Pound Appreciates After BoE Pill's Remarks

10 Luglio 2024 - 3:10PM

RTTF2

The pound moved up against its major counterparts in the New

York session on Wednesday, as comments from Bank of England Chief

Economist Huw Pill cast doubts on a rate cut in August.

Speaking in London, Pill said that although headline annual

inflation returned to the 2% target in May, it's not enough to

attain the target on a sustainable basis.

"Some work to do before domestic persistent component of

inflation is gone."

"I'm reluctant to be drawn on whether I'm cautious or not about

cutting rates, important to get balance right," he added.

Investor sentiment improved after Federal Reserve Chair Jerome

Powell suggested the case for interest-rate cuts is becoming

stronger due to slowing inflation.

The pound advanced to near a 4-week high of 0.8425 against the

euro, 4-week high of 1.2846 against the greenback and a 1-1/2-month

high of 1.1552 against the franc, off its early lows of 0.8459,

1.2779 and 1.1472, respectively. The next possible resistance for

the pound is seen around 0.83 against the euro, 1.31 against the

greenback and 1.21 against the franc.

The pound touched 207.79 against the yen, its highest level

since August 2008. If the currency rises further, it may find

resistance around the 213.00 level.

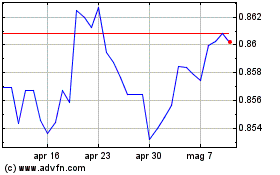

Grafico Cross Euro vs Sterling (FX:EURGBP)

Da Giu 2024 a Lug 2024

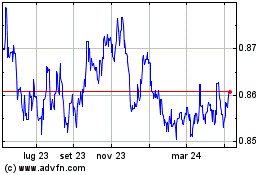

Grafico Cross Euro vs Sterling (FX:EURGBP)

Da Lug 2023 a Lug 2024