HASI Secures Second Investment Grade Credit Rating

20 Maggio 2024 - 2:43PM

Business Wire

Hannon Armstrong Sustainable Infrastructure Capital, Inc.

("HASI," "we," "our" or the "Company") (NYSE: HASI), a leading

investor in climate solutions, today announced it secured an

investment grade rating of BBB- from Fitch Ratings (“Fitch”), a

globally recognized leader in credit ratings and research. This

marks HASI's second investment grade rating from a major credit

rating agency. The Company has maintained an investment grade

credit rating of Baa3 from Moody’s Investors Service since June

2022.

In its report, Fitch stated that HASI’s upgrade reflects the

Company’s enhanced business profile, improved funding flexibility,

continued strong asset quality, solid operating performance, and

maintenance of leverage within the targeted range. The report also

cites the Company’s proven track record in the renewable energy

financing sector, large and profitable securitization platform,

enhanced liquidity, and experienced management team.

“Two investment grade ratings will enable our bonds to be

included in investment grade indices, increasing our access to

low-cost, long-duration debt capital," said Marc Pangburn, Chief

Financial Officer of HASI. "Achieving investment grade is a

testament to our strong financial position, consistent track record

of execution, and resilient business model.”

About HASI

HASI (NYSE: HASI) is a leading climate positive investment firm

that actively partners with clients to deploy real assets that

facilitate the energy transition. With more than $12 billion in

managed assets, our vision is that every investment improves our

climate future. For more information, please visit hasi.com.

Forward-Looking Statements

Some of the information contained in this press release is

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended that are subject to

risks and uncertainties. For these statements, we claim the

protections of the safe harbor for forward-looking statements

contained in such Sections. These forward-looking statements

include information about possible or assumed future results of our

business, financial condition, liquidity, results of operations,

plans and objectives. When we use the words "believe," "expect,"

"anticipate," "estimate," "plan," "continue," "intend," "should,"

"may" or similar expressions, we intend to identify forward-looking

statements.

Forward-looking statements are subject to significant risks and

uncertainties. Investors are cautioned against placing undue

reliance on such statements. Actual results may differ materially

from those set forth in the forward-looking statements. Factors

that could cause actual results to differ materially from those

described in the forward-looking statements include those discussed

under the caption “Risk Factors” included in our most recent Annual

Report on Form 10-K as well as in other periodic reports that we

file with the U.S. Securities and Exchange Commission

Forward-looking statements are based on beliefs, assumptions and

expectations as of the date of this press release. We disclaim any

obligation to publicly release the results of any revisions to

these forward-looking statements reflecting new estimates, events

or circumstances after the date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240520970314/en/

Media: Conor Fryer media@hasi.com 443-321-5754

Investors: Neha Gaddam investors@hasi.com 410-571-6189

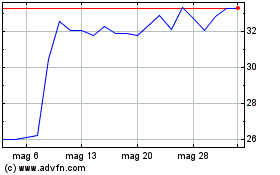

Grafico Azioni HA Sustainable Infrastru... (NYSE:HASI)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni HA Sustainable Infrastru... (NYSE:HASI)

Storico

Da Mar 2024 a Mar 2025