Market Analysis: How Will Mt. Gox’s Bitcoin Distribution Affect Crypto Prices?

31 Maggio 2024 - 8:30PM

NEWSBTC

As the defunct cryptocurrency exchange Mt. Gox prepares to

distribute around $9 billion worth of Bitcoin, some investors are

worried about the potential impact on prices. However, industry

experts and major creditors believe that any short-term volatility

will be outweighed by BTC’s long-term bullish prospects. With

the approval of US spot Bitcoin exchange-traded funds (ETFs), many

market experts anticipate that the market will absorb the newly

available tokens. Bitcoin Optimism Among Market Participants

As reported by our sister website, Bitcoinist, Mt. Gox’s Japanese

trustee, Nobuaki Kobayashi, recently announced plans to start

distributing Bitcoin and Bitcoin Cash to creditors. The

process is expected to commence shortly, with most claimants set to

receive their tokens before the end of October. However, concerns

have emerged regarding the impact of this large-scale distribution

on Bitcoin’s price. According to Bloomberg, significant creditors

and long-time market participants remain confident in Bitcoin’s

resilience despite concerns. Many intend to retain the distributed

coins, anticipating continued price appreciation. Related

Reading: Ethereum Bloodbath: Over $55 Million In Longs Liquidated

As Price Plummets Adam Back, CEO of blockchain technology company

Blockstream and a creditor himself, emphasizes the “illogicality”

of selling at the beginning of a potential bull market. Back

suggests that waiting further, after a decade-long wait, could

yield even greater returns. According to the firm’s CEO Brian

Dixon, other creditors, such as Off the Chain Capital, plan to sell

Bitcoin only when “better investment opportunities arise,”

recognizing Bitcoin’s historical performance as the best-performing

asset in recent years. Dixon further highlights the significant

maturation of the Bitcoin market since Mt. Gox’s bankruptcy. He

argues that the potential impact of the distribution, although

substantial in volume, is unlikely to have a lasting effect on

prices. Cosmo Jiang, a portfolio manager at Pantera Capital,

notes that while the amount is significant, the distribution will

occur over an extended period, making it less actionable regarding

market impact. With around $26.6 billion in daily Bitcoin trading,

the distributed tokens are expected to be absorbed without major

disruption. BCH Sales In Mt. Gox Distribution? Creditors do not

anticipate a simultaneous distribution of tokens to all claimants.

Instead, they expect the trustee to distribute the coins in

tranches, potentially prioritizing earlier-filed claims. This

approach may mitigate any immediate market pressure.

Moreover, Galaxy Research estimates that credit funds, holding

approximately 20,000 BTC, are unlikely to engage in significant

selling. Instead, they are expected to distribute the Bitcoin to

their limited partners (LPs) in kind. While BTC is anticipated to

weather the distribution without major consequences, Bitcoin Cash

(BCH) may face more pressure due to its lower ideological

commitment from holders. Alex Thorn, head of research at

Galaxy, suggests that individual creditors owed the majority of

tokens to be distributed this year, will likely be the primary

source of sales, with some opting to sell their Bitcoin Cash.

Related Reading: Near Protocol Breaks Out From Wedge Pattern: Why

This Could Trigger A 37% Crash In summary, as Mt. Gox prepares to

distribute billions of dollars worth of BTC, industry experts and

major creditors remain optimistic, citing the maturity of the

Bitcoin market, the potential for continued price appreciation, and

the availability of newly approved ETFs. While short-term

volatility is possible, most stakeholders are confident that

Bitcoin’s long-term prospects will outweigh any immediate market

impact. As of press time, the largest cryptocurrency on the

market is trading at $67,900, representing a 1.3% price drop over

the past 24 hours. Featured image from Shutterstock, chart

from TradingView.com

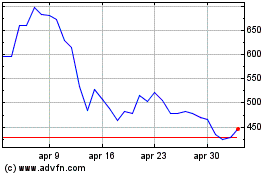

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Apr 2024 a Apr 2025