Magic Software Enterprises Ltd. (NASDAQ and TASE: MGIC), a global

provider of IT consulting services and end-to-end integration and

application development platforms solutions, announced today that

it signed an Memorandum of Understanding (“

MOU“) with

respect to a proposed merger with Matrix I.T Ltd. (TASE: MTRX).

Magic is pleased to announce that on March 10,

2025, it entered into an MOU with Matrix I.T Ltd., a leading public

Israeli IT services company whose shares are traded on the Tel Aviv

Stock Exchange Ltd. (“Matrix“ and together with Magic, the

“Companies“). According to the provisions of the MOU, Magic

and Matrix agreed to negotiate a definitive agreement regarding a

merger, under which Matrix will acquire the entire share capital of

Magic on a fully diluted basis, by way of a reverse triangular

merger, upon completion of which Magic will become a private

company wholly owned by Matrix. The consideration to Magic's

shareholders will be in the form of Matrix's ordinary shares, based

on exchange ratio derived from valuations of the Companies, as

detailed below (the “Merger”).

In light of the fact that Formula Systems (1985)

Ltd. is considered the controlling shareholder of both the Company

and Matrix, since it holds 46.71% and 48.21% of the outstanding

ordinary shares of Magic and Matrix, respectively; the

“Controlling Shareholder), Magic’s Board of Directors

appointed an independent committee (the “Committee“),

composed of three (3) external and independent directors, who

established orderly work procedures to independently evaluate the

deal ; conducted a thorough and comprehensive work process,

including an analysis of Magic’s available alternatives (including

the option not to proceed with the Merger); and engaged in

negotiations with Matrix's independent committee (together with the

Committee, the “Committees“) regarding the terms of the

Merger. Following the negotiations, the MOU was approved by the

Committee (including in its capacity as Magic’s Audit Committee),

and by the Board of Directors (without the presence of

representatives of the Controlling Shareholder), based on the

Committee's recommendation and following its approval.

The combined entity’s aggregate market value is

expected to be $2.1 billion (approximately 7.7 billion ILS), a

valuation that would place it among the largest publicly traded IT

services companies in the U.S and in Europe. Had the Companies

already merged in 2024, the combined entity would have reported the

following results in accordance with International Financial

Reporting Standards as issued by the International Accounting

Standards Board:

-

Revenues: $2.1 billion.

-

Gross profit: approximately $382 million (Gross margin:

18.6%).

-

Operating income: approximately $183 million (Operating

margin: 8.9%).

-

Net income attributable to non-controlling interests:

approximately $110.6 million (Net margin: 5.4%).

The combined entity is expected to operate in

approximately 50 countries, serve around 6,000 active clients, and

employ over 15,000 employees.

Merger RationaleMagic believes that the

contemplated merger represents a compelling strategic opportunity,

strengthening Magic’s market position, expanding its capabilities,

and enhancing value for its shareholders. The combination of Magic

and Matrix is expected to generate significant benefits through

increased scale, complementary geographic presence, and a broader

product and service portfolio. The key rationales for the Merger

are:

-

Enhanced Scale and Market Position

-

The Merger will create a larger, more resilient IT services and

software solutions provider, enhancing the Companies’ position with

large enterprise clients, particularly in the Israeli and U.S.

markets.

-

The combined entity will be better positioned to compete on a

global scale, leveraging a stronger brand, a larger customer base,

and a broader suite of solutions and service offerings.

-

Geographic Complementarity

-

Magic possesses a well-established international presence,

particularly in the U.S. and global markets, while Matrix holds a

dominant market position in Israel. The Merger will allow the

Companies to leverage each other’s strengths to expand geographic

reach and enhance international client engagement and

delivery.

-

Product and Service Portfolio Expansion

-

The Merger will create a more diversified product and service

offering, enabling cross-selling opportunities and providing

Magic's customers with a wider range of solutions and

services.

-

Magic’s proprietary low-code/no-code application development and

business process integration platforms, along with its software

solutions and IT outsourcing services, will be complemented by

Matrix’s advanced IT services, system integration expertise, and

strong relationships with global software vendors.

-

Clients from both Companies will benefit from a broader spectrum of

technology solutions, software products, and IT services under a

single unified organization.

-

Operational Synergies and Efficiencies

-

In addition to the strategic growth anticipated as a result of the

Merger, management expects business, managerial and operational

synergies.

-

The integration of best practices and shared technological

expertise should further enhance shareholder value.

-

Strengthened Financial Profile and Growth Potential

-

The combined entity with enhanced financial resources, operational

capabilities, and revenue streams will be better positioned to

invest in future innovation, research and development, and

strategic growth initiatives further allowing the combined entity

to provide differentiated offerings.

-

The increased scale will support the ability to attract top-tier

clients, develop new market opportunities, and reinforce long-term

sustainable growth.

This Merger represents a transformative

opportunity for both Magic and Matrix, creating a stronger and more

diversified company, with enhanced capabilities to serve customers

worldwide, drive innovation, and generate long-term value for

shareholders. Magic remains committed to a seamless integration

process, ensuring continued operational excellence and business

continuity throughout the transition.

The Committee has appointed Value Base

Mergers and Acquisitions Ltd. as its independent external financial

advisors, and Gornitzky GNY Law Firm as its independent external

legal advisors. Magic intends to utilize the services of the

international investment bank William Blair & Company, L.L.C in

the implementation of the Merger.

Key Terms of the MOUThe following

outlines the key terms of the MOU regarding the proposed Merger. It

should be noted that the MOU is intended to set out the main

agreements reached between the Committees, the audit committees and

the Companies' Board of Directors, including their agreement on the

Merger Consideration. The MOU is not legally binding, except for

the provisions of Disclosure, Governing Law and Jurisdiction and

Binding Effect.

-

Merger Structure. Upon completion of the Merger, Matrix will

acquire the entire share capital of Magic on a fully diluted basis

by way of a reverse triangular merger, and Magic will become a

private wholly-owned (100%) subsidiary of Matrix. Ordinary shares

of Matrix will continue to be traded exclusively on the Tel-Aviv

Stock Exchange Ltd. (the “TASE“). Magic's ordinary shares

are expected to be delisted from trading on the TASE and

NASDAQ.

-

Merger Consideration. Magic's shareholders will receive merger

consideration in Matrix shares, based on the relative valuations of

both Companies presented by the Committees' financial advisors

(which were adopted by the Committee, including in its capacity as

Magic's Audit Committee, and by Magic’s Board of Directors) and the

derived exchange ratio derived of 31.125%/68.875% (Magic and

Matrix, respectively), such that immediately following the Merger,

Magic’s shareholders will hold 31.125% of the issued and

outstanding share capital of Matrix, and the shareholders who held

Matrix's shares prior to the Merger will hold 68.875%, both on a

fully diluted basis (the “Consideration Shares“ or

the “Merger Consideration“). The Companies may

distribute dividends in accordance with the provisions of their

respective distribution policies as in effect on the date of the

MOU (and in any event, up to 75% of their respective net profits

attributable to shareholders), for the year 2024 and for the first

and second quarters of 2025, without it affecting the agreed

relative valuation ratio of 31.125%/68.875%. The Merger is expected

to be accounted for in Matrix's financial statements using the

pooling of interest method, whereby the company’s assets and

liabilities will be recorded at their book value. Accordingly, no

original goodwill will be recognized upon acquisition, and

consequently, no subsequent amortization of original goodwill will

be recorded.

-

Definite Agreement. The Committees have agreed to cooperate and

commence negotiations in good faith, as soon as reasonably

practicable, to reach a definitive agreement (the

“Definitive Agreement“) in order to reach a regarding

the contemplated Merger. The Definitive Agreement will be based on

the aforementioned terms as well as other customary terms and

conditions. The execution of the Definitive Agreement is subject to

the following conditions, among others: (1) satisfactory completion

of a due diligence investigation by each of the Companies in

respect of the other; (2) each Committee obtaining a separate

fairness opinion by an independent financial advisor, confirming

the Merger Consideration is fair to the shareholders of the

respective company to which such fairness opinion was rendered; (3)

obtaining the approval of the Committee, the audit committee and

Board of Directors of each of the Companies to the contemplated

Merger.

-

Conditions to Closing. The consummation of the Merger will be

subject to conditions to be determined in the Definitive Agreement,

including: (1) obtaining each of the Companies’ General Meeting

approval to the Merger, by a special majority of the minority

shareholders as required under Israeli law; (2) obtaining all

regulatory approvals required for the consummation of the Merger;

(3) obtaining third party approvals to the Merger, as will be

specified in the Definitive Agreement; (4) obtaining a pre-ruling

from the Israeli Tax Authority in connection with the Merger and to

postpone the tax liability of shareholders; and (5) completing the

reporting and disclosure documents required to be published by the

Companies under applicable law for the Merger's execution and the

issuance of the Consideration Shares.

On March 10, 2025, the Committee (including in

its capacity as the Audit Committee) discussed the contemplated

Merger structure described above and resolved that, considering the

valuations presented and adopted by the Committee, which it finds

consistent with its views, and the Merger Consideration, the Merger

structure is desirable, appropriate, fair, and best promotes the

interests of Magic and its minority shareholders.

The completion of the Merger is subject to the

completion of negotiations between the Committees as detailed

above, including the completion of due diligence, the signing of

Definitive Agreement, and the final approval of the Merger by the

competent organs of the Companies. Additionally, the completion of

the Merger will be subject to the fulfillment of the conditions

precedent to be determined in the Definitive Agreement, including

obtaining the required regulatory approvals for the execution of

the Merger as well as other third party approvals as shall be

determined in the Definitive Agreement. Accordingly, as of the date

of this report, there is still no certainty regarding the signing

of the Definitive Agreement between the Companies and whether, if

signed, all the conditions precedent for the completion of the

Merger will be met.

Following the approval of the Committee, the

Company's Board of Directors, in its meeting on March 10, 2025,

approved the Merger structure and the signing of the MOU

establishing its principles.

These materials are not an offer of

securities for sale in the United States or in any other

jurisdiction, including Israel.

Securities may not be offered or sold in the

United States absent registration or an exemption from

registration. Any public offering of securities to be made in the

United States will be made by means of a prospectus that may be

obtained from the company and that will contain detailed

information about the company and management, as well as financial

statements.

Some of the statements in this report may

constitute “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, Section 21E of the

Securities and Exchange Act of 1934, and the United States Private

Securities Litigation Reform Act of 1995. Any forward-looking

statement is not a guarantee of future performance, and actual

results could differ materially from those contained in the

forward-looking statement. These statements speak only as of the

date they were made, and the Company undertake no obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events, or otherwise. New risks

emerge from time to time, and it is not possible for the Company to

predict all risks that may affect it. For more information

regarding these risks and uncertainties, as well as certain

additional risks that the Company faces, you should refer to the

Risk Factors detailed in the Company's Annual Report on Form 20-F

for the year ended December 31, 2023, which was filed on May 13,

2024, and subsequent reports and filings made from time to time

with the Securities and Exchange Commission.

About MagicMagic (NASDAQ and TASE: MGIC)

is a global: (i) provider of proprietary application development

and business process integration platforms that accelerate the

planning, development, deployment and integration of on-premise,

mobile and cloud business applications (the “Magic

Technology”); (ii) provider of selected packaged vertical

software solutions; and (iii) vendor of software services

delivering unique and integrative cutting-edge development projects

efficiently and effectively for its customers as well as IT

outsourcing software services.

Magic Technology enables enterprises to

accelerate the process of delivering business solutions that meet

current and future needs and allows enterprises to dramatically

improve their business performance and return on investment. The

Company also offers a complete portfolio of software services in

the areas of infrastructure design and delivery, application

development, technology planning and implementation services,

mobile, IoT, Big Data, communications and other applications,

embedded systems and IoT devices, cloud solutions, cyber and

security solutions, advanced algorithms for AI, media and

interactive platforms, IT professional outsourcing services and

more.

For more information, visit

www.magicsoftware.com.

About Matrix (based on Matrix’s public

disclosures)Matrix (TASE: MTRX) is Israel’s leading IT Services

Company as demonstrated in recent research reports of the Israeli

IT market, published by the research companies IDC and STKI. Matrix

employs approximately 11,570 software, hardware, integration,

engineering and training personnel, which provide advanced IT

services to hundreds of customers in the Israeli market as well as

to customers in the U.S market. Matrix executes some of the

largest IT projects in Israel. It develops and implements leading

technologies, software solutions and products. Matrix provides

infrastructure and consulting services, outsourcing, offshore,

near-shore, training and assimilation services. Matrix represents

and markets leading software vendors. Among its customers are most

of the leading Israeli organizations and companies in the industry,

retail, banking and finances, education and academe, Hi-tech and

start-ups, transportation, defense, healthcare and the

government/public sectors. Matrix also markets sells and

distributes software solutions and hardware representing wide

variety of software vendors from Israel and around the world.

Matrix IT’s shares are traded on the TASE.

For more information, visit

matrix-globalservices.com.

Press Contact:Ronen PlatkevitzMagic Software

Enterprises:ir@magicsoftware.com

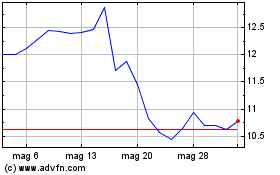

Grafico Azioni Magic Software Enterprises (NASDAQ:MGIC)

Storico

Da Mar 2025 a Apr 2025

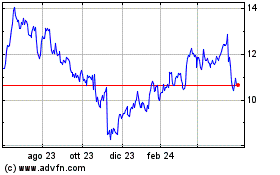

Grafico Azioni Magic Software Enterprises (NASDAQ:MGIC)

Storico

Da Apr 2024 a Apr 2025