Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant ☒ |

Filed by a Party other than the Registrant |

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| |

|

| ☐ |

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e) (2)) |

| |

|

| ☒ |

Definitive Proxy Statement |

| |

|

| ☐ |

Definitive Additional Materials |

| |

|

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

T. Rowe Price

Group, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee paid previously with preliminary materials: |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

Table of Contents

T. Rowe Price Group, Inc.

A Premier Global Active Asset Manager

|

Independent Investment Organization

Focused solely on investment management

and related services |

|

Alignment of Interests

Substantial employee ownership aligns

interests with stockholders |

|

Stable Investment Leadership

Global investment leaders average 17 years’

tenure at T. Rowe Price

|

| |

|

|

|

|

Financial Strength

Ample liquidity and substantial cash reserves

|

|

Global Investment Platform

Full range of equity, fixed income, multi-asset,

and alternative solutions

|

|

Our Multiyear Strategic Objectives

|

Deliver

investment excellence |

|

Innovate

our investment capabilities to remain central to meeting client needs |

| |

|

|

|

| |

|

|

|

|

Globalize

and grow client base |

|

Attract

and develop excellent diverse talent |

| |

|

|

|

| |

|

|

|

|

Deliver

world-class client service |

|

Leverage

data and technology to support innovation and operational excellence, and drive scale |

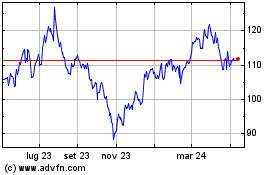

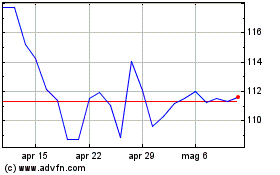

2024 Performance

Investment Results

As

investors, we remained focused on our strategic investing approach and delivering alpha for clients through active management. Our investment

performance was solid across most asset classes, with 56%, 56%, and 70% of our U.S. mutual funds (primary share class only) outperforming

their comparable Morningstar median over the 3-, 5-, and 10-year periods ended December 31, 2024, respectively.(2)

Financial Results

Our

assets under management (AUM) was $1.61 trillion on December 31, 2024, with 8.8% of our AUM domiciled outside the U.S. Average AUM in

2024, was $1.56 trillion, which led to investment advisory revenues of over $6.4 billion. In 2024, we returned $1,469.7 million to stockholders,

including $334.5 million of share repurchases.

Past

performance cannot guarantee future results. As of December 31, 2024.

| (1) | Firmwide

AUM includes assets managed by T. Rowe Price Associates, Inc., and its investment advisory

affiliates. |

| (2) | Source:

© 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1)

is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed;

and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its

content providers are responsible for any damages or losses arising from any use of this

information. Primary share class only. |

Notice

of 2025 Annual Meeting of Stockholders

Date and Time

Thursday, May 8, 2025, 8 a.m. eastern time

Record Date

March 3, 2025. Only stockholders of record at the close of business on the record date are entitled to receive notice of, and to vote

at, the Annual Meeting.

Virtual Meeting

This year’s Annual Meeting will

be held through virtualshareholdermeeting.com/ TROW2025

Voting Methods

YOUR VOTE IS IMPORTANT!

Please vote via the internet or telephone (if such voting methods are available to you) by following the instructions on the accompanying

proxy card promptly. Please see the Notice of Internet Availability of Proxy Materials, your proxy card, or the information your bank,

broker, or other holder of record provided to you for more information on these options.

T. ROWE PRICE GROUP, INC.

1307 POINT STREET

BALTIMORE, MD 21231

| VOTING

ITEM |

|

BOARD

VOTING

RECOMMENDATION |

| 1 |

Elect

a Board of 11 directors |

|

|

| 2 |

Approve,

by a nonbinding advisory vote, the compensation paid by the Company to its Named Executive Officers |

|

|

| 3 |

Ratify

the appointment of KPMG LLP as our independent registered public accounting firm for 2025 |

|

|

| 4 |

Consider

a stockholder proposal for a shareholder approval requirement for excessive golden parachutes |

|

|

Stockholders who owned shares of our common stock as of March 3, 2025, are entitled to attend and vote at the Annual Meeting or any adjournments.

By Order of the Board of Directors,

David Oestreicher

General

Counsel and Corporate Secretary

Baltimore,

Maryland

March

26, 2025

Important Notice Regarding the Availability of Proxy Materials for

the Stockholder Meeting to Be Held on May 8, 2025

On or about March 26, 2025, we are mailing

to our stockholders a Notice of Internet Availability of Proxy Materials directing stockholders to a website where they can access the

proxy statement for our Annual Meeting and the 2024 Annual Report to Stockholders (Annual Report) and view instructions on how to vote

their shares by internet or telephone. This proxy statement and our Annual Report may be viewed, downloaded, and printed, at no charge,

by accessing the following internet address: materials.proxyvote.com/74144T.

Stockholders who wish to attend the Annual

Meeting must follow the instructions on page 89 under the section titled “What must I do to participate in the Annual Meeting?”.

Introduction

This

proxy statement is being made available to you in connection with the solicitation of proxies by the T. Rowe Price Group, Inc. (Price

Group or the Company) Board of Directors (Board) for the 2025 Annual Meeting of Stockholders (Annual Meeting). The purpose of the Annual

Meeting is to:

• Elect

a Board of 11 directors;

• Approve,

by a nonbinding advisory vote, the compensation paid by the Company to its Named Executive Officers;

• Ratify

the appointment of KPMG LLP as our independent registered public accounting firm for 2025; and

• Consider

a stockholder proposal for a shareholder approval requirement for excessive golden parachutes.

This

proxy statement, the proxy card, and our 2024 Annual Report to Stockholders containing our consolidated financial statements and other

financial information for the year ended December 31, 2024, form your "Proxy Materials." We have adopted the Securities and

Exchange Commission's (SEC) "Notice and Access" model of proxy notification, which allows us to furnish proxy materials online,

with paper copies available upon request. We sent you a notice on how to obtain your Proxy Materials on March 26, 2025.

Voting Road Map

Election

of Directors

Director

Nominee Demographics

| INDEPENDENCE |

|

DIVERSITY |

|

TENURE |

| |

|

|

|

|

●

Nine of 11 director nominees are independent under the NASDAQ Global Select Market standards

●

All directors serving on the Audit, Executive Compensation and Management Development and Nominating and Corporate Governance

Committees are independent

●

A well-empowered lead independent director provides valuable independent leadership to our Board |

|

Of our independent director nominees:

|

|

●

Balanced mix of short- and long-tenured directors

●

The tenure of our independent director nominees ranges from 17 months to 15 years, with an average tenure of approximately seven

years |

| QUALIFICATIONS,

SKILLS, AND EXPERIENCE |

|

BOARD

ENGAGEMENT |

| |

|

|

|

|

100%

Executive Leadership |

|

|

|

100%

Financial

Management |

|

|

|

64%

Investment Management |

|

● The

Board held seven meetings in 2024

●

Each director attended at least 75% of the combined total number of meetings of the Board and Board committees of which

he or she was a member

●

The independent directors met in executive session at all seven of the Board meetings in 2024

●

All directors were at the 2024 annual meeting of stockholders and were available to respond to questions from our stockholders

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

82%

International |

|

|

|

73%

Accounting

and Financial Reporting |

|

|

|

100%

Strategy

and Execution |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

91%

Marketing

and Distribution |

|

|

|

45%

Government

and Regulatory |

|

|

|

36%

Technology |

|

| |

|

Recommendation of the Board |

|

Vote

Required |

| |

We

recommend that you vote FOR all the director nominees under Proposal 1. |

|

|

Advisory

Vote on the Compensation Paid to Our Named Executive Officers

Our

Named Executive Officers’ (NEOs) compensation is straightforward, goal oriented, long-term focused, transparent, and aligned with

the interests of our stockholders.

Our

incentive compensation programs are designed to motivate and reward performance, as measured by several factors, including:

● the financial performance and financial stability of Price Group

● the

relative investment performance of our investment products

● the

performance of our NEOs against the corporate and individual goals established at the beginning of the year

Our

executive compensation programs are also designed to reward our NEOs for other important contributions to our success, including corporate

integrity, service quality, customer loyalty, risk management, corporate reputation, and the quality of our team of professionals and

collaboration within that team.

Our

long-term variable compensation creates a strong alignment of the financial interests of our NEOs directly to the long-term performance

of our Company.

|

| |

CEO

COMPENSATION |

|

OTHER

NEOs

COMPENSATION |

|

FORM

OF

COMPENSATION |

|

PERFORMANCE

PERIOD |

|

PERFORMANCE

ALIGNMENT |

|

|

|

|

|

|

Cash |

|

Ongoing |

|

• Individual |

|

|

|

|

|

|

Cash |

|

Annual |

|

•

Maximum bonus pool cannot exceed 5% of net operating income (adjusted)

•

Actual NEO bonus amounts based on Company performance against financial and strategic goals, as well as individual

performance |

|

|

|

|

|

|

|

Performance

Stock Units |

|

Three-year

performance period then vest 50% per year over two following years |

|

•

Company operating margin performance compared with peers

•

Company stock price |

| |

|

|

Restricted

Stock Units |

|

Vest

one-third per year over three years |

|

•

Company stock price |

| |

|

|

|

|

|

|

|

| |

|

|

Carried

Interest |

|

Varies

based on OHA Fund performance |

|

•

OHA Fund performance |

| |

|

Recommendation

of the Board |

|

Vote

Required |

| |

We

recommend that you vote FOR this proposal. |

|

|

Ratification

of the Appointment of KPMG LLP as Our Independent Registered Public Accounting Firm for 2025

The

Audit Committee and the Board believe that the continued retention of KPMG LLP as our independent registered public accounting firm is

in the best interest of Price Group and our stockholders.

| |

|

Recommendation

of the Board |

|

Vote

Required |

| |

We

recommend that you vote FOR this proposal. |

|

|

Stockholder

Proposal for a Shareholder Approval Requirement for Excessive Golden Parachutes

| |

|

Recommendation

of the Board |

|

Vote

Required |

| |

We

recommend that you vote AGAINST this proposal. |

|

|

Table

of Contents

Information About Our Board of Directors

Board Qualifications, Skills,

and Experience

We

believe that the nominees presented in this proxy statement constitute a Board of Directors (Board) with an appropriate level and diversity

of experience, education, skills, and independence. We routinely assess and monitor the capabilities of our existing directors and whether

additional capabilities and independent directors should be added to the Board. In considering the need for additional independent directors,

we review any expected director departures and retirements and factor succession planning for the Board into our deliberations, with

particular focus on the specific skills and capabilities of departing directors. We are very pleased with our current complement of directors

and the varied perspectives they bring to the Board.

The

following are highlights of the composition of our current director nominees, all of whom currently serve on the Board:

| • |

Nine

of 11 of the director nominees are independent under the NASDAQ Global Select Market standards |

| • |

Four

director nominees are women, representing 44% of the independent director nominees |

| • |

Two director nominees are ethnically

diverse, representing 22% of the independent director nominees |

| • |

Two

director nominees were born outside the United States, representing 22% of the independent director nominees |

| • |

Two

director nominees are veterans, representing 22% of the independent director nominees |

| • |

Five of the independent director nominees

joined the Board within the last six years, representing 56% of the independent director nominees; the average independent director

nominee tenure is seven years |

Table of Contents

The

chart below summarizes the specific qualifications, attributes, and skills for each director nominee. A "■"

in the chart below indicates that the director has meaningfully useful expertise in that subject area. The lack of a "■"

does not mean the director does not possess knowledge or skill. Rather, a "■" indicates

a specific area of focus or expertise of a director on which the Board currently relies.

|

| Executive

Leadership |

Financial

Management |

Investment

Management

Industry |

International

Business

Experience |

Technology |

Strategy

Formation/

Execution |

Marketing/

Distribution |

Government/

Regulatory |

| |

|

|

|

|

|

|

|

|

| Name |

|

|

|

|

|

|

|

|

| Robert

W. Sharps |

■ |

■ |

■ |

■ |

|

■ |

■ |

|

| Glenn

R. August |

■ |

■ |

■ |

■ |

|

■ |

■ |

|

| Mark

S. Bartlett |

■ |

■ |

|

|

|

■ |

|

■ |

| William

P. Donnelly |

■ |

■ |

|

■ |

■ |

■ |

■ |

|

| Dina

Dublon |

■ |

■ |

■ |

■ |

■ |

■ |

■ |

|

| Robert

F. MacLellan |

■ |

■ |

■ |

■ |

|

■ |

■ |

■ |

| Eileen

P. Rominger |

■ |

■ |

■ |

■ |

|

■ |

■ |

■ |

| Cynthia

F. Smith |

■ |

■ |

■ |

|

|

■ |

■ |

|

| Robert

J. Stevens |

■ |

■ |

|

■ |

■ |

■ |

■ |

■ |

| Sandra

S. Wijnberg |

■ |

■ |

■ |

■ |

■ |

■ |

■ |

■ |

| Alan

D. Wilson |

■ |

■ |

|

■ |

|

■ |

■ |

|

Nominee Biographies

Each of our director nominees provides significant individual attributes

that are important to the overall makeup and functioning of our Board and described in the biographical summaries provided below:

Glenn R. August, 63

Chief

Executive Officer of OHA

T. Rowe Price Group, Inc.

Director

since: 2021

Committee

Memberships:

•

Management Committee |

|

Mr.

August has been a director of Price Group, a vice president, and an employee since 2021.

He is the founder and chief executive officer of Oak Hill Advisors, L.P. (OHA), an alternative

investment firm specializing in performing and distressed credit investments, which was acquired

by, and operates as a standalone business within, T. Rowe Price. Mr. August is a member of

the Management Committee. He co-founded the predecessor investment firm to OHA in 1987 and

took responsibility for OHA's credit and distressed investment activities in 1990. Prior

to founding OHA, and co-founding its predecessor investment firm in 1987, Mr. August worked

at Morgan Stanley in New York and London.

Mr.

August earned a B.S. in industrial and labor relations from Cornell University and an M.B.A.

from Harvard Business School, where he was a Baker Scholar.

Mr.

August has served on several corporate boards since 1987. From 2021-2024, Mr. August served

on the board of directors of Lucid Group, Inc. From 2020-2024, he served as a member of the

board of directors of MultiPlan, Inc. His nonprofit activities include serving on the boards

of trustees of Horace Mann School, where he co-chairs the investment committee and serves

on the executive committee, and The Mount Sinai Medical Center, where he serves on the finance,

human capital management, and IT committees. He is also a member of the board of directors

of Partnership for New York City and a member of the Council on Foreign Relations.

Mr.

August brings to our Board insight into the alternative investment area of our business based

on his role at OHA and his decades-long success in growing the OHA platform.

|

Mark S. Bartlett, 74

Retired

Managing Partner

Ernst & Young

Independent

Director since: 2013

Committee Memberships:

•

Audit (Chair)

•

Executive Compensation and Management Development |

|

Mr.

Bartlett has been an independent director of Price Group since 2013 and serves as chair of

the Audit Committee and as a member on the Executive Compensation and Management Development

Committee. He was a partner at Ernst & Young, serving as managing partner of the firm's

Baltimore office and senior client service partner for the mid-Atlantic region. Mr. Bartlett

began his career at Ernst & Young in 1972, serving until 2012, and has extensive experience

in financial services, as well as other industries.

Mr.

Bartlett earned a B.S. in accounting from West Virginia University and attended the Executive

Program at the Kellogg School of Business at Northwestern University. He also earned the

designation of certified public accountant.

Mr.

Bartlett is a member of the board of directors, chair of the audit committee, and a member

of the compensation committee of WillScot Mobile Mini Holdings Corp. He is also a member

of the board of directors and a member of the audit committees of FTI Consulting, Inc., and

Zurn Elkay Water Solutions Corp., and also serves as Zurn Elkay Water Solutions Corp.'s lead

independent director.

Mr.

Bartlett offers our Board additional perspective on mergers and acquisitions, significant

accounting and financial reporting experience, as well as expertise in the accounting-related

rules and regulations of the SEC from his experience as a partner of a multinational audit

firm. He has extensive finance knowledge, with a broad range of experience in financing alternatives,

including the sale of securities, debt offerings, and syndications. |

William P. Donnelly, 63

Retired

Executive Vice President

Mettler-Toledo International Inc.

Independent Director since: 2023

Committee

Memberships:

• Audit

•

Executive Compensation and Management Development |

|

Mr.

Donnelly has been an independent director of Price Group since 2023 and serves as a member

on the Audit Committee and the Executive Compensation and Management Development Committee.

Mr. Donnelly was the executive vice president responsible for finance, investor relations,

supply chain and information technology of Mettler-Toledo International Inc., a leading global

manufacturer of precision instruments and services for use in laboratories and manufacturing,

from 2014 until his retirement in 2018. From 1997 to 2002 and from 2004 to 2014, Mr. Donnelly

served as Mettler-Toledo's chief financial officer. From 2002 to 2004, he served as division

head of Mettler-Toledo's product inspection and certain lab businesses. From 1993 to 1997,

Mr. Donnelly served in various senior financial roles, including chief financial officer,

of Elsag Bailey Process Automation, NV and prior to that, he was an auditor with PricewaterhouseCoopers

LLP from 1983 to 1993.

Mr.

Donnelly earned a B.S. in business administration from John Carroll University.

Mr.

Donnelly is the lead independent director and a member of the board of directors of Ingersoll

Rand, Inc., where he also serves as chair of the nominating and corporate governance committee

and as a member of the audit committee. He is also a member of the board of directors and

a member of the audit and compensation committees of Quanterix Corporation.

Mr.

Donnelly brings to our Board substantial expertise with respect to corporate finance, operations,

information technology and mergers and acquisitions gained throughout his career as executive

vice president and chief financial officer of a public company. |

Dina Dublon, 71

Retired

Executive Vice President and Chief Financial Officer

JPMorgan Chase & Co.

Independent

Director since: 2019

Committee

Memberships:

•

Audit

•

Executive Compensation and Management Development |

|

Ms.

Dublon has been an independent director of Price Group since 2019 and serves as a member

on the Audit Committee and the Executive Compensation and Management Development Committee.

She was the executive vice president and chief financial officer of JPMorgan Chase &

Co., a financial services company, from 1998 to 2004. Ms. Dublon previously held numerous

positions at JPMorgan Chase & Co. and its predecessor companies, including corporate

treasurer, managing director of the financial institutions' division, and head of asset liability

management.

Ms.

Dublon earned a B.A. in economics and mathematics from Hebrew University of Jerusalem and

an M.S. from Carnegie Mellon University.

Ms.

Dublon has been a member of the board of directors of PepsiCo, Inc., since 2005, where she

serves as a member of the sustainability, diversity, and public policy committee and the

compensation committee. She previously served as chair of the audit committee. She also serves

as a member of the independent audit quality committee of Ernst & Young USA, since 2020,

and is chair of the board of advisors of Columbia University's Mailman School of Public Health.

She also serves on the boards of the Hastings Center and Westchester Land Trust. From 2021

to 2023, Ms. Dublon served as a director of Motive Capital Corp. II; from 2020 to 2022, as

a director of Motive Capital Corp.; from 2002 to 2017, as a director of Accenture PLC; from

2013 to 2018, as a director of Deutsche Bank AG; from 2005 to 2014, as a director of Microsoft

Corporation; and from 1999 to 2002, as a director of Hartford Financial Services Group, Inc.

She previously served on the faculty of Harvard Business School and on the boards of several

nonprofit organizations, including the Women's Refugee Commission and Global Fund for Women.

Ms.

Dublon brings to our Board significant governance experience from serving on boards of global

companies, accounting and financial reporting experience, as well as substantial expertise

with respect to the financials sector, mergers and acquisitions, global markets, public policy,

and corporate finance gained throughout her career in the financial services industry, particularly

her role as executive vice president and chief financial officer of a major financial institution. |

Robert F. MacLellan, 70

Non-Executive

Chairman

Northleaf Capital Partners

Independent Director since: 2010

Committee Memberships:

•

Audit

• Executive

•

Executive Compensation and Management Development (Chair) |

|

Mr.

MacLellan has been an independent director of Price Group since 2010 and serves as chair

of the Executive Compensation and Management Development Committee and as a member on the

Audit Committee and Executive Committee. He is the non-executive chairman of Northleaf Capital

Partners, an independent global private markets fund manager and advisor, and the chair of

Magna International, a global manufacturer of auto parts. Mr. MacLellan served as chief investment

officer of TD Bank Financial Group (TDBFG) from 2003 to 2009, where he was responsible for

overseeing the management of investments for its Employee Pension Fund, The Toronto-Dominion

Bank, TD Mutual Funds, and TD Capital Group. Earlier in his career, he was managing director

of Lancaster Financial Holdings, a merchant banking group acquired by TDBFG in March 1995.

Prior to that, Mr. MacLellan was vice president and director at McLeod Young Weir Limited

(Scotia McLeod) and a member of the corporate finance department responsible for many corporate

underwritings and financial advisory assignments.

Mr.

MacLellan earned a B.Com. from Carleton University and an M.B.A. from Harvard Business School.

He also earned the designation of certified public accountant.

Mr.

MacLellan is the non-executive chair of the board of directors and a member of the technology

committee of Magna International, Inc., a public company based in Aurora, Ontario. From 2012

to 2018, he was the chair of the board of Yellow Media, Inc., a public company based in Montreal.

Mr.

MacLellan brings substantial experience and perspective to the Board with respect to the

financial services industry, particularly his expertise with respect to investment-related

matters, including those relating to the mutual fund industry and the institutional management

of investment funds, based on his tenure as chief investment officer of a major financial

institution. He also brings an international perspective to the Board as well as significant

accounting and financial reporting experience. |

Eileen P. Rominger, 70

Former

Senior Advisor

CamberView Partners, LLC

Independent Director since: 2021

Committee Memberships:

•

Executive Compensation and Management Development

•

Nominating and Corporate Governance (Chair) |

|

Ms.

Rominger has been an independent director of Price Group since 2021 and serves as chair of

the Nominating and Corporate Governance Committee and as a member on the Executive Compensation

and Management Development Committee. She was a senior advisor to CamberView Partners, LLC,

a provider of investor-led advice for management and boards of public companies on shareholder

engagement and corporate governance, from 2013 to 2018. Ms. Rominger also was the director

of the Division of Investment Management at the Securities and Exchange Commission (SEC)

from 2011 to 2012 and was the global chief investment officer from 2008 to 2011 and a partner

from 2004 to 2011 at Goldman Sachs Asset Management. She began her career in 1981 at Oppenheimer

Capital, where she worked for 18 years as a securities analyst and then as an equity portfolio

manager, serving as a managing director and a member of the executive committee.

Ms.

Rominger earned a B.A. in English from Fairfield University and an M.B.A. in finance from

the University of Pennsylvania, The Wharton School.

Ms.

Rominger served as a member of the board of directors of Swiss Re from 2018 to 2020 and served

as a director on several of its subsidiaries until 2022. She previously served on the board

of directors of Permal Asset Management, Inc., a private company, from 2012 to 2013.

Ms.

Rominger brings a broad range of valuable leadership and investment management experience

to our Board. She also has extensive experience with complex issues relevant to the Company's

business, including budget and fiscal responsibility, economic, regulatory policy, and women's

issues. |

Robert W. Sharps, 53

Chair,

Chief Executive Officer and President

T. Rowe Price Group, Inc.

Director since: 2021

Committee Memberships:

•

Executive (Chair)

•

Management (Chair)

•

Management Compensation and Development Committee (Chair)

|

|

Mr.

Sharps has been the Chair of the Board since May 2024 and a director of Price Group since

2021. He is the chief executive officer (CEO) and president of Price Group and is the chair

of the Company's Executive, Management, and Management Compensation and Development Committees.

Mr. Sharps has been with Price Group since 1997, beginning as an analyst specializing in

financial services stocks, including banks, asset managers, and securities brokers, in the

U.S. Equity Division. He was the lead portfolio manager of the Institutional Large-Cap Growth

Equity Strategy from 2001 to 2016. In 2016, Mr. Sharps stepped down from portfolio management

to assume an investment leadership position as co-head of Global Equity, at which time he

joined the Management Committee. He was head of Investments and group chief investment officer

from 2017 to 2021. In February 2021, Mr. Sharps became President of Price Group and then

CEO in January 2022. Prior to Price Group, he completed an internship as an equity research

analyst at Wellington Management. Mr. Sharps also was employed by KPMG Peat Marwick as a

senior management consultant, where he focused on corporate transactions, before leaving

to pursue his M.B.A. in 1995.

Mr.

Sharps earned a B.S., summa cum laude, in accounting from Towson University and an M.B.A.

in finance from the University of Pennsylvania, The Wharton School. He also has earned the

Chartered Financial Analyst® designation.

Mr.

Sharps currently serves on the boards of directors of the Baltimore Curriculum Project and

the Greater Washington Partnership and the board of trustees for Bridges of Baltimore. He

previously served on the St. Paul's School board of trustees and was chair of the investment

committee from July 2015 to June 2020. He also spent six years on Towson University's College

of Business and Economics alumni advisory board.

Mr.

Sharps brings to our Board insight into the critical investment component of our business

based on the leadership roles he has held in the Equity Division of Price Group and his over

25-year career with the Company.

CFA®

and Chartered Financial Analyst® are registered trademarks

owned by CFA Institute. |

Cynthia F. Smith, 56

Senior

Vice President, Regional Business and Distribution Development

MetLife, Inc.

Independent Director since: 2023

Committee Memberships:

•

Audit

•

Executive Compensation and Management Development |

|

Ms.

Smith has been an independent director of Price Group since 2023 and serves as a member on

the Audit Committee and the Executive Compensation and Management Development Committee.

Ms. Smith is the senior vice president for regional business and distribution development

of MetLife, Inc. (MetLife), one of the world's leading financial services companies, providing

insurance, annuities, employee benefits, and asset management, since 2016, and has been with

MetLife since 1993. Previously, Ms. Smith served as vice president of: the customer unit

(Midwest) in MetLife's group benefits national accounts organization; the group, voluntary

& worksite sales regional market (Southeast region); MetLife's executive benefits sales

organization; group insurance underwriting; strategic planning for the institutional business

organization; and institutional business service, operations, and underwriting. Additionally,

she held a variety of roles in MetLife's finance organization, including chief financial

officer of sales and service and the institutional financial planning officer.

Ms.

Smith earned a B.A. in accounting from Aurora University and an M.B.A. with a concentration

in information technology from Benedictine University. She is a certified management accountant

and a graduate of the executive management program at Smith College.

Ms.

Smith is a member of the boards of directors for Versant Health, a wholly owned subsidiary

of MetLife, and MetLife Legal Plans, Inc., which is also owned by MetLife.

Ms.

Smith brings to our Board a broad range of valuable financial management and investment management

experience, along with a deep understanding of how investment products are distributed to

clients. She also has extensive experience with complex issues relevant to the Company's

business, including budget and fiscal responsibility, client experience and women's issues. |

Robert J. Stevens, 73

Retired

Chairman, President, and Chief Executive Officer

Lockheed

Martin Corporation

Independent Director since: 2019

Committee

Memberships:

•

Executive Compensation and Management Development

•

Nominating and Corporate Governance |

|

Mr.

Stevens has been an independent director of Price Group since 2019 and serves as a member

on the Executive Compensation and Management Development Committee and the Nominating and

Corporate Governance Committee. He was the chairman, president, and chief executive officer

of Lockheed Martin Corporation, an American aerospace, defense, arms, security, and advanced

technologies company, from 2005 to 2012, and served as executive chairman in 2013. He also

served as Lockheed Martin's chief executive officer from August 2004 through 2012. Previously,

Mr. Stevens held a variety of executive positions with Lockheed Martin, including president

and chief operating officer, chief financial officer, and head of strategic planning.

Mr.

Stevens earned a B.A. in psychology from Slippery Rock University of Pennsylvania, an M.S.

in industrial engineering and management from the New York University Tandon School of Engineering,

and an M.S. in business from Columbia University.

Mr.

Stevens serves on the advisory board of the Marine Corps Scholarship Foundation and is a

member of the Council on Foreign Relations. From 2002 to 2018, he was the lead independent

director of Monsanto Corporation, where he also served as the chair of the nominating and

corporate governance committee and a member of the audit committee. Mr. Stevens served as

a director of United States Steel Corporation from 2015 to 2018, where he was on the corporate

governance and public policy committee and the compensation and organization committee.

Mr.

Stevens brings to our Board significant executive management experience. He also adds additional

perspective to our Board regarding financial matters, mergers and acquisitions, strategic

leadership, and international operational experience based on his tenure as chief executive

officer of a publicly traded, multinational corporation. |

Sandra S. Wijnberg, 68

Former

Partner and Chief Administrative Officer

Aquiline Holdings LLC

Independent

Director since: 2016

Committee Memberships:

•

Executive Compensation and Management Development

•

Nominating and Corporate Governance Committee |

|

Ms.

Wijnberg has been an independent director of Price Group since 2016 and serves as a member

on the Executive Compensation and Management Development Committee and the Nominating and

Corporate Governance Committee. She was an executive advisor to Aquiline Holdings LLC, a

registered investment advisory firm from 2015 to early 2019, where she previously served

as a partner and chief administrative officer from 2007 to 2014. Previously, Ms. Wijnberg

served as the senior vice president and chief financial officer of Marsh McLennan Companies,

Inc., and was treasurer and interim chief financial officer of YUM! Brands, Inc. Prior to

that, she held financial positions with PepsiCo, Inc., and worked in investment banking at

Morgan Stanley. In addition, from 2014 through 2015, Ms. Wijnberg was deputy head of mission

for the Office of the Quartet, a development project under the auspices of the United Nations.

Ms.

Wijnberg earned a B.A. in English literature from the University of California, Los Angeles,

and an M.B.A. from the University of Southern California's Marshall School of Business, for

which she is a member of the board of leaders.

Ms.

Wijnberg is a member of the board of directors, chair of the audit committee, and a member

of the nominating and corporate governance committee of Automatic Data Processing, Inc. She

is a member of the board of directors, chair of the audit committee, and a member of the

finance and strategy committee of Cognizant Technology Solutions Corp. She is a member of

the board of directors, the lead director, and a member of the nominating and corporate governance

and audit, risk, and compliance committees of Hippo Holdings, Inc. From 2003 to 2016, Ms.

Wijnberg served on the board of directors of Tyco International, PLC, and from 2007 to 2009,

she served on the board of directors of TE Connectivity, Ltd. She is also a director of Seeds

of Peace and is a trustee of the John Simon Guggenheim Memorial Foundation.

Ms.

Wijnberg brings to our Board a global perspective along with substantial financials sector,

corporate finance, and management experience based on her roles at Aquiline Capital Partners,

Marsh McLennan, and YUM! Brands, Inc. |

Alan D. Wilson, 67

Retired

Executive Chairman

McCormick & Company, Inc.

Lead

Independent Director

Independent

Director since: 2015

Committee

Memberships:

•

Executive

•

Executive Compensation and Management Development

•

Nominating and Corporate Governance |

|

Mr.

Wilson has been an independent director of Price Group since 2015 and serves as a member

on the Executive Committee, the Executive Compensation and Management Development Committee,

and the Nominating and Corporate Governance Committee and is also the lead independent director

of the Board. He was executive chair of McCormick & Company, Inc., a global leader in

flavor, seasonings, and spices, and held many executive management roles, including chairman,

president, and chief executive officer from 2008 to 2016.

Mr.

Wilson earned a B.S. in communications from the University of Tennessee. He attended school

on an R.O.T.C. scholarship and, following college, served as a U.S. Army captain, with tours

in the United States, United Kingdom, and Germany.

Mr.

Wilson is a member of the board of directors of Smurfit Westrock Company and serves on the

compensation and nominating and corporate governance committees. He also serves as chair

for the University of Tennessee's Foundation, and as a member of the University of Tennessee's

Business School advisory board.

Mr.

Wilson brings to our Board significant executive management experience, having led a publicly

traded, multinational company. He also adds additional perspective regarding matters relating

to general management, strategic leadership, and financial matters. |

Director Engagement

Meetings

During 2024, the Board held seven meetings

and approved one matter via unanimous written consent. Each director attended at least 75% of the combined total number of meetings of

the Board and Board committees of which he or she was a member. Consistent with the Company's Corporate Governance Guidelines, the independent

directors met in executive session at each of the Board's regular meetings in 2024. Our Corporate Governance Guidelines provide that

all directors are expected to attend the annual meeting of stockholders. All nominees for director submitted to the stockholders for

approval at last year's annual meeting on May 7, 2024 (2024 Annual Meeting) attended that meeting, and we anticipate that all director

nominees will attend the 2025 Annual Meeting of Stockholders (Annual Meeting).

Beyond

the Boardroom

Director Orientation

and Continuing Education and Development

When a new independent director joins

the Board, we provide an orientation program for the purpose of providing the new director with an understanding of the operations and

the financial condition of the Company, as well as the Board's expectations for its directors. Each director is expected to maintain

the necessary knowledge and information to perform his or her responsibilities as a director. To assist the directors in understanding

the Company and its industry and maintaining the level of expertise required to serve as a director, the Company will from time to time,

offer Company-sponsored continuing education programs or presentations, in addition to briefings during Board meetings related to the

industry, the competitive environment, and the Company's goals and strategies. In addition, at most meetings the Board receives special

education sessions on one or more topics related to key industry trends, relevant business operations, and corporate governance.

The

Board is a member of the National Association of Corporate Directors, which provides resources that help directors strengthen board leadership.

Each director is encouraged to participate at least once every three years in continuing education programs for public company directors

sponsored by nationally recognized educational organizations not affiliated with the Company. The cost of all such continuing education

is paid for by the Company.

Committees

of the Board

Our

Board has an Audit Committee, an Executive Committee, an Executive Compensation and Management Development Committee (Compensation Committee),

and a Nominating and Corporate Governance Committee. The Board has also authorized a Management Committee that is made up entirely of

senior officers of the Company.

Committee

Charters

The

Board has adopted a separate written charter for each of the Audit Committee, the Compensation Committee, and the Nominating and Corporate

Governance Committee. Current copies of each charter, our Corporate Governance Guidelines, and our Code of Ethics for Principal Executive

and Senior Financial Officers (Code) can be found on our website, troweprice.com, by selecting "Investor Relations" and then "Corporate

Governance."

Qualifications

and Financial Expert Determination

The

Board has determined that each of the Audit Committee members meet the independence and financial literacy criteria of the NASDAQ Global

Select Market and the SEC. The Board also has concluded that the chair and all members of the Audit Committee meet the criteria of an

audit committee financial expert as established by the SEC. Mr. Bartlett is a certified public accountant and was an audit partner at

Ernst & Young for 28 years until he left the firm in 2012. He serves as the chair of the audit committee of WillScot Mobile Mini

Holdings Corp. and as a member of the audit committees of FTI Consulting, Inc. and Zurn Elkay Water Solutions Corp. Mr. Donnelly was

the executive vice president responsible for finance, investor relations, supply chain and information technology for Mettler-Toledo

International, Inc. from 2014 to 2018, and previously served as its chief financial officer. He is a member of the audit committees of

Ingersoll Rand, Inc. and Quanterix Corporation. Ms. Dublon was the executive vice president and chief financial officer of JPMorgan Chase

& Co., from 1998 to 2004. She served as member and chair of the audit committee of PepsiCo, Inc. and the chair of the audit committee

of Motive Capital Corp. II. Mr. MacLellan is a chartered accountant, and served as chair of the audit committee of Magna International,

Inc., and was a member of the audit committees of Ace Aviation Holdings, Inc., Maple Leaf Sports, and Entertainment, Ltd. Ms. Smith has

previously held a variety of roles in MetLife's finance organization, including chief financial officer of sales and service and the

institutional financial planning officer, she earned a B.A. in accounting and is a certified management accountant.

Responsibilities

The

primary purpose of the Audit Committee is to assist the Board in fulfilling its oversight responsibilities with respect to:

| • | The

integrity of our financial statements and other financial information provided to our stockholders; |

| • | The

retention of our independent registered public accounting firm, including oversight of the

terms of its engagement and its performance, qualifications, and independence; |

| • | The

performance of our internal audit function, internal controls, and disclosure controls; and |

| • | Our

risk management framework. |

The Audit

Committee:

| • | Provides

an avenue for communication among our internal auditors, financial management, chief risk

officer, independent registered public accounting firm, and the Board; and |

| • | Is

responsible for maintaining procedures involving the receipt, retention, and treatment of

complaints or concerns regarding accounting, internal accounting controls, and auditing matters,

including confidential, anonymous employee submissions. |

The

independent registered public accounting firm reports directly to the Audit Committee and is ultimately accountable to this committee

and the Board for the audit of our consolidated financial statements. The head of the Company's internal audit department reports directly

to the Audit Committee. The Audit Committee receives regular updates from our risk and technology departments concerning our information

security program.

Related

Person Transaction Oversight

The

Audit Committee is responsible under its charter for reviewing related person transactions and any change in, or waiver from, our Code.

Our Board has adopted a written Policy for the Review and Approval of Transactions with Related Persons. Any transaction that would require

disclosure under Item 404(a) of Regulation S-K will not be initiated or materially modified until our Audit Committee has approved

such transaction or modification and will not continue past its next contractual termination date unless it is annually reapproved by

our Audit Committee. During its deliberations, the Audit Committee must consider all relevant details regarding the transaction including,

but not limited to, any role of our employees in arranging the transaction, the potential benefits to our Company, and whether the proposed

transaction is competitively bid or otherwise is on terms comparable to those available to an unrelated third party or our employees

generally. The Audit Committee approves only those transactions that it determines in good faith to be on terms that are fair to us and

comparable to those that could be obtained in an arms-length negotiation with an unrelated third party. Please see the disclosure provided

in the section titled "Certain Relationships and Related Transactions" beginning on page 86.

All

of the non-employee independent directors of the Board serve on the Compensation Committee. The Board has determined that each of these

members meets the independence criteria of the NASDAQ Global Select Market. Dr. Hrabowski, who retired from the Board at the Company's

2024 Annual Meeting, was a member of the Compensation Committee before his retirement.

Responsibilities

The

Compensation Committee is responsible to the Board, and ultimately to our stockholders, for:

| • | Determining

the compensation of our CEO and president and other executive officers; |

| • | Reviewing

and approving general salary and compensation policies for the rest of our senior officers; |

| • | Overseeing

the administration of our Annual Incentive Compensation Plan (AICP), equity incentive plans,

and our 1986 Employee Stock Purchase Plan (ESPP); |

| • | Assisting

management in designing new compensation policies and plans; |

| • | Reviewing

and providing guidance to management concerning succession plans and development actions

for key leadership roles; |

| • | Reviewing

and assisting management regarding regarding diversity, equity, and inclusion efforts across the Company; |

| • | Reviewing

and discussing the Compensation Discussion and Analysis contained in this proxy statement

and other compensation disclosures with management; and |

| • | Overseeing

the Management Compensation and Development Committee. |

Compensation

Committee Interlocks and Insider Participation

During

fiscal year 2024, Messrs. MacLellan (Chair), Bartlett, Donnelly, Stevens, Wilson, Dr. Hrabowski, and Mses. Dublon, Rominger, Smith and

Wijnberg served as members of the Compensation Committee. Dr. Hrabowski retired from the Board at the Company's 2024 Annual Meeting.

No member of the Compensation Committee was an officer or employee of the Company or any of its subsidiaries during 2024 and no member

was formerly an officer of the Company or any of its subsidiaries or was a party to any disclosable related party transaction involving

the Company. During 2024, none of the executive officers of the Company served on the board of directors or on the compensation committee

of any other entity that has or had executive officers serving as a member of the Board or Compensation Committee of the Company.

The

Board has determined that all Nominating and Corporate Governance Committee members meet the independence criteria of the NASDAQ Global

Select Market. Dr. Hrabowski, who retired from the Board at the Company's 2024 Annual Meeting, was chair of the Nominating and Corporate

Governance Committee before his retirement.

Responsibilities

The

Nominating and Corporate Governance Committee supervises and reviews the affairs of Price Group in relation to the Board, director nominees

and compensation, committee composition, stockholder communications, and other corporate governance matters.

Among

the Nominating and Corporate Governance Committee's responsibilities are:

| • | Identifying,

evaluating, and nominating director candidates; |

| • | Considering

the continued membership of each director, and recommending the appropriate skills and characteristics

of potential directors; |

| • | Developing

director orientation and education opportunities; |

| • | Reviewing

and approving the compensation of independent directors; |

| • | Recommending

committee and chair assignments; |

| • | Overseeing

procedures regarding stockholder nominations and other communications to the Board; |

| • | Reviewing

the effectiveness of the Board in the corporate governance process; |

| • | Monitoring

compliance with and recommending any changes to the Corporate Governance Guidelines and other

governance policies; |

| • | Monitoring

and oversight of, in coordination with the Compensation Committee and the Board, succession

planning for the CEO; |

| • | Overseeing

policies related to political expenditures and political activities; |

Table of Contents

| • | Monitoring

policies related to environmental and climate matters, and recommending to the Board specific

actions related thereto; |

| • | Reviewing

actions in furtherance of the Company's corporate social responsibility, including the impact

of the Company's processes on employees, stockholders, citizens, and communities; and |

| • | Reviewing

key trends in legislation, regulation, litigation, and public debate to determine whether

the Company should consider additional corporate environmental, social responsibility, or

governance actions. |

Executive Committee

| Chair |

|

Members |

|

|

|

|

|

|

|

|

|

|

|

| Sharps |

|

MacLellan |

|

Wilson |

|

|

Responsibilities

The Executive Committee functions between meetings of the Board in the event that prompt action be called for that

requires formal action by or on behalf of the Board in circumstances where it is impractical to call and hold a full meeting

of the Board. The Executive Committee possesses the authority to exercise all the powers of the Board except as limited by

Maryland law.

If the Executive Committee acts on matters requiring formal Board action, those acts are reported to the Board at its next

meeting for ratification. Mr. Stromberg, who retired from the Board at the Company’s 2024 Annual Meeting, was a member

of the Executive Committee before his retirement.

Board

Policies and Procedures

Code

of Ethics

Pursuant

to rules promulgated under the Sarbanes-Oxley Act, the Board has adopted the Code. The Code is intended to deter wrongdoing and

promote honest and ethical conduct; full, timely, and accurate financial reporting; compliance with laws; and accountability for

adherence to the Code, including internal reporting of Code violations. A copy of the Code is available on our website. We intend to

satisfy the disclosure requirements regarding any amendment to, or waiver from, a provision of the Code by making disclosures

concerning such matters available on the Investor Relations page of our website, troweprice.com.

We

also have a Code of Ethics and Personal Transactions Policy and a Global Code of Conduct, both of which are applicable to all employees

and directors of the Company. Our Code of Ethics and Personal Transactions Policy prohibits all employees and directors of the Company

from (i) any short sales of our common stock, (ii) purchasing options on our common stock, (iii) entering into any

contract or purchasing any instrument designed to hedge or offset any decrease in the market value of our common stock, or (iv) transacting on the basis of material nonpublic information, as further described in “Insider Trading Arrangements

and Policies” below. It is the Company's

policy for all employees to participate annually in continuing education and training relating to the Code of Ethics and Personal Transactions

Policy and Global Code of Conduct.

Insider

Trading Arrangements and Policies

We have adopted insider

trading policies (Insider Trading Policies), which are contained in our Code of Ethics and Personal Transactions Policy, governing the

purchase, sale, and other dispositions of our securities, including by our directors, officers, and employees. We believe the Insider

Trading Policies are reasonably designed to promote compliance with applicable insider trading laws, rules, and regulations, as well

as NASDAQ Global Select Market listing standards. The foregoing description of our Insider Trading Policies is qualified in its entirety

by reference to the full text of the Code of

Ethics and

Personal Transactions Policy, filed as Exhibit 19 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2024,

filed with the SEC on February 14, 2025.

Corporate

Governance Guidelines

The

Board represents the interests of stockholders in fostering a business that is successful in all respects. The Board is responsible for

determining that the Company is managed with this objective in mind and that management is executing its responsibilities. The Board's

responsibility is to regularly monitor the effectiveness of management policies and decisions, including the execution of its strategies.

In addition to fulfilling its obligations for representing the interests of stockholders, the Board has responsibility to the Company's

employees, the mutual funds and investment portfolios that the Company manages, the Company's other customers and business constituents

and the communities where the Company operates. All are essential to a successful business. Our Corporate Governance Guidelines can be

found on our website, troweprice.com.

Non-employee

Director Independence Determinations

The

Board has considered the independence of current directors and director nominees and of Dr. Hrabowski and Mr. Stromberg, who retired

from the Board at the Company’s 2024 Annual Meeting, and has concluded that, excluding Messrs. Sharps, Stromberg, and August, each

such person qualifies (or qualified) as an independent director within the meaning of the applicable rules of the NASDAQ Global Select

Market.

In

making its determination of independence, the Board applied guidelines that it has adopted and concluded that the following relationships

should not be considered material relationships that would impair a director’s independence:

| • | relationships

where a director or an immediate family member of a director purchases or acquires investment

services, investment securities, or similar products and services from the Company or one

of its sponsored mutual funds and trusts (Price funds) so long as the relationship is on

terms consistent with those generally available to other persons doing business with the

Company, its subsidiaries, or its sponsored investment products; and |

| • | relationships

where a corporation, partnership, or other entity with respect to which a director or an

immediate family member of a director is an officer, director, employee, partner, or member

purchases services from the Company, including investment management or defined contribution

retirement plan services, on terms consistent with those generally available to other entities

doing business with the Company or its subsidiaries. |

The

Board believes that this policy sets an appropriate standard for dealing with ordinary course of business relationships that may arise

from time to time.

Election

of Directors

In

this proxy statement, 11 director nominees are presented pursuant to the recommendation of the Nominating and Corporate Governance Committee.

All have been nominated by the Board to hold office until the next annual meeting of stockholders and until their respective successors

are elected and qualify.

| |

|

Recommendation of the Board |

|

Vote

Required |

| |

We

recommend that you vote FOR all the director nominees under Proposal 1. |

|

|

If

any director nominee becomes unable or unwilling to serve between now and the Annual Meeting, proxies will be voted FOR the election

of a replacement recommended by the Nominating and Corporate Governance Committee and approved by the Board.

Corporate

Governance

Report

of the Nominating and Corporate

Governance Committee

Our

Nominating and Corporate Governance Committee has general oversight responsibility for governance of the Company, including the

assessment and recruitment of new director candidates and the evaluation of director and Board and committee performance. We monitor

regulatory and other developments in the governance area with a view toward both legal compliance and maintaining governance

procedures at the Company, consistent with what we consider to be best practices. In this regard, we routinely receive information

relating to best governance practices for institutions such as the Company, including input from members of the Company’s proxy

voting group concerning relevant trends. In addition, the Nominating and Corporate Governance Committee has oversight of the

Company’s environmental and corporate social responsibility activities and the Company’s policies related to political expenditures

and political activities.

Governance

Highlights

Overview

Our

Board employs practices that foster effective Board oversight of critical matters such as strategy, management succession planning, financial

and other controls, risk management, and compliance. The Board reviews our major governance policies and processes regularly in the context

of current corporate governance trends, regulatory changes, and recognized best practices.

The Board is deeply involved in understanding and developing the culture at the Company. The Board recognizes that the Company’s

people are its most valuable asset, and as such, the Board at several of its meetings holds discussions with the Company’s current

and rising leaders. The Board considers succession planning not just for the CEO, but also for several other key management positions.

In addition, the Board periodically holds its meetings at locations other than at the Company’s headquarters in Baltimore. In 2024,

the Board held a meeting at the Company’s offices in Washington, D.C., which is a key location for its investment advisor T. Rowe

Price Investment Management, Inc. This provided the Board with an opportunity to meet with associates and management affiliated with T.

Rowe Price Investment Management, Inc. These meetings help provide the Board with a broader perspective on the Company and its business.

Committee Oversight

Our

Nominating and Corporate Governance Committee maintains oversight of the Company's environmental and corporate social responsibility

activities, including considering the impact of the Company's policies on employees, stockholders, and communities. During the year,

the Nominating and Corporate Governance Committee and the Board received updates from management on the Company's environmental, social,

and governance (ESG) efforts.

Pursuant

to the Nominating and Corporate Governance Committee's oversight of political activities, the Nominating and Corporate Governance Committee

is informed of, and consulted on, any political developments impacting the Company. Additionally, the Nominating and Corporate Governance

Committee reviews the corporate memberships that the Company maintains with trade associations and requests that these groups not use

the Company's dues for political campaign contributions or to confirm to the Company if they do. The Company does not contribute corporate

funds to candidates, political party committees, political action committees, or any political organization exempt from federal income

taxes. Further, the Company does not maintain a political action committee and does not spend corporate funds directly on independent

expenditures.

Board Composition

Director Nomination Process

Ongoing

Assessment of Composition and Structure

In

considering the overall qualifications of our director nominees and their contributions to our Board, and in determining our need for

additional directors, we seek to create a Board consisting of directors with a diverse set of experiences and attributes who will be

meaningfully involved in our Board activities and will facilitate a transparent and collaborative atmosphere and culture. Our directors

generally develop a long-term association with the Company, which we believe facilitates a deeper knowledge of our business and its strategies,

opportunities, risks, and challenges. At the same time, we periodically look for additions to our Board to enhance our capabilities and

bring new perspectives and ideas to our Board.

Commitment

to Broad Skills, Expertise, and Perspective

Our current Board comprises individuals with a substantial variety of skills and expertise, including with respect to executive management,

financial institutions, government, accounting and finance, investment management, public company boards, and not-for-profit organizations.

The Board historically has valued varying perspectives brought by individuals of differing backgrounds and experiences. Our Board is not

just composed of individuals knowledgeable about our business, but is also reflective of our clients, the communities we serve, and our

stakeholders. The Nominating and Corporate Governance Committee believes it is important to maintain a mix of experienced directors with

a deep understanding of the Company and newer directors who bring a fresh perspective to the challenges of our industry. We consider diversity

as a factor relevant to any particular nominee and to the overall composition of our Board. In considering diversity, we recognize a person’s

background and experience as well as their ethnicity, gender, sexual orientation, race, and other factors that we believe will inform

the way they consider decisions brought before the Board.

Selection

of Director Candidates

The

Nominating and Corporate Governance Committee supervises the nomination process for directors. The Nominating and Corporate Governance

Committee considers the performance, independence, diversity, and other characteristics of our incumbent directors, including their willingness

to serve for an additional term and any change in their employment or other circumstances in considering their renomination each year.

Following the Annual Meeting, the Board will have 11 directors, nine of who will be independent. The tenure of our independent directors

ranges from 17 months to 15 years, with an average tenure of approximately seven years. When a director is set to retire from our Board,

the Nominating and Corporate Governance Committee focuses on identifying candidates with the skills and backgrounds to complement the

Board, in addition to seeking candidates who would bring further capabilities, experience, and diversity to our Board.

Identification

and Consideration of New Nominees

In

the event that a vacancy exists or we decide to increase the size of the Board, we identify, interview and examine, and make

recommendations to the Board regarding appropriate candidates. We will consider Board nominees with diverse capabilities, and we

generally look for nominees with capabilities in one or more of the following areas: investment and money management, general

management and leadership, economics and economic policy, audit and accounting, finance and treasury functions, marketing,

operations, technology and cybersecurity, human resources and personnel, risk management, strategic planning, governance, law,

regulation and compliance, property management, and international and global experience relating to one or more of the foregoing

areas. In evaluating potential candidates, we consider independence from management, background, experience, expertise, commitment,

diversity, number of other public board and related committee seats held, and potential conflicts of interest, among other factors,

and take into account the composition of the Board at the time of the assessment. All candidates for nomination must:

| • | demonstrate

unimpeachable character and integrity, |

| • | have

sufficient time to carry out their duties, |

| • | have

experience at senior levels in areas of expertise helpful to the Company and consistent with the objective of having a diverse and well-rounded

Board, and |

| • | have

the willingness and commitment to assume the responsibilities required of a director of the Company. |

In

addition, candidates expected to serve on the Audit Committee must meet independence and financial literacy qualifications imposed

by the NASDAQ Global Select Market and by the SEC and other applicable law. Candidates expected to serve on the Nominating and

Corporate Governance Committee or the Compensation Committee must meet independence qualifications set out by the NASDAQ Global

Select Market. Our evaluations of potential directors include, among other things, an assessment of a candidate's background and

credentials, personal interviews, and discussions with appropriate references. Once we have selected a candidate, we present him or

her to the full Board for election if a vacancy occurs or is created by an increase in the size of the Board during the course of

the year or for nomination if the director is to be first elected by the Company's stockholders. All directors serve for a one-year

term and must stand for reelection annually.

Stockholder

Recommendations and Nominations

Recommendations

A

stockholder who wishes to recommend a candidate for the Board should send a letter to the chair of the Nominating and Corporate Governance

Committee at the Company's principal executive offices providing: (i) information relevant to the candidate's satisfaction of the

criteria described above under "Director Nomination Process" and (ii) information that would be required for a director

nomination under Section 1.11 of the By-Laws. The Nominating and Corporate Governance Committee will consider and evaluate candidates

recommended by stockholders in the same manner it considers candidates from other sources. Acceptance of a recommendation does not imply

that the Nominating and Corporate Governance Committee will recommend, and the Board will ultimately nominate, the recommended candidate.

Proxy

Access and Nominations

We have adopted a proxy access right to permit a stockholder, or a group of up to 20 stockholders, owning 3% or more of the Company’s

outstanding common stock continuously for at least three years, to nominate and include in the Company’s proxy materials, director

nominees constituting up to two individuals or 20% of the Board (whichever is greater), provided that the stockholder(s) and the nominee(s)

satisfy the requirements specified in the By-Laws. Section 1.13 of the By-Laws sets out the procedures a stockholder must follow to use

proxy access. Section 1.11 of the By-Laws sets out the procedures a stockholder must follow in order to nominate a candidate for Board

membership outside of the proxy access process. For these requirements, please refer to the By-Laws as of February 9, 2021, filed as Exhibit

3.1 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, filed with the SEC on February 11, 2021.

Majority

Voting

We

have adopted a majority voting standard for the election of our directors. Under our By-Laws, in an uncontested election, a nominee will

not be elected unless he or she receives more "FOR" votes than "AGAINST" votes. Under Maryland law, any incumbent

director not so elected would continue in office as a "holdover" director until removed or replaced. As a result, the By-Laws

also provide that any director who fails to obtain the required vote in an uncontested election must submit his or her resignation to

the Board. The Board must decide whether to accept or decline the resignation, or decline the resignation with conditions, taking into

consideration the Nominating and Corporate Governance Committee's recommendation after consideration of all factors deemed relevant,

within 90 days after the vote has been certified. Plurality voting will apply to contested elections.

Board

Leadership

Chair

of the Board and Lead Independent Director

| |

|

|

|

Robert

W. Sharps

Chair

of the Board

Mr. Sharps became the chair of the Board effective May 7, 2024, following the 2024 Annual Meeting, in addition to his role as CEO and president. By serving in both positions, Mr. Sharps has been able to draw on his detailed knowledge of the Company to provide leadership to the Board in coordination with the lead independent director. We believe Mr. Sharps’ service as the chair provides our independent directors with increased exposure to senior management, as well as greater insight into the needs of the business.

|

Alan

D. Wilson

Lead

Independent Director

Mr. Wilson was elected by our independent directors as lead independent director after the 2018 annual meeting of stockholders and is

expected to be reelected after the Annual Meeting. The lead independent director role was created in 2004 and has continually developed

since that time. The lead independent director chairs Board meetings when the chair is not present, approves Board agendas and meeting

schedules, and oversees Board materials distributed in advance of Board meetings. The lead independent director also calls meetings of

the independent directors, chairs all executive sessions of the independent directors, and acts as a liaison between the independent directors

and management. The lead independent director works with the chair of the Nominating and Corporate Governance Committee when considering

new director nominees and provides input on the design and makeup of the Board and its committees. In connection with our annual board

and committee evaluation, the lead independent director conducts interviews with each director to solicit input and to ensure directors’

concerns are being addressed. The lead independent director is available to the Company’s general counsel and corporate secretary

to discuss and, as necessary, respond to stockholder communications to the Board. Finally, the lead independent director generally serves

as the Board representative in various meetings with the Company’s stockholders and other key stakeholders.

Mr. Wilson's

significant executive management experience, including having served as chair and chief executive officer of a publicly traded company,