Wirecard Chairman Steps Down From Embattled Payments Giant

11 Gennaio 2020 - 8:15PM

Dow Jones News

By Paul J. Davies

Wirecard AG's chairman, who resisted calls for an independent

audit of the under-fire German payments group, quit his role

effective immediately -- a move the company said was aimed at

improving its corporate governance.

Wulf Matthias, chairman of the company since 2008, will be

replaced by Thomas Eichelmann, who joined the board in mid-2019 and

heads its audit committee.

Wirecard announced the change at 11 p.m. local time on Friday

following a board vote. Mr. Matthias will remain on the company's

supervisory board until his terms expires in 2021.

Wirecard, one of Europe's biggest and fastest-growing fintech

companies, last year broke into the DAX 30 index of Germany's top

firms, displacing local lender Commerzbank AG. Its

electronic-payments business processes transactions for retailers

online and in stores and has a history of focusing on higher risk

sectors like travel, gambling and pornography.

"We consider this as a step to improve our corporate

governance," a Wirecard spokeswoman said. "Wulf has reached an age

of 75. Everybody is thankful for his contribution, but now it is

time to organize for a change of generation."

Wirecard has faced a string of questions and allegations from

funds who bet against companies' shares through short selling and

from the media over its accounting practices, including in its

important Asian operations. Wirecard is currently under

investigation by the commercial branch of the Singapore police.

The company has consistently denied any improprieties. Some

large investors have privately pressured the group to improve its

financial reporting and transparency, according to people familiar

with the matter. In October, there were calls for it to commission

an independent audit of the issues raised by media reports and

short sellers.

Mr. Matthias initially dismissed these calls, telling the

Financial Times on Oct. 18 that the work of Wirecard's existing

auditor, EY, was sufficient. However, the following Monday, Oct.

21, Wirecard said KPMG would conduct a special audit to try to draw

a final line under the matters. That special audit is expected to

be completed around the end of the first quarter this year.

Wirecard's rapidly appreciating share price -- at its peak last

September, the stock had more than quadrupled in value over the

previous two years -- along with a string of acquisitions and

limited financial disclosure have helped make it a target for short

sellers.

Its stock has been on a roller-coaster ride this year. At its

close Friday of EUR110.60, the share price was nearly 43% below its

peak.

It appeared to have won the support of one of the world's

leading technology investors back in April 2019, when Wirecard said

a unit of SoftBank Group Inc. was investing $1 billion as part of a

strategic partnership. The Wall Street Journal reported in November

that SoftBank had put no money behind the complex convertible bond

transaction. Rather, the investment was backed by several

executives at Softbank's investment arm and Mubadala, a

sovereign-wealth fund based in Abu Dhabi.

"The SoftBank-related entities involved are consistent with our

understanding and expectations and that was communicated to our

shareholders," a Wirecard spokeswoman said at the time.

The new chairman, Mr. Eichelmann, trained as a banker at

Deutsche Bank, worked for consulting firm Roland Berger and later

became chief financial officer of Deutsche Börse, the German stock

exchange. The 54-year-old has held several other board positions in

recent years and will remain head of the Wirecard board audit

committee.

Wirecard declined to expand on the personal reasons behind Mr.

Matthias's decision to quit.

Write to Paul J. Davies at paul.davies@wsj.com

(END) Dow Jones Newswires

January 11, 2020 14:00 ET (19:00 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

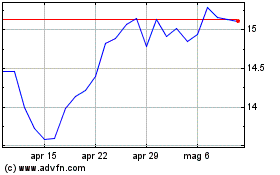

Grafico Azioni Commerzbank (PK) (USOTC:CRZBY)

Storico

Da Feb 2025 a Mar 2025

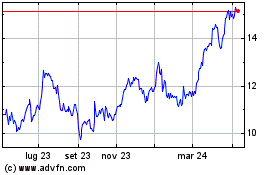

Grafico Azioni Commerzbank (PK) (USOTC:CRZBY)

Storico

Da Mar 2024 a Mar 2025