false000150237700015023772025-03-172025-03-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): March 17, 2025 |

Contango Ore, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-35770 |

27-3431051 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

516 2nd Avenue Suite 401 |

|

Fairbanks, Alaska |

|

99701 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (907) 888-4273 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, Par Value $0.01 per share |

|

CTGO |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 17, 2025, Contango ORE, Inc. (the “Company”) issued a press release announcing its financial results for the year ended December 31, 2024. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

The information included herein and in Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Item 7.01 Regulation FD Disclosure.

On March 17, 2025, the Company made available a new corporate presentation. A copy of this presentation is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is available on the Company’s website at www.contangoore.com.

The Company’s presentation furnished as Exhibit 99.2 to this Current Report contains non-GAAP financial measures. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with United States generally accepted accounting principles, or GAAP. Reconciliations of these non-GAAP financial measures are not included in the furnished presentation due to the inherent difficulty and impracticality of quantifying certain amounts that would be required to calculate the most directly comparable GAAP financial measures. In addition, certain of the non-GAAP financial measures have been prepared by Kinross Gold Corporation, the Company’s partner in, and the manager of, Peak Gold, LLC, a joint venture company in which the Company currently holds a 30% interest, and are based on International Financial Reporting Standards (IFRS) accounting standards and detailed information to which the Company has not had access to at this time. As a result, the Company is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measure without unreasonable efforts.

The information included herein and in Exhibit 99.2 shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Cautionary Note Regarding Forward-Looking Statements

Many of the statements included or incorporated in this Current Report on Form 8-K and the furnished exhibit constitute “forward-looking statements.” In particular, they include statements relating to future actions, strategies, future operating and financial performance, ability to realize the anticipated benefits of various transactions and the Company’s future financial results. These forward-looking statements are based on current expectations and projections about future events. Readers are cautioned that forward-looking statements are not guarantees of future operating and financial performance or results and involve substantial risks and uncertainties that cannot be predicted or quantified, and, consequently, the actual performance of the Company may differ materially from that expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to, factors described from time to time in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission (including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein).

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

CONTANGO ORE, INC. |

|

|

|

|

Date: |

March 17, 2025 |

By: |

/s/ Mike Clark |

|

|

|

Mike Clark, Chief Financial Officer and Secretary |

NEWS RELEASE

CONTANGO ORE, INC.

Contango Announces Earnings for the Year Ended December 31, 2024

FAIRBANKS, AK -- (March 17, 2025) -- Contango ORE, Inc. (“Contango” or the “Company”) (NYSE American: CTGO) announced today that it filed its Form 10-K for the fiscal year ended December 31, 2024 (“FY2024”) with the Securities and Exchange Commission. Other periods referenced in this release include the six-month transition period ended December 31, 2023 (“6ME12-2023”), and the fiscal year ended June 30, 2023 (“FY2023”).

The Company’s unrestricted cash position as of December 31, 2024 was $20.1 million (“M”) compared to $15.5 M as of December 31, 2023. The Company reported total income for operations of $26.3 M and a net loss of $38.0 M, including a non-cash expense of $34.3 M from an unrealized loss on derivative contracts for FY2024.

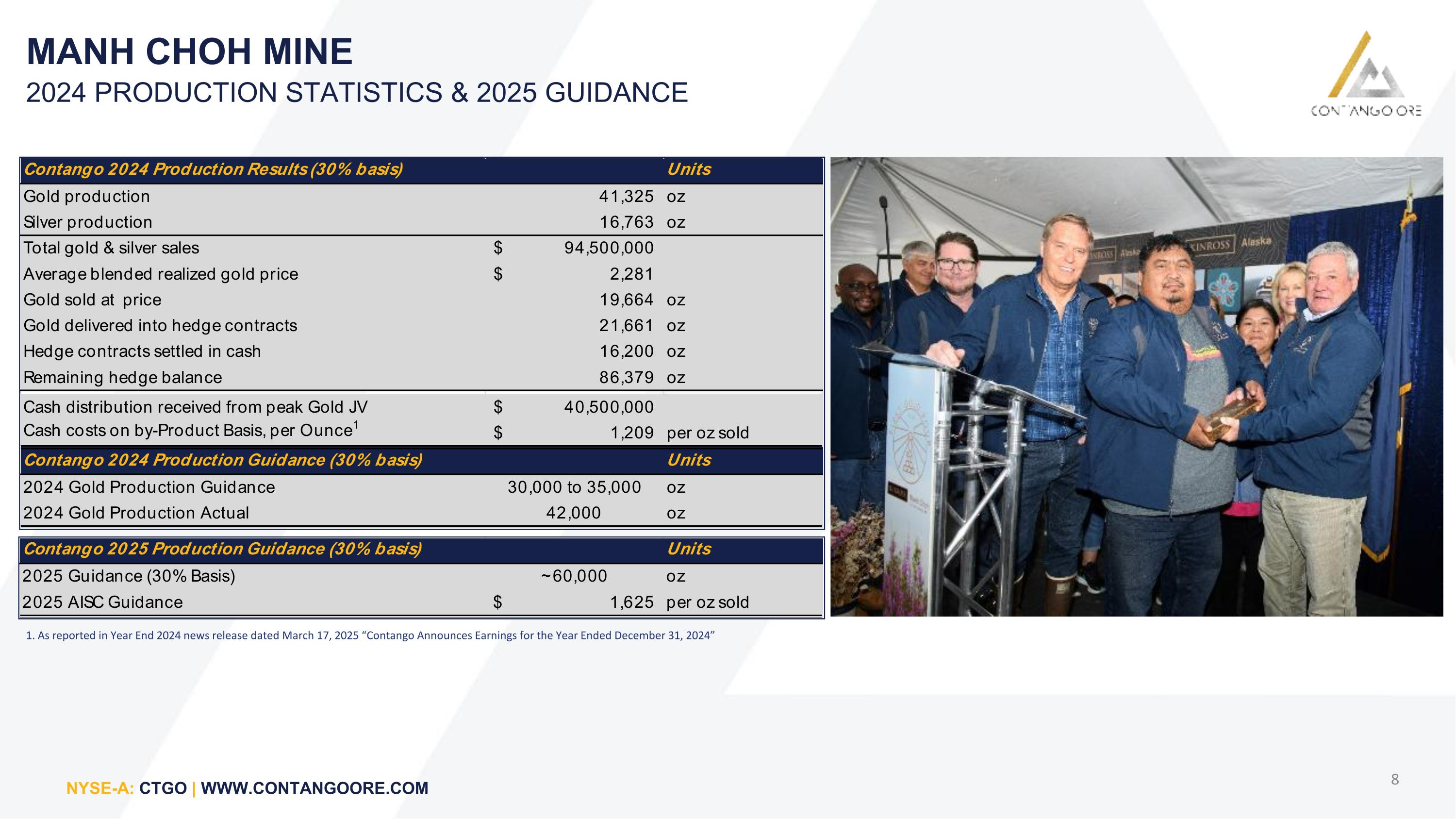

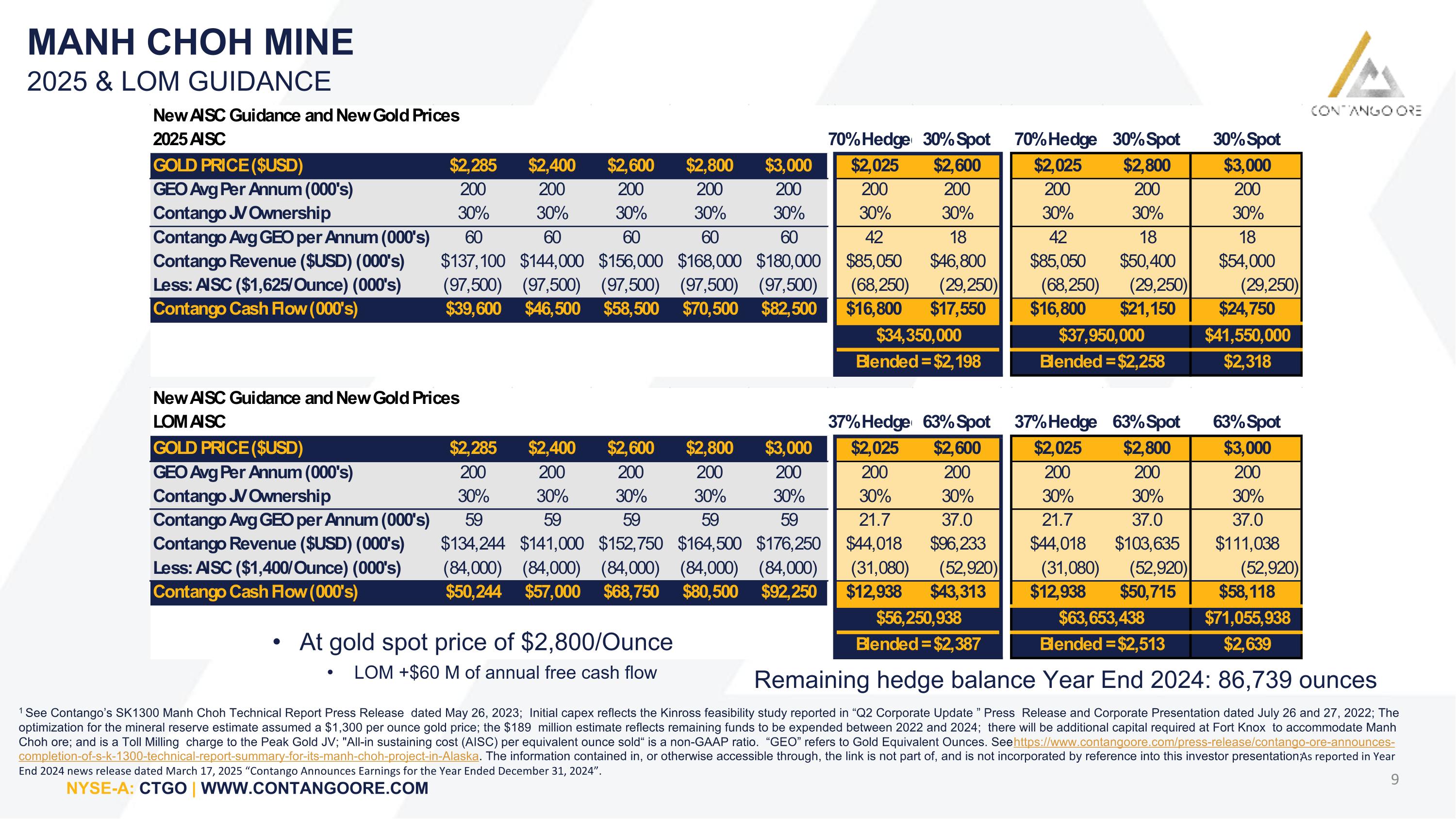

Rick Van Nieuwenhuyse, President and CEO of the Company, stated, “Gold production at the Manh Choh mine surpassed 2024 guidance, with 41,325 ounces of gold produced for Contango’s 30% share of production at a cash cost of $1,209 per ounce of gold sold. The Company achieved an average blended gold price of $2,281 per ounce. Since commencement of Manh Choh production, our focus has been and continues to be repaying down the debt and hedge obligations under our credit facility (the “Facility”) as quickly as possible. As of today, we have reduced the Facility by 36% to a balance of $38.3 M and settled 37,861 ounces of gold hedge contracts, or 30% of the obligation, reducing the outstanding hedge contract to 86,739 ounces. The remaining hedge contract balance represents 36% of the total updated 239,000 proven and probable reserves gold ounces for Manh Choh. Meanwhile, the first campaign of 2025 is more than 50% complete and on track to produce between 15,000 and 18,000 ounces of gold for Contango’s account and we continue to guide to 60,000 ounces of gold production in four campaigns for 2025. Following the recent restructuring of the Facility, the Company is well-positioned financially, with approximately 30% of net gold production for both fiscal years 2025 and 2026 linked to spot gold prices, ensuring robust cash flow throughout the remaining mine life at Manh Choh. This strong financial foundation supports critical permitting efforts at the Johnson Tract project and ongoing discussions regarding milling facilities for Johnson Tract and Lucky Shot ores using our direct ship ore (DSO) approach.”

Mr. Van Nieuwenhuyse added, “We remain focused on delivering the previously announced preliminary economic assessment (PEA) for the Johnson Tract project, which we expect to complete and release in the next few weeks.”

Statement of Cash Flows for FY2024 compared to 6ME12-2023 and FY2023:

Net cash provided from operating activities was $0.7 M for FY2024, a significant improvement compared to net cash used of $9.4 M for 6ME12-2023 and $14.7 M for FY2023. The increase in net cash provided by operating activities was primarily driven by the commencement of gold production at Manh Choh and the receipt of $40.5 M in cash distributions from the Peak Gold JV, partially offset by $19.9 M in realized losses on derivative hedge contracts. Cash used in investing activities totaled $32.1 M for FY2024 compared to $34.4 M for 6ME12-2023 and $21.2 M for FY2023, with all period outflows primarily relating to cash invested in the Peak Gold JV. Cash flows from financing activities amounted to $36.0 M for FY2024, including $30 M drawn from the Facility, offset by $7.9 M in debt repayments, and $15.5 M in equity issuance proceeds. This compares to $47.7 M for 6ME12-2023 and $24.4 M for FY2023, which was comprised of debt drawdowns and equity issuances.

Statement of Operations for FY2024 compared to 6ME12-2023 and FY2023:

The Company reported a net loss of $38.0 M, or a loss of $3.49 per basic and diluted share, for FY2024. This includes a non-cash expense of $34.3 M from an unrealized loss on derivative contracts, based on forward gold prices and contracted hedge price. The Company also incurred $4.1 M in exploration expenditures, primarily related to the Johnson Tract drilling program. Income from the Peak Gold JV equity investment totaled $41.7 M, offset by $11.7 M in interest expense and a $54.2 M loss on derivative contracts. This compares to a net loss of $40.8 M, or $4.44 per share, for 6ME12-2023, and $39.7 M, or $5.61 per share, for FY2023.

During FY2024 and subsequent to period end, the Company has the following updates:

oProduction results for 2024:

|

|

|

|

|

Contango's Share (30% basis) |

|

|

|

Gold ounces sold |

|

|

41,325 |

oz |

Silver ounces sold |

|

|

16,763 |

oz |

Total gold sales |

|

$ |

94,259,852 |

|

Total silver sales |

|

$ |

509,238 |

|

Average blended realized gold price |

$ |

2,281 |

per oz sold |

Gold sold at spot price |

|

19,664 |

oz |

Gold delivered into hedge contracts |

|

21,661 |

oz |

Hedge contracts settled in cash |

|

16,200 |

oz |

Remaining hedge balance |

|

86,739 |

oz |

Cash distributions received from Peak Gold JV |

$ |

40,500,000 |

|

Cash costs on By-Product Basis, per Ounce |

$ |

1,209 |

per oz sold |

2025 Guidance (30% Basis) |

|

|

2025 gold production guidance |

60,000 |

oz |

oThe Manh Choh project, operated by a subsidiary of Kinross Gold Corporation (“Kinross”), commenced producing gold and silver with its first gold pour on July 8, 2024;

oOre transportation ramped up to planned tonnages, full commissioning of the modifications at the Kinross Fort Knox mill were completed, and Contango’s share of the Manh Choh production was 41,325 ounces of gold compared to guidance of 30,000 to 35,000 ounces of gold production;

oCash costs on a by-product basis per ounce were $1,209, plus an additional $250,000 for sustaining capital and reclamation expenditures for FY2024; and

oDuring FY2024, the Peak Gold JV paid cash distributions to the Company in the amount of $40.5 M.

oOn July 10, 2024, the Company completed its acquisition of 100% of the equity interests of HighGold Mining Inc. (“HighGold”), as contemplated by the definitive arrangement agreement, issuing an aggregate of 1,698,887 shares of Contango common stock at a deemed price of $19.66 per Contango Share, with a value of approximately $33.4 M, to HighGold shareholders;

oAt the Johnson Tract Project the Company completed a 3,000 meter (9,842 feet) surface drilling campaign on budget, with 18 holes drilled to infill the upper one-third of the resource and three holes drilled for hydrogeological testing and monitoring to characterize the overall hydrology and water quality around the Johnson Tract deposit (the “JT Deposit”). Several of the holes will also be used for further metallurgical test work and geometallurgical characterization. Contango continued advancing field studies to support permitting and engineering of an exploration drift to access the deeper, high-grade portion of the JT Deposit for infill and exploration drilling; and

oThe Company received the 404 permit for construction of a 2.6 mile (4 km) access road between the camp and the proposed portal and laydown site.

•Repayments on Debt and Reduction of Hedge Contracts:

oContango repaid $7.9 M on the Facility, reducing the outstanding principal balance by 13% to $52.1 M;

oOn January 31, 2025, Contango repaid $13.8 M on the Facility, reducing the outstanding principal balance to $38.3 M; and

oContango delivered 21,661 ounces of gold into the hedge contracts and cash settled a further 16,200 ounces of gold hedges that were scheduled to mature on January 31, 2025, reducing the hedge contract balance by 30% to 86,739 ounces of gold as of December 31, 2024; and

oOn February 18, 2025, the Company announced that it amended the Facility to defer $10.6 M of principal repayments and delivery of 15,000 hedged gold ounces into the first half of 2027 (the "New Repayment Schedule") and extended the maturity

date of the Facility from December 31, 2026 to June 30, 2027. All other key terms of the Facility, including the interest rate, remain the same.

QUALIFIED PERSONS

John Sims, CPG, Sims Resources LLC, a qualified person under S-K 1300, reviewed and approved the technical information related to the proven and probable reserve updates in this release.

CONFERENCE CALL AND WEBCAST

Contango will host a conference call and webcast to discuss the quarterly results on Monday, March 17, 2025, at 4:30pm EST / 1:30pm PST. Participants may join the webcast using the following call-in details: https://6ix.com/event/contango-market-update.

ABOUT CONTANGO

Contango is a NYSE American listed company that engages in exploration for gold and associated minerals in Alaska. Contango holds a 30% interest in the Peak Gold JV, which leases approximately 675,000 acres of land for exploration and development on the Manh Choh project, with the remaining 70% owned by KG Mining (Alaska), Inc., an indirect subsidiary of Kinross Gold Corporation, operator of the Peak Gold JV. The Company and its subsidiaries also have (i) a lease on the Johnson Tract project from the underlying owner, CIRI Native Corporation, (ii) a lease on the Lucky Shot project from the underlying owner, Alaska Hardrock Inc., (iii) 100% ownership of approximately 8,600 acres of peripheral State of Alaska mining claims, and (iv) a 100% interest in approximately 145,000 acres of State of Alaska mining claims that give Contango the exclusive right to explore and develop minerals on these lands. Additional information can be found on our web page at www.contangoore.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements regarding Contango that are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995, based on Contango’s current expectations and includes statements regarding future results of operations, quality and nature of the asset base, the assumptions upon which estimates are based and other expectations, beliefs, plans, objectives, assumptions, strategies or statements about future events or performance (often, but not always, using words such as “expects”, “projects”, “anticipates”, “plans”, “estimates”, “potential”, “possible”, “probable”, or “intends”, or stating that certain actions, events or results “may”, “will”, “should”, or “could” be taken, occur or be achieved). Forward-looking statements are based on current expectations, estimates and projections that involve a number of risks and uncertainties, which could cause actual results to differ materially from those reflected in the statements. These risks

include, but are not limited to: the risks of the exploration and the mining industry (for example, operational risks in exploring for and developing mineral reserves; risks and uncertainties involving geology; the speculative nature of the mining industry; the uncertainty of estimates and projections relating to future production, costs and expenses; the volatility of natural resources prices, including prices of gold and associated minerals; the existence and extent of commercially exploitable minerals in properties acquired by Contango or the Peak Gold JV; ability to realize the anticipated benefits of the Peak Gold JV; potential delays or changes in plans with respect to exploration or development projects or capital expenditures; the interpretation of exploration results and the estimation of mineral resources; the loss of key employees or consultants; health, safety and environmental risks and risks related to weather and other natural disasters); uncertainties as to the availability and cost of financing; Contango’s inability to retain or maintain its relative ownership interest in the Peak Gold JV; inability to realize expected value from acquisitions; inability of our management team to execute its plans to meet its goals; the extent of disruptions caused by an outbreak of disease, such as the COVID-19 pandemic; and the possibility that government policies may change, political developments may occur or governmental approvals may be delayed or withheld, including as a result of presidential and congressional elections in the U.S. or the inability to obtain mining permits. Additional information on these and other factors which could affect Contango’s exploration program or financial results are included in Contango’s other reports on file with the U.S. Securities and Exchange Commission. Investors are cautioned that any forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from the projections in the forward-looking statements. Forward-looking statements are based on the estimates and opinions of management at the time the statements are made. Contango does not assume any obligation to update forward-looking statements should circumstances or management’s estimates or opinions change.

CONTACTS:

Contango ORE, Inc.

Rick Van Nieuwenhuyse

(907) 888-4273

www.contangoore.com

FORWARD LOOKING STATEMENTS The Feasibility Study (“FS”) referenced herein that relates to Peak Gold, LLC (“Peak Gold”), was prepared by Kinross Gold Corporation (“Kinross”), which controls the Manager of Peak Gold and holds 70% of its outstanding membership interests, in accordance with Canadian National Instrument 43-101 (NI 43-101). Contango Ore, Inc. (“CORE” or “Contango”) owns the remaining 30% membership interest in Peak Gold, and must rely on Kinross and its affiliates for the FS and related information. Further, CORE is not subject to regulation by Canadian regulatory authorities and no Canadian regulatory authority has reviewed the FS or passed upon its accuracy or compliance with NI 43-101. The terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” as used in the resource estimate, the FS and this presentation are Canadian mining terms as defined in accordance with NI 43-101. In the United States, mining disclosure is reported under sub-part 1300 of Regulation S-K (“S-K 1300”). Under S-K 1300, the U.S. Securities and Exchange Commission (“SEC”) recognizes estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”. In addition, the definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” are substantially similar to international standards. Under S-K 1300, an SEC registrant with material mining operations must disclose specified information in its SEC filings concerning mineral resources, in addition to mineral reserves, which have been determined on one or more of its properties. Such mineral resources and reserves are supported by a technical report summary (the “S-K 1300 Report”), which is dated and signed by a qualified person or persons, and identifies and summarizes the information reviewed and conclusions reached by each qualified person about the SEC registrant’s mineral resources or mineral reserves determined to be on each material property. CORE prepared an S-K 1300 Report, dated May 12, 2023, based on the FS, that presented mineral resource estimates and mineral reserve estimates for the Manh Choh project as of December 31, 2022 (the "Manh Choh S-K 1300 Report"). CORE prepared an additional S-K 1300 Report, dated May 26, 2023, based on historical and recent drill hole assay information, that presented mineral resource estimates for the Lucky Shot project as of May 26, 2023 (the "Lucky Shot S-K 1300 Report"). Investors are cautioned that while the S-K 1300 definitions are “substantially similar” to the NI 43-101 definitions, there are differences between the two. Accordingly, there is no assurance any mineral reserve or mineral resource estimates that Peak Gold may report as “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had CORE prepared the mineral reserve or mineral resource estimates under S-K 1300. Further, U.S. investors are also cautioned that while the SEC recognizes “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under S-K 1300, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization that has been characterized as resources has a greater degree of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any measured mineral resources, indicated mineral resources or inferred mineral resources that CORE reports are or will be economically or legally mineable. For more detail regarding the FS, please see CORE's press release dated May 26, 2023: https://www.contangoore.com/press-release/contango-ore-announces-completion-of-s-k-1300-technical-report-summary-for-its-manh-choh-project-in-alaska. The information contained in, or otherwise accessible through, the links are not part of, and are not incorporated by reference into this investor presentation. To view a copy of the Manh Choh S-K 1300 Report, see: https://assets.website-files.com/5fc5d36fd44fd675102e4420/6470afdaf94d2ac9f93d93e0_SIMS%20Contango%20Manh%20Choh%20Project%20S-K%201300%20TRS%20FINAL%2020230524%20(1)-compressed.pdf . The information contained in, or otherwise accessible through, the links are not part of, and are not incorporated by reference into this investor presentation. To view a copy of the Lucky Shot S-K 1300 Report, see: https://assets.website-files.com/5fc5d36fd44fd675102e4420/6487270414e64406df8280bb_Contango%20Lucky%20Shot%20Project%20S-K%201300%20TRS%202023-05-26.pdf. The information contained in, or otherwise accessible through, the links are not part of, and are not incorporated by reference into this investor presentation. For additional details on the Johnson Tract Project, see NI 43-101 Technical Report titled “Updated Mineral Resource Estimate and NI 43-101 Technical Report for the Johnson Tract Project, Alaska”, dated August 25, 2022 (effective date of July 12, 2022) authored by Ray C. Brown, James N. Gray, P.Geo. and Lyn Jones, P.Eng, see: https://cdn.prod.website-files.com/5fc5d36fd44fd675102e4420/66b39f847ac30bd736ac91ad_hg-technical-report-25aug-2022_compressed.pdf. The information contained in, or otherwise accessible through, the links are not part of, and are not incorporated by reference into this investor presentation.

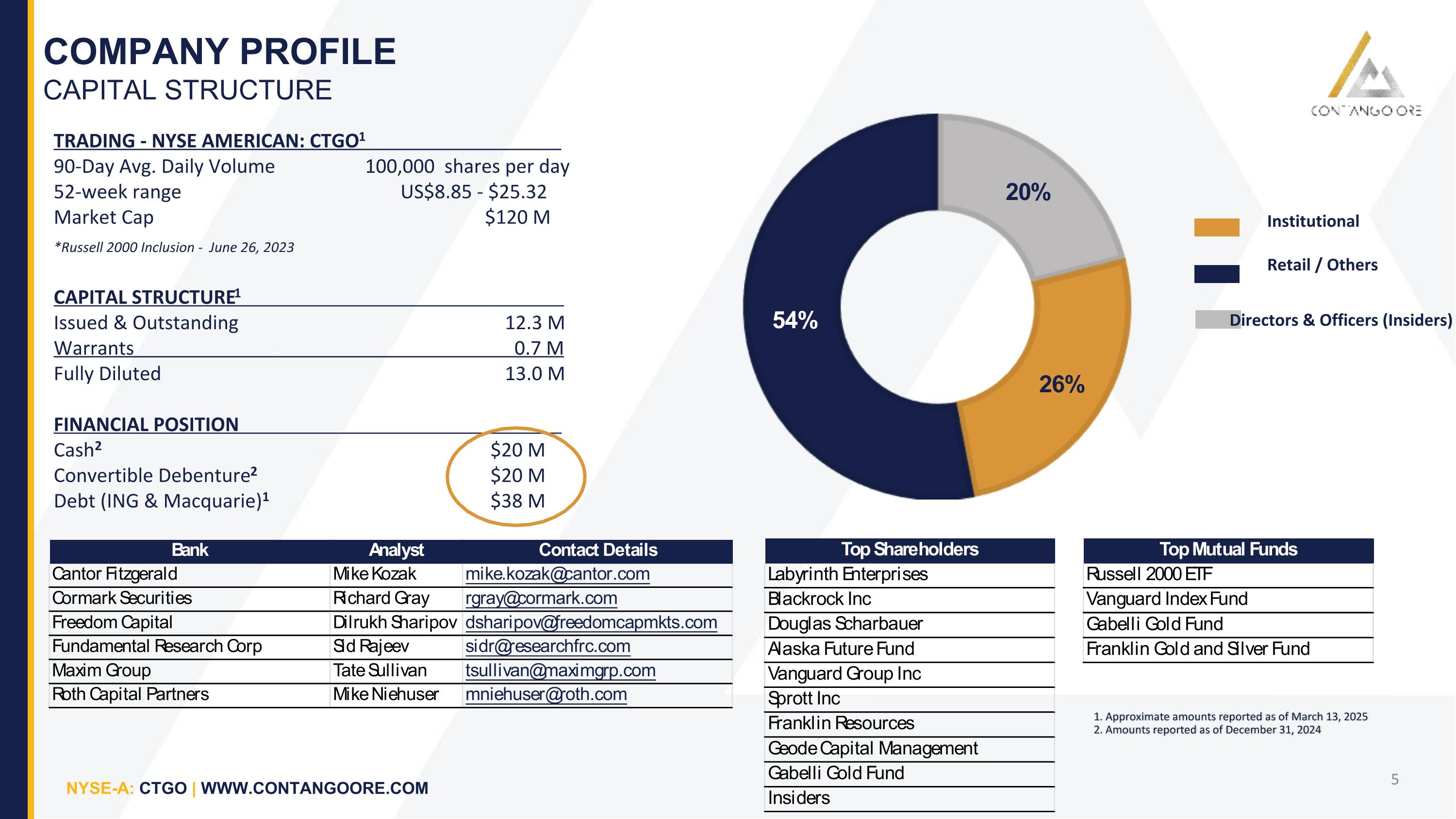

COMPANY PROFILE CAPITAL STRUCTURE TRADING - NYSE AMERICAN: CTGO1 90-Day Avg. Daily Volume 100,000 shares per day 52-week range US$8.85 - $25.32 Market Cap $120 M *Russell 2000 Inclusion - June 26, 2023 CAPITAL STRUCTURE1 Issued & Outstanding 12.3 M Warrants 0.7 M Fully Diluted 13.0 M FINANCIAL POSITION Cash2 $20 M Convertible Debenture2 $20 M Debt (ING & Macquarie)1 $38 M Institutional Retail / Others Directors & Officers (Insiders) 1. Approximate amounts reported as of March 13, 2025 2. Amounts reported as of December 31, 2024

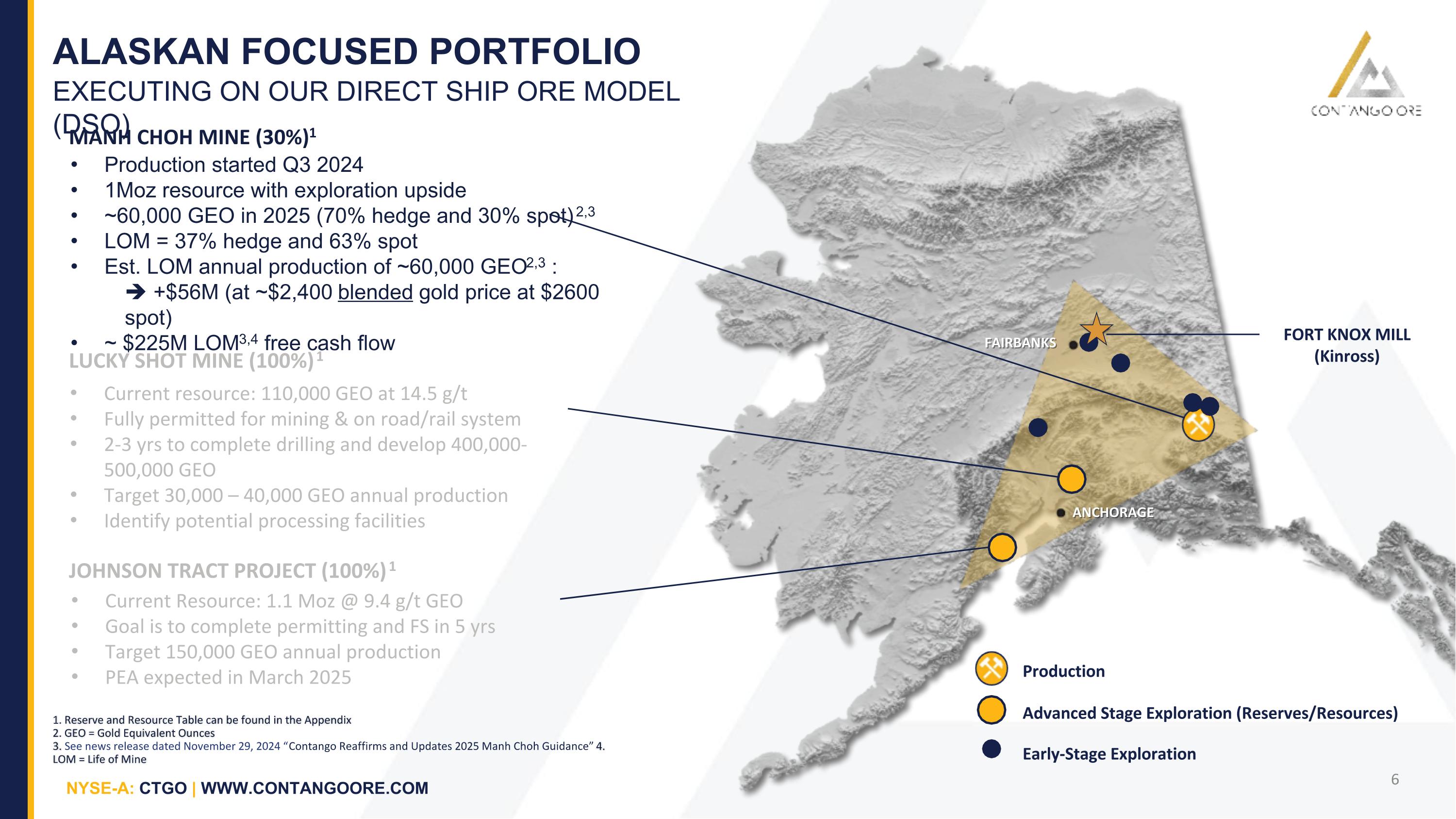

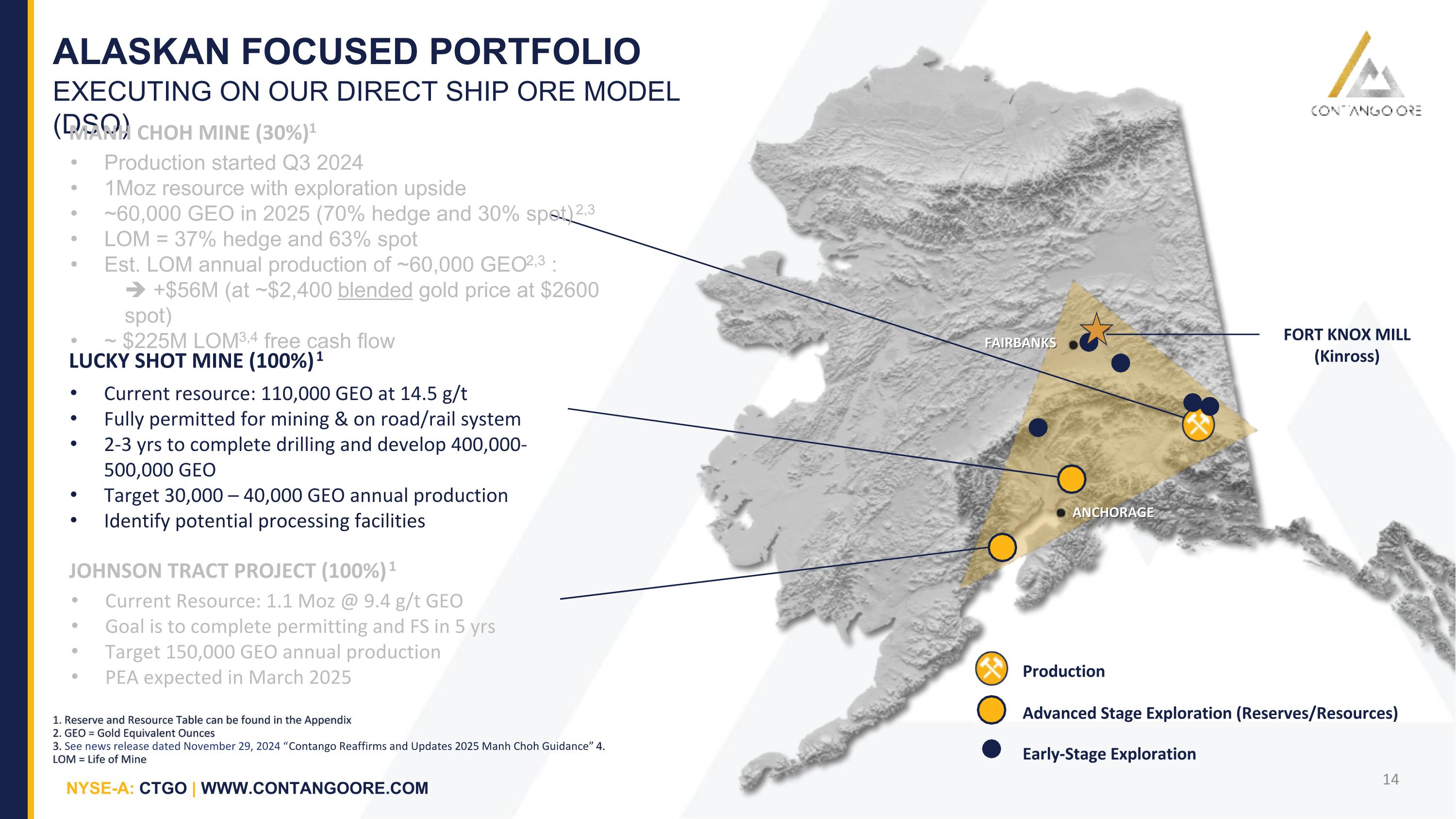

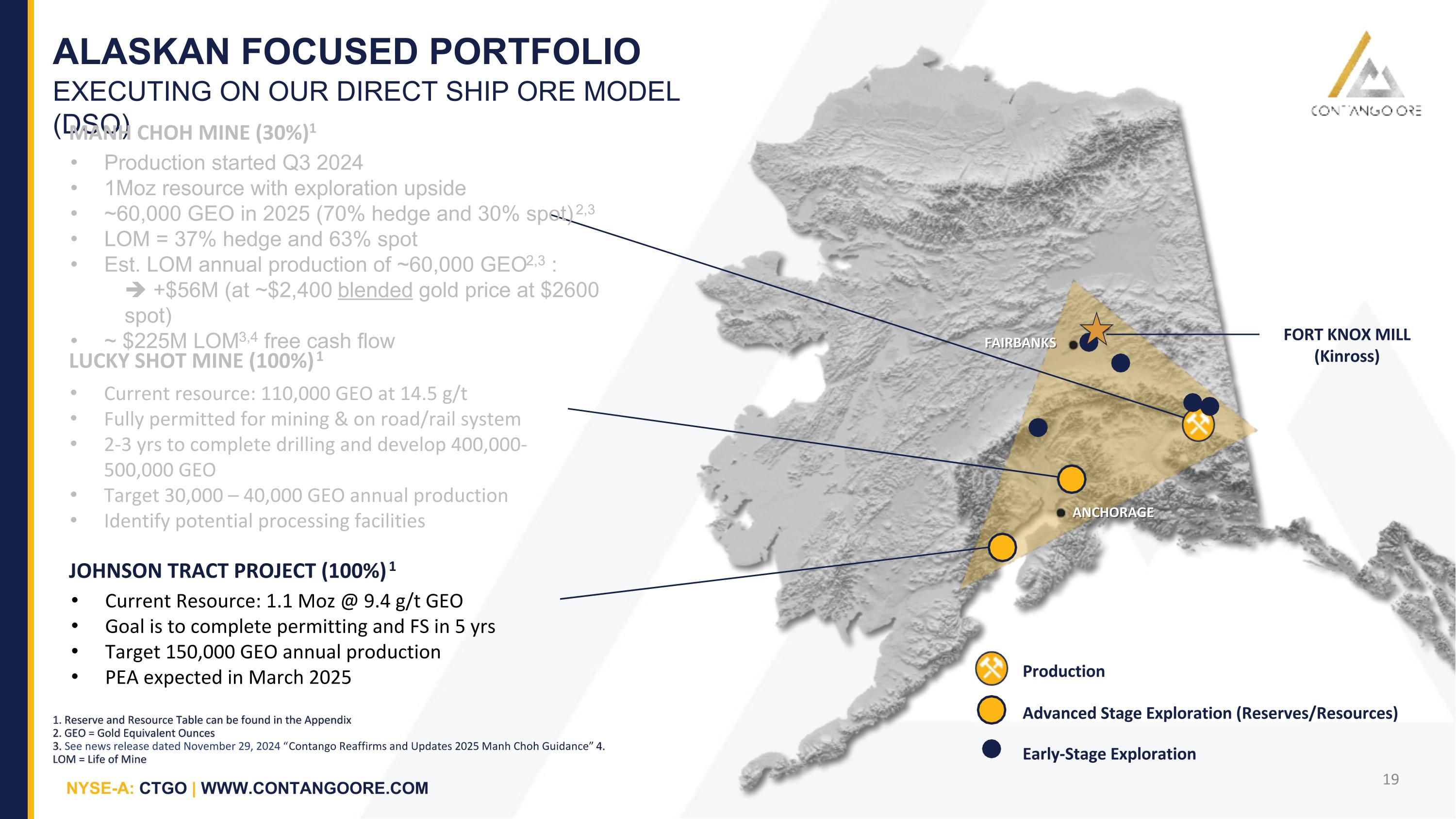

FAIRBANKS ANCHORAGE ALASKAN FOCUSED PORTFOLIO EXECUTING ON OUR DIRECT SHIP ORE MODEL (DSO) FORT KNOX MILL (Kinross) Early-Stage Exploration Advanced Stage Exploration (Reserves/Resources) Production MANH CHOH MINE (30%)1 Production started Q3 2024 1Moz resource with exploration upside ~60,000 GEO in 2025 (70% hedge and 30% spot) 2,3 LOM = 37% hedge and 63% spot Est. LOM annual production of ~60,000 GEO2,3 : +$56M (at ~$2,400 blended gold price at $2600 spot) ~ $225M LOM3,4 free cash flow LUCKY SHOT MINE (100%) 1 Current resource: 110,000 GEO at 14.5 g/t Fully permitted for mining & on road/rail system 2-3 yrs to complete drilling and develop 400,000-500,000 GEO Target 30,000 – 40,000 GEO annual production Identify potential processing facilities JOHNSON TRACT PROJECT (100%) 1 Current Resource: 1.1 Moz @ 9.4 g/t GEO Goal is to complete permitting and FS in 5 yrs Target 150,000 GEO annual production PEA expected in March 2025 1. Reserve and Resource Table can be found in the Appendix 2. GEO = Gold Equivalent Ounces 3. See news release dated November 29, 2024 “Contango Reaffirms and Updates 2025 Manh Choh Guidance” 4. LOM = Life of Mine

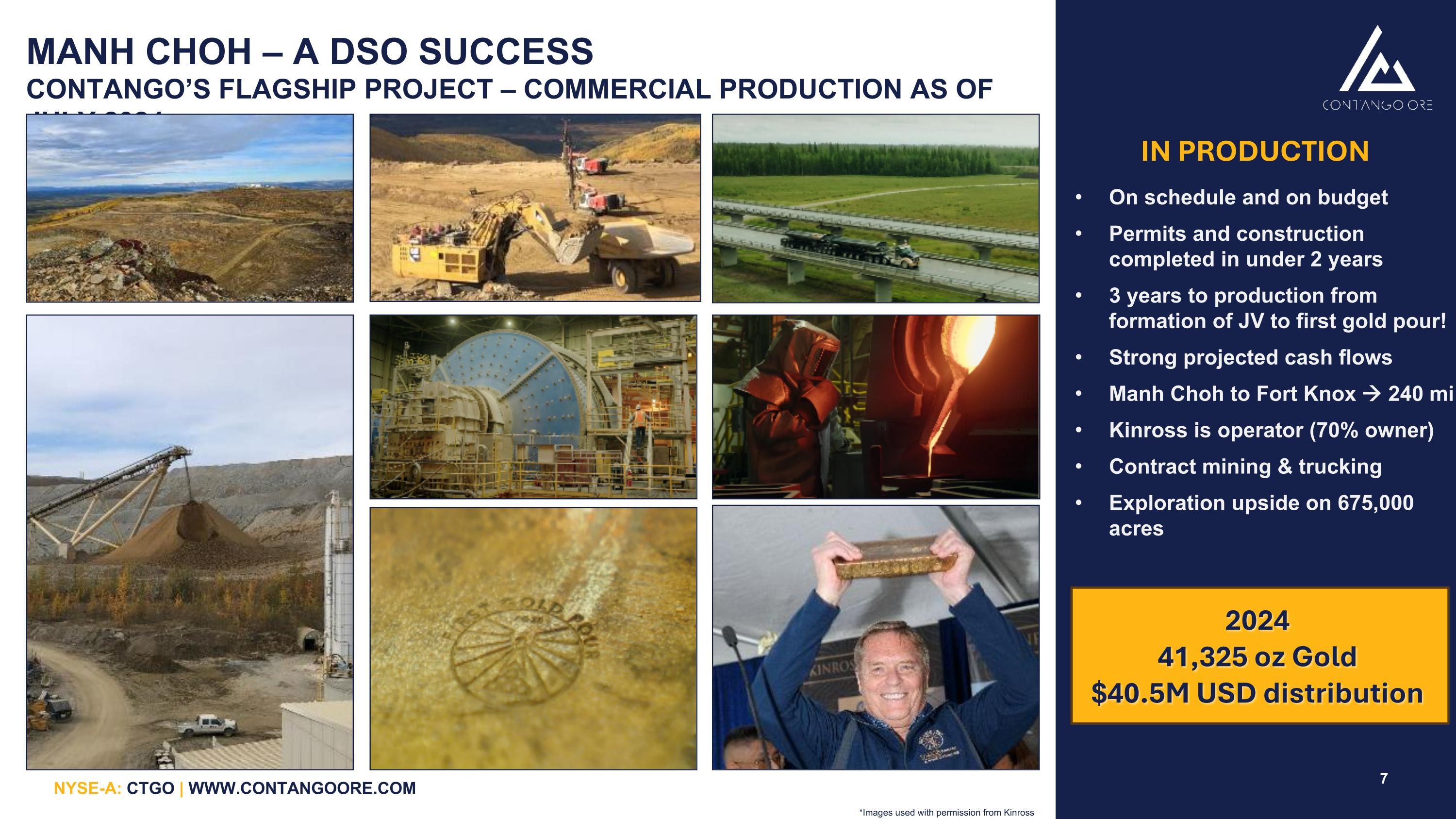

MANH CHOH – A DSO SUCCESS CONTANGO’S FLAGSHIP PROJECT – COMMERCIAL PRODUCTION AS OF JULY 2024 2024 41,325 oz Gold $40.5M USD distribution *Images used with permission from Kinross IN PRODUCTION On schedule and on budget Permits and construction completed in under 2 years 3 years to production from formation of JV to first gold pour! Strong projected cash flows Manh Choh to Fort Knox 240 mi Kinross is operator (70% owner) Contract mining & trucking Exploration upside on 675,000 acres

MANH CHOH MINE 2024 PRODUCTION STATISTICS & 2025 GUIDANCE 1. As reported in Year End 2024 news release dated March 17, 2025 “Contango Announces Earnings for the Year Ended December 31, 2024”

MANH CHOH MINE 2025 & LOM GUIDANCE 1 See Contango’s SK1300 Manh Choh Technical Report Press Release dated May 26, 2023; Initial capex reflects the Kinross feasibility study reported in “Q2 Corporate Update ” Press Release and Corporate Presentation dated July 26 and 27, 2022; The optimization for the mineral reserve estimate assumed a $1,300 per ounce gold price; the $189 million estimate reflects remaining funds to be expended between 2022 and 2024; there will be additional capital required at Fort Knox to accommodate Manh Choh ore; and is a Toll Milling charge to the Peak Gold JV; "All-in sustaining cost (AISC) per equivalent ounce sold“ is a non-GAAP ratio. “GEO” refers to Gold Equivalent Ounces. See: https://www.contangoore.com/press-release/contango-ore-announces-completion-of-s-k-1300-technical-report-summary-for-its-manh-choh-project-in-Alaska. The information contained in, or otherwise accessible through, the link is not part of, and is not incorporated by reference into this investor presentation; As reported in Year End 2024 news release dated March 17, 2025 “Contango Announces Earnings for the Year Ended December 31, 2024”. Remaining hedge balance Year End 2024: 86,739 ounces At gold spot price of $2,800/Ounce LOM +$60 M of annual free cash flow

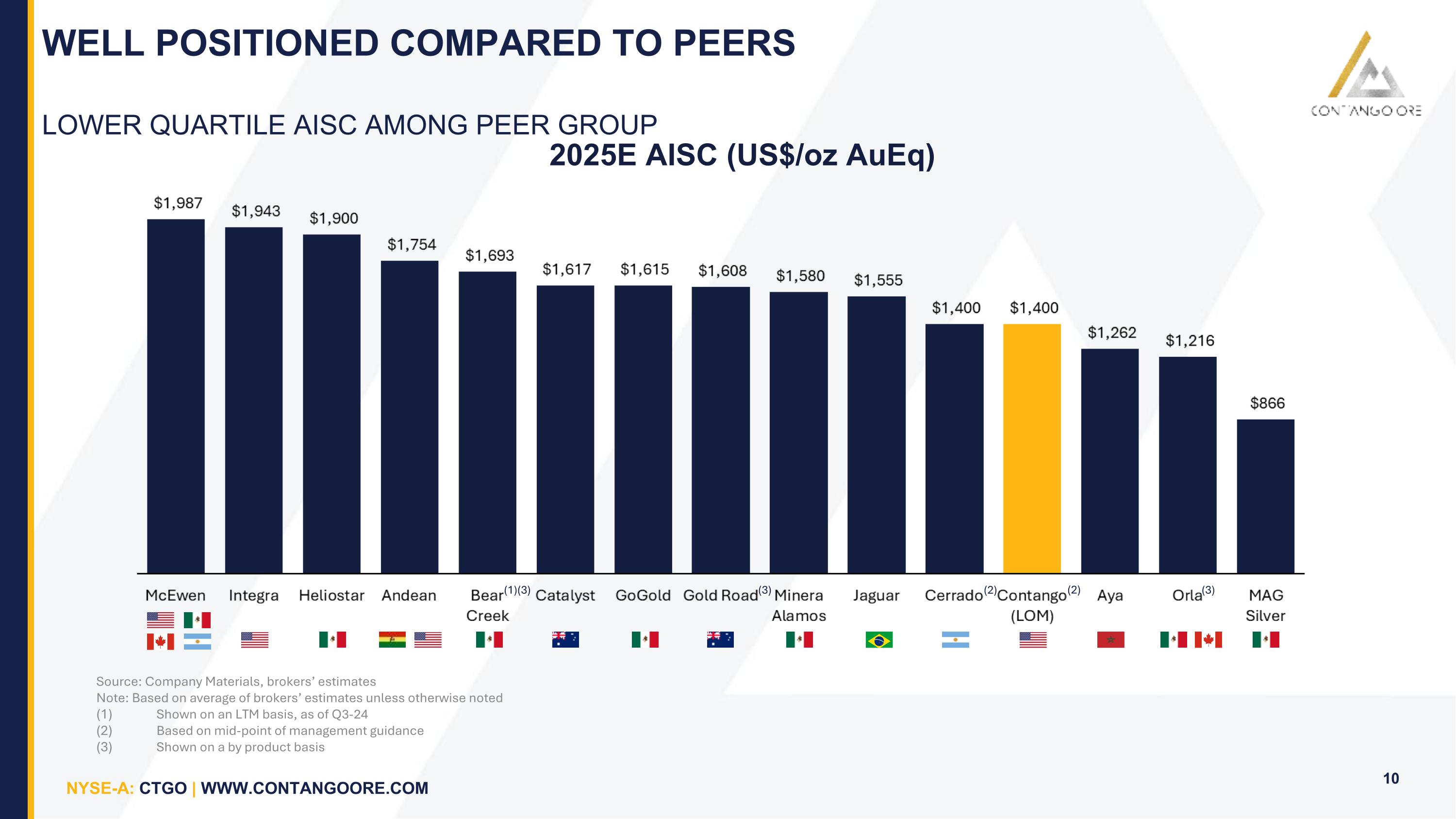

WELL POSITIONED COMPARED TO PEERS LOWER QUARTILE AISC AMONG PEER GROUP Source: Company Materials, brokers’ estimates Note: Based on average of brokers’ estimates unless otherwise noted Shown on an LTM basis, as of Q3-24 Based on mid-point of management guidance Shown on a by product basis 2025E AISC (US$/oz AuEq) (2) (2) (1)(3) (3) (3)

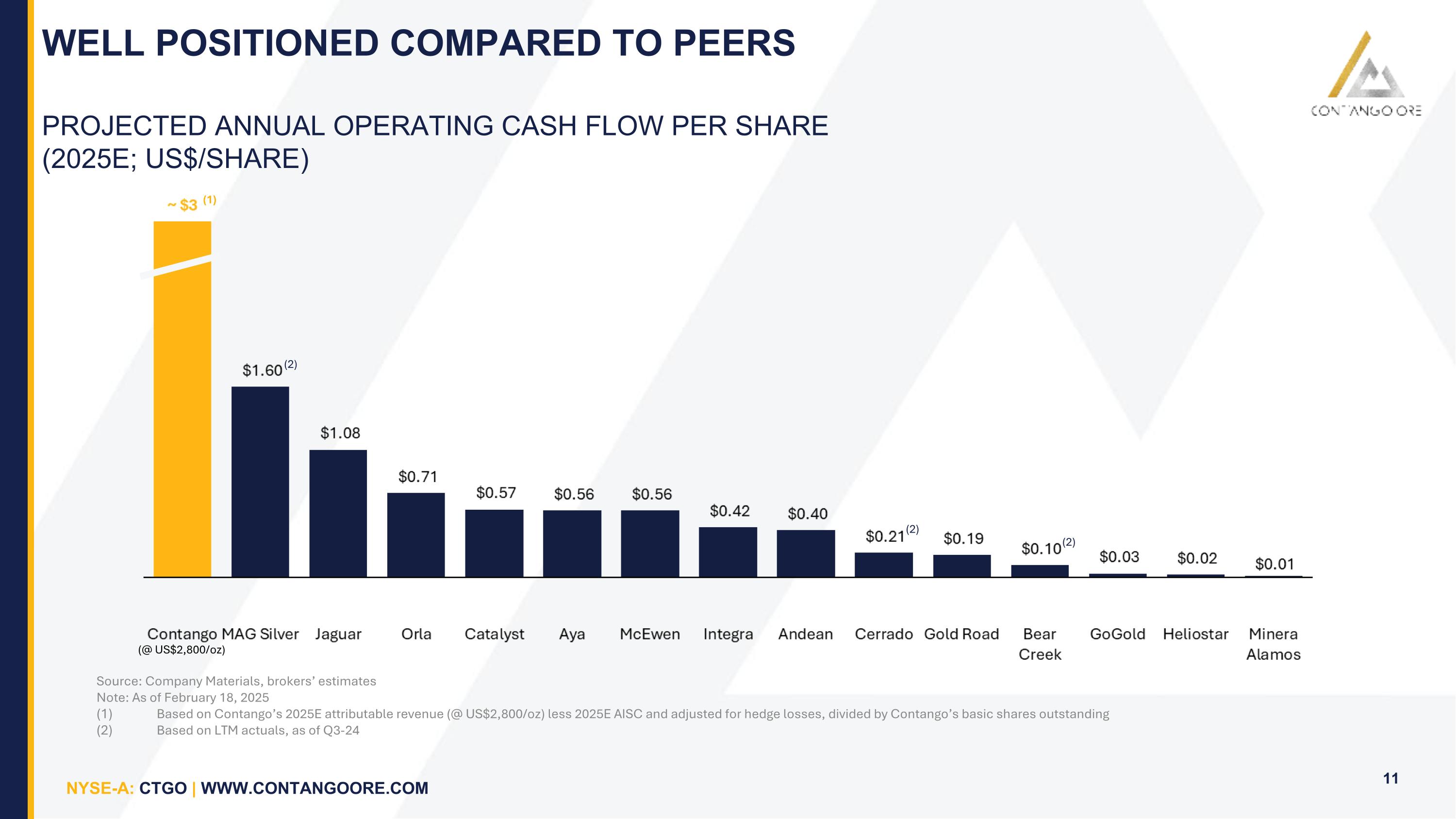

WELL POSITIONED COMPARED TO PEERS PROJECTED ANNUAL OPERATING CASH FLOW PER SHARE (2025E; US$/SHARE) Source: Company Materials, brokers’ estimates Note: As of February 18, 2025 Based on Contango’s 2025E attributable revenue (@ US$2,800/oz) less 2025E AISC and adjusted for hedge losses, divided by Contango’s basic shares outstanding Based on LTM actuals, as of Q3-24 (2) (2) (1) (2) (@ US$2,800/oz)

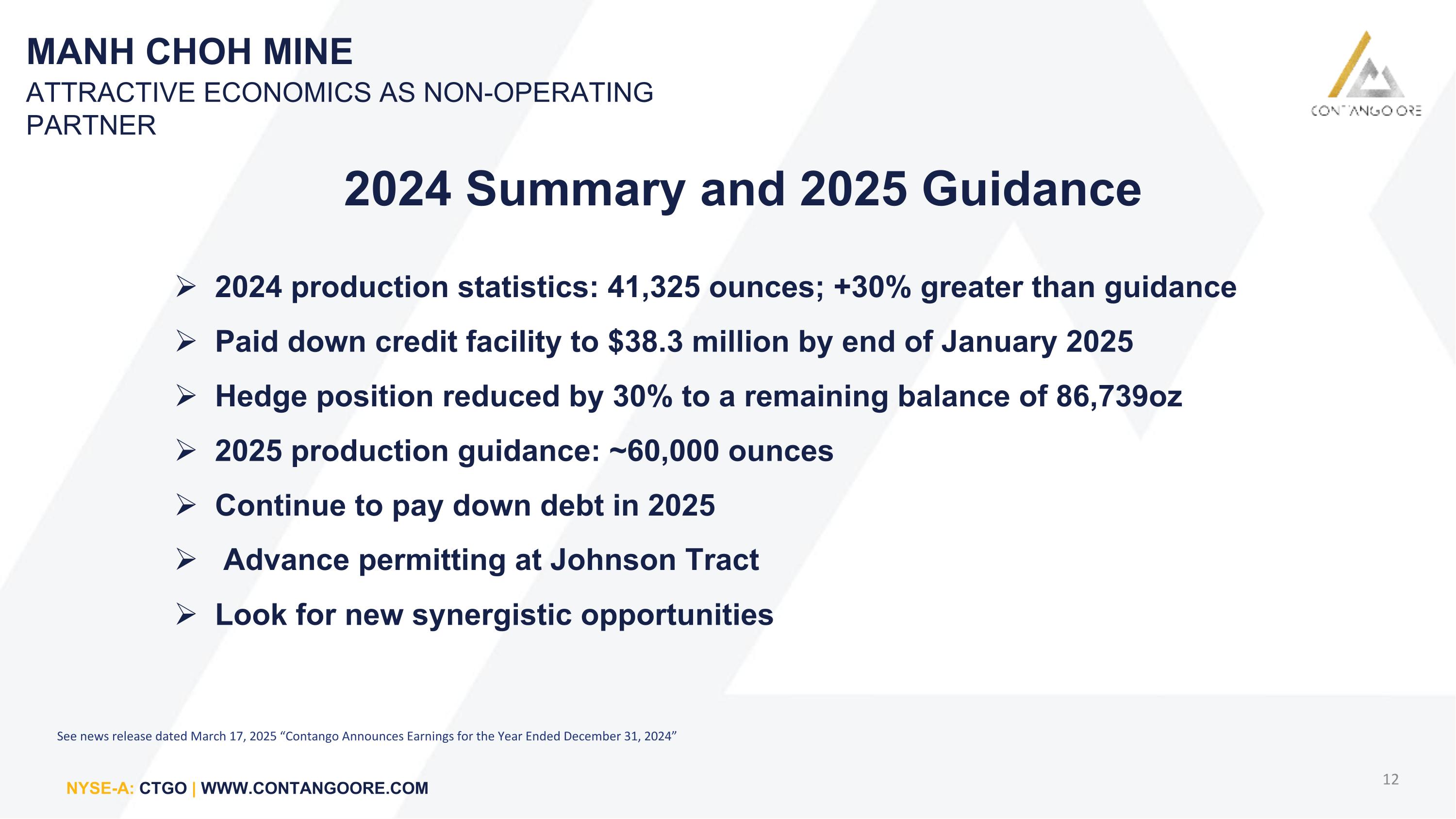

MANH CHOH MINE ATTRACTIVE ECONOMICS AS NON-OPERATING PARTNER 2024 Summary and 2025 Guidance 2024 production statistics: 41,325 ounces; +30% greater than guidance Paid down credit facility to $38.3 million by end of January 2025 Hedge position reduced by 30% to a remaining balance of 86,739oz 2025 production guidance: ~60,000 ounces Continue to pay down debt in 2025 Advance permitting at Johnson Tract Look for new synergistic opportunities See news release dated March 17, 2025 “Contango Announces Earnings for the Year Ended December 31, 2024”

MANH CHOH MINE CTGO SUCCESS OF DSO APPROACH DSO CRITERIA High-grade resources Gold, Silver, Copper focus Near Infrastructure Road Rail Water Simple permitting from a mining perspective Minimal water and wetlands impact Simple mining/processing Private and State lands 2020/2021 2022 2023 2024 JV with Kinross, Community Outreach, PFS/FS, permit applications submitted Construction decision & road construction, mill modifications, campus renovation; 404 Wetlands Permit received Operating permits received; construction completed with groundbreaking ceremony in August; ore transport started in November Ore stockpiled at Manh Choh and Fort Knox; first gold pour in July 2024! FEDERAL PERMITS 1 YR CONSTRUCTION AND RAMP UP 2 YRS Manh Choh deposit before mining

FAIRBANKS ANCHORAGE ALASKAN FOCUSED PORTFOLIO EXECUTING ON OUR DIRECT SHIP ORE MODEL (DSO) FORT KNOX MILL (Kinross) Early-Stage Exploration Advanced Stage Exploration (Reserves/Resources) Production MANH CHOH MINE (30%)1 LUCKY SHOT MINE (100%) 1 Current resource: 110,000 GEO at 14.5 g/t Fully permitted for mining & on road/rail system 2-3 yrs to complete drilling and develop 400,000-500,000 GEO Target 30,000 – 40,000 GEO annual production Identify potential processing facilities JOHNSON TRACT PROJECT (100%) 1 1. Reserve and Resource Table can be found in the Appendix 2. GEO = Gold Equivalent Ounces 3. See news release dated November 29, 2024 “Contango Reaffirms and Updates 2025 Manh Choh Guidance” 4. LOM = Life of Mine Current Resource: 1.1 Moz @ 9.4 g/t GEO Goal is to complete permitting and FS in 5 yrs Target 150,000 GEO annual production PEA expected in March 2025 Production started Q3 2024 1Moz resource with exploration upside ~60,000 GEO in 2025 (70% hedge and 30% spot) 2,3 LOM = 37% hedge and 63% spot Est. LOM annual production of ~60,000 GEO2,3 : +$56M (at ~$2,400 blended gold price at $2600 spot) ~ $225M LOM3,4 free cash flow

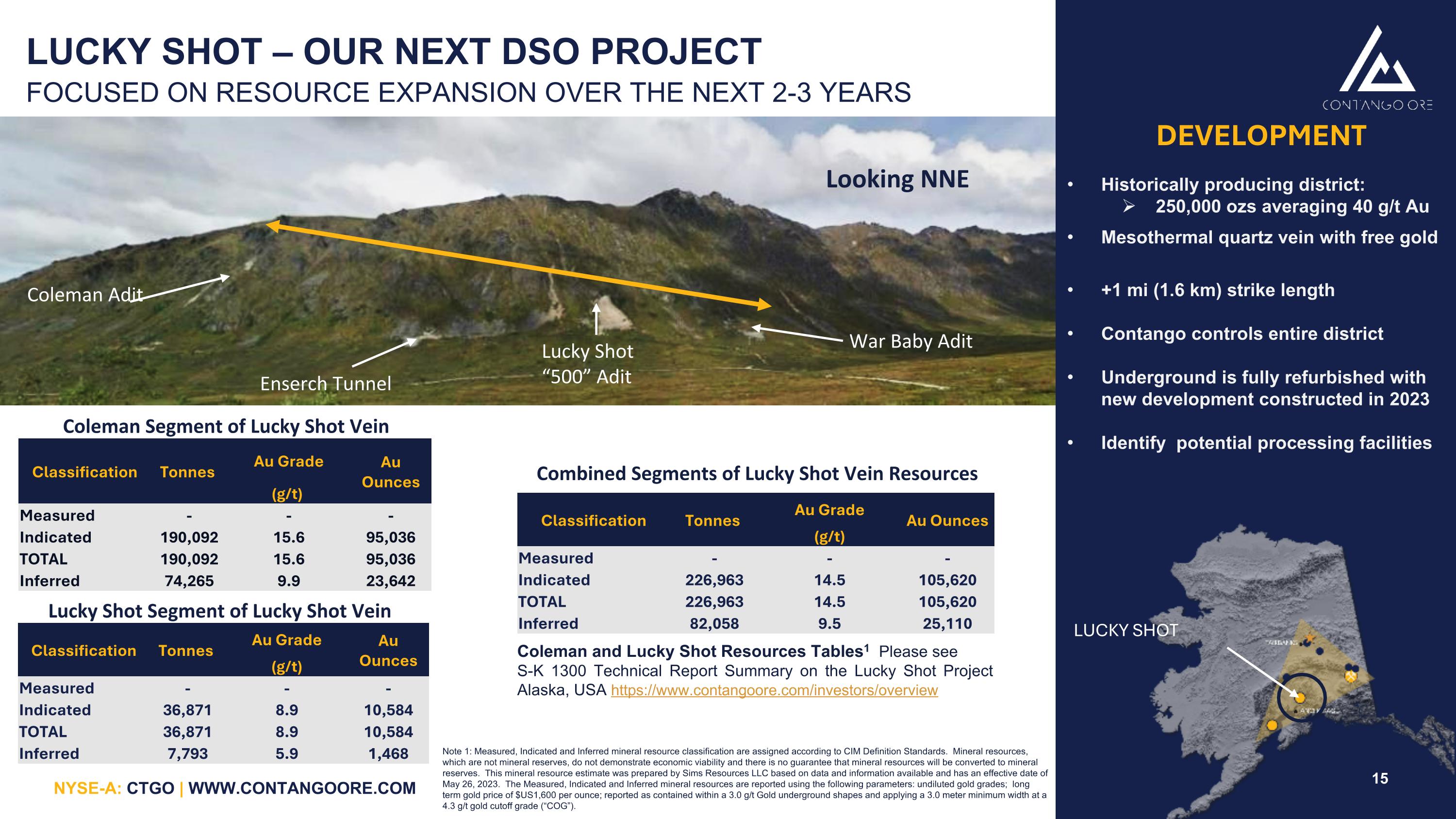

LUCKY SHOT – OUR NEXT DSO PROJECT FOCUSED ON RESOURCE EXPANSION OVER THE NEXT 2-3 YEARS DEVELOPMENT Historically producing district: 250,000 ozs averaging 40 g/t Au Mesothermal quartz vein with free gold +1 mi (1.6 km) strike length Contango controls entire district Underground is fully refurbished with new development constructed in 2023 Identify potential processing facilities LUCKY SHOT Coleman Adit Lucky Shot “500” Adit War Baby Adit Looking NNE Enserch Tunnel Classification Tonnes Au Grade Au Ounces (g/t) Measured - - - Indicated 190,092 15.6 95,036 TOTAL 190,092 15.6 95,036 Inferred 74,265 9.9 23,642 Classification Tonnes Au Grade Au Ounces (g/t) Measured - - - Indicated 36,871 8.9 10,584 TOTAL 36,871 8.9 10,584 Inferred 7,793 5.9 1,468 Coleman and Lucky Shot Resources Tables1 Please see S-K 1300 Technical Report Summary on the Lucky Shot Project Alaska, USA https://www.contangoore.com/investors/overview Lucky Shot Segment of Lucky Shot Vein Coleman Segment of Lucky Shot Vein Combined Segments of Lucky Shot Vein Resources Classification Tonnes Au Grade Au Ounces (g/t) Measured - - - Indicated 226,963 14.5 105,620 TOTAL 226,963 14.5 105,620 Inferred 82,058 9.5 25,110 Note 1: Measured, Indicated and Inferred mineral resource classification are assigned according to CIM Definition Standards. Mineral resources, which are not mineral reserves, do not demonstrate economic viability and there is no guarantee that mineral resources will be converted to mineral reserves. This mineral resource estimate was prepared by Sims Resources LLC based on data and information available and has an effective date of May 26, 2023. The Measured, Indicated and Inferred mineral resources are reported using the following parameters: undiluted gold grades; long term gold price of $US1,600 per ounce; reported as contained within a 3.0 g/t Gold underground shapes and applying a 3.0 meter minimum width at a 4.3 g/t gold cutoff grade (“COG”).

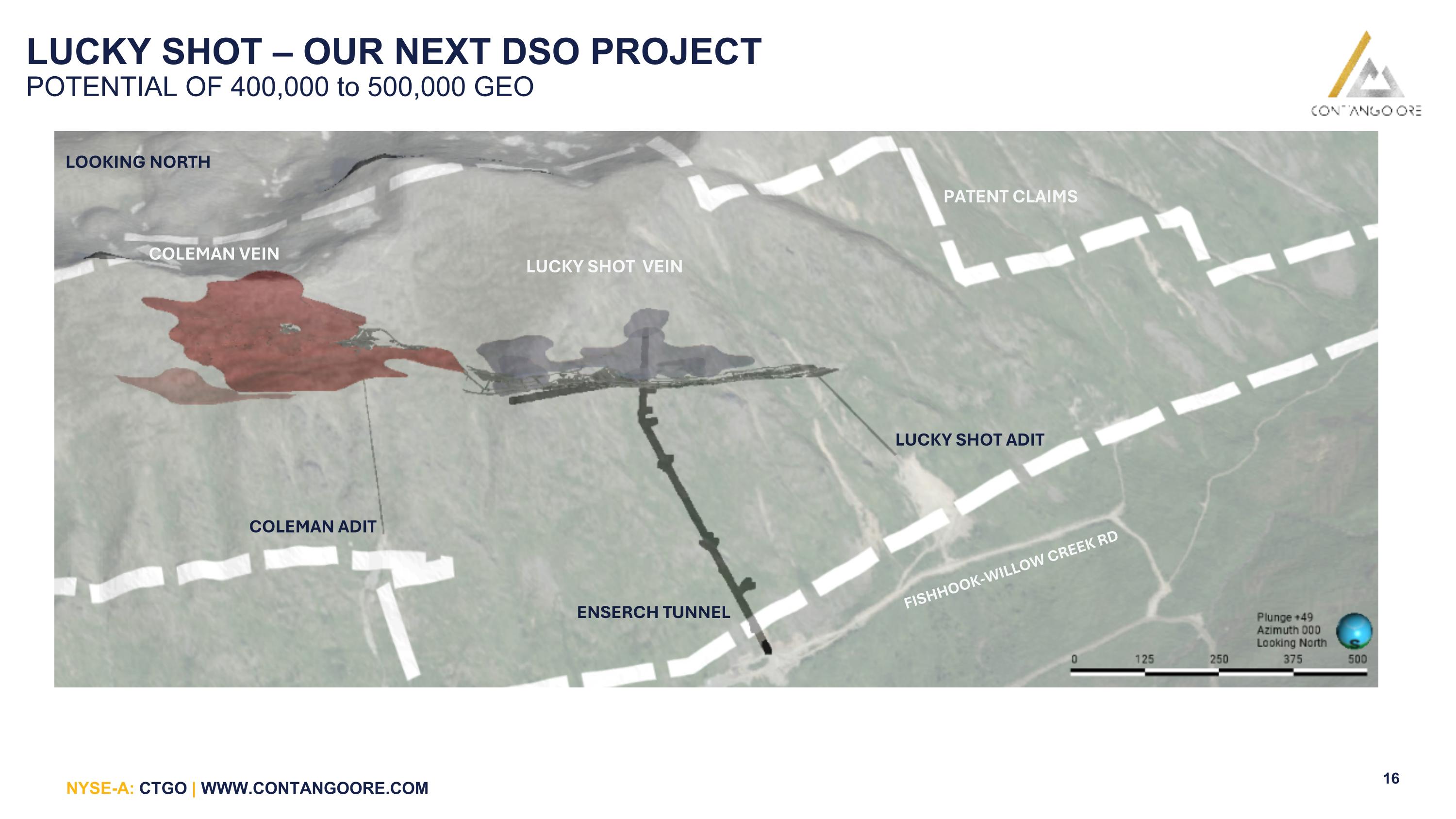

LUCKY SHOT – OUR NEXT DSO PROJECT POTENTIAL OF 400,000 to 500,000 GEO PATENT CLAIMS COLEMAN VEIN LUCKY SHOT VEIN COLEMAN ADIT ENSERCH TUNNEL LUCKY SHOT ADIT LOOKING NORTH FISHHOOK-WILLOW CREEK RD

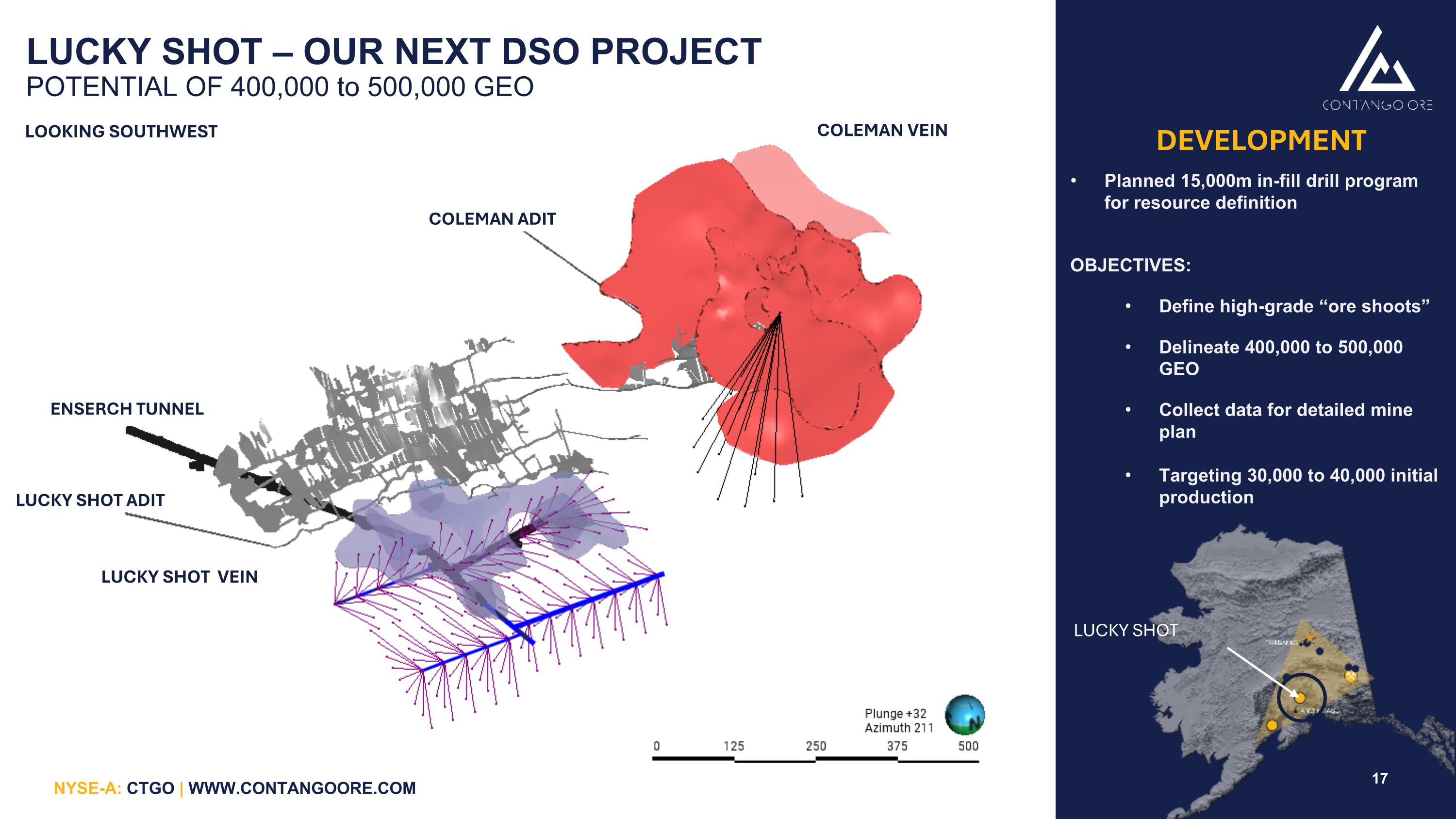

LUCKY SHOT – OUR NEXT DSO PROJECT POTENTIAL OF 400,000 to 500,000 GEO LUCKY SHOT DEVELOPMENT Planned 15,000m in-fill drill program for resource definition OBJECTIVES: Define high-grade “ore shoots” Delineate 400,000 to 500,000 GEO Collect data for detailed mine plan Targeting 30,000 to 40,000 initial production COLEMAN VEIN LUCKY SHOT VEIN COLEMAN ADIT ENSERCH TUNNEL LUCKY SHOT ADIT LOOKING SOUTHWEST

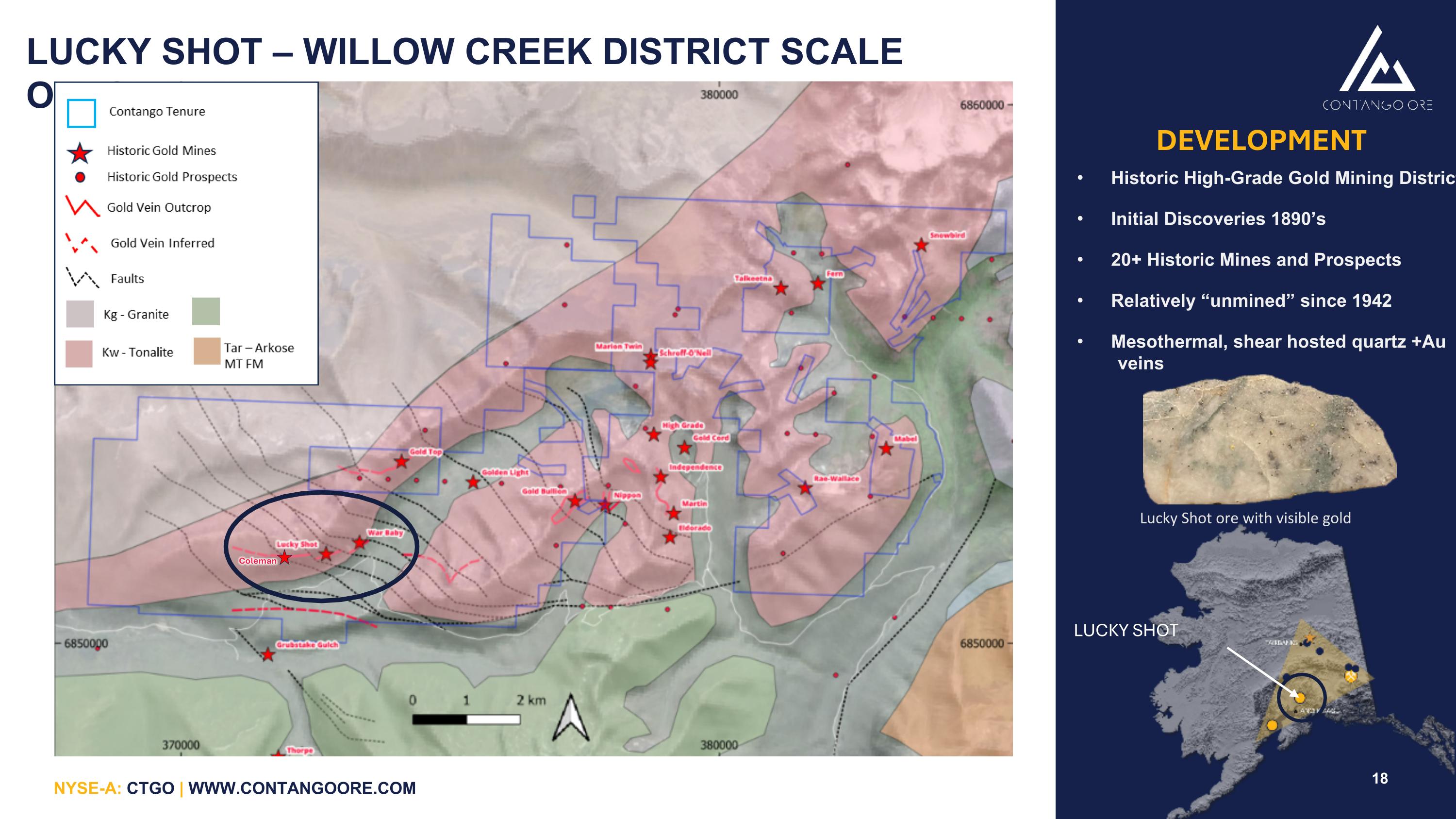

LUCKY SHOT – WILLOW CREEK DISTRICT SCALE OPPORTUNITY DEVELOPMENT Historic High-Grade Gold Mining District Initial Discoveries 1890’s 20+ Historic Mines and Prospects Relatively “unmined” since 1942 Mesothermal, shear hosted quartz +Au veins LUCKY SHOT Lucky Shot ore with visible gold Coleman

FAIRBANKS ANCHORAGE ALASKAN FOCUSED PORTFOLIO EXECUTING ON OUR DIRECT SHIP ORE MODEL (DSO) FORT KNOX MILL (Kinross) Early-Stage Exploration Advanced Stage Exploration (Reserves/Resources) Production LUCKY SHOT MINE (100%) 1 Current resource: 110,000 GEO at 14.5 g/t Fully permitted for mining & on road/rail system 2-3 yrs to complete drilling and develop 400,000-500,000 GEO Target 30,000 – 40,000 GEO annual production Identify potential processing facilities JOHNSON TRACT PROJECT (100%) 1 1. Reserve and Resource Table can be found in the Appendix 2. GEO = Gold Equivalent Ounces 3. See news release dated November 29, 2024 “Contango Reaffirms and Updates 2025 Manh Choh Guidance” 4. LOM = Life of Mine Current Resource: 1.1 Moz @ 9.4 g/t GEO Goal is to complete permitting and FS in 5 yrs Target 150,000 GEO annual production PEA expected in March 2025 MANH CHOH MINE (30%)1 Production started Q3 2024 1Moz resource with exploration upside ~60,000 GEO in 2025 (70% hedge and 30% spot) 2,3 LOM = 37% hedge and 63% spot Est. LOM annual production of ~60,000 GEO2,3 : +$56M (at ~$2,400 blended gold price at $2600 spot) ~ $225M LOM3,4 free cash flow

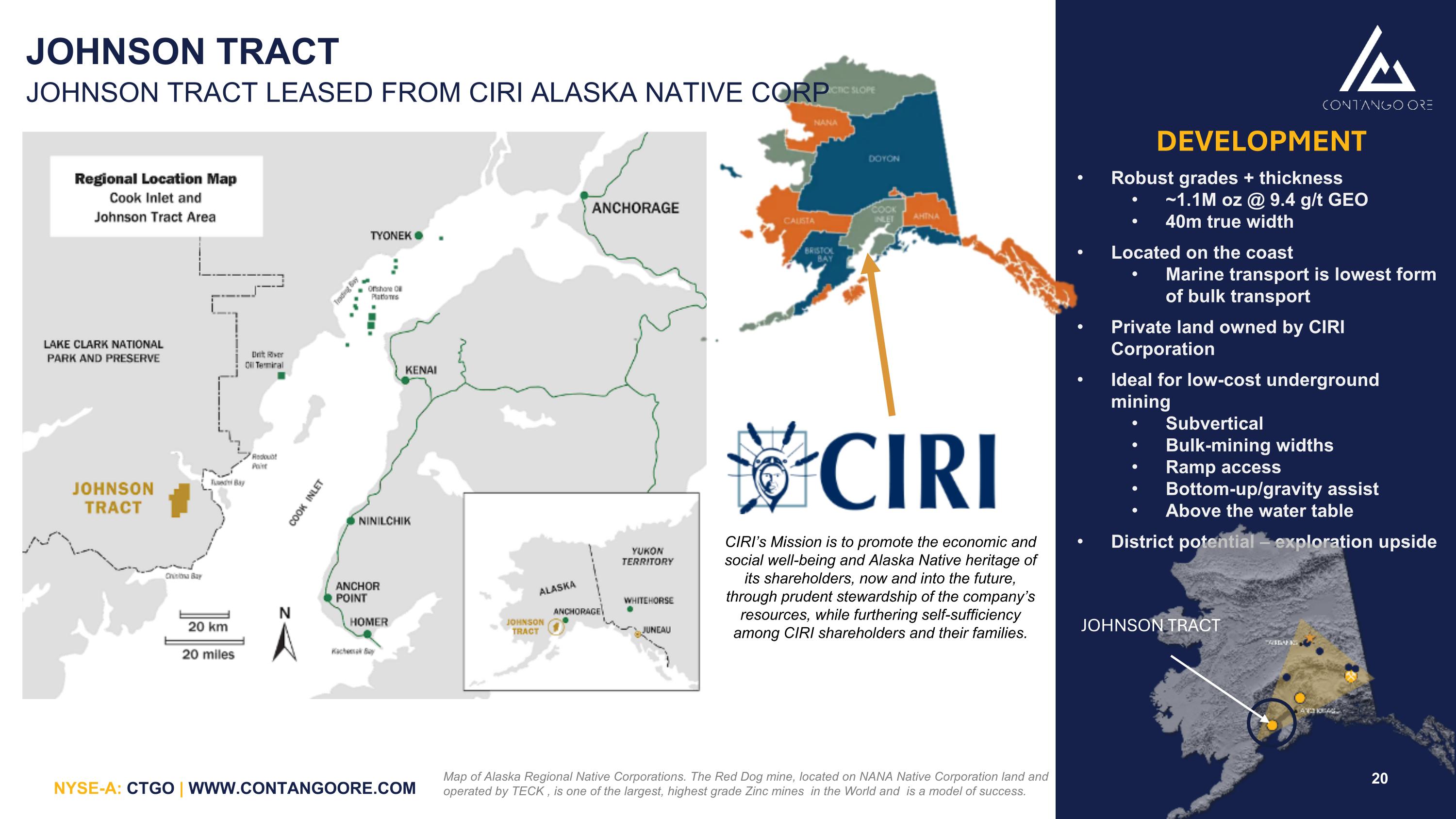

JOHNSON TRACT DEVELOPMENT Robust grades + thickness ~1.1M oz @ 9.4 g/t GEO 40m true width Located on the coast Marine transport is lowest form of bulk transport Private land owned by CIRI Corporation Ideal for low-cost underground mining Subvertical Bulk-mining widths Ramp access Bottom-up/gravity assist Above the water table District potential – exploration upside JOHNSON TRACT CIRI’s Mission is to promote the economic and social well-being and Alaska Native heritage of its shareholders, now and into the future, through prudent stewardship of the company’s resources, while furthering self-sufficiency among CIRI shareholders and their families. JOHNSON TRACT LEASED FROM CIRI ALASKA NATIVE CORP Map of Alaska Regional Native Corporations. The Red Dog mine, located on NANA Native Corporation land and operated by TECK , is one of the largest, highest grade Zinc mines in the World and is a model of success.

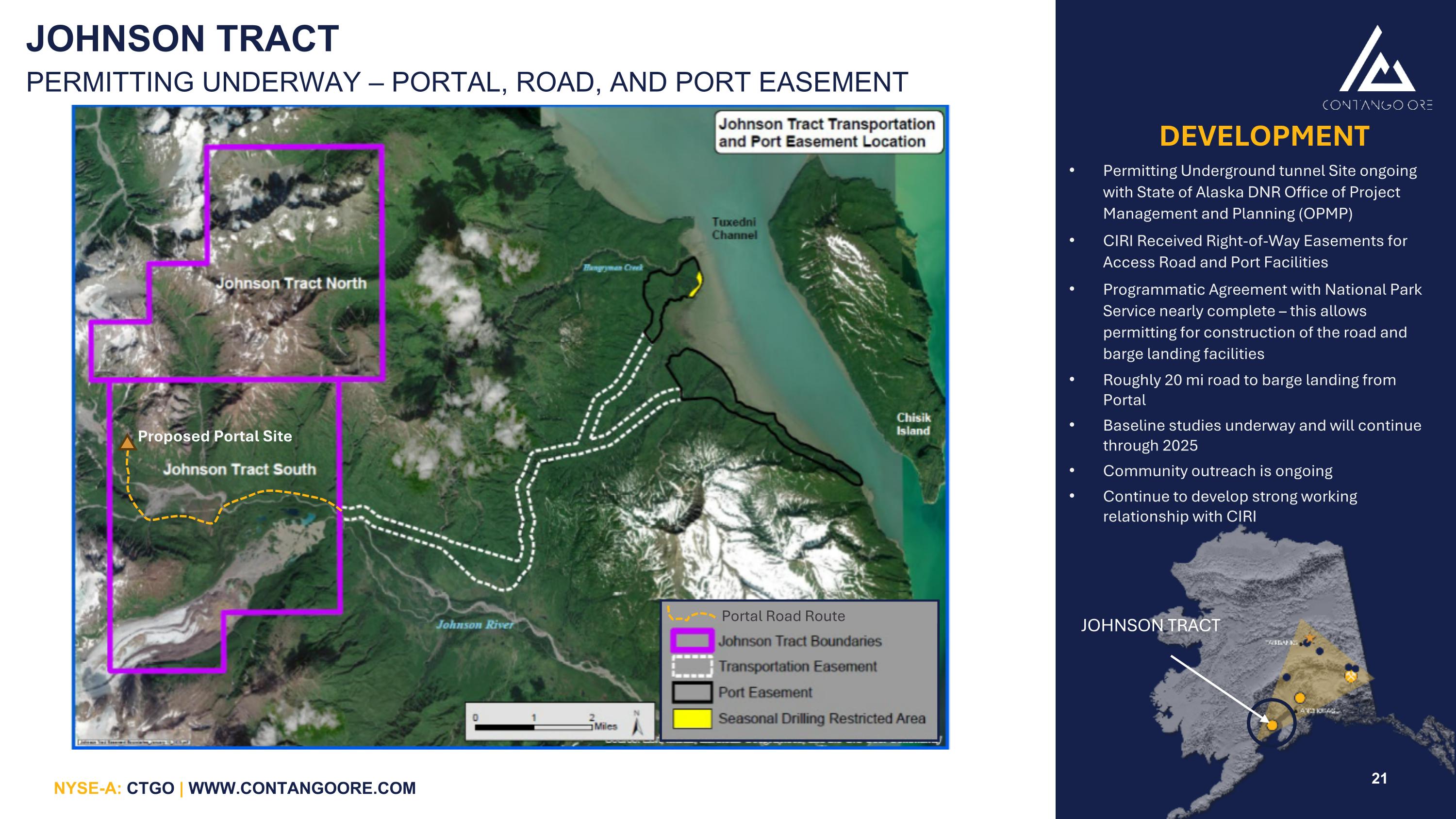

JOHNSON TRACT PERMITTING UNDERWAY – PORTAL, ROAD, AND PORT EASEMENT JOHNSON TRACT DEVELOPMENT Permitting Underground tunnel Site ongoing with State of Alaska DNR Office of Project Management and Planning (OPMP) CIRI Received Right-of-Way Easements for Access Road and Port Facilities Programmatic Agreement with National Park Service nearly complete – this allows permitting for construction of the road and barge landing facilities Roughly 20 mi road to barge landing from Portal Baseline studies underway and will continue through 2025 Community outreach is ongoing Continue to develop strong working relationship with CIRI Portal Road Route Proposed Portal Site

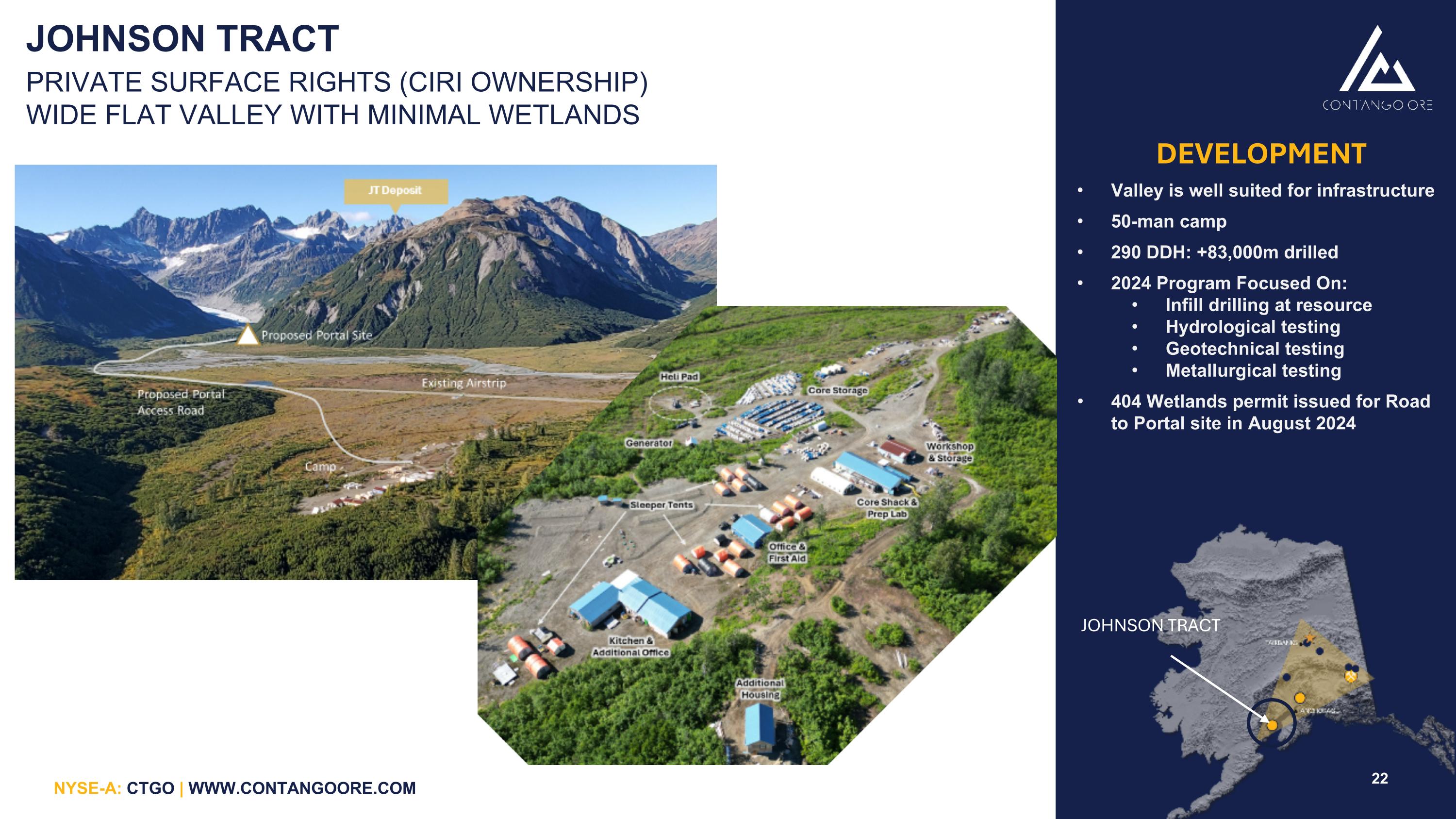

JOHNSON TRACT PRIVATE SURFACE RIGHTS (CIRI OWNERSHIP) WIDE FLAT VALLEY WITH MINIMAL WETLANDS JOHNSON TRACT DEVELOPMENT Valley is well suited for infrastructure 50-man camp 290 DDH: +83,000m drilled 2024 Program Focused On: Infill drilling at resource Hydrological testing Geotechnical testing Metallurgical testing 404 Wetlands permit issued for Road to Portal site in August 2024

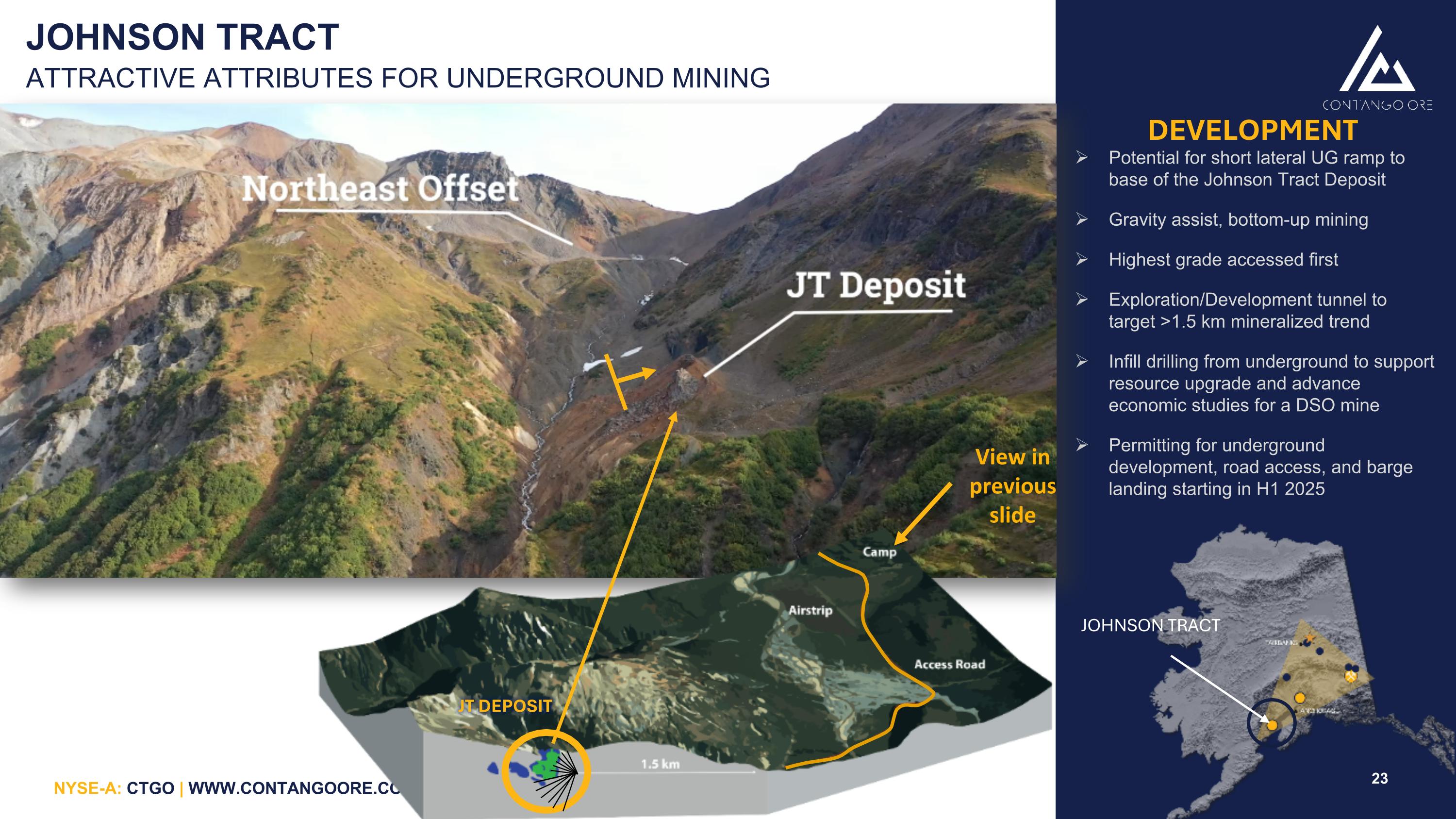

JOHNSON TRACT JOHNSON TRACT DEVELOPMENT Potential for short lateral UG ramp to base of the Johnson Tract Deposit Gravity assist, bottom-up mining Highest grade accessed first Exploration/Development tunnel to target >1.5 km mineralized trend Infill drilling from underground to support resource upgrade and advance economic studies for a DSO mine Permitting for underground development, road access, and barge landing starting in H1 2025 View in previous slide JT DEPOSIT ATTRACTIVE ATTRIBUTES FOR UNDERGROUND MINING

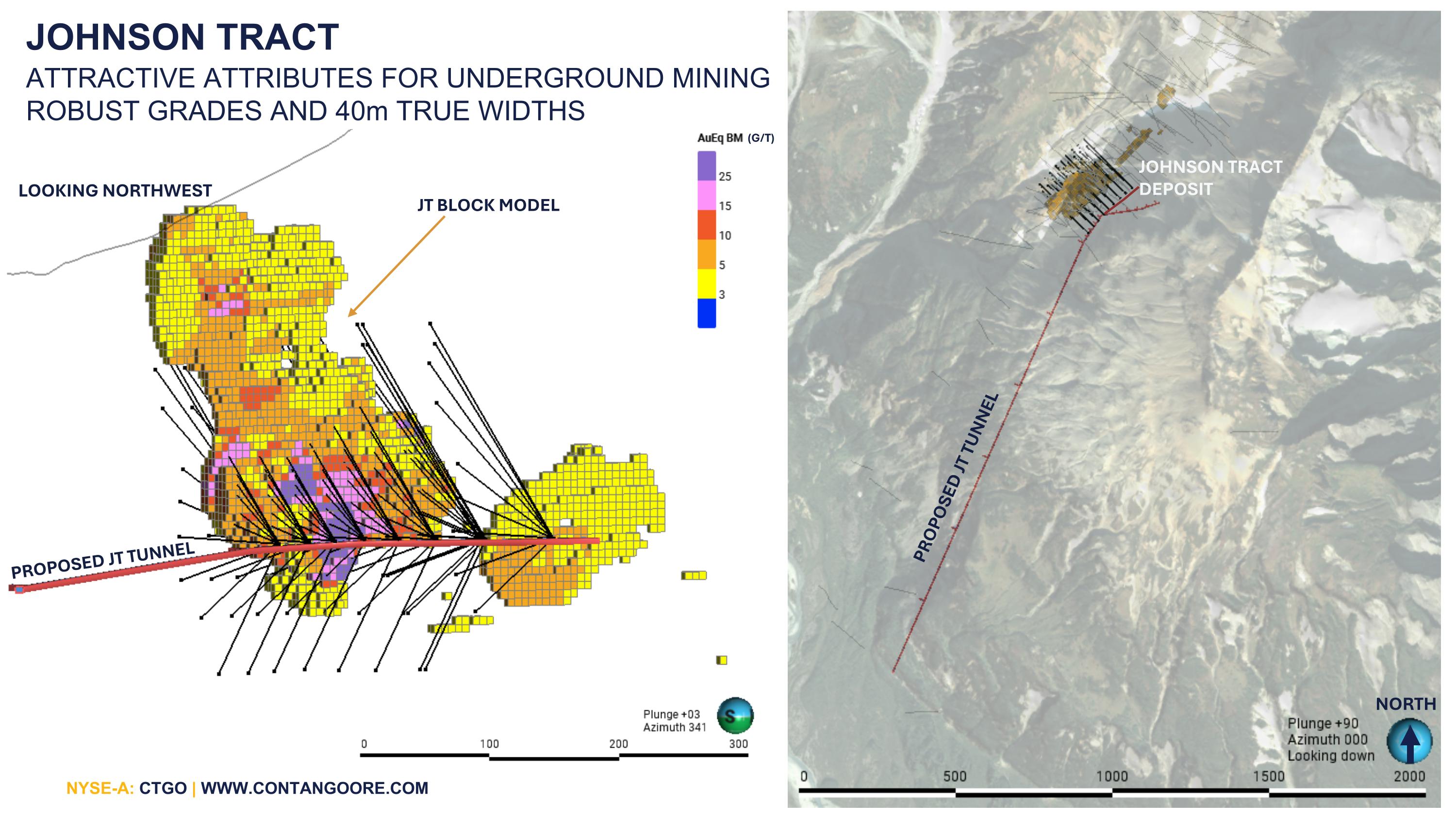

JOHNSON TRACT ATTRACTIVE ATTRIBUTES FOR UNDERGROUND MINING ROBUST GRADES AND 40m TRUE WIDTHS PLAN VIEW LOOKING NORTHWEST PROPOSED JT TUNNEL JT BLOCK MODEL JOHNSON TRACT DEPOSIT PROPOSED JT TUNNEL NORTH (G/T)

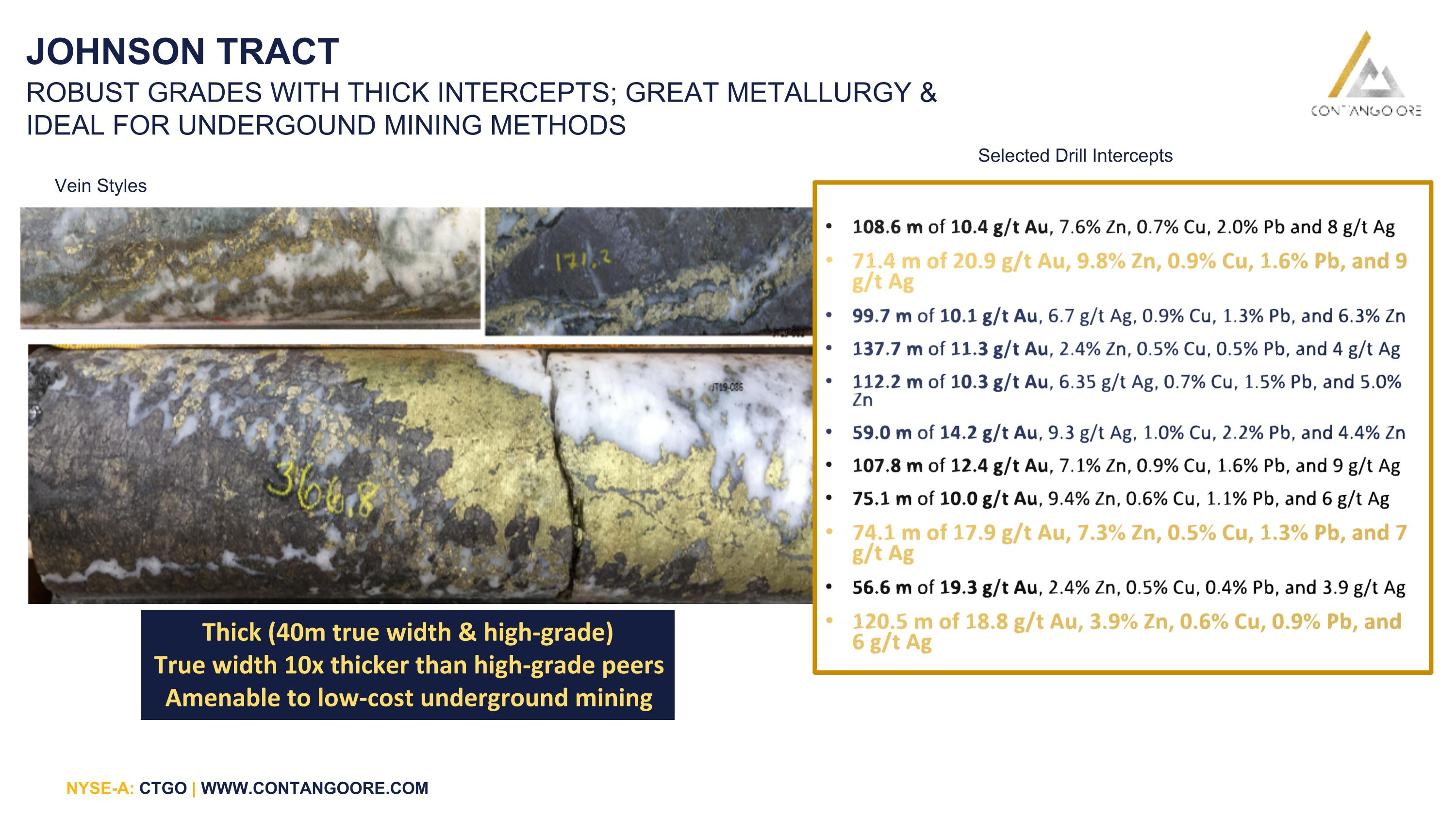

JOHNSON TRACT ROBUST GRADES WITH THICK INTERCEPTS; GREAT METALLURGY & IDEAL FOR UNDERGOUND MINING METHODS 108.6 m of 10.4 g/t Au, 7.6% Zn, 0.7% Cu, 2.0% Pb and 8 g/t Ag 71.4 m of 20.9 g/t Au, 9.8% Zn, 0.9% Cu, 1.6% Pb, and 9 g/t Ag 99.7 m of 10.1 g/t Au, 6.7 g/t Ag, 0.9% Cu, 1.3% Pb, and 6.3% Zn 137.7 m of 11.3 g/t Au, 2.4% Zn, 0.5% Cu, 0.5% Pb, and 4 g/t Ag 112.2 m of 10.3 g/t Au, 6.35 g/t Ag, 0.7% Cu, 1.5% Pb, and 5.0% Zn 59.0 m of 14.2 g/t Au, 9.3 g/t Ag, 1.0% Cu, 2.2% Pb, and 4.4% Zn 107.8 m of 12.4 g/t Au, 7.1% Zn, 0.9% Cu, 1.6% Pb, and 9 g/t Ag 75.1 m of 10.0 g/t Au, 9.4% Zn, 0.6% Cu, 1.1% Pb, and 6 g/t Ag 74.1 m of 17.9 g/t Au, 7.3% Zn, 0.5% Cu, 1.3% Pb, and 7 g/t Ag 56.6 m of 19.3 g/t Au, 2.4% Zn, 0.5% Cu, 0.4% Pb, and 3.9 g/t Ag 120.5 m of 18.8 g/t Au, 3.9% Zn, 0.6% Cu, 0.9% Pb, and 6 g/t Ag Thick (40m true width & high-grade) True width 10x thicker than high-grade peers Amenable to low-cost underground mining Vein Styles Selected Drill Intercepts

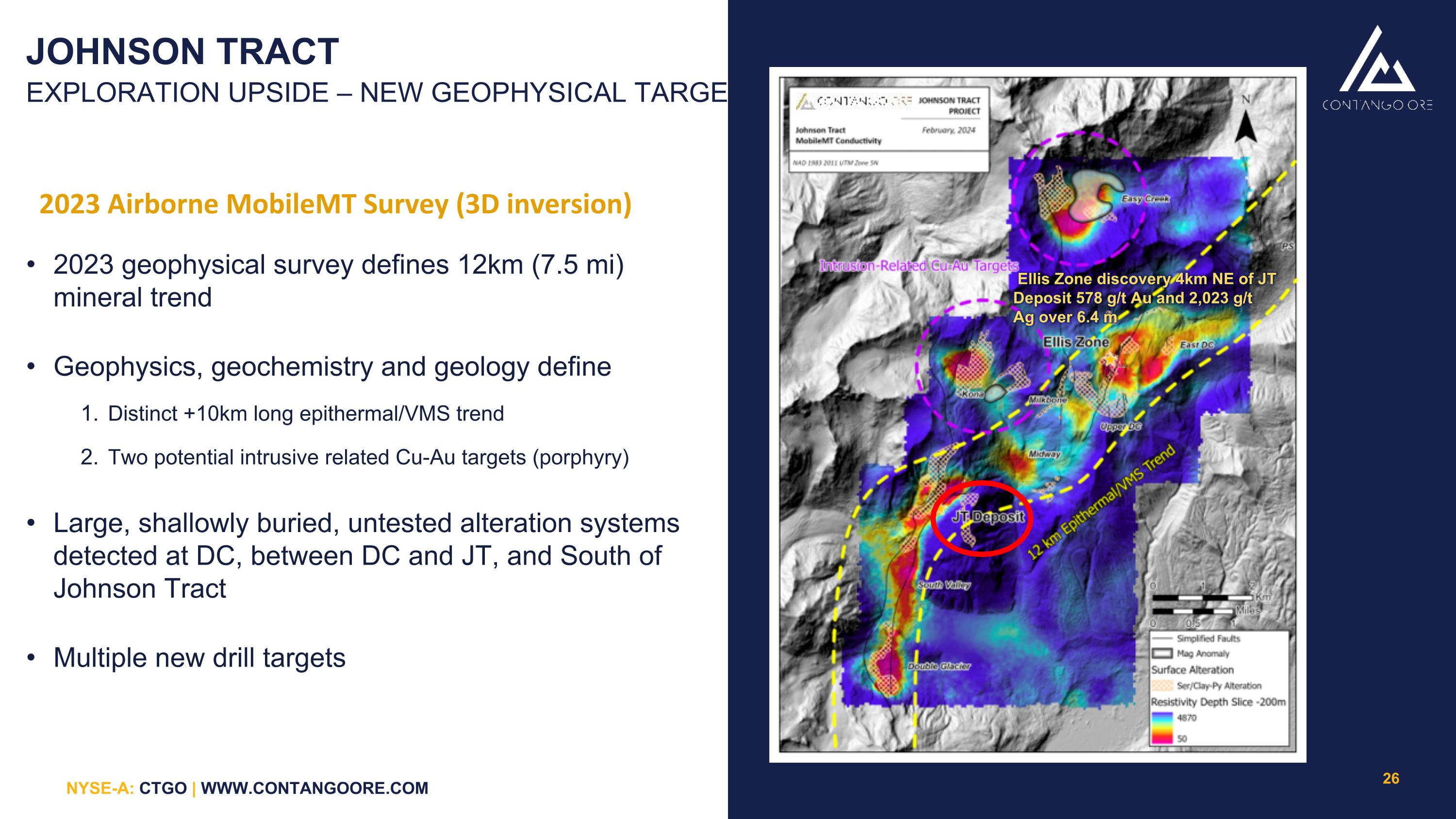

Ellis Zone discovery 4km NE of JT Deposit 578 g/t Au and 2,023 g/t Ag over 6.4 m JOHNSON TRACT EXPLORATION UPSIDE – NEW GEOPHYSICAL TARGETS 2023 geophysical survey defines 12km (7.5 mi) mineral trend Geophysics, geochemistry and geology define Distinct +10km long epithermal/VMS trend Two potential intrusive related Cu-Au targets (porphyry) Large, shallowly buried, untested alteration systems detected at DC, between DC and JT, and South of Johnson Tract Multiple new drill targets 2023 Airborne MobileMT Survey (3D inversion)

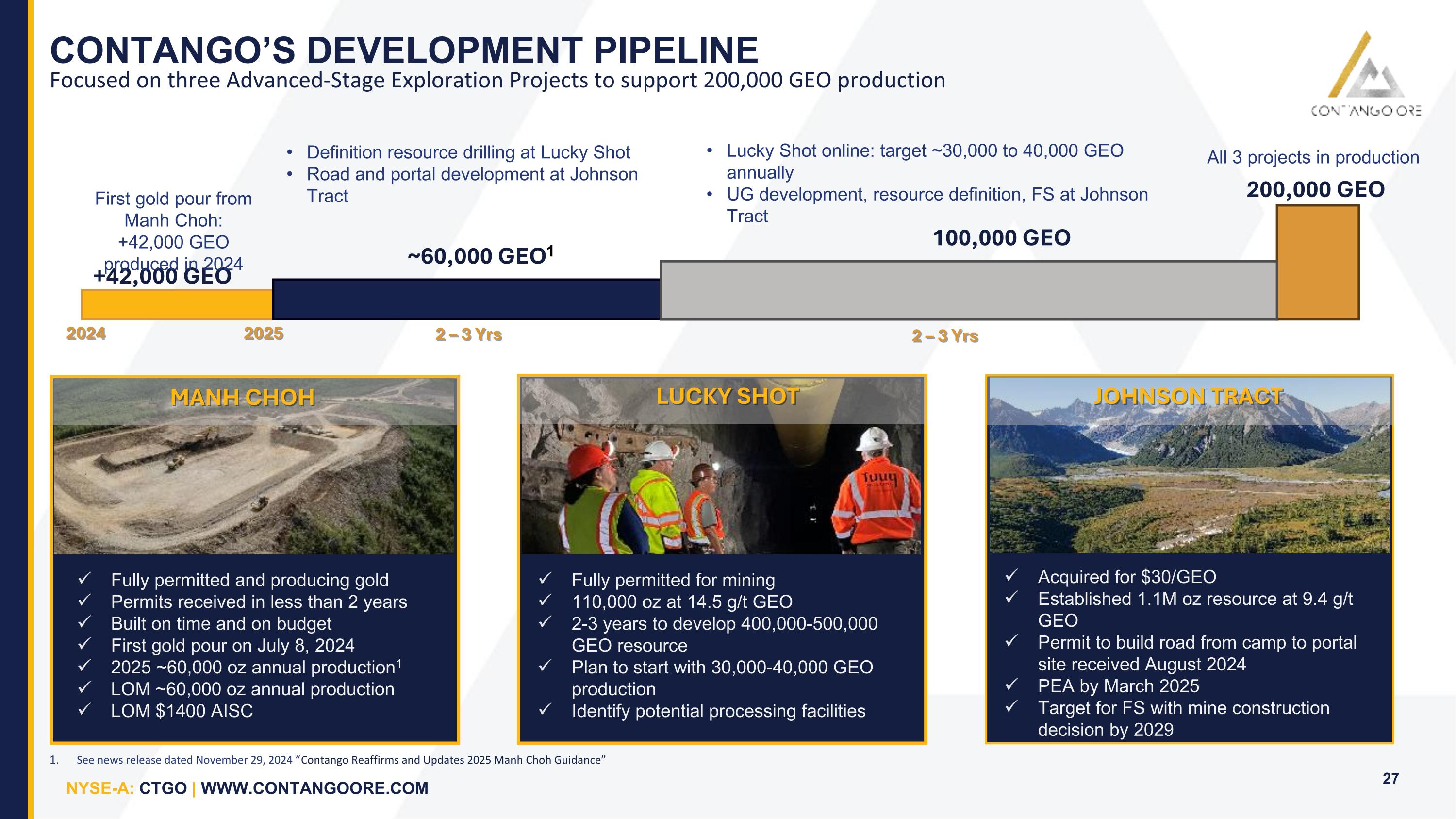

CONTANGO’S DEVELOPMENT PIPELINE Focused on three Advanced-Stage Exploration Projects to support 200,000 GEO production MANH CHOH LUCKY SHOT JOHNSON TRACT Fully permitted and producing gold Permits received in less than 2 years Built on time and on budget First gold pour on July 8, 2024 2025 ~60,000 oz annual production1 LOM ~60,000 oz annual production LOM $1400 AISC Fully permitted for mining 110,000 oz at 14.5 g/t GEO 2-3 years to develop 400,000-500,000 GEO resource Plan to start with 30,000-40,000 GEO production Identify potential processing facilities Acquired for $30/GEO Established 1.1M oz resource at 9.4 g/t GEO Permit to build road from camp to portal site received August 2024 PEA by March 2025 Target for FS with mine construction decision by 2029 2024 2 – 3 Yrs +42,000 GEO 200,000 GEO First gold pour from Manh Choh: +42,000 GEO produced in 2024 ~60,000 GEO1 100,000 GEO Definition resource drilling at Lucky Shot Road and portal development at Johnson Tract Lucky Shot online: target ~30,000 to 40,000 GEO annually UG development, resource definition, FS at Johnson Tract All 3 projects in production 2 – 3 Yrs 2025 See news release dated November 29, 2024 “Contango Reaffirms and Updates 2025 Manh Choh Guidance”

BUILDING OUR ESG FRAMEWORK DEVELOPING OUR STRATEGY AROUND OUR BUSINESS MODEL AND CORE VALUES BUILT ON OUR FUNDAMENTAL DSO CRITERIA High-grade resources Gold, Silver, Copper focus Near Infrastructure Road Rail Water Simple permitting from a mining perspective Minimal water and wetlands impact Simple mining/processing Private and State lands Defining the pillars Social - safety of our people and our communities, valued partnerships with Alaskan Natives Environment – responsible practices, minimize our footprint Governance - business conduct, social responsibility and reporting Growth – resulting in a strong, reputable company Working through materiality assessment Evaluating sustainability risk and opportunities ESG data quality and completeness forms reliable basis for the future Consolidating our understanding of risks, opportunities and policies for all our sites

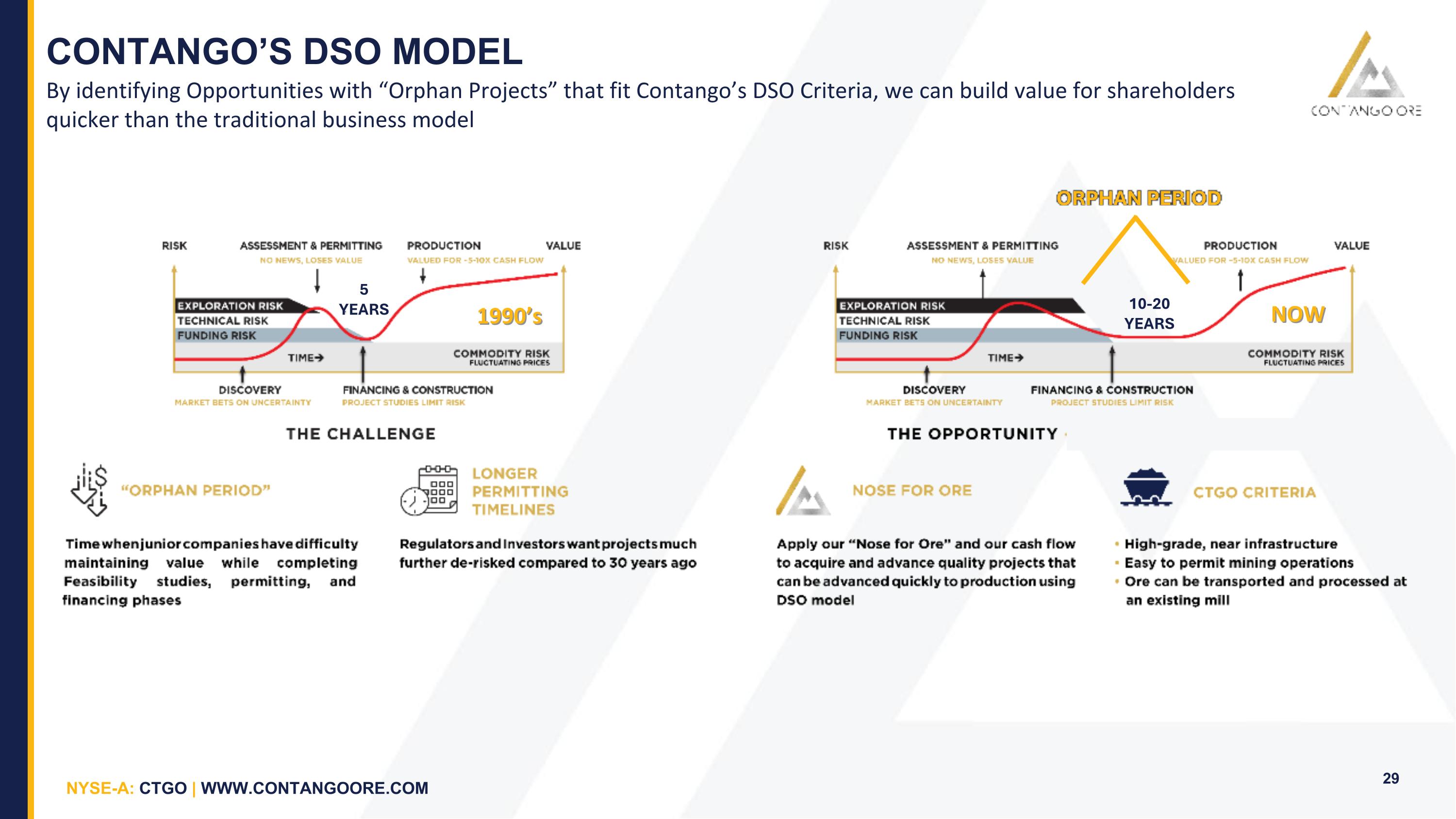

CONTANGO’S DSO MODEL By identifying Opportunities with “Orphan Projects” that fit Contango’s DSO Criteria, we can build value for shareholders quicker than the traditional business model 1990’s NOW 5 YEARS 10-20 YEARS ORPHAN PERIOD

CONTANGO’S CORPORATE STRATEGY 5 YEAR EXECUTION STRATEGY: TO BECOME A MID-TIER GOLD PRODUCER MANH CHOH MINE (30%)1 LUCKY SHOT MINE (100%) 1 JOHNSON TRACT PROJECT (100%) 1 CONTANGO’S 5-YEAR STRATEGY TO CREATE A 200,000 GEO/YEAR ALASKA PRODUCER USING A DSO APPROACH FOR HIGH QUALITY PROJECTS 1. Reserve and Resource Table can be found in the Appendix; 2. GEO = Gold Equivalent Ounces; 3. See news release dated November 29, 2024 “Contango Reaffirms and Updates 2025 Manh Choh Guidance”; 4. LOM = Life of Mine Production started Q3 2024 1Moz resource with exploration upside ~60,000 GEO in 2025 (70% hedge and 30% spot) 2,3 LOM = 37% hedge and 63% spot Est. LOM annual production of ~60,000 GEO2,3 : +$56M (at ~$2,400 blended gold price at $2600 spot) ~ $225M LOM3,4 free cash flow Current resource: 110,000 GEO at 14.5 g/t Fully permitted for mining & on road/rail system 2-3 yrs to complete drilling and develop 400,000-500,000 GEO Target 30,000 – 40,000 GEO annual production Identify potential processing facilities Current Resource: 1.1 Moz @ 9.4 g/t GEO Goal is to complete permitting and FS in 5 yrs Target 150,000 GEO annual production PEA expected in March 2025

THANK YOU 31 Corporate Inquires:��info@contangoore.com�+1-907-888-4273�www.contangoore.com Twitter: @orecontango�LinkedIn: Contango ORE�Instagram: ContangoORE�Facebook: Contango ORE QUESTIONS?

NON-GAAP RECONCILIATION DISCLAIMER This presentation contains forward looking estimates of all-in sustaining cost (“AISC”), resources, free cash flow and EBITDA, which are financial measures not determined in accordance with United States generally accepted accounting principles (“GAAP”). We cannot provide a reconciliation of estimated AISC, resources and EBITDA to estimated costs of goods sold, assets and net income, which are the GAAP financial measures most directly comparable to such non-GAAP measures, without unreasonable efforts due to the inherent difficulty and impracticality of quantifying certain amounts that would be required to calculate projected AISC, resources and EBITDA. In addition, the estimates of AISC, resources and EBITDA have been prepared by Kinross and are based on IFRS accounting standards and detailed information that the Company does not have access to at this time. These amounts that would require unreasonable effort to quantify could be significant, such that the amount of projected GAAP cost of goods sold, assets and net income would vary substantially from the amount of projected AISC, resources and EBITDA. 32 FORWARD DISCLOSURE SPECIFIC TO HIGHGOLD TRANSACTION This corporate presentation contains forward-looking statements and certain “forward-looking information” (within the meaning of Canadian securities legislation) regarding Contango, HighGold, the Transaction, the terms of the Transaction, the expected benefits of the Transaction, the completion of the Transaction, the timing of the Transaction, the development timeline of the Man Choh Project, expectations with respect to the development of the Johnson Tract Project post-Transaction, Contango’s growth plans post-Transaction and the continued cooperation of Contango with CIRI, that are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995, based on Contango and HighGold’s current expectations or assumptions as to the outcome and timing of such future events and includes statements regarding future results of operations, quality and nature of the asset base, the assumptions upon which estimates are based and other expectations, beliefs, plans, objectives, assumptions, strategies or statements about future events or performance (often, but not always, using words such as “expects”, “believes”, “targets”, “approximately”, “projects”, “anticipates”, “plans”, “estimates”, “potential”, “possible”, “probable”, or “intends”, or stating that certain actions, events or results “may”, “will”, “should”, or “could” be taken, occur or be achieved). Forward-looking statements are based on current expectations, estimates and projections that involve a number of risks and uncertainties, which could cause actual results to differ materially from those, reflected in the statements. These risks include, but are not limited to: risks related to the ability of the parties to close the Transaction; risks inherent to the exploration and mining industry (for example, operational risks in exploring for and, developing mineral reserves; risks and uncertainties involving geology; the speculative nature of the mining industry; the uncertainty of estimates and projections relating to future production, costs and expenses; the volatility of natural resources prices, including prices of gold and associated minerals; the existence and extent of commercially exploitable minerals in properties acquired by Contango or the Peak Gold JV; ability to realize the anticipated benefits of the Peak Gold JV and the Johnson Tract Project; potential delays or changes in plans with respect to exploration or development projects or capital expenditures; the interpretation of exploration results and the estimation of mineral resources; the loss of key employees or consultants; health, safety and environmental risks and risks related to weather and other natural disasters); uncertainties as to the availability and cost of financing; Contango’s inability to retain or maintain its relative ownership interest in the Peak Gold JV; inability to realize expected value from acquisitions; inability of our management team to execute its plans to meet its goals; the extent of disruptions caused by an outbreak of disease, such as the COVID-19 pandemic; and the possibility that government policies may change, political developments may occur or governmental approvals may be delayed or withheld, including as a result of presidential and congressional elections in the U.S. or the inability to obtain mining permits. Additional information on these and other factors which could affect Contango’s exploration program or financial results are included in Contango’s other reports on file with the U.S. Securities and Exchange Commission. Investors are cautioned that any forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from the projections in the forward-looking statements. Forward-looking statements are based on the estimates and opinions of management at the time the statements are made. Contango does not assume any obligation to update forward-looking statements should circumstances or management’s estimates or opinions change.

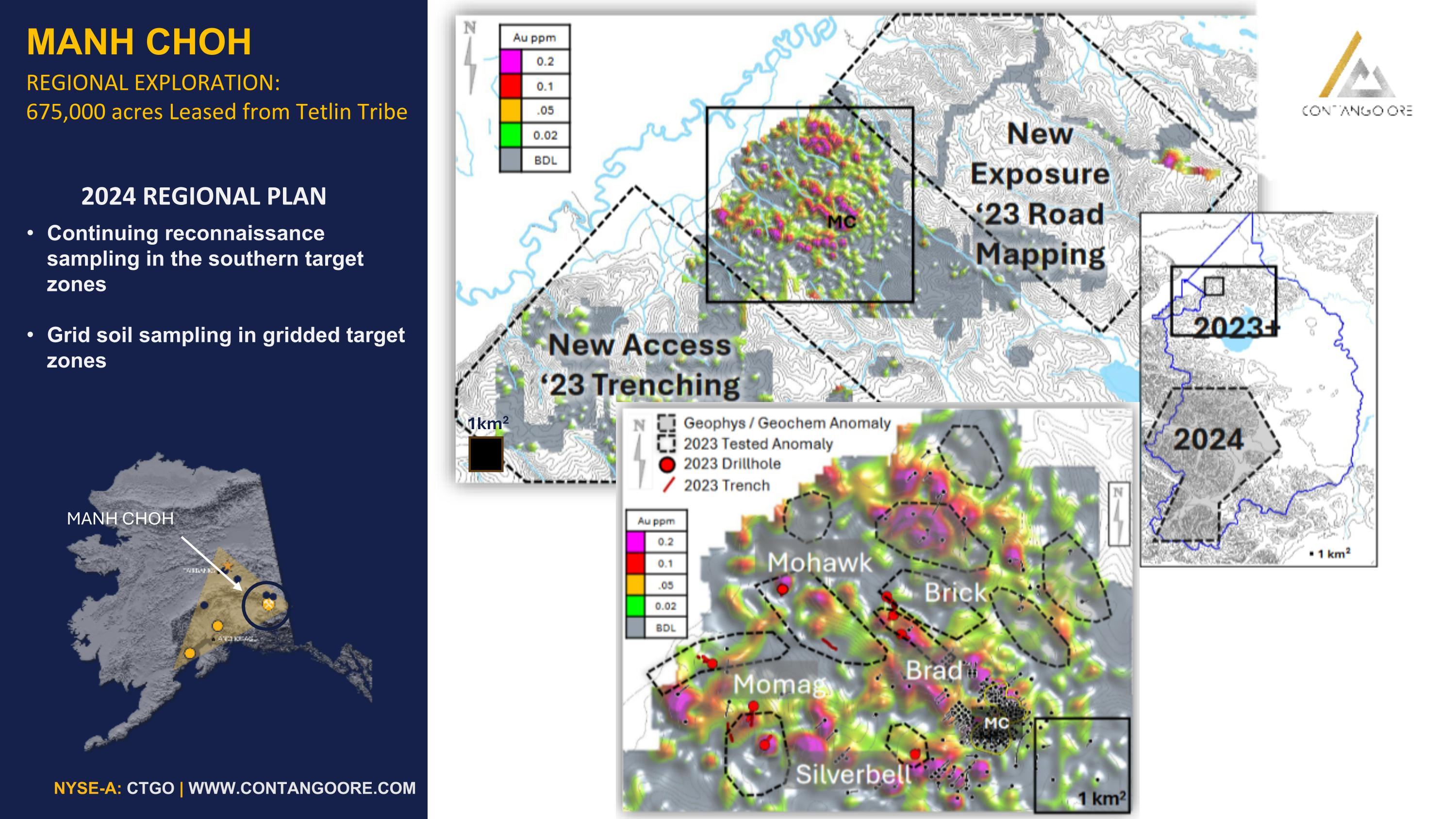

MANH CHOH REGIONAL EXPLORATION: 675,000 acres Leased from Tetlin Tribe Continuing reconnaissance sampling in the southern target zones Grid soil sampling in gridded target zones 2024 REGIONAL PLAN MANH CHOH 1km2

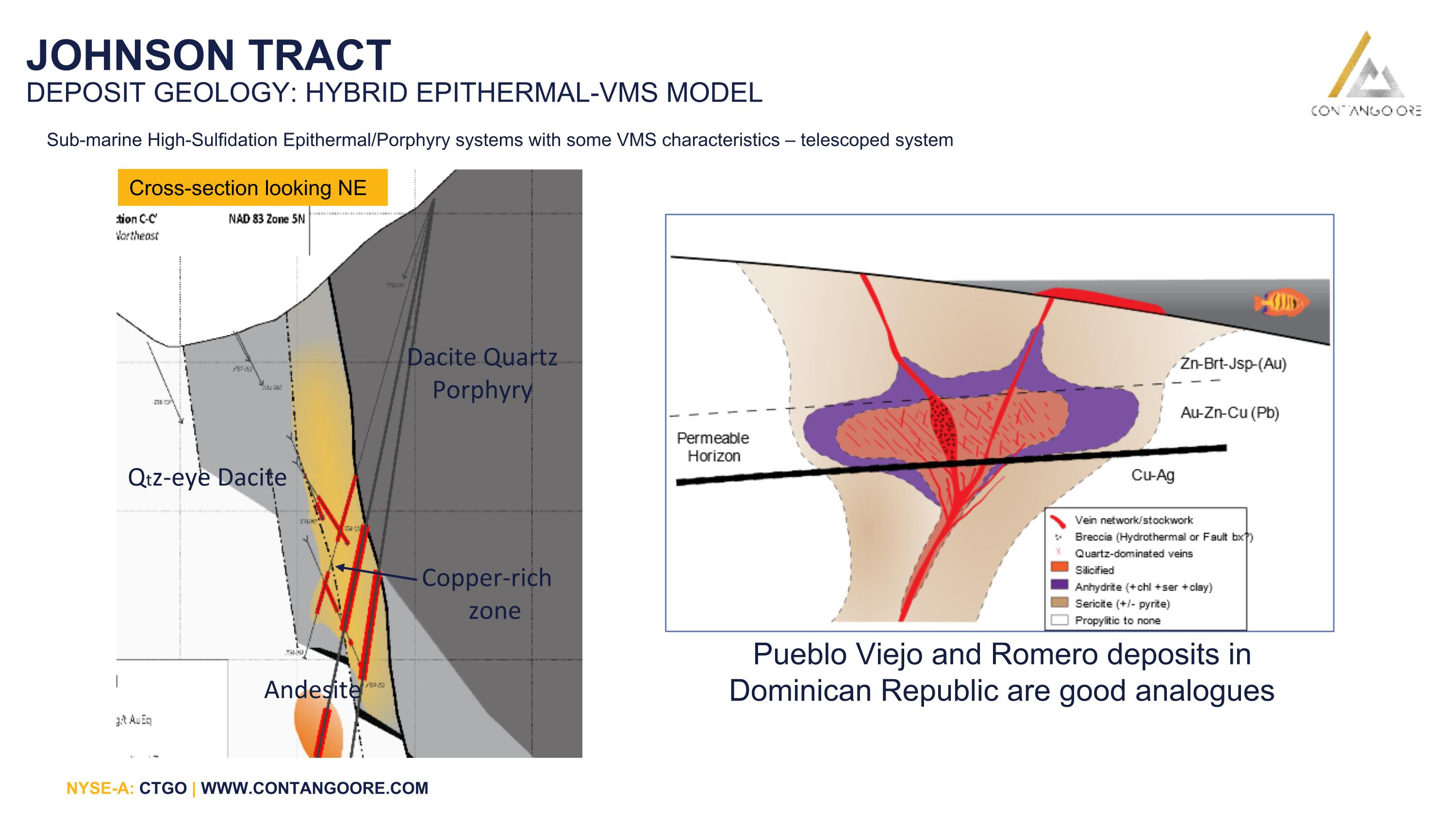

JOHNSON TRACT DEPOSIT GEOLOGY: HYBRID EPITHERMAL-VMS MODEL Pueblo Viejo and Romero deposits in Dominican Republic are good analogues Sub-marine High-Sulfidation Epithermal/Porphyry systems with some VMS characteristics – telescoped system Dacite Quartz Porphyry Qtz-eye Dacite Andesite Cross-section looking NE Copper-rich zone

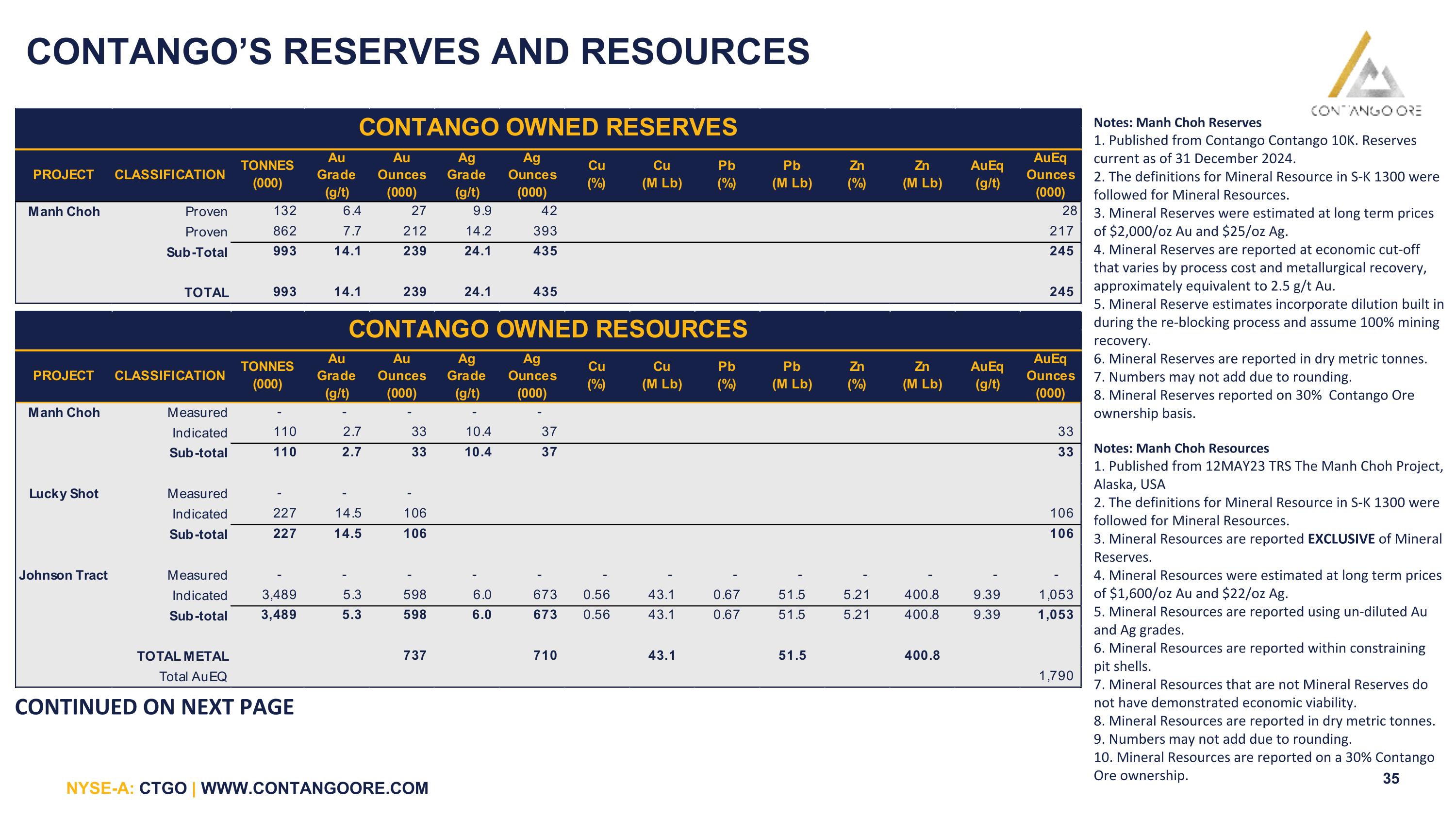

CONTANGO’S RESERVES AND RESOURCES CONTINUED ON NEXT PAGE Notes: Manh Choh Reserves 1. Published from Contango Contango 10K. Reserves current as of 31 December 2024. 2. The definitions for Mineral Resource in S-K 1300 were followed for Mineral Resources. 3. Mineral Reserves were estimated at long term prices of $2,000/oz Au and $25/oz Ag. 4. Mineral Reserves are reported at economic cut-off that varies by process cost and metallurgical recovery, approximately equivalent to 2.5 g/t Au. 5. Mineral Reserve estimates incorporate dilution built in during the re-blocking process and assume 100% mining recovery. 6. Mineral Reserves are reported in dry metric tonnes. 7. Numbers may not add due to rounding. 8. Mineral Reserves reported on 30% Contango Ore ownership basis. Notes: Manh Choh Resources 1. Published from 12MAY23 TRS The Manh Choh Project, Alaska, USA 2. The definitions for Mineral Resource in S-K 1300 were followed for Mineral Resources. 3. Mineral Resources are reported EXCLUSIVE of Mineral Reserves. 4. Mineral Resources were estimated at long term prices of $1,600/oz Au and $22/oz Ag. 5. Mineral Resources are reported using un-diluted Au and Ag grades. 6. Mineral Resources are reported within constraining pit shells. 7. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. 8. Mineral Resources are reported in dry metric tonnes. 9. Numbers may not add due to rounding. 10. Mineral Resources are reported on a 30% Contango Ore ownership.

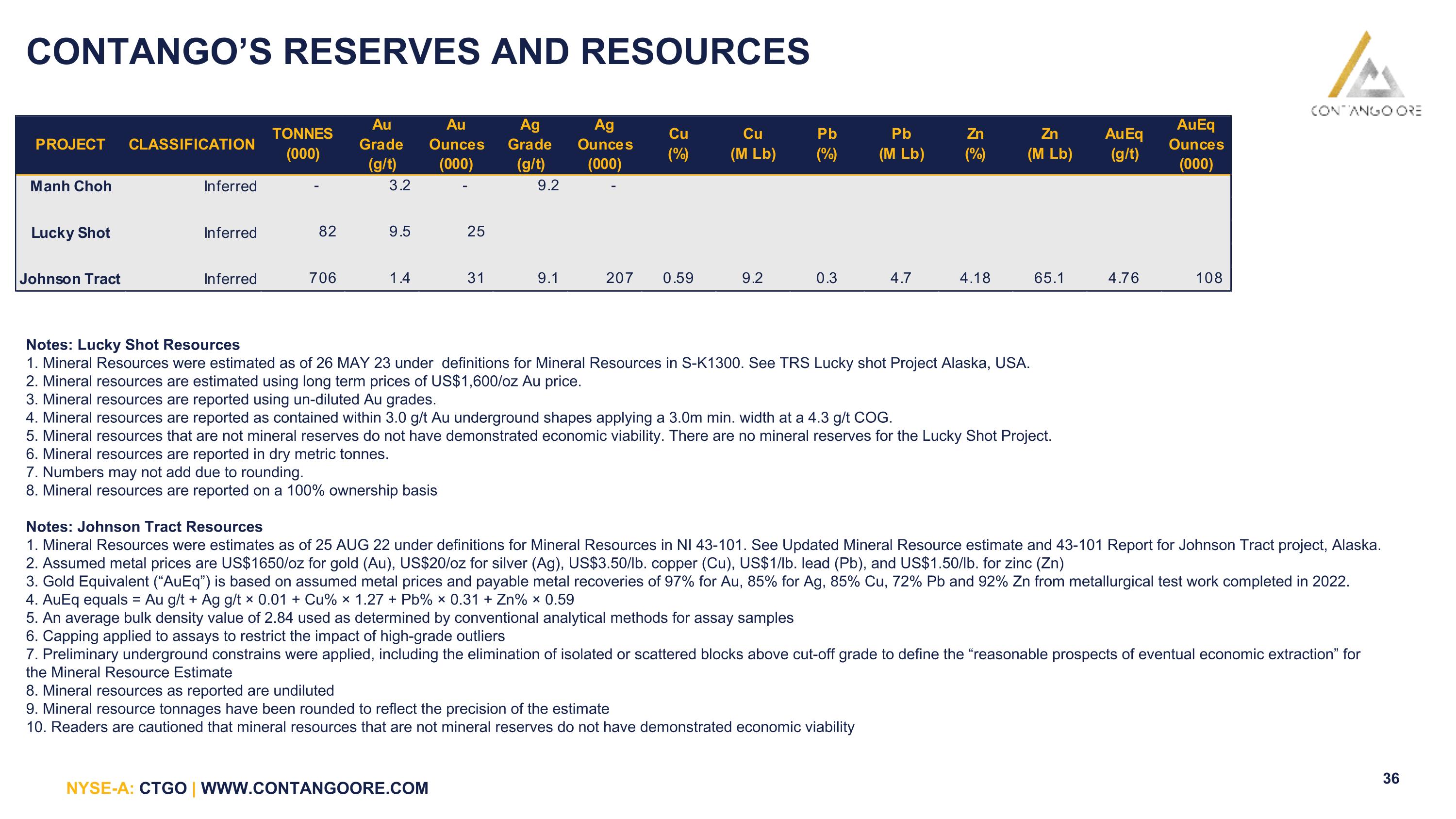

CONTANGO’S RESERVES AND RESOURCES Notes: Lucky Shot Resources 1. Mineral Resources were estimated as of 26 MAY 23 under definitions for Mineral Resources in S-K1300. See TRS Lucky shot Project Alaska, USA. 2. Mineral resources are estimated using long term prices of US$1,600/oz Au price. 3. Mineral resources are reported using un-diluted Au grades. 4. Mineral resources are reported as contained within 3.0 g/t Au underground shapes applying a 3.0m min. width at a 4.3 g/t COG. 5. Mineral resources that are not mineral reserves do not have demonstrated economic viability. There are no mineral reserves for the Lucky Shot Project. 6. Mineral resources are reported in dry metric tonnes. 7. Numbers may not add due to rounding. 8. Mineral resources are reported on a 100% ownership basis Notes: Johnson Tract Resources 1. Mineral Resources were estimates as of 25 AUG 22 under definitions for Mineral Resources in NI 43-101. See Updated Mineral Resource estimate and 43-101 Report for Johnson Tract project, Alaska. 2. Assumed metal prices are US$1650/oz for gold (Au), US$20/oz for silver (Ag), US$3.50/lb. copper (Cu), US$1/lb. lead (Pb), and US$1.50/lb. for zinc (Zn) 3. Gold Equivalent (“AuEq”) is based on assumed metal prices and payable metal recoveries of 97% for Au, 85% for Ag, 85% Cu, 72% Pb and 92% Zn from metallurgical test work completed in 2022. 4. AuEq equals = Au g/t + Ag g/t × 0.01 + Cu% × 1.27 + Pb% × 0.31 + Zn% × 0.59 5. An average bulk density value of 2.84 used as determined by conventional analytical methods for assay samples 6. Capping applied to assays to restrict the impact of high-grade outliers 7. Preliminary underground constrains were applied, including the elimination of isolated or scattered blocks above cut-off grade to define the “reasonable prospects of eventual economic extraction” for the Mineral Resource Estimate 8. Mineral resources as reported are undiluted 9. Mineral resource tonnages have been rounded to reflect the precision of the estimate 10. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability

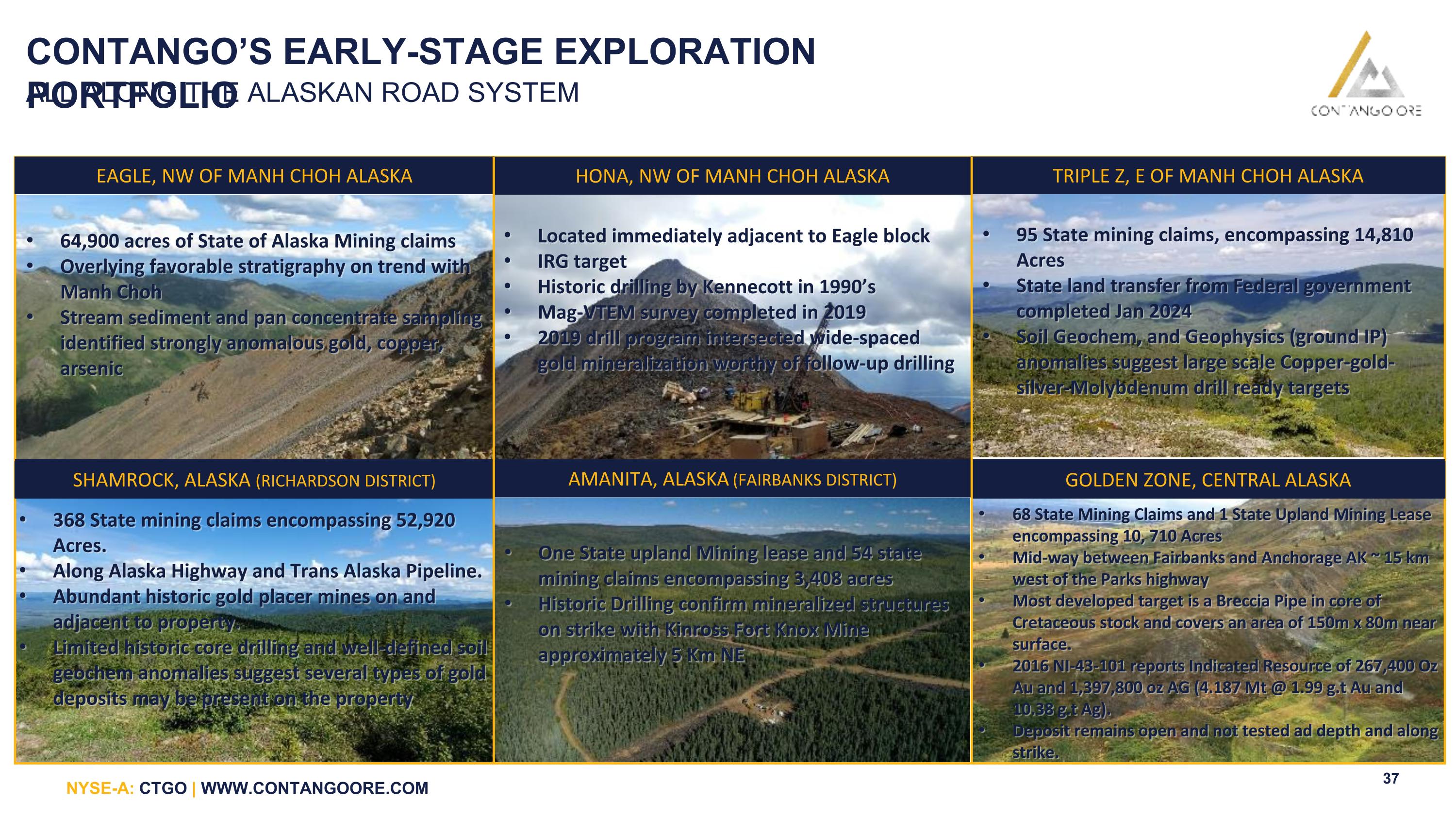

CONTANGO’S EARLY-STAGE EXPLORATION PORTFOLIO ALL ALONG THE ALASKAN ROAD SYSTEM EAGLE, NW OF MANH CHOH ALASKA HONA, NW OF MANH CHOH ALASKA TRIPLE Z, E OF MANH CHOH ALASKA SHAMROCK, ALASKA (RICHARDSON DISTRICT) AMANITA, ALASKA (FAIRBANKS DISTRICT) GOLDEN ZONE, CENTRAL ALASKA 64,900 acres of State of Alaska Mining claims Overlying favorable stratigraphy on trend with Manh Choh Stream sediment and pan concentrate sampling identified strongly anomalous gold, copper, arsenic Located immediately adjacent to Eagle block IRG target Historic drilling by Kennecott in 1990’s Mag-VTEM survey completed in 2019 2019 drill program intersected wide-spaced gold mineralization worthy of follow-up drilling 95 State mining claims, encompassing 14,810 Acres State land transfer from Federal government completed Jan 2024 Soil Geochem, and Geophysics (ground IP) anomalies suggest large scale Copper-gold-silver-Molybdenum drill ready targets 368 State mining claims encompassing 52,920 Acres. Along Alaska Highway and Trans Alaska Pipeline. Abundant historic gold placer mines on and adjacent to property. Limited historic core drilling and well-defined soil geochem anomalies suggest several types of gold deposits may be present on the property One State upland Mining lease and 54 state mining claims encompassing 3,408 acres Historic Drilling confirm mineralized structures on strike with Kinross Fort Knox Mine approximately 5 Km NE 68 State Mining Claims and 1 State Upland Mining Lease encompassing 10, 710 Acres Mid-way between Fairbanks and Anchorage AK ~ 15 km west of the Parks highway Most developed target is a Breccia Pipe in core of Cretaceous stock and covers an area of 150m x 80m near surface. 2016 NI-43-101 reports Indicated Resource of 267,400 Oz Au and 1,397,800 oz AG (4.187 Mt @ 1.99 g.t Au and 10.38 g.t Ag). Deposit remains open and not tested ad depth and along strike.

CONTANGO MANAGEMENT Mr. Van Nieuwenhuyse was appointed to serve as President, Chief Executive Officer, and director of the Company effective January 6, 2020. He previously served as President and Chief Executive Officer of Trilogy Metals Inc. from January 2012 until December 2019. Between May 1999 and January of 2012, he served as the President and Chief Executive Officer of NOVAGOLD, Inc, a company that he founded. He served as the Vice President of Exploration for Placer Dome from 1990 to 1997. Mr. Van Nieuwenhuyse holds a Candidature degree in Science from Université de Louvain, Belgium and a Master of Science degree in Geology from the University of Arizona. Mr. Van Nieuwenhuyse currently serves on the board of directors of Alexco Resource Corp. He served on the board of directors of Sandfire Resources America, Inc. (formerly, Tintina Resources Inc.) from 2008 until 2016. Mr. Van Nieuwenhuyse has over forty years of experience in the minerals mining industry and brings significant industry and technical knowledge to the Company. Rick Van Nieuwenhuyse PRESIDENT & CEO Mr. Clark was appointed to serve as Executive Vice President - Finance of the Company, effective July 11, 2023. He was then appointed as Chief Financial Officer & Corporate Secretary, effective January 1, 2024. He previously served as Chief Financial Officer and Corporate Secretary for Alexco Resource Corp. from December 2014 to September 2022 at which time Alexco Resource Corp was acquired by Hecla Mining Company. Between 2010 and 2014, Mr. Clark served as Chief Financial Officer of Goldgroup Mining Inc. and from 2007 to 2010 Mr. Clark served as Chief Financial Officer for the Grosso Group and its member companies. Mr. Clark received an undergraduate degree from the British Columbia Institute of Technology and is a Canadian Qualified Chartered Professional Accountant. Between 2016 and 2020, Mr. Clark also served on the Board of Trustees for the Burnaby Hospital Foundation as Chair of the Finance Committee. Mike Clark CHIEF FINANCIAL OFFICER Mr. Derek Meneghin assumed the role of Director of Finance for Contango Ore in October 2023, bringing a wealth of financial leadership to the organization including a robust background in the mining and exploration sector. Mr. Meneghin has been involved in various stages of the mine life, from exploration and permitting to construction and operations. Prior to his current position, Mr. Meneghin has held key roles, including his tenure at Hecla Mining, where he was the Site Controller for the Keno Hill Mine. His journey includes extensive experience in financial and operational reporting, evolving into a strategic financial professional with a specialized focus on the unique challenges inherent in the minerals mining industry. Mr. Meneghin is a Chartered Professional Accountant, Certified General Accountant and holds a Bachelor of Business Administration from Simon Fraser University. Derek Meneghin DIRECTOR OF FINANCE

CONTANGO DIRECTORS Co-founder of Contango Ore Chairman since 2013 Sole Manager of Juneau Exploration – a company involved in the exploration and production of oil and natural gas Petroleum Engineer with years of experience at Zilkha Energy Company, Texas International Company, Enserch Corporation, Contango Oil & Gas, Talos Energy BSc in Petroleum Engineering from Louisiana State University Brad Juneau CHAIRMAN Joeseph Compofelice DIRECTOR Curtis Freeman DIRECTOR Rick Van Nieuwenhuyse PRESIDENT & CEO Darwin Green DIRECTOR Richard Shortz DIRECTOR President & CEO of Contango Ore Founder of NovaGold, currently permitting the 40Moz Au Donlin Gold Project Founder of Trilogy Metals, currently developing the Arctic Deposit with South32 Winner of the 2015 Colin Spence award for Excellence in Mineral Exploration from AMEBC Winner of the 2009 Thayer Lindsley Award from the PDAC for the Donlin Gold Discovery Candidature Degree in Science from Universite de Louvain, Belgium and a MSc in Geology from University of Arizona President & CEO of HighGold Mining prior to the acquisition by Contango Ore Executive Chairman of Onyx Gold Corp Previously served as VP Exploration for Constantine Metals Awarded the Commissioner’s Award for Project Excellence by the State of Alaska for overseeing the underground development program at the Niblack deposit BSc from University of British Columbia and an MSc in Economic Geology from Carleton University US Certified Professional Geologist licensed in the State of Alaska Formed Avalon Development Corp in 1985 – a geologic exploration services company responsible for the discovery of the Manh Choh deposit now in production Founding Director of Tectonic Metals Inc, Valhalla Metals Inc and is on the Technical Advisory Boards of Metallic Minerals, Group Ten Metals, and Granite Creek Copper BSc at College of Wooster in Ohio and a MSc at University of Alaska - Fairbanks Retired partner of White Deer Energy – an energy focused private equity fund Retired Chairman and CEO of Axios Industrial Group Previously served as Chairman of the Board and CEO of Trico Marin Service, CEO of Aquilex Service Corp, CompX International, CFO of NL Industries, Titanium Metals Corp, and Tremont Corp. BSc at California State University at Los Angeles and a MBA at Pepperdine University President & CEO of Pavia Capital LLP – a family office investment company Previously served as Partner of Morgan, Lewis & Bockius LLP and Jones Day Reavis & Pogue LLP Previously was an executive at Tosco Corporation and Senior VP, General Counsel BSc in Accounting from Indiana University and a Juris Doctor degree from Harvard Law School

MEET THE CONTANGO TEAM Chris Kennedy General Manager – Lucky Shot Mine Dave Larimer Exploration Manager Nathan Steeves Johnson Tract Chief Geologist Allegra Cairns Environment and Permitting Manager Alina Wyatt Lands and Database Manager Vanessa Larimer Community Affairs & Operations Manager Shayne Price Johnson Tract Project Manager Kei Quinn Senior Geologist Keith Miles Mine Superintendent – Lucky Shot Mine Jessica Roberts Geologist Mu Li Geologist & Database

v3.25.1

Document And Entity Information

|

Mar. 17, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 17, 2025

|

| Entity Registrant Name |

Contango Ore, Inc.

|

| Entity Central Index Key |

0001502377

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-35770

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

27-3431051

|

| Entity Address, Address Line One |

516 2nd Avenue

|

| Entity Address, Address Line Two |

Suite 401

|

| Entity Address, City or Town |

Fairbanks

|

| Entity Address, State or Province |

AK

|

| Entity Address, Postal Zip Code |

99701

|

| City Area Code |

(907)

|

| Local Phone Number |

888-4273

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, Par Value $0.01 per share

|

| Trading Symbol |

CTGO

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Grafico Azioni Contango Ore (AMEX:CTGO)

Storico

Da Mar 2025 a Mar 2025

Grafico Azioni Contango Ore (AMEX:CTGO)

Storico

Da Mar 2024 a Mar 2025