UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☒ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material under Rule 14a-12 |

HOUSTON

AMERICAN ENERGY CORP.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☐ |

Fees

paid previously with preliminary materials |

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

HOUSTON

AMERICAN ENERGY CORP.

801

Travis St., Suite 1425

Houston,

Texas 77002

March __, 2025

Dear

Stockholder:

We

cordially invite you to attend a special meeting of stockholders of Houston American Energy Corp. (“HUSA”, the “Company”,

“we”, “us”, or “our”), which will be held virtually at 10:00 am Central Daylight Time on March 26,

2025. There will not be a physical meeting location. The virtual meeting url is www.virtualshareholdermeeting.com/HUSA2025SM.

Stockholders as of the record date may participate in the meeting online, vote, or submit questions by visiting the meeting website and

logging in with the control number on their proxy card or voting instruction form.

The

board of directors of HUSA (the “Board”) has approved a Share Exchange Agreement dated as of February 20, 2025 (as amended

from time to time, the “Share Exchange Agreement”) by and among HUSA, Abundia Financial, LLC, a Delaware limited liability

company (“Abundia Financial”), and Bower Family Holdings, LLC, a North Carolina limited liability company (“BFH”,

and together with Abundia Financial, the “AGIG Unitholders”). The AGIG Unitholders are the record and beneficial owners of

all the issued and outstanding units of Abundia Global Impact Group, LLC, a Delaware limited liability company (“AGIG”).

Under the terms of the Share Exchange Agreement, HUSA will acquire all of the outstanding units of AGIG in exchange for their pro rata

portion of a number of shares of common stock, par value $0.001 per share, of HUSA (the “Common Stock”) equal to 94% of all

the issued and outstanding common stock of HUSA at the time of the closing of the Share Exchange Agreement (the “Share Exchange”).

Based on the number of shares of Common Stock outstanding as of February 27, 2025, the Share Exchange would require the issuance of 245,755,684

shares of Common Stock. The Share Exchange is subject to customary closing conditions, including the condition that our stockholders

approve the Share Exchange Agreement.

In

addition, pursuant to the Share Exchange Agreement, we are also seeking approval of stockholders to amend and restate HUSA’s

Amended and Restated Certificate of Incorporation to conduct a reverse split of Common Stock as required to meet the NYSE American

listing standards and increase the amount of our authorized Common Stock to 300,000,000 shares to facilitate the Share

Exchange.

We

will hold the special meeting of the stockholders to vote on these matters. The Board also asks that you approve a proposal to approve

an adjournment of the special meeting, if necessary, to solicit additional proxies in favor of the foregoing proposals. Please refer

to the enclosed proxy statement for detailed information on the proposals and other important information about HUSA, AGIG, and the Share

Exchange.

We

hope you will be able to attend the special meeting, but we understand that not every stockholder will be able to do so. Whether or not

you plan to attend, please complete, sign and return your proxy, or vote by telephone or via the Internet according to the instructions

on the proxy card, so that your shares will be voted at the special meeting.

| |

Sincerely, |

| |

|

| |

STEPHEN HARTZELL |

| |

Chairman of the Board |

HOUSTON

AMERICAN ENERGY CORP.

801

Travis St., Suite 1425

Houston,

Texas 77002

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

March __, 2025

Dear

Stockholder:

Please

join us for the special meeting of stockholders (the “special meeting”) of Houston American Energy Corp.

(“HUSA” or the “Company”), which will be held virtually at 10:00 am Central Daylight Time on March 26, 2025.

There will not be a physical meeting location. The virtual meeting url is www.virtualshareholdermeeting.com/HUSA2025SM.

Stockholders as of the record date may participate in the meeting online, vote, or submit questions by visiting the meeting website

and logging in with the control number on their proxy card or voting instruction form. We encourage you to join us and participate

online. We recommend that you log in a few minutes before 10:00 am, Central Daylight Time, on March 26, 2025 to ensure you are

logged in when the special meeting starts. You will not be able to attend the special meeting in person.

The

purposes of the special meeting are:

| |

1. |

To

approve, in accordance with Sections 712 and 713 of the Rules of the NYSE American LLC Company Guide, the issuance of a number of

shares of common stock, par value $0.001 per share, of HUSA (the “Common Stock”) equal to 94% of all the issued and outstanding

common stock of HUSA at the time of the closing under that certain Share Exchange Agreement dated as of February 20, 2025 (as amended

from time to time, the “Share Exchange Agreement”), by and among HUSA, Abundia Financial, LLC, a Delaware limited liability

company, (“Abundia Financial”) and Bower Family Holdings, LLC, a North Carolina limited liability company (“BFH”

and, together with Abundia Financial, the “AGIG Unitholders”)(such proposal, the “Issuance Proposal”); |

| |

|

|

| |

2. |

To

approve and adopt an amendment to the certificate of incorporation of HUSA (as amended, the “Charter”), to effect a reverse

stock split of all of the outstanding shares of Common Stock, at a ratio in the range of 1-for-5 to 1-for-60, with such ratio

to be determined by the Board of Directors of HUSA (the “Board”, and such proposal, the “Reverse Stock Split Proposal”);

|

| |

3. |

To

approve and adopt an amendment to the Charter to increase the number of authorized shares of Common Stock that may

be issued from 20,000,000 to 300,000,000 (the “Share Increase Proposal”); and |

| |

|

|

| |

4. |

To approve the adjournment

of the special meeting, to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies

if there are insufficient votes at the time of the special meeting to approve the Reverse Stock Split Proposal, the Issuance Proposal,

or the Share Increase Proposal (the “Adjournment Proposal”). |

These

items of business are more fully described in this proxy statement.

The

Board has approved the Share Exchange Agreement and the other agreements and transactions contemplated by the Share Exchange Agreement

and determined that the Share Exchange Agreement and the other agreements and transactions contemplated by the Share Exchange Agreement,

are advisable and in the best interests of HUSA and its stockholders and unanimously recommends that HUSA stockholders vote “FOR”

the adoption and approval of the Issuance Proposal and “FOR” each of the other proposals listed above, including the

Adjournment Proposal, if necessary, to solicit additional proxies in favor of the Issuance

Proposal or other proposals.

Only

stockholders of record at the close of business on February 25, 2025 will be entitled to vote at the special meeting and any and all

adjourned sessions thereof. Our stock transfer books will remain open.

Your

vote is very important. To ensure that your vote is recorded promptly and to avoid the unnecessary waste of company resources seeking

stockholder votes, PLEASE VOTE YOUR SHARES as soon as possible. If you are a stockholder of record, please complete, sign and

mail the proxy card in the enclosed postage-paid envelope. If your shares are held in “street name”, that is held for your

account by a broker or other nominee, you will receive instructions from the holder of record that you must follow for your shares to

be voted.

In

the event of a change in the time, date or meeting website of the special meeting, we will make an announcement, issue a press release

or post information on the Investors Overview section of our website at www.houstonamerican.com to notify stockholders, as appropriate.

Information on or accessible through our website is not incorporated by reference in this proxy statement.

THE

BOARD UNANIMOUSLY RECOMMENDS THAT HUSA STOCKHOLDERS APPROVE THE ISSUANCE PROPOSAL, THE REVERSE STOCK SPLIT PROPOSAL, THE SHARE INCREASE

PROPOSAL, AND THE ADJOURNMENT PROPOSAL.

| |

By Order of the Board of Directors, |

| |

|

| |

STEPHEN HARTZELL |

| |

Chairman |

TABLE

OF CONTENTS

HOUSTON

AMERICAN ENERGY CORP.

801

Travis St., Suite 1425

Houston,

Texas 77002

PROXY

STATEMENT

The

Board of Directors (the “Board”) of Houston American Energy Corp. (“HUSA” or the “Company”)

is soliciting your proxies to be voted at the special meeting of stockholders to be held virtually on March 26, 2025 at 10:00 am Central

Daylight Time (the “special meeting”) and at any and all adjourned sessions of the special meeting. There will not be a physical

meeting location. The virtual meeting url is www.virtualshareholdermeeting.com/HUSA2025SM. Stockholders as of the record date

may participate in the meeting online, vote, or submit questions by visiting the meeting website and logging in with the control number

on their proxy card or voting instruction form.

We

are mailing this notice and proxy statement (including the form of proxy) to our stockholders on or about March 11, 2025.

Record

Date and Quorum Requirements

Only

stockholders of record at the close of business on February 25, 2025 (the “record date”) will be entitled to vote at the

special meeting. The list of HUSA stockholders entitled to vote at the special meeting will be available at HUSA’s headquarters

during regular business hours for examination by any HUSA stockholder for any purpose germane to the special meeting for a period of

at least ten days prior to the special meeting. The holders of more than one-third of HUSA’s common stock, par value $0.001 per

share (the “Common Stock”), issued and outstanding and entitled to vote on the record date must be present online (by

remote communication) or by proxy to have a quorum for the transaction of business at the special meeting. Shares of Common Stock

represented by proxy (includes shares which abstain, withhold the vote or do not vote with respect to one or more of the matters presented

for stockholder approval) will be counted for purposes of determining whether a quorum exists for a matter presented at the special meeting.

At the close of business on February 25, 2025, we had 15,686,533 shares of Common Stock issued and outstanding. Each share of

Common Stock is entitled to one vote.

Items

to be Voted Upon, Voting Your Shares and Votes Required

Stockholders

will be voting upon four matters as well as any other business that may properly come before the meeting. The specific items to be voted

on are:

PROPOSAL |

|

BOARD

RECOMMENDATION |

|

PAGE

REFERENCE |

| Proposal

1: To approve, in accordance with Sections 712 and 713 of the Rules of the NYSE American LLC Company Guide, the issuance of a

number of shares of Common Stock equal to 94% of all the issued and outstanding Common Stock of HUSA at the time of

the closing under the Share Exchange Agreement (the “Issuance Proposal”); |

|

☑ FOR |

|

Page 42 |

| Proposal

2: To approve and adopt an amendment to the Company’s Certificate of Incorporation (the “Charter”), substantially

in the form appended hereto as Annex A (the “Reverse Stock Split Amendment”), to effect a reverse stock split

of all of the outstanding shares of Common Stock at a ratio in the range of 1-for-5 to 1-for-60, with such ratio to be determined

by the Board (the “Reverse Stock Split Proposal”). |

|

☑

FOR |

|

Page

93 |

| Proposal 3: To approve and adopt an amendment

to the Charter to increase the number of authorized shares of Common Stock that may be issued from 20,000,000 to 300,000,000 (the

“Share Increase Proposal”). |

|

☑

FOR |

|

Page

99 |

| Proposal 4: To approve the adjournment of the

special meeting, to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies if there

are insufficient votes at the time of the special meeting to approve the Issuance Proposal, the Reverse Stock Split Proposal, or

the Share Increase Proposal (the “Adjournment Proposal”). |

|

☑

FOR |

|

Page

101 |

The

Issuance Proposal, Reverse Stock Split Proposal, Share Increase Proposal, and Adjournment Proposal (collectively, the “Proposals”)

are further described in this proxy statement, which we encourage you to read in its entirety before voting. Only holders

of record of Common Stock at the close of business on February 25, 2025 are entitled to notice of the special meeting and to vote and

have their votes counted at the special meeting and any adjournments or postponements of the special meeting. A complete list of HUSA

stockholders of record entitled to vote at the special meeting will be available for ten days before the special meeting at the principal

executive offices of HUSA for inspection by stockholders during ordinary business hours for any purpose germane to the special meeting.

The

Board unanimously recommends that HUSA stockholders vote “FOR” each of the Proposals.

The

existence of any financial and personal interests of one or more of HUSA’s directors may be argued to result in a conflict of interest

on the part of such director(s) between what he, she, or they may believe is in the best interests of HUSA and its stockholders and what

he, she, or they may believe is best for himself, herself, or themselves in determining to recommend that stockholders vote for the Proposals.

See the section entitled “Interests of HUSA Directors and Executive Officers in the AGIG Transaction” in this proxy

statement for a further discussion of this issue

PLEASE

VOTE AS PROMPTLY AS POSSIBLE, WHETHER OR NOT YOU PLAN TO ATTEND THE SPECIAL MEETING. IF YOU LATER DESIRE TO REVOKE OR CHANGE YOUR PROXY

FOR ANY REASON, YOU MAY DO SO IN THE MANNER DESCRIBED IN THIS PROXY STATEMENT. FOR FURTHER INFORMATION CONCERNING THE PROPOSALS BEING

VOTED UPON, THE SHARE EXCHANGE AGREEMENT, USE OF THE PROXY AND OTHER RELATED MATTERS, YOU ARE URGED TO READ THIS PROXY STATEMENT.

Your

vote is very important. Assuming a quorum is present at the special meeting, (i) the Reverse Stock Proposal and the Share Increase Proposal

require the affirmative vote of the majority of the votes cast by the holders of Common Stock present at the special meeting,

or represented by proxy, and entitled to vote thereon and (ii) the other Proposals require the affirmative vote of the majority of Common

Stock present at the special meeting, or represented by proxy, and entitled to vote on the matter at the special meeting. If you do not

attend the special meeting, either online (by remote communication) or by proxy, to vote your shares, you will not have an impact

with respect to the Reverse Stock Proposal or the Share Increase Proposal. Whether or not you plan to attend the special meeting,

please vote by proxy over the internet or telephone using the instructions included with the accompanying proxy card, or promptly complete

your proxy card and return it in the enclosed postage-paid envelope, in order to authorize the individuals named on your proxy card to

vote your shares of Common Stock at the special meeting. If you hold your shares by a broker, bank, or other nominee (i.e., in “street

name”), you should receive instructions from your nominee which you must follow in order to vote your shares.

If

you do not provide voting instructions with respect to shares held in “street name”, your broker, bank, or other nominee

may vote your shares in its discretion with respect to routine, or discretionary, items but cannot vote your shares on non-discretionary

items. We expect that the Reverse Stock Split Proposal, the Share Increase Proposal and the Adjournment Proposal will be considered

routine and that your broker, bank, or other nominee may vote your shares with respect to such proposal even if you do not provide voting

instructions. We expect that the Issuance Proposal will be considered a non-discretionary matter and that your broker, bank or other

nominee will not be permitted to vote on such proposal unless you provide your broker with voting instructions on such proposal. Abstentions

and “broker non-votes” will have no effect on the voting on a proposal that requires the affirmative vote of a certain percentage

of the votes cast or shares voting on a proposal but will have the effect of a vote against proposals requiring the affirmative vote

of all shares entitled to vote. However, abstentions are considered to be present or represented in determining whether a quorum exists

on a given matter.

Submitting

Your Proxy

If

you complete and submit your proxy, the persons named as proxies will vote the shares represented by your proxy in accordance with your

instructions. If you submit a proxy card but do not fill out the voting instructions on the proxy card, the persons named as proxies

will vote the shares represented by your proxy as follows:

| |

● |

“FOR”

the Issuance Proposal; |

| |

|

|

| |

● |

“FOR”

the Reverse Stock Split Proposal; |

| |

|

|

| |

● |

“FOR”

the Share Increase Proposal; and |

| |

|

|

| |

● |

“FOR”

the Adjournment Proposal, if presented. |

To

ensure that your vote is recorded promptly, please vote as soon as possible. To vote by proxy, please complete, sign, and mail the proxy

card in the enclosed postage-paid envelope.

Stockholders

that attend the special meeting and wish to vote online (by remote communication) will be given the opportunity to vote. If you

want to vote shares that are held in “street name” or are otherwise not registered in your name, you will need to obtain

a “legal proxy” from the holder of record and present it at the special meeting.

Revoking

or Changing Your Proxy

You

may revoke or change your proxy at any time before it is voted. For a stockholder “of record”, meaning one whose shares are

registered in his or her own name, to revoke or change a proxy, the stockholder may submit another properly signed proxy, which bears

a later date; deliver a written revocation to the Company at our address; or attend the special meeting and vote virtually.

If

you are a beneficial owner of Common Stock, and not the stockholder of record (for example Common Stock is registered in “street

name” with a brokerage firm), you must follow the procedures required by the holder of record, which is usually a brokerage firm

or bank, to revoke or change a proxy. You should contact the stockholder of record directly for more information on these procedures.

Other

Information

We

will bear the expenses of soliciting proxies. Our officer and certain other employees, without additional remuneration, may solicit proxies

personally or by telephone, e-mail or other means. We may reimburse brokerage houses and other custodians, nominees, and fiduciaries

for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to stockholders.

Our

Annual Report on Form 10-K for the year ended December 31, 2024, which is not delivered with these proxy soliciting materials but can

be obtained via our website at www.houstonamerican.com or at www.sec.gov, is incorporated by reference with this Proxy Statement.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

table below shows the number of our shares of Common Stock beneficially owned as of February 25, 2025 by:

| |

● |

each person

or group known by us to beneficially own more than 5% of our outstanding Common Stock; |

| |

● |

the Chief Executive

Officer; and |

| |

● |

all of our

current directors and executive officers of the company as a group. |

The

number of shares beneficially owned by each 5% holder, director, or executive officer is determined by the rules of the SEC, and the

information does not necessarily indicate beneficial ownership for any other purpose. Under such rules, beneficial ownership includes

any shares over which the person or entity has sole or shared voting power or investment power and also any shares that the person or

entity can acquire within 60 days of February 25, 2025 through the exercise of any stock option or other right. For purposes of computing

the percentage of outstanding shares of Common Stock held by each person or entity, any shares that the person or entity has the right

to acquire within 60 days after February 25, 2025 are deemed to be outstanding with respect to such person or entity but are not deemed

to be outstanding for the purpose of computing the percentage of ownership of any other person or entity. Unless otherwise indicated,

each person or entity has sole investment and voting power (or shares such power with his or her spouse) over the shares set forth in

the following table. The inclusion in the table below of any shares deemed beneficially owned does not constitute an admission of beneficial

ownership of those shares. As of February 25, 2025, there were 15,686,533 shares of Common Stock issued and outstanding.

| Name and Address of Beneficial Owner | |

Shares of Common Stock Beneficially Owned | | |

Percentage of Common Stock Outstanding | |

| Bower Family Holdings, LLC (1) | |

| 2,180,180 | (4) | |

| 13.29 | % |

| 3i Management LLC(2) | |

| 1,300,000 | (5) | |

| 7.92 | % |

| John Terwilliger(3)* | |

| 1,100,000 | (6) | |

| 6.71 | % |

| Stephen Hartzell(3)** | |

| 120,000 | (7) | |

| † | |

| Keith Grimes(3)** | |

| 118,000 | (7) | |

| † | |

| Peter Longo(3)*** | |

| 42,161 | (8) | |

| † | |

| Robert Bailey(3)** | |

| 15,000 | (9) | |

| † | |

| All current directors and executive officers as a group (4 persons) | |

| 295,161 | (10) | |

| 1.80 | % |

| * |

Former CEO and director of our company |

| ** |

Director of our company |

| *** |

CEO and director of our company |

| † |

Less

than 1% of the shares of total Common Stock outstanding as of February 25, 2025. |

| (1) |

Address is 110 Kings Road, Kings Mountain, NC 28086.

|

| (2) |

Address is 2 Wooster Street, 2nd Floor, New York, NY

10013. |

| (3) |

Address is 801 Travis St., Suite 1425, Houston, Texas

77002. |

| (4) |

Information is based on a Schedule 13G filed by Bower

Family Holdings, LLC on November 18, 2024. All shares are of sole voting power and sole dispositive power. |

| (5) |

Information is based on

a Schedule 13G filed by (i) 3i, LP, a Delaware limited partnership (“3i”); (ii) 3i Management LLC, a Delaware limited

liability company (“3i Management”); and (iii) Maier Joshua Tarlow (“Mr. Tarlow”) on January 1, 2025. All

shares are of shared voting power and shared dispositive power. 3i is the beneficial owner of all of the shares and has the power

to dispose of and the power to vote the shares beneficially owned by it, which power may be exercised by 3i Management, the manager

and general partner of 3i. Mr. Tarlow, as the manager of 3i Management, has shared power to vote and/or dispose of the shares beneficially

owned by each of 3i and 3i Management. Therefore, Mr. Tarlow may be deemed to beneficially own the shares beneficially owned by 3i

and 3i Management, and 3i Management may be deemed to beneficially own the Shares beneficially owned by 3i. |

| (6) |

Includes (a) 380,000 shares issuable upon exercise

of stock options, and (b) 48,000 shares issuable upon exercise of warrants. |

| (7) |

Includes 116,000 shares issuable upon exercise of stock

options. |

| (8) |

Includes 42,161 shares issuable upon exercise of stock

options. |

| (9) |

Includes 15,000 shares issuable upon exercise of stock

options. |

| (10) |

Includes 289,161 shares issuable upon exercise of

stock options. |

REFERENCES

TO ADDITIONAL INFORMATION

This

proxy statement incorporates important business and financial information about HUSA from other documents that HUSA has filed with the

U.S. Securities and Exchange Commission (“SEC”) and that are not contained in and are instead incorporated by reference in

this proxy statement. For a list of documents incorporated by reference in this proxy statement, see “Where You Can Find More

Information.” This information is available for you, without charge, to review through the SEC’s website at www.sec.gov.

The

contents of the websites of the SEC, HUSA, AGIG, or any other entity are not incorporated in this proxy statement. The information

about how you can obtain certain documents that are incorporated by reference in this proxy statement at these websites is being provided

only for your convenience.

FREQUENTLY

ASKED QUESTIONS

The

following questions and answers briefly address some questions that you, as a HUSA stockholder, may have regarding the matters being

considered at the special meeting. You are urged to carefully read this proxy statement and the other documents referred to in this proxy

statement in their entirety because this section may not provide all the information that is important to you regarding these matters.

See “Summary” for a summary of important information regarding the special meeting. Additional important information is contained

in the annexes to, and the documents incorporated by reference in, this proxy statement. You may obtain the information incorporated

by reference in this proxy statement, without charge, by following the instructions in the section titled “Where You Can Find More

Information.”

Why

am I receiving this proxy statement?

We

sent you this proxy statement because our Board is soliciting your proxy to vote at the special meeting that HUSA is holding to seek

stockholder approval on certain matters described in further detail herein. This proxy statement summarizes the information you need

to vote at the special meeting. You do not need to attend the special meeting to vote your shares.

What

is being voted on?

You

are being asked to vote on four proposals:

| |

1. |

To approve the issuance

of a number of shares of Common Stock equal to 94% of all the issued and outstanding Common Stock of HUSA at the time of the closing

under the Share Exchange Agreement; |

| |

2. |

To

approve and adopt the Reverse Stock Split Amendment, to effect a reverse stock split of all of the outstanding shares of Common Stock,

at a ratio in the range of 1-for-5 to 1-for-60, with such ratio to be determined by the Board; |

| |

|

|

| |

3. |

To approve and adopt an

amendment to the Charter to increase the number of authorized shares of Common Stock that may be issued from 20,000,000 to 300,000,000;

and |

| |

4. |

To approve the adjournment

of the special meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of

the special meeting to approve the Issuance Proposal, the Reverse Stock Split Proposal, or the Share Increase Proposal. |

When

are this proxy statement and the accompanying materials scheduled to be sent to stockholders?

On

or about March 11, 2025, we will begin mailing our proxy materials, including the Notice of the Special Meeting, this proxy statement,

and the accompanying proxy card or, for shares held in street name (i.e., shares held for your account by a broker or other nominee),

a voting instruction form.

When

and where will the special meeting take place?

The

special meeting will be held virtually via a live, webcast on March 26, 2025, beginning at 10:00 a.m., Central Daylight Time. There will

not be a physical meeting location. HUSA stockholders will be able to virtually attend and vote at the special meeting by visiting www.virtualshareholdermeeting.com/HUSA2025SM,

which is referred to as the “Special Meeting website.” In order to virtually attend and vote at the special meeting,

you will need the control number located on your proxy card or voting instruction form.

When

is the record date for the special meeting?

The

record date for determination of stockholders entitled to vote at the special meeting is the close of business on February 25, 2025.

Who

is entitled to vote at the special meeting?

HUSA

stockholders of record as of the close of business on the record date are entitled to attend and vote at the special meeting.

Does

my vote matter?

Yes,

your vote is very important, regardless of the number of shares that you own.

How

does the HUSA Board recommend that I vote at the special meeting?

The

HUSA Board unanimously recommends that HUSA stockholders vote “FOR” each of the Proposals.

What

is the purpose of the Share Exchange Agreement?

HUSA

and the AGIG Unitholders have agreed that HUSA will acquire AGIG from the AGIG Unitholders under the terms of a Share Exchange

Agreement. The Share Exchange Agreement provides that we will acquire all of the issued and outstanding shares of AGIG in exchange

for issuing to the AGIG Unitholders a number of shares equal to 94% of the issued and outstanding shares of

Common Stock of HUSA at the time of the closing of the Share Exchange Agreement, after taking into account issuance to the AGIG Unitholders.

Based on the number of shares of Common Stock outstanding as of February 27, 2025, the Share Exchange would require the issuance of 245,755,684

shares of Common Stock. The Share Exchange Agreement is attached to this proxy statement as Annex B, and is incorporated

into this proxy statement by reference. You are encouraged to read this proxy statement, and all the annexes hereto, in their

entirety.

Are

there risks involved in undertaking the Share Exchange?

Yes.

In evaluating the Share Exchange, you should carefully consider the factors discussed in “Risk Factors” of this proxy

statement and other information about AGIG and us included in this proxy statement and the documents incorporated by reference into this

proxy statement.

Why

should I vote for the Issuance Proposal?

Based

on a lengthy evaluation of possible acquisition transactions, and due diligence investigation of AGIG and the industry

in which it operates, including the financial and other information provided by AGIG, our Board believes that the Share Exchange will

provide HUSA stockholders with an opportunity to participate in the future growth potential of AGIG.

When

does HUSA expect to complete the Share Exchange?

We

are working to complete the Share Exchange as quickly as practicable. However, we cannot assure you when or if the Share Exchange will

be completed, even if the HUSA stockholders approve the Issuance Proposal. Completion of the Share Exchange is subject to satisfaction

or waiver of the conditions specified in the Share Exchange Agreement, including the approval of the HUSA stockholders. See “Conditions

to Closing” in this proxy statement. It is possible that factors outside of our control could result in the Share Exchange

being completed later than expected or not at all. Although the exact timing of the completion of the Share Exchange cannot be predicted

with certainty, we anticipate completing the Share Exchange in the second quarter of 2025. If the Share Exchange is not completed on

or before June 30, 2025, the Share Exchange Agreement may be terminated by the AGIG Unitholders or us.

What

is the Reverse Stock Split Amendment and why is it necessary?

If

the Reverse Stock Split Proposal is approved, then the Charter will be amended so that the outstanding shares of Common Stock will be

combined into a lesser number of shares to be determined by the Board and publicly announced by HUSA. We agreed to seek stockholder approval

for a reverse stock split in the Share Exchange Agreement to comply with the rules of the NYSE American LLC Company Guide (the “NYSE

American Rules”).

What

will happen to outstanding shares of Common Stock after the Reverse Stock Split?

If

the stockholders approve and the Board elects to effect the Reverse Stock Split Proposal then, except for adjustments that may result

from the treatment of fractional shares, each HUSA stockholder will hold the same percentage of outstanding common stock immediately

following the reverse stock split as such stockholder held immediately prior to the reverse stock split. The par value of the common

stock would remain unchanged at $0.001 per share.

Why

should I vote for the Reverse Stock Split Proposal?

The

Board believes that a reverse stock split is desirable for a number of reasons. We expect that a reverse stock split of Common Stock

will increase the per share market price, enabling the Common Stock to comply with NYSE American’s minimum share price listing

requirements, although we cannot assure that it will be able to do so. The Board intends to implement the reverse stock split at a ratio

of between and including 1-for-5 and 1-for-60.

What

is the Share Increase Proposal and why is it necessary?

The

purpose of the Share Increase Proposal is to amend our Charter to increase the number of shares of common stock that HUSA is authorized

to issue from 20,000,000 to 300,000,000 (without giving effect to the reverse stock split, if approved) so that we may issue the

shares of common stock as part of the Share Exchange. We agreed to ask HUSA stockholders to approve the Share Increase Proposal in the

Share Exchange Agreement.

As

of February 27, 2025, there were 15,686,533 shares of Common Stock issued and outstanding. If, as contemplated by the Share Exchange

Agreement, we issue the AGIG Unitholders 245,755,684 shares of Common Stock, there will be approximately 261,442,217 shares of Common

Stock outstanding. Therefore, it is necessary to increase the authorized amount of common stock to at least such amount. As the Board

believes it is important to ensure that we have sufficient shares of common stock available for other general corporate purposes, we

are seeking to amend the Charter to increase the number of shares of common stock that HUSA is authorized to issue to 300,000,000.

What

is the purpose of the Adjournment Proposal?

The

purpose of the Adjournment Proposal is to provide more time for us to solicit proxies in favor of the Issuance Proposal or the Reverse

Stock Split Proposal. In no event will we solicit proxies to adjourn the special meeting beyond the date by which we may properly do

so under Delaware law.

Why

should I vote for the Adjournment Proposal?

The

Adjournment Proposal allows the Board to submit a proposal to adjourn the special meeting to a later date or dates, if necessary, to

permit further solicitation of proxies in the event there are not sufficient votes at the time of the special meeting to approve the

Issuance Proposal or the Reverse Stock Split Proposal.

What

is a proxy?

A

proxy is your legal designation of another person or persons to vote on your behalf. By completing and returning the enclosed proxy card,

you are giving the person or persons designated in the proxy card the authority to vote your shares in the manner you indicate on your

proxy card.

How

many votes do I have at the special meeting?

Each

share of Common Stock is entitled to one vote on all matters to be voted on at the special meeting, and can be voted only if the record

owner is present to vote or is represented by proxy. The proxy card provided with this proxy statement indicates the number of shares

of Common Stock that you own and are entitled to vote at the special meeting.

What

constitutes a quorum for the special meeting?

A

quorum of HUSA’s stockholders at the special meeting is necessary to transact business. Under the HUSA by-laws, the holders of

more than one-third of Common Stock issued and outstanding and entitled to vote, represented online (by remote communication)

or by proxy, shall constitute a quorum for the transaction of business at the special meeting.

What

stockholder vote is required for the approval of each of the Proposals at the special meeting?

The

Reverse Stock Proposal and the Share Increase Proposal require the affirmative vote of the majority of the votes cast by the holders

of Common Stock present at the special meeting, or represented by proxy, and entitled to vote thereon. The other Proposals

require the affirmative vote of the majority of Common Stock present at the special meeting, or represented by proxy, and entitled to

vote on the matter at the special meeting.

If

I am a beneficial owner of shares of Common Stock, what happens if I don’t provide voting instructions? What is discretionary voting?

What is a broker non-vote?

If

you are a beneficial owner and you do not provide voting instructions to your broker, bank, or other holder of record holding shares

for you, your shares will not be voted with respect to any proposal for which your broker does not have discretionary authority to vote.

The NYSE American Rules determine whether proposals presented at stockholder meetings are “discretionary” or “non-discretionary.”

If a proposal is determined to be discretionary, your broker, bank, or other holder of record is permitted under the NYSE American Rules

to vote on the proposal without receiving voting instructions from you. If a proposal is determined to be non-discretionary, your broker,

bank, or other holder of record is not permitted under the NYSE American Rules to vote on the proposal without receiving voting instructions

from you.

A

“broker non-vote” occurs when a bank, broker, or other holder of record holding shares for a beneficial owner does not vote

on a non-discretionary proposal because the holder of record has not received voting instructions from the beneficial owner.

We

expect that the Reverse Stock Split Proposal, the Share Increase Proposal and Adjournment Proposal, if presented, will be considered

discretionary and that your broker, bank, or other nominee may vote your shares with respect to such proposal even if you do not provide

voting instructions. We expect that the Issuance Proposal will be considered a non-discretionary matter and that your broker, bank or

other nominee will not be permitted to vote on such proposal unless you provide your broker with voting instructions on such proposal.

Accordingly, if you are a beneficial owner and you do not provide voting instructions to your broker, bank, or other holder of record

holding shares for you, your shares may be voted with respect to any of the Proposals other than the Issuance Proposal. Broker non-votes

will have no effect on the outcome of the vote on the Issuance Proposal.

What

will happen if I fail to vote or abstain from voting on any of the Proposals at the special meeting?

Your

failure to vote your shares or your abstention from voting on the Issuance Proposal or the Adjournment Proposal, if presented, will have

the effect of a vote against such proposal because each such proposal requires the affirmative vote of the majority of all shares present

and entitled to vote. Your failure to vote or your abstention from voting on the Reverse Stock Split Proposal or the Share Increase Proposal

will not have any effect on the outcome of the vote thereon.

What

is the difference between holding shares as a stockholder of record and as a beneficial owner of shares held in “street name”?

If

your shares of Common Stock are registered directly in your name with our transfer agent, you are considered the stockholder of record

with respect to those shares. As the stockholder of record, you have the right to vote or to grant a proxy for your vote directly to

us, or to a third party, to vote at the special meeting.

If

your shares are held by a brokerage firm, bank, dealer, or other similar organization, trustee, or nominee, you are considered the beneficial

owner of shares held in “street name,” and your brokerage firm, bank, dealer, or other similar organization, trustee, or

nominee is considered the stockholder of record with respect to those shares. Your brokerage firm, bank, dealer, or other similar organization,

trustee, or nominee will send you, as the beneficial owner, a package describing the procedure for voting your shares. You should follow

the instructions provided by them to vote your shares. You will only be able vote your shares online (by remote communication)

at the special meeting if you obtain a legal proxy from your brokerage firm, bank, dealer, or other similar organization, trustee, or

nominee. Your brokerage firm, bank, dealer or other similar organization, trustee, or nominee is not permitted to vote on the Issuance

Proposal unless you provide your broker with voting instructions on such proposal. We expect that your brokerage firm, bank, dealer or

other similar organization, trustee, or nominee will be permitted to vote in favor of the Reverse Stock Split Proposal and the

Share Increase Proposal if you do not vote but your broker is not obligated to do so.

What

should I do if I receive more than one set of voting materials for the special meeting?

You

may receive more than one set of voting materials for the special meeting, including multiple copies of this proxy statement, proxy cards,

and/or voting instruction forms. This can occur if you hold your shares of common stock in more than one brokerage account, if you hold

shares directly as a record holder and also in street name, or otherwise through a nominee. Other circumstances may apply. If you receive

more than one set of voting materials, each should be voted and/or returned separately in order to ensure that all of your shares of

common stock are voted.

How

will my shares be voted if I return a blank proxy card?

If

you sign and return your proxy card without indicating how to vote on one or more of the Proposals, the Common Stock represented by your

proxy will be voted in accordance with the Board’s recommendation for each such proposal. Proxy cards that are returned without

a signature will not be counted as present at the special meeting and cannot be voted.

Can

I change my vote after I have submitted my proxy?

You

can change your vote at any time before the special meeting. For a stockholder “of record”, meaning one whose shares are

registered in his or her own name, you can do this in one of three ways:

| ● | you

can send a signed notice of revocation of proxy; |

| ● | you

can grant a new, valid proxy bearing a later date; or |

| ● | if

you are a holder of record, you can attend the applicable special meeting and vote virtually,

but your attendance alone will not revoke any proxy that you have previously given. |

If

you choose either of the first two methods to revoke your proxy, you must submit your notice of revocation or your new proxy to HUSA

at 801 Travis St., Suite 1425, Houston, Texas 77002 Attention: Investor Relations, so that it is received no later than the beginning

of the special meeting.

If

you are a beneficial owner of Common Stock, and not the stockholder “of record”, as of the close of business on the record

date, you must follow the instructions of your brokerage firm, bank, dealer or other similar organization, trustee, or nominee to revoke

or change your voting instructions.

Where

can I find the voting results of the special meeting?

Final

voting results will be published in a Current Report on Form 8-K that we expect to file within four business days after the special meeting.

If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the special

meeting, we intend to file a Current Report on Form 8-K to publish preliminary voting results and, within four business days after the

final results are known to us, file an additional Current Report on Form 8-K to publish the final results.

What

happens if I sell my shares of Common Stock after the record date but before the special meeting?

If

you sell or transfer your shares of Common Stock after the record date but before the special meeting, you will retain your right to

vote at the special meeting but ownership of the shares will be transferred as of the time the actions approved at the special meeting

occur, if such actions occur.

Who

will solicit and pay the cost of soliciting proxies?

HUSA

will solicit and bear the expenses of soliciting proxies. In addition to solicitation by mail, our officers and certain other

employees, without additional remuneration, may solicit proxies personally or by telephone, e-mail or other means. We may reimburse brokerage

houses and other custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation

materials to our stockholders. We have engaged Okapi Partners LLC (“Okapi”) to assist in the solicitation of proxies. We

have paid Okapi a fixed fee of $20,000 for services relating to solicitation and will reimburse Okapi for significant out-of-pocket expenses.

If we utilize an additional direct telephone campaign service, we will pay Okapi a one-time modest set up and training fee and flat fees

per incoming and outgoing proxy solicitation call and per telephone vote received.

What

should I do now?

Read

and consider the information contained in and incorporated by reference into this proxy statement, including its annexes.

Stockholders

of Record. In order for your shares to be represented at the special meeting:

| ● | you

can submit a proxy by telephone or through the Internet by following the instructions included

on your proxy card; |

| ● | you

can indicate on the enclosed proxy card how you would like to vote and sign and return the

proxy card in the accompanying pre-addressed postage paid envelope; or |

| ● | you

can attend the special meeting virtually and vote at the meeting. |

Beneficial

owner. If you are a beneficial owner, please refer to the instructions provided by your brokerage firm, bank, dealer or other similar

organization, trustee, or nominee to see which of the above choices are available to you. Please note that if you are a beneficial owner

and you wish to vote at the special meeting online (by remote communication), you will need to obtain a legal proxy from your

brokerage firm, bank, dealer or other similar organization, trustee, or nominee.

Whom

do I call if I have questions about the special meeting?

If

you have additional questions about the AGIG Transactions or the special meeting, you should contact:

Houston

American Energy Corp.

801

Travis St., Suite 1425

Houston,

Texas 77002

Attention:

Investor Relations

Phone

Number: 713-222-6966

E-mail

Address: info@houstonamerican.com

If

you would like additional copies of this proxy statement or you need assistance voting your shares, you should contact Okapi, our proxy

solicitor, at the following:

Okapi

Partners LLC

1212

Avenue of the Americas, 17th Floor

New

York, New York 10036

Phone

Number: 212-297-0720

Email

Address: info@okapipartners.com

SUMMARY

For

your convenience, provided below is a brief summary of certain information contained in this proxy statement. This summary highlights

selected information from this proxy statement and does not contain all of the information that may be important to you as an HUSA stockholder.

To understand the Share Exchange Agreement and the transactions contemplated therein (the “AGIG Transaction”) fully and for

a more complete description of the terms of the AGIG Transaction, you should read carefully this entire proxy statement, its annexes,

and the other documents to which you are referred. You may obtain the information incorporated by reference in this proxy statement,

without charge, by following the instructions under “Where You Can Find More Information.”

The

AGIG Transaction

On

February 20, 2025, we entered into a Share Exchange Agreement with the AGIG Unitholders. The AGIG Unitholders are the record and beneficial

owners of all the issued and outstanding units of AGIG. The Share Exchange Agreement provides that we will acquire all of the outstanding

units of AGIG in exchange for issuing a number of shares of Common Stock equal to 94% of all the issued and outstanding Common Stock

of HUSA at the time of the closing under the Share Exchange Agreement, after taking into account issuance to the AGIG Unitholders.

Based on the number of shares of Common Stock outstanding as of February 27, 2025, we expect that the Share Exchange Agreement

would require the issuance of 245,755,684 shares of Common Stock to the AGIG Unitholders. The Share Exchange is subject to customary

closing conditions, including the condition that our stockholders approve the Share Exchange Agreement.

Immediately

following the completion of the Share Exchange, AGIG will be a wholly-owned subsidiary of HUSA. Outstanding shares of Common Stock will

remain outstanding and unaffected upon completion of the Share Exchange. Common Stock will continue to be registered under the Securities

Exchange Act of 1934 immediately following the Share Exchange. Pursuant to a letter engagement between AGIG and Univest Securities,

LLC (“Univest”), Univest will receive a fee equal to 3.5% of the aggregate transaction value, payable in shares of Common

Stock, upon completion of the Share Exchange.

We

refer to the Share Exchange and the other transactions contemplated by the Share Exchange Agreement, including the reverse stock split,

collectively as the “AGIG Transaction”.

A

copy of the Share Exchange Agreement, as amended, is included as Annex B to this proxy statement and is incorporated herein by

reference. We urge you to read it in its entirety because it is the legal document that governs the AGIG Transaction.

The

Parties to the AGIG Transaction

Houston

American Energy Corp.

HUSA

is an independent oil and gas company focused on the development, exploration, exploitation, acquisition, and production of natural gas

and crude oil properties. Our principal properties, and operations, are in the U.S. Permian Basin.

Additionally, we have properties in the Louisiana U.S. Gulf Coast region.

We

were incorporated in Delaware in 2001. Our principal executive offices are located at 801 Travis Street, Suite 1425, Houston, Texas 77002

and our telephone number at that location is (713) 222-6966. Our website address is https://houstonamerican.com.

Abundia

Financial, LLC

Abundia

Financial, a Delaware limited liability company formed in 2019, is a venture capital and asset investment firm specializing in sustainable

fuels, energy, and chemical technologies. AGIG focuses on early-stage renewable technology ventures, providing strategic support to achieve

technical validation, secure critical agreements, and position its investments for significant growth. This approach ensures ventures

are commercially prepared to attract larger capital funding rounds.

Abundia

Financial’s mission is to scale innovative solutions that accelerate the energy transition while delivering measurable economic

and environmental impact. AGIG has built a robust portfolio of investments designed to meet the growing global demand for renewable and

sustainable alternatives.

Abundia

Financial’s principal executive offices are located at 48 Wall Street, 11th floor, New York, New York 10005, and its phone number

at that location is +1-888-547-0111. Its website address is https://abundiafinancial.com.

Bower

Family Holdings, LLC

BFH,

a North Carolina limited liability company, was formed in 2019. BFH’s purpose is to invest in real estate and personal property

including securities and to engage in any lawful business for which limited liability companies may be organized under the North Carolina

Limited Liability Company Act. BFH holds approximately 10% of the issued and outstanding equity of AGIG. BFH also holds approximately

13.9% of the issued and outstanding shares of Common Stock.

BFH’s

principal executive offices are located at 110 Kings Road, Kings Mountain, NC 28086 and its phone number at that location is (704) 790-6012.

Abundia

Global Impact Group, LLC

AGIG,

a Delaware limited liability company, was formed in 2019. AGIG is a technology solution company that operates in the recycling and renewable

energy, environmental change, fuels and chemicals sectors. AGIG is focused on using waste products to decarbonize the energy, fuels and

chemicals sector by providing renewable or recycled alternatives. AGIG uses a combination of proprietary, licensed and commercialized

technologies to provide a complete process that turns waste plastics and biomass into drop-in alternatives to fossil-derived energy,

fuels and chemicals. AGIG’s holistic approach has brought together the complete commercial chain with feedstocks, technology, a

diverse management team, and world class off-take partners for the growing suite of products in place.

Abundia

Global Impact Group’s strategy has four key aspects:

| 1. | identifying

waste plastics and waste biomass feedstock supplies; |

| 2. | identifying

strategically advantaged sites; |

| 3. | securing

long-term off-take partners to distribute products; and |

| | 4. | deploying

our unique technology combination to provide a complete renewable solution. |

AGIG’s

principal executive offices are located at 48 Wall Street, 11th Floor, New York, New York, 10043 and its phone number is

(646) 844-0960. Its website address is https://abundiaimpact.com.

The

Special Meeting

The

special meeting will be held virtually at 10:00 am Central Daylight Time on March 26, 2025. There will not be a physical meeting location.

The virtual meeting url is www.virtualshareholdermeeting.com/HUSA2025SM. Stockholders as of the record date may participate in

the meeting online, vote, or submit questions by visiting the meeting website and logging in with the control number on their proxy card

or voting instruction form. At the special meeting, HUSA stockholders will be asked to:

| 1. | Issuance

Proposal — approve the issuance of a number of shares of Common Stock equal to

94% of all the issued and outstanding Common Stock of HUSA at the time of the closing under

the Share Exchange Agreement; |

| 2. | Reverse

Stock Split Proposal — approve and adopt the Reverse Stock Split Amendment, to

effect a reverse stock split of all of the outstanding shares of Common Stock, at a ratio

in the range of 1-for-5 to 1-for-60, with such ratio to be determined by the Board; |

| 3. | Share

Increase Proposal —approve and adopt an amendment to the Charter to increase the

number of authorized shares of Common Stock that may be issued from 20,000,000 to 300,000,000;

and |

| 4. | Adjournment

Proposal —approve the adjournment of the special meeting, to a later date or dates,

if necessary or appropriate, to permit further solicitation and vote of proxies if there

are insufficient votes at the time of the special meeting to approve the Issuance Proposal,

the Reverse Stock Split Proposal, or the Share Increase Proposal. |

The

HUSA stockholder approval of the Issuance Proposal, the Reverse Stock Split Proposal, and the Share Issuance Proposal is a condition

for completing the Share Exchange. As such, our stockholders must approve the Proposals in order for the Share Exchange to be completed.

Voting

at the Special Meeting

Record

Date; Votes.

We

have fixed the close of business on February 25, 2025 as the record date for determining the HUSA stockholders entitled to receive notice

of and to vote at the special meeting. Only holders of record of Common Stock on the record date are entitled to receive notice of and

vote at the special meeting and any adjournment or postponement thereof.

Each

share of Common Stock is entitled to one vote on each matter brought before the special meeting. On the record date, there were 15,686,533

shares of Common Stock issued and outstanding.

Required

Vote.

Approval

of the Issuance Proposal and the Adjournment Proposal require the affirmative vote of the majority of Common Stock present at the special

meeting, or represented by proxy, and entitled to vote on each of the Proposals at the special meeting at which a quorum is present.

The Reverse Stock Proposal and the Share Increase Proposal require the affirmative vote of the majority of the votes cast by the holders

of Common Stock present at the special meeting, or represented by proxy, and entitled to vote thereon.

Failure

to Vote; Abstentions.

If

you are a stockholder of record of Common Stock, then your failure to vote your shares or your abstention from voting on the Issuance

Proposal or the Adjournment Proposal, if presented, will have the effect of a vote against such proposal because each such proposal requires

the affirmative vote of the majority of all shares present and entitled to vote. Your failure to vote or your abstention from voting

on the Reverse Stock Split Proposal or the Share Increase Proposal will not have any effect on the outcome of the vote thereon.

If

you are a stockholder of record of Common Stock and you sign and return a proxy card or otherwise submit a proxy card without giving

specific voting instructions, your shares will be voted:

| ● | “FOR”

the approval of the Issuance Proposal; |

| ● | “FOR”

the approval of the Reverse Stock Split Proposal; |

| ● | “FOR”

the approval of the Share Increase Proposal; and |

| ● | “FOR”

the approval of the Adjournment Proposal. |

If

you are a beneficial owner and you do not provide voting instructions to your broker, bank, or other holder of record holding shares

for you (including by signing and returning a blank voting instruction card), your shares:

| ● | will

be counted as present for purposes of establishing a quorum; |

| ● | will

be voted in accordance with the broker’s, bank’s, or other nominee’s discretion

on “routine” matters, which are the Reverse Stock Split Proposal, the Share Increase

Proposal and the Adjournment Proposal, if applicable; and |

| ● | will

not be counted in connection with the Issuance Proposal or any other non-discretionary matters

that are properly presented at the special meeting. For each of these proposals, your shares

will be treated as “broker non-votes. |

Revocation

of Proxies.

With

respect to shares of Common Stock that you hold of record, you have the power to revoke your proxy at any time before the proxy is voted

at the special meeting. You can revoke your proxy in one of three ways:

| ● | you

can send a signed notice of revocation of proxy; |

| ● | you

can grant a new, valid proxy bearing a later date; or |

| ● | if

you are a holder of record, you can attend the applicable special meeting and vote virtually,

but your attendance alone will not revoke any proxy that you have previously given. |

If

you choose either of the first two methods to revoke your proxy, you must submit your notice of revocation or your new proxy to HUSA

at 801 Travis St., Suite 1425, Houston, Texas 77002 Attention: Investor Relations, so that it is received no later than the beginning

of the special meeting.

If

you are a beneficial owner of Common Stock, and not the stockholder of record, as of the close of business on the record date, you must

follow the instructions of your brokerage firm, bank, dealer or other similar organization, trustee, or nominee to revoke or change your

voting instructions.

Stock

Ownership of Directors and Executive Officers.

On

the record date, our directors and executive officers were entitled to vote 6,000 shares of Common Stock, or approximately 0.04%

of the voting power of outstanding Common Stock. To our knowledge, our directors and executive officers intend to vote their shares of

Common Stock in favor of all the Proposals presented at the special meeting, and any adjournment or postponement thereof.

Interests

of HUSA Directors and Executive Officers in the AGIG Transaction

When

you consider the Board’s recommendations that stockholders vote in favor of the Proposals described in this proxy statement, you

should be aware that some of our executive officers and directors may have interests that may be different from, or in addition to, HUSA

stockholders’ interests in general, with the main interest in having certain indemnification and insurance provisions provided

in the Share Exchange Agreement.

Ownership

of HUSA after the Share Exchange

As

of February 27, 2025, we had 15,686,533 shares of Common Stock issued and outstanding. Following our issuance of the shares

of Common Stock in the Share Exchange, AGIG Unitholders would hold approximately 94% of the Company’s outstanding voting power

and capital stock and existing holders of Common Stock would hold approximately 6%.

Post

Share Exchange Structure

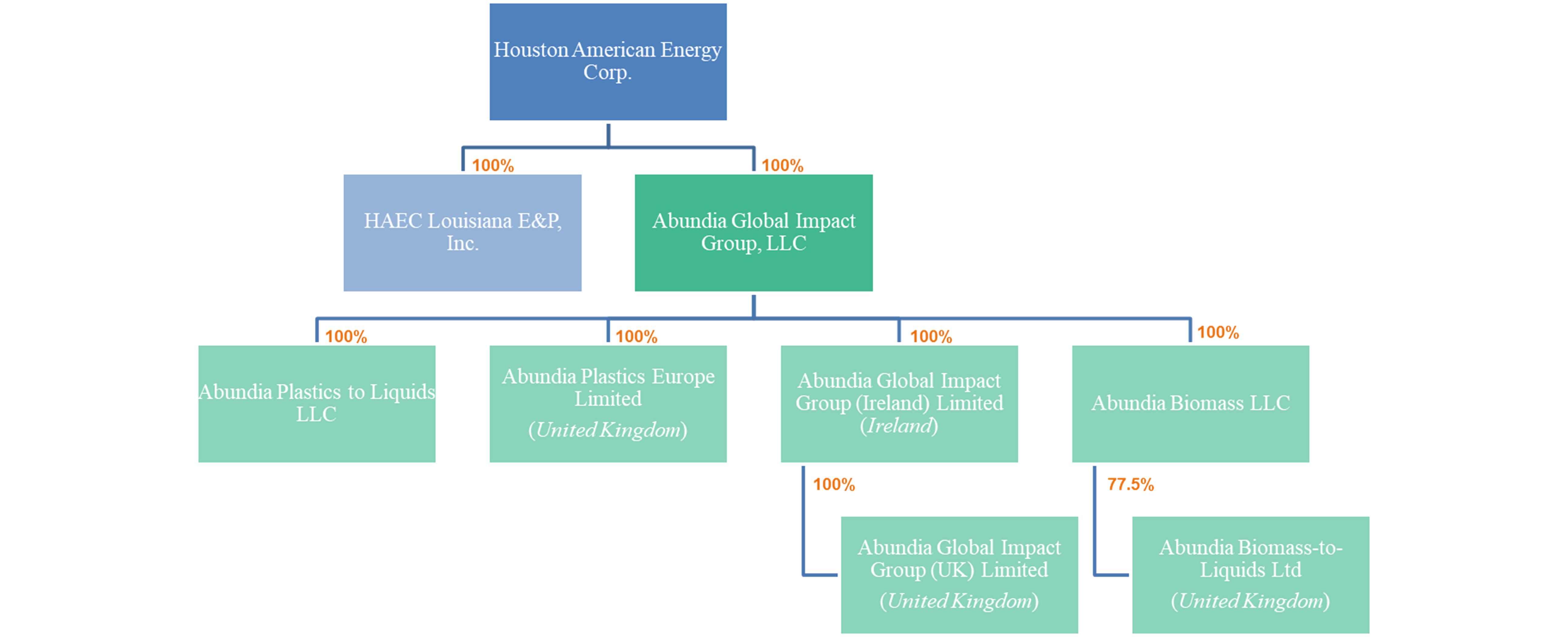

Following

the Share Exchange, AGIG will be a wholly-owned subsidiary of HUSA. The following chart illustrates the ownership structure of the combined

company immediately following the Share Exchange.

Governance

and Management of HUSA after the Share Exchange

Upon

the completion of the Share Exchange, the Board will be comprised of five directors. Further, in accordance with the Share Exchange Agreement,

the two current HUSA directors, Stephen P. Hartzell and R. Keith Grimes, will resign, and AGIG’s Chief Executive Officer, Edward

Gillespie, will be appointed to the Board. Therefore, upon the completion of the Share Exchange, the HUSA directors will be Edward Gillespie,

Peter Longo, Robert Bailey, and the HUSA Board of Directors shall appoint two other persons to be nominated by AGIG, each of whom shall

be required to qualify as an “independent director” (as defined under NYSE American Rules), to fill the vacancies left by

such resignations.

We

have agreed that within 45 days of the closing of the Share Exchange, our current Chief Executive Officer, Peter Longo, will resign as

Chief Executive Officer, but not as director. After the closing of the Share Exchange, our Chief Executive Officer will be Edward Gillespie,

our Chief Operating Officer will be Joesph Gasik, and our Chief Financial Officer (principal accounting and financial officer) will be

Lucie Harwood.

Opinion

of HUSA’s Financial Advisor

Our

Board retained Evans & Evans, Inc. (“Evans & Evans”) on December 30, 2024, as its financial advisor in connection

with the Share Exchange and requested they render an opinion as to the fairness to HUSA stockholders of the Share Exchange. On February

20, 2025, Evans & Evans delivered its opinion to the Board that, as of that date, and based upon and subject to the factors

and assumptions set forth in its written opinion, the Share Exchange was fair to HUSA stockholders from a financial perspective. The

full text of this written opinion provided to the Board, which describes, among other things, the assumptions made, procedures followed,

matters considered, and qualifications and limitations on the review undertaken, is attached as Annex C to this proxy statement

and is incorporated by reference in its entirety. Holders of Common Stock are encouraged to read the opinion carefully in its entirety.

Evans & Evans’ opinion was provided to the Board in connection with its evaluation of the consideration provided for

in the Share Exchange Agreement. It does not address any other aspect of the Share Exchange or any alternative to the Share Exchange

and does not constitute a recommendation as to how any stockholders should vote or act in connection with the Share Exchange or otherwise.

HUSA’s

Reasons for the AGIG Transaction

The

legacy HUSA business is primarily focused on the U.S. Oil and Gas markets. As disclosed in our Annual Report on Form 10-K for the year ended December 31, 2024, the

Colombian based investments did not prove viable. The outlook for U.S. Oil and Gas markets for the next two years is declining

prices and demand, and the Oil and Gas Markets have historically been volatile.

In

addition, there is substantial competition for capital available for investment in the oil and natural gas industry. We may

not be able to compete successfully in the future in acquiring prospective reserves, developing reserves, marketing hydrocarbons,

attracting and retaining quality personnel and raising additional capital.

The

AGIG business has proprietary technology and operates in a growing market for alternative products such as Sustainable Aviation Fuel

(“SAF”) and the renewable diesel markets are also growing significantly. SAF is one of the fastest growing

niches in energy as airlines are looking for more industry capacity. As a result, we believe the revenue growth potential for AGIG exceeds

the HUSA Oil and Gas opportunity.

Following the

completion of the AGIG Transaction, the combined company will be operating in a growing market with the potential to significantly

increase revenue and cash flow over the next three to five years and beyond, and investors are eager to provide capital for required

investments.

The Board and HUSA management believe the AGIG Transaction provides a strong opportunity for growth, which will benefit

the existing HUSA stockholders.

Recommendation

of the HUSA Board

YOUR

VOTE IS IMPORTANT. The Issuance Proposal and the Reverse Stock Split Proposal to be presented at the special meeting are conditions

to consummating the Share Exchange, and as such, HUSA stockholders must approve the Issuance Proposal and the Reverse Stock Split Proposal

in order for the Share Exchange to be completed.

The

Board unanimously recommends that HUSA stockholders vote:

| ● | “FOR”

Proposal 1, the Issuance Proposal; |

| ● | “FOR”

Proposal 2, the Reverse Stock Split Proposal; |

| ● | “FOR”

Proposal 3, the Share Increase Proposal; and |

| ● | “FOR”

Proposal 4, the Adjournment Proposal. |

In

making its recommendation that the stockholders vote to approve the Issuance Proposal, the Board considered, among other matters, the

strategic benefits of combining HUSA and AGIG and the new growth opportunities available to the combined company.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

proxy statement and the documents incorporated by reference into this proxy statement include certain “forward-looking statements”

within the meaning of, and subject to the safe harbor created by, Section 27A of the Securities Act, Section 21E of the Exchange Act

and the Private Securities Litigation Reform Act of 1995, which are referred to as the “safe harbor provisions.” Statements

contained or incorporated by reference in this proxy statement that are not historical facts are forward-looking statements, including

statements regarding HUSA’s or AGIG’s business and future financial and operating results, and other aspects of HUSA’s

or AGIG’s operations or operating results. Words such as “may,” “should,” “will,” “believe,”

“expect,” “anticipate,” “target,” “project,” and similar phrases that denote future expectations

or intent regarding HUSA’s or AGIG’s financial results, operations, and other matters are intended to identify forward-looking

statements that are intended to be covered by the safe harbor provisions. Investors are cautioned not to rely upon forward-looking statements

as predictions of future events. The outcome of the events described in these forward-looking statements is subject to known and unknown

risks, uncertainties, and other factors that may cause future events to differ materially from the forward-looking statements in this

proxy statement, including:

| |

● |

risks relating to fluctuations

of the market value of Common Stock, including as a result of uncertainty as to the long-term value of the common stock of HUSA or

as a result of broader stock market movements; |

| |

|

|

| |

● |

the occurrence of any event,

change, or other circumstances that could give rise to the termination of the Share Exchange Agreement; |

| |

● |

failure to attract, motivate and retain executives

and other key employees; |

| |

● |

disruptions in the business

of HUSA or AGIG, which could have an adverse effect on their respective businesses and financial results; |

| |

● |

the

unaudited pro forma combined consolidated financial information in this proxy statement is presented for illustrative purposes only

and may not be reflective of the operating results and financial condition of the combination of HUSA and AGIG; and |

| |

|

|

| |

● |

The other factors summarized under the section entitled

“Risk Factors.” |

The

forward-looking statements contained in this proxy statement are also subject to additional risks, uncertainties, and factors, including

those described in financial statements of HUSA included in this proxy statement, as well as HUSA’s most recent Annual Report on

Form 10-K and Quarterly Reports on Form 10-Q and other documents filed by either of them from time to time with the SEC. See the section

titled “Where You Can Find More Information.”

The

forward-looking statements included in this report are made only as of the date hereof. HUSA does not undertake to update, alter, or

revise any forward-looking statements made in this report to reflect events or circumstances after the date of this report or to reflect

new information or the occurrence of unanticipated events, except as required by law.

RISK

FACTORS

In

addition to the other information included and incorporated by reference into this proxy statement, including the matters addressed in

“Cautionary Statement Regarding Forward-Looking Statements,” you should carefully consider the following risk factors before

deciding how to vote on the matters presented to the stockholders at the special meeting. In addition to the risk factors set forth below,

you should read and consider other risk factors specific to our business and securities that will also affect the combined company after

the AGIG Transaction, which are described in Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2024,

which was filed with the SEC on February 24, 2025, and all of which are incorporated by reference into this proxy statement. If any of

the risks described below or in the periodic reports incorporated by reference into this proxy statement actually occur, the business,

financial condition, results of operations, prospects, or stock price of HUSA or the combined company could be materially adversely affected.

For more information, see “Where You Can Find More Information.”

Risk

Factor Summary

We

are providing the following summary of the risk factors contained in this proxy statement to enhance the readability and accessibility

of our risk factor disclosures. We encourage you to carefully review the full risk factors in the proxy statement in their entirety for

additional information regarding the material factors that make the AGIG Transaction, the Proposals, and an investment in our securities

speculative or risky. These risks and uncertainties include, but are not limited to, the following:

| ● | AGIG

has incurred losses and anticipate continuing to incur losses while it commercializes and

scales its business. |

| ● | AGIG

will require substantial additional financing to fund its operations and complete the development

and commercialization of its technologies and AGIG may not be able to do so on favorable

terms. |

| ● | AGIG

has identified material weaknesses in its internal control over financial reporting. |

| ● | AGIG’s

technology may not be successful in developing commercial products. |

| ● | AGIG

expects to rely on a limited number of industry partners for a significant portion of its

near-term revenue. |

| ● | AGIG

is vulnerable to fluctuations in the supply and price of raw materials. |

| ● | AGIG

may face manufacturing capacity issues that may adversely affect its deployment targets. |

| ● | AGIG

and its industry partners are subject to extensive international, national and subnational

laws and regulations, and any changes in relevant laws or regulations, or failure to comply

with these laws and regulations could have a material adverse effect on its business. |

| ● | AGIG

may be subject to product liability claims, which could result in material expense, diversion

of management time and attention and damage to its business, reputation and brand. |

| ● | AGIG’s

failure to protect its intellectual property and proprietary technology may significantly

impair its competitive advantage. |

| ● | AGIG

may be involved in lawsuits to protect or enforce its patents or the patents of its licensors,

or lawsuits asserted by a third party, which could be expensive, time consuming and unsuccessful. |

| ● | Governmental

programs designed to incentivize the production and consumption of low carbon fuels and carbon

capture and utilization, may be implemented in a way that does not include AGIG’s products

or could be repealed, curtailed or otherwise changed, which would have a material adverse

effect on AGIG’s business and financial condition. |

| ● | If