UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

| TETRA Technologies, Inc. |

(Name of Registrant as Specified In Its Charter)

|

| |

BRADLEY L. RADOFF

THE RADOFF FAMILY FOUNDATION

JEC II ASSOCIATES, LLC

THE MOS TRUST

MOS PTC, LLC

MICHAEL TOROK

SIMON BATES

EVAN BEHRENS

ANDREW K. RUBEN

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Bradley L. Radoff, Michael Torok

and the other participants named herein (collectively, the “Radoff-Torok Group”) intends to file a preliminary proxy statement

and accompanying BLUE universal proxy card with the Securities and Exchange Commission to be used to solicit votes for the election

of its slate of highly qualified director nominees at the 2025 annual meeting of stockholders of TETRA Technologies, Inc., a Delaware

corporation (the “Company”).

On March 24, 2025, the Radoff-Torok

Group issued the following press release and open letter to the board of directors of the Company:

The Radoff-Torok Group Nominates Four Highly Qualified,

Independent Director Candidates for Election to the TETRA Technologies Board of Directors

Sends Letter to TTI Board Highlighting Decades-Long

Underperformance, Lack of Strategy, Poor Corporate Governance, Failed Succession Planning and Board Entrenchment

Believes TTI Board is More Concerned with Preserving

the Seats of Chairman John F. Glick and Directors Mark E. Baldwin and Thomas R. Bates, Jr., Than Addressing the Company’s Corporate

Strategy, Capital Allocation and Governance Failures

Believes TTI Board Change is Urgently Needed to

Create Long-Term Value for Stockholders

HOUSTON, TX – March 24, 2025 –

Bradley L. Radoff and Michael Torok (together with certain of their affiliates, the “Radoff-Torok Group”), who collectively

own more than 4.9% of the outstanding stock of TETRA Technologies, Inc. (NYSE: TTI) (“TTI” or the “Company”),

today announced that it has nominated four highly qualified, independent director candidates – Simon Bates, Evan Behrens, Bradley

L. Radoff and Andrew K. Ruben – for election to the Company’s Board of Directors (the “Board”) in connection with

the 2025 Annual Meeting of Stockholders.

The Radoff-Torok Group today also issued an open letter

to the Board regarding the urgent need for Board change to restore good governance and create long-term value for all TTI stockholders.

The full text of the letter is as follows:

TETRA Technologies, Inc.

24955 Interstate 45 North

The Woodlands, Texas 77380

Attn: Board of Directors

Members of the Board,

As longtime, constructive investors who collectively

own more than 4.9% of the outstanding stock of TETRA Technologies, Inc. (“TTI” or the “Company”), Bradley L. Radoff

and Michael Torok (together with certain of their affiliates, the “Radoff-Torok Group” or “we”) believe that the

Company possesses a portfolio of valuable businesses that have the potential to deliver significant, sustained value to stockholders.

Specifically, we believe that investors could value the Company like a focused, high margin and free cash flow generating specialty materials

business as opposed to a lifestyle oil-field service company that has no stockholder returns. It is clear to us that the Board of Directors

(the “Board”), as currently constructed, is incapable of developing, implementing or overseeing execution of a strategy to

achieve this potential or acting in the best interests of stockholders.

Over the past five months, we have sought to work

constructively with the Board to reach a mutually agreeable path forward for the Company. We have highlighted fundamental issues with

director tenure, succession planning and capital allocation, which we believe are all necessary to address to ensure successful governance

and management of the business. As you know, we recently offered to withdraw our privately nominated slate of director nominees in exchange

for the Company’s over-tenured, deeply entrenched directors – Chairman John F. Glick, Mark E. Baldwin and Thomas R. Bates,

Jr. – stepping down from the Board. We also earlier offered to support a Board refresh that contemplated the retirement of two long-standing

directors and the immediate appointment of a mutually agreed director who possesses industry and transactional expertise. Finally, as

a last ditch effort to avoid a proxy contest after President and Chief Executive Officer Brady M. Murphy made it clear to us that Messrs.

Glick and Bates, Jr. would not be departing the Board as part of a mutually agreed resolution, we even offered to allow two of the over-tenured

directors to stay on the Board if the Company was willing to add one of our highly qualified nominees.

The Board’s rejection of all of our proposals

– coupled with its belief that it can begin to create value despite a lengthy track record that clearly indicates otherwise –

is incomprehensible and underscores the Board’s troublesome desire to maintain the status quo. Notably, the Board is seemingly unconcerned

that two of its directors were simultaneously unseated from another company’s board by stockholders for a similar disregard for

stockholders’ interests, and that a third director sits on another company’s board currently being accused of significant

governance failures and entrenchment. The Board appears to be more concerned with preserving the seats of Messrs. Glick, Baldwin and Bates,

Jr., who have served for more than 11, 11 and 13 years, respectively, than working to address the Company’s obvious failures.

Accordingly, and with all stockholders’ best

interests in mind, we have nominated four highly qualified, independent director candidates – Simon Bates, Evan Behrens, Bradley

L. Radoff and Andrew K. Ruben – for election to the Board at the Company’s 2025 Annual Meeting of Stockholders. We believe

that with the addition of their fresh perspectives, relevant skillsets, public company board experience and stockholder-first mindset,

the Board will be better positioned to help oversee the successful transition of the Company into a focused, appropriately capitalized

and highly profitable business capable of delivering long-term value for stockholders.

TTI’S stock price has cratered under the

current Board and leadership.

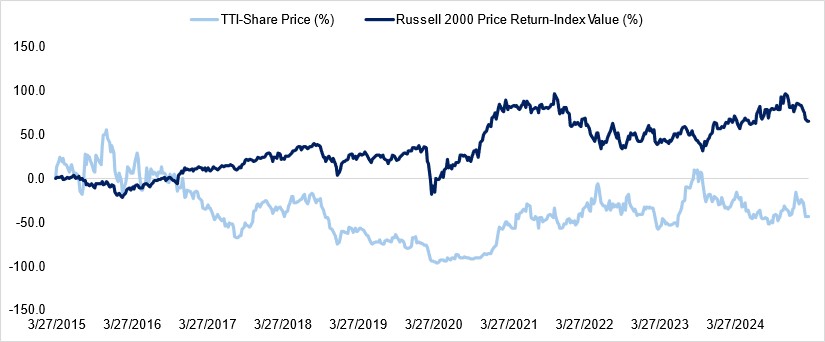

The numbers speak for themselves. Over the last decade,

TTI’s stock price has declined nearly 43%. During the same period, the Russell 2000 returned approximately 66% in value:1

It is clear to us that TTI’s Board and management

team are out of touch with the challenges facing the business and refuse to be held accountable for their underperformance. Leadership

has simply refused to address TTI’s myriad performance issues—including a bloated corporate overhead and unnecessarily high

debt—which have been a constant drag on earnings and free cash flow. The Board should know that public market investors attribute

low valuation multiples to commodity oil-field service companies, which TTI is perceived to be, and it is apparent that the Company’s

leadership does not have a strategy in place to address this challenge. In fact, when convenient, management will compare its poor performance

to an oil-field service index, knowing all too well that the Company possesses many valuable specialty chemical assets.

TTI Board’s must take action to unlock value

for stockholders.

As we have recommended repeatedly, we believe the

Board should immediately form a Strategy Committee of independent directors to review its portfolio of businesses, capital structure and

corporate overhead. We believe a review, supported by qualified financial advisors, will reveal options to unlock value and strengthen

the Company. The most obvious examples include divesting underperforming parts of the Company’s Water business and evaluating funding

options for the Arkansas processing facility, including partnerships and JVs. Importantly, each of these initiatives would also enable

a significant reduction in corporate overhead expense and net debt, thereby increasing free cash flow, profitability and – seemingly

for the first time under the tenure of this management team and Board – stockholder capital returns.

Additionally, articulating a succession plan on an

accelerated timetable and addressing major flaws with its capital allocation strategy are critical to restoring the Company’s credibility

with the market. Frankly, it is poor governance that a Board led by an over-tenured Chairman has allowed the Company to be run by a CEO

and CFO who are each past the standard retirement age, particularly given their inability to create value for stockholders. Worse still,

the Board has authorized the pursuit of large, capital-intensive projects (like the Arkansas processing facility) even though none of

the current Chairman, CEO or CFO will likely be at the Company upon the project’s completion.

1 Source: Bloomberg. Calculated as of market close on March 21, 2025, the last trading day prior to this letter.

TTI’s Board only acts following stockholder

pressure.

As you know, in 2021 some of us entered into an agreement

with the Company, which resulted in Paul D. Coombs not running for re-election that year, William D. Sullivan retiring from the Board

both in his capacities as Chairman and director in 2022, and Shawn D. Williams being appointed to the Board in 2021. If not for our pressure,

the Board would be even more deeply entrenched and intransigent than it is today. It is a sad commentary on this Board that you have only

begrudgingly reacted to our suggestions and pressure rather than taking proactive measures to improve the Company, but are seemingly so

entrenched that you are unwilling to have any of our candidates (or even a mutually agreed director) in the boardroom. This “country

club” mentality, combined with an awful track record, is unacceptable.

Our four highly qualified director candidates collectively

have the relevant industry, public company board and financial expertise the Board requires, are deeply committed to overseeing the Company

with stockholders’ best interests in mind and would bring much-needed stockholder representation to the Board.

The direction of TTI is untenable. We believe that

the Company’s continued poor share price performance demonstrates that stockholders have lost confidence in the Board’s ability

to provide the oversight required to drive meaningful and sustainable stockholder value.

Our nominees – Simon Bates, Evan Behrens, Bradley

L. Radoff and Andrew K. Ruben – collectively have proven track records of driving sustained stockholder value as executives, investors

and board members at leading specialty chemical, materials and building products companies.

Under a stronger Board committed to providing proper

management oversight, assessing the business portfolio, optimizing the Company’s capital structure and meaningfully reducing corporate

overhead, we believe TTI will be well-positioned to deliver sustainable growth and value creation to all stockholders.

Sincerely,

Bradley L. Radoff and Michael Torok

Director Nominee Biographies

Simon Bates

We believe Mr. Bates’ more than 30 years

of leadership experience in the chemical, construction and industrial segments, coupled with his public company board experience at manufacturing

and performance materials companies, will make him a valuable addition to the Board.

| · | Mr. Bates currently serves on the Board of Directors of DMC Global Inc., a holding company which operates

a portfolio of asset-light manufacturing businesses, primarily providing engineered products and services to the energy, industrial, and

building products markets. |

| · | Previously, Mr. Bates served as CEO of Argos North America Corp. (“Argos”), President and

CEO and a member of the Board of Directors of GCP Applied Technologies Inc., and President of the Infrastructure Products Group, a division

of CRH plc, as well as on the Board of Directors of U.S. Silica Holdings, Inc. |

| · | He has also held numerous leadership positions at public companies, including Westlake Corporation (“Westlake”),

Axiall Corporation, and Royal Building Products Inc. |

Evan Behrens

We believe Mr. Behrens’ extensive public

and private board service experience in the oil and gas industry, coupled with his significant management, financial and business development

skills and acumen, will make him a valuable addition to the Board.

| · | Mr. Behrens is currently a Managing Member of Behrens Investment Group LLC, an investment firm. |

| · | He has served on the boards of directors of Oppenheimer Holdings Inc., Harte Hanks, Inc., SEACOR Marine

Holdings Inc., Sidewinder Drilling LLC, Penford Corporation, Hornbeck Offshore Services, Inc., Stemline Therapeutics, Inc., Continental

Insurance Group, Ltd., Global Marine Systems Ltd. as well as Chairman of the Board of Directors of Trailer Bridge, Inc., and Board Chairman

and Managing Member of Illinois Corn Processing, LLC. |

| · | Previously, he served as Senior Vice President of Business Development at SEACOR Holdings Inc., Portfolio

Manager and Partner at Level Global Investors, L.P., Co-Founder, CEO and Portfolio Manager of B Capital Advisors, LP (formerly Behrens

Rubinoff Capital Partners LP), and Senior Portfolio Manager at SAC Capital Advisors LP. |

Bradley L. Radoff

We believe Mr. Radoff’s financial and

investment expertise together with his perspective as a significant stockholder of the Company and public company board experience will

make him a valuable addition to the Board.

| · | Mr. Radoff is a successful private investor after previously serving as a Portfolio Manager at Third Point

LLC and a Managing Director of Lonestar Capital Management LLC. |

| · | Mr. Radoff currently serves on the board of directors of Harte Hanks, Inc., Farmer Bros. Co. and Enzo

Biochem, Inc. |

| · | Previously, he served on the board of directors of VAALCO Energy, Inc., a Texas-based independent energy

company, Pogo Producing Company, an oil and gas exploration, development and production company, and Support.com, Inc. |

Andrew K. Ruben

We believe Mr. Ruben’s extensive executive

leadership experience, including at one of the world’s largest public companies, and expertise in corporate sustainability will

make him a valuable addition to the Board.

| · | Mr. Ruben is the Founder and currently serves as Chair of the Board of Directors of Trove Recommerce,

Inc. He was previously Executive Chair from May 2022 to December 2023, and CEO and a director from 2012 to April 2022. He is also currently

on the Board of Directors of Zevia PBC, where he also serves as Lead Independent Director. |

| · | Between 2002 to 2012, he served in several executive roles of increasing responsibility at Walmart Inc.

(“Walmart”), a multinational retail corporation, including as Vice President of Corporate Strategy, Sustainability Officer,

Vice President of Private Brand Strategy and Operations, and Vice President of Omni-Channel. During his time at Walmart, Mr. Ruben led

various transformational efforts, including overseeing global corporate strategy, launching Walmart’s sustainability efforts and

leading omnichannel and e-commerce efforts. |

| · | Additionally, he is currently a Senior Advisor to Boston Consulting Group, a global consulting firm, and

has served as a member of the Competitive Council at Cerberus Capital Management, a private investment firm. |

| · | He has been recognized professionally as the Sam M. Walton Entrepreneur of the Year, a Retailing Rising

Star by Chain Store Age and a 40 Under 40 Business Leader. |

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Bradley L. Radoff and Michael Torok, together with

the other participants named herein (collectively, the “Radoff-Torok Group”), intends to file a preliminary proxy statement

and accompanying BLUE universal proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit

votes for the election of its slate of highly qualified director nominees at the 2025 annual meeting of stockholders of TETRA Technologies,

Inc., a Delaware corporation (the “Company”).

THE RADOFF-TOROK GROUP STRONGLY ADVISES ALL STOCKHOLDERS

OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS, INCLUDING A PROXY CARD, AS THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV.

IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON

REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The participants in the anticipated proxy solicitation

are expected to be The Radoff Family Foundation (“Radoff Foundation”), Bradley L. Radoff, JEC II Associates, LLC (“JEC

II”), The MOS Trust (“MOS Trust”), MOS PTC, LLC (“MOS PTC”), Michael Torok, Simon Bates, Evan Behrens and

Andrew K. Ruben.

As of the date hereof, Radoff Foundation directly

beneficially owns 550,000 shares of Common Stock, $0.01 par value per share, of the Company (“Common Stock”). As of the date

hereof, Mr. Radoff directly beneficially owns 4,500,000 shares of Common Stock. Mr. Radoff, as a director of Radoff Foundation, may be

deemed to beneficially own the 550,000 shares of Common Stock owned by Radoff Foundation, which, together with the 4,500,000 shares of

Common Stock he directly owns, constitutes an aggregate of 5,050,000 shares of Common Stock beneficially owned by Mr. Radoff. As of the

date hereof, JEC II directly beneficially owns 1,010,000 shares of Common Stock. As of the date hereof, MOS Trust directly beneficially

owns 259,500 shares of Common Stock. MOS PTC, as the trustee of MOS Trust, may be deemed to beneficially own the 259,500 shares of Common

Stock directly beneficially owned by MOS Trust. As of the date hereof, Mr. Torok directly beneficially owns 235,000 shares of Common Stock.

Mr. Torok, as the Manager of JEC II and a Manager of MOS PTC, may be deemed to beneficially own the 1,269,500 shares of Common Stock directly

beneficially owned in the aggregate by JEC II and MOS Trust, which, together with the 235,000 shares of Common Stock he directly beneficially

owns, constitutes an aggregate of 1,504,500 shares of Common Stock beneficially owned by Mr. Torok. As of the date hereof, none of Messrs.

Bates, Behrens or Ruben beneficially own any shares of Common Stock.

Contacts

Media:

Nathaniel Garnick/Amanda Shpiner/Sam Cohen

Gasthalter & Co.

(212) 257-4170

Grafico Azioni TETRA Technologies (NYSE:TTI)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni TETRA Technologies (NYSE:TTI)

Storico

Da Apr 2024 a Apr 2025