More than 70 US crypto ETFs await SEC decision this year — Bloomberg

21 Aprile 2025 - 9:23PM

Cointelegraph

More than 70 cryptocurrency exchange-traded funds (ETFs) are

slated for review by the US Securities and Exchange Commission

(SEC) this year. According to Bloomberg analyst Eric Balchunas, the

list includes proposed ETFs holding a range of assets, from

altcoins to memecoins to derivatives instruments.

“Everything from XRP, Litecoin and Solana to Penguins, Doge and

2x Melania and everything in between,” Balchunas

said

in an April 21 post on the X platform. “Gonna be a wild year.”

Crypto ETFs’ SEC review schedule. Source:

Eric

Balchunas/Bloomberg

Crypto ETFs’ SEC review schedule. Source:

Eric

Balchunas/Bloomberg

Related: ARK adds

staked Solana to two tech ETFs

Uncertain institutional demand

The planned funds listings come as institutional investors turn

increasingly bullish on crypto as an asset class.

Upward of 80% of institutions say they plan to

increase allocations to crypto in 2025, according to a March

report by Coinbase and EY-Parthenon.

However, analysts caution that just because ETFs are approved

for US listings doesn’t guarantee widespread adoption, especially

for funds holding more obscure alternative cryptocurrencies.

“Having your coin get ETF-ized is like being in a band and

getting your songs added to all the music streaming services,”

Balchunas said.

“Doesn’t guarantee listens but it puts your music where the vast

majority of the listeners are.”

Comparing asset manager Grayscale’s net assets pre-ETF

launch across different cryptocurrencies suggests tepid demand for

altcoin ETFs. Source: Sygnum Bank

Comparing asset manager Grayscale’s net assets pre-ETF

launch across different cryptocurrencies suggests tepid demand for

altcoin ETFs. Source: Sygnum Bank

Sygnum Bank’s research head, Katalin Tischhauser, told

Cointelegraph she expects altcoin ETFs to see cumulative inflows of

several hundred million to $1 billion,

far less than spot Bitcoin funds.

Funds holding Bitcoin (BTC) — the first spot

cryptocurrency approved for listing in a US ETF wrapper — attracted

upward

of $100 billion in net assets last year.

However, ETFs using options and other derivatives to provide

structured exposure to cryptocurrencies such as Bitcoin and Ether

might see more institutional uptake, analysts said.

Options on spot cryptocurrencies unlock numerous potential

portfolio strategies for investors and could

potentially

catalyze “explosive” price upside for digital assets such as

Bitcoin, Jeff Park, Bitwise Invest’s head of alpha strategies, said

in September.

Options are contracts granting the right to buy or sell an

underlying asset at a certain price.

On April 21, ARK Invest

added exposure to staked Solana (SOL) to two of

its existing ETFs. The asset manager said it marks the first time

spot SOL has been available to US investors in an ETF.

Magazine: ‘Bitcoin layer 2s’ aren’t really L2s at all:

Here’s why that matters

...

Continue reading More than 70 US crypto ETFs await

SEC decision this year — Bloomberg

The post

More than 70 US crypto ETFs await SEC decision this

year — Bloomberg appeared first on

CoinTelegraph.

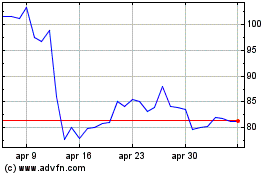

Grafico Azioni Litecoin (COIN:LTCUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Litecoin (COIN:LTCUSD)

Storico

Da Apr 2024 a Apr 2025