Key takeaways

- Accepting crypto payments reduces transaction

fees, eliminates chargebacks, and enables seamless global

transactions.

- Businesses of all sizes, from e-commerce to real

estate, are integrating cryptocurrency payments to attract new

customers.

- Risks like price volatility and regulatory

compliance can be managed with trusted payment processors like

BitPay, CoinsPaid and Coinbase Commerce.

- Setting up crypto payments is easier than ever,

with zero upfront costs and user-friendly integration options for

small businesses.

- The rapid adoption of cryptocurrencies has led

businesses of all sizes to increasingly embrace digital currencies

like Bitcoin as a legitimate payment method.

And it’s not just a rehash of old news. For years, you might

have seen luxury brands like Gucci and telecommunications companies

like AT&T

accepting Bitcoin. But today, crypto payments are much more

than an easy bit of PR — they’re seamlessly integrating into

e-commerce, hospitality, travel and even your neighborhood coffee

shop.

What started as a niche trend in the

early 2010s has accelerated over the years. As of 2025, over

659 million people worldwide — roughly 1 in 13 individuals — are

using cryptocurrency. Moreover, approximately 15,000 businesses

globally accept Bitcoin (BTC), including

around 2,300 in the United States.

While there are considerations to keep in mind, many view

accepting BTC and other cryptocurrencies, even as a small business,

as a win-win. The benefits often outweigh any challenges, with

minimal downsides and significant potential rewards.

The following sections explore the whos, the whys and the

hows.

What companies are currently accepting cryptocurrencies?

As briefly touched upon, it’s not only niche crypto-specific

sectors that are accepting Bitcoin payments. Here are some sectors

that you might not have considered, with accompanying case

studies.

E-commerce

-

Shopify enables merchants to accept cryptocurrency payments

through various payment gateways, including BitPay and Coinbase

Commerce.

-

Newegg accepts Bitcoin and other cryptocurrencies for

electronics purchases, integrating crypto payments into its

checkout process.

-

Rakuten Japan allows users to convert Rakuten Points into

Bitcoin, Ether (ETH) and Bitcoin

Cash (BCH),

effectively incorporating crypto into its rewards ecosystem.

Food and beverage

-

Subway accepts Bitcoin at selected locations, with franchises

in Europe and North America processing crypto payments.

-

Burger King franchises in Brazil and Venezuela allow customers

to pay for meals with Bitcoin and select altcoins.

-

Starbucks supports Bitcoin payments through the Bakkt app,

enabling customers to reload their Starbucks cards with

cryptocurrency.

Retail

-

Home Depot accepts Bitcoin payments via Flexa, allowing

customers to use cryptocurrency for home improvement

purchases.

-

Whole Foods processes crypto payments through the Spedn app,

which enables Bitcoin and other digital currency transactions at

checkout.

-

Nordstrom integrates crypto payments into its in-store and

online shopping platforms, supporting purchases with Bitcoin and

Ethereum.

Real estate

- In Miami,

a $22.5-million penthouse in the Arte Surfside complex was

purchased entirely with Bitcoin, one of the largest real estate

transactions involving cryptocurrency.

-

Magnum Real Estate Group sold a retail condo in Manhattan for

$15.3 million in Bitcoin, marking one of the first large-scale

commercial real estate deals in crypto.

-

Kuper Sotheby’s International Realty in Texas completed a home

sale using Bitcoin, expanding crypto transactions into the

residential property market.

Hospitality and travel

- Mirai Flights processes cryptocurrency payments

for private jet charters, catering to high-net-worth

individuals.

-

Travala accepts BTC, ETH and other cryptocurrencies for hotel

and flight bookings, partnering with major travel service

providers.

-

Expedia facilitates crypto payments for hotel bookings through

Travala, offering Bitcoin payment options on select

accommodations.

Advertising

- Claimr, a Web3 marketing platform, processes

approximately 8 million euros annually, with the majority of

transactions conducted in cryptocurrency.

- Accessible.org began accepting Bitcoin and other

cryptocurrencies in 2025, allowing clients to pay for digital

accessibility services with crypto.

- Black Iris Social Club in Richmond accepts

Bitcoin for event bookings and memberships, integrating

cryptocurrency into its operations.

Did you know? The first-ever real-world

transaction using Bitcoin took place on May 22, 2010, when

programmer Laszlo Hanyecz bought two pizzas for 10,000 BTC. Today,

those 10,000 BTC would be worth hundreds of millions of dollars,

making it one of the most expensive pizza orders in history. This

event is now celebrated annually as Bitcoin Pizza Day in the crypto

community.

Why are businesses accepting crypto payments?

So, all the big brands are in. But what’s driving this trend,

and can small businesses benefit, too?

One of the most significant advantages is lower transaction

fees. Traditional payment processors and credit card companies

typically charge businesses between 2% and 4% per transaction,

while crypto payment gateways often reduce this to less than 1%.

For businesses processing high volumes of transactions, these

savings can be substantial.

Another key factor is the ability to access a global market

without the restrictions of currency exchange rates and

international banking fees. Cryptocurrency payments enable seamless

cross-border transactions, allowing businesses to serve

international customers without friction. This is especially

beneficial for industries like travel, luxury goods and digital

services, where cross-border commerce is common.

Security and fraud prevention also play a role.

Cryptocurrency transactions are final, eliminating chargebacks

— something that costs businesses billions of dollars annually in

fraudulent disputes. This makes crypto payments particularly

appealing to merchants in industries where chargebacks are common,

such as e-commerce and online services.

Did you know? In 2025, chargeback fraud,

particularly friendly fraud, has become a significant concern for

merchants. Notably, a recent survey revealed that 55% of Generation

Z and 49% of Millennials earning over $100,000 annually admitted to

engaging in digital shoplifting — a form of first-party fraud where

consumers falsely claim issues with online orders to secure refunds

or avoid payments.

Additionally, businesses recognize that accepting cryptocurrency

aligns with the preferences of a growing demographic of crypto

users. Companies integrating crypto payments position themselves as

forward-thinking and innovative, appealing to solvent, tech-savvy

consumers who prefer digital transactions over traditional banking

systems.

Finally, some businesses are drawn to the potential of

holding crypto as an asset. While many use payment processors

that instantly convert cryptocurrency into fiat currency to avoid

volatility, others see it as an opportunity to gain exposure to a

growing asset class. With major corporations like Tesla and

MicroStrategy

holding Bitcoin on their balance sheets, smaller businesses are

following suit, recognizing the potential long-term value.

Small businesses stand to benefit the most here, as accepting

crypto payments is an easy way to carve out a niche for the brand,

reaching far more customers than would be possible by offering only

fiat payments. The strategy might well mean the difference between

failure and success in a competitive startup environment.

Did you know? A survey by Deloitte found

that 85% of

merchants see crypto payments as a way to reach new

customers.

Risks of accepting cryptocurrency payments

While accepting crypto payments is often seen as a win-win,

businesses must also be aware of potential risks in doing so on

their own, without proper accounting systems and crypto processing

partners.

Price volatility

Cryptocurrencies like Bitcoin are known for significant price

fluctuations. For example, in early 2025, Bitcoin’s price dropped

from $109,071 to around $80,000 — a

nearly 25% decline within a short period. Such volatility can

impact the value of received payments if not promptly converted to

stable currencies.

Regulatory and tax compliance

The regulatory landscape for cryptocurrencies varies by

jurisdiction and is continually evolving. For example, in the

United States, the Internal Revenue Service (IRS) classifies

cryptocurrencies as

property, not currency, which introduces complexities in tax

reporting and compliance. Businesses must stay informed about

applicable regulations to ensure adherence to tax obligations and

avoid potential legal issues.

Security concerns

Accepting cryptocurrencies necessitates the use of digital

wallets and exchanges, which can be susceptible to cybersecurity

threats.

Without robust security measures, businesses risk

unauthorized access and theft of digital assets. Implementing

strong cybersecurity protocols is essential.

Technical barriers

Integrating cryptocurrency payment systems requires technical

knowledge that some small business owners may lack. Establishing

digital

wallets and navigating digital

currency exchanges can be challenging, potentially leading to

operational inefficiencies or errors. Investing in employee

training or consulting with experts may be necessary to overcome

these hurdles.

Market acceptance and perception

Despite growing adoption, cryptocurrencies are not universally

accepted or understood. Some customers may be hesitant to use

digital currencies due to concerns about security or unfamiliarity,

potentially limiting the perceived benefits of offering crypto

payment options. Businesses should assess their customer base to

determine if accepting cryptocurrencies aligns with their

clientele’s preferences.

Use a crypto payment provider

It’s unlikely that, as a small business, you’ll take this road

alone — especially when leading

crypto payment processors offer zero up-front integration

costs:

- These processors offer immediate conversion

services, transforming volatile cryptocurrencies into stable fiat

currencies upon receipt, thereby shielding businesses from price

fluctuations.

- They also assist in navigating complex

regulatory landscapes by providing tools for accurate tax reporting

and ensuring compliance with evolving laws.

- To address security concerns, reputable

processors implement robust cybersecurity measures, safeguarding

digital assets against potential threats.

- Additionally, they offer user-friendly platforms

that simplify the technical aspects of cryptocurrency transactions,

making integration accessible even for those with limited technical

expertise.

The next section will explore a number of crypto processing

providers that you may wish to choose from as a small business.

Which crypto payment gateway to choose in 2025

BitPay

Founded in 2011, BitPay is a pioneering cryptocurrency payment

processor. As of 2024, it holds a 6.26% market share in the Bitcoin

payment processing sector, serving over 523 customers.

BitPay caters to a diverse clientele, including retailers,

investment banking firms, and nonprofit organizations. The company

offers direct crypto-to-fiat settlements, helping businesses avoid

volatility while ensuring seamless integration with existing

accounting systems.

Its security infrastructure includes

two-factor authentication (2FA) and encrypted transactions,

making it a trusted option for enterprises looking to accept

cryptocurrency payments.

CoinsPaid

Established in 2014,

CoinsPaid has grown into a comprehensive crypto payment

gateway, processing over 41 million transactions worth 23 billion

euros. The company facilitates approximately 8% of all onchain

Bitcoin transactions, making it a major player in the crypto

payments sector.

Supporting over 30 cryptocurrencies, CoinsPaid serves industries

such as IT, marketing, financial services, real estate and

gambling. The platform offers a business wallet, an over-the-counter

(OTC) desk for large-volume transactions and

software-as-a-service solutions tailored for crypto

integration.

CoinsPaid is licensed in Estonia and complies with

Know Your Customer (KYC) and Anti-Money Laundering (AML)

regulations while undergoing regular independent security audits to

maintain its reputation for secure and compliant processing.

Coinbase Commerce

Launched in 2018 by Coinbase, Coinbase Commerce enables

merchants to accept multiple cryptocurrencies directly into a

user-controlled wallet. It provides seamless integration with major

e-commerce platforms such as Shopify and WooCommerce, allowing

businesses to accept ETH, Litecoin (LTC) and USDC

(USDC).

Notably, in February 2024, Coinbase Commerce

ended support for Bitcoin and other unspent transaction output

(UTXO)-based coins. To make Bitcoin payments, users will need a

Coinbase account. The decision comes as Coinbase faces challenges

in implementing updates to its Ethereum Virtual Machine payment

protocol for Bitcoin.

While specific market share data is limited, Coinbase Commerce

is widely used by small to mid-sized businesses across sectors such

as computer software, utilities and telecommunications.

The platform offers a straightforward setup with no transaction

fees apart from standard network costs, making it an attractive

option for businesses looking for a simple crypto payment solution

without intermediaries.

Binance Pay

Binance Pay, introduced by Binance, is a cryptocurrency payment

solution that enables merchants and users to conduct transactions

using various cryptocurrencies. It supports over 30

cryptocurrencies, including BTC, ETH and BNB (BNB),

allowing for versatile payment options.

The platform offers zero transaction fees for both merchants and

users, making it an attractive option for businesses aiming to

integrate crypto payments without incurring additional costs.

Binance Pay also emphasizes security by incorporating features such

as 2FA and encrypted transactions, ensuring safe and reliable

payment processing.

Step-by-step guide to set up a crypto payment

gateway

Despite a run-in with the Lazarus Group last year, CoinsPaid

continues to operate as a major crypto payment gateway, maintaining

competitive setup costs and fees. As such, this section will walk

you through the steps you’d be expected to take when integrating

any crypto payment processor, using CoinsPaid’s flow as an

example.

- Request a consultation:

Businesses can begin by submitting a request on the CoinsPaid

website. A CoinsPaid representative will promptly reach out to

schedule a meeting and discuss requirements.

- Receive a free demo and

proposal: The CoinsPaid team provides a detailed

demonstration of the system, answers any questions, and prepares a

tailored proposal based on the company’s specific needs.

- Onboarding: To finalize the

agreement, businesses must complete the Know Your Business (KYB)

verification by submitting the necessary documents for compliance

with regulatory standards.

- Integration: CoinsPaid’s team

assists in integrating the payment gateway into the company’s

existing infrastructure, ensuring a smooth and efficient

setup.

- Start accepting crypto: Once

integration is complete, businesses can begin offering

cryptocurrency payments, providing customers with an additional

payment option while potentially expanding their market reach.

By following these steps, you can effectively integrate

CoinsPaid into your business, offering your customers the option to

pay with cryptocurrencies.

Integrating cryptocurrency payments is a forward-thinking

investment

With lower transaction fees, access to a global customer base

and protection from chargebacks, crypto payments provide clear

advantages over traditional payment methods.

The risks associated with crypto payments — such as volatility,

regulatory compliance and security concerns — are easily mitigated

by using a trusted payment processor like CoinsPaid, BitPay or

Coinbase Commerce. These platforms handle everything from instant

fiat conversion to security and compliance, making the transition

to crypto seamless and low-risk.

With major brands already embracing digital currencies, there’s

no reason for small and medium-sized businesses to be left behind.

Crypto payments are fast, borderless and cost-effective, making

them a no-brainer for any forward-thinking business.

Whether you’re a startup looking to gain a competitive edge or

an established company seeking new revenue streams, integrating

cryptocurrency payments is an investment in the future.

This article does not contain investment advice or recommendations.

Every investment and trading move involves risk, and readers should

conduct their own research when making a decision.

...

Continue reading Crypto payments for small

businesses: Benefits, risks and how to get started

The post

Crypto payments for small businesses: Benefits,

risks and how to get started appeared first on

CoinTelegraph.

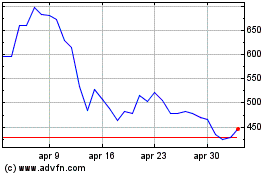

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Mar 2025 a Mar 2025

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Mar 2024 a Mar 2025