Q3false202412/310000063908xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesmcd:Restaurantxbrli:pure00000639082024-01-012024-09-3000000639082024-09-3000000639082023-12-3100000639082024-07-012024-09-3000000639082023-07-012023-09-3000000639082023-01-012023-09-300000063908us-gaap:RetainedEarningsMember2024-07-012024-09-300000063908us-gaap:RetainedEarningsMember2024-01-012024-09-3000000639082024-06-3000000639082023-06-3000000639082022-12-3100000639082023-09-300000063908us-gaap:CommonStockMember2022-12-310000063908us-gaap:AdditionalPaidInCapitalMember2022-12-310000063908us-gaap:RetainedEarningsMember2022-12-310000063908us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310000063908us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2022-12-310000063908us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310000063908us-gaap:TreasuryStockCommonMember2022-12-310000063908us-gaap:RetainedEarningsMember2023-01-012023-09-300000063908us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-09-300000063908us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-01-012023-09-300000063908us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-09-300000063908us-gaap:TreasuryStockCommonMember2023-01-012023-09-300000063908us-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-300000063908us-gaap:CommonStockMember2023-09-300000063908us-gaap:AdditionalPaidInCapitalMember2023-09-300000063908us-gaap:RetainedEarningsMember2023-09-300000063908us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-09-300000063908us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-09-300000063908us-gaap:AccumulatedTranslationAdjustmentMember2023-09-300000063908us-gaap:TreasuryStockCommonMember2023-09-300000063908us-gaap:CommonStockMember2023-12-310000063908us-gaap:AdditionalPaidInCapitalMember2023-12-310000063908us-gaap:RetainedEarningsMember2023-12-310000063908us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310000063908us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-12-310000063908us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310000063908us-gaap:TreasuryStockCommonMember2023-12-310000063908us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-01-012024-09-300000063908us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2024-01-012024-09-300000063908us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-09-300000063908us-gaap:TreasuryStockCommonMember2024-01-012024-09-300000063908us-gaap:AdditionalPaidInCapitalMember2024-01-012024-09-300000063908us-gaap:CommonStockMember2024-09-300000063908us-gaap:AdditionalPaidInCapitalMember2024-09-300000063908us-gaap:RetainedEarningsMember2024-09-300000063908us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-09-300000063908us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2024-09-300000063908us-gaap:AccumulatedTranslationAdjustmentMember2024-09-300000063908us-gaap:TreasuryStockCommonMember2024-09-300000063908us-gaap:CommonStockMember2023-06-300000063908us-gaap:AdditionalPaidInCapitalMember2023-06-300000063908us-gaap:RetainedEarningsMember2023-06-300000063908us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-06-300000063908us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-06-300000063908us-gaap:AccumulatedTranslationAdjustmentMember2023-06-300000063908us-gaap:TreasuryStockCommonMember2023-06-300000063908us-gaap:RetainedEarningsMember2023-07-012023-09-300000063908us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-07-012023-09-300000063908us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-07-012023-09-300000063908us-gaap:AccumulatedTranslationAdjustmentMember2023-07-012023-09-300000063908us-gaap:TreasuryStockCommonMember2023-07-012023-09-300000063908us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300000063908us-gaap:CommonStockMember2024-06-300000063908us-gaap:AdditionalPaidInCapitalMember2024-06-300000063908us-gaap:RetainedEarningsMember2024-06-300000063908us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-06-300000063908us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2024-06-300000063908us-gaap:AccumulatedTranslationAdjustmentMember2024-06-300000063908us-gaap:TreasuryStockCommonMember2024-06-300000063908us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-07-012024-09-300000063908us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2024-07-012024-09-300000063908us-gaap:AccumulatedTranslationAdjustmentMember2024-07-012024-09-300000063908us-gaap:TreasuryStockCommonMember2024-07-012024-09-300000063908us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300000063908mcd:ConventionalFranchisesMemberus-gaap:FranchisedUnitsMember2024-09-300000063908mcd:ConventionalFranchisesMemberus-gaap:FranchisedUnitsMember2023-09-300000063908mcd:DevelopmentalLicenseesMemberus-gaap:FranchisedUnitsMember2024-09-300000063908mcd:DevelopmentalLicenseesMemberus-gaap:FranchisedUnitsMember2023-09-300000063908srt:AffiliatedEntityMemberus-gaap:FranchisedUnitsMember2024-09-300000063908srt:AffiliatedEntityMemberus-gaap:FranchisedUnitsMember2023-09-300000063908us-gaap:FranchisedUnitsMember2024-09-300000063908us-gaap:FranchisedUnitsMember2023-09-300000063908us-gaap:EntityOperatedUnitsMember2024-09-300000063908us-gaap:EntityOperatedUnitsMember2023-09-300000063908us-gaap:SpecialTerminationBenefitsMember2024-01-010000063908us-gaap:ContractTerminationMember2024-01-010000063908us-gaap:OtherRestructuringMember2024-01-0100000639082024-01-010000063908us-gaap:SpecialTerminationBenefitsMember2024-01-012024-03-310000063908us-gaap:ContractTerminationMember2024-01-012024-03-310000063908us-gaap:OtherRestructuringMember2024-01-012024-03-3100000639082024-01-012024-03-310000063908us-gaap:SpecialTerminationBenefitsMember2024-03-310000063908us-gaap:ContractTerminationMember2024-03-310000063908us-gaap:OtherRestructuringMember2024-03-3100000639082024-03-310000063908us-gaap:SpecialTerminationBenefitsMember2024-04-012024-06-300000063908us-gaap:ContractTerminationMember2024-04-012024-06-300000063908us-gaap:OtherRestructuringMember2024-04-012024-06-3000000639082024-04-012024-06-300000063908us-gaap:SpecialTerminationBenefitsMember2024-06-300000063908us-gaap:ContractTerminationMember2024-06-300000063908us-gaap:OtherRestructuringMember2024-06-300000063908us-gaap:SpecialTerminationBenefitsMember2024-07-012024-09-300000063908us-gaap:ContractTerminationMember2024-07-012024-09-300000063908us-gaap:OtherRestructuringMember2024-07-012024-09-300000063908us-gaap:SpecialTerminationBenefitsMember2024-09-300000063908us-gaap:ContractTerminationMember2024-09-300000063908us-gaap:OtherRestructuringMember2024-09-300000063908mcd:GrandFoodsHoldingMember2024-09-300000063908mcd:GrandFoodsHoldingMember2023-12-310000063908mcd:McDonaldsJapanHoldingsCo.LtdMember2024-09-300000063908mcd:McDonaldsJapanHoldingsCo.LtdMember2023-12-310000063908mcd:AdditionalGrandFoodsHoldingSharesMember2024-09-300000063908mcd:AdditionalGrandFoodsHoldingSharesMember2024-01-012024-09-300000063908us-gaap:EquityMethodInvesteeMember2024-01-012024-09-300000063908us-gaap:EquityMethodInvesteeMember2023-01-012023-09-300000063908us-gaap:EquityMethodInvesteeMember2024-09-300000063908us-gaap:EquityMethodInvesteeMember2023-09-300000063908us-gaap:ForeignExchangeMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-09-300000063908us-gaap:ForeignExchangeMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-12-310000063908us-gaap:ForeignExchangeMemberus-gaap:DesignatedAsHedgingInstrumentMembermcd:AccruedExpensesAndOtherCurrentLiabilitiesMember2024-09-300000063908us-gaap:ForeignExchangeMemberus-gaap:DesignatedAsHedgingInstrumentMembermcd:AccruedExpensesAndOtherCurrentLiabilitiesMember2023-12-310000063908us-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-09-300000063908us-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-12-310000063908us-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMembermcd:AccruedExpensesAndOtherCurrentLiabilitiesMember2024-09-300000063908us-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMembermcd:AccruedExpensesAndOtherCurrentLiabilitiesMember2023-12-310000063908us-gaap:ForeignExchangeMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherAssetsMember2024-09-300000063908us-gaap:ForeignExchangeMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherAssetsMember2023-12-310000063908us-gaap:ForeignExchangeMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentLiabilitiesMember2024-09-300000063908us-gaap:ForeignExchangeMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentLiabilitiesMember2023-12-310000063908us-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherAssetsMember2024-09-300000063908us-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherAssetsMember2023-12-310000063908us-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentLiabilitiesMember2024-09-300000063908us-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentLiabilitiesMember2023-12-310000063908us-gaap:DesignatedAsHedgingInstrumentMember2024-09-300000063908us-gaap:DesignatedAsHedgingInstrumentMember2023-12-310000063908us-gaap:EquityMemberus-gaap:NondesignatedMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-09-300000063908us-gaap:EquityMemberus-gaap:NondesignatedMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-12-310000063908us-gaap:EquityMemberus-gaap:NondesignatedMembermcd:AccruedExpensesAndOtherCurrentLiabilitiesMember2024-09-300000063908us-gaap:EquityMemberus-gaap:NondesignatedMembermcd:AccruedExpensesAndOtherCurrentLiabilitiesMember2023-12-310000063908us-gaap:ForeignExchangeMemberus-gaap:NondesignatedMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-09-300000063908us-gaap:ForeignExchangeMemberus-gaap:NondesignatedMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-12-310000063908us-gaap:ForeignExchangeMemberus-gaap:NondesignatedMembermcd:AccruedExpensesAndOtherCurrentLiabilitiesMember2024-09-300000063908us-gaap:ForeignExchangeMemberus-gaap:NondesignatedMembermcd:AccruedExpensesAndOtherCurrentLiabilitiesMember2023-12-310000063908us-gaap:EquityMemberus-gaap:NondesignatedMemberus-gaap:OtherAssetsMember2024-09-300000063908us-gaap:EquityMemberus-gaap:NondesignatedMemberus-gaap:OtherAssetsMember2023-12-310000063908us-gaap:NondesignatedMember2024-09-300000063908us-gaap:NondesignatedMember2023-12-310000063908us-gaap:ForeignExchangeMemberus-gaap:CashFlowHedgingMember2024-01-012024-09-300000063908us-gaap:ForeignExchangeMemberus-gaap:CashFlowHedgingMember2023-01-012023-09-300000063908us-gaap:InterestRateContractMemberus-gaap:CashFlowHedgingMember2024-01-012024-09-300000063908us-gaap:InterestRateContractMemberus-gaap:CashFlowHedgingMember2023-01-012023-09-300000063908us-gaap:CashFlowHedgingMember2024-01-012024-09-300000063908us-gaap:CashFlowHedgingMember2023-01-012023-09-300000063908mcd:OtherForeignCurrencyDenominatedDebtMemberus-gaap:NetInvestmentHedgingMember2024-01-012024-09-300000063908mcd:OtherForeignCurrencyDenominatedDebtMemberus-gaap:NetInvestmentHedgingMember2023-01-012023-09-300000063908us-gaap:ForeignExchangeForwardMemberus-gaap:NetInvestmentHedgingMember2024-01-012024-09-300000063908us-gaap:ForeignExchangeForwardMemberus-gaap:NetInvestmentHedgingMember2023-01-012023-09-300000063908us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:NetInvestmentHedgingMember2024-01-012024-09-300000063908us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:NetInvestmentHedgingMember2023-01-012023-09-300000063908us-gaap:NetInvestmentHedgingMember2024-01-012024-09-300000063908us-gaap:NetInvestmentHedgingMember2023-01-012023-09-300000063908us-gaap:ForeignExchangeMemberus-gaap:NondesignatedMember2024-01-012024-09-300000063908us-gaap:ForeignExchangeMemberus-gaap:NondesignatedMember2023-01-012023-09-300000063908us-gaap:EquityMemberus-gaap:NondesignatedMember2024-01-012024-09-300000063908us-gaap:EquityMemberus-gaap:NondesignatedMember2023-01-012023-09-300000063908us-gaap:NondesignatedMember2024-01-012024-09-300000063908us-gaap:NondesignatedMember2023-01-012023-09-300000063908us-gaap:InterestRateSwapMember2024-09-300000063908us-gaap:InterestRateRiskMemberus-gaap:FairValueHedgingMember2024-01-012024-09-300000063908us-gaap:RoyaltyArrangementMember2024-01-012024-09-300000063908us-gaap:RoyaltyArrangementMember2024-09-300000063908us-gaap:TreasuryLockMember2024-09-300000063908us-gaap:DebtMember2024-01-012024-09-300000063908mcd:IntercompanyDebtMember2024-01-012024-09-300000063908mcd:U.S.MarketMember2024-09-300000063908mcd:InternationalOperatedMarketsMember2024-09-300000063908mcd:InternationalDevelopmentalLicensedMarketsandCorporateMember2024-09-300000063908mcd:U.S.MarketMember2024-07-012024-09-300000063908mcd:U.S.MarketMember2023-07-012023-09-300000063908mcd:U.S.MarketMember2024-01-012024-09-300000063908mcd:U.S.MarketMember2023-01-012023-09-300000063908mcd:InternationalOperatedMarketsMember2024-07-012024-09-300000063908mcd:InternationalOperatedMarketsMember2023-07-012023-09-300000063908mcd:InternationalOperatedMarketsMember2024-01-012024-09-300000063908mcd:InternationalOperatedMarketsMember2023-01-012023-09-300000063908mcd:InternationalDevelopmentalLicensedMarketsandCorporateMember2024-07-012024-09-300000063908mcd:InternationalDevelopmentalLicensedMarketsandCorporateMember2023-07-012023-09-300000063908mcd:InternationalDevelopmentalLicensedMarketsandCorporateMember2024-01-012024-09-300000063908mcd:InternationalDevelopmentalLicensedMarketsandCorporateMember2023-01-012023-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

| | | | | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended | September 30, 2024 |

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission File Number 1-5231

McDONALD’S CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | |

| Delaware | | 36-2361282 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

| |

| 110 North Carpenter Street | | 60607 |

| Chicago, | Illinois | |

| (Address of Principal Executive Offices) | | (Zip Code) |

(630) 623-3000

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | MCD | New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

Large Accelerated Filer | ☒ | | Accelerated Filer | ☐ |

| | | |

Non-accelerated Filer | ☐ | | Smaller Reporting Company | ☐ |

| | | | |

Emerging Growth Company | ☐ | | | |

| | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| |

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

716,619,686

(Number of shares of common stock

outstanding as of September 30, 2024)

McDONALD’S CORPORATION

___________________________

INDEX

_______

All trademarks used herein are the property of their respective owners and are used with permission.

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

| | | | | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED BALANCE SHEET |

| | | | | |

| | (unaudited) | | | |

| In millions, except per share data | | September 30,

2024 | | | December 31,

2023 |

| Assets | | | | | |

| Current assets | | | | | |

| Cash and equivalents | | $ | 1,221 | | | | $ | 4,579 | |

| Accounts and notes receivable | | 2,460 | | | | 2,488 | |

| Inventories, at cost, not in excess of market | | 54 | | | | 53 | |

| Prepaid expenses and other current assets | | 1,176 | | | | 866 | |

| | | | | |

| Total current assets | | 4,912 | | | | 7,986 | |

| Other assets | | | | | |

| Investments in and advances to affiliates | | 2,960 | | | | 1,080 | |

| Goodwill | | 3,220 | | | | 3,040 | |

| Miscellaneous | | 5,673 | | | | 5,618 | |

| Total other assets | | 11,853 | | | | 9,738 | |

| Lease right-of-use asset, net | | 13,632 | | | | 13,514 | |

| Property and equipment | | | | | |

| Property and equipment, at cost | | 45,178 | | | | 43,570 | |

| Accumulated depreciation and amortization | | (19,403) | | | | (18,662) | |

| Net property and equipment | | 25,775 | | | | 24,908 | |

| Total assets | | $ | 56,172 | | | | $ | 56,147 | |

| Liabilities and shareholders’ equity | | | | | |

| Current liabilities | | | | | |

| Short-term borrowings and current maturities of long-term debt | | $ | 596 | | | | $ | 2,192 | |

| Accounts payable | | 944 | | | | 1,103 | |

| Dividend Payable | | 1,265 | | | | — | |

| Lease liability | | 668 | | | | 688 | |

| Income taxes | | 786 | | | | 705 | |

| Other taxes | | 263 | | | | 268 | |

| Accrued interest | | 433 | | | | 469 | |

| Accrued payroll and other liabilities | | 1,353 | | | | 1,434 | |

| | | | | |

| Total current liabilities | | 6,308 | | | | 6,859 | |

| Long-term debt | | 38,990 | | | | 37,153 | |

| Long-term lease liability | | 13,157 | | | | 13,058 | |

| Long-term income taxes | | 74 | | | | 363 | |

| Deferred revenues - initial franchise fees | | 800 | | | | 790 | |

| Other long-term liabilities | | 855 | | | | 950 | |

| Deferred income taxes | | 1,166 | | | | 1,681 | |

| Shareholders’ equity (deficit) | | | | | |

Preferred stock, no par value; authorized – 165.0 million shares; issued – none | | — | | | | — | |

Common stock, $0.01 par value; authorized – 3.5 billion shares; issued – 1,660.6 million shares | | 17 | | | | 17 | |

| Additional paid-in capital | | 9,194 | | | | 8,893 | |

| Retained earnings | | 64,819 | | | | 63,480 | |

| Accumulated other comprehensive income (loss) | | (2,337) | | | | (2,456) | |

Common stock in treasury, at cost; 944.0 and 937.9 million shares | | (76,870) | | | | (74,640) | |

| Total shareholders’ equity (deficit) | | (5,177) | | | | (4,707) | |

| Total liabilities and shareholders’ equity (deficit) | | $ | 56,172 | | | | $ | 56,147 | |

See Notes to condensed consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED STATEMENT OF INCOME (UNAUDITED) | | | | | | |

| | | | | | | | | | | |

| | Quarters Ended | | | Nine Months Ended |

| | | September 30, | | | September 30, |

| In millions, except per share data | | 2024 | | | 2023 | | | 2024 | | | 2023 |

| Revenues | | | | | | | | | | | |

| Sales by Company-owned and operated restaurants | | $ | 2,656 | | | | $ | 2,556 | | | | $ | 7,472 | | | | $ | 7,267 | |

| Revenues from franchised restaurants | | 4,094 | | | | 4,047 | | | | 11,756 | | | | 11,568 | |

| Other revenues | | 124 | | | | 89 | | | | 304 | | | | 252 | |

| Total revenues | | 6,873 | | | | 6,692 | | | | 19,532 | | | | 19,088 | |

| Operating costs and expenses | | | | | | | | | | | |

| Company-owned and operated restaurant expenses | | 2,248 | | | | 2,135 | | | | 6,358 | | | | 6,149 | |

| Franchised restaurants-occupancy expenses | | 646 | | | | 625 | | | | 1,902 | | | | 1,842 | |

| Other restaurant expenses | | 104 | | | | 68 | | | | 241 | | | | 188 | |

| Selling, general & administrative expenses | | | | | | | | | | | |

| Depreciation and amortization | | 111 | | | | 97 | | | | 311 | | | | 291 | |

| Other | | 536 | | | | 584 | | | | 1,748 | | | | 1,704 | |

| Other operating (income) expense, net | | 39 | | | | (25) | | | | 129 | | | | 68 | |

| Total operating costs and expenses | | 3,685 | | | | 3,484 | | | | 10,688 | | | | 10,243 | |

| Operating income | | 3,188 | | | | 3,208 | | | | 8,844 | | | | 8,845 | |

| Interest expense | | 381 | | | | 341 | | | | 1,126 | | | | 1,001 | |

| Nonoperating (income) expense, net | | (36) | | | | (56) | | | | (90) | | | | (163) | |

| Income before provision for income taxes | | 2,843 | | | | 2,924 | | | | 7,807 | | | | 8,007 | |

| Provision for income taxes | | 588 | | | | 606 | | | | 1,600 | | | | 1,577 | |

| Net income | | $ | 2,255 | | | | $ | 2,317 | | | | $ | 6,207 | | | | $ | 6,430 | |

| Earnings per common share-basic | | $ | 3.15 | | | | $ | 3.19 | | | | $ | 8.63 | | | | $ | 8.82 | |

| Earnings per common share-diluted | | $ | 3.13 | | | | $ | 3.17 | | | | $ | 8.59 | | | | $ | 8.76 | |

| Dividends declared per common share | | $ | 3.44 | | | | $ | 1.52 | | | | $ | 6.78 | | | | $ | 4.56 | |

| Weighted-average shares outstanding-basic | | 716.7 | | | | 727.2 | | | | 719.1 | | | | 729.2 | |

| Weighted-average shares outstanding-diluted | | 720.0 | | | | 731.6 | | | | 722.7 | | | | 733.8 | |

See Notes to condensed consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (UNAUDITED) | | | | | | |

| | | | | | | | | | | |

| | Quarters Ended | | | Nine Months Ended |

| | September 30, | | | September 30, |

| In millions | | 2024 | | | 2023 | | | 2024 | | | 2023 |

| Net income | | $ | 2,255 | | | | $ | 2,317 | | | | $ | 6,207 | | | | $ | 6,430 | |

| Other comprehensive income (loss), net of tax | | | | | | | | | | | |

| Foreign currency translation adjustments: | | | | | | | | | | | |

Gain (loss) recognized in accumulated other comprehensive

income ("AOCI"), including net investment hedges | 188 | | | | (145) | | | | 101 | | | | (90) | |

| Reclassification of (gain) loss to net income | (6) | | | | — | | | | 35 | | | | — | |

Foreign currency translation adjustments-net of tax

benefit (expense) of $158, $(98), $36 and $(44) | 182 | | | | (145) | | | | 136 | | | | (90) | |

| Cash flow hedges: | | | | | | | | | | | |

| Gain (loss) recognized in AOCI | (54) | | | | 50 | | | | (14) | | | | 43 | |

| Reclassification of (gain) loss to net income | 8 | | | | 1 | | | | 7 | | | | (12) | |

Cash flow hedges-net of tax benefit (expense) of $15, $(14), $2 and $(8) | (46) | | | | 51 | | | | (7) | | | | 31 | |

| Defined benefit pension plans: | | | | | | | | | | | |

| Gain (loss) recognized in AOCI | (11) | | | | 4 | | | | — | | | | 10 | |

| Reclassification of (gain) loss to net income | — | | | | — | | | | (10) | | | | (10) | |

Defined benefit pension plans-net of tax benefit (expense)

of $0, $0, $1 and $1 | (11) | | | | 4 | | | | (10) | | | | — | |

| Total other comprehensive income (loss), net of tax | 125 | | | | (90) | | | | 119 | | | | (59) | |

| Comprehensive income | | $ | 2,380 | | | | $ | 2,227 | | | | $ | 6,326 | | | | $ | 6,371 | |

See Notes to condensed consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED) | |

| | | | | | | | | |

| | Quarters Ended | | Nine Months Ended | |

| | | September 30, | | September 30, | |

| In millions | | 2024 | | 2023 | | 2024 | | 2023 | |

| Operating activities | | | | | | | | | |

| Net income | | $ | 2,255 | | | $ | 2,317 | | | $ | 6,207 | | | $ | 6,430 | | |

| Adjustments to reconcile to cash provided by operations | | | | | | | | | |

| Charges and credits: | | | | | | | | | |

| Depreciation and amortization | | 532 | | | 498 | | | 1,544 | | | 1,481 | | |

| Deferred income taxes | | (137) | | | (176) | | | (501) | | | (415) | | |

| Share-based compensation | | 40 | | | 43 | | | 128 | | | 138 | | |

| Other | | (33) | | | (106) | | | (48) | | | (183) | | |

| Changes in working capital items | | 79 | | | 453 | | | (514) | | | (328) | | |

| Cash provided by operations | | 2,736 | | | 3,029 | | | 6,816 | | | 7,123 | | |

| Investing activities | | | | | | | | | |

| Capital expenditures | | (794) | | | (570) | | | (1,968) | | | (1,600) | | |

| Purchases of restaurant businesses | | (433) | | | (92) | | | (595) | | | (304) | | |

| Purchases of equity method investments | | — | | | — | | | (1,837) | | | — | | |

| Sales of restaurant businesses | | 54 | | | 16 | | | 156 | | | 96 | | |

| Sales of property | | 10 | | | 14 | | | 32 | | | 35 | | |

| Other | | (103) | | | (301) | | | (392) | | | (572) | | |

| Cash used for investing activities | | (1,266) | | | (933) | | | (4,604) | | | (2,345) | | |

| Financing activities | | | | | | | | | |

| Net short-term borrowings (repayments) | | 474 | | | 6 | | | 133 | | | (137) | | |

| | | | | | | | | |

| Long-term financing issuances | | — | | | 1,996 | | | 1,731 | | | 3,050 | | |

| Long-term financing repayments | | — | | | — | | | (1,785) | | | (1,377) | | |

| Treasury stock purchases | | (469) | | | (1,054) | | | (2,321) | | | (2,203) | | |

| Common stock dividends | | (1,197) | | | (1,105) | | | (3,602) | | | (3,325) | | |

| Proceeds from stock option exercises | | 132 | | | 62 | | | 253 | | | 211 | | |

| Other | | (27) | | | (42) | | | (26) | | | (7) | | |

| Cash used for financing activities | | (1,087) | | | (137) | | | (5,617) | | | (3,788) | | |

| Effect of exchange rates on cash and cash equivalents | | 46 | | | (89) | | | 47 | | | (77) | | |

| Cash and equivalents increase (decrease) | | 429 | | | 1,871 | | | (3,358) | | | 913 | | |

| Cash and equivalents at beginning of period | | 792 | | | 1,626 | | | 4,579 | | | 2,584 | | |

| Cash and equivalents at end of period | | $ | 1,221 | | | $ | 3,496 | | | $ | 1,221 | | | $ | 3,496 | | |

See Notes to condensed consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED STATEMENT OF SHAREHOLDERS' EQUITY (UNAUDITED) |

For the nine months ended September 30, 2023 |

| | Common stock

issued | | | | | | Accumulated other

comprehensive income (loss) | | Common stock in

treasury | Total

shareholders’

equity (deficit) |

Additional

paid-in

capital | | Retained

earnings | Pensions | Cash flow

hedges | Foreign

currency

translation | |

| In millions, except per share data | Shares | Amount | Shares | | Amount |

| Balance at December 31, 2022 | 1,660.6 | | | $ | 17 | | | $ | 8,547 | | | $ | 59,544 | | | $ | (298) | | | $ | 31 | | | $ | (2,219) | | | (929.3) | | | $ | (71,624) | | | $ | (6,003) | |

| Net income | | | | | | | 6,430 | | | | | | | | | | | | | 6,430 | |

Other comprehensive income (loss),

net of tax | | | | | | | | | — | | | 31 | | | (90) | | | | | | | (59) | |

| Comprehensive income | | | | | | | | | | | | | | | | | | | 6,371 | |

Common stock cash dividends ($4.56 per share) | | | | | | | (3,325) | | | | | | | | | | | | | (3,325) | |

| Treasury stock purchases | | | | | | | | | | | | | | | (7.8) | | | (2,246) | | | (2,246) | |

| Share-based compensation | | | | | 138 | | | | | | | | | | | | | | | 138 | |

| Stock option exercises and other | | | | | 140 | | | | | | | | | | | 1.8 | | | 71 | | | 211 | |

| Balance at September 30, 2023 | 1,660.6 | | | $ | 17 | | | $ | 8,825 | | | $ | 62,649 | | | $ | (298) | | | $ | 62 | | | $ | (2,310) | | | (935.3) | | | $ | (73,799) | | | $ | (4,855) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| | | | | | | | | | |

|

For the nine months ended September 30, 2024 |

| | Common stock

issued | | | | | | Accumulated other

comprehensive income (loss) | | Common stock in

treasury | Total

shareholders’

equity (deficit) |

Additional

paid-in

capital | | Retained

earnings | Pensions | Cash flow

hedges | Foreign

currency

translation | |

| In millions, except per share data | Shares | Amount | Shares | | Amount |

| Balance at December 31, 2023 | 1,660.6 | | | $ | 17 | | | $ | 8,893 | | | $ | 63,480 | | | $ | (367) | | | $ | (6) | | | $ | (2,083) | | | (937.9) | | | $ | (74,640) | | | $ | (4,707) | |

| Net income | | | | | | | 6,207 | | | | | | | | | | | | | 6,207 | |

Other comprehensive income (loss),

net of tax | | | | | | | | | (10) | | | (7) | | | 136 | | | | | | | 119 | |

| Comprehensive income | | | | | | | | | | | | | | | | | | | 6,326 | |

Common stock cash dividends ($6.78 per share) | | | | | | | (4,867) | | | | | | | | | | | | | (4,867) | |

| Treasury stock purchases | | | | | | | | | | | | | | | (8.3) | | | (2,310) | | | (2,310) | |

| Share-based compensation | | | | | 128 | | | | | | | | | | | | | | | 128 | |

| Stock option exercises and other | | | | | 173 | | | | | | | | | | | 2.3 | | | 81 | | | 254 | |

| Balance at September 30, 2024 | 1,660.6 | | | $ | 17 | | | $ | 9,194 | | | $ | 64,819 | | | $ | (377) | | | $ | (13) | | | $ | (1,947) | | | (944.0) | | | $ | (76,870) | | | $ | (5,177) | |

See Notes to condensed consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED STATEMENT OF SHAREHOLDERS' EQUITY (UNAUDITED) |

For the quarter ended September 30, 2023 |

| | Common stock

issued | | | | | | Accumulated other

comprehensive income (loss) | | Common stock in

treasury | Total

shareholders’

equity (deficit) |

Additional

paid-in

capital | | Retained

earnings | Pensions | Cash flow

hedges | Foreign

currency

translation | |

| In millions, except per share data | Shares | Amount | Shares | | Amount |

| Balance at June 30, 2023 | 1,660.6 | | | $ | 17 | | | $ | 8,736 | | | $ | 61,437 | | | $ | (303) | | | $ | 11 | | | $ | (2,164) | | | (931.9) | | | $ | (72,733) | | | $ | (4,999) | |

| Net income | | | | | | | 2,317 | | | | | | | | | | | | | 2,317 | |

Other comprehensive income (loss),

net of tax | | | | | | | | | 4 | | | 51 | | | (145) | | | | | | | (90) | |

| Comprehensive income | | | | | | | | | | | | | | | | | | | 2,227 | |

Common stock cash dividends ($1.52 per share) | | | | | | | (1,105) | | | | | | | | | | | | | (1,105) | |

| Treasury stock purchases | | | | | | | | | | | | | | | (3.6) | | | (1,083) | | | (1,083) | |

| Share-based compensation | | | | | 43 | | | | | | | | | | | | | | | 43 | |

| Stock option exercises and other | | | | | 46 | | | | | | | | | | | 0.2 | | | 16 | | | 62 | |

| Balance at September 30, 2023 | 1,660.6 | | | $ | 17 | | | $ | 8,825 | | | $ | 62,649 | | | $ | (298) | | | $ | 62 | | | $ | (2,310) | | | (935.3) | | | $ | (73,799) | | | $ | (4,855) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| | | | | | | | | | |

For the quarter ended September 30, 2024 |

| | Common stock

issued | | | | | | Accumulated other

comprehensive income (loss) | | Common stock in

treasury | Total

shareholders’

equity (deficit) |

Additional

paid-in

capital | | Retained

earnings | Pensions | Cash flow

hedges | Foreign

currency

translation | |

| In millions, except per share data | Shares | Amount | Shares | | Amount |

| Balance at June 30, 2024 | 1,660.6 | | | $ | 17 | | | $ | 9,055 | | | $ | 65,026 | | | $ | (367) | | | $ | 33 | | | $ | (2,129) | | | (943.3) | | | $ | (76,459) | | | $ | (4,824) | |

| Net income | | | | | | | 2,255 | | | | | | | | | | | | | 2,255 | |

Other comprehensive income (loss),

net of tax | | | | | | | | | (11) | | | (46) | | | 182 | | | | | | | 125 | |

| Comprehensive income | | | | | | | | | | | | | | | | | | | 2,380 | |

Common stock cash dividends ($3.44 per share) | | | | | | | (2,462) | | | | | | | | | | | | | (2,462) | |

| Treasury stock purchases | | | | | | | | | | | | | | | (1.6) | | | (443) | | | (443) | |

| Share-based compensation | | | | | 40 | | | | | | | | | | | | | | 40 |

| Stock option exercises and other | | | | | 100 | | | | | | | | | | | 1.0 | | | 33 | | | 133 | |

| Balance at September 30, 2024 | 1,660.6 | | | $ | 17 | | | $ | 9,194 | | | $ | 64,819 | | | $ | (377) | | | $ | (13) | | | $ | (1,947) | | | (944.0) | | | $ | (76,870) | | | $ | (5,177) | |

See Notes to condensed consolidated financial statements.

| | |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) |

McDonald’s Corporation, the registrant, together with its subsidiaries, is referred to herein as the "Company." The Company, its franchisees and suppliers, are referred to herein as the "System."

Basis of Presentation

The accompanying condensed consolidated financial statements should be read in conjunction with the Consolidated Financial Statements contained in the Company’s December 31, 2023 Annual Report on Form 10-K. In the opinion of management, all normal recurring adjustments necessary for a fair presentation have been included. The results for the quarter and nine months ended September 30, 2024 do not necessarily indicate the results that may be expected for the full year.

Change in Presentation

In the first quarter of 2024, the Company changed its rounding presentation to the nearest whole number in millions of reported amounts, except per share data or as otherwise designated. The change in rounding presentation has been applied to all prior year amounts presented. In certain circumstances, this change adjusted previously reported balances, however, these changes were not significant, and no other changes were made to previously reported financial information. Additionally, certain columns and rows within the financial statements and tables presented may not add due to rounding. Percentages have been calculated from the underlying whole-dollar amounts for all periods presented.

Restaurant Information

The following table presents restaurant information by ownership type:

| | | | | | | | | | | | |

| Restaurants at September 30, | 2024 | | | 2023 |

| Conventional franchised | 21,864 | | | | 21,761 | |

| Developmental licensed | 9,077 | | | | 8,450 | |

| Foreign affiliated | 9,814 | | | | 8,843 | |

| Total Franchised | 40,755 | | | | 39,054 | |

| Company-owned and operated | 2,064 | | | | 2,144 | |

| Total Systemwide restaurants | 42,819 | | | | 41,198 | |

The results of operations of restaurant businesses purchased and sold in transactions with franchisees were not material either individually or in the aggregate to the accompanying condensed consolidated financial statements.

Per Common Share Information

Diluted earnings per common share is calculated as net income divided by diluted weighted-average shares. Diluted weighted-average shares include weighted-average shares outstanding plus the dilutive effect of share-based compensation, calculated using the treasury stock method, of 3.3 million shares and 4.4 million shares for the quarters ended 2024 and 2023, respectively, and 3.6 million shares and 4.6 million shares for the nine months ended 2024 and 2023, respectively. Share-based compensation awards that would have been antidilutive, and therefore were not included in the calculation of diluted weighted-average shares, totaled 2.0 million shares and 1.2 million shares for the quarters ended 2024 and 2023, respectively, and 2.0 million shares and 2.1 million shares for the nine months ended 2024 and 2023, respectively.

Recent Accounting Pronouncements

Recent Accounting Pronouncements Not Yet Adopted

Segment Reporting

In November 2023, the Financial Accounting Standards Board (the "FASB") issued Accounting Standards Update ("ASU") No. 2023-07, "Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures" ("ASU 2023-07"). The pronouncement expands annual and interim disclosure requirements for reportable segments, primarily through enhanced disclosures about significant segment expenses. ASU 2023-07 is effective for fiscal years beginning after December 15, 2023, and for interim periods beginning after December 15, 2024. We are currently in the process of determining the impact that ASU 2023-07 will have on the Company's consolidated financial statement disclosures.

Income Taxes

In December 2023, the FASB issued ASU No. 2023-09, "Income Taxes (Topic 740): Improvements to Income Tax Disclosures" ("ASU 2023-09"). The pronouncement expands the disclosure requirements for income taxes, specifically related to the rate reconciliation and income taxes paid. ASU 2023-09 is effective for fiscal years beginning after December 15, 2024. We are currently in the process of determining the impact that ASU 2023-09 will have on the Company's consolidated financial statement disclosures.

Accelerating the Organization

In January 2023, the Company announced an evolution of its successful Accelerating the Arches strategy. Enhancements to the strategy included the addition of Restaurant Development to the Company’s growth pillars and an internal effort to modernize ways of working, Accelerating the Organization, both of which are aimed at elevating the Company’s performance. Accelerating the Organization is designed to unlock further growth as the Company focuses on becoming faster, more innovative and more efficient for its customers and people.

The Company incurred $146 million of restructuring charges related to Accelerating the Organization in the nine months ended September 30, 2024. These charges were recorded in the Other operating (income) expense, net line within the consolidated statement of income, and primarily recorded within the Corporate segment. For the period presented, restructuring charges primarily consisted of professional services costs. There were no significant non-cash impairment charges included in the amounts listed in the table below.

The following table summarizes the balance of accrued expenses related to this strategic initiative (in millions):

| | | | | | | | | | | | | | |

| Employee Termination Benefits | Costs to Terminate Contracts | Professional Services and Other Costs | Total |

| 2024 | | | | |

| Accrued Balance at Beginning of Year | $ | 41 | | $ | 11 | | $ | 7 | | $ | 59 | |

| Restructuring Costs Incurred | — | | — | | 44 | | 44 | |

| Cash Payments | (14) | | (5) | | (44) | | (63) | |

| Other Non-Cash Items | — | | — | | (1) | | (1) | |

| Accrued Balance at March 31, 2024 | $ | 27 | | $ | 6 | | $ | 6 | | $ | 39 | |

| Restructuring Costs Incurred | (1) | | — | | 58 | | 57 | |

| Cash Payments | (5) | | (1) | | (50) | | (56) | |

| Other Non-Cash Items | — | | — | | — | | — | |

| Accrued Balance at June 30, 2024 | $ | 21 | | $ | 5 | | $ | 14 | | $ | 40 | |

| Restructuring Costs Incurred | (1) | | — | | 47 | | 46 | |

| Cash Payments | (3) | | (1) | | (41) | | (45) | |

| Other Non-Cash Items | — | | — | | 1 | | 1 | |

| Accrued Balance at September 30, 2024 | $ | 17 | | $ | 4 | | $ | 21 | | $ | 42 | |

The Company continues to evolve its ways of working by driving efficiency and effectiveness across the organization, primarily led by its Global Business Services organization. Transformation efforts under Accelerating the Organization will continue to result in various restructuring charges as the strategy progresses through its anticipated completion during 2027. The Company expects to incur approximately $250 million of restructuring charges in 2024, primarily related to professional services costs.

Equity Method Investments

The Company has various investments accounted for using the equity method. Under the equity method of accounting, the Company records its proportionate share of the net income or loss of each equity method investee, with a corresponding change to the carrying value of the investment. The carrying value of the investment is also adjusted for any dividends received and the effect of foreign exchange. The Company records its proportionate share of net income or loss within the Other operating (income) expense, net line on the consolidated statement of income. The carrying value of the investments are recorded within the Investments in and advances to affiliates line on the consolidated balance sheet.

The Company’s primary equity method investments include partial ownership in Grand Foods Holding, an entity that operates and manages McDonald's business in mainland China, Hong Kong and Macau, and partial ownership in McDonald’s Japan Holdings Co., Ltd, an entity that operates and manages McDonald’s business in Japan. The Company has granted these entities the right to operate the McDonald's business as part of a Master Franchise Agreement. Revenue related to these agreements are accounted for in a manner consistent with the Company’s other franchise arrangements.

The following table summarizes the amounts related to the Company’s primary equity method investees during the periods presented.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| In Millions | Percentage Ownership | | Fair Value (Level 1) | | Carrying Amount | | Percentage Ownership | | Fair Value (Level 1) | | Carrying Amount |

| Grand Foods Holding | 48 | % | | N/A | | $ | 2,140 | | | 20 | % | | N/A | | $ | 238 | |

| McDonald's Japan Holdings Co., Ltd | 35 | % | | $ | 2,236 | | | $ | 630 | | | 35 | % | | $ | 2,034 | | | $ | 597 | |

On January 30, 2024, the Company acquired an additional 28% ownership stake in Grand Foods Holding from the global investment firm Carlyle in exchange for $1.8 billion in cash. The acquisition increased the Company's equity ownership to 48%, but did not result in control of the entity. As such, the Company remains a minority partner and will continue to account for the investment under the equity method.

As of September 30, 2024, the aggregate carrying amount of the Company's investments in these equity method investees exceeded its proportionate share of the net assets of these equity method investees by $1.4 billion. This difference is not amortized. Management has concluded that there are no indicators of impairment related to these investments.

The following table summarizes the amounts recorded related to the Company's primary equity method investments during the nine months ended September 30, 2024 and September 30, 2023, respectively.

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| In Millions | 2024 | | 2023 |

| Revenue | $ | 402 | | | $ | 364 | |

| Equity in Earnings | $ | 107 | | | $ | 84 | |

| Accounts Receivable | $ | 125 | | | $ | 114 | |

| Dividends Received | $ | 13 | | | $ | 14 | |

Income Taxes

The effective income tax rate was 20.7% and 20.7% for the quarters ended 2024 and 2023, respectively, and 20.5% and 19.7% for the nine months ended 2024 and 2023, respectively.

Fair Value Measurements

The Company measures certain financial assets and liabilities at fair value. Fair value disclosures are reflected in a three-level hierarchy, maximizing the use of observable inputs and minimizing the use of unobservable inputs. The valuation hierarchy is based upon the transparency of inputs to the valuation of an asset or liability on the measurement date and are defined as follows:

•Level 1 – inputs to the valuation methodology are quoted prices (unadjusted) for an identical asset or liability in an active market.

•Level 2 – inputs to the valuation methodology include quoted prices for a similar asset or liability in an active market or model-derived valuations in which all significant inputs are observable for substantially the full term of the asset or liability.

•Level 3 – inputs to the valuation methodology are unobservable and significant to the fair value measurement of the asset or liability.

There were no significant changes to the valuation techniques used to measure fair value as described in the Company's December 31, 2023 Annual Report on Form 10-K.

At September 30, 2024, the fair value of the Company’s debt obligations was estimated at $38.8 billion, compared to a carrying amount of $39.6 billion. The fair value of debt obligations is based upon quoted market prices, classified as Level 2 within the valuation hierarchy. The carrying amount of cash and equivalents and notes receivable approximate fair value.

Financial Instruments and Hedging Activities

The Company is exposed to global market risks, including the effect of changes in interest rates and foreign currency fluctuations. The Company uses foreign currency denominated debt and derivative instruments to mitigate the impact of these changes. The Company does not hold or issue derivatives for trading purposes.

The following table presents the fair values of derivative instruments included on the condensed consolidated balance sheet:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Derivative Assets | | Derivative Liabilities |

| In millions | Balance Sheet Classification | | September 30, 2024 | | December 31, 2023 | | Balance Sheet Classification | | September 30, 2024 | | December 31, 2023 |

| Derivatives designated as hedging instruments | | | | | | | | |

| Foreign currency | Prepaid expenses and other current assets | | $ | 4 | | | $ | 9 | | | Accrued payroll and other liabilities | | $ | (79) | | | $ | (37) | |

| Interest rate | Prepaid expenses and other current assets | | $ | 4 | | | $ | 4 | | | Accrued payroll and other liabilities | | $ | — | | | $ | (4) | |

| Foreign currency | Miscellaneous other assets | | $ | — | | | $ | 2 | | | Other long-term liabilities | | $ | (42) | | | $ | (14) | |

| Interest rate | Miscellaneous other assets

| | $ | — | | | $ | — | | | Other long-term liabilities | | $ | (39) | | | $ | (58) | |

| Total derivatives designated as hedging instruments | | $ | 8 | | | $ | 15 | | | | | $ | (160) | | | $ | (113) | |

| Derivatives not designated as hedging instruments | | | | | | | | |

| Equity | Prepaid expenses and other current assets

| | $ | 141 | | | $ | — | | | Accrued payroll and other liabilities | | $ | — | | | $ | — | |

| Foreign currency | Prepaid expenses and other current assets

| | $ | — | | | $ | 6 | | | Accrued payroll and other liabilities | | $ | (6) | | | $ | (5) | |

| Equity | Miscellaneous other assets | | $ | — | | | $ | 189 | | | | | | | |

| Total derivatives not designated as hedging instruments | | $ | 141 | | | $ | 195 | | | | | $ | (6) | | | $ | (5) | |

| Total derivatives | | $ | 149 | | | $ | 210 | | | | | $ | (166) | | | $ | (118) | |

The following table presents the pre-tax amounts from derivative instruments affecting income and AOCI for the nine months ended September 30, 2024 and 2023, respectively:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Location of gain or loss

recognized in income on

derivative | | | Gain (loss)

recognized in AOCI | | | Gain (loss)

reclassified into income from AOCI | | | Gain (loss) recognized in

income on derivative |

| | | | | | |

| | | | | | |

| In millions | | | | 2024 | | | 2023 | | | 2024 | | | 2023 | | | 2024 | | | 2023 |

| Foreign currency | Nonoperating income/expense | | | $ | (25) | | | | $ | 33 | | | | $ | (10) | | | | $ | 15 | | | | | | | |

| Interest rate | Interest expense | | | $ | 7 | | | | $ | 22 | | | | $ | 1 | | | | $ | 1 | | | | | | | |

| Cash flow hedges | | | $ | (18) | | | | $ | 55 | | | | $ | (9) | | | | $ | 16 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Foreign currency denominated debt | Nonoperating income/expense | | | $ | (133) | | | | $ | 157 | | | | | | | | | | | | | |

| Foreign currency derivatives | Nonoperating income/expense | | | $ | (18) | | | | $ | 65 | | | | | | | | | | | | | |

Foreign currency derivatives(1) | Interest expense | | | | | | | | | | | | | | | $ | 32 | | | | $ | 18 | |

| Net investment hedges | | | $ | (151) | | | | $ | 222 | | | | | | | | | | $ | 32 | | | | $ | 18 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Foreign currency | Nonoperating income/expense | | | | | | | | | | | | | | | $ | (10) | | | | $ | 7 | |

| Equity | Selling, general & administrative expenses | | | | | | | | | | | | | | | $ | (2) | | | | $ | 5 | |

| | | | | | | | | | | | | | | | | | | |

| Undesignated derivatives | | | | | | | | | | | | | | | $ | (12) | | | | $ | 12 | |

(1)The amount of gain (loss) recognized in income related to components excluded from effectiveness testing. |

Fair Value Hedges

The Company enters into fair value hedges to reduce the exposure to changes in fair values of certain liabilities. The Company enters into fair value hedges that convert a portion of its fixed rate debt into floating rate debt by use of interest rate swaps. At September 30, 2024, the carrying amount of fixed-rate debt that was effectively converted was an equivalent notional amount of $795 million, which included a decrease of $39 million of cumulative hedging adjustments. For the nine months ended September 30, 2024, the Company recognized a $22 million gain on the fair value of interest rate swaps, and a corresponding loss on the fair value of the related hedged debt instrument to interest expense.

Cash Flow Hedges

The Company enters into cash flow hedges to reduce the exposure to variability in certain expected future cash flows. To protect against the reduction in value of forecasted foreign currency cash flows (such as royalties denominated in foreign currencies), the Company uses foreign currency forwards to hedge a portion of anticipated exposures. The hedges cover up to the next 18 months for certain exposures and are denominated in various currencies. As of September 30, 2024, the Company had derivatives outstanding with an equivalent notional amount of $2.2 billion that hedged a portion of forecasted foreign currency denominated cash flows.

To protect against the variability of interest rates on anticipated bond issuances, the Company may use treasury locks to hedge a portion of expected future cash flows. As of September 30, 2024, the Company had derivatives outstanding with a notional amount of $500 million that hedge a portion of forecasted cash flows.

Based on market conditions at September 30, 2024, the $12 million in cumulative cash flow hedging losses, after tax, is not expected to have a significant effect on the Company's earnings over the next 12 months.

Net Investment Hedges

The Company uses foreign currency denominated debt (third-party and intercompany) and foreign currency derivatives to hedge its investments in certain foreign subsidiaries and affiliates. Realized and unrealized translation adjustments from these hedges are included in shareholders' equity in the foreign currency translation component of Other comprehensive income ("OCI") and offset translation adjustments on the underlying net assets of foreign subsidiaries and affiliates, which also are recorded in OCI. As of September 30, 2024, $14.3 billion of the Company's third-party foreign currency denominated debt, $560 million of the Company's intercompany foreign currency denominated debt and $1.8 billion of foreign currency derivatives were designated to hedge investments in certain foreign subsidiaries and affiliates.

Undesignated Hedges

The Company enters into certain derivatives that are not designated for hedge accounting. Therefore, the changes in the fair value of these derivatives are recognized immediately in earnings together with the gain or loss from the hedged balance sheet position. As an example, the Company enters into equity derivative contracts, including total return swaps, to hedge market-driven changes in certain of its supplemental benefit plan liabilities. The Company may also use certain investments to hedge changes in these liabilities. Changes in the fair value of these derivatives or investments are recorded in Selling, general & administrative expenses together with the changes in the supplemental benefit plan liabilities. In addition, the Company uses foreign currency forwards to mitigate the change in fair value of certain foreign currency denominated assets and liabilities. The changes in the fair value of these derivatives are recognized in Nonoperating (income) expense, net, along with the currency gain or loss from the hedged balance sheet position.

Credit Risk

The Company is exposed to credit-related losses in the event of non-performance by its derivative counterparties. The Company did not have significant exposure to any individual counterparty at September 30, 2024 and has master agreements that contain netting arrangements. For financial reporting purposes, the Company presents gross derivative balances in its financial statements and supplementary data, including for counterparties subject to netting arrangements. Some of these agreements also require each party to post collateral if credit ratings fall below, or aggregate exposures exceed, certain contractual limits. At September 30, 2024, the Company was required to post $122 million of collateral due to the negative fair value of certain derivative positions. The Company's counterparties were not required to post collateral on any derivative position, other than on certain hedges of the Company’s supplemental benefit plan liabilities where the counterparties were required to post collateral on their liability positions.

Franchise Arrangements

Revenues from franchised restaurants consisted of:

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Quarters Ended | | Nine Months Ended |

| September 30, | | September 30, |

| In millions | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Rents | $ | 2,609 | | | $ | 2,570 | | | $ | 7,512 | | | $ | 7,348 | |

| Royalties | 1,463 | | | 1,462 | | | 4,191 | | | 4,175 | |

| Initial fees | 22 | | | 16 | | | 53 | | | 45 | |

| Revenues from franchised restaurants | $ | 4,094 | | | $ | 4,047 | | | $ | 11,756 | | | $ | 11,568 | |

Segment Information

The Company operates under an organizational structure with the following global business segments reflecting how management reviews and evaluates operating performance:

•U.S. - the Company's largest market. The segment is 95% franchised as of September 30, 2024.

•International Operated Markets - comprised of markets or countries in which the Company owns and operates and franchises restaurants, including Australia, Canada, France, Germany, Italy, Poland, Spain and the U.K. The segment is 89% franchised as of September 30, 2024.

•International Developmental Licensed Markets & Corporate - comprised primarily of developmental licensee and affiliate markets in the McDonald’s System, including equity method investments in China and Japan. Corporate activities are also reported in this segment. The segment is 99% franchised as of September 30, 2024.

The following table presents the Company’s revenues and operating income by segment:

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarters Ended | | Nine Months Ended |

| September 30, | | September 30, |

| In millions | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | | | | | | | |

| U.S. | $ | 2,739 | | | $ | 2,704 | | | $ | 7,997 | | | $ | 7,893 | |

| International Operated Markets | 3,309 | | | 3,300 | | | 9,443 | | | 9,251 | |

| International Developmental Licensed Markets & Corporate | 825 | | | 688 | | | 2,092 | | | 1,944 | |

| Total revenues | $ | 6,873 | | | $ | 6,692 | | | $ | 19,532 | | | $ | 19,088 | |

| Operating Income | | | | | | | |

| U.S. | $ | 1,493 | | | $ | 1,478 | | | $ | 4,400 | | | $ | 4,268 | |

| International Operated Markets | 1,602 | | | 1,585 | | | 4,459 | | | 4,295 | |

| International Developmental Licensed Markets & Corporate | 93 | | | 146 | | | (15) | | | 282 | |

| Total operating income | $ | 3,188 | | | $ | 3,208 | | | $ | 8,844 | | | $ | 8,845 | |

.

Subsequent Events

The Company evaluated subsequent events through the date the financial statements were issued and filed with the Securities and Exchange Commission ("SEC"). There were no subsequent events that required recognition or disclosure.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Basis of Presentation

This Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) should be read in conjunction with the accompanying condensed consolidated financial statements and the notes thereto, and the audited consolidated financial statements and notes thereto included in our 2023 Annual Report on Form 10-K.

In the first quarter of 2024, the Company changed its rounding presentation to the nearest whole number in millions of reported amounts, except per share data or as otherwise designated. The change in rounding presentation has been applied to all prior year amounts presented. In certain circumstances, this change adjusted previously reported balances, however, these changes were not significant, and no other changes were made to previously reported financial information. Additionally, certain columns and rows in financial tables within management's discussion and analysis of financial condition and results of operations may not add due to rounding. Percentages have been calculated from the underlying whole-dollar amounts for all periods presented.

Overview

The Company franchises and owns and operates McDonald’s restaurants, which serve a locally relevant menu of quality food and beverages in communities across more than 100 countries. Of the 42,819 McDonald's restaurants at September 30, 2024, approximately 95% were franchised.

The Company’s reporting segments are aligned with its strategic priorities and reflect how management reviews and evaluates operating performance. Significant reportable segments include the United States ("U.S.") and International Operated Markets. In addition, there is the International Developmental Licensed Markets & Corporate segment, which includes the results of over 75 countries, as well as Corporate activities.

McDonald’s franchised restaurants are owned and operated under one of the following structures - conventional franchise, developmental license or affiliate. The optimal ownership structure for an individual restaurant, trading area or market (country) is based on a variety of factors, including the availability of individuals with entrepreneurial experience and financial resources, as well as the local legal and regulatory environment in critical areas such as property ownership and franchising. The business relationship between the Company and its independent franchisees is supported by adhering to standards and policies, including McDonald's Global Brand Standards, and is of fundamental importance to overall performance and to protecting the McDonald’s brand.

The Company is primarily a franchisor and believes franchising is paramount to delivering great-tasting food, locally relevant customer experiences and driving profitability. Franchising enables an individual to be their own employer and maintain control over all employment related matters, marketing and pricing decisions, while also benefiting from the strength of McDonald’s global brand, operating system and financial resources.

Directly operating McDonald’s restaurants contributes significantly to the Company's ability to act as a credible franchisor. One of the strengths of the franchising model is that the expertise from Company-owned and operated restaurants allows McDonald’s to improve the operations and success of all restaurants while innovations from franchisees can be tested and, when viable, efficiently implemented across relevant restaurants. Having Company-owned and operated restaurants provides Company personnel with a venue for restaurant operations training experience. In addition, in our Company-owned and operated restaurants, and in collaboration with franchisees, the Company is able to further develop and refine operating standards, marketing concepts and product and pricing strategies that will ultimately benefit McDonald’s restaurants.

The Company’s revenues consist of sales by Company-owned and operated restaurants and fees from franchised restaurants owned and operated by conventional franchisees, developmental licensees and affiliates. Fees vary by type of site, amount of Company investment, if any, and local business conditions. These fees, along with occupancy and operating rights, are stipulated in franchise/license agreements that generally have 20-year terms. The Company’s Other revenues are comprised of fees paid by franchisees to recover a portion of costs incurred by the Company for various technology platforms and revenues from brand licensing arrangements to market and sell consumer packaged goods using the McDonald’s brand.

Conventional Franchise

Under a conventional franchise arrangement, the Company generally owns or secures a long-term lease on the land and building for the restaurant location and the franchisee pays for equipment, signs, seating and décor. The Company believes that ownership of real estate, combined with the co-investment by franchisees, enables it to achieve restaurant performance levels that are among the highest in the industry.

Franchisees are responsible for reinvesting capital in their businesses over time. In addition, to accelerate implementation of certain initiatives, the Company may co-invest with franchisees to fund improvements to their restaurants or operating systems. These investments, developed in collaboration with franchisees, are designed to cater to consumer preferences, improve local business performance and increase the value of the McDonald's brand through the development of modernized, more attractive and higher revenue generating restaurants.

The Company requires franchisees to meet rigorous standards and generally does not work with passive investors. The business relationship with franchisees is designed to facilitate consistency and high quality at all McDonald’s restaurants. Conventional franchisees contribute to the Company’s revenue, primarily through the payment of rent and royalties based upon a percent of sales, with specified minimum rent payments, along with initial fees paid upon the opening of a new restaurant or grant of a new franchise. The Company's heavily franchised business model is designed to generate stable and predictable revenue, which is largely a function of franchisee sales, and resulting cash flow streams.

Developmental License or Affiliate

Under a developmental license or affiliate arrangement, licensees are responsible for operating and managing their businesses, providing capital (including the real estate interest) and developing and opening new restaurants. The Company generally does not invest any capital under a developmental license or affiliate arrangement, and it receives a royalty based on a percent of sales, and generally receives initial fees upon the opening of a new restaurant or grant of a new license.

While developmental license and affiliate arrangements are largely the same, affiliate arrangements are used in a limited number of foreign markets (primarily China and Japan) within the International Developmental Licensed Markets & Corporate segment, as well as a limited number of individual restaurants within the International Operated Markets segment where the Company also has an equity investment and records its share of net results in equity in earnings of unconsolidated affiliates.

Strategic Direction

The Company’s Accelerating the Arches growth strategy (the “Strategy”) encompasses all aspects of McDonald’s business as the leading global omni-channel restaurant brand. Our Strategy reflects the Company’s purpose, mission and values, as well as growth pillars that build on the Company’s competitive advantages.

Purpose, Mission and Values

The following purpose, mission and values underpin the Company’s success and are at the heart of our Strategy.

Through its size and scale, the Company embraces and prioritizes its role in and commitment to the communities in which it operates through its purpose to feed and foster communities, and its mission to make delicious feel-good moments easy for everyone. The Company is guided by five core values that define who it is and how it runs its business across the three-legged stool of McDonald's franchisees, suppliers and employees:

1.Serve - We put our customers and people first;

2.Inclusion - We open our doors to everyone;

3.Integrity - We do the right thing;

4.Community - We are good neighbors; and

5.Family - We get better together.

The Company believes that its people, all around the world, set it apart and bring these values to life daily.

Growth Pillars

The following growth pillars, M-C-D, build on historic strengths and articulate areas of further opportunity. Under our Strategy, the Company will:

•Maximize our Marketing by investing in new, culturally relevant approaches, grounded in fan truths, to effectively communicate the story of our brand, food and purpose. The Company continues to build relevance with customers through emotional connections and world class creative, which are central to the brand’s “Feel-Good Marketing” approach. This is exemplified by campaigns that elevate the entire brand and continue to be scaled around the globe to connect with customers in authentic and relatable ways. Another way McDonald’s connects with its customers is through personalized value and digital offers available in our mobile app. The Company is committed to a marketing strategy that highlights value at every tier of the menu, as providing delicious and affordable menu options remains a cornerstone of the McDonald’s brand. This includes everyday low-price options on our menu along with limited-time deals for our customers.

•Commit to the Core menu by tapping into customer demand for the familiar and focusing on serving our iconic products that are beloved by customers around the world such as our World Famous Fries, Big Mac, Quarter Pounder and Chicken McNuggets, which are some of our seventeen unique billion-dollar brands. Building on its foundational strength with burgers, the Company will continue to evolve and innovate its longest-standing menu item with plans to implement “Best Burger”; a series of operational and formulation changes designed to deliver hotter, juicier, tastier burgers to nearly all markets by the end of 2026. Further, the Company is focused on continuing to gain share in the rapidly growing chicken category, as we continue to aggressively expand our chicken brands. This includes plans to offer the McCrispy sandwich in nearly all markets by the end of 2025 and to extend the McCrispy brand into strips and wraps in several markets. These planned innovations and new menu offerings reflect the Company’s ability to meet evolving customer preferences. The Company also continues to see a significant

opportunity with coffee, demonstrated by markets leveraging the McCafé brand, customer experience, value and quality to drive long-term growth.

•Double Down on the 4D's: Digital, Delivery, Drive Thru and Restaurant Development by continuing to leverage competitive strengths and building a powerful digital experience growth engine to deliver a personalized and convenient customer experience. As another way to unlock further growth, the Company plans to continue to accelerate the pace of restaurant openings and technology innovation so that whenever and however customers choose to interact with McDonald’s, they can enjoy a fast, easy experience that meets their needs.

◦Digital: The Company’s digital experience is transforming how customers order, pay and receive their food. Through digital tools, customers can access personalized offers, participate in a loyalty program, order through our mobile app and receive McDonald's food through the channel of their choice. In the U.S., we are providing increased convenience to customers through “Ready on Arrival”: a digital enhancement that enables crew to begin assembling a customer’s mobile order prior to arrival at the restaurant to expedite service and elevate customer satisfaction. The Company plans to deploy this initiative across its top six markets by the end of 2025. The Company has successful loyalty programs in approximately 50 markets, including its top six markets. McDonald’s loyalty customers have proven to be highly engaged, and the Company plans to increase its 90-day active users to 250 million by 2027. Further, the Company plans to grow its annual Systemwide sales to loyalty members to $45 billion by 2027.

◦Delivery: The Company offers delivery from over 36,000 restaurants across approximately 100 markets, representing over 85% of McDonald’s restaurants. The Company is continuing to build on and enhance the delivery experience for customers, including adding the ability to place a delivery order in our mobile app (a feature that is currently available in five of the Company’s top markets). The Company continues to scale this capability and expects to increase the percentage of Systemwide delivery sales originating from our mobile app to 30% by 2027. The Company also has long-term strategic partnerships with delivery providers that continue to benefit the Company, customers and franchisees by optimizing operational efficiencies and creating a seamless customer experience.

◦Drive Thru: The Company has the most drive thru locations worldwide, with more than 27,000 drive thru locations globally, including nearly 95% of the approximately 13,500 locations in the U.S. This channel remains a competitive advantage in meeting customers’ demand for flexibility and choice. McDonald’s network currently provides unmatched scale and convenience for customers, while also offering significant growth opportunities, such as adding additional drive thru lanes to increase capacity and improve speed and efficiency. The Company continues to build on its drive thru advantage, as the vast majority of new restaurant openings in the U.S. and International Operated Markets will include a drive thru.

◦Restaurant Development: The Company will continue to accelerate the pace of restaurant openings to attempt to fully capture the demand being driven through our Strategy in many of our largest markets. In 2024, the Company plans to open more than 2,100 new restaurants across the globe, which will contribute to nearly 4% new unit growth (net of closures). Further, the Company continues to build on its industry-leading development progress by targeting expansion to 50,000 restaurants by the end of 2027, which would make it the fastest period of restaurant unit growth in Company history.

Foundation and Platforms

Foundational to our Strategy is keeping the customer and restaurant crew at the center of everything the Company does, along with a relentless focus on running great restaurants, empowering its people and continuing to modernize our ways of working. Further, as part of the Company's plans for long term growth and solidifying McDonald’s leadership position, the Company will continue to develop and implement three technology-enabled platforms designed to build our competitive advantages, cement our place in culture and stay one step ahead of our customers' expectations. Together, our foundation and platforms will extend the Company’s leadership position and unlock new growth opportunities and efficiencies for our business over the long-term.

Our platforms are:

•Consumer: The Company is building one of the world’s largest consumer platforms to fuel engagement, which will bring together the best of our brand and utilize our physical and digital competitive advantages. The consumer platform will enable the Company to accelerate growth in our loyalty program and drive valuable loyalty customers to visit more frequently.

•Restaurant: The Company is building the easiest and most efficient restaurant operating platform which enables franchisees to run restaurants more efficiently and utilize the latest cloud-based technology to make it easier for restaurant crew to deliver exceptional customer service. The Company intends to deploy new, universal software that all McDonald’s restaurants will run on, enabling restaurants to roll out innovation even faster, with less complexity and more stability; and customers will enjoy a more familiar, consistent experience.

•Company: The Company is building a modern company platform that unlocks speed and innovation throughout the organization, to enable further growth as it modernizes the way it works by focusing on becoming faster, more innovative and more efficient at solving problems for its customers and people.

Developing and implementing these platforms includes continued investments in digital, innovation and our Global Business Services organization.

Our Strategy is aligned with the Company’s capital allocation philosophy of investing in opportunities to grow the business and drive strong returns, for example through new restaurants and reinvesting in existing restaurants, and returning free cash flow to shareholders over time through dividends and share repurchases.

The Company believes our Strategy builds on our inherent strengths by harnessing the Company's competitive advantages while leveraging its size, scale, agility and the power of the McDonald's brand to adapt and adjust to meet customer demands in varying economic environments, including the current industry-wide challenges associated with more discerning consumer spending. Our Strategy is supported by a strong global senior leadership team aimed at executing against the MCD growth pillars, further developing our three platforms and driving long-term growth, including both guest count-led and industry market share growth.

Third Quarter and Nine Months 2024 Financial Performance

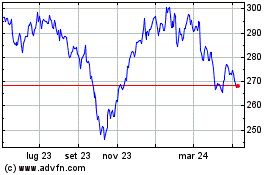

Global comparable sales decreased 1.5% for the quarter and decreased 0.2% for the nine months.

•U.S. comparable sales increased 0.3% for the quarter and 0.7% for the nine months. Comparable sales results for both periods reflect average check growth, partly offset by slightly negative comparable guest counts for the quarter and negative comparable guest counts for the nine months. Effective value and marketing campaigns featuring the core menu, successful restaurant level execution and continued digital and delivery growth contributed to slightly positive comparable sales results for both periods.

•International Operated Markets segment comparable sales decreased 2.1% for the quarter and 0.3% for the nine months. Segment performance for the quarter was impacted by negative comparable sales across a number of markets, driven by France and the U.K. For the nine months, segment performance was driven by negative comparable sales across a number of markets, led by France.

•International Developmental Licensed Markets segment comparable sales decreased 3.5% for the quarter and 1.7% for the nine months. The continued impact of the war in the Middle East and negative comparable sales in China more than offset positive comparable sales in Latin America, for both periods.

In addition to the comparable sales results, the Company had the following financial results for the quarter and nine months:

•Consolidated revenues increased 3% (2% in constant currencies) for the quarter and increased 2% (2% in constant currencies) for the nine months.

•Systemwide sales were flat (flat in constant currencies) for the quarter and increased 1% (1% in constant currencies) for the nine months.