ve come to expect from our desktop platform,” said

Steve Sanders, Executive Vice President of Marketing and Product

Development. “With tools like the AI-powered Commentary Generator,

we’re empowering advisors to save time, deliver value, and focus on

what matters most: their clients.”

Advisor Portal gives financial advisors web-based access to

Interactive Brokers’ technology and other resources at no charge,

including: PortfolioAnalyst®, a client relationship management

(CRM) dashboard, activity statements, QuickTrade, Investors’

Marketplace and more. The latest enhancements bring

industry-leading trading tools from its Trader Workstation desktop

platform to the web-based portal:

- Portfolio View provides an overview of client account

performance, giving advisors the ability to drill down by

individual positions or accounts. Advisors can choose to view

values in the native currency of the security or account, or in

their own master base currency.

- Allocation Order allows a single stock order to be

distributed across multiple accounts. Advisors can choose to

customize the allocation themselves or can use one of 14 allocation

algorithms.

- With Rebalance, advisors can adjust multiple positions

across multiple accounts using target allocation percentages.

- Models enable advisors to manage different portfolio

strategies and invest accounts in them in a scalable way. Advisors

create their investment models, define their target positions and

the tool generates orders to align selected client accounts to the

target positions. Positions can be adjusted at any time and the

model rebalance tool can realign client allocations as needed.

- Tax Loss Harvesting scans advisors’ client accounts for

harvesting opportunities, in accordance with US tax laws. Advisors

can search for losses at the entire position level, lot level, and

within short- or long-term capital losses.

Introducing the AI Commentary Generator

US-based financial advisors can easily create custom portfolio

performance reports and market commentary using the AI Commentary

Generator, a new generative AI-enabled tool available through the

Advisor Portal. The AI Commentary Generator is integrated with

PortfolioAnalyst reporting and is designed to help – not replace –

advisors with client portfolio performance reporting, market

updates and ticker-specific news.

By combing through dozens of sources and citing them for the

advisor’s convenience, the AI Commentary Generator conducts

research in seconds that would otherwise take hours to

complete.

The AI Commentary Generator provides four sections of

content:

- Portfolio Summary identifies and describes the

performance of the five best performing holdings, five worst

performing holdings, and five highest concentrated holdings in the

selected account.

- Portfolio News and Trends searches for, and summarizes,

publicly available information for news relating to the holdings

identified in Portfolio Summary.

- Macro Update summarizes content from the Federal

Reserve's Beige Book as well as Federal Open Market Committee

(FOMC) meeting notes.

- Economic and Market Outlook searches publicly available

information for all market news and provides a summary.

Interactive Brokers’ free portfolio management offering,

PortfolioAnalyst, offers a unified and holistic view of client

accounts plus an extensive selection of reporting and analytics

content. It enables advisors to consolidate their clients’ finances

from over 15,000 financial institutions, assess client portfolios

and simplify investment decision-making.

“We’re excited about our clients’ early response to the AI

Commentary Generator in the US and look forward to rolling it out

to advisors worldwide,” said Sanders. “Interactive Brokers is

always looking for new ways to apply innovation and automation to

help advisors everywhere be more efficient and more engaged with

their clients.”

The AI Commentary Generator is only available to US-based

financial advisors.

For additional information about Interactive Brokers’ offering

for financial advisors, please visit:

US: Financial Advisors - United States Canada: Financial

Advisors - Canada UK: Financial Advisors - United Kingdom Europe:

Financial Advisors - Europe Hong Kong: Financial Advisors - Hong

Kong Singapore: Financial Advisors - Singapore Australia: Financial

Advisors - Australia

About Interactive Brokers Group, Inc.: Interactive

Brokers Group affiliates provide automated trade execution and

custody of securities, commodities, foreign exchange, and forecast

contracts around the clock on over 150 markets in numerous

countries and currencies from a single unified platform to clients

worldwide. We serve individual investors, hedge funds, proprietary

trading groups, financial advisors and introducing brokers. Our

four decades of focus on technology and automation have enabled us

to equip our clients with a uniquely sophisticated platform to

manage their investment portfolios. We strive to provide our

clients with advantageous execution prices and trading, risk and

portfolio management tools, research facilities and investment

products, all at low or no cost, positioning them to achieve

superior returns on investments. Interactive Brokers has

consistently earned recognition as a top broker, garnering multiple

awards and accolades from respected industry sources such as

Barron's, Investopedia, Stockbrokers.com, and many others.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241219498477/en/

Contacts for Interactive Brokers Group, Inc. Media: Katherine

Ewert, media@ibkr.com

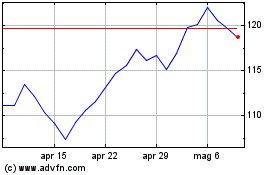

Grafico Azioni Interactive Brokers (NASDAQ:IBKR)

Storico

Da Mar 2025 a Apr 2025

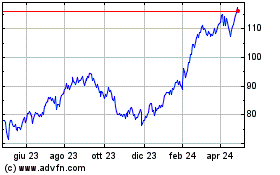

Grafico Azioni Interactive Brokers (NASDAQ:IBKR)

Storico

Da Apr 2024 a Apr 2025