Bitcoin Price Could Run Up To $131,000 — But It Must Hold Above This Level

27 Aprile 2025 - 1:30PM

NEWSBTC

The Bitcoin price has been in a red-hot form over the past two

weeks, leading to talks of the premier cryptocurrency reclaiming

the significant $100,000 mark. Interestingly, the latest on-chain

data suggests that the price of BTC could fly past this level and

forge a new all-time high over the coming weeks. What Will Happen

If Bitcoin Price Falls Beneath $93,145? In an April 26 post on X,

popular crypto analyst Ali Martinez shared an exciting analysis and

projection for the Bitcoin price over the next few weeks. According

to the online pundit, the flagship cryptocurrency could be on its

way to as high as $131,800 so long as it stays above a critical

support level. Related Reading: Bitcoin Sees Highest Exchange

Outflows In 2 Years, What This Means For Price This projection is

based on the Short-Term Holder (STH) Cost Basis, which measures the

average price at which recent investors — typically defined as

wallets holding Bitcoin for less than 155 days — acquired their

coins. This metric often offers insight into the sentiment of

short-term investors and can act as a relevant psychological

support or resistance level. When the Bitcoin price is above the

STH Cost Basis, it typically signals bullish momentum among

short-term market participants. On the other hand, a sustained

break beneath this metric could trigger increased selling pressure,

as short-term holders are known for their speculative and reactive

nature. According to data from Glassnode, the Short-Term Holder

Cost Basis currently stands around $93,145, which represents a

crucial support level for the Bitcoin price. Martinez noted that

the premier cryptocurrency needs to hold above this support to make

a run to a new all-time high price of $131,800. However, Martinez

warned that if the Bitcoin price fails to defend the $93,145

support cushion, this could open the door to a broader correction.

In this case, the market leader may suffer a deep price pullback

toward the next major support level around $71,150 — an almost 25%

decline from the current price point. As of this writing, the price

of Bitcoin stands around $94,410, reflecting a 0.6% decline in the

past 24 hours. According to data from CoinGecko, the premier

cryptocurrency is up by more than 10% on the weekly timeframe.

Could BTC Whales Provide The Needed Bullish Impetus? In a separate

post on X, Martinez revealed that the Bitcoin whales have been

getting busy in the market, loading up their bags following the

recent price rally. Whales are significant market participants due

to their substantial holdings and also their often informed trading

decisions and positions. Related Reading: Bitcoin Perpetual Swaps

Signal Short Bias Amid Price Rebound – Details Data from Santiment

shows that Bitcoin whales (holding between 1,000 – 10,000 coins)

bought over 20,000 BTC in the last 48 hours. With this increased

buying activity from large investors, the Bitcoin price might get

the needed momentum to attempt a run at a new all-time high.

Featured image from iStock, chart from TradingView

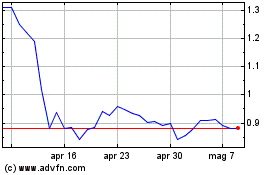

Grafico Azioni Flow (COIN:FLOWUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Flow (COIN:FLOWUSD)

Storico

Da Apr 2024 a Apr 2025