LONDON MARKETS: FTSE 100 Ends Lower While Political Turmoil Whacks The Pound

13 Novembre 2017 - 7:09PM

Dow Jones News

By Carla Mozee and Victor Reklaitis, MarketWatch

Blue-chip benchmark falls for third session in a row

U.K. blue chips stocks finished slightly lower Monday, though

their drop was limited by the pound's fall, which came after

reports that British Prime Minister Theresa May is facing pressure

to resign.

What markets are doing: The FTSE 100 index fell 0.2% to end at

7,415.18, extending Friday's fall of 0.7%

(http://www.marketwatch.com/story/retailers-help-drive-ftse-100-toward-biggest-weekly-fall-in-2-months-2017-11-10).

The benchmark, which has fallen for three straight sessions, closed

at its lowest level since Sept. 29.

The pound traded at $1.3104, down from $1.3191 late Friday in

New York. Against the euro, sterling bought EUR1.1238, falling from

EUR1.1309 late Friday.

What's moving markets: The pound was knocked back after The

Sunday Times reported

(https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=2&cad=rja&uact=8&ved=0ahUKEwjJwKegh7vXAhVD2KQKHX25AqkQqUMILDAB&url=https%3A%2F%2Fwww.thetimes.co.uk%2Farticle%2Ftory-turmoil-as-40-mps-say-may-must-go-kkg3w6l89&usg=AOvVaw0P3ydYgZ0X_1ThNri40pNZ)

that 40 lawmakers in the British parliament had agreed to sign a

letter of no confidence in Prime Minister Theresa May. Just eight

more MPs are required to start a formal leadership challenge,

according to the report.

But the pound's decline bolstered shares of multinational

companies that make most of their earnings overseas. A weak pound

can boost profits once they are converted from other currencies

into sterling.

Check out:Is British leader Theresa May on her way out? Why

that's the fear--and why it matters

(http://www.marketwatch.com/story/is-british-leader-theresa-may-on-her-way-out-why-thats-the-fear-and-why-it-matters-2017-11-09)

What strategists are saying: "The remainder of Europe is firmly

in the red, but the weakness in sterling has cushioned the fall in

the British index," said David Madden, a CMC Markets UK analyst, in

a note.

Opinion:Brexit hard-liners are selling England by the pound

(http://www.marketwatch.com/story/brexit-hardliners-are-selling-england-by-the-pound-2017-11-09)

Stock movers: Among multinationals, shares of drugmaker

AstraZeneca PLC (AZN.LN) (AZN.LN) climbed 1.2% and consumer

products heavyweight Unilever PLC (ULVR.LN) rose 0.8%.

Iron-ore miner Rio Tinto PLC (RIO) (RIO) (RIO) closed up

0.1%.

Oil producer Royal Dutch Shell PLC (RDSB.LN) (RDSB.LN) tacked on

0.8%. Shell said it would raise 2.2 billion Australian dollars

($1.7 billion) from the sale of 71.6 million shares

(http://www.marketwatch.com/story/shell-raises-a22-bln-from-woodside-shares-sale-2017-11-13)

in Woodside Petroleum Ltd. (WPL.AU).

Meanwhile, Coca-Cola HBC shares fell 4.5%. The bottler's rating

was cut to neutral from overweight at J.P. Morgan Cazenove,

according to Dow Jones Newswires.

Taylor Wimpey PLC (TW.LN) edged down less than 0.1%, giving up

gains, after the house builder said it's on track to meet yearly

expectations

(http://www.marketwatch.com/story/taylor-wimpey-on-track-to-meet-yearly-expectations-2017-11-13).

(END) Dow Jones Newswires

November 13, 2017 12:54 ET (17:54 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

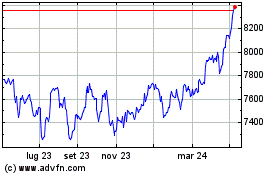

Grafico Indice FTSE 100

Da Mar 2024 a Apr 2024

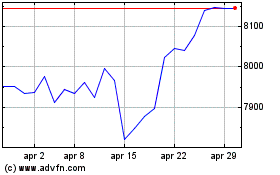

Grafico Indice FTSE 100

Da Apr 2023 a Apr 2024