AvalonBay Communities, Inc. Announces Participation in Nareit’s REITweek Conference, Provides Second Quarter 2024 Operating Update, and Publishes Updated Investor Presentation

31 Maggio 2024 - 10:15PM

Business Wire

AVALONBAY COMMUNITIES, INC. (NYSE: AVB) (the “Company”)

announced today that the Company will be participating in Nareit’s

REITweek Conference from June 3 – 6, 2024. During this event,

management may discuss the Company's current operating environment

and trends; development, redevelopment, disposition and acquisition

activity; portfolio strategy and other business and financial

matters affecting the Company.

The Company also provided the following Same Store Residential

operating information:

Physical Occupancy

2024

Q1

April

May(1)

Total

95.6%

95.5%

95.5%

Like-Term Effective Rent

Change

2024

Q1

April

May(1)

New England

3.2%

4.4%

4.6%

Metro NY / NJ

2.6%

3.5%

4.3%

Mid-Atlantic

3.2%

5.1%

6.0%

Southeast FL

0.7%

0.6%

(0.3%)

Denver, CO

2.3%

3.4%

3.8%

Pacific NW

2.8%

4.4%

5.2%

Northern California

0.0%

2.6%

2.9%

Southern California

1.7%

1.8%

2.3%

Other Expansion Regions

0.4%

1.3%

(1.9%)

Total

2.0%

3.2%

3.7%

Suburban

2.3%

3.5%

4.0%

Urban

1.2%

2.6%

3.2%

Total

2.0%

3.2%

3.7%

New Move-in

(0.5%)

1.8%

2.8%

Renewal

4.3%

4.4%

4.6%

Total

2.0%

3.2%

3.7%

(1) Based on preliminary results through May 30, 2024.

- Renewal Offers for June and July 2024 are being delivered to

residents at an average increase of 6.0% over the existing

lease.

The Company has posted an updated Investor Presentation to its

website. The presentation can be found in the Investor Relations

section of www.avalonbay.com.

Definitions

Like-Term Effective Rent Change for

an individual apartment home represents the percentage change in

effective rent between two leases of the same lease term category

for the same apartment. The Company defines effective rent as the

contractual rent for an apartment less amortized concessions and

discounts. Like-Term Effective Rent Change with respect to multiple

apartment homes represents an average. New Move-In Like-Term

Effective Rent Change is the change in effective rent between the

contractual rent for a resident who moves out of an apartment, and

the contractual rent for a resident who moves into the same

apartment with the same lease term category. Renewal Like-Term

Effective Rent Change is the change in effective rent between two

consecutive leases of the same lease term category for the same

resident occupying the same apartment.

Other Expansion Regions include

markets located in Charlotte, North Carolina, and Dallas,

Texas.

Renewal Offers generally represent

initial offers made to market rate apartments with expiring leases

for which the residents have not provided notice of their intent to

vacate.

Residential represents results

attributable to the Company's apartment rental operations,

including parking and other ancillary Residential revenue.

Same Store is composed of

consolidated communities where a comparison of operating results

from the prior year to the current year is meaningful as these

communities were owned and had Stabilized Operations, as defined

below, as of the beginning of the respective prior year period.

Therefore, for 2024 operating results, Same Store is composed of

consolidated communities that have Stabilized Operations as of

January 1, 2023, are not conducting or are not probable to conduct

substantial redevelopment activities and are not held for sale or

probable for disposition within the current year.

Stabilized Operations is defined as

operations of a community that occur after the earlier of (i)

attainment of 90% physical occupancy or (ii) the one-year

anniversary of completion of development or redevelopment.

Suburban represents results

attributable to submarkets having less than 3,500 households per

square mile.

Urban represents results

attributable to submarkets having 3,500 or more households per

square mile.

Forward-Looking Statements

This release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

which include, but are not limited to, statements related to the

Company’s operating performance. We intend such forward-looking

statements to be covered by the safe harbor provisions for

forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995. The Company cautions investors that

any such forward-looking statements are based on current beliefs or

expectations of future events and on assumptions made by, and

information currently available to, management. You can identify

forward-looking statements by the use of the words “believe,”

“expect,” “anticipate,” “intend,” “estimate,” “assume,” “project,”

“plan,” “may,” “shall,” “will,” “pursue” and other similar

expressions in this press release, that predict or indicate future

events and trends and that do not report historical matters. Such

forward-looking statements are subject to various risks and

uncertainties, including, among others, that occupancy rates and

market rents may be adversely affected by competition and local

economic and market conditions which are beyond the Company’s

control and other trends affecting the Company’s financial

condition or results of operations. These factors should not be

construed as exhaustive and should be read in conjunction with the

other cautionary statements that are described under the sections

entitled “Forward-Looking Statements” and “Risk Factors” in the

Company's Annual Report on Form 10-K for the year ended December

31, 2023, as such factors may be updated from time to time in the

Company’s periodic filings with the SEC, which are accessible on

the SEC’s website at . Accordingly, there are or will be important

factors that could cause actual outcomes or results to differ

materially from those indicated in these statements. The

forward-looking statements speak only as of the date of this press

release, and the Company expressly disclaims any obligation or

undertaking to publicly update or review any forward-looking

statement, whether as a result of new information, future

developments or otherwise, except to the extent otherwise required

by law.

About AvalonBay Communities, Inc.

As of March 31, 2024, the Company owned or held a direct or

indirect ownership interest in 299 apartment communities containing

90,673 apartment homes in 12 states and the District of Columbia,

of which 17 communities were under development. The Company is an

equity REIT in the business of developing, redeveloping, acquiring

and managing apartment communities in leading metropolitan areas in

New England, the New York/New Jersey Metro area, the Mid-Atlantic,

the Pacific Northwest, and Northern and Southern California, as

well as in the Company's expansion regions of Raleigh-Durham and

Charlotte, North Carolina, Southeast Florida, Dallas and Austin,

Texas, and Denver, Colorado. More information may be found on the

Company’s website at https://www.avalonbay.com.

Copyright © 2024 AvalonBay Communities, Inc.

All Rights Reserved

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240531433581/en/

Jason Reilley Vice President Investor Relations AvalonBay

Communities, Inc. 703-317-4681

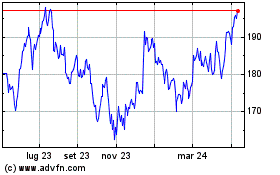

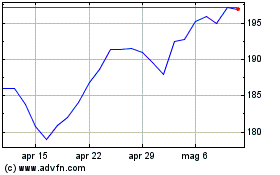

Grafico Azioni Avalonbay Communities (NYSE:AVB)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Avalonbay Communities (NYSE:AVB)

Storico

Da Mar 2024 a Mar 2025