Saputo Inc. (TSX: SAP) (we, Saputo or the Company) reported today

its financial results for the third quarter of fiscal 2024, which

ended on December 31, 2023. All amounts in this news release are in

millions of Canadian dollars (CDN), except per share amounts,

unless otherwise indicated, and are presented according to

International Financial Reporting Standards (IFRS).

“In the third quarter, we continued to execute

with discipline and advance our long-term strategy in a dynamic

macroeconomic environment, characterized by volatile commodity

markets and a resilient but cautious consumer. Importantly, our

continued focus on managing the factors within our control resulted

in strong operating cash flow,” said Lino A. Saputo, Chair of the

Board, President, and CEO. “We are making tangible progress with

our Global Strategic Plan. I am pleased with how our capital

projects are advancing and the impact of many of the actions and

initiatives completed to date.”

Fiscal 2024 Third Quarter Financial

Highlights

- Revenues amounted to $4.267 billion, down $320 million or

7.0%.

- Net loss totalled $124 million, compared to net earnings of

$179 million. Net loss per share was $0.29, compared to net

earnings per share (EPS) of $0.43.

- Adjusted EBITDA1 amounted to $370 million, down $75 million or

16.9%.

- Adjusted net earnings1 totalled $163 million, down from $221

million, and adjusted EPS1 (basic and diluted) were $0.38, down

from $0.53.

- Net cash generated from operating activities amounted to $388

million, up from $134 million.

- A non-cash goodwill impairment charge of $265 million was

recorded in relation to the Dairy Division (Australia).

|

(unaudited) |

For the three-month periods ended December 31 |

For the nine-month periods ended December 31 |

|

2023 |

|

2022 |

2023 |

2022 |

|

Revenues |

4,267 |

|

4,587 |

12,797 |

13,375 |

| Adjusted

EBITDA1 |

370 |

|

445 |

1,130 |

1,161 |

| Net earnings

(loss) |

(124 |

) |

179 |

173 |

463 |

| Adjusted net

earnings1 |

163 |

|

221 |

498 |

515 |

| Earnings

(loss) per share |

|

|

|

|

|

Basic and Diluted |

(0.29 |

) |

0.43 |

0.41 |

1.11 |

| Adjusted

EPS1 |

|

|

|

|

|

Basic and Diluted |

0.38 |

|

0.53 |

1.18 |

1.34 |

- The macroeconomic environment was not favourable to Saputo’s

results. Under volatile market conditions, commodity prices

dropped, negatively impacting both the USA Sector and the

International Sector. The deep devaluation of the Argentine peso

late in the quarter had a non-cash negative impact on the results

of the International Sector, due to the application of

hyperinflation accounting to the Dairy Division (Argentina)

results. Despite these market headwinds, Saputo delivered higher

sales volumes and increased cash flows from operations with its

continued focus on strategic priorities and progression of major

capital projects.

- Adjusted EBITDA1 reflected the following:

- Solid performance in the Canada Sector;

- Continued improvement on operational controllables in the USA

Sector, although results were affected by negative USA Market

Factors2;

- Higher sales volumes in both domestic and export markets;

- In the International Sector, lower international cheese and

dairy ingredient market prices; and

- In the Europe Sector, the selling of inventory produced at

higher milk prices.

- The Board of Directors approved a dividend of $0.185 per share

payable on March 15, 2024, to shareholders of record on March 5,

2024.

DRIP SUSPENSION

Saputo announces that it suspends its Dividend

Reinvestment Plan (“DRIP”), effective February 8, 2024. Until

further notice, shareholders who were enrolled in the DRIP will

automatically receive dividend payments in the form of cash,

including the dividend declared today and payable on March 15,

2024. If Saputo elects to reinstate the DRIP in the future,

shareholders that were enrolled in the DRIP at suspension and

remained enrolled at reinstatement will automatically resume

participation in the DRIP.

1 This is a total of segments measure, a

non-GAAP financial measure, or a non-GAAP ratio. These measures and

ratios do not have a standardized meaning under IFRS. Therefore,

they are unlikely to be comparable to similar measures presented by

other issuers. See the “Non-GAAP Measures” section of this news

release for more information, including the definition and

composition of the measure or ratio as well as the reconciliation

to the most comparable measure in the primary financial statements,

as applicable. Adjusted net earnings and adjusted EPS for

comparative periods were aligned to meet the current

presentation.2 Refer to the "Glossary" section of the

Management's Discussion and Analysis.

FY24 OUTLOOK

- We expect to benefit from additional capacity and capabilities,

cost containment and efficiency initiatives, new product

innovations, and investments in our brands and advertising.

- We will continue to manage the current inflationary environment

through our pricing protocols and cost containment measures.

- A more stabilized workforce and fewer supply chain constraints

are expected to further enhance our ability to service customers,

particularly in the USA Sector.

- As we approach the completion of our major capital projects, we

expect to increase our operational efficiencies while further

improving our cost structure, particularly in the USA Sector.

- Global demand for dairy products is expected to remain moderate

due to macroeconomic conditions and the impact of pricing

elasticity.

- The outlook for USA Market Factors2 remains mixed. Management

believes that the long-term environment is likely to be relatively

supportive for commodity prices but with continued volatility in

the short to medium-term.

- Cheese and dairy ingredient market prices are expected to

remain low.

- The Europe Sector is expected to continue to be impacted,

although to a lesser extent than in the third quarter of fiscal

2024, by the selling of inventory produced at higher milk

prices.

- Capital expenditures are expected to remain at similar levels

versus last fiscal year, driven by Global Strategic Plan

optimization and capacity expansion initiatives, as well as

continued investments in automation.

- We expect strong operating cash flow to continue to support a

balanced capital allocation strategy and provide the financial

flexibility to consider value-enhancing opportunities, with

priority given to: (i) organic growth initiatives through capital

expenditures, (ii) shareholder dividends, and (iii) debt

repayments.

GLOBAL STRATEGIC PLAN

HIGHLIGHTS

- In the Canada Sector, we continued the roll-out of our

automation projects, which included the completion of several

cheese slicing, shredding, and packing automation projects, to take

advantage of new business opportunities and to continue to grow

with some of our national retail customers.

- In the USA Sector, (i) our new cheese shred lines are in

start-up mode at our Tulare Paige, California, plant and are

currently meeting customer demand; the planned closure of our Big

Stone, South Dakota, Green Bay, Wisconsin, and South Gate,

California, facilities by the end of fiscal 2025 should further

support network optimization plans, (ii) benefits from the recently

converted Reedsburg, Wisconsin, goat cheese manufacturing plant

should begin in the first quarter of fiscal 2025 once our Lancaster

facility is closed, and (iii) the new automated cut-and-wrap

facility in Franklin, Wisconsin, is running with benefits expected

to begin by the end of fiscal 2024.

- In the Europe Sector, efficiency benefits from the expanded

Nuneaton packing facility are expected to accelerate once the

closure of the Frome facility is completed in the first quarter of

fiscal 2025. Shipments of new private label contracts began in the

fourth quarter of fiscal 2024.

- In the International Sector, previously announced network

optimization activities in Australia will result in eleven plants

being consolidated into six. Some of these benefits began to be

realized in fiscal 2024. We are in the process of also divesting

two fresh milk processing facilities and we commenced a review of

strategic alternatives related to our King Island facility in

Tasmania.

THE SAPUTO PROMISE

The Saputo Promise is our approach to social,

environmental, and economic performance which guides our everyday

actions and consists of seven Pillars: Food Quality and Safety, Our

People, Business Ethics, Responsible Sourcing, Environment,

Nutrition, and Community. It is an integral part of our business

and a key component of our growth. As we seek to create shared

value for all our stakeholders, it provides a framework that

ensures we manage ESG risks and opportunities successfully across

our operations globally.

Anchored in the most pressing ESG issues for our

business, our three-year plan (FY23-FY25) builds on the momentum of

the past few years and continues to drive, enable, and sustain our

growth.

In the third quarter of fiscal 2024, we

continued our efforts across our seven Pillars to progress on our

three-year goals. Additional details will be shared with our Q4

results in June with the release of our annual Promise Report.

Additional Information

For more information, reference is made to the

condensed interim consolidated financial statements, the notes

thereto and to the Management’s Discussion and Analysis for the

third quarter of fiscal 2024. These documents can be obtained on

SEDAR+ under the Company’s profile at www.sedarplus.ca and in the

“Investors” section of the Company’s website, at

www.saputo.com.

Webcast and Conference Call

A webcast and conference call will be held on

Friday, February 9, 2024, at 8:30 a.m. (Eastern Time).

The webcast will begin with a short presentation

followed by a question and answer period. The speakers will be Lino

A. Saputo, Chair of the Board, President and CEO, and Maxime

Therrien, Chief Financial Officer and Secretary.

To participate:

- Webcast :

https://www.gowebcasting.com/13127Presentation slides will be

included in the webcast and can also be accessed in the “Investors”

section of Saputo's website (www.saputo.com), under “Calendar of

Events”.

- Conference line (audio only): 1-800-945-5981

Please dial-in five minutes prior to the start time.

Replay of the conference call and

webcast presentation For those unable to join, the webcast

presentation will be archived on Saputo’s website (www.saputo.com)

in the “Investors” section, under “Calendar of Events”. A replay of

the conference call will also be available until Friday, February

16, 2024, 11:59 p.m. (ET) by dialling 1-800-558-5253 (ID number:

22028964).

About Saputo

Saputo, one of the top ten dairy processors in

the world, produces, markets, and distributes a wide array of dairy

products of the utmost quality, including cheese, fluid milk,

extended shelf-life milk and cream products, cultured products, and

dairy ingredients. Saputo is a leading cheese manufacturer and

fluid milk and cream processor in Canada, a leading dairy processor

in Australia and the top dairy processor in Argentina. In the USA,

Saputo ranks among the top three cheese producers and is one of the

top producers of extended shelf-life and cultured dairy products.

In the United Kingdom, Saputo is the leading manufacturer of

branded cheese and dairy spreads. In addition to its dairy

portfolio, Saputo produces, markets, and distributes a range of

dairy alternative cheeses and beverages. Saputo products are sold

in several countries under market-leading brands, as well as

private label brands. Saputo Inc. is a publicly traded company and

its shares are listed on the Toronto Stock Exchange under the

symbol “SAP”. Follow Saputo’s activities at www.saputo.com or via

Facebook, Instagram, and LinkedIn.

Investor Inquiries Nicholas

Estrela Director, Investor Relations 1-514-328-3117

Media Inquiries 1-514-328-3141 /

1-866-648-5902 media@saputo.com

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This news release contains statements which are

forward-looking statements within the meaning of applicable

securities laws. These forward-looking statements include, among

others, statements with respect to our objectives, outlook,

business projects, strategies, beliefs, expectations, targets,

commitments, goals, ambitions and strategic plans including our

ability to achieve these targets, commitments, goals, ambitions and

strategic plans, and statements other than historical facts. The

words “may”, “could”, “should”, “will”, “would”, “believe”, “plan”,

“expect”, “intend”, “anticipate”, “estimate”, “foresee”,

“objective”, “continue”, “propose”, “aim”, “commit”, “assume”,

“forecast”, “predict”, “seek”, “project”, “potential”, “goal”,

“target”, or “pledge”, or the negative of these terms or variations

of them, the use of conditional or future tense or words and

expressions of similar nature, are intended to identify forward-

looking statements. All statements other than statements of

historical fact included in this news release may constitute

forward-looking statements within the meaning of applicable

securities laws.

By their nature, forward-looking statements are

subject to inherent risks and uncertainties. Actual results could

differ materially from those stated, implied, or projected in such

forward-looking statements. As a result, we cannot guarantee that

any forward-looking statements will materialize, and we warn

readers that these forward-looking statements are not statements of

historical fact or guarantees of future performance in any way.

Assumptions, expectations, and estimates made in the preparation of

forward-looking statements and risks and uncertainties that could

cause actual results to differ materially from current expectations

are discussed in our materials filed with the Canadian securities

regulatory authorities from time to time, including the “Risks and

Uncertainties” section of the Management's Discussion and Analysis

dated June 8, 2023, available on SEDAR+ under Saputo's profile at

www.sedarplus.ca.

Such risks and uncertainties include the

following: product liability; the availability and price variations

of milk and other inputs, our ability to transfer input costs

increases, if any, to our customers in competitive market

conditions; supply chain strain and supplier concentration; the

price fluctuation of dairy products in the countries in which we

operate, as well as in international markets; our ability to

identify, attract, and retain qualified individuals; the increased

competitive environment in our industry; consolidation of

clientele; cyber threats and other information technology-related

risks relating to business disruptions, confidentiality, data

integrity business and email compromise-related fraud;

unanticipated business disruption; continuing economic and

political uncertainties, resulting from actual or perceived changes

in the condition of the economy or economic slowdowns or

recessions; the ongoing military conflict in Ukraine; public health

threats, such as the recent global COVID-19 pandemic, changes in

consumer trends; changes in environmental laws and regulations; the

potential effects of climate change; increased focus on

environmental sustainability matters; the failure to execute our

Global Strategic Plan as expected or to adequately integrate

acquired businesses in a timely and efficient manner; the failure

to complete capital expenditures as planned; changes in interest

rates and access to capital and credit markets. There may be other

risks and uncertainties that we are not aware of at present, or

that we consider to be insignificant, that could still have a

harmful impact on our business, financial state, liquidity,

results, or reputation.

Forward-looking statements are based on

Management’s current estimates, expectations and assumptions

regarding, among other things; the projected revenues and expenses;

the economic, industry, competitive, and regulatory environments in

which we operate or which could affect our activities; our ability

to identify, attract, and retain qualified and diverse individuals;

our ability to attract and retain customers and consumers; our

environmental performance; the results of our sustainability

efforts; the effectiveness of our environmental and sustainability

initiatives; our operating costs; the pricing of our finished

products on the various markets in which we carry on business; the

successful execution of our Global Strategic Plan; our ability to

deploy capital expenditure projects as planned; reliance on third

parties; our ability to gain efficiencies and cost optimization

from strategic initiatives; our ability to correctly predict,

identify, and interpret changes in consumer preferences and demand,

to offer new products to meet those changes, and to respond to

competitive innovation; our ability to leverage our brand value;

our ability to drive revenue growth in our key product categories

or platforms or add products that are in faster-growing and more

profitable categories; the successful execution of our M&A

strategy; the market supply and demand levels for our products; our

warehousing, logistics, and transportation costs; our effective

income tax rate; the exchange rate of the Canadian dollar to the

currencies of cheese and dairy ingredients. To set our financial

performance targets, we have made assumptions regarding, among

others: the absence of significant deterioration in macroeconomic

conditions; our ability to mitigate inflationary cost pressure; the

USA commodity market conditions; labour market conditions and

staffing levels in our facilities; the impact of price elasticity;

our ability to increase the production capacity and productivity in

our facilities; and the demand growth for our products. Our ability

to achieve our environmental targets, commitments, and goals is

further subject to, among others: our ability to access and

implement all technology necessary to achieve our targets,

commitments, and goals; the development and performance of

technology, innovation and the future use and deployment of

technology and associated expected future results; the

accessibility of carbon and renewable energy instruments for which

a market is still developing and which are subject to risk of

invalidation or reversal; and environmental regulation. Our ability

to achieve our 2025 Supply Chain Pledges is further subject to,

among others, our ability to leverage our supplier relationships

and our sustainability advocacy efforts.

Management believes that these estimates,

expectations, and assumptions are reasonable as of the date hereof,

and are inherently subject to significant business, economic,

competitive, and other uncertainties and contingencies regarding

future events, and are accordingly subject to changes after such

date. Forward-looking statements are intended to provide

shareholders with information regarding Saputo, including our

assessment of future financial plans, and may not be appropriate

for other purposes. Undue importance should not be placed on

forward-looking statements, and the information contained in such

forward-looking statements should not be relied upon as of any

other date.

Unless otherwise indicated by Saputo,

forward-looking statements in this news release describe our

estimates, expectations and assumptions as of the date hereof, and,

accordingly, are subject to change after that date. Except as

required under applicable securities legislation, Saputo does not

undertake to update or revise forward-looking statements, whether

written or verbal, that may be made from time to time by itself or

on our behalf, whether as a result of new information, future

events, or otherwise. All forward-looking statements contained

herein are expressly qualified by this cautionary statement.

SELECTED QUARTERLY FINANCIAL

INFORMATION

|

Fiscal years |

Q3 |

|

2024Q2 |

|

Q1 |

|

Q4 |

|

2023Q3 |

|

Q2 |

|

Q1 |

|

2022Q4 |

|

|

Revenues |

4,267 |

|

4,323 |

|

4,207 |

|

4,468 |

|

4,587 |

|

4,461 |

|

4,327 |

|

3,957 |

|

| Adjusted

EBITDA1 |

370 |

|

398 |

|

362 |

|

392 |

|

445 |

|

369 |

|

347 |

|

260 |

|

|

Adjusted EBITDA margin1 |

8.7 |

% |

9.2 |

% |

8.6 |

% |

8.8 |

% |

9.7 |

% |

8.3 |

% |

8.0 |

% |

6.6 |

% |

| Net earnings

(loss) |

(124 |

) |

156 |

|

141 |

|

159 |

|

179 |

|

145 |

|

139 |

|

37 |

|

| Acquisition

and restructuring costs2 |

4 |

|

— |

|

— |

|

21 |

|

27 |

|

16 |

|

6 |

|

51 |

|

| Goodwill

impairment charge |

265 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

| Loss (gain)

on hyperinflation |

3 |

|

9 |

|

(2 |

) |

— |

|

— |

|

(26 |

) |

(18 |

) |

(15 |

) |

| Amortization

of intangible assets related to |

|

|

|

|

|

|

|

|

business acquisitions2 |

15 |

|

16 |

|

15 |

|

16 |

|

15 |

|

16 |

|

16 |

|

20 |

|

|

Adjusted net earnings1 |

163 |

|

181 |

|

154 |

|

196 |

|

221 |

|

151 |

|

143 |

|

93 |

|

|

Adjusted net earnings margin1 |

3.8 |

% |

4.2 |

% |

3.7 |

% |

4.4 |

% |

4.8 |

% |

3.4 |

% |

3.3 |

% |

2.4 |

% |

| Earnings

(loss) per share (basic and diluted) |

(0.29 |

) |

0.37 |

|

0.33 |

|

0.38 |

|

0.43 |

|

0.35 |

|

0.33 |

|

0.09 |

|

| Adjusted EPS

basic1 |

0.38 |

|

0.43 |

|

0.37 |

|

0.47 |

|

0.53 |

|

0.36 |

|

0.34 |

|

0.22 |

|

|

Adjusted EPS diluted1 |

0.38 |

|

0.43 |

|

0.36 |

|

0.46 |

|

0.53 |

|

0.36 |

|

0.34 |

|

0.22 |

|

Selected factor(s) positively (negatively)

impacting Adjusted EBITDA1

|

Fiscal years |

Q3 |

|

2024 Q2 |

|

Q1 |

|

Q4 |

|

2023 Q3 |

|

Q2 |

|

Q1 |

|

2022 Q4 |

|

|

USA Market Factors3.4 |

(27 |

) |

32 |

|

(14 |

) |

29 |

|

(6 |

) |

(27 |

) |

(7 |

) |

(19 |

) |

|

Inventory write-down |

(14 |

) |

(7 |

) |

(10 |

) |

— |

|

— |

|

— |

|

— |

|

— |

|

|

Foreign currency exchange4,5 |

(33 |

) |

(3 |

) |

4 |

|

(12 |

) |

(7 |

) |

(12 |

) |

(7 |

) |

(12 |

) |

1 This is a total of segments measure, a

non-GAAP financial measure, or a non-GAAP ratio. These measures and

ratios do not have a standardized meaning under IFRS. Therefore,

they are unlikely to be comparable to similar measures presented by

other issuers. See the “Non-GAAP Measures” section of this news

release for more information, including the definition and

composition of the measure or ratio as well as the reconciliation

to the most comparable measure in the primary financial statements,

as applicable. Adjusted net earnings and adjusted EPS for

comparative periods were aligned to meet the current presentation.

2 Net of applicable income taxes. 3 Refer to the ‘‘Glossary’’

section of the Management's Discussion and Analysis. 4 As compared

to the same quarter of the previous fiscal year. 5 Foreign currency

exchange includes the effect of conversion of US dollars,

Australian dollars, British pounds sterling, and Argentine pesos to

Canadian dollars.

CONSOLIDATED RESULTS FOR THE THIRD QUARTER AND FISCAL

PERIOD ENDED DECEMBER 31, 2023

Revenues

Revenues for the third quarter of fiscal

2024 totalled $4.267 billion, down $320 million or 7.0%,

as compared to $4.587 billion for the same quarter last fiscal

year. For the nine months of fiscal 2024, revenues

totalled $12.797 billion, down $578 million or 4.3%, as

compared to $13.375 billion for last fiscal year.

In the third quarter of fiscal 2024, the

conversion of foreign currencies to the Canadian dollar had an

unfavourable impact of approximately $280 million, mainly due to

the devaluation of the Argentine peso. In the nine months of fiscal

2024, the conversion of foreign currencies to the Canadian dollar

had an unfavourable impact of approximately $179 million,

mainly due to the devaluation of the Argentine peso.

The combined effect of the lower average block

market price2 and of the lower average butter market price2 in our

USA Sector had a negative impact of $167 million and $587 million,

in the third quarter of fiscal 2024 and for the nine months of

fiscal 2024, respectively. Lower international cheese and dairy

ingredient market prices had a negative impact in all our

sectors.

Higher domestic selling prices in line with the

higher cost of milk as raw material had a favourable impact.

The effects of currency fluctuations on export

sales denominated in US dollars were favourable.

Both domestic and export sales volumes were

higher in the third quarter of fiscal 2024, despite continued

softening of global demand for dairy products. For the nine months

of fiscal 2024, export sales volumes were lower due to the

softening global demand for dairy products and competitive market

conditions, while domestic sales volumes were stable.

Operating costs excluding depreciation,

amortization, and restructuring costs

Operating costs excluding depreciation,

amortization, and restructuring costs for the third quarter

of fiscal 2024 totalled $3.897 billion, down $245 million

or 5.9%, as compared to $4.142 billion for the same quarter last

fiscal year. These decreases were in line with lower commodity

market prices, which reduced the cost of raw materials and

consumables used.

For the nine months of fiscal

2024, operating costs excluding depreciation,

amortization, and restructuring costs totalled $11.667 billion,

down $547 million or 4.5%, as compared to $12.214 billion for the

same period last fiscal year. These decreases were in line with

lower commodity market prices, which reduced the cost of raw

materials and consumables used.

Also contributing to these decreases were lower

logistics costs and the favourable impacts from our cost

containment measures and from our Global Strategic Plan

initiatives. The decreases were partially offset by the negative

impacts of ongoing inflation on costs, as well as higher employee

salary and benefit expenses, which include the effect of wage

increases, as well as costs incurred to implement previously

announced network optimization initiatives.

Net earnings (loss)

Net loss for the third quarter of fiscal

2024 totalled $124 million , as compared to net earnings

of $179 million for the same quarter last fiscal year. The net loss

is primarily due to a non-cash goodwill impairment charge of $265

million, lower adjusted EBITDA1, as described below, a loss on

hyperinflation, and higher financial charges, offset by lower

acquisition and restructuring costs, and lower income tax

expense.

For the nine months of fiscal

2024, net earnings totalled $173 million, down $290

million or 62.6%, as compared to $463 million for the same

period last fiscal year. The decrease is primarily due to a

non-cash goodwill impairment charge, lower adjusted EBITDA1, as

described below, a loss on hyperinflation compared to a gain for

the same period last fiscal year, and higher financial charges,

offset by lower acquisition and restructuring costs, and lower

income tax expense.

Adjusted

EBITDA1

Adjusted EBITDA1 for the third quarter

of fiscal 2024 totalled $370 million, down $75 million or

16.9%, as compared to $445 million for the same quarter last fiscal

year.

Adjusted EBITDA1 reflected a solid performance

in the Canada Sector and continued operational improvements in the

USA Sector. USA Market Factors2 resulted in a negative impact of

$27 million, driven by the combined negative impacts of the

fluctuation of the average block market price2 related to our

cheese products and of the lower average butter market price2

related to our dairy food products. The milk-cheese Spread2 was

less negative as compared to the same period last fiscal year.

Results also reflected higher sales volumes in

both domestic and export markets while lower international cheese

and dairy ingredient market prices had a negative impact.

The International Sector also showed lower

results due to the persistent unfavourable relationship between

international cheese and dairy ingredient market prices and the

cost of milk, and an inventory write-down of $14 million.

In the Europe Sector, the selling of inventory

produced at higher milk prices had a negative impact.

Our ongoing cost containment measures

implemented to minimize the effect of inflation, along with lower

logistics costs, mainly in North America, had a favourable impact.

The benefits derived from our Global Strategic Plan, including

continuous improvement, supply chain optimization, and automation

initiatives, also had a favourable impact. These favourable impacts

were partially offset by costs incurred to implement previously

announced network optimization initiatives, including $10 million

in the USA Sector.

The conversion of foreign currencies to the

Canadian dollar had an unfavourable impact of approximately $33

million, mainly due to the devaluation of the Argentine peso.

Adjusted EBITDA1 for the nine months of

fiscal 2024 totalled $1.13 billion, down $31 million or

2.7%, as compared to $1.161 billion for the same period last fiscal

year.

Results increased in the Canada Sector and in

the USA Sector, where operational improvements had a positive

impact.

Export sales volumes were lower due to softening

of the global demand for dairy products. Lower international cheese

and dairy ingredient market prices had a negative impact.

The International Sector performance was

negatively impacted by the unfavourable relationship between

international cheese and dairy ingredient market prices and the

cost of milk.

The Europe Sector performance was negatively

impacted by the selling of inventory produced at higher milk

prices.

We benefited from the carryover impact of higher

average selling prices, driven by previously announced pricing

initiatives, which were implemented to mitigate higher input costs

in line with ongoing inflation and volatile commodity markets.

USA Market Factors2 had a negative impact of $9

million, driven by the combined negative impacts of the fluctuation

of the average block market price2 related to our cheese products

and of the lower average butter market price2 related to our dairy

food products. The milk-cheese Spread2 was less negative as

compared to the same period last fiscal year.

Our ongoing cost containment measures

implemented to minimize the effect of inflation, along with lower

logistics costs, including lower fuel prices, mainly in North

America, had a favourable impact. Benefits derived from our Global

Strategic Plan, including continuous improvement, supply chain

optimization, and automation initiatives, also had a favourable

impact. These favourable impacts were partially offset by costs

incurred to implement previously announced network optimization

initiatives, including $21 million in the USA Sector.

Results included an inventory write-down of $31

million as a result of the decrease in certain market selling

prices.

The conversion of foreign currencies to the

Canadian dollar had an unfavourable impact of approximately $32

million, mainly due to the devaluation of the Argentine peso.

Depreciation and amortization

Depreciation and amortization for the

third quarter of fiscal 2024 and the nine

months of fiscal 2024 totalled $147 million and $438

million respectively, flat, as compared to the comparative period

last fiscal year.

Acquisition and restructuring

costs

During the third quarter of fiscal

2024, we announced the permanent closure of our Lancaster,

Wisconsin, facility, in line with our Global Strategic Plan. As a

result, restructuring costs of $6 million ($4 million after tax),

which include non-cash fixed assets write-down of $4 million and

employee-related costs of $2 million, were recorded. There were no

other restructuring costs in the first half of fiscal 2024.

Acquisition and restructuring costs for the

third quarter of fiscal 2023 totalled $38 million

and included a non-cash fixed assets write-down of $30 million, and

employee-related costs of $7 million in connection with

consolidation initiatives in our Dairy Division (Australia) being

undertaken as part of our Global Strategic Plan.

Acquisition and restructuring costs in the

nine months of fiscal 2023 totalled $67 million

and comprised costs as described above in relation to initiatives

undertaken in Australia, as well as a non-cash fixed assets

write-down of $19 million, accelerated depreciation, and

employee-related costs in connection with capital investments and

consolidation initiatives in our USA Sector, as well as site

closure costs of $9 million relating to the consolidation

activities in our Europe Sector as part of our Global Strategic

Plan. Restructuring costs also included a $2 million gain on

disposal of assets related to the sale of a closed facility in the

Canada Sector.

Goodwill impairment charge

In the third quarter of fiscal

2024 and nine months of fiscal 2024, a

non-cash goodwill impairment charge of $265 million was

recorded.

In performing our annual goodwill impairment

testing as at December 31, 2023, our Dairy Division (Australia)

Cash Generating Unit (the Australia CGU) estimates of future

discounted cash flows were reduced due to the increasing disconnect

in the relationship between international cheese and dairy

ingredient prices and farm gate milk prices in a context of

declining milk production in Australia.

As a result, the estimated recoverable value of

the Australia CGU was determined to be lower than its carrying

value and a non-cash goodwill impairment charge of $265 million

(non tax-deductible) was recorded, representing the total value of

the goodwill for this CGU.

Loss (gain) on hyperinflation

Loss on hyperinflation for the third

quarter of fiscal 2024 totalled $3 million (nil in fiscal

2023). For the nine months of fiscal 2024, the

loss on hyperinflation totalled $10 million ($44 million gain in

fiscal 2023). The change in the loss (gain) on hyperinflation is

relative to the application of hyperinflation accounting for the

Dairy Division (Argentina).

Financial charges

Financial charges for the third quarter

of fiscal 2024 totalled $42 million, up $5 million

compared to the same quarter last fiscal year. For the nine

months of fiscal 2024, financial charges totalled $126

million, up $20 million compared to the same period last fiscal

year. These increases reflected higher interest rates.

Income tax expense

Income tax expense for the third quarter

of fiscal 2024 and for the nine months of fiscal

2024 totalled $31 million and $112 million respectively.

Excluding the effect of the non tax-deductible goodwill impairment

charge of $265 million, the effective tax rate would have been 18%

for the third quarter of fiscal 2024 and 20% for the nine months of

fiscal 2024, as compared to 20% and 22% in the corresponding

quarter and period last fiscal year.

The effective income tax rate is impacted by the

tax and accounting treatments of inflation in Argentina. This

impact varies from quarter to quarter. For the third quarter and

nine months of fiscal 2024, this impact was positive, resulting in

a reduction of the effective tax rate.

The effective tax rate varies and could increase

or decrease based on the geographic mix of quarterly and year-to-

date earnings across the various jurisdictions in which we operate,

the tax and accounting treatments of inflation in Argentina, the

amount and source of taxable income, amendments to tax legislations

and income tax rates, changes in assumptions, as well as estimates

we use for tax assets and liabilities.

Adjusted net

earnings1

Adjusted net earnings1 for the third

quarter of fiscal 2024 totalled $163 million, down $58

million or 26.2%, as compared to $221 million for the same quarter

last fiscal year. This is mainly due to a decrease in net earnings,

as described above, excluding a non-cash goodwill impairment

charge, lower acquisition and restructuring costs after tax, as

well as the impact of a loss on hyperinflation.

Adjusted net earnings1 for the nine

months of fiscal 2024 totalled $498 million, down $17

million or 3.3%, as compared to $515 million for the same period

last fiscal year. This is mainly due to a decrease in net earnings,

as described above, excluding a non-cash goodwill impairment

charge, lower acquisition and restructuring costs after tax, as

well as the impact of the loss on hyperinflation compared to a gain

that was recognized in the same period last fiscal year.

1 This is a total of segments measure, a

non-GAAP financial measure, or a non-GAAP ratio. See the “Non-GAAP

Measures” section of this news release for more information,

including the definition and composition of the measure or ratio as

well as the reconciliation to the most comparable measure in the

primary financial statements, as applicable.

INFORMATION BY SECTOR

CANADA SECTOR

|

Fiscal years |

Q3 |

|

2024 Q2 |

|

Q1 |

|

Q4 |

|

2023 Q3 |

|

Q2 |

|

Q1 |

|

|

Revenues |

1,271 |

|

1,248 |

|

1,211 |

|

1,156 |

|

1,213 |

|

1,185 |

|

1,142 |

|

| Adjusted

EBITDA |

150 |

|

148 |

|

144 |

|

134 |

|

149 |

|

136 |

|

132 |

|

|

Adjusted EBITDA margin |

11.8 |

% |

11.9 |

% |

11.9 |

% |

11.6 |

% |

12.3 |

% |

11.5 |

% |

11.6 |

% |

USA SECTOR

|

Fiscal years |

Q3 |

|

2024 Q2 |

|

Q1 |

|

Q4 |

|

2023 Q3 |

|

Q2 |

|

Q1 |

|

|

Revenues |

2,056 |

|

1,950 |

|

1,876 |

|

2,062 |

|

2,172 |

|

2,062 |

|

2,043 |

|

| Adjusted

EBITDA |

133 |

|

147 |

|

103 |

|

143 |

|

146 |

|

102 |

|

97 |

|

|

Adjusted EBITDA margin |

6.5 |

% |

7.5 |

% |

5.5 |

% |

6.9 |

% |

6.7 |

% |

4.9 |

% |

4.7 |

% |

Selected factor(s) positively (negatively)

impacting Adjusted EBITDA

|

Fiscal years |

Q3 |

|

2024 Q2 |

Q1 |

|

Q4 |

2023 Q3 |

|

Q2 |

|

Q1 |

|

|

USA Market Factors1,2 |

(27 |

) |

32 |

(14 |

) |

29 |

(6 |

) |

(27 |

) |

(7 |

) |

|

Inventory write-down |

— |

|

— |

(10 |

) |

— |

— |

|

— |

|

— |

|

|

US currency exchange2 |

— |

|

3 |

5 |

|

5 |

8 |

|

3 |

|

3 |

|

1 Refer to the ‘‘Glossary’’ section of the

Management's Discussion and Analysis. 2 As compared to same quarter

last fiscal year.

Other pertinent information

(in US dollars, except for average exchange

rate)

|

Fiscal years |

Q3 |

|

2024 Q2 |

Q1 |

|

Q4 |

2023 Q3 |

|

Q2 |

|

Q1 |

|

|

Block market price1 |

|

|

|

|

|

|

|

| Opening |

1.720 |

|

1.335 |

1.850 |

|

2.135 |

1.968 |

|

2.195 |

|

2.250 |

|

| Closing |

1.470 |

|

1.720 |

1.335 |

|

1.850 |

2.135 |

|

1.968 |

|

2.195 |

|

| Average |

1.620 |

|

1.817 |

1.579 |

|

1.943 |

2.077 |

|

1.927 |

|

2.287 |

|

|

Butter market price1 |

|

|

|

|

|

|

|

| Opening |

3.300 |

|

2.440 |

2.398 |

|

2.380 |

3.145 |

|

2.995 |

|

2.700 |

|

| Closing |

2.665 |

|

3.300 |

2.440 |

|

2.398 |

2.380 |

|

3.145 |

|

2.995 |

|

| Average |

2.898 |

|

2.706 |

2.394 |

|

2.375 |

2.904 |

|

3.035 |

|

2.808 |

|

| Average whey

powder market price1 |

0.370 |

|

0.265 |

0.358 |

|

0.397 |

0.432 |

|

0.469 |

|

0.600 |

|

| Spread1 |

(0.061 |

) |

0.075 |

(0.061 |

) |

0.040 |

(0.120 |

) |

(0.222 |

) |

(0.261 |

) |

| US average

exchange rate to Canadian |

|

|

|

|

|

|

|

|

dollar2 |

1.359 |

|

1.344 |

1.343 |

|

1.353 |

1.357 |

|

1.306 |

|

1.275 |

|

1 Refer to the ‘‘Glossary’’ section of the

Management's Discussion and Analysis. 2 Based on Bank of Canada

published information.

INTERNATIONAL SECTOR

|

Fiscal years |

Q3 |

|

2024 Q2 |

|

Q1 |

|

Q4 |

|

2023 Q3 |

|

Q2 |

|

Q1 |

|

|

Revenues |

636 |

|

879 |

|

868 |

|

963 |

|

917 |

|

989 |

|

916 |

|

| Adjusted

EBITDA |

85 |

|

83 |

|

77 |

|

84 |

|

111 |

|

97 |

|

82 |

|

|

Adjusted EBITDA margin |

13.4 |

% |

9.4 |

% |

8.9 |

% |

8.7 |

% |

12.1 |

% |

9.8 |

% |

9.0 |

% |

Selected factor(s) positively (negatively)

impacting Adjusted EBITDA

|

Fiscal years |

Q3 |

|

2024 Q2 |

|

Q1 |

|

Q4 |

|

2023Q3 |

|

Q2 |

|

Q1 |

|

|

Inventory write-down |

(14 |

) |

(7 |

) |

— |

|

— |

|

— |

|

— |

|

— |

|

|

Foreign currency exchange1 |

(36 |

) |

(12 |

) |

(2 |

) |

(15 |

) |

(13 |

) |

(9 |

) |

(6 |

) |

1 As compared to same quarter last fiscal

year.

EUROPE SECTOR

|

Fiscal years |

Q3 |

|

2024 Q2 |

|

Q1 |

|

Q4 |

|

2023 Q3 |

|

Q2 |

|

Q1 |

|

|

Revenues |

304 |

|

246 |

|

252 |

|

287 |

|

285 |

|

225 |

|

226 |

|

| Adjusted

EBITDA |

2 |

|

20 |

|

38 |

|

31 |

|

39 |

|

34 |

|

36 |

|

|

Adjusted EBITDA margin |

0.7 |

% |

8.1 |

% |

15.1 |

% |

10.8 |

% |

13.7 |

% |

15.1 |

% |

15.9 |

% |

Selected factor(s) positively (negatively)

impacting Adjusted EBITDA

|

Fiscal years |

Q3 |

2024 Q2 |

Q1 |

Q4 |

|

2023 Q3 |

|

Q2 |

|

Q1 |

|

|

Foreign currency exchange1 |

3 |

3 |

1 |

(1 |

) |

(2 |

) |

(4 |

) |

(2 |

) |

1 As compared to same quarter last fiscal

year.

NON-GAAP MEASURES

We report our financial results in accordance

with GAAP and generally assess our financial performance using

financial measures that are prepared using GAAP. However, this news

release also refers to certain non-GAAP and other financial

measures which do not have a standardized meaning under GAAP, and

are described in this section.

We use non-GAAP measures and ratios to provide

investors with supplemental metrics to assess and measure our

operating performance and financial position from one period to the

next. We believe that those measures are important supplemental

metrics because they eliminate items that are less indicative of

our core business performance and could potentially distort the

analysis of trends in our operating performance and financial

position. We also use non-GAAP measures to facilitate operating and

financial performance comparisons from period to period, to prepare

annual budgets and forecasts, and to determine components of

management compensation. We believe these non-GAAP measures, in

addition to the financial measures prepared in accordance with

IFRS, enable investors to evaluate the Company's operating results,

underlying performance, and future prospects in a manner similar to

management. These metrics are presented as a complement to enhance

the understanding of operating results but not in substitution of

GAAP results.

These non-GAAP measures have no standardized

meaning under GAAP and are unlikely to be comparable to similar

measures presented by other issuers. Our method of calculating

these measures may differ from the methods used by others, and,

accordingly, our definition of these non-GAAP financial measures

may not be comparable to similar measures presented by other

issuers. In addition, non-GAAP financial measures should not be

viewed as a substitute for the related financial information

prepared in accordance with GAAP. This section provides a

description of the components of each non-GAAP measure used in this

news release and the classification thereof.

NON-GAAP FINANCIAL MEASURES AND

RATIOS

A non-GAAP financial measure is a financial

measure that depicts the Company's financial performance, financial

position, or cash flow and either excludes an amount that is

included in or includes an amount that is excluded from the

composition of the most directly comparable financial measures

disclosed in the Company's financial statements. A non-GAAP ratio

is a financial measure disclosed in the form of a ratio, fraction,

percentage, or similar representation and that has a non-GAAP

financial measure as one or more of its components.

Below are descriptions of the non-GAAP financial

measures and ratios that we use as well as reconciliations to the

most comparable GAAP financial measures, as applicable.

Adjusted net earnings and adjusted net

earnings margin

We believe that adjusted net earnings and

adjusted net earnings margin provide useful information to

investors because this financial measure and this ratio provide

precision with regards to our ongoing operations by eliminating the

impact of non-operational or non-cash items. We believe that in the

context of highly acquisitive companies, adjusted net earnings

provide a more effective measure to assess performance against the

Company's peer group, including due to the application of various

accounting policies in relation to the amortization of acquired

intangible assets.

We also believe adjusted net earnings and

adjusted net earnings margin are useful to investors because they

help identify underlying trends in our business that could

otherwise be masked by certain write-offs, charges, income, or

recoveries that can vary from period to period, as well as by the

effect of tax law changes and rate enactments. We believe that

securities analysts, investors, and other interested parties also

use adjusted net earnings to evaluate the performance of issuers.

Excluding these items does not imply they are non-recurring. These

measures do not have any standardized meanings under GAAP and are

therefore unlikely to be comparable to similar measures presented

by other companies.

The following table provides a reconciliation of

net earnings (loss) to adjusted net earnings.

|

|

For the three-month periods ended December

31 |

|

For the nine-month periods ended December 31 |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

Net earnings (loss) |

(124 |

) |

179 |

|

173 |

|

463 |

|

|

Acquisition and restructuring costs1 |

4 |

|

27 |

|

4 |

|

49 |

|

|

Amortization of intangible assets related to |

|

|

|

|

|

business acquisitions1 |

15 |

|

15 |

|

46 |

|

47 |

|

|

Goodwill impairment charge |

265 |

|

— |

|

265 |

|

— |

|

|

Loss (gain) on hyperinflation2 |

3 |

|

— |

|

10 |

|

(44 |

) |

|

Adjusted net earnings |

163 |

|

221 |

|

498 |

|

515 |

|

|

Revenues |

4,267 |

|

4,587 |

|

12,797 |

|

13,375 |

|

|

Adjusted net earnings margin (expressed as a |

|

|

|

|

|

percentage of revenues) |

3.8 |

% |

4.8 |

% |

3.9 |

% |

3.9 |

% |

1 Net of applicable income taxes.

2 Starting in the first quarter of fiscal 2024:

- the loss (gain) on hyperinflation is presented on a separate

line on the consolidated income statements (Refer to Note 16 of the

condensed interim consolidated financial statements for further

information); and

- adjusted net earnings exclude the loss (gain) on hyperinflation

to provide investors with more useful information with regards to

our ongoing operations.Comparative periods included in this news

release were aligned to meet the current presentation.

Adjusted EPS basic and adjusted EPS

diluted

Adjusted EPS basic (adjusted net earnings per

basic common share) and adjusted EPS diluted (adjusted net earnings

per diluted common share) are non-GAAP ratios and do not have any

standardized meaning under GAAP. Therefore, these measures are

unlikely to be comparable to similar measures presented by other

issuers. We define adjusted EPS basic and adjusted EPS diluted as

adjusted net earnings divided by the basic and diluted weighted

average number of common shares outstanding for the period.

Adjusted net earnings is a non-GAAP financial measure. For more

details on adjusted net earnings, refer to the discussion above in

the adjusted net earnings and adjusted net earnings margin

section.

We use adjusted EPS basic and adjusted EPS

diluted, and we believe that certain securities analysts,

investors, and other interested parties use these measures, among

other ones, to assess the performance of our business without the

effect of the acquisition and restructuring costs, amortization of

intangible assets related to business acquisitions, gain on

disposal of assets, impairment of intangible assets, goodwill

impairment charge, and loss (gain) on hyperinflation. We exclude

these items because they affect the comparability of our financial

results and could potentially distort the analysis of trends in

business performance. Adjusted EPS is also a component in the

determination of long-term incentive compensation for

management.

TOTAL OF SEGMENTS MEASURES

A total of segments measure is a financial

measure that is a subtotal or total of two or more reportable

segments and is disclosed within the notes to Saputo's condensed

interim consolidated financial statements, but not in its primary

financial statements. Consolidated adjusted EBITDA is a total of

segments measure.

Consolidated adjusted EBITDA is the total of the

adjusted EBITDA of our four geographic sectors. We report our

business under four sectors: Canada, USA, International, and

Europe. The Canada Sector consists of the Dairy Division (Canada),

the USA Sector consists of the Dairy Division (USA), the

International Sector consists of the Dairy Division (Australia) and

the Dairy Division (Argentina), and the Europe Sector consists of

the Dairy Division (UK). We sell our products in three different

market segments: retail, foodservice, and industrial.

Adjusted EBITDA and adjusted EBITDA

margin

We believe that adjusted EBITDA and adjusted

EBITDA margin provide investors with useful information because

they are common industry measures. Adjusted EBITDA margin consists

of adjusted EBITDA expressed as a percentage of revenues. These

measures are also key metrics of the Company's operational and

financial performance without the variation caused by the impacts

of the elements itemized below and provide an indication of the

Company's ability to seize growth opportunities in a cost-effective

manner, finance its ongoing operations, and service its long-term

debt. Adjusted EBITDA is the key measure of profit used by

management for the purpose of assessing the performance of each

sector and of the Company as a whole, and to make decisions about

the allocation of resources. We believe that securities analysts,

investors, and other interested parties also use adjusted EBITDA to

evaluate the performance of issuers. Adjusted EBITDA is also a

component in the determination of short- term incentive

compensation for management.

The following table provides a reconciliation of

net earnings (loss) to adjusted EBITDA on a consolidated basis.

|

|

For the three-month periods ended December

31 |

|

For the nine-month periods ended December 31 |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

Net earnings (loss) |

(124 |

) |

179 |

|

173 |

|

463 |

|

|

Income taxes |

31 |

|

44 |

|

112 |

|

131 |

|

|

Financial charges1 |

42 |

|

37 |

|

126 |

|

106 |

|

|

Loss (gain) on hyperinflation1 |

3 |

|

— |

|

10 |

|

(44 |

) |

|

Acquisition and restructuring costs |

6 |

|

38 |

|

6 |

|

67 |

|

|

Goodwill impairment charge |

265 |

|

— |

|

265 |

|

— |

|

|

Depreciation and amortization |

147 |

|

147 |

|

438 |

|

438 |

|

|

Adjusted EBITDA |

370 |

|

445 |

|

1,130 |

|

1,161 |

|

|

Revenues |

4,267 |

|

4,587 |

|

12,797 |

|

13,375 |

|

|

Adjusted EBITDA margin |

8.7 |

% |

9.7 |

% |

8.8 |

% |

8.7 |

% |

1 Starting in the first quarter of fiscal

2024, the loss (gain) on hyperinflation is presented on a separate

line on the consolidated income statements (Refer to Note 16 of the

condensed interim consolidated financial statements for further

information). Comparative periods included in this news release

were aligned to meet the current presentation.

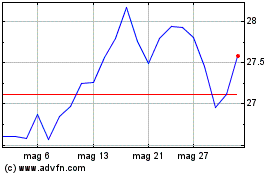

Grafico Azioni Saputo (TSX:SAP)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Saputo (TSX:SAP)

Storico

Da Mar 2024 a Mar 2025