HASI Invests in 605 MW Renewables Portfolio Owned and Operated by AES

04 Gennaio 2024 - 1:30PM

Business Wire

HASI (NYSE: HASI), a leading investor in climate solutions,

today announced an investment in a portfolio of renewable energy

assets developed, owned and operated by The AES Corporation (NYSE:

AES), a Fortune 500 global energy company and one of the largest

developers and operators of clean power in the United States.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240104710826/en/

Pictured: Illustrative solar and

solar-plus-storage projects included in the HASI and AES renewables

portfolio. (Photos courtesy of AES)

Per the agreement, which reached financial close on December 22,

2023, HASI will make a structured equity investment in an

approximately 605-megawatt (MW) portfolio of solar and

solar-plus-storage assets spanning seven power markets and 11

states: Arizona, California, Colorado, Connecticut, Georgia,

Hawaii, Illinois, Massachusetts, New York, Rhode Island, and

Vermont. The portfolio consists of more than 200 operational

renewable energy projects, composed primarily of community solar

and commercial & industrial solar assets, with more than a

third of the total capacity paired with battery energy storage.

With a weighted average remaining contract life of 16 years, the

portfolio's cash flows are contracted with a diverse group of

predominately investment-grade corporate, utility, and municipal

off-takers. AES will continue to own and operate the assets.

The transaction further expands the longstanding relationship

between HASI and AES. In January 2023, HASI announced a common

equity investment with AES in an approximately 1.3-GW portfolio of

operating utility-scale solar and wind projects. Additionally, HASI

and AES' clean energy business in the U.S. have a six-year track

record of successful solar land transactions.

“HASI is immensely proud to advance our partnership with AES

with this latest transaction,” said Susan Nickey, Chief Client

Officer of HASI. “Together, we share an unwavering commitment to

accelerating the energy transition. AES’ exceptional leadership in

closely aligning renewable energy supply with demand is precisely

the focus our industry needs for the next phase of growth. This

investment not only significantly expands our programmatic

investment partnership but also offers diversification and scale to

our balance sheet.”

“AES’ purpose is to accelerate the future of energy,” said James

Marshall, Chief Financial Officer for AES’ clean energy business in

the U.S. “This investment in AES’ operating renewables portfolio

represents a continuation of our partnership with HASI that will

free up capital to develop and build new clean energy projects in

the U.S.”

About HASI

HASI (NYSE: HASI) is a leading climate positive investment firm

that actively partners with clients to deploy real assets that

facilitate the energy transition. With more than $11 billion in

managed assets, our vision is that every investment improves our

climate future. For more information, please visit hasi.com.

Forward-Looking Statements

Some of the information contained in this press release is

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended that are subject to

risks and uncertainties. For these statements, we claim the

protections of the safe harbor for forward-looking statements

contained in such Sections. These forward-looking statements

include information about possible or assumed future results of our

business, financial condition, liquidity, results of operations,

plans and objectives. When we use the words "believe," "expect,"

"anticipate," "estimate," "plan," "continue," "intend," "should,"

"may" or similar expressions, we intend to identify forward-looking

statements.

Forward-looking statements are subject to significant risks and

uncertainties. Investors are cautioned against placing undue

reliance on such statements. Actual results may differ materially

from those set forth in the forward-looking statements. Factors

that could cause actual results to differ materially from those

described in the forward-looking statements include those discussed

under the caption “Risk Factors” included in our most recent Annual

Report on Form 10-K as well as in other periodic reports that we

file with the U.S. Securities and Exchange Commission

Forward-looking statements are based on beliefs, assumptions and

expectations as of the date of this press release. We disclaim any

obligation to publicly release the results of any revisions to

these forward-looking statements reflecting new estimates, events

or circumstances after the date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240104710826/en/

Media: Gil Jenkins media@hasi.com 443-321-5753

Investors: Neha Gaddam investors@hasi.com 410-571-6189

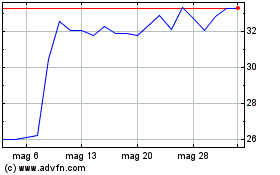

Grafico Azioni HA Sustainable Infrastru... (NYSE:HASI)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni HA Sustainable Infrastru... (NYSE:HASI)

Storico

Da Apr 2024 a Apr 2025