0000895417DEF 14Afalseiso4217:USD00008954172024-01-012024-12-3100008954172023-01-012023-12-3100008954172022-01-012022-12-3100008954172021-01-012021-12-3100008954172020-01-012020-12-310000895417ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2024-01-012024-12-310000895417ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2024-01-012024-12-310000895417ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-01-012023-12-310000895417ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2023-01-012023-12-310000895417ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-01-012022-12-310000895417ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2022-01-012022-12-310000895417ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-01-012021-12-310000895417ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2021-01-012021-12-310000895417ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-01-012020-12-310000895417ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2020-01-012020-12-310000895417ecd:PeoMember2024-01-012024-12-310000895417ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2024-01-012024-12-310000895417ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2024-01-012024-12-310000895417ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2024-01-012024-12-310000895417ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2024-01-012024-12-310000895417ecd:PeoMember2023-01-012023-12-310000895417ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-01-012023-12-310000895417ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310000895417ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2023-01-012023-12-310000895417ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2023-01-012023-12-310000895417ecd:PeoMember2022-01-012022-12-310000895417ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-01-012022-12-310000895417ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-01-012022-12-310000895417ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2022-01-012022-12-310000895417ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2022-01-012022-12-310000895417ecd:PeoMember2021-01-012021-12-310000895417ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-01-012021-12-310000895417ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2021-01-012021-12-310000895417ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2021-01-012021-12-310000895417ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2021-01-012021-12-310000895417ecd:PeoMember2020-01-012020-12-310000895417ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2020-01-012020-12-310000895417ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2020-01-012020-12-310000895417ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2020-01-012020-12-310000895417ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2020-01-012020-12-310000895417els:AverageReportedValueOfEquityAwardsMemberecd:NonPeoNeoMember2024-01-012024-12-310000895417els:AverageEquityAwardAdjustmentsMemberecd:NonPeoNeoMember2024-01-012024-12-310000895417els:AverageReportedValueOfEquityAwardsMemberecd:NonPeoNeoMember2023-01-012023-12-310000895417els:AverageEquityAwardAdjustmentsMemberecd:NonPeoNeoMember2023-01-012023-12-310000895417els:AverageReportedValueOfEquityAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310000895417els:AverageEquityAwardAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310000895417els:AverageReportedValueOfEquityAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310000895417els:AverageEquityAwardAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310000895417els:AverageReportedValueOfEquityAwardsMemberecd:NonPeoNeoMember2020-01-012020-12-310000895417els:AverageEquityAwardAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310000895417ecd:NonPeoNeoMember2024-01-012024-12-310000895417ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2024-01-012024-12-310000895417ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000895417ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000895417ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000895417ecd:EqtyAwrdsAdjsMemberecd:NonPeoNeoMember2024-01-012024-12-310000895417ecd:NonPeoNeoMember2023-01-012023-12-310000895417ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-01-012023-12-310000895417ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000895417ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000895417ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000895417ecd:EqtyAwrdsAdjsMemberecd:NonPeoNeoMember2023-01-012023-12-310000895417ecd:NonPeoNeoMember2022-01-012022-12-310000895417ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-01-012022-12-310000895417ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000895417ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000895417ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000895417ecd:EqtyAwrdsAdjsMemberecd:NonPeoNeoMember2022-01-012022-12-310000895417ecd:NonPeoNeoMember2021-01-012021-12-310000895417ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-01-012021-12-310000895417ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000895417ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000895417ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000895417ecd:EqtyAwrdsAdjsMemberecd:NonPeoNeoMember2021-01-012021-12-310000895417ecd:NonPeoNeoMember2020-01-012020-12-310000895417ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-01-012020-12-310000895417ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000895417ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000895417ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000895417ecd:EqtyAwrdsAdjsMemberecd:NonPeoNeoMember2020-01-012020-12-31000089541712024-01-012024-12-31000089541722024-01-012024-12-31000089541732024-01-012024-12-31000089541742024-01-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary proxy statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive proxy statement

[ ] Definitive additional materials

[ ] Soliciting Material pursuant to §14a-12

Name of Registrant as Specified in its Charter:

EQUITY LIFESTYLE PROPERTIES, INC.

Name of Person(s) Filing Proxy Statement if other than the Registrant:

N/A

Payment of filing fee (check the appropriate box):

[X] No fee required.

[ ] Fee paid previously with preliminary materials.

[ ] Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

EQUITY LIFESTYLE PROPERTIES, INC.

To Our Stockholders:

You are cordially invited to attend the 2025 Annual Meeting of Stockholders (the "Annual Meeting") of Equity LifeStyle Properties, Inc., a Maryland corporation. You will be able to attend the virtual Annual Meeting, vote your shares electronically and submit your questions during the live webcast.

¿ DATE AND TIME

Tuesday, April 29, 2025

9:00 a.m. Central Time

: ACCESS THE ANNUAL MEETING

Stockholders may participate in the virtual Annual Meeting by logging in at www.virtualshareholdermeeting.com/ELS2025.

& RECORD DATE

Stockholders of record at the close of business on February 14, 2025 (the "Record Date") are entitled to attend and vote at the Annual Meeting. On that date, there were 191,142,869 shares of Common Stock of Equity LifeStyle Properties, Inc. outstanding and entitled to vote. On March 20, 2025, these proxy materials and our annual report are being mailed or made available to stockholders.

Every Vote is Important to Equity LifeStyle Properties

1 ITEMS OF BUSINESS

1 Elect Nine (9) Directors to serve until the 2026 Annual Meeting of Stockholders and until their respective successors are duly elected and qualify.

2 Ratify the appointment of Ernst & Young, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025.

3 Conduct a non-binding advisory vote to approve executive compensation as described in the Proxy Statement.

4 To transact any other business properly brought before the Annual Meeting and at any adjournments or postponements thereof.

Your vote is important to us. Whether or not you plan to attend the Annual Meeting, we urge you to authorize a proxy to vote your shares as soon as possible. Instructions on how to authorize a proxy are contained in this Proxy Statement. Only stockholders of record at the close of business on the Record Date will be entitled to notice of, and to vote at, the Annual Meeting and at any adjournments or postponements thereof. If you attend the virtual Annual Meeting, you may vote personally if you wish, even if you have previously authorized a proxy to vote your shares. Please note, however, that if your shares of Common Stock are held of record by a broker, bank or other nominee and you wish to vote in person at the Annual Meeting, you must obtain a proxy issued in your name from such broker, bank or other nominee.

* Vote by Mail

If you received a paper copy of the proxy form by mail, you may mark, sign, date and return the proxy form in the enclosed, postage-paid envelope.

( Vote by Internet or Telephone

Authorizing a proxy by internet or by telephone is fast and convenient, and your vote is immediately confirmed and tabulated.

Internet www.proxyvote.com (24/7)

Telephone 1-800-690-6903

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING TO BE HELD ON April 29, 2025.

The Company's Proxy Statement for the 2025 Annual Meeting and our 2024 Annual Report for the year ended December 31, 2024 are available at https://materials.proxyvote.com/29472R.

By Order of the Board of Directors

David P. Eldersveld

Executive Vice President, Chief Legal Officer and Corporate Secretary

March 18, 2025

EQUITY LIFESTYLE PROPERTIES, INC.

TABLE OF CONTENTS

| | | | | |

| Page |

| Proxy Statement Summary | |

| Our Nature: Uniting People, Places and Purpose | 4 |

| Corporate Governance | |

| Governance Policies, Code of Ethics and Committee Charters | |

| Board and Committee Self-Evaluation Process | |

| Engaging with Our Stakeholders | 5 |

| Stockholder Communications with the Board | |

| Non-Management Directors' Executive Sessions | |

| Board Leadership Structure | 6 |

| Management Development and Succession Planning | |

| Risk Oversight | |

| Cybersecurity | |

| Policy on Securities Trading | |

| Policy and Practices Related to the Timing of Equity Awards | 8 |

| Compensation Recovery Policy | 8 |

| Political Contributions Policy | |

| Committees of the Board; Meetings | |

| Board Composition and Refreshment | 11 |

| Executive Officers' Biographical Information | |

| Stockholder Right to Amend the Bylaws | |

| Proposal No. 1 - Election of Directors | |

| Independence of Directors | |

| Nominee Information, Qualifications, Skills and Experience | |

| Nominees' Biographical Information | |

| Director Compensation | |

| Proposal No. 2 - Ratification of the Selection of Independent Registered Public Accounting Firm | |

| Audit Committee Report | |

| Compensation Discussion and Analysis | |

| Compensation Committee Report | |

| Executive Compensation | |

| Summary Compensation Table | |

| Grants of Plan-Based Awards | |

| Outstanding Equity Awards at Fiscal Year-End | 38 |

| Option Exercises and Stock Vested | |

| Potential Payments Upon Termination of Employment or Change in Control | |

| CEO Pay Ratio | |

| Pay Versus Performance | |

| Narrative Disclosure of the Company's Compensation Policies and Practices as They Relate to Risk Management | |

| Compensation Recovery | 44 |

| Compensation Committee Interlocks and Insider Participation | |

| Proposal No. 3 - Non-Binding, Advisory Vote on Executive Compensation | |

| Security Ownership of Certain Beneficial Owners | |

| Security Ownership of Management and Directors | |

| Questions and Answers About the Annual Meeting | |

| Additional Information | 50 |

| Certain Relationships and Related Transactions | |

| Delinquent Section 16(a) Reports | 50 |

| Stockholder Proposals for the 2026 Annual Meeting | |

| 2024 Annual Report | 51 |

| Householding of Proxy Materials | 51 |

| Other Matters | |

| Appendix A | |

PROXY STATEMENT

________________

This Proxy Statement contains information related to the 2025 Annual Meeting of Stockholders (the "Annual Meeting") of Equity LifeStyle Properties, Inc., a Maryland corporation (the "Company," "Equity LifeStyle Properties," "ELS" or "we," "us," or "our"), which will be held on Tuesday, April 29, 2025, at 9:00 a.m. Central Time. The Annual Meeting will be a virtual meeting held over the Internet. You will be able to attend the Annual Meeting, vote your shares electronically and submit your questions during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/ELS2025 and entering your 16-digit control number included in the notice containing instructions on how to access Annual Meeting materials, your proxy card, or the voting instructions that accompanied your proxy materials. On March 20, 2025, these proxy materials and our annual report are being mailed or made available to stockholders.

PROXY STATEMENT SUMMARY

The following pages provide a summary of important information you will find in this Proxy Statement. As it is only a summary, please review the complete Proxy Statement before submitting your vote.

Summary of Matters for Stockholder Voting

| | | | | | | | | | | |

| Proposal | | | Board's Voting Recommendation |

| Proposal 1 | Election of Nine (9) Directors | | FOR each nominee |

| Proposal 2 | Ratification of the Appointment of Independent Accountant | | FOR |

| Proposal 3 | Advisory Vote on Executive Compensation | | FOR |

| Stockholders will consider any other business properly brought before the Annual Meeting or any adjournments or postponements thereof. |

Unless directions are set forth on the proxy, the representatives holding proxies will vote

as recommended by the Board of Directors (the "Board") or, if no recommendation is given, in their own discretion.

About Equity LifeStyle Properties

Equity LifeStyle Properties is a fully integrated owner of lifestyle-oriented properties consisting of property operations and home sales and rental operations primarily within manufactured home ("MH") and recreational vehicle ("RV") communities and marinas. Mr. Samuel Zell served as Chairman of our Board from the Company’s initial public offering until his passing in May 2023. Mr. Zell is recognized as a founder of the modern REIT industry.

1

1

| | | | | | | | |

| Business Highlights | ELS | Peer Group Average (1) |

| 5-Year Net Income Per Common Share Growth | 27.3% | 45.5% |

5-Year FFO Per Common Share Annualized Growth (2) | 7.5% | 5.1% |

5-Year NFFO Per Common Share Annualized Growth (2) | 7.3% | 5.5% |

| 5-Year Annual Dividend Per Common Share Growth | 56% | 40% |

(1) See "Compensation Discussion and Analysis - Peer Group" for a list of the companies that comprise our peer group for the year ended December 31, 2024.

(2) Funds From Operations ("FFO") per share of common stock of the Company ("Common Share") and Normalized FFO ("NFFO") per Common Share are non-generally accepted accounting principle ("GAAP") measures. See Appendix A to this Proxy Statement for a discussion and reconciliation to the most directly comparable GAAP measure.

| | | | | |

2024 Accomplishments (1) | l Net income per Common Share on a fully diluted basis was $1.96, 16.0% higher than 2023. l FFO per Common Share on a fully diluted basis was $3.03, 9.5% higher than 2023. l Normalized FFO per Common Share on a fully diluted basis was $2.91, 5.9% higher than 2023. l Core Portfolio generated growth of 6.5% in income from property operations, excluding property management,(2) compared to 2023. l Core MH base rental income increased by 6.1%, compared to 2023. l Manufactured homeowners within our Core Portfolio increased by 379 to 67,002 sites in 2024 compared to 66,623 in 2023. l Core RV and marina base rental income increased by 3.0%, compared to 2023. l Core Annual RV and marina base rental income increased by 6.5%, compared to 2023. l New home sales of 756 in 2024. l Added 736 expansion sites in 2024. l Increased the annual dividend for 2024 to $1.91 per Common Share, an increase of 6.7%, or $0.12, compared to the 2023 annual dividend of $1.79. Over the past ten years, we have increased our dividend by an average of 11.4% per year. l Closed on the modification of our $500 million unsecured line of credit to extend the maturity date to July 18, 2028. All other material terms, including interest rate terms, remained the same. Additionally, we repaid our $300 million senior unsecured term loan and terminated the interest rate swaps. l Sold approximately 4.5 million shares of our common stock at a price of $70.00 per Common Share from our prior at-the-market ("ATM") offering program that was entered into in February 2024. l In November 2024, we entered into our current ATM equity offering program with an aggregate offering price of up to $700 million. |

(1) Capitalized terms not defined herein shall have the meaning ascribed to them in the Company's Annual Report on Form 10-K for the year ended December 31, 2024 (the "2024 Form 10-K").

(2) Income from property operations, excluding property management is a non-generally accepted accounting principle ("GAAP") measure. See Appendix A to this Proxy Statement for a discussion and reconciliation to the most directly comparable GAAP measure.

2

2

| | | | | |

| Governance Highlights |

| |

l 8 out of 9 Director Nominees are Independent l Independent Lead Director l Separate Board Chairman and CEO l Independent Audit Committee l Independent Compensation, Nominating & Corporate Governance Committee l Independent Compensation Consultant to Advise the Compensation, Nominating & Corporate Governance Committee l Executive Sessions of Non-Management Directors l Risk Oversight by Board and Committees l Two New Directors Added Within Last Five Years l Ongoing Succession Planning l All Directors Stand for Election Each Year l Director Resignation Policy l Annual Board and Committee Evaluation Process l All Audit Committee Members are Financial Experts | l No Poison Pill l Ability of Stockholders to Amend Bylaws by a Majority Vote l Proxy Access l Business Ethics and Conduct Policy for Directors, Officers and Employees l Vendor Code of Conduct l Policy on Securities Trading l Prohibition Against Hedging and Pledging l Internal Disclosure Committee for Financial Controls l Annual Advisory Vote on Executive Compensation l No Employment Agreements with Named Executive Officers ("NEOs") l Compensation Recovery Policy l Performance-Driven Executive Compensation l Meaningful Share Ownership Guidelines for Directors and Executives |

The Board believes that, as a group, the nominees bring a diverse range of thought and perspective to the Board's deliberations.

| | | | | |

| Compensation Highlights |

| |

l No Employment Agreements with NEOs l Three-Year Vesting of Restricted Stock Awards l Performance and Time-Based Restricted Stock Awards | l Stock Ownership Guidelines for Board and NEOs l Performance-Based Cash Bonus Compensation

|

3

3

OUR NATURE: UNITING PEOPLE, PLACES AND PURPOSE

Sustainability Highlights

At ELS, sustainability is at the core of our nature. Our sustainability strategy is in "Our Nature: Uniting People, Places and Purpose." We are rooted in protecting and enhancing the environments where we live, work and play. We aim to provide these environments for our customers and residents to do the same. Our Nature also speaks to our culture of opportunity, inclusivity, caring, transparency and respect.

Information on our sustainability practices can be found in our 2023-24 Sustainability Report published in November 2024, which references the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB) and Task Force on Climate-related Financial Disclosures (TCFD), and United Nation Sustainable Development Goals (SDG) frameworks. These reports and other sustainability policies and collaborations are available at www.equitylifestyleproperties.com/sustainability. Such information is not considered part of, nor incorporated by reference into, this Proxy Statement. In addition, information on our sustainability practices and sustainability risks can be found in our 2024 Form 10-K.

CORPORATE GOVERNANCE

Governance Policies, Code of Ethics and Committee Charters

The Board regularly evaluates the Company's corporate governance policies and benchmarks those policies against the rules and regulations of governmental authorities, the best practices of other public companies and suggestions received from various authorities. The Board has adopted the Company's Guidelines on Corporate Governance, as amended. The Company's Guidelines on Corporate Governance require that a majority of the Directors be independent within the meaning of New York Stock Exchange ("NYSE") standards. The Company’s Common Stock is listed on the NYSE under the ticker symbol "ELS." The Company has also adopted a Business Ethics and Conduct Policy, which applies to all Directors, officers and employees of the Company. We will disclose on our website any amendment to, or waiver of, any provision of the Business Ethics and Conduct Policy applicable to our Directors and executive officers ("Executive Officers") that would otherwise be required to be disclosed under the rules of the Securities and Exchange Commission ("SEC") or NYSE.

Our Guidelines on Corporate Governance include a Director resignation policy, whereby an incumbent Director who fails to receive a majority of the votes cast in an uncontested election is expected to submit his or her resignation. If an incumbent Director fails to receive such a majority vote and tenders his or her resignation, the Compensation, Nominating and Corporate Governance Committee ("Compensation Committee") will make a recommendation to the Board as to whether to accept or reject the tendered resignation, or whether other action is recommended, taking into account any information that it considers appropriate and relevant, including the circumstances that led to the failure to receive the vote, if known. The Board will act on the tendered resignation within ninety (90) days following certification of the stockholder vote and will promptly disclose its decision and rationale as to whether to accept the resignation (or the reasons for rejecting the resignation, if applicable) in a press release, filing with the SEC or other public announcement. Our Guidelines on Corporate Governance also provide that the Compensation Committee will have oversight with respect to executive officer succession planning and management development plans.

4

4

| | | | | |

| Key Corporate Governance Documents |

Please visit the Company's website at www.equitylifestyleproperties.com in the investor relations section under "Corporate Governance" or "Sustainability" to view the following documents: |

l Articles of Amendment and Restatement, as amended ("Charter") l Fourth Amended and Restated Bylaws ("Bylaws") l Audit Committee Charter l Compensation, Nominating and Corporate Governance Committee Charter l Anti-Corruption Compliance Policy l Business Ethics and Conduct Policy | l Compensation Recovery Policy l Economic Sanctions and Anti-Money Laundering Laws Compliance Policy l Guidelines on Corporate Governance l Human Rights and Labor Rights Statement l Political Contributions Policy l Sustainability Policy l Vendor Code of Conduct l Policy on Securities Trading |

These documents are also available free of charge by sending a written request to Equity LifeStyle Properties, Inc., Attn: Investor Relations, Two North Riverside Plaza, Suite 800, Chicago, Illinois 60606, or by emailing our Company's Investor Relations Department at investor_relations@equitylifestyle.com. No information contained on the Company's website is part of or incorporated into this Proxy Statement. |

Board and Committee Self-Evaluation Process

On an annual basis, a Board evaluation process is completed whereby the Board's Lead Director (the "Lead Director"), Philip Calian, conducts interviews independently with each Director. The evaluation process includes an assessment of the performance of the Board and each Board committee as a whole and individual Directors, with a focus on areas such as independence and objectivity, meeting attendance, participation and input, knowledge and expertise, insightfulness and forethought, preparation and commitment to improvement. The Lead Director discusses the results of these evaluations with the Directors individually as necessary and with the Board and each Board committee as a whole.

Engaging with Our Stakeholders

We place great importance on consistent dialogue with all our stakeholders, including stockholders, employees, customers and members of the communities that we serve. We regularly engage in discussions with, and provide comprehensive publicly-available information for, constituents interested in our strategy, performance, governance, citizenship, stewardship and environmental compliance. We are receptive to stakeholder input, and we are committed to transparency and proactive interactions.

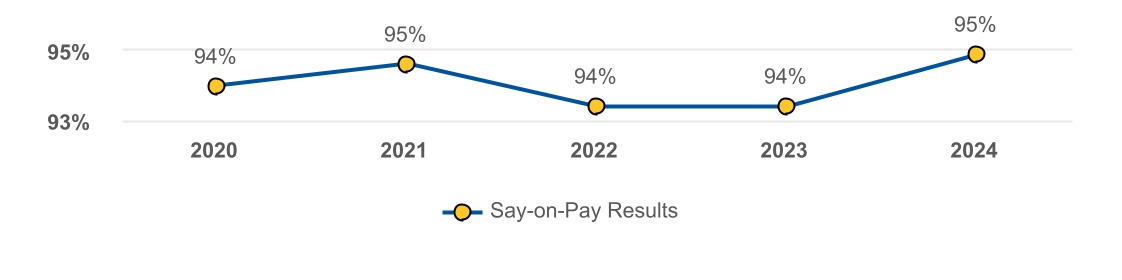

We maintain an active dialogue with our investors, which includes meetings with investors and regular participation in investor conferences. Management periodically discusses feedback, including key themes and insights gained from our investor outreach at Board and Board committee meetings, as appropriate. Additionally, the Compensation Committee takes into consideration the results of the annual advisory vote on the Company's executive compensation. At the 2024 annual meeting of stockholders, 94.7% of all the votes cast approved the compensation program described in the proxy statement for the 2024 annual meeting of stockholders. Although each Director is encouraged to attend each annual meeting of stockholders, the Board has no formal policy with respect to such attendance. All of the nine Directors who stood for re-election at the 2024 annual meeting of stockholders attended that virtual stockholder meeting.

5

5

Stockholder Communications with the Board

The Board's Lead Director is Mr. Calian who, as an independent Director, acts in the lead capacity to coordinate with the other independent Directors, consults with our Chief Executive Officer on Board agendas, chairs the executive sessions of the non-management Directors, advises executive management regarding strategy and performs such other functions as the Board may direct. Through his experience as a founder of a private equity firm, former CEO of a publicly traded company, member of private company boards and as a managing member of various companies, Mr. Calian has proven leadership ability and brings to the Board the skills necessary to be Lead Director. Any stockholder or other interested party who has a concern or inquiry regarding the conduct of the Company may communicate directly with the Lead Director, who will receive all such communications on behalf of the Board or the non-management Directors.

Communications may be confidential or anonymous, and may be submitted in writing or by email to:

Lead Director, c/o Corporate Secretary

Equity LifeStyle Properties, Inc.

Two North Riverside Plaza, Suite 800

Chicago, Illinois 60606

Email: Investor_Relations@equitylifestyle.com

All communications will be received and processed by our Corporate Secretary, and all substantive communications will be referred to the Lead Director. All such communications will be reviewed and, if necessary, investigated and/or addressed by the Lead Director and the status of such communications will be reported to the Board or the non-management Directors (as applicable) on a quarterly basis. The Lead Director may direct special treatment, including the retention of outside advisors or counsel, for any such concern or inquiry.

Non-Management Directors' Executive Sessions

Executive sessions of the Company's non-management Directors are scheduled in connection with regularly scheduled meetings of the Board and are held without management present. Executive sessions may also be held at such other times as requested by the non-management Directors. The Lead Director presides at these executive sessions. During the year ended December 31, 2024, the non-management Directors held four executive sessions.

Many regular quarterly Board committee meetings include educational briefings from management regarding a wide variety of strategic initiatives. The Company also provides an orientation program for new Directors, which includes an overview of duties and our corporate governance policies, as well as one-on-one sessions with each member of executive management on the Company's strategy and industry.

Board Leadership Structure

The Company has separated the positions of chairman of the board and chief executive officer since 1996. Thomas Heneghan currently serves as Chairman of the Board, and Marguerite Nader currently serves as our President and Chief Executive Officer ("CEO") and is a member of the Board.

Mr. Calian, an independent Director, serves as the Board's Lead Director as discussed above. The Board has determined that this leadership structure is appropriate as it allows the CEO to focus on our day-to-day business, while allowing the Chairman of the Board to lead the Board in its fundamental role of providing advice to and independent oversight of management.

Management Development and Succession Planning

The Board's goal, through the oversight of the Compensation Committee, is to have an ongoing program for executive leadership development and succession for executive management. As reflected in the Guidelines on Corporate Governance, the Compensation Committee is responsible for overseeing the preparation of executive succession and management development plans tailored to reflect the Company's current business strategy and vision. The Compensation Committee and the CEO review these succession plans for senior management at least annually and report to the Board on these plans. Individuals who are identified as high potential leaders are given exposure and visibility to Board members through formal presentations and informal events.

6

6

Risk Oversight

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. The Company faces a number of risks, including economic, environmental and regulatory risks, and others such as the impact of competition, cybersecurity, data privacy and weather conditions. The Company believes one way to manage risk is to maintain balance sheet flexibility and evaluate major capital items, including the dividend policy, debt policy, acquisitions and dispositions, and equity and debt issuances, in light of the potential impact on financial flexibility. Management is responsible for the day-to-day management of risks the Company faces, while the Board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the Board has the responsibility to satisfy itself that the risk management processes designed by management are adequate and functioning as designed.

The Board believes that establishing the right "tone at the top" and full and open communications between management and the Board are essential for effective risk management and oversight. Our CEO meets quarterly with Board committee chairpersons, updating them on a variety of matters, including risk management and related controls. Our CEO also meets monthly with our Lead Director. Our Executive Officers attend each quarterly Board meeting and are available to address any questions or concerns raised by the Board on risk management-related and any other matters. At the quarterly Board meetings, the Board receives presentations from our Executive Officers on strategic matters involving the Company's operations. Our Executive Officers also attend Strategic Planning Committee meetings and Audit Committee meetings and report on relevant topics.

While the Board is ultimately responsible for risk oversight at the Company, our three Board committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk.

| | | | | | | | | | | | | | |

| Board of Directors |

Oversees the Company's most significant risks and ensures that management responds

with appropriate strategic and tactical mitigation plans. |

| | | | | | | | |

| Board Committees |

| Audit | Compensation, Nominating and Corporate Governance | Strategic Planning |

| ......................................Oversees Risk Related to ...................................... |

•Financial Reporting •Internal Controls •Compliance with Legal & Regulatory Requirements •Risk Assessment and Risk Management •Insurance Coverage •Interest Rates •Cybersecurity •Human Rights •Sustainability | •Compensation Policies & Programs •Board Organization, Membership & Structure •Succession Planning •Corporate Governance •Sustainability | •Company Strategy •Strategic Initiatives •Capital Planning and Investment •Sustainability |

7

7

Cybersecurity

The Board, in coordination with the Audit Committee, oversees the management of risks from cybersecurity threats, including the policies, standards, processes and practices that the Company's management implements to address risks from cybersecurity threats. The Board and the Audit Committee each receive regular presentations and reports on cybersecurity risks, and the Board and the Audit Committee receive prompt and timely information regarding any cybersecurity incident that meets established reporting guidelines. Decisions regarding the disclosure and reporting of such incidents are made by management in a timely manner. The Board and Audit Committee receive ongoing updates regarding any such incidents until they have been addressed. The Audit Committee regularly interacts with the Company's enterprise risk management function, the Company's Vice President of Information Technology, other members of management and relevant management committees, including the Company's Security Advisory Board ("SAB") and Security Incident Response Team ("SIRT") as necessary. On a quarterly basis each year, the Audit Committee discusses the Company's approach to cybersecurity risk management with the Company's Vice President of Information Technology.

The SIRT is comprised of a cross-functional team of employees from compliance, information technology, investor relations, communications, risk management, financial reporting, legal and human resources and directs the mitigation and remediation of cybersecurity incidents. The SAB is comprised of members of the executive management team, is responsible for identifying SIRT members and has oversight of the SIRT. Additional information relating to the Company's approach to cybersecurity risk management, strategy and governance is contained in the Company's 2024 Form 10-K.

Policy on Securities Trading

The Company has adopted the Policy on Securities Trading, which governs the purchase, sale or other disposition of Company securities by directors, officers and employees that are reasonably designed to promote compliance with insider trading laws, rules and regulations, and the listing standards of the NYSE. Our directors, officers and employees are subject to certain "blackout periods" and certain pre-clearance requirements and procedures prior to effecting any transaction involving our securities, except for trades made pursuant to a pre-approved Rule 10b5-1 trading plan. The Policy provides that our directors and officers and their respective family members are prohibited from engaging in hedging or monetization transactions and from pledging our stock as collateral. A copy of our Policy on Securities Trading was filed as Exhibit 19 to our 2024 Form 10-K.

Policy and Practices Related to the Timing of Equity Awards

While we do not have a formal written policy in place with regard to the timing of equity awards in relation to the disclosure of material nonpublic information, the Compensation Committee does not seek to time equity awards to take advantage of information, either positive or negative, about our company that has not been publicly disclosed.

Compensation Recovery Policy

The Compensation Recovery Policy provides the Company will recover reasonably promptly, from all Executive Officers, the amount of erroneously awarded incentive-based compensation in the event that the Company is required to prepare an accounting restatement due to its material noncompliance with any financial reporting requirement under the applicable U.S. securities laws.

Political Contributions Policy

The Company has a robust policy governing political expenditures. Under the policy approved by the Board, any political spending by the Company must be legitimately linked to the Company's business purposes and strategic intent, approved by the Chief Executive Officer, and reviewed annually by the Compensation Committee.

8

8

Committees of the Board; Meetings

During the year ended December 31, 2024, the Board held four meetings. Each of the Directors attended at least 75% of the total number of meetings of the Board and meetings of the Board committees of which he or she was a member. The members of the Board committees are elected by the Board each year at the Board meeting that is held after the annual meeting of stockholders.

The three standing committees of the Board are: Audit Committee, Compensation, Nominating and Corporate Governance Committee and Strategic Planning Committee. The Board has determined that each member of the Audit Committee and Compensation Committee is an "independent" Director within the meaning set forth in the NYSE listing standards and Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). The Audit Committee and Compensation Committee are each governed by a charter which generally states the purpose of the committee and outlines the committee's structure and responsibilities. These charters are available on our website at www.equitylifestyleproperties.com in the investor relations section under "Corporate Governance." The current membership information for our Board committees is presented below.

| | | | | | | | |

| Audit Committee | | |

| | |

Members: Philip Calian (Chair) Derrick Burks David Contis Scott Peppet | | •Engages our independent registered public accounting firm ("Independent Accountants"). •Reviews with our Independent Accountants the plans for and results of the audit engagement. •Approves professional services provided by our Independent Accountants. •Reviews the independence of our Independent Accountants. •Reviews the adequacy of the Company’s internal accounting controls and accounting and reporting practices and assesses the quality and integrity of our audited financial statements. •Establishes procedures for the processing of complaints received from employees regarding internal control, accounting and auditing matters. •Reviews policies with respect to risk assessment and risk management, including, but not limited to, insurance coverage, interest rate risk management, cybersecurity, human rights and sustainability. •Reviews compliance with financial, legal, tax and regulatory requirements. •All members meet the independence, experience and financial literacy requirements of the NYSE and SEC. •All members are designated by the Board as "audit committee financial experts" in accordance with SEC regulations. •The "Audit Committee Report" is included herein. |

|

|

|

| |

| Meetings in 2024: 9 | |

| |

9

9

| | | | | | | | |

| Compensation, Nominating and Corporate Governance Committee |

| | |

Members: David Contis (Chair) Philip Calian Constance Freedman Radhika Papandreou | | •Determines compensation for our NEOs and exercises the powers of the Board in connection with compensation matters, including incentive compensation and equity-based plans. •Receives recommendations regarding executive compensation from our CEO and considers these recommendations in determining appropriate compensation plans. •Does not delegate its authority in regard to establishing executive compensation. •Authorizes grants of stock awards under our equity compensation plan. •Recommends for approval by the Board all stock award grants to independent Directors. •Reviews, administers and interprets the Compensation Recovery Policy. •Develops and recommends to the Board succession plans for the CEO and other senior executive officers. •Identifies and recommends qualified individuals to become Directors. •Develops and recommends the Guidelines on Corporate Governance applicable to the Company. •Reviews sustainability strategy, initiatives and policies. •Reviews any political contributions made by or on behalf of the Company and any applicable disclosures under the Company's Political Contributions Policy. •Recommends to the Board Director nominees for each committee of the Board. •Directs the Board in an annual review of its performance. •All members meet the independence requirements of the NYSE and SEC. •Reviews stockholder proposals and makes recommendations to the Board concerning any such proposals. •The "Compensation Committee Report" is included herein. |

|

|

|

| |

| Meetings in 2024: 5 | |

| |

| | | | | | | | |

| Strategic Planning Committee |

| | |

Members: Thomas Heneghan (Chair) Andrew Berkenfield Constance Freedman Scott Peppet | | •Sets specific broad strategic goals for the executive team that are re-assessed on an annual basis. •Meets with the Executive Officers to discuss and evaluate the progress with respect to these strategic goals. •Reviews strategy and progress on initiatives related to: ◦technology and innovation; ◦capital planning, development, acquisitions and investments; ◦utilities and energy; ◦legal proceedings; ◦property and casualty insurance; ◦sustainability; and ◦any other matters which may impact the overall strategy of the Company. •All members meet the independence requirements of the NYSE. |

|

|

|

| |

| Meetings in 2024: 4 | |

| |

10

10

Board Composition and Refreshment

Nominees for Director are selected by the Compensation Committee, which will consider nominees recommended by stockholders. If you wish to recommend a person who you consider qualified to serve on the Board, you must give written notice to our Corporate Secretary in accordance with the requirements described in the "Stockholder Proposals for the 2026 Annual Meeting" section of this Proxy Statement. This notice must contain: (i) as to each nominee, all information that would be required to be disclosed in a proxy statement with respect to the election of Directors pursuant to the Exchange Act, (ii) the name and address of the stockholder giving the notice, (iii) the number of shares of Common Stock owned beneficially and of record by such stockholder and each nominee, (iv) the written consent of each nominee to serve as a Director if so elected, and (v) such other additional information as required pursuant to the Company's Bylaws. The Compensation Committee will consider and evaluate persons recommended by stockholders in the same manner as potential nominees identified by the Board and/or the Compensation Committee. For the upcoming Annual Meeting, the Compensation Committee did not receive any recommendations for nominees from stockholders.

The Compensation Committee identifies nominees for Director from various sources. In assessing potential Director nominees, the Compensation Committee considers the character, background and professional experience of candidates. All nominees should possess good judgment and an inquiring and independent mind. Familiarity with the issues affecting the Company is among the relevant criteria. All Director nominees must possess a reputation for the highest personal and professional ethics, integrity and values. The Compensation Committee will also carefully consider any potential conflicts of interest. Nominees must also be willing and able to devote sufficient time and effort to carrying out the duties and responsibilities of a Director effectively and should be committed to serving on the Board for an extended period of time. The Compensation Committee considers diversity in identifying and evaluating Director nominees. The Compensation Committee strives to nominate Directors with a variety of complementary skills so that, if elected, the Board will contain the appropriate mix of diversity in background and experience to oversee the Company's business.

Executive Officers' Biographical Information

See "Compensation Discussion and Analysis - Executive Officers' Biographical Information" of this Proxy Statement for the biographical information for each of our Executive Officers.

Stockholder Right to Amend the Bylaws

Stockholders have the power, by the affirmative vote of a majority of all votes entitled to be cast on the matter, to alter or repeal any provision of our Bylaws and to adopt new Bylaws, except that the stockholders shall not have the power to alter or repeal Article XIV relating to amendment of the Bylaws or adopt any provision of the Bylaws inconsistent with Article XIV relating to amendment of the Bylaws without the approval of the Board.

11

11

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Independence of Directors

Pursuant to the Company's Guidelines on Corporate Governance, which require that a majority of our Directors be independent within the meaning of NYSE standards and do not include any additional categorical standards other than those required by the NYSE, the Board undertook a review of the independence of Directors nominated for reelection at the upcoming Annual Meeting. During this review, the Board considered transactions and relationships, if any, during the prior year between each Director or any member of his or her immediate family and the Company. As provided in the Guidelines on Corporate Governance, the purpose of this review was to determine whether any such relationships or transactions were inconsistent with a determination that the Director is independent.

As a result of this review, the Board affirmatively determined that all the Directors nominated for election at the Annual Meeting are independent of the Company and its management with the exception of our President and CEO, Marguerite Nader. The Board determined that none of the independent Directors has or had a material relationship with the Company other than being a Director and/or a stockholder of the Company.

The Board specifically considered Mr. Heneghan's role as former CEO of the Company and determined that this role did not hinder Mr. Heneghan's independence within the meaning of the NYSE listing standards.

Nominee Information, Qualifications, Skills and Experience

You are being asked to vote on the election of nine Director nominees listed below. The Company's Charter currently provides for the annual election of all Directors. All nominees are presently Directors, and each nominee has consented to be named in this Proxy Statement and to serve if elected.

12

12

In addition to each Director nominee's qualifications, skills and experience outlined in their biographical data below, the Company's Board looked for certain attributes in each of the Director nominees and based on these attributes, concluded that each Director nominee should serve on the Board. The Board does not require that the Director nominees possess each attribute, but rather the Board is looking for a mix of attributes among the Directors.

The following table shows the attributes of each Director nominee.

13

13

Nominees' Biographical Information

Mr. Heneghan has been Chairman of the Board since May 2023, was Vice Chairman of the Board from 2018 to 2023, and was Co-Vice Chairman from 2013 to 2018. Mr. Heneghan has been chief executive officer of Equity International, a private investment firm focused on real estate-related companies, since February 2013. Mr. Heneghan was Chief Executive Officer of the Company from January 2004 to February 2013 and President of the Company from February 2011 to May 2012. He was also President of the Company from January 2004 to January 2008. Mr. Heneghan was President and Chief Operating Officer of the Company from May 2000 to December 2003. He was Executive Vice President, Chief Financial Officer and Treasurer of the Company from April 1997 to May 2000, and Vice President, Chief Financial Officer and Treasurer of the Company from February 1995 to March 1997. Mr. Heneghan served on the board of directors of Farmland Partners Inc., a publicly traded real estate company that owns and seeks to acquire high-quality North American farmland, from 2020 to 2024. He is a director of Chai Trust.

Mr. Berkenfield has been a partner and the chief executive officer of Duncan Channon, a nationally acclaimed, independent advertising agency, since January 2009. Mr. Berkenfield joined Duncan Channon in January 2000 as the agency’s general manager. Prior to 2000, Mr. Berkenfield held senior positions at Foote, Cone & Belding, a global advertising agency, and Lintas: NY, an advertising communications company.

Mr. Burks was a partner at Ernst & Young, LLP, a public accounting firm, from 2002 until his retirement in 2017 and served as the managing partner of the Indianapolis office from 2004 to 2017. Mr. Burks was employed by Arthur Andersen, a public accounting firm, from 1978 to 2002, where he served for three years as the managing partner of the Indianapolis office. Mr. Burks has been a director of Duke Energy, a publicly traded electric power holding company, since March 2022. Mr. Burks has been a director of Kite Realty Group Trust, a publicly traded shopping mall REIT, since 2021. Mr. Burks was a director of Vectren Corporation, a publicly traded regional energy company, from 2017 until the time of its sale in 2019 and was a member of its audit committee and finance committee. Mr. Burks’ business experience spans small businesses, large international corporations and public companies. He has extensive merger and acquisition, capital markets, enterprise risk and SEC expertise. Throughout his career he has served companies in various industries, including energy, manufacturing, mass merchandising and logistics with a focus for more than 25 years in real estate (REITs).

Mr. Burks was a partner at Ernst & Young, LLP, a public accounting firm, from 2002 until his retirement in 2017 and served as the managing partner of the Indianapolis office from 2004 to 2017. Mr. Burks was employed by Arthur Andersen, a public accounting firm, from 1978 to 2002, where he served for three years as the managing partner of the Indianapolis office. Mr. Burks has been a director of Duke Energy, a publicly traded electric power holding company, since March 2022. Mr. Burks has been a director of Kite Realty Group Trust, a publicly traded shopping mall REIT, since 2021. Mr. Burks was a director of Vectren Corporation, a publicly traded regional energy company, from 2017 until the time of its sale in 2019 and was a member of its audit committee and finance committee. Mr. Burks’ business experience spans small businesses, large international corporations and public companies. He has extensive merger and acquisition, capital markets, enterprise risk and SEC expertise. Throughout his career he has served companies in various industries, including energy, manufacturing, mass merchandising and logistics with a focus for more than 25 years in real estate (REITs). 14

14

Mr. Calian has been the Board's Lead Director since 2019. Mr. Calian has been founder and managing partner of Kingsbury Partners LLC since January 2002. Kingsbury Partners LLC is a private equity and consulting firm focused on providing capital and ownership skills to middle market distressed businesses. Mr. Calian also served as operating partner of Waveland Investments LLC, a Chicago-based private equity firm with committed equity capital, from July 2003 until December 2019. Prior to founding Kingsbury Partners LLC, Mr. Calian was chief executive officer of American Classic Voyages Co., a publicly traded travel and leisure company, from 1995 until 2002. Mr. Calian is managing member of MCS Investment Group, LLC, a private producer and seller of mineral well brine; Hudson Lock, LLC, a private lock and hardware manufacturer; and LCP2, LLC, a community newspaper technology platform company. Mr. Calian is a member of the board of directors of CC - Development Group, Inc., a private owner and operator of senior living communities.

Mr. Contis has been a principal of Agora Advisors, Inc., which provides consulting services to domestic and international real estate and retail companies, since May 2017. Mr. Contis was president - mall platform and senior executive vice president of Simon Properties Group, Inc., a publicly traded retail REIT, from May 2011 to May 2017. Mr. Contis was president of real estate for Equity Group Investments from November 2006 to May 2011. He was executive vice president and chief operating officer of The Macerich Company, a publicly traded shopping center REIT, from May 1997 to October 2006. Mr. Contis was employed in various capacities by affiliates of Equity Group Investments from 1980 to 1997, including as vice chairman, executive vice president and chief operating officer of Equity Properties & Development L.P., from 1992 to 1997. Mr. Contis has been a director of CBL Properties, a publicly traded retail REIT, since 2021 and currently serves as chairman of the board and as a member of the audit committee and previously served as a member of the compensation committee. He served on the board of directors of BRMalls, Brazil’s largest shopping center company from 2008 to 2011. Mr. Contis was a director and served as a member of the board of directors, compensation committee and audit committee of Dundee Realty Corp., a Canadian-based real estate company, from 1997 to 2003. Mr. Contis is an advisor to Equity International. He is a director of Chai Trust. Mr. Contis is a director and serves on the Investment Committee of Acosta Verde, which owns and operates shopping centers in Mexico and is listed on the Mexican Stock Exchange.

15

15

Ms. Freedman is the founder and managing partner of Moderne Ventures, an early-stage investment fund she founded in 2015 that is focused on technology companies in and around real estate, finance, insurance and home services. Prior to Moderne Ventures, Ms. Freedman was the vice president of strategic investments for the National Association of Realtors where she launched the investment fund Second Century Ventures in 2008 and founded REach, its technology accelerator, in 2012.

Ms. Nader has been President and CEO of the Company since February 2013. She was President and Chief Financial Officer from May 2012 to October 2012 and Executive Vice President and Chief Financial Officer from December 2011 to May 2012. Ms. Nader was Executive Vice President - New Business Development from February 2011 to December 2011. She was Executive Vice President - Sales and Marketing from February 2009 to February 2011. Ms. Nader was Senior Vice President of New Business Development from January 2007 to February 2009. She was Vice President of New Business Development from January 2001 to January 2007. Ms. Nader was Vice President of Asset Management from January 1998 to January 2001. She has been employed with the Company since 1993. Ms. Nader has been a director of Ventas, a publicly traded healthcare REIT since 2020 and serves on the Audit Committee and Nominating, Governance and Corporate Responsibility Committee. Ms. Nader was a trustee of Liberty Property Trust, a publicly traded industrial REIT, from June 2017, until its sale in 2020. Ms. Nader served as the National Association of Real Estate Investment Trust's ("NAREIT") 2022 chair and served on NAREIT's executive board from 2013 to 2025.

Ms. Papandreou has been president of North America for Korn Ferry since May 2024 and was managing partner for Korn Ferry’s Chicago office from 2021 to May 2024, and previously served as senior client partner from 2019 to 2021. Ms. Papandreou specializes in executive and board placements and has managed large-scale client projects including bankruptcies, turnarounds, spin-offs and mergers and acquisitions. In addition, Ms. Papandreou leads Korn Ferry’s North American travel, hospitality and leisure practice and is a core member within the Korn Ferry board and CEO Services practice. Ms. Papandreou was employed by an executive search firm from 2016 to 2019, where she was managing director and global head of its hospitality and leisure practice and a core partner within the board practice. From 1998 to 2016, Ms. Papandreou held various positions in the investment banking industry.

16

16

Mr. Peppet is president of Chai Trust Company, LLC, a private trust company for the Zell family. Before joining Chai Trust, Mr. Peppet was a Professor of Law at the University of Colorado Law School for nearly 20 years. Mr. Peppet is an advisor to Equity International. Mr. Peppet was a director of Anixter International Inc., a publicly traded global provider of communications, security, and wire cable products, from 2014 until its sale in June 2020. Mr. Peppet is the son-in-law of the late Mr. Samuel Zell, who served as Chairman of the Board until May 2023. Mr. Peppet has been involved in entrepreneurial-related philanthropic ventures sponsored by the Zell Family Foundation, including the Zell Lurie Institute for Entrepreneurial Studies at the University of Michigan Ross School of Business, the Zell Fellows Program at Northwestern University's Kellogg School of Management and the Zell Entrepreneurship Program at Reichman University in Israel. Mr. Peppet brings experience in contracts, negotiations, complex transactions, legal ethics, privacy law and technology to the Board along with an outstanding record of leadership and extensive experience in the legal field.

17

17

Director Compensation

The following table includes compensation information for the year ended December 31, 2024 for each non-executive Director.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash ($) (1) | | Stock Awards ($) (2) | | Option Awards

($) (2) | | Non-Equity Incentive Plan Compensation

($) | | All Other Compensation ($) (3) | |

Total

($) |

| Andrew Berkenfield | | 76,250 | | | 152,473 | | | — | | — | | — | | 228,723 | |

| Derrick Burks | | 76,250 | | | 157,477 | | | — | | — | | — | | 233,727 | |

| Philip Calian | | 76,250 | | | 197,510 | | | — | | — | | — | | 273,760 | |

| David Contis | | 76,250 | | | 177,494 | | | — | | — | | — | | 253,744 | |

| Constance Freedman | | 76,250 | | | — | | 202,525 | | | — | | — | | 278,775 | |

| Thomas Heneghan | | 151,250 | | | — | | 253,806 | | | — | | — | | 405,056 | |

| Radhika Papandreou | | 76,250 | | | 152,473 | | | — | | — | | — | | 228,723 | |

| Scott Peppet | | 76,250 | | | 164,953 | | | — | | — | | — | | 241,203 | |

Sheli Rosenberg4 | | 22,843 | | | — | | — | | — | | — | | 22,843 | |

(1) For 2024, the Company paid each of its non-executive Directors, with the exception of Mr. Heneghan and Ms. Rosenberg, an annual fee of $76,250 reflecting an increase in the annual fee from $65,000 to $80,000 effective April 1, 2024. Mr. Heneghan received a fee of $151,250 reflecting an increase in his annual fee from $65,000 to $180,000 effective April 1, 2024 for serving as Chairman of the Board. On February 6, 2024, Ms. Rosenberg informed the Board that she would not stand for re-election at the Company's 2024 annual meeting. Ms. Rosenberg received an annual fee of $22,843 for her services through April 30, 2024.

(2) These amounts reflect the grant date fair value, as calculated in accordance with FASB ASC Topic 718 "Stock Compensation" ("FASB ASC 718"), related to grants of restricted stock and options to purchase shares of Common Stock made in 2024.

Refer to Note 2. "Summary of Significant Accounting Policies" and Note 13. "Equity Incentive Awards," in the Notes to the Consolidated Financial Statements included in the Company's 2024 Form 10-K for the relevant assumptions used to determine the valuation of our restricted stock and stock option awards.

The Board historically has approved an annual award of Restricted Stock (as defined below) to non-executive Board members in conjunction with their re-election at the annual meeting of stockholders. On April 30, 2024, upon recommendation of the Compensation Committee, the Board approved the following awards of Restricted Stock to non-executive Directors then in office. Each recipient was allowed to take these shares as stock options (as defined below) equal to five times the number of shares of Restricted Stock that would have been awarded. All shares were granted on May 1, 2024 at a per share price of $60.29, the NYSE closing price of the Company’s Common Stock on April 30, 2024. The number of shares of Restricted Stock awarded was determined by dividing the dollar value of the award by $60.29.

•The following Directors: (i) the Chairman of the Board, (ii) the Audit Committee Chairperson and Lead Director, (iii) the Compensation Committee Chairperson, and (iv) the Strategic Planning Committee Chairperson each received an award of Restricted Stock for their services rendered in such capacity in 2024.

Mr. Heneghan was awarded shares of Restricted Stock for services rendered as Chairman of the Board valued at $180,000. Mr. Heneghan elected to take these shares as stock options and received an award of 14,930 stock options.

Mr. Calian, Mr. Heneghan and Mr. Contis were each awarded shares of Restricted Stock for services rendered as Committee Chairpersons valued at $20,000. In addition, Mr. Calian was awarded shares of Restricted Stock valued at $25,000 for services rendered as Lead Director. Accordingly, Mr. Calian and Mr. Contis were awarded 747 and 332 shares of Restricted Stock, respectively. Mr. Heneghan elected to take these shares as stock options and received an award of 1,660 stock options. One-third of these shares of Restricted Stock and stock options will vest on May 1, 2025, one-third will vest on May 1, 2026, and one-third will vest on April 30, 2027.

•With the exception of the Committee Chairpersons, each member of the Audit Committee received an award of 207 shares of Restricted Stock valued at $12,500 and each member of the Compensation Committee and the Strategic Planning Committee received an award of 124 shares of Restricted Stock valued at $7,500 for their services on their respective Committees in 2024. Ms. Freedman elected to take these shares as stock options and received an award of 1,240 stock options. These shares of Restricted Stock and stock options will vest 100% on May 1, 2025.

•Each non-executive Director with the exception of the Chairman of the Board received an award of Restricted Stock for their services rendered as a Director during 2024. With the exception of Ms. Freedman, each recipient elected to take this award as Restricted Stock. Mr. Berkenfield, Mr. Burks, Mr. Calian, Mr. Contis, Mr. Peppet and Ms. Papandreou each received an award of 2,405 shares of Restricted Stock valued at $145,000. Ms. Freedman elected to take these shares as stock options and received an award of 12,025 stock options. One-third of these shares of Restricted Stock and stock options vested on November 1, 2024, one-third will vest on May 1, 2025 and one-third will vest on May 1, 2026.

18

18

As of December 31, 2024, each non-executive Director had the following unexercised stock options and unvested Restricted Stock awards outstanding:

| | | | | | | | | | | | | | | | | | | | |

| Name | | Number of Securities Underlying Unexercised Options (#)

Exercisable | | Number of Securities Underlying Unexercised Options (#) Unexercisable | |

Number of Shares of Stock That Have Not Vested |

| Andrew Berkenfield | | 15,305 | | | — | | | 2,218 | |

| Derrick Burks | | — | | | — | | | 2,301 | |

| Philip Calian | | — | | | — | | | 4,085 | |

| David Contis | | — | | | — | | | 2,913 | |

| Constance Freedman | | 34,188 | | | 11,707 | | | — | |

| | | | | | |

| Thomas Heneghan | | — | | | 16,590 | | | 1,050 | |

| Radhika Papandreou | | — | | | — | | | 1,728 | |

| Scott Peppet | | — | | | — | | | 2,425 | |

(3) During the year ended December 31, 2024, Directors did not receive any perquisites or other compensation. The Company reimburses the Directors for travel expenses incurred in connection with their activities on behalf of the Company.

(4) On February 6, 2024, Ms. Rosenberg informed the Board that she would not stand for re-election at the Company's Annual Meeting. Ms. Rosenberg's unvested Restricted Stock fully vested upon her retirement.

Vote Required

A plurality of the votes cast by stockholders of record in person or by proxy at the Annual Meeting is required for the election of directors. Although we know of no reason why any nominee would not be able to serve, if any nominee should become unavailable for election, the persons named as proxies will vote your shares of Common Stock to approve the election of any substitute nominee proposed by the Board.

Board Recommendation

The Board unanimously recommends that you vote "FOR" each of the nine nominees for director to serve until the next annual meeting of stockholders and until his or her successor is duly elected and qualifies.

19

19

PROPOSAL NO. 2

RATIFICATION OF THE SELECTION OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board recommends that the stockholders ratify the selection of Ernst & Young, LLP ("Ernst & Young") as the Company's Independent Accountants for the fiscal year ending December 31, 2025. As a matter of good corporate governance, the selection of Ernst & Young is being submitted to stockholders for ratification. In the event of a negative vote on such ratification, the Audit Committee will reconsider its selection. Even if Ernst & Young is ratified as Independent Accountants by the stockholders, the Audit Committee and the Board, at its discretion, may direct the appointment of different Independent Accountants at any time during the year if it determines that such a change would be in the best interests of the Company.

Ernst & Young has advised us that neither it nor any member thereof has any financial interest, direct or indirect, in the Company or any of its subsidiaries in any capacity. There have been no disagreements between the Company and Ernst & Young relating to accounting procedures, financial statement disclosures or related items.

Representatives of Ernst & Young are expected to be available at the Annual Meeting. These representatives will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

The following table provides information relating to the fees billed or expected to be billed to the Company by Ernst & Young for the years ended December 31, 2024 and 2023:

| | | | | | | | |

| 2024 | 2023 |

Audit Fees(1) | $ | 1,388,950 | | $ | 1,376,450 | |

Audit-Related Fees(2) | $ | 57,390 | | $ | 55,900 | |

Tax Fees(3) | $ | 75,150 | | $ | 84,500 | |

| All Other Fees | $ | — | | $ | — | |

(1) Audit fees consist of fees for the audit of the Company's financial statements, for the audit of internal controls relating to Section 404 of the Sarbanes-Oxley Act and for reviews of financial statements included in the Company's Quarterly Reports on Form 10-Q.

(2) Audit-Related Fees consist primarily of fees for services provided to assist the Company with attestation services related to audits of subsidiaries and benefit plans and other accounting consultations.

(3) Tax fees consist of professional services rendered for tax compliance, tax advice and tax planning.

Auditor Independence. The Audit Committee has determined that the Independent Accountants' provision of the non-audit services described above is compatible with maintaining the Independent Accountants' independence.

Policy on Pre-Approval. The Company and the Audit Committee are committed to ensuring the independence of the Company’s Independent Accountants, both in fact and in appearance. In this regard, the Audit Committee has established a pre-approval policy in accordance with the applicable rules of the SEC and the NYSE. The Audit Committee must pre-approve all audit services and permissible non-audit services provided by the Independent Accountants, except for any de minimis non-audit services. The Audit Committee may delegate to one or more of its members who is an independent director the authority to grant pre-approvals pursuant to policies and procedures established by the Audit Committee. All services provided by Ernst & Young in 2024 were pre-approved by the Audit Committee.

Vote Required

The affirmative vote of a majority of the votes cast by stockholders of record is necessary to ratify the selection of Ernst & Young.

Board Recommendation

The Board unanimously recommends that you vote "FOR" ratification of the selection of Ernst & Young as the Company's Independent Accountants for the year ending December 31, 2025.

20

20

AUDIT COMMITTEE REPORT

The Audit Committee of the Board is composed of four Directors, each of whom the Board has determined meets the independence and financial literacy requirements of the NYSE and Rule 10A-3 under the Exchange Act. In addition, the Board has determined that each of these four Directors qualifies as an "audit committee financial expert" as defined by the SEC rules. No member of the Audit Committee is a current or former officer or employee of the Company, and no member serves on more than two other public company audit committees.

The Audit Committee oversees the Company’s financial reporting and enterprise risk processes on behalf of the Board. The Company's management has the primary responsibility for the financial statements, for maintaining effective internal control over financial reporting and for assessing the effectiveness of internal control over financial reporting. The Audit Committee is governed by a written charter approved by the Board, which is posted on the Company's website. In accordance with this charter, the Audit Committee oversees the accounting, auditing, financial reporting, and risk management practices of the Company. The Audit Committee is responsible for the appointment, retention, compensation and oversight of the work of the Independent Accountants. The Audit Committee pre-approves the services of the Independent Accountants in accordance with the applicable independence standards, including rules of the SEC and the NYSE. The Audit Committee has also established procedures for processing complaints received from employees regarding internal control, accounting and auditing matters. The Audit Committee held nine meetings during 2024.

In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed the audited financial statements in the Company’s 2024 Form 10-K with the Company's management, including a discussion of the quality, not just the acceptability, of the accounting principles; the reasonableness of significant judgments; and the clarity of disclosures in the financial statements. The Audit Committee also reviewed and discussed management’s report on its assessment of the effectiveness of the Company’s internal control over financial reporting and the Independent Accountant’s report on the Company’s internal control over financial reporting with management, the internal auditors and the Independent Accountants.

The Independent Accountants are responsible for expressing an opinion on the conformity of the Company's audited financial statements with generally accepted accounting principles. The Audit Committee reviewed and discussed with the Independent Accountants their judgments as to the quality, not just the acceptability, of the Company's accounting principles and such other matters as are required to be discussed with the Audit Committee by standards of the Public Company Accounting Oversight Board ("PCAOB"), rules of the SEC and other applicable regulations. In addition, the Audit Committee has discussed independence with the Independent Accountants. These discussions included the Independent Accountant’s independence from the Company’s management and the Company, including the matters in the written disclosures and the letter from the Independent Accountants required by the PCAOB regarding the Independent Accountant’s communications with the Audit Committee concerning independence. The Audit Committee also considered the compatibility of non-audit services provided to the Company by the Independent Accountants with the Independent Accountant’s independence.

The Audit Committee discussed with the Independent Accountants the overall scope and plans for their audit. The Audit Committee met with the Independent Accountants, with and without management present, to discuss the results of their audit; their evaluation of the Company's internal controls, including internal control over financial reporting; and the overall quality of the Company's financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board, and the Board approved, that the audited financial statements and management's assessment of the effectiveness of the Company’s internal control over financial reporting be included in the 2024 Form 10-K for filing with the SEC. The Audit Committee and the Board have recommended that stockholders ratify the selection of Ernst & Young as the Company’s Independent Accountants for the year ending December 31, 2025.

Respectfully submitted,

Philip Calian, Chair

Derrick Burks

David Contis

Scott Peppet

21

21

COMPENSATION DISCUSSION AND ANALYSIS

Executive Officers' Biographical Information

For information with respect to Ms. Nader, please refer to the "Nominees' Biographical Information" section of this Proxy Statement. All of our Executive Officers are NEOs.

Paul Seavey - Executive Vice President and Chief Financial Officer

Mr. Seavey, 56, has been Executive Vice President and Chief Financial Officer of the Company since February 2020. He was Executive Vice President, Chief Financial Officer and Treasurer from January 2014 to February 2020. Mr. Seavey was Senior Vice President, Chief Financial Officer and Treasurer from October 2012 to January 2014; Senior Vice President of Finance and Treasurer from May 2012 to October 2012; Senior Vice President and Treasurer from December 2011 to May 2012; Vice President of Financial Planning and Treasurer from January 2009 to December 2011; and Vice President of Financial Planning from December 2001 to January 2009. Mr. Seavey has been employed with the Company since 1994.

Patrick Waite - Executive Vice President and Chief Operating Officer