Since US President Donald Trump’s inauguration on Jan. 20,

Bitcoin (BTC) has swung from a

record high of

$109,000 to below $78,000 as major tariff announcements from

the US and retaliatory moves from trade partners shaved off chunks

of cryptocurrency market value and rattled global markets.

“The back-and-forth on tariffs, with Trump sometimes tough and

sometimes accommodating, has left markets in a limbo state, where

few people are willing to be decidedly bullish but just as few are

willing to part with their assets, fearing to be left on the

side-lines at the next rally,” Justin d’Anethan, head of sales at

Liquify, told Cointelegraph.

By mid-March, investors began regaining confidence as White

House messaging pointed to a more measured approach. But mixed

signals remain, and with a second wave of “reciprocal tariffs”

looming on April 2 — dubbed Liberation Day — market jitters haven’t

fully subsided.

Trump’s trade war saga has rattled global markets but

evolved to a softer stance by late March.

Colombian tariff standoff and DeepSeek disruption

shakes Bitcoin

Bitcoin hovered above $100,000 until Jan. 26, when Trump

threatened 25% tariffs on all Colombian imports after Colombian

President Gustavo Petro refused to accept US military aircraft

carrying deported migrants. Petro accused Trump of mistreating

immigrants and retaliated with tariffs of his own.

Colombia quickly reversed course — agreeing to

accept deportees — after facing pressure over its dependence on US

trade. Bitcoin reclaimed $100,000 shortly after. But market

sentiment was further shaken by the sudden rise of Chinese AI firm

DeepSeek, whose budget-built model sparked fears of disruption in

the tech sector and contributed to risk-off sentiment across

markets.

Bitcoin’s dip below $100,000 in late January coincided with

US tariffs standoff with Colombia and the rise of DeepSeek.

Source: CoinGecko

Tariff war begins and Bitcoin racks

losses

On Feb. 1, Trump signed an

executive order to impose 10% tariffs on all Chinese imports

and 25% on Canadian and Mexican goods, effective Feb. 4, citing

national emergency over immigration and fentanyl. China, Canada and

Mexico all threatened retaliation.

Bitcoin tumbled below $93,000, rebounding only after Trump

agreed to a 30-day pause on the Canada and Mexico tariffs on Feb.

3. But the Chinese tariffs took effect as scheduled on Feb. 4 — and

that was the last time Bitcoin traded above $100,000.

Bitcoin’s falls as Trump signs executive order, its

subsequent recovery was a dead cat bounce. Source:

CoinGecko

Bitcoin remained volatile through mid-February. On Feb. 10,

Trump announced the

removal of steel and aluminum tariff exemptions, raising all metal

tariffs to 25%, effective March 12. He then

unveiled a

“reciprocal tariffs” plan to match foreign import taxes.

Bitcoin held steady around $93,000 and briefly rallied to

$99,000. But on Feb. 21, the momentum collapsed

following the Bybit hack

— the largest crypto breach in history — sending Bitcoin back below

$90,000.

Related: In

pictures: Bybit’s record-breaking $1.4B hack

Bitcoin falls just before reaching $100,000 following Bybit

hack, then copper tariff. Source: CoinGecko

On Feb. 25, Trump added to bearish pressure by ordering a review

of potential tariffs on imported copper, citing national security.

Bitcoin dipped below $80,000 for the first time since November.

March shows signs of relief for Bitcoin

March kicked off with Trump issuing

another order reviewing tariffs on lumber and timber. But crypto

briefly rallied after the White House unveiled

plans for a Strategic Bitcoin Reserve and digital asset

stockpile — including XRP, SOL, and ADA.

On March 4, Trump followed through with 25% tariffs on Canada

and Mexico, and doubled Chinese tariffs to 20%. All three countries

vowed to retaliate. The next day, Trump granted a one-month

exemption on tariffs for US automakers importing from Canada and

Mexico. A day later, the White House extended the tariff pause on

many imports that qualify under the USMCA, while still threatening

reciprocal tariffs on April 2.

Related: Does

XRP, SOL or ADA belong in a US crypto

reserve?

Trump credited Mexican President Claudia Sheinbaum for

“unprecedented” border cooperation. Canada also signaled easing

tensions. Bitcoin see-sawed on the $90,000 mark but eventually

dipped below on March 7, and it has not reclaimed that level at the

time of writing.

Meanwhile, Trump finalized the steel and aluminum hikes. Then on

March 13, he threatened 200% tariffs on European wine, champagne

and spirits if the EU moved forward with a 50% tax on American

whiskey as a retaliation against steel and aluminum tax.

Bitcoin trades at around $84,000 on March 1 and March 16

despite large swings in between. Source: CoinGecko

Tone softens and Bitcoin starts rebound but ‘Liberation

Day’ looms

By mid-March, the administration’s tone began to soften. On

March 18, Treasury Secretary Scott Bessent

said tariffs would be

tailored to each country’s trade practices and could be avoided

entirely if partners lowered their own barriers.

Financial markets, rattled for weeks, began to recover. On March

24, Bitcoin rose to $88,474 on reports that Trump’s next round of

tariffs would be more targeted than initially feared.

Softer White House tone sparks Bitcoin recovery. Source:

CoinGecko

“In the week leading up to Trump’s reciprocal tariffs on April

2, expect market volatility, corporate lobbying for exemptions,

preemptive price hikes, and global diplomatic efforts to mitigate

the impact,” Ryan Lee, chief analyst at Bitget Research said in a

written analysis shared with Cointelegraph.

“After the tariffs take effect, anticipate inflation spikes,

supply chain disruptions, and mixed job outcomes, with potential

stock market shocks and retaliatory trade measures from partners

like China and Canada possibly slowing US economic growth.”

Meanwhile, Liquify’s d’Anethan said investors should continue

monitoring traditional market developments, especially with

Bitcoin’s rising correlation with traditional indexes.

“With BTC’s correlation to the S&P 500 and other traditional

assets, it wouldn’t be silly to discount tariffs and geopolitical

maneuvering,” he said.

With April 2 approaching, crypto markets remain fragile — and

investors are bracing for what “Liberation Day” might bring. Trump

recently hinted while speaking to

reporters that tariffs on automobiles, aluminum and pharmaceuticals

are under consideration.

Magazine: What

are native rollups? Full guide to Ethereum’s latest

innovation

...

Continue reading Timeline: How Trump tariffs dragged

Bitcoin below $80K

The post

Timeline: How Trump tariffs dragged Bitcoin below

$80K appeared first on

CoinTelegraph.

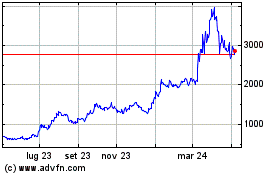

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Mar 2025 a Apr 2025

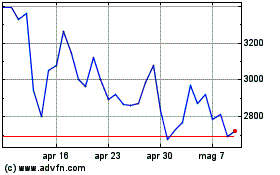

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Apr 2024 a Apr 2025