0001030192false--12-31FY2024falseSuite 200000000001239761513665058falsefalsefalsefalse2.500.370.2115.4700.990.990.0100010301922024-01-012024-12-310001030192us-gaap:SubsequentEventMemberus-gaap:OptionMember2025-01-012025-01-150001030192njmc:DueOneYearToFiveYearsMember2024-01-012024-12-310001030192njmc:DueWithinOneYearMember2024-01-012024-12-310001030192njmc:USTreasuryNotesNonCurrentMember2023-01-012023-12-310001030192njmc:USTreasuryNotesNonCurrentMember2024-01-012024-12-310001030192us-gaap:USTreasuryNotesSecuritiesMember2024-01-012024-12-310001030192us-gaap:USTreasuryNotesSecuritiesMember2023-01-012023-12-310001030192njmc:OphirHoldingsLlcMember2023-01-012023-12-310001030192njmc:StockOptionsMember2024-12-310001030192njmc:StockOptionsMember2023-05-012023-05-310001030192njmc:WeightedAverageExercisePricesMember2022-01-012022-12-310001030192njmc:WeightedAverageExercisePricesMember2023-01-012023-12-310001030192us-gaap:StockOptionMember2023-12-310001030192us-gaap:StockOptionMember2022-01-012022-12-310001030192us-gaap:StockOptionMember2023-01-012023-12-310001030192us-gaap:StockOptionMember2021-12-310001030192us-gaap:StockOptionMember2022-12-310001030192njmc:WarrantsMembernjmc:BottomMember2024-12-310001030192njmc:WarrantsMembernjmc:TopMember2024-01-012024-12-310001030192njmc:WarrantsMembernjmc:BottomMember2024-01-012024-12-310001030192njmc:WarrantsMembernjmc:TopMember2023-12-310001030192njmc:WarrantsMembernjmc:BottomMember2023-12-310001030192njmc:WarrantsMember2024-01-012024-12-310001030192njmc:WarrantsMember2023-12-310001030192njmc:BuckskinMember2021-08-310001030192njmc:BuckskinMember2024-01-012024-12-310001030192njmc:BuckskinMember2023-01-012023-12-310001030192njmc:BuckskinMember2021-10-310001030192njmc:ButteHighlandsJvLlcMember2016-01-012016-01-290001030192njmc:NewJerseyMillMember2024-12-310001030192njmc:ButteHighlandsJvLlcMember2024-01-012024-12-310001030192njmc:NewJerseyMillMember2023-12-310001030192njmc:NewJerseyMillMember2024-01-012024-12-310001030192njmc:NewJerseyMillMember2011-01-310001030192njmc:ButteHighlandsJvLlcMember2016-01-290001030192njmc:NotePayableMembernjmc:OtherMember2024-01-012024-12-310001030192njmc:NotePayableMembernjmc:OtherMember2023-01-012023-12-310001030192njmc:NotePayableMembernjmc:BuildingsLandMember2024-01-012024-12-310001030192njmc:NotePayableMembernjmc:MillEquipmentMember2024-01-012024-12-310001030192njmc:NotePayableMembernjmc:BuildingsLandMember2023-01-012023-12-310001030192njmc:NotePayableMembernjmc:MillEquipmentMember2023-01-012023-12-310001030192njmc:MineEquipmentMembernjmc:NotePayableMember2024-01-012024-12-310001030192njmc:MineEquipmentMembernjmc:NotePayableMember2023-01-012023-12-310001030192njmc:NotePayableMembernjmc:OtherMember2023-12-310001030192njmc:NotePayableMembernjmc:OtherMember2024-12-310001030192njmc:NotePayableMembernjmc:BuildingsLandMember2023-12-310001030192njmc:NotePayableMembernjmc:MillEquipmentMember2023-12-310001030192njmc:NotePayableMembernjmc:BuildingsLandMember2024-12-310001030192njmc:NotePayableMembernjmc:MillEquipmentMember2024-12-310001030192njmc:MineEquipmentMembernjmc:NotePayableMember2023-12-310001030192njmc:MineEquipmentMembernjmc:NotePayableMember2024-12-310001030192njmc:ParkCopperGoldMember2024-01-012024-12-310001030192njmc:PotosiMember2024-01-012024-12-310001030192njmc:EasternStarMember2024-01-012024-12-310001030192njmc:McKinleyMonarchMember2024-01-012024-12-310001030192njmc:NewJerseysMember2024-01-012024-12-310001030192njmc:GoldenChestMember2023-01-012023-12-310001030192njmc:GoldenChestMember2024-01-012024-12-310001030192njmc:OxfordMember2024-01-012024-12-310001030192njmc:OxfordMember2023-12-310001030192njmc:OxfordMember2024-12-310001030192njmc:EasternStarMember2024-12-310001030192njmc:EasternStarMember2023-12-310001030192njmc:ParkCopperGoldMember2023-12-310001030192njmc:ParkCopperGoldMember2024-12-310001030192njmc:PotosiMember2023-12-310001030192njmc:PotosiMember2024-12-310001030192njmc:McKinleyMonarchMember2023-12-310001030192njmc:McKinleyMonarchMember2024-12-310001030192us-gaap:NewJerseyDivisionOfTaxationMember2023-12-310001030192us-gaap:NewJerseyDivisionOfTaxationMember2024-12-310001030192njmc:GoldenChestMember2023-12-310001030192njmc:GoldenChestMember2024-12-310001030192njmc:MillEquipmentMember2023-12-310001030192njmc:MineEquipmentMember2023-12-310001030192njmc:MineEquipmentMember2024-12-310001030192njmc:MillEquipmentMember2024-12-310001030192us-gaap:BuildingMember2023-12-310001030192us-gaap:BuildingMember2024-12-310001030192njmc:CoreDrillingSuppliesAndMaterialsMember2023-12-310001030192njmc:CoreDrillingSuppliesAndMaterialsMember2024-12-310001030192njmc:MillPartAndSuppliesMember2023-12-310001030192njmc:MillPartAndSuppliesMember2024-12-310001030192njmc:MinePartsAndSuppliesMember2023-12-310001030192njmc:MinePartsAndSuppliesMember2024-12-310001030192njmc:FinishedGoodMember2023-12-310001030192njmc:FinishedGoodMember2024-12-310001030192njmc:ConcentrateInventoryMember2023-12-310001030192njmc:ConcentrateInventoryMember2024-12-310001030192njmc:IncrementalSharesMember2023-01-012023-12-310001030192njmc:IncrementalSharesMember2024-01-012024-12-310001030192njmc:BuckskinMember2023-12-310001030192njmc:BuckskinMember2024-12-310001030192njmc:ButteHighlandsJointVentureMember2023-12-310001030192njmc:ButteHighlandsJointVentureMember2024-12-310001030192njmc:NJMJVMember2023-12-310001030192njmc:NJMJVMember2024-12-310001030192us-gaap:NoncontrollingInterestMember2024-12-310001030192us-gaap:RetainedEarningsMember2024-12-310001030192us-gaap:CommonStockMember2024-12-310001030192us-gaap:NoncontrollingInterestMember2024-01-012024-12-310001030192us-gaap:RetainedEarningsMember2024-01-012024-12-310001030192us-gaap:CommonStockMember2024-01-012024-12-310001030192us-gaap:NoncontrollingInterestMember2023-12-310001030192us-gaap:RetainedEarningsMember2023-12-310001030192us-gaap:CommonStockMember2023-12-310001030192us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001030192us-gaap:RetainedEarningsMember2023-01-012023-12-310001030192us-gaap:CommonStockMember2023-01-012023-12-3100010301922022-12-310001030192us-gaap:NoncontrollingInterestMember2022-12-310001030192us-gaap:RetainedEarningsMember2022-12-310001030192us-gaap:CommonStockMember2022-12-3100010301922023-01-012023-12-3100010301922023-12-3100010301922024-12-3100010301922025-03-0100010301922024-06-28iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pureiso4217:USDutr:mmtu

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______ to ______

Commission file number: 001-41320

IDAHO STRATEGIC RESOURCES, INC. |

(Name of small business issuer in its charter) |

Idaho | | 82-0490295 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. employer identification No.) |

201 N. Third Street, Coeur d’Alene, ID 83814

(Address of principal executive offices) (zip code)

(208) 625-9001

Registrant’s telephone number, including area code

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

Common Stock, No par value | IDR | NYSE American |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and no disclosure will be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act Yes ☐ No ☒

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

Indicate by check mark whether the filings included in this filing by the registrant as defined in Rule 12b of the Exchange Act include any corrections of an error to previously issued financial statements Yes ☐ No ☒

Indicate by check mark whether any of those corrections (if any) are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b) Yes ☐ No ☒

The aggregate market value of all common stock held by non-affiliates of the registrant, based on the average of the bid and ask prices on June 28, 2024 was $118,144,095.

On March 1, 2025 there were 13,665,058 shares of the registrant’s Common Stock outstanding.

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and the exhibits attached hereto contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements other than statements of historical fact are forward-looking statements for purposes of federal and state securities laws, including statements about anticipated future operating and financial performance, financial position and liquidity, growth opportunities and growth rates, pricing plans, acquisition and divestiture opportunities, business prospects, strategic alternatives, business strategies, regulatory and competitive outlook, investment and expenditure plans, financing needs and availability and other similar forecasts and statements of expectation and statements of assumptions underlying any of the foregoing. The words “aims,” “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “seeks,” “should” and variations of these words and similar expressions are generally intended to identify these forward-looking statements. These forward-looking statements are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond Idaho Strategic Resources, Inc.’s (“IDR”) control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change.

Forward-looking statements by us are based on estimates, projections, beliefs and assumptions of management and are not guarantees of future performance. Such forward-looking statements may be contained in this Annual Report on Form 10-K under Item 1 Description of the Business, Item 1A Risk Factors, and Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations, or in our Current Reports on Form 8-K, among other places. Some of other risk factors include, but are not limited to, the following:

| · | adverse effects of climate changes or natural disasters; |

| · | adverse effects of global or regional pandemic disease spread or other crises; |

| · | global economic and capital market uncertainties; |

| · | the speculative nature of gold or mineral exploration, including risks of diminishing quantities or grades of qualified resources; |

| · | operational or technical difficulties in connection with exploration, processing or mining activities; |

| · | costs, hazards and uncertainties associated with precious metal based activities, precious metal exploration, resource development, economic feasibility assessment and cash generating mineral production; |

| · | contests over our title to properties; |

| · | potential dilution to our shareholders from our stock issuances, recapitalization and balance sheet restructuring activities; |

| · | potential inability to comply with applicable government regulations or law; |

| · | adoption of or changes in legislation or regulations adversely affecting our businesses; |

| · | permitting constraints or delays; |

| · | ability to achieve the benefits of business opportunities that may be presented to, or pursued by, us, including those involving the ability to successfully identify, finance, complete and integrate acquisitions, joint ventures, strategic alliances, business combinations, asset sales, and investments that we may be party to in the future; |

| · | changes in the United States or other monetary or fiscal policies or regulations; |

| · | interruptions in our production capabilities due to capital constraints; |

| · | equipment failures; |

| · | fluctuation of prices for gold or certain other commodities (such as rare earth elements, water, diesel, gasoline and alternative fuels and electricity); |

| · | changes in generally accepted accounting principles; |

| · | adverse effects of war, mass shooting, terrorism and geopolitical events; |

| · | potential inability to implement our business strategies; |

| · | potential inability to grow revenues; |

| · | potential inability to attract and retain key personnel; |

| · | interruptions in delivery of critical supplies, equipment and raw materials due to credit or other limitations imposed by vendors; |

| · | assertion of claims, lawsuits and proceedings against us; |

| · | potential inability to satisfy debt and lease obligations; |

| · | potential inability to maintain an effective system of internal controls over financial reporting; and |

| · | work stoppages or other labor difficulties. |

Occurrence of such events or circumstances could have a material adverse effect on our business, financial condition, results of operations or cash flows, or the market price of our securities. All subsequent written and oral forward-looking statements by or attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated, or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Except as may be required by securities or other law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

We qualify all the forward-looking statements contained in this Annual Report by the foregoing cautionary statements.

GLOSSARY OF SIGNIFICANT MINING TERMS

Ag-Silver.

Au-Gold.

Alluvial-Adjectivally used to identify rocks or minerals deposited over time by moving water.

Argillites-Metamorphic rock containing clay minerals.

Arsenopyrite-An iron-arsenic sulfide. Common constituent of gold mineralization.

Ball Mill-A large rotating cylinder usually filled to about 45% of its total volume with steel grinding balls. The mill rotates and crushed rock is fed into one end and discharged through the other. The rock is pulverized into small particles by the cascading and grinding action of the balls.

Bedrock-Solid rock underlying overburden.

Cu-Copper.

CIL-A standard gold recovery process involving the leaching with cyanide in agitated tanks with activated carbon. CIL means “carbon-in-leach.”

Crosscut-A nominally horizontal mine passageway, generally driven at right angles to the strike of a vein.

Dip-Angle made by an inclined surface with the horizontal, measured perpendicular to strike.

Deposit-A mineral deposit is a mineralized body that has been intersected by sufficient closely spaced drill holes or underground sampling to support sufficient tonnage and average grade(s) of metal(s) to warrant further exploration or development activities.

Drift-A horizontal mine opening driven on the vein. Driving is a term used to describe the excavation of a mine passageway.

Exploration Stage-As defined by the United States Securities and Exchange Commission (“SEC”)-includes all issuers engaged in the search for mineral deposits (reserves), which are not in the production stage.

Fault-A fracture in the earth’s crust accompanied by a displacement of one side of the fracture with respect to the other and in a direction parallel to the fracture.

Flotation-A physiochemical process for the separation of finely divided solids from one another. Separation of these (dissimilar) discrete solids from each other is affected by the selective attachment of the particle surface to gas bubbles.

GPT-grams per metric tonne.

Galena-A lead sulfide mineral. The most important lead mineral in the Coeur d’Alene Mining District.

Grade-A term used to assign the concentration of metals per unit weight of ore. An example-ounces of gold per ton of ore (opt). One troy ounce per short ton is 34.28 parts per million or 34.28 grams per metric tonne.

Mill-A general term used to denote a mineral processing plant.

Mineralization-The presence of minerals, usually of potential economic significance, in a specific area or geologic formation.

Mineral Reserve-An estimate of tonnage and grade or quality of indicated and measured mineral resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a measured or indicated mineral resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted.

Mineral Resource-A concentration or occurrence of material of economic interest in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A mineral resource is a reasonable estimate of mineralization considering relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralization drilled or sampled.

Net Smelter Return (“NSR”)-The Net Smelter Return from a processed ore is the value recouped from the mineral products less the costs associated with smelting, refining, and transport to the smelter. The NSR specifically does not permit the deduction of mining and milling costs.

Ore-A mineral or aggregate of minerals that can be mined and treated at a profit. A large quantity of ore that is surrounded by waste or sub-ore material is called an orebody.

Patented Claim-A mineral claim where the title has been obtained from the U.S. federal government through the patent process of the 1872 Mining Law. The owner of the patented claim is granted title to the surface and mineral rights.

Production Stage-As defined by the SEC-includes all issuers engaged in the exploitation of a mineral deposit (reserve).

Proven Reserve-The economically mineable part of a measured mineral resource and can only result from conversion of a measured mineral resource.

Pyrite-An iron sulfide mineral that usually has no commercial value but is commonly associated with mineral deposits of gold, copper, and other metals.

Quartz-Crystalline silica (SiO2). An important rock-forming and gangue material in veins or other types of mineral deposits.

Quartzites-Metamorphic rock containing significant amounts of quartz.

Raise-An underground opening driven upward, generally on the vein.

Ramp-An underground opening usually driven downward, but not always, to provide access to an orebody for rubber-tired equipment such as loaders and trucks. Typically, ramps are inclined at a slope grade of approximately 15%.

Rare Earth Elements-Comprised of 15 elements that range in atomic number from 57 (lanthanum) to 71 (lutetium) on the periodic table. Most of the rare earth elements are not as rare as the group’s name suggests. Although rare earth elements are relatively abundant in the Earth’s crust, they are rarely concentrated into mineable ore deposits. These elements are in demand because they are essential for a diverse and expanding array of high-technology applications and emerging alternative energy uses.

Royalty or NSR Royalty-A mineral royalty is a percentage of the value extracted from an ore that is paid to an interest holding party, usually a claim owner. The NSR Royalty is calculated based on the value of the processed ore after deducting the costs of smelting, refining, and transport to a smelter. However, the cost of mining and milling is not deducted. Typical NSR Royalty rates in the United States are on the order of 1–5%.

Shoot-A body of ore, usually of elongated form, extending downward or upward in a vein.

Stope-An underground void created by the mining of ore.

Strike-The bearing or azimuth of the line created by the intersection of a horizontal plane with an inclined rock strata, vein or body.

Tellurium-Relatively rare chemical element found with gold and silver that can form minerals known as tellurides.

Tetrahedrite-Sulfosalt mineral containing copper, antimony, and silver.

Vein-A zone or body of mineralized rock lying within boundaries separating it from neighboring wallrock. A mineralized zone having a more or less regular development in length, width and depth to give it a tabular form and commonly inclined at a considerable angle to the horizontal.

Unpatented Claim-A mineral claim staked on United States Public Domain (“USPD”) that is open for mineral entry. Unpatented lode claims can be no more than 1,500 feet long by 600 feet wide. The claimant owns the mineral rights, but does not own the surface, which is USPD. Unless otherwise allowed, subsurface exploration or mining on the claim must first be submitted in a plan of operations for approval to the appropriate federal land management entity.

Wallrock-Usually barren rock surrounding a vein.

PART I

ITEM 1. DESCRIPTION OF THE BUSINESS

History and Organization

Idaho Strategic Resources, Inc. (“the Company”, “Idaho Strategic” or “IDR”) was incorporated under the laws of the State of Idaho on July 18, 1996. The Company’s head office and registered records office is located at 201 N. 3rd St. Coeur d’Alene, ID 83814. On December 6, 2021, the Company changed its name to Idaho Strategic Resources, Inc. (formerly New Jersey Mining Company (“NJMC”)) to better reflect its corporate focus, Idaho-based operations and being domiciled in Idaho. IDR is one of the few resource-based companies (public or private) possessing the combination of officially recognized U.S. domestic rare earth element properties (in Idaho) and Idaho-based gold production located in an established mining community.

Any Bankruptcy, Receivership or Similar Proceedings

There have been no bankruptcy, receivership, or similar proceedings.

Any Material Reclassification, Merger, Consolidation, or Purchase or Sale of a Significant Amount of Assets Not in the Ordinary Course of Business.

There have been no material reclassifications, mergers, consolidations, purchases, or sales not in the ordinary course of business for the past three years.

General Description of the Business

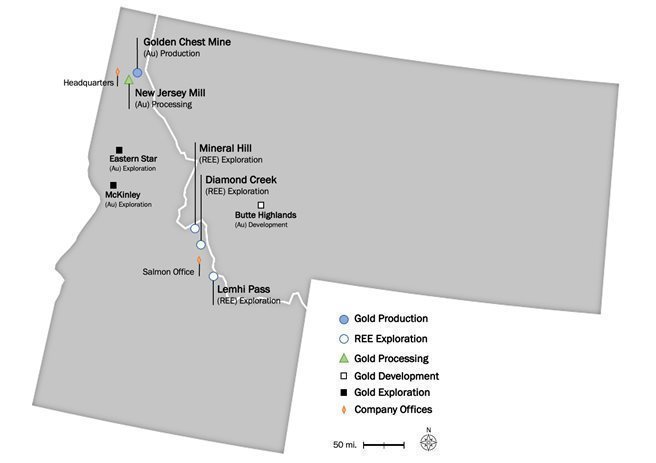

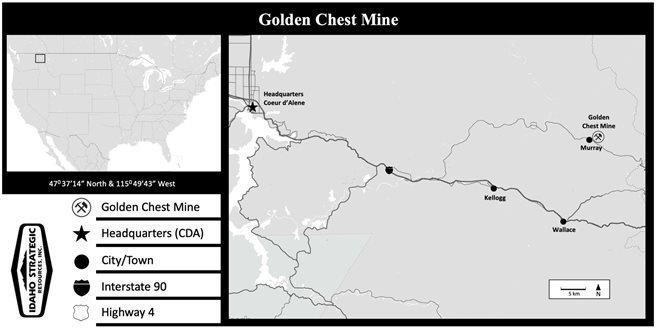

Idaho Strategic produces gold at the Golden Chest Mine located in the Murray Gold Belt (“MGB”) area of the world-class Coeur d’Alene Mining District, north of the prolific Silver Valley. With over 7,000 acres of patented and unpatented land, the Company has the largest private land position in the area following its consolidation of the Murray Gold Belt for the first time in over 100-years.

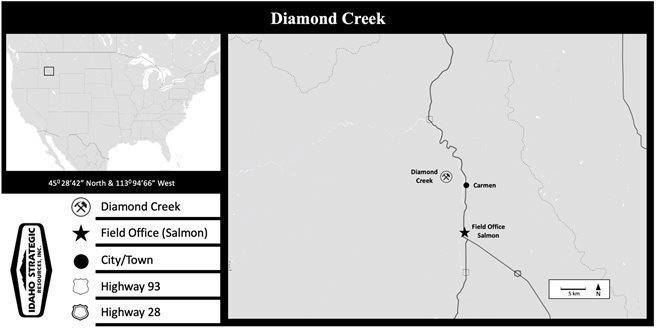

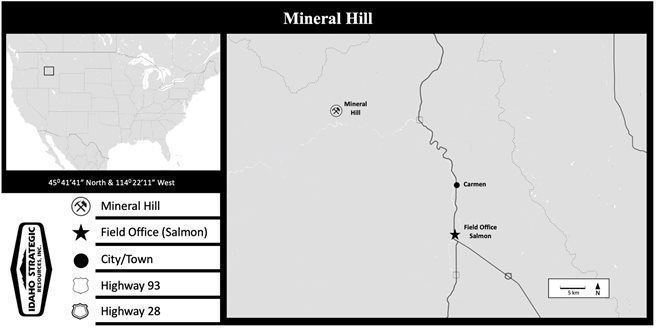

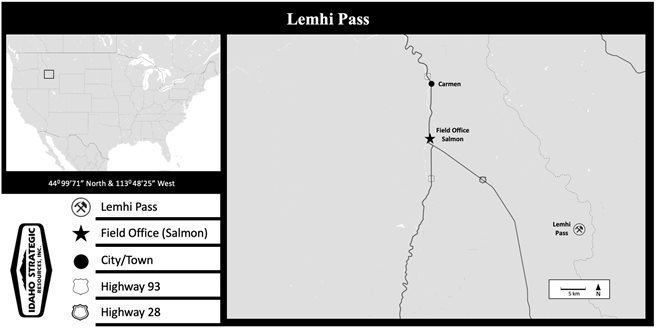

The Company is an established gold producer, with prior surface and current underground mining operations at its 100-percent owned Golden Chest Mine and conducts milling operations at its majority-owned New Jersey Mill. In addition to gold and gold production, the Company maintains an important strategic presence in the U.S. Critical Minerals sector, specifically focused on the more “at-risk” rare earth elements (“REE”). The Company’s Lemhi Pass, Diamond Creek and Mineral Hill REE properties are included the U.S. national REE inventory as listed in United States Geologic Survey (“USGS”), Idaho Geologic Survey (“IGS”) and Department of Energy (“DOE”) publications. All three projects are in central Idaho and participating in the USGS Earth MRI program, with the Diamond Creek Project also participating in the Idaho Department of Commerce’s Idaho Global Entrepreneurial Mission (“IGEM”) program.

The Company focuses its exploration and production efforts in historical mining districts mostly located within the state of Idaho. Its portfolio of mineral properties includes:

| · | The Golden Chest Mine, a producing gold mine located in the Murray Gold Belt of North Idaho; |

| · | Approximately 1,500 acres of patented mineral property and over 5,800 acres of nearby and adjacent un-patented mineral property. These holdings are considered early-stage exploration properties and located within the MGB, many of which include historic gold mines and known gold mineralization; |

| · | REE Projects–located in the Idaho Rare Earth Element-Thorium (“REE-Th”) Belt near Salmon, Idaho. Projects include; |

| o | Lemhi Pass – Significant land package with high value REE potential–USGS also recognized as the #1 thorium prospect in the U.S. |

| o | Diamond Creek – Nationally recognized rare earth prospects in the US |

| o | Mineral Hill – Nationally recognized and high grade REE property in the northern portion of the Idaho REE-Th Belt |

| · | A significant portfolio of early-stage exploration properties in Central Idaho, primarily in the Elk City area. |

In addition to its portfolio of exploration, pre-development, and producing properties, the Company is also the manager and majority-owner of the New Jersey Mill, which currently processes ore from the Golden Chest Mine. The New Jersey Mill can process gold and silver ore through a 360-tonne per day flotation plant.

The Company has focused its efforts on underground development and growing production at the Golden Chest Mine and exploration at its extensive land holdings within the MGB area. With all debt associated with land acquisition and the start-up of operations behind it, the Company significantly increased its exploration and expansion activities in the Murray Gold Belt. This progress, combined with the existing infrastructure and development, has created a solid foundation of real estate holdings, and a tangible base of value regardless of market cycles.

Competitive Business Conditions

While there has been a market for gold and precious metals historically, the Company competes on several different fronts within the minerals exploration industry. The Company may find the need to compete with other junior mining companies for the capital necessary to sustain its exploration and development programs. IDR has focused its gold operations at and near the Golden Chest Mine, however if it chose to expand to other geographic areas it may compete with other mining companies for exploration properties and/or mining assets. The Company has been successful in resuming operations at the New Jersey Mill, consolidating 100% ownership of the Golden Chest Mine, and assembling one of the largest rare earth element landholdings in the US. In October 2016 production at the Golden Chest resumed with the Company as the sole owner and operator.

Generally, the Company is subject to economic conditions and risks inherent to the mineral industry. A primary risk of mineral exploration is the low probability of finding a major ore deposit. The Company attempts to mitigate this risk by focusing its efforts in areas known to host significant and/or economic mineral deposits, and by relying on its experienced management team to drive analysis, evaluation, and acquisition of properties that it feels have a higher-than-average probability of success. In addition to deal essentials, such as cost, terms, timing, and market considerations, the Company’s process of property acquisition involves screening target properties based on geological, economic, engineering, environmental, and metallurgical factors. In all its operations the Company competes for skilled labor within the mining industry.

The risks associated with the Company’s mining and milling operations include other risks typical of the mining industry, such as: operational effectiveness in the processing plant that could result in lower recovery of the economic metals, mechanical failure of equipment that could increase costs or decrease efficacy, ability to hire and retain qualified operators, and risks that the mining operations are unable to economically extract material due to lower grade material, ground or slope failures or other development challenges that can increase costs. The Company manages these risks with engineering and geologic analysis, detailed mine planning, a preventive maintenance program, and installing experienced and technically proficient management.

Another significant risk in the mining industry is the price of metals such as gold and silver. If the prices of these metals were to fall substantially, in addition to an impact on economics and/or profitability, it could lead to a loss of investor interest in the mining sector which could make it more difficult to raise capital if considered necessary for the Company to move exploration and development plans forward.

Customer Dependence and Product Distribution

The Company sold all its flotation gold concentrate to H&H Metals Corporation (“H&H Metals” or “H&H”) of New York, NY which accounted for 99% of gold sales in 2024. The remaining gold sales were gold doré which was sold to a western U.S. refinery. H&H Metals is also an IDR shareholder. Although not expected, if H&H Metals could not purchase the gold concentrate, it is anticipated another customer could be found readily as the flotation gold concentrate is a high value concentrate with minor deleterious element content.

Effect of Existing or Probable Governmental Regulations on the Business

The mining business is subject to extensive federal, state, and local laws and regulations governing development, production, labor standards, occupational health, waste disposal, the use of toxic substances, environmental regulations, mine safety and other matters. The Company is subject to potential risks and liabilities occurring from mineral exploration and production activities. Insurance against environmental risk (including potential liability for pollution or other hazards from the disposal of waste products occurring from exploration and production) is not generally available to the Company (or to other companies in the minerals industry) at a reasonable price. To the extent that the Company becomes subject to environmental liabilities, the satisfaction of any such liabilities would reduce funds otherwise available to the Company and could have a material adverse effect on the Company. Laws and regulations intended to ensure the protection of the environment are constantly changing and are generally becoming more restrictive.

All operating and exploration plans have been made in consideration of existing governmental regulations. Regulations that most affect operations are related to surface water quality and access to public lands. An approved plan of operations (“POO”) and a financial bond are usually required before exploration or mining activities can be conducted on public land that is administered by the United States Bureau of Land Management (“BLM”) or United States Forest Service (“USFS”).

The New Jersey Mine, Golden Chest Mine, and other nearby properties are part of the expanded Bunker Hill Superfund Site. Current plans for expanded cleanup do not include any IDR projects. There is no known evidence that previous operations at the New Jersey Mine (prior to 1910) caused any groundwater or surface water pollution or discharged any tailings into the South Fork of the Coeur d’Alene River; however, it is possible that such evidence could surface. Should such a liability emerge for the Company, its exposure would likely be to clean up or cover old mine tailings that may have washed downstream from upstream mining operations. There are no mineral processing tailings deposits at the Golden Chest Mine. However, at least two old adits have small water discharges. The Company could conceivably be required to conduct cleanup operations at its own expense; however, the Environmental Protection Agency’s (“EPA”) Record of Decision for the Bunker Hill Mining and Metallurgical Complex Operating Unit 3 does not include any cleanup activities at the Company’s projects. Recently, the EPA has proposed a new cleanup plan that greatly increases the number of historic mine sites to be reclaimed, however, the plan has not been approved. IDR has not received any notifications that it could be liable for any environmental cleanup.

Costs and Effects of Compliance with Environmental Laws (Federal, State and Local)

No major Federal permits are required for the Golden Chest and New Jersey Mines because the operations are on private land and there are no process discharges to surface waters. However, any exploration program conducted by the Company on unpatented mining claims, usually administered by the BLM or USFS, requires a POO to be submitted. The Company’s exploration programs on public land can be delayed for significant periods of time (one to two years) because of the slow permitting process applied by the USFS. The Company believes that such permitting delays are caused by insufficient manpower, complicated regulations, competing priorities, and sympathy for environmental groups who oppose all mining projects.

The Company is also subject to the rules of the U.S. Department of Labor, Mine Safety and Health Administration (“MSHA”) for the New Jersey Mill and Golden Chest Mine operations. When an underground mine or mill is operating, MSHA performs a series of regular quarterly inspections to verify compliance with mine safety laws and can assess financial penalties for violations of MSHA regulations. A typical mine citation order for a violation that is not significant or substantial is about $200.

The New Jersey Mill has two State of Idaho permits. The first is a permit for its tailings storage facility with the Idaho Department of Water Resources (“IDWR”). The Company submitted an engineered design for the tailings storage facility and constructed a buttress and Phase 5 lift in 2022, and the Phase 6 lift in 2023. IDWR inspected and approved the tailings storage facility for tailings disposal in Phase 5 and Phase 6. The Company posted a reclamation bond of $107,000 for the tailings storage facility. An Idaho Cyanidation Permit was granted for the New Jersey Mill on October 10, 1995 [No. CN-000027]. Construction of the concentrate leach plant at the New Jersey Mill was completed in November of 2007. The Idaho Cyanidation permit requires quarterly surface water and groundwater monitoring. In 2022 the Company submitted a Closure Plan for the cyanidation permit since it no longer uses the cyanidation process. The plan is under review the by the Idaho Department of Environmental Quality (“IDEQ”). The plan calls for continued surface and groundwater monitoring for as long as tailings are deposited in the tailings storage facility and for a post-closure period of five years. IDR estimates the cost of water-monitoring associated with the concentrate leach plant to be approximately $10,000 per year. The New Jersey Mill also has an EPA general stormwater permit.

The Idaho Department of Lands (“IDL”) approved a surface mining reclamation plan for the New Jersey Mine in 1993. The plan calls for grading of steep fill slopes and planting of vegetation on the area disturbed by the open pit mine. IDR pays an annual reclamation fee of $133 to IDL for surface disturbance associated with the New Jersey Mine open pit. The Company has estimated its costs to reclaim the New Jersey Mine and Mill site to be $117,000.

The Company submitted a reclamation plan to IDL for its past open pit mining operation at the Golden Chest Mine. The plan was approved, and the Company was required to post a reclamation bond of $103,320. This plan also calls for the grading of steep fill slopes and re-vegetation of disturbed land as well as erosion control measures utilizing best practices. Surface water monitoring is also performed at the Golden Chest and results are reported to IDEQ on a quarterly basis. The Company estimates the cost of this water monitoring at $6,000 annually. The Golden Chest Mine also has an EPA general stormwater permit.

When the Company plans an exploration drilling program on public lands, it must submit a POO to either the BLM or USFS. Compilation of the plan can take as much as several months of professional time and a reclamation bond is usually required to start drilling once the plan is approved. Bond costs vary directly with surface disturbance area. As an example, IDR’s core drilling at Diamond Creek on USFS administered land required a bond of $85,800 for minimal disturbance with drill pads adjacent to an existing road (bond returned following reclamation). If a plan requires road building, the bond amount can increase significantly. Upon completion of site reclamation and approval by the managing agency, the bond is returned to the Company.

The Company complies with local building codes and ordinances as required by law.

Number of Total Employees and Number of Full Time Employees

The Company’s total number of full-time employees is 51.

REPORTS TO SECURITY HOLDERS

The Company is not required to deliver an annual report to shareholders; however, its 10K is available digitally on the Company website and through other public sources.

The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Commission and SEC.

The Company maintains a website where recent press releases and other information can be found. A link to the Company’s filings with the SEC is provided on the Company’s website www.idahostrategic.com.

ITEM 1A. RISK FACTORS

The following risks and uncertainties, together with the other information set forth in this report, should be carefully considered by those who invest in the Company’s securities. Any of the following material risk factors could adversely affect its business, financial condition or operating results and could decrease the value of its common stock. These are not all the risks the Company may face, and other factors not currently believed to be immaterial may also affect the business if they occur.

Financial Risks

Diversity in application of accounting literature in the mining industry may impact reported financial results.

The mining industry has limited industry-specific accounting literature and, as a result, the Company understands diversity in practice exists in the interpretation and application of accounting literature to mining-specific issues. As diversity in mining industry accounting is addressed, the Company may need to restate its reported results if the resulting interpretations differ from current accounting practices.

The Company’s accounting and other estimates may be imprecise.

Preparing consolidated financial statements requires management to make estimates and assumptions that affect the reported amounts and related disclosure of assets, liabilities, revenue, and expenses at the date of the consolidated financial statements and reporting periods. The more significant areas requiring the use of management assumptions and estimates relate to:

| · | mineral reserves, resources, and exploration targets that are the basis for future income and cash flow estimates and units-of-production depreciation, depletion and amortization calculations; |

| · | future ore grades, throughput and recoveries; |

| · | future metals prices; |

| · | future capital and operating costs; |

| · | environmental, reclamation and closure obligations; |

| · | permitting and other regulatory considerations; |

| · | asset impairments; |

| · | valuation of business combinations; |

| · | future foreign exchange rates, inflation rates and applicable tax rates; |

| · | reserves for contingencies and litigation; and |

| · | deferred tax asset valuation allowance. |

Future estimates and actual results may differ materially from these estimates from using different assumptions or conditions.

You may lose all or part of your investment.

If the Company is unable to effectively develop, mine, recover and sell adequate quantities of gold or generate cash flows from other diversified precious and strategic metals properties (including, but not limited to, metals exploration, engineering, resource development, economic feasibility assessments, mineral production, metal processing and related ventures), it is unlikely that the cash generated from the Company’s internal operations will suffice as a source of the liquidity necessary for anticipated working capital requirements. There is no assurance that the Company’s initiatives to improve its liquidity and financial position will be successful. Accordingly, there is substantial risk that the Company will be unable to continue as a going concern. In the event of insolvency, liquidation, reorganization, dissolution or other winding up of the Company, the Company’s creditors would be entitled to payment in full out of the Company’s assets before holders of common stock would be entitled to any payment, and the claims on such assets may exceed the value of such assets.

Because the Company may never earn significant revenues from its mine operations or other diversified precious metal-based and strategic metal properties, the business may fail.

The Company recognizes that if it is unable to generate significant revenues from the exploration and exploitation of mineral reserves or other diversified precious and strategic metals properties in the future, it will not be able to earn profits or continue operations. The Company is generating positive operating income; however, there can be no assurance that this will continue. There is no history upon which to base any assumption as to the likelihood that the Company will prove successful, and the Company can provide no assurance that it will generate significant revenues or ever achieve profitability. If the Company is unsuccessful, its business will fail, and investors may lose all their investment in the Company.

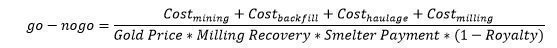

The Company will not be successful unless it recovers precious or strategic metals and sells them for a profit.

The Company’s success depends on the ability to recover precious or strategic metals, process them, and successfully sell them for more than the cost of production. The success of this process depends on the market prices of metals in relation to the costs of production. The Company may not be able to generate a profit on the sale of gold or other minerals because of the limited control over costs and not having the ability to control the market prices. The total cash costs of production at any location are frequently subject to great variation from year to year due to a number of factors, such as the changing composition of the grade of the mineralized material mined for production, and metallurgy and exploration activities in response to the physical shape and location of the mineral deposit. In addition, costs are affected by the price of commodities, such as fuel and electricity. Such commodities are at times subject to volatile price movements, including increases that could make production unprofitable. A material increase in production costs or a decrease in the price of gold or other minerals could adversely affect the Company’s ability to earn a profit on the sale of gold or other minerals.

Cost estimates and timing of new projects are uncertain, which may adversely affect the Company’s expected production and profitability.

The capital expenditures and time required to acquire, develop, and explore the Company’s projects are considerable and changes in costs, construction schedules or both, can adversely affect project economics and expected production and profitability. There are many factors that can affect costs and construction schedules, including, among others:

| · | availability of labor, energy, transportation, equipment, and infrastructure; |

| · | changes in input commodity prices and labor costs; |

| · | fluctuations in currency exchange rates; |

| · | availability and terms of financing; |

| · | changes in anticipated tonnage, grade and metallurgical characteristics of the mineralized material to be mined and processed; |

| · | recovery rates of gold and other metals from mineralized materials; |

| · | difficulty of estimating construction costs over a period of a year; |

| · | delays in completing any environmental review or in obtaining environmental or other government permits; |

| · | weather and severe climate impacts; and |

| · | potential delays related to health, social, political and community issues. |

The Company’s ability to execute its strategic plan depends on many factors, some of which are beyond its control.

The Company’s strategic plan is focused on high-value, cash-generating, precious and strategic metal-based activities, including, but not limited to, precious and strategic metal exploration, resource development, economic feasibility assessments and cash-generating mineral production. Many of the factors that impact the Company’s ability to execute its strategic plan, such as the advancement of certain technologies, legal and regulatory obstacles and general economic conditions, are beyond its control. Changes in value or a lack of demand for the sale of non-core assets would negatively affect the Company’s financial condition and performance. Its inability to identify successful joint venture candidates and to complete joint ventures or strategic alliances as planned or to realize expected synergies and strategic benefits could impact its financial condition and performance. Its inability to deploy capital to maximize shareholder value could impact our financial performance. The Company cannot give assurance that it will be able to execute any or all of its strategic plan. Failure to execute any or all of the strategic plan could have a material adverse effect on our financial condition, results of operations, and cash flows.

Risks Associated with Operations, Climate, Development, Exploration, and Acquisition Risks

Exploration activities involve a high degree of risk, and exploratory drilling activities may not be successful.

The Company’s future success will largely depend on the success of the exploration drilling programs at the Golden Chest Mine, adjacent properties, and other exploration properties. Participation in exploration drilling activities involves numerous risks, including the significant risk that no commercially marketable minerals will be discovered. The mining of minerals and the manufacture of mineral products involves numerous hazards, including:

| · | Ground or slope failures; |

| · | Pressure or irregularities in formations affecting ore or wall rock characteristics; |

| · | Equipment failures or accidents; |

| · | Adverse weather conditions; |

| · | Compliance with governmental requirements and laws, present and future; |

| · | Shortages or delays in the availability and delivery of equipment; and |

| · | Lack of adequate infrastructure, including access to roads, electricity and available housing. |

Poor results from the Company’s drilling activities would materially and adversely affect the Company’s future cash flows and results of operations.

Transportation and weather interruptions may affect and delay proposed mining operations and impact the Company’s business plans.

The Company’s mining properties are accessible by road. The climate in the area is hot and dry in the summer but cold and subject to snow and other precipitation in the winter, which could, at times, hamper accessibility depending on the winter season precipitation levels. As a result, the Company’s exploration and mining plans could be delayed for several months each year. Such delays could affect its anticipated business operations and increase expenses.

Moreover, extreme weather events (such as increased frequency or intensity of storms or prolonged drought, flooded or frozen terrain) have the potential to disrupt operations at the Company’s projects. Extended disruptions to supply lines due to extreme weather could result in interruption of activities at the project sites, delay or increase the cost of construction of the projects, or otherwise adversely affect its business.

Supplies and equipment needed for exploration may not always be available. If the Company is unable to secure raw materials and exploration supplies, it may have to delay anticipated business operations.

Competition, the imposition of tariffs and other trade sanctions, and unforeseen limited sources of supplies needed for the Company’s proposed exploration work could result in occasional shortages of supplies of certain products, equipment, or materials. There is no guarantee the Company will be able to obtain certain products, equipment and/or materials as and when needed, without interruption, or on favorable terms, if at all. Such delays could affect the Company’s anticipated business operations and increase expenses.

The mining industry is highly competitive and there is no assurance that the Company will continue to be successful in acquiring mineral properties, claims, or leases. If the Company cannot continue to acquire properties to explore for mineral resources, it may be required to reduce or cease exploration activity and/or operations.

The mineral exploration, development, and production industry is largely un-integrated. The Company competes with other exploration companies looking for mineral properties and the minerals that can be produced from them. While the Company competes with other exploration companies in the effort to locate and license mineral properties, it does not compete with them for the removal or sales of mineral products from its claims if a discovery is made in quantities sufficient to make production economically feasible. Readily available markets exist worldwide for the sale of gold and other mineral products, subject to market conditions and prices. Therefore, the Company will likely be able to sell any gold or mineral products that are identified and produced; however, such sales are subject to market fluctuations that may materially and adversely affect the Company’s future cash flows and results of operations.

Many of the Company’s competitors have greater financial resources and technical facilities. Accordingly, the Company will attempt to compete primarily through the knowledge and experience of its management. This competition could adversely affect its ability to acquire suitable prospects for exploration in the future. Accordingly, there can be no assurance that the Company will acquire any interest in additional mineral properties that might yield reserves or result in commercial mining operations.

The estimation of the ultimate recovery of gold and other metals is subjective. Actual recoveries may vary from the Company’s estimates.

The Company utilizes a conventional flotation process to produce a bulk sulfide flotation concentrate that is sold to smelters in South Korea and/or Asia. Ore is crushed, ground and valuable minerals are separated using the flotation process which is longstanding and well understood metallurgical process. However, the Company’s estimates of gold recovery can vary from actual gold recovery because of several factors such as oxidation, hardness of the ore, deleterious mineralogy, and gold grade estimation errors due to the nugget effect. Also, final payment is determined by sampling of the concentrate at the smelter which could lead to variations from provisional sampling at the mill facility. Sampling procedures at the mill have been modified to try to increase correlation with smelter samples such as by increasing the sample mass collected for the provisional sample at the mill. Due to the complexity of the estimation process and the number of steps involved, among other things, actual recoveries can vary from estimates, and the amount of the variation could be significant and could have a material adverse impact on the Company’s financial condition and results of operations.

Resource and other mineralized material statements are estimates only and are subject to uncertainty due to factors including metal prices, inherent variability of the mineral deposits and recoverability of metal in the mining and beneficiation processes.

The Company’s reports of mineral resources and other mineralized material depend upon geological interpretation and statistical inferences or assumptions drawn from drilling and sampling analysis, which may prove to be unpredictable. There is a degree of uncertainty attributable to the calculation of mineral resources and corresponding grades. Until mineral resources and other mineralized materials are actually mined and processed, the quantity of mineralized material and grades must be considered as an estimate only. In addition, the quantity of mineral resources and mineral reserves may vary depending on metal prices. Any material changes in the quantity of mineral resources, mineral reserves, mineralization, grade or stripping ratio may affect the economic viability of the Company’s properties. In addition, the Company can provide no assurance that gold recoveries or other metal recoveries experienced in small-scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

The Company’s mining and metal production depends on the availability of sufficient water supplies.

The Company’s mining and milling operations require significant quantities of water for mining, processing, and related support facilities. Continuous production at its mines and mill is dependent on the ability to maintain water rights and claims, and the continuing physical availability of water.

The Company may experience increased costs or losses resulting from the hazards and uncertainties associated with mining.

The exploration for natural resources and the development and production of mining operations are activities that involve a high level of uncertainty. These can be difficult to predict and are often affected by risks and hazards outside of the Company’s control. These factors include, but are not limited to:

| · | environmental hazards, including discharge of metals, concentrates, pollutants or hazardous chemicals; |

| · | industrial accidents, including in connection with the operation of mining transportation equipment, milling equipment and/or conveyor systems, and accidents associated with the preparation and ignition of large-scale blasting operations, milling, processing and transportation of chemicals, explosives or other materials; |

| · | surface or underground fires or floods; |

| · | unexpected geological formations or conditions (whether in mineral or gaseous form); |

| · | ground and water conditions; |

| · | fall-of-ground accidents in underground operations; |

| · | failure of mining pit slopes and tailings dam walls; |

| · | seismic activity; and |

| · | other natural phenomena, such as lightning, severe rain or snowstorms, floods, or other inclement weather conditions. |

Climate change could negatively or positively impact the Company’s operations and financial performance.

Climate change is expected to create more extreme weather patterns that can increase the frequency of droughts and increase the amount of rainfall, circumstances that require careful water management. Potential key material physical risks to the Company from climate change include but are not limited to: increased volumes of mine contact water requiring storage and treatment, increased design requirements for stormwater diversion and associated water management systems, and reduced freshwater availability due to potential drought conditions. Warmer winters may make it easier to operate the mine in the winter and extend the exploration drilling season. The Company has identified opportunities and risks with the advent of technologies that support decarbonization and renewable energy sources, such as: electric vehicles and energy storage that may require the metals the Company produces, or seeks to produce in the future. These technologies may not have the same reliability as conventional technologies and costs may increase to produce such technologies, which could negatively impact the Company’s financial performance.

The Company’s operations are subject to a range of risks related to climate change and transitioning the business to meet regulatory, societal and investor expectations for operating in a low-carbon economy.

Climate change is expected to create more extreme weather patterns that can increase the frequency or severity of forest fires and droughts and sudden heavy rainfall. These latter two events require careful water management. Potential key material physical risks to the Company from climate change include, but are not limited to:

| · | increased volumes of mine contact water requiring storage and treatment; |

| · | increased design requirements for stormwater diversion and associated water management systems; |

| · | reduced freshwater availability due to potential drought conditions; |

| · | damage to roads and other infrastructure at our sites due to extreme weather events, including intense rainfalls and related events such as landslides; and |

| · | unpermitted or otherwise non-compliant discharge of wastewater due to an increased frequency of extreme weather events exceeding the design capacity of existing tailings storage facilities and other stormwater management infrastructure. |

Such events can temporarily slow or halt operations due to physical damage to assets, reduced worker productivity for safety protocols on-site related to extreme weather events, worker aviation, and transport to or from the site, and local or global supply route disruptions that may limit the transport of essential materials and supplies. Additional financial impacts could include increased capital or operating costs to increase water storage and treatment capacity, obtain or develop maintenance and monitoring technologies, increase resiliency of facilities and establish supplier climate resiliency and contingency plans. The occurrence of weather and climate events have in the past and could in the future cause the Company to incur unplanned costs, which may be material, to address or prevent resulting damage.

In addition, potential opportunities and risks have been identified for the Company as the U.S. shifts toward a low-carbon economy. Technologies that support decarbonization include renewable energy sources, electric vehicles, and energy storage, all of which require the metals the Company produces and/or is exploring for. However, renewable energies currently may not have the same reliability as conventional energy sources. Thus, as the U.S. transitions toward renewable energy sources, the Company could experience a possible curtailment of its energy supply, and these new energy sources may cost more in the future than current supplies, which could negatively impact the Company’s financial performance. Further, transitioning to a lower-carbon economy will require significant investment and may entail extensive policy, legal, technology, and market changes to address mitigation and adaptation requirements related to climate change. Depending on the nature, speed, focus, and jurisdiction of these changes, transition risks may pose varying levels of financial and reputational risk to the Company’s business.

Policy and regulatory risk related to actual and proposed changes in climate and water-related laws, regulations and taxes developed to regulate the transition to a low-carbon economy may result in increased costs for the Company’s operations, third-party smelters and refiners, and its suppliers, including increased energy, capital equipment, environmental monitoring and reporting and other costs to comply with such regulations. Regulatory uncertainty may cause higher costs and lower economic returns than originally estimated for new development projects and operations, including closure reclamation and remediation obligations.

The development and deployment of technological improvements or innovations will be required to support the transition to a low-carbon economy, which could result in write-offs and early retirement of existing assets, increased costs to adopt and deploy new practices and processing including planning and design for mines, development of alternative power sources, site level efficiencies and other capital investments.

A failure to meet the Company’s climate strategy commitments and/or societal or investor expectations could also result in damage to its reputation, decreased investor confidence and challenges in maintaining positive community relations, which can pose additional obstacles to the Company’s ability to conduct its operations and develop its projects, which may result in a material adverse impact on the Company’s business, financial position, results of operations and growth prospects.

Risks Related to the Company

The cost of the Company’s exploration, development and acquisition activities is substantial, and there is no assurance that the quantities of minerals and metals discovered, acquired or recovered will justify commercial operations or replace reserves.

Mineral exploration, development and beneficiation, particularly for gold and other strategic metals, is highly speculative in nature and frequently is nonproductive. There can be no assurance that the Company’s exploration, development and/or acquisition activities will be commercially successful. Substantial expenditures are required to acquire existing gold properties, to establish mineral reserves through drilling and analysis, to develop metallurgical processes to extract metal from the mineralized material and, in the case of new properties, to develop the processing facilities and infrastructure at any site chosen for mineral exploration. There can be no assurance that any gold reserves or mineralized material that may be discovered or acquired in the future, if any, will be in sufficient quantities or of adequate grade to justify continued commercial operations, or that the funds required for mineral production operation can be obtained on a timely or reasonable basis, if at all. Mining companies must continually replace mineral reserves depleted by production. There can be no assurance that the Company will be successful in replacing any reserves or mineralized material acquired or established in the future.

The prices of gold and other strategic metals fluctuate on a regular basis and a downturn in price could negatively impact the Company’s operations and cash flow.

Our operations will be significantly affected by changes in the market price of gold. Gold prices can fluctuate widely and may be affected by numerous factors, such as expectations for inflation, levels of interest rates, currency exchange rates, purchases and sales by governments and central banks, monetary policies employed by the world’s major central banks, fiscal policies employed by the world’s major industrialized economies, forward selling or other hedging activities, demand for diversified precious and strategic metals, global or regional political and economic crises, and production costs in major gold-producing regions, such as but not limited to South Africa and the Russian Federation. The aggregate effect of these factors, all of which are beyond the Company’s control, are impossible to predict. If gold prices decline substantially, it could adversely affect the realizable value of the Company’s assets and, potentially, future results of operations and cash flow.

As opportunities rise, the Company expects to continue to acquire properties with gold and strategic metals reserves or mineralized material with exploration potential. The price that is paid to acquire these properties will be influenced, in large part, by the price of gold and other strategic metals at the time of the acquisition. The Company expects its potential future revenues to be derived from the production and sale of gold and strategic metals from these properties or from the sale of some of these properties. The value of any mineralized material, and the value of any potential mineral production therefrom, will vary in direct proportion to variations in those mineral prices. The price of gold and strategic metals has fluctuated widely due to numerous factors beyond the Company’s control. The effect of these factors on the price of gold and strategic metals, and therefore the economic viability of the Company’s projects, cannot accurately be predicted. Any drop in the price of gold or strategic metals would negatively affect the Company’s asset values, cash flows, potential revenues, and profits.

The use of hedging instruments may not prevent losses being realized on subsequent price decreases or may prevent gains being realized from subsequent price increases.

The Company may, from time to time, sell some future production of gold pursuant to hedge positions. If the gold price rises above the price at which future production has been committed under these hedge instruments, the Company will have an opportunity loss. If the gold price falls below that committed price, the Company may experience losses if a hedge counterparty defaults under a contract when the contract price exceeds the gold price.

Competition from other mineral exploration and mining companies with greater resources may impact the Company.

The Company competes with other mineral exploration and mining companies or individuals, including large, established metals and mining companies with substantial capabilities and far greater financial resources, to acquire rights to mineral properties, metal processing technology and other methods for extracting and processing precious, and other metals and minerals. There is a limited supply of desirable lands available for claim staking, lease or other acquisition. There can be no assurance that the Company will be able to acquire such properties when competing against competitors with substantially greater financial resources. Increases in the amount of gold and associated minerals sold by competitors of the Company may also result in price reductions and/or reduced margins, and the Company may not be able to compete effectively against current and future competitors.

The construction of the Company’s mine(s) are subject to all of the risks inherent in start-up operations.

These risks include potential delays, cost overruns, shortages of material or labor, construction defects, and injuries to persons and property. The Company expects to engage, or hire, employees in order to continue the development of its mine(s). While the Company anticipates taking all measures that deemed reasonable and prudent in connection with the production phase, there is no assurance that the risks described above will not cause delays or cost overruns in connection with such development, production, or operation. Any delays would postpone the Company’s anticipated receipt of revenue and adversely affect its operations, which in turn may adversely affect the price of its stock.

The Company’s business requires substantial capital investment and it may be unable to raise additional funding on favorable terms.

The construction and operation of potential future projects and various exploration projects will require significant funding. The Company’s operating cash flow and other sources of funding may become insufficient to meet all of these requirements, depending on the timing and costs of development of these and other projects. As a result, new sources of capital may be needed to meet the funding requirements of these investments and fund ongoing business activities. The ability to raise and service significant new sources of capital will be a function of macroeconomic conditions, future gold and strategic metal prices, the Company’s operational performance and its current cash flow and debt position, among other factors. In the event of lower gold and strategic metal prices, unanticipated operating or financial challenges, or a further dislocation in the financial markets as experienced in recent years, the Company’s ability to pursue new business opportunities, invest in existing and new projects, fund ongoing operations and retire or service outstanding debt could be significantly constrained.

Owning real estate and water rights carries inherent risks.

The Company is susceptible to the following real estate industry risks beyond its control:

| · | Changes in national, regional and local economic conditions and outlook; |

| · | Economic downturns in the areas where the properties are located; |

| · | Adverse changes in local real estate market conditions such as an oversupply of properties, reduction in demand, intense competition for buyers and/or demographic changes; |

| · | Changes in business or consumer preferences that reduce the attractiveness of our properties; |

| · | Changes in zoning, regulatory restrictions or tax laws; |

| · | Changes in interest rates or availability of financing. |

These conditions could adversely affect the Company’s financial position, results of operations and cash flows, or the market price of its stock.

Illiquidity of real estate investments could significantly impede the Company’s ability to respond to changes in economic and other conditions.

The Company’s ability to sell one or more of its properties in response to changing economic, financial and investment conditions may be limited. The Company cannot predict whether it will be able to sell any of its properties for the price or terms it set, or whether any price or other terms offered by a prospective buyer would be acceptable. The Company also cannot predict the length of time needed to find a willing buyer and to the close the sale of an asset. The real estate market is affected by many factors that are beyond the Company’s control.

The Company may undertake joint ventures, investments, joint projects and other strategic alliances and such undertakings may be unsuccessful and may have an adverse effect on its business.

The Company continually evaluates and explores strategic opportunities as they arise, including product, technology, business or asset transactions. Such undertakings may not be successful or may take a substantially longer period than initially expected to become successful, and the Company may never recover its investments or achieve desired synergies or economies from these undertakings. Nevertheless, the Company may, in the future, seek to grow its operations in part by entering into joint ventures, or undertaking investments, joint projects or other strategic alliances with third parties in diversified precious and strategic metals production and processing industries. These activities involve challenges and risks in negotiation, execution, valuation and integration, and closing of the transactions could be delayed or prevented by regulatory approval requirements, including permitting issues, or other conditions.

Any future agreements that the Company may enter into also could expose it to new operational, regulatory, market, litigation and geographical risks as well as risks associated with significant capital requirements, the diversion of management and financial resources, unforeseen operating difficulties and expenditures, sharing of proprietary information, loss of control over day-to-day operations, non-performance by a counterparty, potential competition and conflicts of interest. In addition, the Company may not be successful in finding suitable targets on terms that are favorable, or at all. Even if successfully negotiated and closed, expected synergies from a joint venture, investment or other strategic alliance may not materialize, may not advance the Company’s business strategy, may fall short of expected return-on-investment targets or may not prove successful or effective for its business. The Company may also encounter difficulty integrating the operations, personnel, and financial and operating systems of an acquired business into its current business.

The Company may need to raise additional debt funding or sell additional equity securities to enter into such joint ventures or make such acquisitions. However, the Company may not be able to obtain such debt funding or sell equity securities on terms that are favorable, or at all. The raising of additional debt funding, if required and available, would result in increased debt service obligations and could result in additional operating and financing covenants, or liens on the Company’s assets, that would restrict its operations. The sale of additional equity securities, if required and available, could result in dilution to the Company’s shareholders.

The Company’s business depends on a limited number of key personnel, the loss of whom could have a negative impact.

The Company’s officers and employees are important to its success. If any of them becomes unable or unwilling to continue in their respective positions, and the Company is unable to find suitable replacements, its business and financial results could be materially negatively affected.

Legal, Regulatory and Compliance Risks

The Company’s ability to execute its strategic plans depends upon success in obtaining a variety of required governmental approvals that may be opposed by third parties.

The Company’s operations may be delayed, hindered, or prevented to the extent that it is unable to obtain the governmental permits or approvals necessary to conduct the full extent of the operations contemplated by its strategic plan in a timely fashion or at all. This inability may occur due to a variety of factors, including opposition by third parties, such as members of the public or environmental groups. The Company expects that future permit and approval applications and issuances will meet with similar opposition. The Company may encounter delays and added costs if permits and approvals are challenged.

The Company is subject to complex laws and regulations, including environmental regulations that can adversely affect the cost, manner or feasibility of doing business.

The Company’s production, development and exploratory mining operations are subject to numerous federal, state and local laws and regulations governing the operations, discharge, emission, or release of materials into the environment and the protection of the environment and human health and safety, including the Federal Clean Water Act (“CWA”), Clean Air Act (“CAA”), Endangered Species Act (“ESA”), Safe Drinking Water Act (“SDWA”), Migratory Bird Treaty Act (“MBTA”), National Environmental Policy Act (“NEPA”, Resource Conservation and Recovery Act (“RCRA”), and Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”). Federal initiatives are often also administered and enforced through state agencies operating under parallel state statutes and regulations. Failure to comply with such rules and regulations could result in substantial penalties or construction or operational delays or requirements to cease production and have an adverse effect on the Company. These laws and regulations may, among other things:

| · | Require that the Company obtain permits before commencing mining work and to comply with ongoing permit requirements; |

| · | Restrict the substances that can be released into the environment in connection with mining work and require remediation of substances that are released; |

| · | Impose obligations to reclaim land in order to minimize long term effects of land disturbance; and |

| · | Limit or prohibit mining work on protected areas. |