ICE Announces That a Record 2 Billion Contracts Traded in 2024

22 Gennaio 2025 - 2:00PM

Business Wire

Includes Record 1.2 Billion Commodity Contracts

and Record 753 Million Interest Rates Contracts

Intercontinental Exchange, Inc. (NYSE: ICE), a leading global

provider of technology and data, today announced that a record 2

billion futures and options traded on ICE in 2024, marking the

highest volume year in ICE’s history, including a record 1.2

billion commodity contracts and a record 753 million interest rate

derivatives contracts.

ICE is home to the largest and most liquid energy derivatives

markets in the world. 2024 marked the largest volume year for the

number of oil contracts traded on ICE with a record 655 million oil

futures and options contracts traded, including a record 346

million Brent futures and options, a record 92.8 million Gasoil

futures and options contracts, 21 million ICE Dubai (Platts)

futures and options contracts and 6 million ICE Murban futures

contracts.

ICE’s global oil offering sits alongside the broadest range of

benchmarks to support natural gas markets offering customers margin

offsets for maximum capital efficiency when trading. 2024 saw

record natural gas trading on ICE, with 404 million natural gas

futures and options contracts traded, including a record 93 million

ICE TTF futures and options contracts and a record 53 million U.S.

financial natural gas futures and options contracts. ICE’s U.S.

financial gas markets cover 70 hubs across North America allowing

customers to manage regional supply and demand dynamics.

“We thank our customers for making 2024 the best year in ICE’s

history by futures and options trading volume, which shows the

scale of risk management which derivatives markets support,” said

Trabue Bland, SVP of Futures Markets at ICE. “We have worked for

over 25 years to build out the scope and depth of ICE’s multi-asset

and multi-geography offering to allow for both flexibility and

precision trading from wherever in the world customers choose to

trade on ICE.”

Meanwhile, ICE’s multi-currency European, U.K. and Swiss

interest rate markets, including the benchmarks Euribor, €STR,

SONIA and SARON as well as Gilts, the benchmark for the U.K.

government bond yield curve, reached record traded volume in 2024.

This included a record 467 million Euribor futures and options

contracts and a record 186 million SONIA futures and options

contracts.

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune

500 company that designs, builds and operates digital networks that

connect people to opportunity. We provide financial technology and

data services across major asset classes helping our customers

access mission-critical workflow tools that increase transparency

and efficiency. ICE’s futures, equity, and options exchanges

– including the New York Stock Exchange – and clearing

houses help people invest, raise capital and manage risk. We

offer some of the world’s largest markets to trade and clear energy

and environmental products. Our fixed income, data services

and execution capabilities provide information, analytics and

platforms that help our customers streamline processes and

capitalize on opportunities. At ICE Mortgage Technology, we

are transforming U.S. housing finance, from initial consumer

engagement through loan production, closing, registration and the

long-term servicing relationship. Together, ICE transforms,

streamlines and automates industries to connect our customers to

opportunity.

Trademarks of ICE and/or its affiliates include Intercontinental

Exchange, ICE, ICE block design, NYSE and New York Stock Exchange.

Information regarding additional trademarks and intellectual

property rights of Intercontinental Exchange, Inc. and/or its

affiliates is located here. Key Information Documents for

certain products covered by the EU Packaged Retail and

Insurance-based Investment Products Regulation can be accessed on

the relevant exchange website under the heading “Key Information

Documents (KIDS).”

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 – Statements in this press release regarding

ICE's business that are not historical facts are "forward-looking

statements" that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange Commission (SEC)

filings, including, but not limited to, the risk factors in ICE's

Annual Report on Form 10-K for the year ended December 31, 2023, as

filed with the SEC on February 8, 2024.

Category: EXCHANGES

ICE-CORP

Source: Intercontinental Exchange

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250122813250/en/

ICE Media: Jess Tatham jess.tatham@ice.com +44 7377

947136 ICE Investor: Katia Gonzalez katia.gonzalez@ice.com

(678) 981-3882

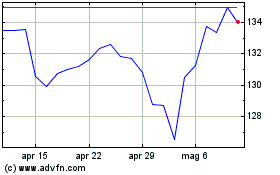

Grafico Azioni Intercontinental Exchange (NYSE:ICE)

Storico

Da Mar 2025 a Apr 2025

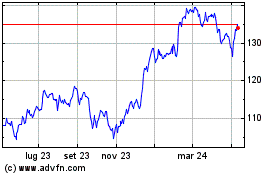

Grafico Azioni Intercontinental Exchange (NYSE:ICE)

Storico

Da Apr 2024 a Apr 2025