Leading Proxy Advisor ISS Recommends Medallion Shareholders Vote “FOR” Both of the Board’s Director Nominees on the BLUE Proxy Card

28 Maggio 2024 - 1:30PM

Medallion Financial Corp. (NASDAQ: MFIN) (“Medallion” or the

“Company”) today announced that leading independent proxy advisory

firm Institutional Shareholder Services ("ISS") has recommended

that Medallion shareholders vote on the BLUE proxy card “FOR” ONLY

the two incumbent candidates nominated by the Board of Directors,

Robert M. Meyer and David L. Rudnick and “FOR” the advisory vote on

the compensation of the Company’s named executive officers in

connection with the Company’s 2024 Annual Meeting of Shareholders

(the “Annual Meeting”). The Annual Meeting will be held on June 11,

2024.

In its report issued on May 24, 2024, ISS noted:

- “The company's TSR has outperformed its peers and the broader

market over the one-, three-, and five-year periods ending on the

unaffected date.” 1

- “In light of the company's TSR and operational performance, and

the board's willingness to engage with its shareholders, as

evidenced by a recent settlement, incremental changes at the board

level do not appear necessary at this time.”

- “The company has posted continued growth over the last five

years coming out of the taxi medallion crisis and write-off of the

associated medallion loan portfolio. The consumer recreation and

home improvement portfolios have shown continued growth, and the

company's profitability metrics have recovered, allowing the

company to resume returning capital to shareholders via a

reinstated dividend and stock repurchases.”

- “As there is no case for incremental change at this time,

shareholders are recommended to vote FOR all management

nominees.”

In supporting Medallion’s executive compensation, ISS stated:

“pay and performance are reasonably aligned for the year in review,

STI awards were entirely based on quantified, pre-set goals, and

the company introduced performance equity into the LTI program,

which vests based on clearly disclosed, multi-year goals.” 2

“We are pleased that ISS, a leading independent governance

advisory firm, supports our nominees and our approach to executive

compensation,” said Alvin Murstein, Chairman & CEO of

Medallion.

Brent O. Hatch, Lead Independent Director of the Medallion

Board, added: “Medallion’s highly experienced Board is focused on

delivering substantial value creation for all shareholders. We look

forward to delivering continued strong performance.”

The Board has nominated two highly qualified directors for

re-election at the 2024 Annual Meeting – Robert M. Meyer and David

L. Rudnick. These nominees bring significant relevant experience,

proven leadership and a mix of tenures and perspectives to our

Board that are crucial to the Company’s continued successful

transformation and execution of its strategy.

Medallion reminds shareholders that every vote is important and

encourages shareholders to vote on the BLUE proxy card

“FOR” ONLY the Board’s nominees, Mr. Meyer and Mr.

Rudnick, “FOR” the approval of the 2023 compensation paid to our

named executive officers and FOR “one year” on the say-on-frequency

vote. The Board urges Medallion stockholders to DISCARD all white

proxy cards and materials sent by Mr. Stephen Hodges.

Stockholders who have any questions or need assistance voting

may call our proxy solicitors, Alliance Advisors, toll-free at

(855) 600-2578.

Medallion’s definitive proxy statement and other materials

regarding the Board of Directors recommendations for the 2024

Annual Meeting can be found at www.votemedallion.com/.

About Medallion Financial Corp.Medallion

Financial Corp. (NASDAQ:MFIN) and its subsidiaries originate and

service a growing portfolio of consumer loans and mezzanine loans

in various industries. Key industries served include recreation

(towable RVs and marine) and home improvement (replacement roofs,

swimming pools, and windows). Medallion Financial Corp. is

headquartered in New York City, NY, and its largest subsidiary,

Medallion Bank, is headquartered in Salt Lake City, Utah. For more

information, please visit www.medallion.com.

Forward-Looking Statements

Please note that this press release contains forward-looking

statements that involve risks and uncertainties relating to

business performance, cash flow, net interest income and expenses,

other expenses, earnings, growth, and our growth strategy. These

statements are often, but not always, made using words or phrases

such as “will” and “continue” or the negative version of those

words or other comparable words or phrases of a future or

forward-looking nature. These statements relate to future public

announcements of our earnings, the impact of the pending SEC

litigation, expectations regarding our loan portfolio, including

collections on our medallion loans, the potential for future asset

growth, and market share opportunities. Medallion’s actual results

may differ significantly from the results discussed in such

forward-looking statements. For example, statements about the

effects of the current economy, whether inflation or the risk of

recession, operations, financial performance and prospects

constitute forward-looking statements and are subject to the risk

that the actual impacts may differ, possibly materially, from what

is reflected in those forward-looking statements due to factors and

future developments that are uncertain, unpredictable and in many

cases beyond Medallion’s control. In addition to risks relating to

the current economy, a description of certain risks to which

Medallion is or may be subject, including risks related to the

pending SEC litigation, please refer to the factors discussed under

the heading “Risk Factors” in Medallion’s 2023 Annual Report on

Form 10-K.

Important Additional Information and Where to Find

It

Medallion has filed its definitive proxy statement, accompanying

BLUE proxy card and other relevant documents with the SEC in

connection with the solicitation of proxies for Medallion’s

upcoming 2024 Annual Meeting of Shareholders. BEFORE MAKING ANY

VOTING DECISION, SHAREHOLDERS OF THE COMPANY ARE URGED TO READ ALL

RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING

MEDALLION’S DEFINITIVE PROXY STATEMENT AND ANY AMENDMENTS AND

SUPPLEMENTS THERETO, BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. Investors and shareholders will be able to obtain a

copy of the definitive proxy statement and other documents filed by

the Company with the SEC free of charge from the SEC’s website at

www.sec.gov. In addition, copies will be available at no charge by

visiting the “Investor Relations” section of Medallion’s website at

www.medallion.com, as soon as reasonably practicable after such

materials are filed with, or furnished to, the SEC.

Medallion Financial Contact: Investor Relations

212-328-2176 InvestorRelations@medallion.com

1 TSR: Total Shareholder Return2 STI: Short-Term Incentive; LTI:

Long-Term Incentive

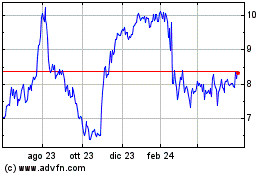

Grafico Azioni Medallion Financial (NASDAQ:MFIN)

Storico

Da Mar 2025 a Mar 2025

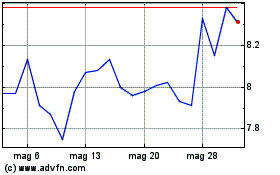

Grafico Azioni Medallion Financial (NASDAQ:MFIN)

Storico

Da Mar 2024 a Mar 2025