Announces Exploration of Sale of Water

Distribution Business

Eversource Energy (NYSE: ES) today reported a full-year 2023

loss of $(442.2) million, or $(1.26) per share, compared with

full-year 2022 earnings of $1,404.9 million, or $4.05 per share.

Eversource also reported a fourth quarter 2023 loss of $(1,288.5)

million, or $(3.68) per share, compared with fourth quarter 2022

earnings of $320.2 million, or $0.92 per share.

Results for the full year and the fourth quarter of 2023 include

after-tax impairment charges of $1,953 million, or $5.58 per share,

and $1,622 million, or $4.63 per share, respectively, related to

Eversource Energy’s offshore wind investment. In addition, results

for both years include other after-tax non-recurring costs and

charges that totaled $6.9 million for the full year of 2023

compared with $15 million for the full year of 2022.

2023 Non-GAAP EPS of $4.34 – Focus on

Core Electric and Natural Gas Distribution and Transmission

Businesses

Excluding the charges noted above, Eversource Energy reported

non-GAAP earnings of $1,517.7 million1, or $4.34 per share1, for

the full-year 2023 and $333.5 million1, or $0.95 per share1, in the

fourth quarter of 2023, compared with $1,419.9 million1, or $4.09

per share1, for the full-year 2022 and $322.3 million1, or $0.92

per share1, in the fourth quarter of 2022. Eversource’s core

distribution and transmission businesses are well positioned to

deliver solid operational and financial results as we move forward

in supporting the region’s transition to a cleaner energy

environment.

Full Exit of Offshore Wind

Business

With the announcement today of the sale of South Fork Wind and

Revolution Wind to Global Infrastructure Partners, the agreement

reached with Ørsted for the sale of Sunrise Wind and the completed

sale of the uncommitted lease area last year, we now have the

pathway to a full exit of Eversource’s offshore wind business.

Eversource will continue to hold its existing tax equity investment

in South Fork Wind.

Potential Sale of Water Distribution

Business

Eversource’s water distribution business segment comprises a set

of valuable, well-performing and well managed assets. Although the

business has been earnings accretive to Eversource, a potential

sale of the water business is an opportunity to reduce equity needs

and improve regulatory diversity. With its $1.3 billion rate base

as of December 31, 2023, the water business is likely of

substantial value to another owner as part of a larger strategic

water business or infrastructure platform. As a result, Eversource

plans to launch a process evaluating market interest in a

transaction for this business segment, with the objective of

delivering greater value to all stakeholders. Eversource cannot

provide assurances regarding the ultimate outcome or the timing

around this process.

“Aquarion has been a meaningful investment to Eversource, and I

appreciate the hard work and dedication of the Aquarion team and

its leadership. The company is well recognized and respected for

its operational excellence in the water distribution business,”

said Joe Nolan, Eversource Energy Chairman, President and Chief

Executive Officer. “The Aquarion team truly shares the Eversource

values of customer commitment and stewardship of the

environment.”

Eversource Energy is focused on building the necessary

transmission and distribution infrastructure for the clean energy

future that its customers and states desire. We continue to work

constructively with stakeholders to improve the regulatory

environment in Connecticut to provide customers with a high level

of safe, reliable and cost-effective investments.

Also today, Eversource Energy projected 2024 non-GAAP earnings

of between $4.50 per share and $4.67 per share. The Company also

projected that its compound annual earnings per share growth rate

from its regulated businesses would be within the range of 5 to 7

percent through 2028, using the adjusted $4.34 per share1 earned in

2023 as the base year. Eversource anticipates its equity issuances

of up to $1.3 billion over the next several years, in combination

with the potential sale of its water distribution business

segment.

“Although we experienced great challenges over the past year,

our core utility operations completed an excellent year owing to

the dedication of our 10,000 employees in providing safe and

reliable service to our 4.4 million customers,” said Nolan. “Our

focus remains on improving our already strong service metrics,

making the required investments to modernize the region’s energy

delivery system and enabling our clean energy future while

enhancing our balance sheet condition.”

Electric Transmission

Eversource Energy’s transmission segment earned $643.4 million

in 2023, compared with earnings of $596.6 million in 2022.

Transmission earnings were $167 million in the fourth quarter of

2023, compared with earnings of $140.7 million in the fourth

quarter of 2022. Transmission segment results improved due to a

higher level of investment in Eversource’s electric transmission

system.

Electric Distribution

Eversource Energy’s electric distribution segment earned $608

million in 2023, compared with earnings of $592.8 million in 2022.

Electric distribution earned $103.7 million in the fourth quarter

of 2023, compared with earnings of $97.9 million in the fourth

quarter of 2022. Improved full-year and fourth-quarter results were

due primarily to higher revenues from investments in our

distribution system and a base distribution rate increase for

Eversource’s Massachusetts electric business, partially offset by

higher operations and maintenance (O&M), interest expense,

property taxes and depreciation. Fourth-quarter results also

included the benefit of a seasonal rate design impact in

Massachusetts that has no impact on annual results.

Natural Gas Distribution

Eversource Energy’s natural gas distribution segment earned

$224.8 million in 2023, compared with earnings of $234.2 million in

2022. It earned $76.5 million in the fourth quarter of 2023,

compared with earnings of $87.1 million in the fourth quarter of

2022. Lower full-year results were due primarily to higher

depreciation, interest expense, and a higher effective tax rate,

partially offset by higher revenues. Lower fourth-quarter results

were due primarily to higher O&M and depreciation expense,

partially offset by higher revenues.

Water Distribution

Eversource Energy’s water distribution segment earned $33.1

million in 2023, compared with earnings of $36.8 million in 2022.

The water distribution segment earned $5.7 million in the fourth

quarter of 2023, compared with earnings of $7.4 million in the

fourth quarter of 2022. Lower full-year and fourth-quarter results

were due primarily to higher depreciation, O&M and interest

expense.

Eversource Parent and Other

Companies

Eversource Energy parent and other companies earned $8.4

million1 in 2023, compared with a loss of $(40.5) million1 in 2022.

It lost $(19.4) million1 in the fourth quarter of 2023, compared

with a loss of $(12.9) million1 in the fourth quarter of 2022.

Improved full-year results primarily reflect a lower effective tax

rate and a benefit from the disposition of Eversource’s interest in

a clean energy fund and a resultant contribution in the first

quarter of 2023 to the Eversource Energy Foundation, partially

offset by higher interest expense. Lower fourth-quarter results

were due primarily to higher interest expense, partially offset by

a lower effective tax rate.

The following table reconciles 2023 and 2022 fourth quarter and

full-year GAAP earnings per share:

Fourth Quarter

Full Year

2022

Reported EPS

$0.92

$4.05

Higher electric transmission segment

earnings in 2023,

net of dilution

0.07

0.12

At the electric distribution segment,

higher revenues in 2023, partially offset by higher O&M,

interest expense, property taxes, and depreciation, net of

dilution

0.02

0.03

At the natural gas distribution segment in

2023, higher depreciation, interest expense, and a higher effective

tax rate, partially offset by higher revenues, net of dilution

(0.03)

(0.03)

At the water distribution segment, higher

depreciation, O&M and interest expense

(0.01)

(0.02)

At Parent and Other companies in 2023, a

lower effective tax rate, partially offset by higher interest

expense

(0.02)

0.15

Impairment charges of Offshore Wind

Investment

(4.63)

(5.58)

Lower other non-recurring charges

-

0.02

2023

Reported EPS

$(3.68)

$(1.26)

Three months ended:

(in millions, except EPS)

December 31, 2023

December 31, 2022

Increase/ (Decrease)

2023 EPS1

Electric Transmission

$167.0

$140.7

$26.3

$0.47

Electric Distribution

103.7

97.9

5.8

0.30

Natural Gas Distribution

76.5

87.1

(10.6)

0.22

Water Distribution

5.7

7.4

(1.7)

0.01

Eversource Parent and Other Companies1

(19.4)

(12.9)

(6.5)

(0.05)

Impairment of Offshore Wind Investment

(1,622.0)

-

(1,622.0)

(4.63)

Reported (Loss)/Earnings

$(1,288.5)

$320.2

$(1,608.7)

$(3.68)

Full year ended:

(in millions, except EPS)

December 31, 2023

December 31, 2022

Increase/ (Decrease)

2023 EPS1

Electric Transmission

$643.4

$596.6

$46.8

$1.84

Electric Distribution

608.0

592.8

15.2

1.74

Natural Gas Distribution

224.8

234.2

(9.4)

0.64

Water Distribution

33.1

36.8

(3.7)

0.09

Eversource Parent and Other Companies1

8.4

(40.5)

48.9

0.03

Transaction and other charges

(6.9)

(15.0)

8.1

(0.02)

Impairments of Offshore Wind

Investment

(1,953.0)

-

(1,953.0)

(5.58)

Reported (Loss)/Earnings

$(442.2)

$1,404.9

$(1,847.1)

$(1.26)

Eversource Energy has approximately 350 million common shares

outstanding and operates New England’s largest energy delivery

system. It serves approximately 4.4 million electric, natural gas

and water customers in Connecticut, Massachusetts and New

Hampshire.

Note: Eversource Energy will webcast a

conference call with senior management on February 14, 2024,

beginning at 9 a.m. Eastern Time. The webcast and associated slides

can be accessed through Eversource Energy’s website at

www.eversource.com.

1 All per-share amounts in this news release are reported on a

diluted basis. The only common equity securities that are publicly

traded are common shares of Eversource Energy. The earnings

discussion includes financial measures that are not recognized

under generally accepted accounting principles (non-GAAP)

referencing earnings and EPS excluding the impairment charges for

the offshore wind investments and certain transaction, transition

and other charges. EPS by business is also a non-GAAP financial

measure and is calculated by dividing the net income attributable

to common shareholders of each business by the weighted average

diluted Eversource Energy common shares outstanding for the period.

The earnings and EPS of each business do not represent a direct

legal interest in the assets and liabilities of such business, but

rather represent a direct interest in Eversource Energy’s assets

and liabilities as a whole. Eversource Energy uses these non-GAAP

financial measures to evaluate and provide details of earnings

results by business and to more fully compare and explain results

without including these items. This information is among the

primary indicators management uses as a basis for evaluating

performance and planning and forecasting of future periods.

Management believes the impacts of the impairment charges for the

offshore wind investments and transaction, transition and other

charges are not indicative of Eversource Energy’s ongoing costs and

performance. Management views these charges as not directly related

to the ongoing operations of the business and therefore not an

indicator of baseline operating performance. Due to the nature and

significance of the effect of these items on net income

attributable to common shareholders and EPS, management believes

that the non-GAAP presentation is a more meaningful representation

of Eversource Energy’s financial performance and provides

additional and useful information to readers in analyzing

historical and future performance of the business. These non-GAAP

financial measures should not be considered as alternatives to

Eversource Energy’s reported net income attributable to common

shareholders or EPS determined in accordance with GAAP as

indicators of Eversource Energy’s operating performance. This

document includes statements concerning Eversource Energy’s

expectations, beliefs, plans, objectives, goals, strategies,

assumptions of future events, future financial performance or

growth and other statements that are not historical facts. These

statements are “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995. Generally,

readers can identify these forward-looking statements through the

use of words or phrases such as “estimate,” “expect,” “anticipate,”

“intend,” “plan,” “project,” “believe,” “forecast,” “should,”

“could” and other similar expressions. Forward-looking statements

involve risks and uncertainties that may cause actual results or

outcomes to differ materially from those included in the

forward-looking statements. Forward-looking statements are based on

the current expectations, estimates, assumptions or projections of

management and are not guarantees of future performance. These

expectations, estimates, assumptions or projections may vary

materially from actual results. Accordingly, any such statements

are qualified in their entirety by reference to, and are

accompanied by, the following important factors that may cause our

actual results or outcomes to differ materially from those

contained in our forward-looking statements, including, but not

limited to: cyberattacks or breaches, including those resulting in

the compromise of the confidentiality of our proprietary

information and the personal information of our customers; our

ability to complete the offshore wind investments sales process on

the timelines, terms and pricing we expect; if we and the

counterparties are unable to satisfy all closing conditions and

consummate the purchase and sale transactions with respect to our

offshore wind assets; if Sunrise Wind does not win in the OREC

contract solicitation process; if we are unable to qualify for

investment tax credits related to these projects; if we experience

variability in the projected construction costs of the offshore

wind projects, if there is a deterioration of market conditions in

the offshore wind industry; and if the projects do not commence

operation as scheduled or within budget or are not completed,

disruptions in the capital markets or other events that make our

access to necessary capital more difficult or costly; changes in

economic conditions, including impact on interest rates, tax

policies, and customer demand and payment ability; ability or

inability to commence and complete our major strategic development

projects and opportunities; acts of war or terrorism, physical

attacks or grid disturbances that may damage and disrupt our

electric transmission and electric, natural gas, and water

distribution systems; actions or inaction of local, state and

federal regulatory, public policy and taxing bodies; substandard

performance of third-party suppliers and service providers;

fluctuations in weather patterns, including extreme weather due to

climate change; changes in business conditions, which could include

disruptive technology or development of alternative energy sources

related to our current or future business model; contamination of,

or disruption in, our water supplies; changes in levels or timing

of capital expenditures; changes in laws, regulations or regulatory

policy, including compliance with environmental laws and

regulations; changes in accounting standards and financial

reporting regulations; actions of rating agencies; and other

presently unknown or unforeseen factors.

Other risk factors are detailed in Eversource Energy’s reports

filed with the Securities and Exchange Commission (SEC). They are

updated as necessary and available on Eversource Energy’s website

at www.eversource.com and on the SEC’s website at www.sec.gov. All

such factors are difficult to predict and contain uncertainties

that may materially affect Eversource Energy’s actual results, many

of which are beyond our control. You should not place undue

reliance on the forward-looking statements, as each speaks only as

of the date on which such statement is made, and, except as

required by federal securities laws, Eversource Energy undertakes

no obligation to update any forward-looking statement or statements

to reflect events or circumstances after the date on which such

statement is made or to reflect the occurrence of unanticipated

events.

EVERSOURCE ENERGY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF (LOSS)/INCOME Unaudited)

For the Three Months Ended

December 31,

(Thousands of Dollars, Except Share

Information)

2023

2022

Operating Revenues

$

2,694,238

$

3,029,740

Operating Expenses:

Purchased Power, Purchased Natural Gas and

Transmission

935,329

1,295,796

Operations and Maintenance

513,141

486,431

Depreciation

343,363

308,535

Amortization

(51,657

)

30,248

Energy Efficiency Programs

160,145

159,342

Taxes Other Than Income Taxes

235,370

227,150

Total Operating Expenses

2,135,691

2,507,502

Operating Income

558,547

522,238

Interest Expense

231,300

186,765

Impairments of Offshore Wind

Investments

1,766,000

—

Other Income, Net

85,090

90,834

(Loss)/Income Before Income Tax

Expense

(1,353,663

)

426,307

Income Tax (Benefit)/Expense

(67,058

)

104,269

Net (Loss)/Income

(1,286,605

)

322,038

Net Income Attributable to Noncontrolling

Interests

1,880

1,880

Net (Loss)/Income Attributable to Common

Shareholders

$

(1,288,485

)

$

320,158

Basic and Diluted (Loss)/Earnings Per

Common Share

$

(3.68

)

$

0.92

Weighted Average Common Shares

Outstanding:

Basic

349,938,891

348,786,307

Diluted

350,167,959

349,267,768

The data contained in this report is preliminary and is

unaudited. This report is being submitted for the sole purpose of

providing information to shareholders about Eversource Energy and

Subsidiaries and is not a representation, prospectus, or intended

for use in connection with any purchase or sale of securities.

EVERSOURCE ENERGY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF (LOSS)/INCOME (Unaudited)

For the Years Ended December

31,

(Thousands of Dollars, Except Share

Information)

2023

2022

2021

Operating Revenues

$

11,910,705

$

12,289,336

$

9,863,085

Operating Expenses:

Purchased Power, Purchased Natural Gas and

Transmission

5,168,241

5,014,074

3,372,344

Operations and Maintenance

1,895,703

1,865,328

1,739,685

Depreciation

1,305,840

1,194,246

1,103,008

Amortization

(490,117

)

448,892

231,965

Energy Efficiency Programs

691,344

658,051

592,775

Taxes Other Than Income Taxes

940,359

910,591

829,987

Total Operating Expenses

9,511,370

10,091,182

7,869,764

Operating Income

2,399,335

2,198,154

1,993,321

Interest Expense

855,441

678,274

582,334

Impairments of Offshore Wind

Investments

2,167,000

—

—

Other Income, Net

348,069

346,088

161,282

(Loss)/Income Before Income Tax

Expense

(275,037

)

1,865,968

1,572,269

Income Tax Expense

159,684

453,574

344,223

Net (Loss)/Income

(434,721

)

1,412,394

1,228,046

Net Income Attributable to Noncontrolling

Interests

7,519

7,519

7,519

Net (Loss)/Income Attributable to Common

Shareholders

$

(442,240

)

$

1,404,875

$

1,220,527

Basic (Loss)/Earnings Per Common Share

$

(1.27

)

$

4.05

$

3.55

Diluted (Loss)/Earnings Per Common

Share

$

(1.26

)

$

4.05

$

3.54

Weighted Average Common Shares

Outstanding:

Basic

349,580,638

346,783,444

343,972,926

Diluted

349,840,481

347,246,768

344,631,056

The data contained in this report is preliminary and is

unaudited. This report is being submitted for the sole purpose of

providing information to shareholders about Eversource Energy and

Subsidiaries and is not a representation, prospectus, or intended

for use in connection with any purchase or sale of securities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240212627310/en/

Robert S. Becker (860) 665-3249

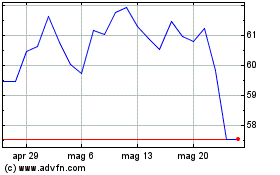

Grafico Azioni Eversource Energy (NYSE:ES)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Eversource Energy (NYSE:ES)

Storico

Da Apr 2024 a Apr 2025