Dogecoin Soars 17% To Break $0.21 As Volume Explodes

28 Marzo 2024 - 3:00PM

NEWSBTC

Dogecoin has jumped 17% in the past 24 hours to break past the

$0.21 barrier as on-chain data shows a significant increase in

volume for the memecoin. Dogecoin Beats Market With 17% Rally In

The Last Day Most of the top cryptocurrencies have seen flat

returns in the last 24 hours, but Dogecoin has gone its own way as

the original meme coin has enjoyed a strong rally. Related Reading:

Bitcoin “Liquid Inventory Ratio” Hits All-Time Low, What It Means

The below chart shows what the asset’s performance has looked like

during the last few days: The price of the coin appears to have

sharply soared over the past day | Source: DOGEUSD on TradingView

In this latest rally, Dogecoin has surged more than 17% in the last

24 hours and has cleared the $0.21 level. Among the top 100

cryptocurrencies by market cap, only Bitcoin Cash (BCH) has

registered comparable profits in the same period. DOGE still beats

BCH in the 1-week timeframe, however, as the memecoin has managed

returns of more than 40% in this period, while the Bitcoin

hard-fork has seen 33%. The reason behind these two assets in

particular seeing a strong performance may lie in the fact that

Coinbase plans to add futures products for them starting the 1st of

April. Litecoin (LTC) is also set to see a listing on the same day,

but its performance has been much weaker than the other two. In

terms of market cap, Dogecoin is currently the eighth-largest coin

in the sector, as the table below shows: Looks like the market cap

of the memecoin is just under $31 billion at the moment | Source:

CoinMarketCap From the table, it’s apparent that the gap to USD

Coin (USDC) in seventh isn’t too much right now, so if Dogecoin can

keep up its surge, it’s possible that it may be able to flip the

stablecoin. DOGE Transaction Volume Has Observed A Sharp Increase

Recently Something that would confirm that widespread speculation

around Dogecoin is ripe for a rally currently would be its

Transaction Volume. As a user on X pointed out using data from the

on-chain analytics firm Santiment, DOGE’s Transaction Volume has

shot up recently. The “Transaction Volume” keeps track of the total

amount of tokens (in USD) for a given cryptocurrency that has

observed some movement on the blockchain in the past 24 hours. When

the value of this metric is high, it means that the users are

transacting large amounts on the network right now. Such a trend

implies the trading interest around the asset is high currently. On

the other hand, low values of the indicator can be a sign that the

general interest in the cryptocurrency, both as an asset and a

network, is low at the moment. Related Reading: Bitcoin Coinbase

Premium Returns To Neutral: Buying Push Already Over? Now, here is

a chart that shows the trend in the Dogecoin Transaction Volume

over the past year: The metric seems to have gone up in recent days

| Source: @trader_kamikaze on X As is visible in the chart, the

Dogecoin Transaction Volume has experienced quite a boost recently,

and what has accompanied this rise has been the latest rally. A

rising volume can often be a positive sign for the sustainability

of any rally, as it means that interest in the asset is going up,

and thus, more fuel is potentially coming in. Something to keep in

mind, though, is that selling and buying alike affect this

indicator, so a mass selloff would also register as a spike in the

metric. Thus, while high volumes are usually a requirement for

rallies to continue (as without interest, the run can easily die

down), they alone can’t predict a further rise, as the nature of

this activity can be hard to ascertain. Featured image from

Kanchanara on Unsplash.com, Santiment.net, chart from

TradingView.com

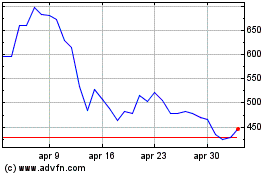

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Apr 2024 a Apr 2025