Ethereum Accumulation Is Almost Over – Breakout Above $2,200 Could Trigger Expansion Phase

25 Marzo 2025 - 6:30PM

NEWSBTC

Ethereum is trading back above the key $2,000 level after spending

several volatile weeks attempting to reclaim it. Since late

February, ETH has dropped more than 38%, triggering widespread

panic as the price broke below major support and briefly dipped

under $1,800. The decline sparked fears of a prolonged downtrend,

with many questioning whether Ethereum had entered a bear market.

Related Reading: Dogecoin Bollinger Bands Tighten On 12H Chart

Hinting At Imminent Price Move – Insights However, sentiment is

beginning to shift. Investors are now looking for signs of recovery

as ETH stabilizes and retests important levels. A growing number of

analysts believe that the recent volatility may have been a final

shakeout before a new uptrend. Top analyst Ted Pillows shared

insights on X, suggesting that Ethereum may be wrapping up its

“manipulation phase.” This phase typically features erratic price

action designed to exhaust both bulls and bears before the market

commits to a clear direction. If the phase ends soon, Ethereum

could rebound significantly in the coming weeks. As ETH hovers near

$2,000, the next few sessions will be crucial in determining

whether bulls can maintain momentum or if further downside lies

ahead. Ethereum Bulls Face A Test As Expansion Phase Looms Ethereum

is showing early signs of strength as it hovers just above the

critical $2,000 mark, a level that has acted as both a

psychological and technical battleground for weeks. Bulls are being

called into action as the broader market begins to stabilize, with

ETH price action hinting at a potential recovery. However, the

situation remains fragile, with uncertainty dominating sentiment

and no clear trend established yet. Speculation is split between

those anticipating a deeper correction and others betting on a

full-scale recovery. For now, Ethereum remains range-bound, and any

breakout attempt must be backed by strong conviction to shift

momentum. Bulls must defend the $2,000 level and begin targeting

higher resistance zones to spark confidence in a sustained uptrend.

Pillows stated that Ethereum is likely exiting what he calls the

“manipulation phase” — a confusing, price movement designed to

exhaust buyers and sellers. According to Pillows, this phase is

nearly over, and Ethereum’s expansion time is about to begin. A

confirmed breakout above the $2,200 level would be the catalyst for

a new expansion cycle, potentially sending ETH into higher

territory in the weeks ahead. Until then, price action will remain

sensitive, with the next few sessions crucial in deciding

Ethereum’s trajectory. Related Reading: Ondo Finance Eyes Breakout

As Price Tests $0.89 Channel Resistance – Analyst But Bulls Face

Key Resistance Ahead Ethereum is currently trading at $2,070 after

managing to reclaim the $2,000 level—a crucial psychological and

technical zone that had acted as resistance in recent weeks. This

move marks an important step for bulls who are now trying to

solidify momentum and prevent further downside. However, the real

test lies ahead, as ETH must reclaim the $2,250 level to initiate a

true recovery phase. The $2,250 mark aligns with previous areas of

heavy trading activity and could act as the launchpad for a broader

uptrend if bulls manage to flip it into support. Successfully

retaking this level would likely attract fresh demand and restore

investor confidence, especially after the asset shed more than 38%

of its value since late February. Related Reading: Chainlink Poised

For Recovery If $13 Support Holds – Expert Sets Optimistic Targets

Despite the short-term optimism, downside risks remain. If Ethereum

fails to hold above $2,000, the market could experience renewed

selling pressure, potentially pushing ETH back toward the $1,800

support level. Such a drop would reinforce bearish sentiment and

delay any potential recovery rally. For now, traders are watching

closely to see if Ethereum can build on its current strength and

reclaim higher levels in the sessions ahead. Featured image from

Dall-E, chart from TradingView

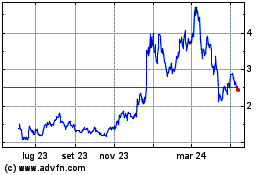

Grafico Azioni Optimism (COIN:OPUSD)

Storico

Da Mar 2025 a Mar 2025

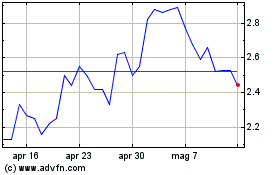

Grafico Azioni Optimism (COIN:OPUSD)

Storico

Da Mar 2024 a Mar 2025