| 28 © CTO Realty Growth, Inc. | ctoreit.com

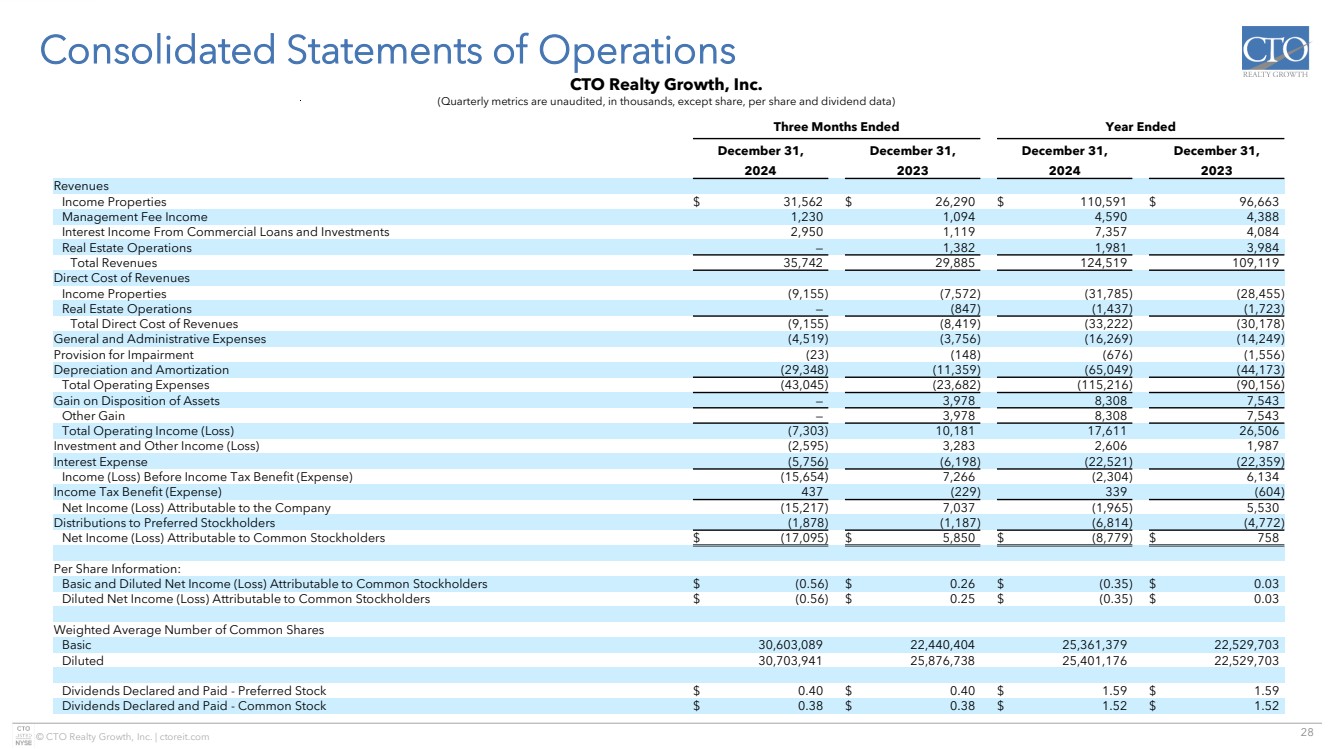

Consolidated Statements of Operations

CTO Realty Growth, Inc.

(Quarterly metrics are unaudited, in thousands, except share, per share and dividend data)

Three Months Ended Year Ended

December 31, December 31, December 31, December 31,

2024 2023 2024 2023

Revenues

Income Properties $ 31,562 $ 26,290 $ 110,591 $ 96,663

Management Fee Income 1,230 1,094 4,590 4,388

Interest Income From Commercial Loans and Investments 2,950 1,119 7,357 4,084

Real Estate Operations — 1,382 1,981 3,984

Total Revenues 35,742 29,885 124,519 109,119

Direct Cost of Revenues

Income Properties (9,155) (7,572) (31,785) (28,455)

Real Estate Operations — (847) (1,437) (1,723)

Total Direct Cost of Revenues (9,155) (8,419) (33,222) (30,178)

General and Administrative Expenses (4,519) (3,756) (16,269) (14,249)

Provision for Impairment (23) (148) (676) (1,556)

Depreciation and Amortization (29,348) (11,359) (65,049) (44,173)

Total Operating Expenses (43,045) (23,682) (115,216) (90,156)

Gain on Disposition of Assets — 3,978 8,308 7,543

Other Gain — 3,978 8,308 7,543

Total Operating Income (Loss) (7,303) 10,181 17,611 26,506

Investment and Other Income (Loss) (2,595) 3,283 2,606 1,987

Interest Expense (5,756) (6,198) (22,521) (22,359)

Income (Loss) Before Income Tax Benefit (Expense) (15,654) 7,266 (2,304) 6,134

Income Tax Benefit (Expense) 437 (229) 339 (604)

Net Income (Loss) Attributable to the Company (15,217) 7,037 (1,965) 5,530

Distributions to Preferred Stockholders (1,878) (1,187) (6,814) (4,772)

Net Income (Loss) Attributable to Common Stockholders $ (17,095) $ 5,850 $ (8,779) $ 758

Per Share Information:

Basic and Diluted Net Income (Loss) Attributable to Common Stockholders $ (0.56) $ 0.26 $ (0.35) $ 0.03

Diluted Net Income (Loss) Attributable to Common Stockholders $ (0.56) $ 0.25 $ (0.35) $ 0.03

Weighted Average Number of Common Shares

Basic 30,603,089 22,440,404 25,361,379 22,529,703

Diluted 30,703,941 25,876,738 25,401,176 22,529,703

Dividends Declared and Paid - Preferred Stock $ 0.40 $ 0.40 $ 1.59 $ 1.59

Dividends Declared and Paid - Common Stock $ 0.38 $ 0.38 $ 1.52 $ 1.52 |