Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

28 Agosto 2024 - 11:08PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

F O R M 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

TAT TECHNOLOGIES LTD.

(Name of Registrant)

Hamelacha 5, Netanya 4250407 Israel

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☐

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ____________

TAT Technologies Ltd.

Explanatory Note

TAT Technologies Ltd. (the "Company") hereby furnishes its investors presentation, which is attached to this Form 6-K as Exhibit 99.1

Disclaimer

The information contained herein is only a summary, does not exhaust all the information about the Company and its Operations, and does not replace a review

of the Company's Periodical and Annual Reports on Form 20-F and in other information which is filed and furnished with the Israel Securities Authority and the U.S. Securities and Exchange Commission. Material information regarding the Company which is

included in this slide deck has been published to the public in the past as part of the Company’s reporting. That said, the information or data presented may be presented in a different manner and/or segmentation from those previously furnished in the

Company's Reports.

The presentation does not constitute or form part of any invitation or offer to invest or purchase the Company's securities and in particular does not

constitute an "offer to the public" or "sale to the public" of any kind, the presentation is intended solely for the provision of information included in it and does not constitute a recommendation or opinion or a substitute for the judgment of an

investor for any kind of decision and does not pretend to include all the information that may be relevant for the purpose of making any decision regarding the investment in the Company's securities and in general.

This presentation may include forward-looking information as defined in the Securities Law, 1968 and in the U.S. Private Securities Litigation Reform Act of

1995, including forecasts, goals, business strategy, evaluations and estimates regarding both the Company's activities and the markets in which it operates, as well as any other information, in any form in which it is presented, that relates for future

events or matters, the realization of which is uncertain and not under the Company's control.

Any forward-looking information is based on current estimates and assumptions, among others, by the Company's management, which, although the Company

believes are reasonable, are inherently uncertain and are partially based on subjective estimates. The realization or non-realization of the forward-looking information will be affected and depended on a variety of factors including, including the risk

factors which are inherent to the Company’s activity, third party decisions, including regulatory authorities and engagements with third parties, as well as by developments in the economic environment and the external factors which impact the Company’s

activity, which cannot be assessed in advance and are out of the Company’s control. Actual results and achievements of the Company in the future may be materially different from those presented in the forward-looking information presented in this

presentation. The Company does not undertake to update or change such a forecast or estimate in order to reflect events and/or reasons that will apply after the date of this presentation and does not undertake to update this presentation.

Exhibit Index

This Report on Form 6-K of TAT Technologies Ltd. consists of the following document, which is attached hereto and incorporated by reference herein:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly

authorized.

| |

TAT TECHNOLOGIES LTD. |

|

| |

|

(Registrant) |

|

|

|

|

|

|

By:

|

/s/ Ehud Ben-Yair |

|

|

|

Ehud Ben-Yair |

|

|

|

Chief Financial Officer |

|

Date: August 28, 2024

Exhibit 99.1

I N V E S TO R’ S P R E S E N TAT I O N August 2024

LOOKING FORWARD STATEMENTS INVESTOR'S PRESENTATION - Aug 2024 2 This

presentation may contain certain forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Generally, the words “expects,” “anticipates,” “targets,” “goals,”

“projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words and similar expressions identify forward-looking statements and any statements regarding TAT’s future financial condition, results of operations and

business are also forward- looking statements. These forward-looking statements involve certain risks and uncertainties. Factors that could cause actual results to differ materially from those contemplated by the forward-looking statements

include, among others, the following factors: continued compliance with government regulations; competition in the industry in which TAT does business; TAT’s business strategy and plans; exchange rate fluctuations; general economic conditions;

and political, economic and military conditions in Israel. Any forward-looking statements in this presentation are not guarantees of future performance, and actual results, developments and business decisions may differ from those contemplated

by those forward-looking statements, possibly materially. Except as otherwise required by applicable law, TAT disclaims any duty to update any forward-looking statements. Additional discussions of risks and uncertainties that may affect the

accuracy of forward-looking statements included in this presentation or which may otherwise affect TAT’s business is included under the heading “RISK FACTORS” in TAT’s filings on Forms 20-F and 6-K, which are filed from time to time.

Second Quarter 2024 Results key indicators Improvement in all parameters compared

to Q2-2023 INVESTOR'S PRESENTATION - Aug 2024

UPWARD TREND IN REVENUE AND EBITDA STARTED IN Q4/22 4 INVESTOR'S PRESENTATION -

Aug 2024

Revenues and Profit 1 INVESTOR'S PRESENTATION - Aug 2024

TAT UNIQUE PROPOSITION INVESTOR'S PRESENTATION - MARCH 2024 6 EXPERIENCE AND

EXPERTISE Over 7 decades in defense and commercial aviation THERMAL SOLUTION Over 60 years of design, production and repair of heat transfer solutions OVER $400 MILLION Backlog and LTA 3 OPERATIONAL SITES Greensboro NC, Tulsa OK,

Kiryat Gat Israel DECADES OF EXCELLENCE In MRO for Honeywell APU, Safran and Liebherr landing gears , and thermal components MRO OVER 300 CUSTOMERS Partner with tier 1 aircraft manufacturers, system integrators and airlines INVESTOR'S

PRESENTATION - Aug 2024

KEY STRATEGIC PRODUCT SEGMENTS 7 THERMAL SYSTEMS & COMPONENTS OEM AND

MRO APU-HONEYWELL AUTHORIZED MRO LANDING GEARS- LIEBHERR & SAFRAN AUTHORIZED MRO INVESTOR'S PRESENTATION - Aug 2024

TOP MANAGEMENT 8 Previous Positions: 2007-2015 – Chairman of the Board of

Logic Industries Ltd. 2007-2010 – Chairman of the Board of Plasan Sasa Ltd. 2002-2005 – CEO at Elul Technologies Ltd. Previous Positions: 2009-2013 – President at Mapco Express (subsidiary of Delek US Holdings Inc). 2006-2009 – CEO at

Metrolight Ltd. 1997-2004 – CEO at Rostam Ltd. Previous Positions: 2016-2017 - CFO at SHL Telemedicine (SHLTN) 2013-2016 – CFO & Vice CEO at Opgal Optronics (Subsidiary of Elbit Systems and Rafael). 2005-2012 – CFO at Orad Hi-Tech

Systems (OHT). Amos Malka Chairman of the Board In position since June 2016 Maj. Gen. (ret.) Former Head of the Israeli Defense Intelligence and Commander of the IDF Ground Forces Command. Retired in 2002. Mr. Igal Zamir President &

CEO In position since April 2016 Mr. Ehud Ben Yair CFO In position since May 2018 TAT IS DUALLY LISTED ON NASDAQ (“TATT”) AND ON THE TEL- AVIV STOCK EXCHANGE ( תתאת) . MAIN SHAREHOLDER: FIMI 51% INVESTOR'S PRESENTATION - Aug 2024

GLOBAL PRESENCE INVESTOR'S PRESENTATION - MARCH 2024 9 TULSA, OKLAHOMA OEM

& MRO THERMAL MANAGEMENT SOLUTIONS GREENSBORO, NORTH CAROLINA MRO POWER & ACTUATION SOLUTIONS CHARLOT TE, NORTH CAROLINA GROUP OFFICE KIRYAT GAT, ISRAEL OEM & MRO THERMAL MANAGEMENT AND POWER & ACTUATION

SOLUTIONS SCHENZHEN CHINA THERMAL COMPONENTS MRO – IN PARTNERSHIP WITH LTS - LUFTHANSA SHENZHEN FULL OWNERSHIP PARTIAL OWNERSHIP / COLLABORATION INVESTOR'S PRESENTATION - Aug 2024

STRATEGIC SHIFT – KEY ELEMENTS 2020 – 2024 10 FROM 4 INDEPENDENT COMPANIES TO

ONE GROUP WITH 3 OPERATIONAL SITES centralized S&M, R&D and finance team. Cost savings of $1.5 million a year STRONG MRO PARTNERSHIP WITH HONEYWELL for certifications and part costs on the new APU models (LTAs over

$90M) ESTABLISHED STRONG PRESENCE IN APU LEASING AND PARTS TRADING (10 years exclusive contract with Honeywell) PARTNERSHIP WITH GULFSTREAM FOR THE GS4&5 AND WITH REPUBLIC AIRLINE for the E170 landing gear MRO (with LTA worth over

$55M) FROM LEGACY PRODUCTS TO NEW PRODUCTS AND PLATFORM (Heat exchangers, APU and Landing gears) INCREASE THE NUMBER OF ACCOUNTS WITH ANNUAL REVENUE ABOVE $5M and reduce the long tail of small accounts INVESTOR'S PRESENTATION - Aug 2024

STRATEGIC SHIFTS TIMELINE- STARTED IN

2020 11 2020 2021 2022 2023 ORGANIZATION STRUCTURE CHANGE LEASING AND TRADING BUSINESS UNIT INITIATION 3 HONEYWELL APU STRATEGIC AGREEMENTS APU 331-500 LICENSE AGREEMENT APU 131 LICENSE AGREEMENT 131 A/ B APU

READINESS $50M CONTRACT PRIVATE JETS LANDING GEAR MRO APU 331-20X LICENSE AGREEMENT $50M CONTRACT FIRST REVENUE APU 331-500 FIRST REVENUE FROM APU 131 2024 INVESTOR'S PRESENTATION - Aug 2024

HONEYWELL STRATEGIC AGREEMENTS DURING 2020-21 INVESTOR'S PRESENTATION - MARCH

2024 12 18 ENGINES PURCHASED AS HONEYWELL EXCLUSIVE ENGINE BANK FOR APU B777. CURRENTLY 1,700 AIRCRAFTS AND PRODUCTION IS ONGOING. 10 years agreement Annual estimated lease income of $4.5M MRO FOR B777 APU CURRENTLY 1,700 AIRCRAFT AND

PRODUCTION IS ONGOING 10 years agreement Estimated market size of $290M Annually MRO FOR B737 & A 319-20-21 APU CURRENTLY 22,000 AIRCRAFT AND PRODUCTION IS ONGOING 10 years agreement Estimated market size of over $2,200M annually.

First customer launched Q124 SIGNED 12/2020 SIGNED 12/2020 SIGNED 06/2021 MRO FOR B757/767,C17 APU 1,500 AIRCRAFTS 10 years agreement Estimated annual market size of $85M SIGNED 09/2020 TAT Piedmont is licensed to serve most of

Honeywell’s APUs installed in about 25,000 aircrafts and gained full capabilities to serve all engines since Q4-23 INVESTOR'S PRESENTATION - Aug 2024

HONEYWELL STRATEGIC DEALS POTENTIAL 13 CURRENT ENGINE PLATFORM

YEARLY TAT’S CURRENT MARKET SHARE POTENTIAL MARKET SIZE MARKET SHARE FOR THE COMING YEARS 331-20X B 767, B 757, C 17 $85M 29% 53% 331-500 B 777 $290M NONE 10% 131 B 737, A 319-21 $2,200M NONE 5% INVESTOR'S PRESENTATION -

Aug 2024

REVENUE AND EBITDA GROWTH ENGINES FOR 2024-2025 14 Strong demand for products

and services as the industry is ramping out of COVID- strong backlog coverage for 2024-2025 Strong growth in APU331-200 for 2024 and 2025 Growth from APU131 and 331-500 with improved profitability as we start penetrating the market 2

strategic deals for landing gears SEVERAL STRONG PILLARS WILL SUPPORT THE GROWTH IN REVENUE AND EBITDA INVESTOR'S PRESENTATION - Aug 2024

NEW TECHNOLOGIES: LONG-TERM GROWTH POTENTIAL 15 THERMAL SYSTEMS FOR ELECTRICAL

AIRCRAFT AND AUTONOMOUS AIRCRAFTS ADDITIVE MANUFACTURING AND 3D PRINTING CONFORMAL HEAT EXCHANGERS AND OIL COOLERS FOR ENGINES INVESTOR'S PRESENTATION - Aug 2024

LATEST INVESTOR NEWS 16 TAT Signs a new $50M contract with a major airline June

9, 2022 TAT signs a contract expansion valued $6 million a year with Collins Aerospace October 18, 2022 TAT signs a five years contract extension valued $50M with a major airline February 6, 2023 TAT received first APU331-500 order TAT

Signed a new $7.5M contract with a major carrier Read more Read more Read more June 13,2023 Read more August 16, 2023 Read more TAT signs a $10 million contract with a major airline January 16, 2024 Read more TAT completed a private

placement to Israeli investors December 28, 2023 Read more INVESTOR'S PRESENTATION - Aug 2024

F INANCIALS INVESTOR'S PRESENTATION - MARCH 2024 17

Second Quarter 2024 Results key indicators Improvement in all parameters compared

to Q2-2023 INVESTOR'S PRESENTATION - Aug 2024

UPWARD TREND IN REVENUE AND EBITDA STARTED IN Q4/22 19 INVESTOR'S PRESENTATION -

Aug 2024

Revenues by Product Product segment growth works according to our

strategy INVESTOR'S PRESENTATION - Aug 2024

21 UPWARD TRENDING REVENUE INVESTOR'S PRESENTATION - Aug 2024

22 * Q4-22 include Grants Improve Profit and Margins INVESTOR'S PRESENTATION

- Aug 2024

23 * Q4-22 include Grants INVESTOR'S PRESENTATION - Aug 2024

24 * Q4-22 include Grants INVESTOR'S PRESENTATION - Aug 2024

Back-log During the 2nd quarter TAT received orders of over 38M$ INVESTOR'S

PRESENTATION - Aug 2024

BUSINESS BREAKDOWN Q2-2024 26 INVESTOR'S PRESENTATION - Aug 2024

TAT Technologies (NASDAQ:TATT) Multiples 27 INVESTOR'S PRESENTATION - Aug

2024 TAT EV/EBITDA is below market average (12X)

APPENDICES PRODUCT L INES AND SERVICES INVESTOR'S PRESENTATION - MARCH 2024 28

WE KEEP OUR CUSTOMERS FLYING INVESTOR'S PRESENTATION - MARCH 2024 29 MORE

THAN 300 CUSTOMERS WORKING WITH MORE THAN 50 MAJOR AIRLINES 5 LARGEST CUSTOMERS, PRESENT 33% OF REVENUE INVESTOR'S PRESENTATION - Aug 2024

WE KEEP OUR CUSTOMERS FLYING 30 INVESTOR'S PRESENTATION - Aug 2024

THERMAL MANAGEMENT 31 HEAT EXCHANGERS ELECTRONIC DEVICES COOLING SYSTEM

COLD PLATES FUEL SUBMERGED HX OIL COOLERS ECU DESIGN, MANUFACTURE (OEM) AND MRO SERVICES FOR THERMAL MANAGEMENT SOLUTIONS INVESTOR'S PRESENTATION - Aug 2024

THERMAL MANAGEMENT SOLUTIONS INVESTOR'S PRESENTATION - MARCH 2024 32 POWER

ELECTRONICS: COLD PLATES (PAO) LIQUID- COOLED HEAT EXCHANGERS POWER PLANT: AIR- COOLED OIL COOLERS FUEL- OIL HEAT EXCHANGERS CONFORMAL AIR- COOLED OIL COOLERS FUEL INERTING SYSTEM: AIR- COOLED AIR COOLERS APU: AIR- COOLED OIL

COOLERS CONFORMAL AIR- COOLED OIL COOLERS GALLEY: AIR CHILLERS ENVIRONMENTAL CONTROL SYSTEM: PRECOOLERS CONDENSERS REHEATERS HYDRAULIC SYSTEM: FUEL SUBMERGED OIL COOLERS FUEL- COOLED OIL COOLERS INVESTOR'S PRESENTATION - Aug 2024

POWER AND ACTUATION INVESTOR'S PRESENTATION - MARCH 2024 33 APU ECS

ACCESSORIES LANDING GEARS BLADES FUEL SYSTEM ACCESSORIES COOLING SYSTEMS ACCESSORIES PUMPS DESIGN, MANUFACTURING AND MRO SERVICES FOR POWER AND ACTUATION SOLUTIONS INVESTOR'S PRESENTATION - Aug 2024

T H A N K YO U INVESTOR'S PRESENTATION - MARCH 2024 34

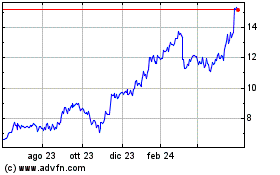

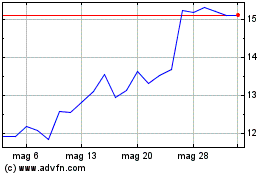

Grafico Azioni TAT Technologies (NASDAQ:TATT)

Storico

Da Mar 2025 a Mar 2025

Grafico Azioni TAT Technologies (NASDAQ:TATT)

Storico

Da Mar 2024 a Mar 2025