Ethereum’s (ETH) path back to $2.5K depends on 3 key factors

26 Marzo 2025 - 8:11PM

Cointelegraph

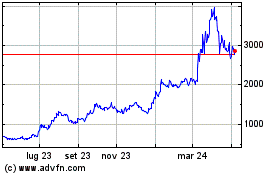

Ether (ETH) price reclaimed the $2,000

support on March 24 but remains 18% below the $2,500 level seen

three weeks ago. Data shows Ether has underperformed the altcoin

market by 14% over the past 30 days, leading traders to question

whether the altcoin can regain bullish momentum and which factors

might drive a trend reversal.

Ether/USD (left) vs. total altcoin capitalization, USD

(right). Source: TradingView / Cointelegraph

Ether appears well-positioned to attract institutional demand

and significantly reduce the FUD that has limited its upside

potential. Critics have long argued that the Ethereum ecosystem

lags behind competitors in overall user experience and still offers

limited base-layer scalability, which has negatively impacted

network fees and transaction efficiency.

Will the Ethereum Pectra upgrade impact ETH

price?

Many of the Ethereum network’s challenges are expected to be

addressed in the upcoming Pectra network

upgrade, scheduled for late April or early June. Among the

proposed changes is a doubling of the data that can be included in

each block, which should help lower fees for rollups and

privacy-focused mechanisms. Additionally, the cost of call data

will increase, encouraging developers to adopt blobs—a more

efficient method for data storage.

Another notable improvement in the upcoming upgrade is the

introduction of

smart accounts, which allow wallets to function like smart

contracts during transactions. This enables gas fee sponsorship,

passkey authentication, and batch transactions. Additionally,

several other enhancements focus on optimizing staking deposits and

withdrawals, providing greater flexibility, and extending block

history for smart contracts that rely on past data.

Arthur Hayes, co-founder of BitMEX, set a $5,000 price target

for ETH on March 25, stating that it should significantly

outperform competitor Solana (SOL).

Source: CryptoHayes

Regardless of the rationale behind Arthur’s price prediction,

ETH options traders do not share the same bullish sentiment. The

Sept. 26 call (buy) option with a $5,000 strike price costs only

$35.40, implying extremely low odds. However, Ethereum remains the

undisputed leader in smart contract deposits and is the only

altcoin with a spot

exchange-traded fund (ETF) in the US, currently holding $8.9

billion in assets under management.

Ethereum TVL growth and reduced ETH supply on

exchanges

Ethereum’s network boasts a total value locked (TVL) of $52.5

billion, significantly surpassing Solana’s $7 billion. More

importantly, deposits on the Ethereum network grew 10% over the

past 30 days, reaching 25.4 million ETH, while Solana saw an 8%

decline over the same period. Notable highlights on Ethereum

include Sky (formerly Maker), which saw a 17% increase in deposits,

and Ethena, whose TVL surged by 38% in 30 days.

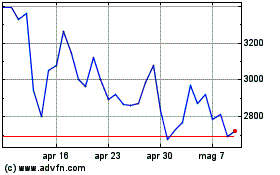

Ether balance on exchanges, ETH. Source: Glassnode

The Ether supply on exchanges stood at 16.9 million ETH on March

25, just 3.5% above its five-year low of 16.32 million ETH,

according to Glassnode data. This trend suggests that investors are

withdrawing from exchanges, signaling a long-term capital

commitment. Similarly, flows into spot Ether ETFs remained

relatively muted on March 24 and March 25, in contrast to the $316

million in net outflows accumulated since March 10.

Related: Ethereum devs prepare final Pectra test before

mainnet launch

Lastly, the Ethereum network is gaining momentum in the Real

World Asset (RWA) industry, particularly after the

BlackRock BUILD

fund surpassed $1.5 billion in capitalization. The Ethereum

ecosystem, including its layer-2 scalability solutions, accounts

for over 80% of this market, according to RWA.XYZ data,

underscoring Ethereum’s dominance in the decentralized finance

(DeFi) space.

Ether’s price drop below $1,900 on March 10 likely reflected

overly bearish expectations. However, the tide appears to have

turned as the Ethereum network demonstrated resilience, and traders

continued to withdraw from exchanges, setting the stage for a

potential rally toward $2,500.

This article is for

general information purposes and is not intended to be and should

not be taken as legal or investment advice. The views, thoughts,

and opinions expressed here are the author’s alone and do not

necessarily reflect or represent the views and opinions of

Cointelegraph.

...

Continue reading Ethereum’s (ETH) path back to $2.5K

depends on 3 key factors

The post

Ethereum’s (ETH) path back to $2.5K depends on 3 key

factors appeared first on

CoinTelegraph.

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Mar 2025 a Mar 2025

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Mar 2024 a Mar 2025